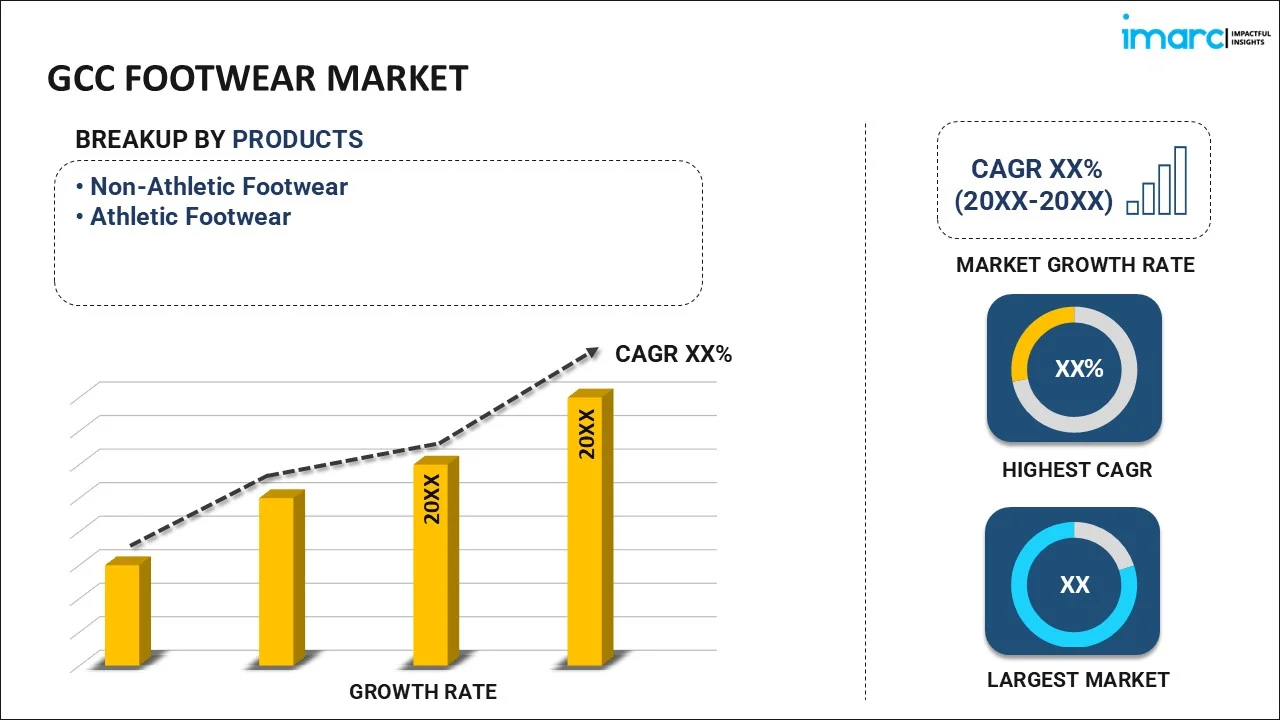

GCC Footwear Market Report by Product (Non-Athletic Footwear, Athletic Footwear), Material (Rubber, Leather, Plastic, Fabric, and Others), Distribution Channel (Footwear Specialists, Supermarkets and Hypermarkets, Departmental Stores, Clothing Stores, Online Sales, and Others), Pricing (Premium, Mass), End User (Men, Women, Kids), and Country 2025-2033

GCC Footwear Market Size:

The GCC footwear market size reached USD 4.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.8 Billion by 2033, exhibiting a growth rate (CAGR) of 3.41% during 2025-2033. The market is mainly driven by the increase in fashion awareness and rising disposable incomes, along with an increase in e-commerce adoption. The presence of international brands and robust retail infrastructure in the region, including extensive model networks, further propels the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.9 Billion |

|

Market Forecast in 2033

|

USD 6.8 Billion |

| Market Growth Rate 2025-2033 | 3.41% |

GCC Footwear Market Analysis:

- Major Market Drivers: The market is mainly driven by various key factors which contributes to its growth and expansion. The rising fashion consciousness among consumers in the GCC, along with the inflating disposable income, is significantly boosting the demand for both luxury and casual footwear. In line with this, rapid urbanization and the development of retail infrastructure, which includes expansive shopping malls and ecommerce platforms, facilitate easy access to a wide array of footwear products. Seasonal sales promotion and shopping festivals like Dubai shopping festival further stimulate the consumer spending on footwear. Moreover, the growing tourism in the GCC has also led to an increase in demand for comfortable and stylish footwear from tourists. Furthermore, health and wellness trends also influence the market significantly because there is a growing demand of sports footwear mainly driven by the heightened interest in fitness activities, which is further propelling the GCC footwear market growth.

