GCC Functional Foods Market Size, Share, Trends and Forecast by Product Type, Ingredient, Distribution Channel, Application, and Country, 2025-2033

GCC Functional Foods Market Size and Share:

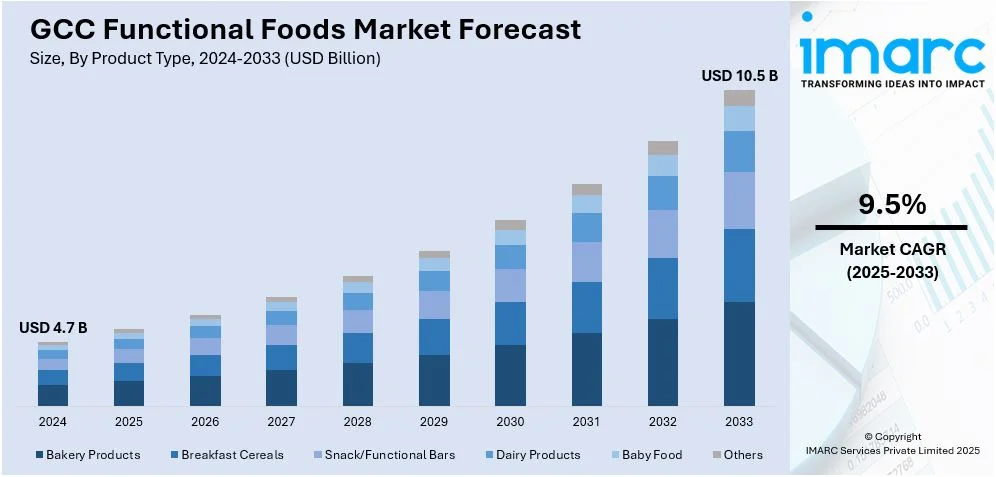

The GCC Functional Foods market size was valued at USD 4.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.5 Billion by 2033, exhibiting a CAGR of 9.5% from 2025-2033. The rising health awareness and demand for nutrient-rich diets among consumers, increasing prevalence of lifestyle-related diseases, growing investments in research and development for innovative functional food products, expansion of retail and e-commerce channels offering greater product accessibility, and government initiatives promoting health and wellness across the region are some of the major factors propelling the GCC functional foods market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.7 Billion |

|

Market Forecast in 2033

|

USD 10.5 Billion |

| Market Growth Rate (2025-2033) | 9.5% |

The GCC functional foods market growth is driven by increasing health consciousness among consumers and a growing focus on preventive healthcare. Moreover, urbanization and busy lifestyles have fueled demand for on-the-go health solutions, boosting sales of functional snacks, beverages, and ready-to-eat products in the region. For instance, according to industry reports, 96.6% of the total population in Qatar, 92.1% of the total population in Saudi Arabia, and 81.1% of the total population in the UAE lives in urban areas in 2025. Besides this, functional foods fortified with vitamins, minerals, probiotics, and omega-3 fatty acids are also gaining popularity as consumers seek convenient ways to meet dietary and health goals.

Other than this, authorities in GCC countries are encouraging the development and consumption of healthier food options to combat public health challenges. The research and innovation investments by major players have further increased the number of diverse functional food products designed according to regional tastes. The growing availability of modern retail outlets and e-commerce websites has improved access to products, while marketing campaigns about health benefits have increased consumer awareness. As per a report published by the IMARC Group, the GCC e-commerce market is forecasted to exhibit a CAGR of 9.26% during 2024-2032. All these factors contribute to a favorable GCC functional foods market outlook overall.

GCC Functional Foods Market Trends:

Rising health consciousness and demand for preventive care

The GCC functional food market trends indicate that rising health consciousness among consumers is significantly driving the industry. Numerous individuals are suffering due to lifestyle problems such as increasing cases of diabetes, obesity, and heart issues, and seeking healthier choices in diet in the form of nutritional and medicative benefits together. Functional food is becoming popular as it is enriched with nutrients such as vitamins, minerals, probiotics, and omega-3 fatty acids. In addition, preventive healthcare is becoming a priority, and consumers are seeking products that can help manage weight, improve immunity, and support overall well-being. Preventive healthcare is particularly driven by urban and younger demographics in the region.

Government initiatives and supportive policies

Governmental schemes that advocate for public health and nutritional awareness have significantly added to the GCC functional food market demand. As regional authorities tackle rising health concerns, there have been initiatives aimed at getting consumers to use fortified and nutrition-boosting food products. Rules are also coming up regarding standardizing production as well as labeling to enhance the safety and functionality of food items among consumer groups. Also, interaction between government departments and the private sector has catalyzed the research investment process that will allow to produce a plethora of new products customized to local demand. These measures are being aligned with larger national health strategies, such as the Saudi Vision 2030, in order to promote healthier lifestyles.

