GCC Flexible Packaging Market Report by Raw Material Type (Polymer, Paper, Foil), Product Type (Pouches and Bags, Squeezable Bottles, and Others), Application (Food and Beverages, Non-Food, Consumer Products, Pharmaceuticals, and Others), Printing Technology (Rotogravure, Flexography, Offset, Digital, and Others), and Country 2025-2033

Market Overview:

The GCC flexible packaging market size reached USD 3.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.3 Billion by 2033, exhibiting a growth rate (CAGR) of 5.38% during 2025-2033. The increasing demand for packaged products, the rising purchasing power and consumer spending on packaged goods, the changing consumer preferences for convenience and on-the-go products, and the expanding retail sector in the GCC region are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 6.3 Billion |

| Market Growth Rate (2025-2033) | 5.38% |

Flexible packaging refers to a versatile and innovative solution for packaging various products. It is a lightweight and adaptable packaging format that offers numerous benefits. It is manufactured from plastic films, aluminum foil, or paper. It provides excellent protection against moisture, light, and oxygen, extending the shelf life of perishable goods. It offers flexibility, allowing it to conform to the product's shape and reduce wastage. It is also lightweight, reducing transportation costs and carbon emissions. Moreover, flexible packaging is easy to open, resealable, and offers convenience to consumers. The versatility of flexible packaging enables its use across a wide range of industries, including food and beverages, pharmaceuticals, personal care products, and more. It offers branding opportunities with customizable printing options, vibrant colors, and eye-catching designs. It is environmentally friendly, typically requiring fewer manufacturing resources and generating less waste than traditional packaging. It is also recyclable and offers the potential for innovative sustainable materials. It is a modern solution that combines functionality, convenience, and sustainability, meeting the evolving needs of both consumers and businesses.

The market in GCC is majorly driven by the increasing shift from traditional rigid packaging formats to flexible packaging due to its advantages, such as space efficiency, reduced transportation costs, and improved product visibility. In line with this, the GCC region is a hub for international trade and export. Flexible packaging offers numerous advantages, making it suitable for export-oriented industries and significantly contributing to the market. Furthermore, the rising focus on hygiene and food safety is positively influencing product demand as it offers superior barrier properties, ensuring food safety and hygiene by protecting products from contaminants, moisture, and tampering. Apart from this, the rapid growth of e-commerce in the GCC region has created a need for durable, secure, and lightweight packaging solutions. Flexible packaging provides cost-effective and protective packaging options for online deliveries, catalyzing the market. Moreover, the GCC region has a growing pharmaceutical and healthcare sector. Flexible packaging provides advantages like tamper-evidence, protection from light and moisture, and extended shelf life, making it an ideal choice for this industry. Besides, the heavy investments by the key players in the packaging infrastructure, including establishing new packaging facilities and adopting advanced machinery, support the market expansion. Additionally, governments across GCC countries are implementing regulations and standards to ensure the safety and quality of packaged products. This has encouraged manufacturers to adopt flexible packaging solutions that comply with these regulations, creating a positive outlook for the market.

GCC Flexible Packaging Market Trends/Drivers:

Rapid technological advancements

Rapid technological advancements are propelling the market. The packaging industry is embracing new technologies that enhance the functionality, sustainability, and aesthetics of flexible packaging solutions. The development of high-performance barrier films is fueling the market. These films provide excellent protection against moisture, oxygen, and light, extending the shelf life of perishable goods and preserving product quality. Advanced barrier technologies, such as nanotechnology and multilayer structures, enable manufacturers to create flexible packaging with superior barrier properties. Furthermore, advanced printing techniques such as digital printing and high-definition flexography allow for vibrant and detailed designs, enhancing product branding and shelf appeal. Customizable printing options enable manufacturers to create unique and eye-catching packaging that stands out in the market. Moreover, innovative manufacturing processes and machinery have improved production efficiency and reduced costs. Advanced automation and robotics have made the production of flexible packaging faster, more precise, and less labor-intensive. These advancements enable manufacturers to meet the evolving needs of consumers and industries while providing innovative and functional packaging solutions.

