GCC Hollow Concrete Blocks Market Report by Product (Smooth-Faced, Split-Faced), Application (Industrial, Residential, Commercial, and Others), and Country 2026-2034

GCC Hollow Concrete Blocks Market:

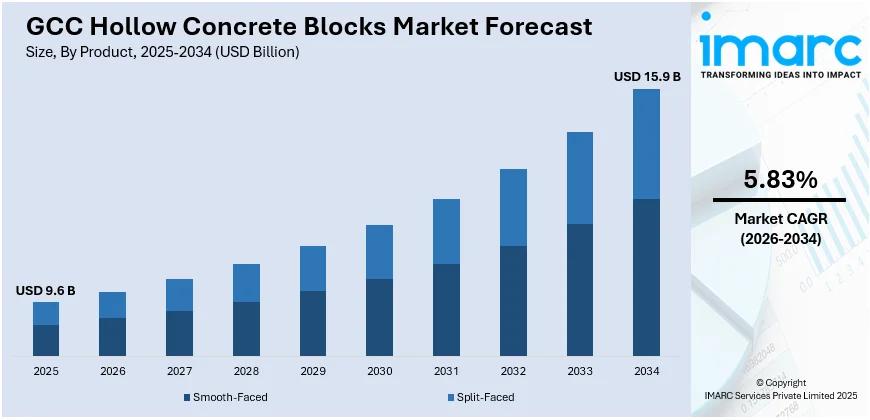

GCC hollow concrete blocks market size reached USD 9.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 15.9 Billion by 2034, exhibiting a growth rate (CAGR) of 5.83% during 2026-2034. The growing construction of smart cities is augmenting the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 9.6 Billion |

|

Market Forecast in 2034

|

USD 15.9 Billion |

| Market Growth Rate 2026-2034 | 5.83% |

GCC Hollow Concrete Blocks Market Analysis:

- Major Market Drivers: The growing demand for efficient and sustainable building solutions is catalyzing the market in this region.

- Key Market Trends: Several innovations, including advanced mix designs, improved production efficiency, enhanced block geometries, etc., are leading to higher quality and optimal product variants.

- Competitive Landscape: The report has also provided a comprehensive analysis of the competitive landscape in the market. Also, detailed profiles of all major companies have been provided.

- Geographical Trends: The elevating commercial projects are positively impacting the market in Saudi Arabia. The expanding construction sector is augmenting the market in the United Arab Emirates. Apart from this, the rising focus on energy efficiency is propelling the market across Qatar.

- Challenges and Opportunities: The fluctuating costs of raw materials are hindering the market. However, the introduction of recycled materials will continue to drive the market in the foreseeable future.

To get more information on this market Request Sample

GCC Hollow Concrete Blocks Market Trends:

Widespread Adoption of Sustainable Materials

The growing consumer environmental awareness is escalating the market. As regulatory bodies in the region encourage greener construction practices, builders and developers are seeking eco-friendly alternatives to traditional building materials. In May 2024, SCG International Corporation Co., Ltd. took a major step in promoting environmental stewardship by entering into a Memorandum of Understanding (MOU) with Buna Al Mamlaka (BUNA) to develop sustainable and advanced construction technologies in Saudi Arabia.

Expanding Infrastructure Development Projects

The rising investments by government bodies in residential developments, such as transportation networks and commercial buildings, as part of their long-term economic diversification plans are elevating the GCC hollow concrete blocks market share. For example, in March 2024, regulatory authorities in Saudi Arabia recently celebrated the unveiling of the world's first-ever mosque crafted via the revolutionary technique of 3D printing in Jeddah. The project was facilitated by using hollow concrete blocks, thereby signifying a bold step towards a progressive and sustainable future.

Novel Manufacturing Technologies

Digitalization and automation are integrated into the manufacturing process to allow for more precise control over the block-making process and reduce material wastage. Besides this, the adoption of 3D printing technology in block manufacturing offers the potential for customized designs and faster production times, which is acting as a significant growth-inducing factor. In February 2024, Nakheel received the first license for the construction of the Al Furjan Hills project using 3D printing technology for buildings.

GCC Hollow Concrete Blocks Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on product and application.

Breakup by Product:

- Smooth-Faced

- Split-Faced

The report has provided a detailed breakup and analysis of the market based on the product. This includes smooth-faced and split-faced.