Growing retail and e-commerce penetration

Modern retail channels and e-commerce platforms are rapidly increasing the accessibility of functional foods to GCC consumers. Dedicated sections for health and wellness products are increasingly being seen in supermarkets and hypermarkets, with online retailers offering a wide variety of functional foods that are tailored to meet different consumer needs. Convenience through online shopping, along with effective digital marketing, has helped in building awareness and further enhancing sales within the segment. Associations between functional food manufacturers and retail chains also help improve distribution networks, including both the urban and the rural markets, helping sustain the overall growth momentum of the market.

GCC Functional Foods Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC functional foods market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on product type, ingredient, distribution channel, and application.

Analysis by Product Type:

- Bakery Products

- Breakfast Cereals

- Snack/Functional Bars

- Dairy Products

- Baby Food

- Others

Bakery products form an important segment, as they remain one of the most versatile and widely consumed foods in the GCC. Fortified vitamins, minerals, and dietary fiber-fortified bread, biscuits, and pastries are more recently gaining importance for consumers as these foods help them stay healthy through a simple, daily diet. Increased emphasis on gluten-free and low-calorie items also influences innovation in the segment.

Breakfast cereals are also fast emerging in the GCC functional foods market, as consumers with increasing health awareness and busy lifestyles prefer healthy and easy-to-eat food. Enriched with fiber, proteins, and essential nutrients, these products offer a balanced meal. Their increasing demand and easy availability from modern retailing outlets contribute to their popularity within the region.

Snack and functional bars are quickly gaining popularity in the GCC functional foods market. They attract young, active individuals seeking fast, on-the-go nutrition. They are mainly rich in proteins, energy-boosting ingredients, and superfoods such as chia seeds and nuts. Their convenience and ability to satisfy different types of diets, be it keto or high-protein diets, make them a favorite for urban dwellers.

Analysis by Ingredient:

- Probiotics

- Minerals

- Proteins and Amino Acids

- Prebiotics and Dietary Fiber

- Vitamins

- Others

Probiotics are gaining an increasing share in the GCC functional foods market because of their well-documented gut health and immune benefits. These products, mainly yogurts, beverages, and supplements, are enriched with probiotics and are gaining popularity among health-conscious consumers, who are on the lookout for digestive health-related products and benefits from probiotics for overall well-being.

Minerals are a key segment in the market and include fortified foods that have added calcium, iron, and zinc that address various nutritional gaps in diets. Common deficiencies, such as those concerning bones, immunity, and energy levels, are addressed by these functional foods. Mineral-fortified foods are in high demand among children, pregnant women, and the elderly populations of GCC. As a result, growth in this sector remains steady.

Functional food sales in the GCC are also dominated by proteins and amino acids, with rising demand for solutions to achieve fitness and build muscle. High-protein snacks, bars, and beverages are widely sought after by athletes and individuals with active lifestyles. Consumers are also seeking more plant-based and whey protein alternatives to aid weight management, energy, and health, driving market expansion.

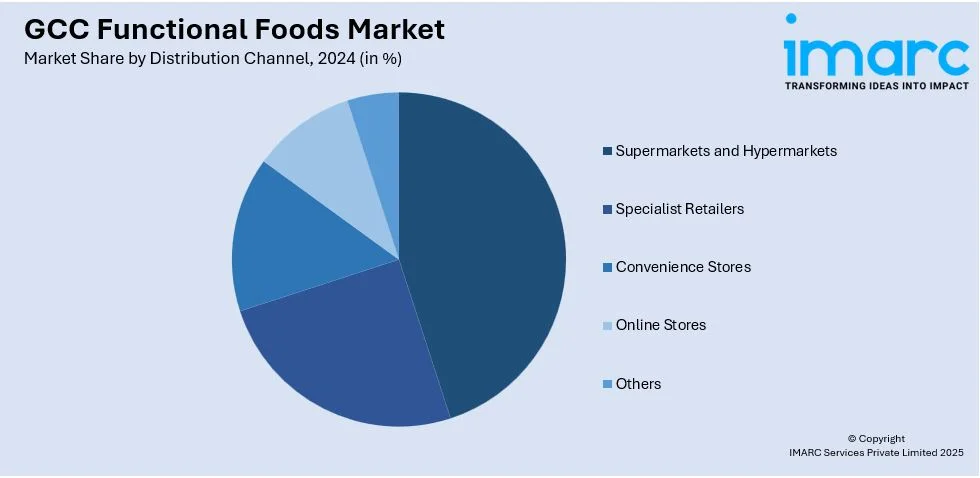

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialist Retailers

- Convenience Stores

- Online Stores

- Others

The GCC functional foods market is mainly dominated by supermarkets and hypermarkets. They have a huge number of products available and provide all the amenities at one stop, thus attracting a larger base of customers. Their periodic promotions, offers, and wide accessibility in both urban and suburban locations make these big retail chains the ideal place for purchasing functional food products.