Increasing shift toward sustainable packaging

The increasing shift towards sustainable packaging is stimulating the market. As consumers and businesses become more environmentally conscious, there is a growing demand for packaging solutions that minimize waste, reduce carbon footprint, and support a circular economy. Flexible packaging offers several sustainability advantages that contribute to its market growth. It utilizes fewer resources than traditional packaging formats, such as rigid containers or glass bottles. Flexible packaging typically requires less material for production, leading to reduced energy consumption and lower greenhouse gas emissions during manufacturing. Furthermore, the flexible packaging is lightweight, which significantly reduces transportation costs and fuel consumption. The lightweight nature of flexible packaging also contributes to lower carbon emissions throughout the supply chain. Moreover, flexible packaging offers sustainable materials and recycling options. Many flexible packaging products are made from recyclable materials, such as high-density polyethylene (HDPE) or polyethylene terephthalate (PET), which can be recycled and reused to produce new packaging or other products. Additionally, technological advancements in recycling processes have made it easier to recycle flexible packaging materials, further enhancing their sustainability profile.

Significant growth in the food and beverage industry across the region

The growth in the food and beverage industry is favorably impacting the market growth across the region. As the demand for packaged food and beverages continues to rise, manufacturers increasingly turn to flexible packaging solutions for various reasons. Flexible packaging provides several benefits that align with the requirements of the food and beverage industry. It offers excellent product protection, preserving food and beverages' freshness, flavor, and quality. The barrier properties of flexible packaging materials protect against moisture, oxygen, and light, extending the shelf life of perishable goods. Furthermore, the flexible packaging enables attractive branding and shelf appeal. With customizable printing options, vibrant colors, and innovative designs, manufacturers can create visually appealing packaging that stands out on store shelves and attracts consumers. Additionally, flexible packaging offers convenience features consumers value, such as resealable closures, easy-to-open seals, and portion control options. These features enhance the usability and convenience of food and beverage products, driving consumer satisfaction and loyalty. Moreover, flexible packaging is lightweight and space-efficient, reducing transportation costs and carbon emissions. This makes it a cost-effective and environmentally friendly choice for manufacturers, contributing to market expansion.

GCC Flexible Packaging Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC flexible packaging market report, along with forecasts at the regional and country levels from 2025-2033. Our report has categorized the market based on raw material type, product type, application and printing technology.

Breakup by Raw Material Type:

- Polymer

- Paper

- Foil

Polymer dominates the market

The report has provided a detailed breakup and analysis of the market based on raw material type. This includes polymer, paper, and foil. According to the report, polymer represented the largest segment.

Polymers, such as polyethylene (PE) and polypropylene (PP), offer excellent versatility, durability, and barrier properties, making them ideal for flexible packaging applications. The popularity of polymers in the GCC region can be attributed to their ability to meet the diverse packaging needs of various industries. Polymers can be easily molded and shaped into different forms, allowing for the production of flexible packaging solutions that cater to a wide range of product sizes and shapes.

Furthermore, polymers offer excellent protection against moisture, oxygen, and other external factors, ensuring the quality and freshness of packaged goods. This is particularly important in the food and beverage industry, where maintaining product integrity is crucial. Polymers also contribute to the growth of the flexible packaging market in the GCC region due to their cost-effectiveness. They are relatively affordable compared to other raw materials, making them an attractive choice for manufacturers looking to optimize production costs. Moreover, polymers are lightweight, which reduces transportation costs and carbon emissions, aligning with the region's focus on sustainability.

Breakup by Product Type:

- Pouches and Bags

- Squeezable Bottles

- Others

Pouches and bags hold the largest share of the market

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes pouches and bags, squeezable bottles, and others. According to the report, pouches and bags accounted for the largest market share.

