GCC Jewelry Market Size, Share, Trends and Forecast by Product, Material, and Country, 2026-2034

GCC Jewelry Market Size and Share:

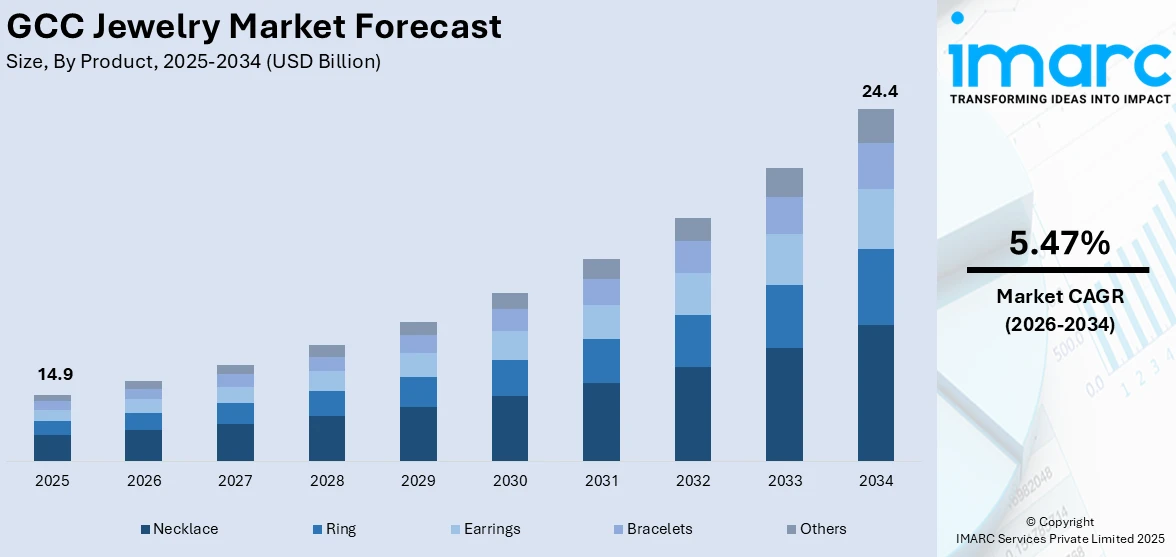

The GCC jewelry market size was valued at USD 14.9 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 24.4 Billion by 2034, exhibiting a CAGR of 5.47% from 2026-2034. The market is driven by rising disposable incomes, cultural traditions, thriving tourism, increasing demand for branded designs, and growing e-commerce adoption.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 14.9 Billion |

| Market Forecast in 2034 | USD 24.4 Billion |

| Market Growth Rate (2026-2034) | 5.47% |

To get more information on this market Request Sample

One of the biggest drivers of the GCC jewelry market is the growing disposable income among residents. With a GDP surpassing USD 2 trillion in 2023 and continued growth driven by rising employment, the region is set to see increased consumer spending and a booming retail sector. The GCC region, which includes countries like the UAE, Saudi Arabia, and Qatar, is home to some of the wealthiest populations in the world. High per capita income means people can spend more on luxury items, and jewelry tops the list. Gold, diamonds, and precious stones have long been symbols of status, wealth, and cultural pride, making jewelry a preferred purchase for many individuals.

In addition to residents, the region attracts a large number of affluent expatriates who are equally willing to spend on fine jewelry as a mark of achievement or to celebrate special occasions. The number of expatriates exceeded the number of nationals in the region, reaching 88.5% of the population in the UAE, 87.9% in Qatar, 70.1% in Kuwait, and 53.2% in Bahrain. This growing financial comfort encourages spending not only on traditional jewelry but also on branded and contemporary designs. Moreover, jewelry holds deep cultural and traditional value across GCC countries. From weddings to festivals and religious ceremonies, it plays an essential role in marking special occasions. For instance, it is common for families to invest heavily in gold, diamond, and gemstone jewelry as gifts and bridal adornments during weddings.