Specialist retailers target a niche audience seeking specific functional food products tailored to dietary needs, such as organic, gluten-free, or high-protein items. These stores offer expert recommendations and personalized service, appealing to health-conscious consumers. Their focus on premium and exclusive offerings, along with the availability of international brands, contributes to their growing popularity in the GCC.

Convenience stores are becoming a growing retail channel for functional foods. Accessibility and a quick-service format attract time-pressured urban consumers seeking healthy, ready-to-go snack and beverage items. Strategically located in residential neighborhoods, offices, and transportation terminals, convenience stores capitalize on the consumer need for an immediate response, thus contributing more to growth.

Analysis by Application:

- Sports Nutrition

- Weight Management

- Clinical Nutrition

- Cardio Health

- Others

Sports nutrition forms a dominant application in GCC functional foods due to the flourishing culture of fitness and active lifestyles. Protein bars, energy drinks, and other supplements are hugely sought after by sports individuals and those who exercise. An increased number of gyms and sporting activities has boosted the popularity of functional foods in the performance recovery category as well.

Weight management represents a key application segment, fueled by the continually increasing rates of obesity and better health awareness about functional foods meant to support body weight control. Low-calorie snacks, replacement shakes for meals, and high-protein products are gathering momentum among consumers seeking successful and convenient measures. These comprise some of the most popular goods for those intent on healthier life choices and also reaching fitness goals.

Clinical nutrition is of immense importance to the GCC functional foods market, as it caters to the dietary needs of patients and individuals with specific medical conditions. Functional foods endowed with necessary and essential nutrients are used to manage conditions such as diabetes, cardiac diseases, and gastrointestinal disorders, amongst others. These foods are found more in hospitals and healthcare segments where customized food is an important element that determines recovery.

Analysis by Country:

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

Saudi Arabia leads the GCC functional foods market, supported by a large population and increased awareness about health issues. Rising incidences of lifestyle-related diseases, along with the support of the government toward healthy diets, enhance demand. Increased penetration of modern retail outlets and online portals enhances accessibility, and the high disposable incomes facilitate the expansion of premium functional food products.

The health-conscious public and a vigorous fitness culture help the UAE act as an ideal market for functional foods. The country also has many expats residing there, along with an increase in urban population, hence enhancing demand for multiple innovative products. The advanced retailing infrastructure of the country, such as supermarkets, hypermarkets, and specialty stores, is further enhancing the wide acceptance of functional food by local consumers and international markets.

Steady growth in the functional foods market in Qatar is a result of increasing health awareness and a focus on preventive healthcare. High disposable incomes and modern retail landscapes make functional foods more accessible to consumers. Qatar's attempts at diversification in the economy, as well as in its quality of life, through health-conscious initiatives contribute further to functional food product adoption.

Competitive Landscape:

Key players in the GCC functional foods market are driving growth through strategic investments, product innovation, and regional expansion. This is primarily aligned with region-specific preferences among consumers in the GCC. Many companies are now developing functional food using advanced technology supported with probiotics, vitamins, and minerals. This reflects the expanding demand for a healthier lifestyle in consumers. Partnerships with retail and e-commerce platforms are increasing the visibility and availability of products for a wider population. In addition, key players are working with government health initiatives to support regional wellness objectives. Sustainability measures such as green packaging and the use of local ingredients are further making them more attractive to environmentally conscious consumers.

The report provides a comprehensive analysis of the competitive landscape in the GCC functional foods market with detailed profiles of all major companies.

Latest News and Developments:

- 28 June 2023: House of Pop, a leading healthy frozen desserts brand based in Dubai, has entered into an Indication of Interest (IO) agreement with Saudi partners to open over 80 shops over the next six years and is also deliberating agreements with franchises in Oman, Qatar, and Kuwait. This expansion comes as a result of consumer trends in the Middle East, demanding personalization and plant-based and functional foods in the desserts sector.

GCC Functional Foods Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Bakery Products, Breakfast Cereals, Snack/Functional Bars, Dairy Products, Baby Food, Others |

| Ingredients Covered | Probiotics, Minerals, Proteins and Amino Acids, Prebiotics and Dietary Fiber, Vitamins, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialist Retailers, Convenience Stores, Online Stores, Others |

| Applications | Sports Nutrition, Weight Management, Clinical Nutrition, Cardio Health, Others |

| Countries Covered | Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, Oman |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC functional foods market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC functional foods market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC functional foods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The functional foods market in the GCC was valued at USD 4.7 Billion in 2024.

The increasing prevalence of lifestyle-related diseases, such as diabetes and obesity, growing consumer awareness about health and wellness, government initiatives promoting nutrition and preventive healthcare, expansion of modern retail and e-commerce platforms, and rising investments in innovation and regionally tailored functional food products are the primary factors driving the GCC functional foods market.

IMARC estimates the GCC functional foods market to exhibit a CAGR of 9.5% during 2025-2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)