Pouches and bags offer a wide range of benefits that cater to the diverse packaging needs of industries in the region. They are highly versatile, allowing for easy size, shape, and functionality customization. This flexibility makes them suitable for packaging various products, ranging from food and beverages to personal care items and pharmaceuticals. The convenience features offered by pouches and bags, such as resealable closures and easy-open seals, enhance consumer usability and contribute to market growth.

Their lightweight nature and compact design also contribute to cost-effective transportation, reducing logistics expenses and carbon emissions. Furthermore, pouches and bags provide ample space for branding and product information, offering opportunities for eye-catching designs and marketing messages. Their attractive shelf presence helps products stand out in competitive retail environments, driving consumer appeal and purchase decisions. The growing demand for on-the-go and single-serve products in the GCC region further fuels the popularity of pouches and bags. Their portability and portion control capabilities make them ideal for these consumption trends.

Breakup by Application:

- Food and Beverages

- Non-Food

- Consumer Products

- Pharmaceuticals

- Others

Food and Beverages hold the largest share of the market

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes food and beverages, non-food, consumer products, pharmaceuticals, and others. According to the report, food and beverages accounted for the largest market share.

The food and beverages sector is a significant consumer of flexible packaging due to its numerous advantages and specific packaging requirements. Flexible packaging provides excellent product protection, extending the shelf life of food and beverages by safeguarding them against moisture, oxygen, and other external factors. This protection ensures the freshness, flavor, and quality of perishable goods, meeting the industry's demand for high-quality packaging solutions. Moreover, the food and beverages industry values the convenience features of flexible packaging, such as resealable closures, easy-to-open seals, and portion control options. These features enhance consumer usability and contribute to the growing popularity of flexible packaging in the industry.

Additionally, flexible packaging offers branding opportunities through customizable printing options, vibrant colors, and innovative designs. This enables food and beverage manufacturers to create visually appealing packaging that stands out on store shelves and attracts consumers. Furthermore, the lightweight and space-efficient nature of flexible packaging reduces transportation costs and carbon emissions, making it a cost-effective and sustainable choice for the industry.

Breakup by Printing Technology:

- Rotogravure

- Flexography

- Offset

- Digital

- Others

Rotogravure holds the largest share of the market

A detailed breakup and analysis of the market based on the printing technology have also been provided in the report. This includes rotogravure, flexography, offset, digital, and others. According to the report, rotogravure accounted for the largest market share.

Rotogravure printing is a high-quality and efficient printing method with several advantages, driving its widespread adoption. It excels in reproducing vibrant colors, intricate designs, and fine details, making it ideal for visually appealing packaging that attracts consumers. The high-resolution printing capability of rotogravure ensures sharp and crisp images, enhancing the aesthetic appeal of flexible packaging. Additionally, rotogravure printing provides excellent ink coverage and consistency, producing vibrant and long-lasting printed designs. This is particularly important in the highly competitive food and beverage industry, where packaging is crucial in brand recognition and product differentiation.

Moreover, rotogravure printing allows for a wide range of printable substrates, including various polymers and films used in flexible packaging. This versatility enables manufacturers to achieve the desired visual and tactile effects while maintaining the functional properties of the packaging. Furthermore, rotogravure printing offers high-speed production capabilities, improving efficiency and reducing costs for large-volume printing. This is beneficial for meeting the growing demand in the GCC region, where the food and beverage industry is expanding rapidly.