GCC Jewelry Market Trends:

Thriving Tourism and Duty-Free Shopping

The GCC region is a global hub for luxury tourism, attracting millions of international visitors each year. Dubai alone witnessed a record 17.15 million international visitors in the year 2023, an increase of 19.4% compared to 2022 levels. Cities like Dubai, Doha, and Riyadh are renowned for their high-end shopping experiences, particularly in gold and diamond jewelry. Tourists often consider jewelry purchases during their visits due to attractive pricing, duty-free benefits, and the wide variety of options available. For instance, in the year 2023, Dubai Duty Free, which is the world's busiest airport retailer at Dubai International, registered a revenue that reached 7.885 billion UAE dirhams ($2.16 Billion). This surge was credited to robust gold demand, as gold sales constituted 10% of total revenue, a notable increase from its 2019 rankings. Many international travelers take advantage of the tax-free environment and competitive prices, making it a prime location for purchasing high-value jewelry.

Growing Popularity of E-commerce and Online Jewelry Platforms

The rise of digital platforms is significantly changing how people shop for jewelry in the GCC. Online jewelry retailers and luxury e-commerce platforms have made it significantly easier for customers to search, customize, and buy jewelry from their homes. With advancements in technology, such as virtual try-ons and interactive three-dimensional (3D) views, online platforms are bridging the gap between physical and digital experiences. The younger and tech-enthusiast buyers are particularly drawn to online channels due to convenience, access to diverse designs, and secure payment options. Thus, the GCC e-commerce market is projected to grow at a rapid pace of 9.26% during 2024-2032. Many online retailers also offer competitive pricing, customization services, and free delivery, making online shopping even more attractive. This trend is boosting sales for both traditional and contemporary jewelry while expanding the market’s reach across borders.

Strong Demand for Gold as a Safe Investment

Gold continues to dominate the GCC jewelry market, not just for its aesthetic appeal but also as a safe investment option. According to the World Gold Council, the UAE’s total consumption of gold jewelry between January and December 2023 reached 39.7 tonnes. In Kuwait, it reached 14.3 tonnes, while Saudi Arabia outperformed as its consumption rose marginally by 1% to 38 tonnes. The tradition of investing in gold has been passed down for generations, particularly in families where jewelry serves as a form of wealth preservation. With fluctuating global markets, the demand for gold jewelry as a form of investment remains steady. Additionally, GCC governments’ focus on economic diversification has further fueled gold’s importance as a trade asset, boosting its demand in the jewelry market.

GCC Jewelry Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC jewelry market, along with forecasts at the country levels from 2026-2034. The market has been categorized based on product and material.

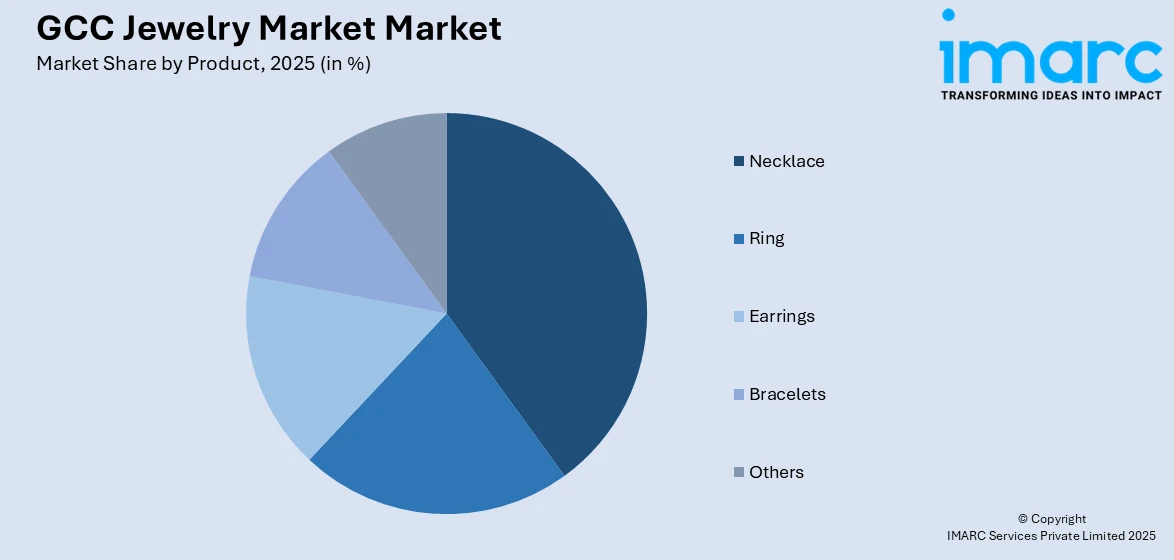

Analysis by Product:

Access the comprehensive market breakdown Request Sample

- Necklace

- Ring

- Earrings

- Bracelets

- Others

Necklaces hold a substantial market share in the region due to their cultural and traditional significance, particularly at weddings and festive events. Gold necklaces, which are often elaborate in design and beautifully made, are a common feature in wedding sets, representing prosperity and dignity. The increased desire for diamond and gemstone-encrusted necklaces are also gaining momentum among wealthy consumers. Luxury brands and local jewelers continue to create statement and individualized designs that respond to the changing demands of younger consumers.