Smooth-faced blocks have a uniform surface that provides a modern look. Consequently, they find extensive applications in contemporary commercial buildings. In addition, these blocks are adopted where the finished wall is intended to be left exposed. Split-faced blocks have a rough surface, thereby providing a more traditional or rustic look.

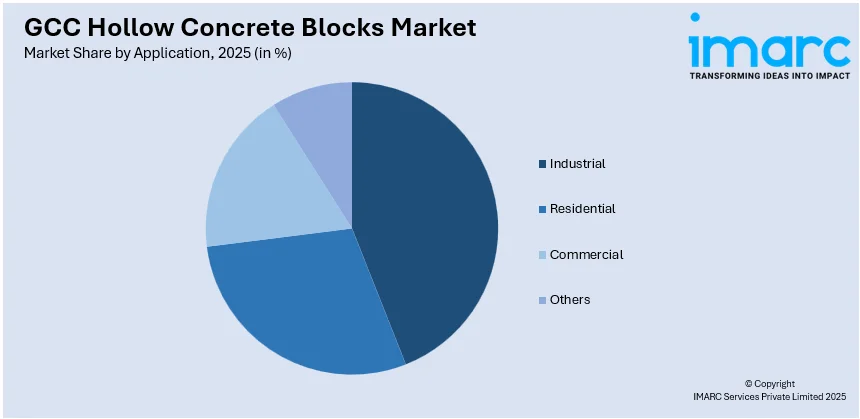

Breakup by Application:

Access the comprehensive market breakdown Request Sample

- Industrial

- Residential

- Commercial

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes industrial, residential, commercial, and others.

The growing demand for durable and robust structures, including factories, warehouses, and utility buildings, is catalyzing the market in this segmentation. In the residential sector, hollow concrete blocks are widely used for constructing homes, as they have thermal insulation properties. Their ease of installation and flexibility in design make them suitable for commercial settings.

Breakup by Country:

- Saudi Arabia

- United Arab Emirates

- Qatar

- Kuwait

- Oman

- Bahrain

The report has also provided a comprehensive analysis of all the major regional markets, which include Saudi Arabia, the United Arab Emirates, Qatar, Kuwait, Oman, and Bahrain.

Saudi Arabia, with its Vision 2030 initiative, is driving the market, focusing on mega-projects like NEOM, which demand construction materials, including hollow concrete blocks. The United Arab Emirates continues to be a key player in ongoing real estate development. Qatar's infrastructure expansion is acting as a significant growth-inducing factor. Meanwhile, Oman, Kuwait, and Bahrain are driven by urbanization and government-led infrastructure projects.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive GCC hollow concrete blocks market price analysis, such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant, has been covered in the report. Also, detailed profiles of all major companies have been provided.

GCC Hollow Concrete Blocks Market Recent Developments:

- May 2024: SCG International Corporation Co., Ltd. entered into a Memorandum of Understanding (MOU) with Buna Al Mamlaka (BUNA) to develop sustainable construction technologies in Saudi Arabia.

- March 2024: Regulatory authorities in Saudi Arabia recently celebrated the unveiling of the world's first-ever mosque crafted via the revolutionary technique of 3D printing in Jeddah. The project was facilitated by using hollow concrete blocks.

- February 2024: Nakheel received the first license for the construction of the Al Furjan Hills project using 3D printing technology for buildings.

GCC Hollow Concrete Blocks Market Report:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Smooth-Faced, Split-Faced |

| Applications Covered | Industrial, Residential, Commercial, Others |

| Countries Covered | Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, Bahrain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the GCC hollow concrete blocks market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the GCC hollow concrete blocks market?

- What is the breakup of the GCC hollow concrete blocks market on the basis of product?

- What is the breakup of the GCC hollow concrete blocks market on the basis of application?

- What are the various stages in the value chain of the GCC hollow concrete blocks market?

- What are the key driving factors and challenges in the GCC hollow concrete blocks?

- What is the structure of the GCC hollow concrete blocks market and who are the key players?

- What is the degree of competition in the GCC hollow concrete blocks market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC hollow concrete blocks market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the GCC hollow concrete blocks market.

- The study maps the leading, as well as the fastest-growing, markets. It further enables stakeholders to identify the key country-level markets within the region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC hollow concrete blocks industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)