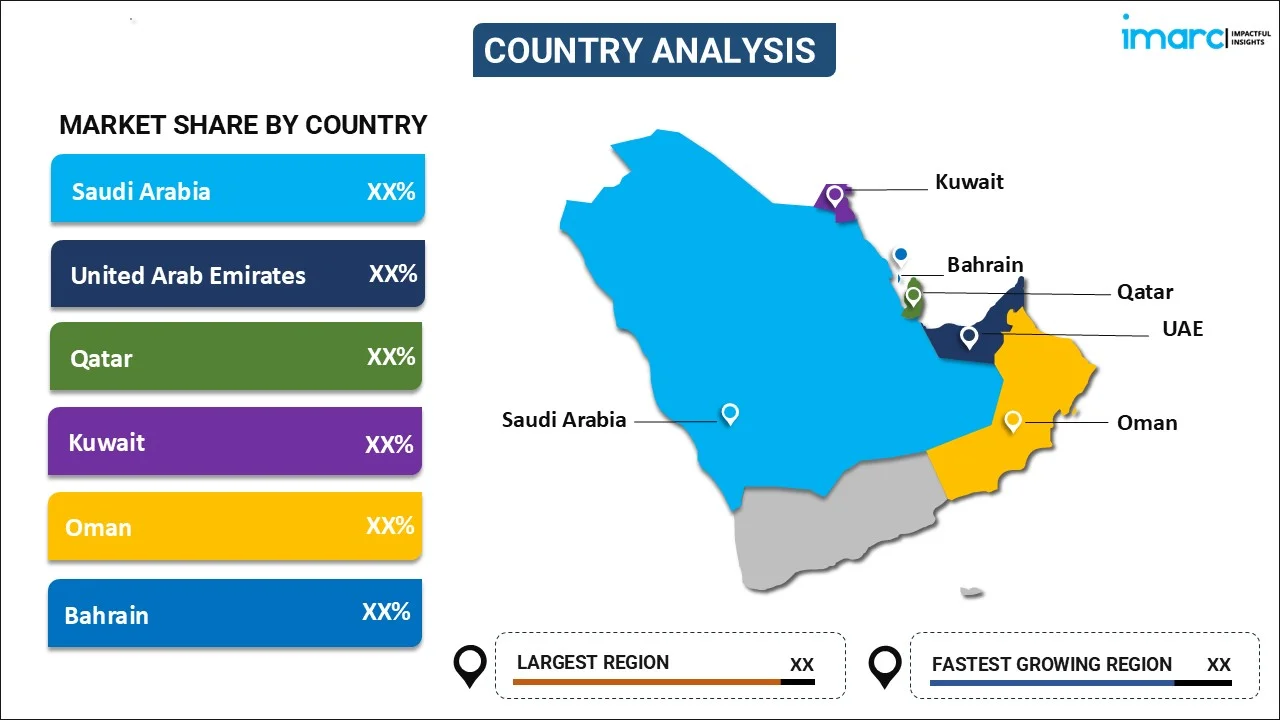

Breakup by Country:

- Saudi Arabia

- UAE

- Oman

- Kuwait

- Bahrain

- Qatar

Saudi Arabia exhibits a clear dominance, accounting for the largest market share

The report has also provided a comprehensive analysis of all the major regional markets, which include Saudi Arabia, UAE, Oman, Kuwait, Bahrain, and Qatar.

Several factors contribute to Saudi Arabia's leading position in the flexible packaging industry. Saudi Arabia has a large and growing population, increasing urbanization and consumer spending. This drives the demand for packaged goods and creates a thriving market for flexible packaging solutions. Furthermore, the country has a strong manufacturing base, with numerous local and international companies operating in the region. These companies cater to various industries, including food and beverages, pharmaceuticals, personal care, and more, generating substantial demand for flexible packaging.

Moreover, the government’s focus on economic diversification and industrial development has led to significant investments in infrastructure, including packaging facilities and advanced machinery. This supports the growth of the flexible packaging market by enhancing production capabilities and efficiency. Besides, the geographical location of Saudi Arabia and its status as a regional trade hub contributes to its dominance in the flexible packaging market. The country serves as a gateway for import and export activities, attracting multinational companies and stimulating the demand for flexible packaging solutions. These factors create a favorable market growth environment, attracting local and international players and contributing to the overall expansion of the flexible packaging industry in the GCC region.