Rings are a popular jewelry segment in the GCC, driven by both cultural and modern trends. Engagement and wedding rings hold significant value, with a growing inclination toward diamond rings and bespoke designs. Consumers increasingly prefer branded and certified pieces for authenticity and quality assurance. In addition, fashion rings embedded with precious stones are gaining popularity among millennials, contributing to the segment's steady growth in the region.

Earrings are a versatile and widely purchased jewelry segment, appealing to both traditional and modern tastes. From everyday gold studs to luxurious diamond and gemstone-embedded designs, earrings remain a sought-after accessory. Cultural preferences for heavier and intricate designs during weddings and festivals ensure robust demand. Lightweight and minimalist styles are becoming trendy among younger buyers, driving innovation and attracting a broader customer base.

The market growth of bracelets is driven by demand for both traditional gold bangles and modern, minimalistic designs. Gold bracelets remain essential in bridal trousseaus. Meanwhile, international and local brands are introducing personalized and gemstone-embedded bracelets, appealing to affluent buyers. Adjustable designs and lightweight options are becoming popular for everyday wear, further boosting this segment.

Analysis by Material:

- Gold

- Platinum

- Diamond

- Others

Gold jewelry constitutes a major part of the market share, driven by its cultural, traditional, and investment significance. Gold's dual appeal as both an adornment and a financial asset ensures consistent demand. Traditional gold pieces, such as bridal sets and intricate necklaces, continue to thrive during weddings and festive seasons, while lightweight and modern designs attract younger buyers looking for daily wear options.

Platinum jewelry's popularity is increasing in the GCC market, particularly among wealthy purchasers looking for uniqueness and durability. Platinum, known for its hypoallergenic characteristics and futuristic style, appeals to those seeking subtle elegance and high-value investment items. Platinum engagement and wedding rings are especially popular because they provide a modern alternative to gold. Growing awareness of its rarity and link with luxury products is fueling its demand, especially in metropolitan areas such as Dubai.

Diamond jewelry is a rapidly expanding industry in the GCC, driven by rising consumer desires for luxury, exclusivity, and innovative designs. Diamond engagement rings, necklaces, and earrings are particularly popular among younger and wealthy purchasers, with demand for branded and certified pieces constantly growing. The UAE and Saudi Arabia remain important markets, with Dubai known as the diamond destination due to its tax-free shopping and cheap rates. Lab-grown diamonds and personalized settings are also assisting in boosting the market by appealing to modern tastes while also providing environmentally friendly solutions.

Country Analysis:

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

Saudi Arabia accounts for a considerable portion of the market share of GCC jewelry. The country's long-standing cultural reliance on gold, notably for weddings and festivals, generates enormous demand. With the execution of Vision 2030 and increased disposable incomes, there is a growing demand for luxury and branded jewelry, particularly in metropolitan hubs like Riyadh and Jeddah. Furthermore, Saudi Arabia's younger population is moving toward modern and bespoke designs, broadening the market growth.

The UAE serves as the jewelry hub of the GCC, particularly through Dubai, often called the City of Gold. The country attracts millions of tourists annually, contributing significantly to jewelry sales through tax-free shopping and gold souks. The market is also expanding with increasing demand for branded and designer jewelry, fueled by affluent buyers and expatriates. Innovations like online platforms and customized offerings are helping the UAE maintain its leadership in the GCC jewelry market.

Qatar's jewelry market is gaining pace with the increase in disposable incomes, luxury spending, and preference for premium brands. The country’s focus on organizing major international events, such as the FIFA World Cup in 2022, adds impetus to its luxury retail space. In addition, a marked increase in the demand for diamond jewelry has been noticed as Qatari buyers are becoming more interested in high-end and branded jewelry. Increased per capita income and a penchant for contemporary design are also major factors that are ensuring consistency in jewelry demand, with gold constituting a part in marriage traditions and cultural celebrations.

