GCC Fast Food Market Size, Share, Trends and Forecast by Product Type, End User, and Country, 2025-2033

GCC Fast Food Market Size and Share:

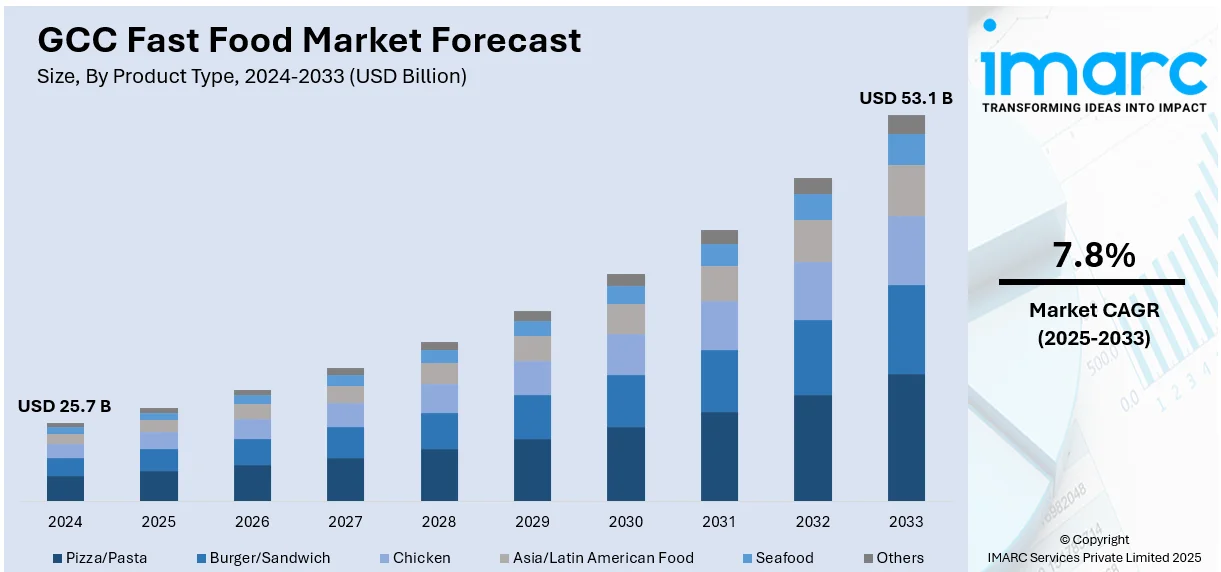

The GCC fast food market size was valued at USD 25.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 53.1 Billion by 2033, exhibiting a CAGR of 7.8% from 2025-2033. The market is driven by growing urbanization rates, rising younger and working population, increasing disposable incomes, growing influence of Western lifestyles, and innovative menu offerings.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 25.7 Billion |

| Market Forecast in 2033 | USD 53.1 Billion |

| Market Growth Rate (2025-2033) | 7.8% |

The GCC fast food market is booming due to increased urbanization and a busy lifestyle within the region that propels consumers to seek fast dining alternatives. Millennials and working professionals, which form a significant population, are also fueling demand for fast food restaurants and food delivery services. This is further complemented by increased disposable incomes, allowing consumers to spend more and visit outlets more frequently. Another preference shift that has positively impacted on the adoption of global fast-food chains is a desire for diversified and international foods, enriching the diversity of offerings in the market.

Online food delivery platforms and mobile apps have made it even easier to access fast food, embedding it into daily routines. Health-conscious trends are also driving the market, with a growing demand for healthier fast-food alternatives, such as vegan and low-calorie options. This trend aligns with increasing awareness about balanced eating habits, prompting innovation among brands to adapt to changing preferences. Fast food providers in Saudi Arabia and the GCC are investing in localized menus that contain flavors and ingredients that appeal to regional tastes. The tourism drive of the government has increased visitors to the region, further growing the food service industry. Social media plays a significant role in building brand visibility, especially among the young and more tech-savvy consumer base that seeks convenience and variety.

GCC Fast Food Market Trends:

Rise of digital food delivery platforms

The fast-food market in the GCC is witnessing an increase in the adoption of digital food delivery platforms that are transforming the dining behavior of consumers. The increasingly tech-friendly population, particularly in the urban regions, is driving people to prefer apps and online portals to order their meals. Services like Talabat, Zomato, and Uber Eats are improving the convenience level while offering cuisines at affordable prices. These platforms make life more convenient and give fast food chains valuable insight into the consumer, thus allowing them to promote to the right audience and create personalized experiences. Adding real-time tracking, loyalty programs, and secure payment options further increases customer satisfaction, making delivery platforms a significant driver of GCC fast food market growth. According to the IMARC Group, the online food delivery market size in UAE reached USD 720.7 Million in 2024 and is estimated to increase nearly double to USD 1,799.1 Million by 2033 with a robust growth of 10.17% CAGR during 2025-2033. This will highlight the dependence upon these digital services that depicts the great influence that fast food markets are generating here.