- Key Market Trends: The market is witnessing various prominent trends, including the rising preference of online shopping mainly fueled by convenience and variety it offers, which has led to proliferation of ecommerce platforms specializing in footwear. There is also a growing inclination towards sustainable and eco-friendly footwears as consumers nowadays become more environmentally conscious. Furthermore, the market is witnessing the rise in demand for athleisure shoes mainly driven by the increase in health and fitness awareness among consumers. Luxury footwear remains popular with its high demand for exclusive and designer brands, further reflecting the GCCs affluent consumer base and its taste for opulence.

- Competitive Landscape: The key players in the GCC footwear market are mainly focusing on expanding their digital presence and enhancing e-commerce platforms to capitalize on shift towards online shopping. They are also introducing eco-friendly and innovative products to cater to rising demand for sustainability. Strategic partnerships and collaborations with fashion icons and celebrities help drive brand visibility and its appeal. Furthermore, companies nowadays are investing in aggressive marketing campaigns and significantly participating in GCC trade shows and fashion events to solidify their market presence and attract a diverse consumer base. The report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

- Challenges and Opportunities: The market faces various challenges, including competition from both local and international brands, which can pressure profit margins. In line with this, fluctuation in raw material prices and the growing need for compliance with various international standards can increase operational costs. On the opportunity side, the GCC’s high per capita income and fashion-conscious population present substantial potential for luxury and designer footwear brands. There is also significant opportunity in expanding online sales platforms, which have seen rising consumer preference post pandemic. Furthermore, the growing trend towards sustainability offer a chance for brands to innovate with ecofriendly materials and production processes.

GCC Footwear Market Trends:

Growth of E-Commerce Platforms

The e-commerce sector’s growth within the market is generally fueled by a significant shift in consumer shopping behaviors with more consumers opting to purchase shoes online rather than visiting the stores in person. The rise in e-commerce is further amplified by the convenience and safety of shopping from home, an aspect that has become particularly appealing in post pandemic era. According to a report published by the International Trade Administration, the UAE leads in e-commerce among GCC states with the 53% market jump in the year 2020, further reaching $3.9 billion mainly due to the COVID-19 pandemic. Furthermore, the transition is mainly supported by the development of robust digital platforms which offers a wide array of footwear options, user friendly interfaces and enhanced consumer services features like virtual try-ons and easy returns.

Technological Advancements

In the GCC footwear market, technological advancements are prominently marked by the integration of AI technologies, enhancing both customer service and inventory management. AI is utilized to streamline customer interactions, offering personalized shopping experiences through chatbots that provide product recommendations and support. Additionally, AI aids in inventory management by analyzing sales data to forecast demand, optimize stock levels, and prevent overstock situations. The UAE and Saudi Arabia partnered with Huawei and Alibaba to develop their tech infrastructure, including 5G networks and smart city applications. In September 2023, Huawei launched a "cloud region" in Riyadh to support government services and AI applications. Chinese scholars also play a significant role in leading AI research in these countries. This not only improves operational efficiency, but also ensures that customer needs are met promptly and accurately, enhancing overall customer satisfaction.

Rising Health Awareness

The GCC footwear market's shift towards health and wellness has notably fueled the popularity of sports and athleisure footwear. This trend is driven by a broader health consciousness among consumers, who are increasingly engaging in fitness activities and adopting healthier lifestyles. As a result, there is a higher demand for footwear that not only supports athletic performance, but also fits the casual, health-oriented lifestyle of consumers. This has led footwear brands to innovate and expand their offerings in sports shoes and athleisure footwear, meeting both functional and fashion needs of the health-aware consumer base.

GCC Footwear Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on product, material, distribution channel, pricing, and end user.

Breakup by Product:

- Non-Athletic Footwear

- Athletic Footwear

Non-Athletic accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product. This includes non-athletic and athletic footwear. According to the report, non-athletic footwear represented the largest segment.

Non-athletic footwear dominates the market, reflecting a broad consumer preference for versatile and stylish options suitable for everyday wear, formal occasions, and work environments. This segment's strength lies in its wide appeal across diverse consumer groups, offering designs that blend comfort with style, which is crucial in a region known for both its high standards of living and strong cultural affinity for fashion. The widespread availability of non-athletic shoes across various price points and styles helps maintain their popularity, ensuring they meet the fashion and practical needs of a significant portion of the market.

Breakup by Material:

- Rubber

- Leather

- Plastic

- Fabric

- Others

Leather holds the largest share of the industry

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes rubber, leather, plastic, fabric, and others. According to the report, leather accounted for the largest market share.