Bahrain, recognized for its long history of pearl digging, boasts a strong market for both gold and pearl jewelry. The country's jewelry sector benefits from its cultural roots in high craftsmanship and classic styles, which appeal to both residents and visitors. Gold remains a popular material and luxurious and customized items are gaining popularity among younger and wealthy buyers. Bahrain's biennial Jewelry Arabia Exhibition has been attracting international companies and buyers, reaffirming the country's status as a prominent participant in the GCC jewelry sector.

Kuwait’s jewelry market thrives on high purchasing power and cultural significance. Gold remains a cornerstone of jewelry consumption, particularly for weddings and family celebrations. In 2023, Kuwait witnessed a growing demand for diamond and platinum jewelry, reflecting the evolving preferences of its wealthy consumer base. International luxury brands are increasingly targeting Kuwaiti buyers, who favor bespoke and branded designs. Additionally, strong government support for retail and economic stability ensures sustained demand for both traditional and modern jewelry.

Oman’s jewelry market blends tradition with modern trends, driven by its strong cultural affinity for gold and silver ornaments. Gold remains the most preferred material, particularly for traditional weddings and festivals. Oman is also known for its silver jewelry, which reflects the country’s heritage and craftsmanship. Rising tourism and economic diversification are encouraging the growth of luxury and designer jewelry. The younger generation is showing increasing interest in contemporary designs, while cultural celebrations continue to drive consistent demand for traditional pieces.

Competitive Landscape:

To meet increasing customer demands, key industry participants are concentrating on innovation, expansion, and customization. Companies are extending their retail presence throughout the region and opening additional showrooms to meet rising demand. Furthermore, international luxury brands are launching distinctive, region-specific collections that combine modern aesthetics with regional elements in order to appeal to GCC shoppers. Another major focus is digital transformation, with major brands spending substantially on e-commerce platforms, virtual try-ons, and personalization tools to entice tech-savvy millennials and Gen Z shoppers. Sustainability is also gaining traction, with firms offering ethically sourced gold and lab-grown diamonds to meet growing consumer demands for environmentally friendly solutions. Furthermore, collaborations with local designers and influencers help firms increase consumer engagement and widen their appeal. Additionally, promotional campaigns during festivals like Ramadan and Eid, along with events like the Dubai Shopping Festival, are driving seasonal sales and reinforcing brand visibility across the market.

The report provides a comprehensive analysis of the competitive landscape in the GCC jewelry market with detailed profiles of all major companies.

Latest News and Developments:

- In October 2024, Bhima Jewellers unveiled its plans for an aggressive expansion strategy for the GCC region. They planned to open 15 new stores across the UAE within the next three years. The group opened its new 6,000 sq ft head office in Dubai in the month of October and aims to raise AED1 billion ($272.2 million) from HNWIs and FIIs to fund its expansion plan. It also includes boosting the company’s presence in other GCC countries like Qatar and Bahrain.

- In October 2024, Joyalukkas announced the grand opening of its second showroom located in the Manama Centre in Bahrain. This expansion has emphasized the company's commitment to improving its regional presence that combines luxurious craftsmanship with timeless tradition. They aim to provide their customers with the finest jewelry by merging their legacy of trust with a promise of artistry and quality.

GCC Jewelry Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Necklace, Ring, Earrings, Bracelets, Others |

| Materials Covered | Gold, Platinum, Diamond, Others |

| Countries Covered | Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, Oman |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC jewelry market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC jewelry market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC jewelry industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

In the report, jewelry is characterized as decorative items made from precious metals, gemstones, or other materials, worn for personal adornment. It includes rings, necklaces, bracelets, and earrings. Jewelry serves cultural, symbolic, and aesthetic purposes, often used in weddings, celebrations, fashion, and as an investment or status symbol.

The GCC jewelry market was valued at USD 14.9 Billion in 2025.

IMARC estimates the GCC jewelry market to exhibit a CAGR of 5.47% from 2026-2034.

The GCC jewelry market is driven by rising disposable incomes, cultural significance of gold in weddings and festivals, thriving tourism, increasing demand for branded and designer jewelry, growth of e-commerce platforms, strong gold investment trends, and innovation in personalized and sustainable jewelry designs.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)