Rising healthier choices demand

Health-conscious trends shape the GCC fast food landscape as consumers prioritize nutritious and balanced meals. In response, fast food chains are offering healthier alternatives, including vegan, gluten-free, and low-calorie menu options, often incorporating fresh, locally sourced ingredients. This shift comes amid rising awareness about lifestyle diseases and the growing influence of fitness and wellness movements in the region. The Alarabiya news states that, as per the World Obesity Atlas 2024 reports, by 2035, more than half of Saudis will be obese or overweight, which contributes to massive chronic diseases and great costs in the economy, 78% of Saudi women and 76% of men have been affected by obesity, while it is projected that obesity is increasing 2.4% annually. As the region faces this burgeoning health concern, the innovation in quick food service that meets a health-conscious need is deemed a prime response. Those brands catering to such demands of consumers are witnessing rising loyalty as the consumer feels they can have their way of having fast food while not letting health goals be forsaken.

Localization of menus to cater to regional tastes

There has been a growing trend for fast food brands in the GCC countries to localize their menus to suit diverse cultural preferences, reflecting a greater demand for food that appeals to local tastes and traditions. The regional and global chains introducing international flavors and ingredients are also trying to adapt their offerings by including elements of Middle Eastern cuisine, which has substantially increased their popularity among locals. Items like shawarma burgers, hummus-based dips, and falafel wraps are now common as they bring familiar flavors in comforting food formats that appeal to the fast-food industry. This localization strategy strengthens the loyalty of local customers toward a brand and appeals to a broader audience - the tourists seeking authentic, yet modern, culinary experiences. Embracing culturally appropriate ingredients and flavors, fast food chains find a balance between innovation and tradition, which adds appeal to the market by targeting a diverse range of consumers.

GCC Fast Food Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC fast food market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type and end user.

Analysis by Product Type:

- Pizza/Pasta

- Burger/Sandwich

- Chicken

- Asia/Latin American Food

- Seafood

- Others

On the basis of the product type, the GCC fast food market has been categorized into pizza/pasta, burger/sandwich, chicken, Asia/Latin American food, and seafood. Pizza/pasta is a favorite among crowds as it is versatile, comes in customizable flavors, and is in high demand by all age groups. Burger/sandwich is in demand due to its convenience and appeal to on-the-go consumers, with premium and plant-based options gaining importance. Affordability and versatility in diverse cuisines are the sources of strength for the chicken segment. Asia/Latin American food is gaining momentum since its flavors are bold and very diverse. This appeals to growing multicultural preferences in the area. Seafood is more attractive to health-conscious consumers looking for nutrient-dense food items that suit today's dieting culture.

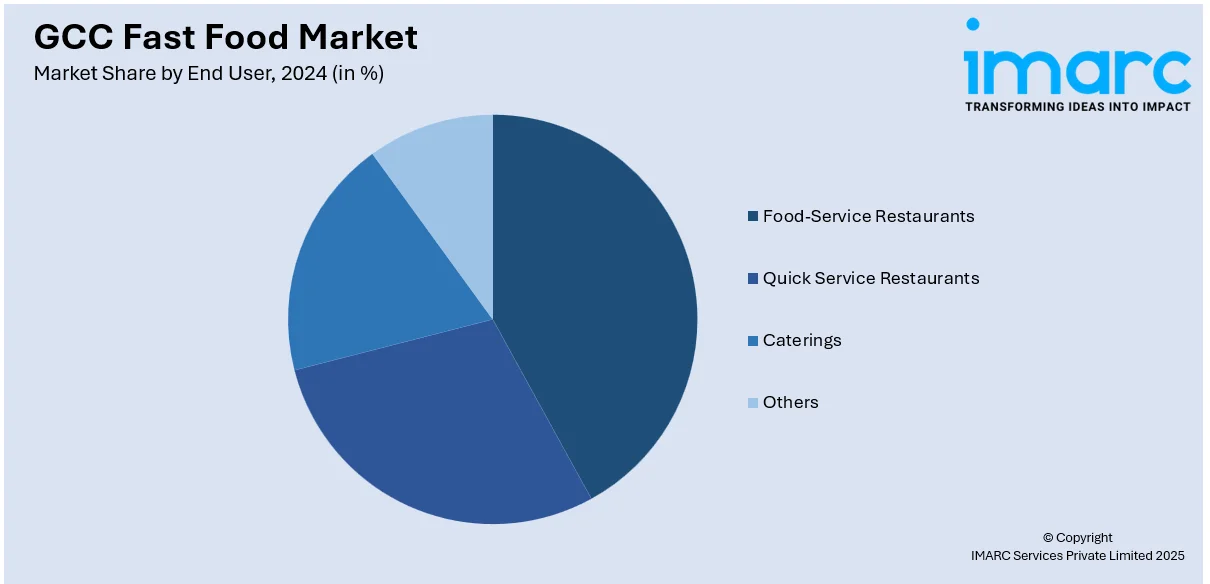

Analysis by End User:

- Food-Service Restaurants

- Quick Service Restaurants

- Caterings

- Others

Based on the end user, the GCC fast food market is classified into food-service restaurants, quick-service restaurants, and catering. Food-service restaurants primarily focus on a dine-in experience and have big menus along with personalized services to fulfill the requirements of customers seeking a leisurely dining experience. Dubai Department of Economic Development (DED) states that, as per the DET report, Dubai residents remain active participants in the city's culinary culture and dine out on average three times a week and there has been a sharp 14% increase in weekly spending. This pattern reflects the increasingly high level of demand for food-service establishments that serve quality food and customized experience for those interested in eating out. Quick-service restaurants are typically associated with speed and affordability, dominating the GCC fast food market share by fulfilling the requirements of busy urban consumers looking for convenience without compromising on quality. The catering segment offers customized fast-food services for events, corporate meetings, and parties, where menus are tailored to the specific client's requirements. This segmentation brings out the diversity in service models within the market, ensuring fast food caters to the preferences and demands of various consumer groups.

Country Analysis:

- Saudi Arabia

- UAE

- Qatar

- Oman

- Kuwait

- Bahrain

The fast-food market in Saudi Arabia, UAE, Qatar, Oman, Kuwait, and Bahrain is growing fast, driven by shifting lifestyles of consumers, increasing urbanization, and rising disposable incomes. In Saudi Arabia, the international tourist influx, with 17.5 Million visiting between January and July 2024, as reported by the Ministry of Tourism, has been significantly boosting demand for diverse and convenient dining options, especially in key cities. The UAE, too, has witnessed tourism growth and the existence of multinational chains that help increase market penetration. Qatar and Oman enjoy high per capita income and infrastructure expansion, which is beneficial for both global and local fast-food brands. Kuwait's established food delivery services are aimed at a digitally connected audience, and Bahrain's diversified demographic preferences drive demand for a variety of cuisines. Besides this, healthier options and halal ones are becoming more in line with the local food trend. With newer technologies like mobile applications, and online ordering, the systems are further simplified, thus improving customer engagement.

Competitive Landscape:

Active outlet expansions through new openings in attractive locations such as shopping malls, airports, and other tourist hotspots characterize key players in the GCC fast food market. Also, menus are becoming locality-based and halal to enhance appeal. Major technological investment in mobile applications for delivery, online ordering capabilities, and loyalty schemes improve the convenience of accessing this fast-food market for a large section of customers. Local food delivery aggregators such as Talabat and Deliveroo are expanding market access. As per the industry reports it is reported that in Oman, Talabat has partnered with the Ministry of Labour, Oman Logistics Association, and Tashgheel launched a training program for 20 job seekers to equip them with skills required for employment in the food delivery sector. There is also the adoption of sustainable practices, including eco-friendly packaging and energy-efficient practices, to align with consumer expectations. Regional brands are now focusing on fresh, locally sourced ingredients to differentiate themselves and cater to a growing customer base that values high-quality, value-driven meals.

The report provides a comprehensive analysis of the competitive landscape in the GCC fast food market with detailed profiles of all major companies.

Latest News and Developments:

- In October 2024, American fast-food chain Chipotle brought its Mexican flavors to Dubai for the first time. At the time of the first store's launch, it was stated that four stores would open in the UAE by the end of 2024.

GCC Fast Food Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Pizza/Pasta, Burger/Sandwich, Chicken, Asia/Latin American Food, Seafood, Others |

| End Users Covered | Food-Service Restaurants, Quick Service Restaurants, Caterings, Others |

| Countries Covered | Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, Oman |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC fast food market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC fast food market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC fast food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Fast food is a quick-service food sector offering convenient ready-to-eat meals. Fast food caters to the busy urban lifestyle in a market that has options in burgers, pizzas, and fried chicken, mostly consumed in malls, drive-thrus, and through delivery services with speed and affordability.

The GCC fast food market was valued at USD 25.7 Billion in 2024.

IMARC estimates the GCC fast food market to exhibit a CAGR of 7.8% during 2025-2033.

The market is driven by the growing urbanization, increasing disposable incomes, the growing influence of Western lifestyles, innovative menu offerings, and tourism and infrastructure development.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)