Competitive Landscape:

The top flexible packaging companies in the GCC region play a crucial role in fostering the market. These companies lead the way with their innovative solutions, expertise, and strong market presence. They are investing in research and development to develop advanced and sustainable packaging materials and technologies. They continuously strive to improve the functionality, barrier properties, and eco-friendliness of their packaging solutions, aligning with the evolving needs of consumers and industries. Furthermore, these companies have robust manufacturing capabilities and a wide range of production capabilities, allowing them to cater to diverse packaging requirements. They can produce a variety of packaging formats, including pouches, bags, films, and labels, for various industries such as food and beverages, pharmaceuticals, personal care, and more. Additionally, these companies prioritize customer satisfaction and collaboration. They work closely with their clients to understand their specific packaging needs, provide customized solutions, and offer efficient supply chain management to ensure timely delivery. Moreover, these companies have strong distribution networks and market reach, enabling them to serve domestic and international markets. Their ability to meet the demand for flexible packaging across the GCC region and beyond contributes to the overall market growth.

The report has provided a comprehensive analysis of the competitive landscape in the GCC flexible packaging market. Detailed profiles of all major companies have also been provided.

- Huhtamaki

- Rotopak

- Arabian Packaging

- Integrated Plastics Packaging

- Emirates Printing Press

- Emirates Technopack

- Fujairah Plastics

- Amber Packaging Industries LLC

- Saudi Printing & Packaging Co.

- Printo Pack

- APSCO

GCC Flexible Packaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD, Kilo Tons |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Raw Material Types Covered | Polymer, Paper, Foil |

| Product Types Covered | Pouches and Bags, Squeezable Bottles, Others |

| Applications Covered | Food and Beverages, Non-Food, Consumer Products, Pharmaceuticals, Others |

| Printing Technologies Covered | Rotogravure, Flexography, Offset, Digital, Others |

| Countries Covered | Saudi Arabia, UAE, Oman, Kuwait, Bahrain, Qatar |

| Companies Covered | Huhtamaki, Rotopak, Arabian Packaging, Integrated Plastics Packaging, Emirates Printing Press, Emirates Technopack, Fujairah Plastics, Amber Packaging Industries LLC, Saudi Printing & Packaging Co., Printo Pack and APSCO |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC flexible packaging market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC flexible packaging market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC flexible packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The GCC flexible packaging market was valued at USD 3.8 Billion in 2024.

We expect the GCC flexible packaging market to exhibit a CAGR of 5.38% during 2025-2033.

The rising consumer inclination towards flexible packaging as it offers cost-effective alternative for storage issues, minimizes product wastage, and keeps the food safe and suitable for consumption, is primarily driving the GCC flexible packaging market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several GCC nations, resulting in the temporary closure of various end-use industries for flexible packaging.

Based on the raw material type, the GCC flexible packaging market has been segmented into polymer, paper, and foil, where polymer currently holds the majority of the total market share.

Based on the product type, the GCC flexible packaging market can be divided into pouches and bags, squeezable bottles, and others. Currently, pouches and bags exhibit a clear dominance in the market.

Based on the application, the GCC flexible packaging market has been categorized into food and beverages, non-food, consumer products, pharmaceuticals, and others. Among these, food and beverages currently account for the largest market share.

Based on the printing technology, the GCC flexible packaging market can be segregated into rotogravure, flexography, offset, digital, and others. Currently, rotogravure exhibits a clear dominance in the market.

On a regional level, the market has been classified into Saudi Arabia, UAE, Oman, Kuwait, Bahrain, and Qatar, where Saudi Arabia currently dominates the GCC flexible packaging market.

Some of the major players in the GCC flexible packaging market include Huhtamaki, Rotopak, Arabian Packaging, Integrated Plastics Packaging, Emirates Printing Press, Emirates Technopack, Fujairah Plastics, Amber Packaging Industries LLC, Saudi Printing & Packaging Co., Printo Pack, APSCO, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)