Leather holds the largest share in the GCC footwear market, predominantly due to its durability, comfort, and luxury appeal, which aligns well with the region's consumer preferences. In the GCC, where style and quality are highly prized, leather footwear is regarded as a staple for its ability to combine elegance with practicality. This preference supports a robust market for leather shoes, which are favored across various segments, including formal, casual, and luxury footwear, meeting the needs and tastes of a diverse and fashion-conscious population.

Breakup by Distribution Channel:

- Footwear Specialists

- Supermarkets and Hypermarkets

- Departmental Stores

- Clothing Stores

- Online Sales

- Others

Footwear Specialists represent the leading market segment

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes footwear specialists, supermarkets and hypermarkets, departmental stores, clothing stores, online sales, and others. According to the report, footwear specialists represented the largest segment.

In the GCC footwear market, footwear specialists hold the dominant market segment, showcasing the region's preference for specialized retail experiences. These outlets cater specifically to footwear, offering a wide array of brands and styles, which appeals to consumers seeking expert advice and a dedicated shopping experience. This segment's strength is further bolstered by a consumer base that values quality and specificity in their purchases, making these specialist stores key destinations for both everyday buyers and fashion enthusiasts looking for the latest trends and the best in footwear options.

Breakup by Pricing:

- Premium

- Mass

Mass is the largest segment in the market

The report has provided a detailed breakup and analysis of the market based on the pricing. This includes premium and mass. According to the report, mass represented the largest segment.

The mass pricing segment holds the largest GCC footwear market share. This reflects the broad consumer base's preference for affordable footwear options that offer good value for money. The majority of consumers in the GCC are price-conscious and opt for footwear that balances cost with quality and style. This segment thrives due to its wide appeal, catering to a diverse demographic that demands functional yet fashionable shoes at accessible price points, making it a crucial driver of the overall market volume.

Breakup by End User:

- Men

- Women

- Kids

Women is the predominant market segment

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes men, women, and kids. According to the report, women accounted for the largest market share.

In the GCC footwear market, women represent the largest consumer segment. This dominance is driven by women's diverse needs and fashion sensibilities, which require a wide variety of footwear for different occasions, from daily wear to formal events. Women's collections often include everything from high heels and ballet flats to boots and sandals, reflecting a wide range of styles that cater to various age groups, lifestyles, and preferences. This broad demand makes women a pivotal demographic in the footwear market, influencing trends and driving substantial sales across the region.

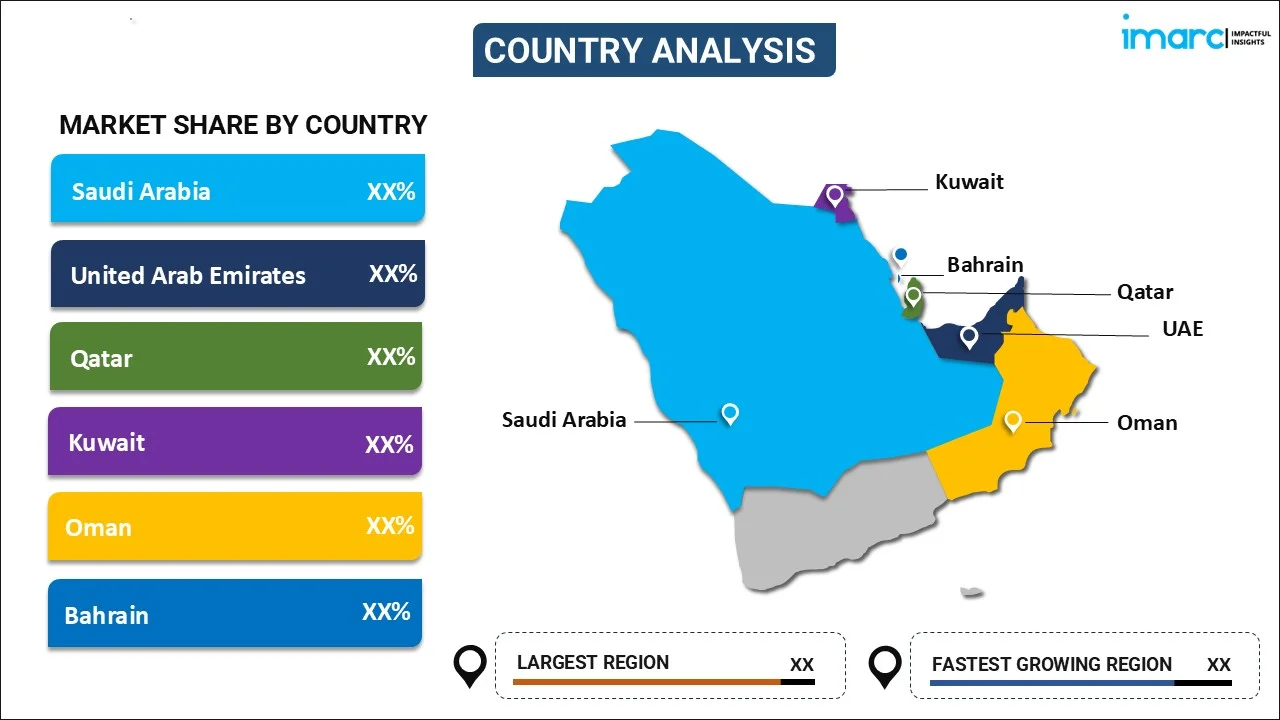

Breakup by Country:

- Saudi Arabia

- UAE

- Qatar

- Oman

- Kuwait

- Bahrain

Saudi Arabia leads the market, accounting for the largest market share

The report has also provided a comprehensive analysis of all the major markets in the region, which include Saudi Arabia, UAE, Qatar, Oman, Kuwait, and Bahrain. According to the report, Saudi Arabia was the largest market for footwear in the GCC.

Saudi Arabia holds the predominant position in the GCC footwear market, accounting for the largest market share. This leadership is driven by its significant population size, strong economic status, and a well-developed retail sector featuring numerous luxury and mainstream shopping destinations. The country's diverse consumer base, which includes a large number of expatriates alongside local residents, further contributes to a dynamic market environment where various footwear styles and price points find demand, ensuring robust sales across the sector.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have been provided.

- The competitive landscape of the GCC footwear market is characterized by a mix of local and international brands vying for dominance. Key players leverage strong retail presence, both through physical stores and online platforms, to capture consumer interest. Luxury and designer footwear brands thrive due to the region's affluent consumer base, while mass-market brands appeal widely with affordability and variety. Technological integration in terms of e-commerce and customer service innovations is also a critical competitive factor, as brands strive to enhance consumer experience and operational efficiency.

GCC Footwear Market News:

- In May 2024, Nike has partnered with the Olympic Refuge Foundation to support displaced youth in accessing sports. The collaboration involves financial contributions to aid the Foundation's programs, including providing training and competition uniforms for refugee athletes at the Paris 2024 Olympics. The initiative aims to impact 7,000 young people in Paris by 2025 and expand to reach one million displaced youth globally by 2024, promoting the benefits of safe sport for mental health and community integration.

- In April 2024, New Balance reintroduced the 1000 shoe model and unveiled British rapper Dave as its latest brand ambassador. This collaboration expands New Balance's roster of original talent, with Dave set to represent the brand alongside the relaunch of the 1000, showcasing a blend of style and celebrity endorsement in their marketing strategy.

GCC Footwear Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products | Non-Athletic Footwear, Athletic Footwear |

| Materials | Rubber, Leather, Plastic, Fabric, Others |

| Distribution Channels | Footwear Specialists, Supermarkets and Hypermarkets, Departmental Stores, Clothing Stores, Online Sales, Others |

| Pricings | Premium, Mass |

| End Users | Men, Women, Kids |

| Countries Covered | Saudi Arabia, UAE, Qatar, Oman, Kuwait, Bahrain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC footwear market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the GCC footwear market.

- The study maps the leading, as well as the fastest-growing, markets. It further enables stakeholders to identify the key country-level markets within the region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC footwear industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The GCC footwear market was valued at USD 4.9 Billion in 2024.

We expect the GCC footwear market to exhibit a CAGR of 3.41% during 2025-2033.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of footwear across the nation.

The expanding export of leather-made footwear, along with the increasing demand for sports-focused footwear owing to the high participation in athletic and fitness activities, is primarily driving the GCC footwear market.

Based on the product, the GCC footwear market can be bifurcated into non-athletic footwear and athletic footwear, where non-athletic footwear currently accounts for the majority of the total market share.

Based on the material, the GCC footwear market has been divided into rubber, leather, plastic, fabric, and others. Currently, leather holds the largest market share.

Based on the distribution channel, the GCC footwear market can be segmented into footwear specialists, supermarkets and hypermarkets, departmental stores, clothing stores, online sales, and others. Among these, footwear specialists exhibit a clear dominance in the market.

Based on the pricing, the GCC footwear market has been categorized into premium and mass, where mass currently holds the majority of the total market share.

Based on the end user, the GCC footwear market can be segregated into men, women, and kids. Currently, women account for the largest market share.

On a regional level, the market has been classified into Saudi Arabia, UAE, Qatar, Oman, Kuwait, and Bahrain, where Saudi Arabia currently dominates the GCC footwear market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)