GCC Facility Management Market Size, Share, Trends and Forecast by Service, Mode of Facility, End User, and Country, 2025-2033

GCC Facility Management Market Size and Share:

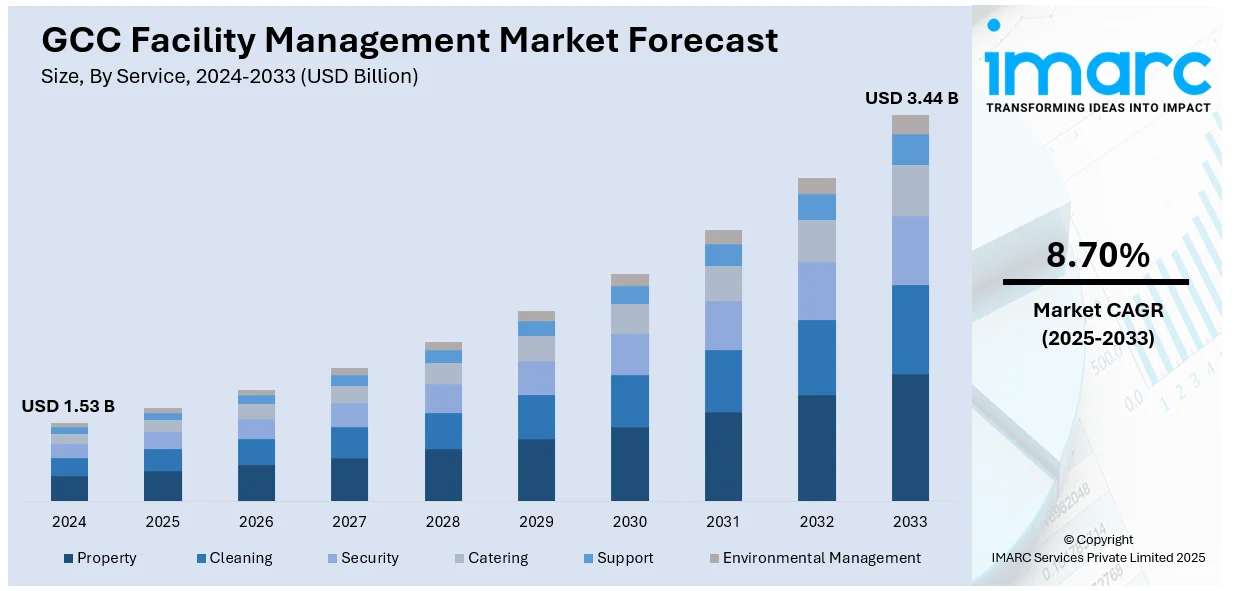

The GCC facility management market size was valued at USD 1.53 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3.44 Billion by 2033, exhibiting a CAGR of 8.70% from 2025-2033. The market is propelled by rapid urbanization, infrastructure development, increasing investments in real estate, and a growing focus on sustainability. Saudi Arabia represents the largest segment in the facility management market in the GCC region. The rising demand for integrated services, smart technologies, and energy-efficient solutions, coupled with government initiatives promoting smart cities and tourism, further propel the market's growth across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.53 Billion |

| Market Forecast in 2033 | USD 3.44 Billion |

| Market Growth Rate (2025-2033) | 8.70% |

The GCC facility management market growth is growing quickly due to several factors. Urbanization and large infrastructure projects, like smart cities, airports, and stadiums, are key drivers. For instance, in November 2024, a Saudi company started a new project for 6 billion Saudi riyals (USD 1.6 billion) to construct a smart city on the eastern side of the Gulf Kingdom. Also, during the Citiscape show in the Saudi capital, Riyadh, Tilal Real Estates stated that the multipurpose 'Heart of Khobar' project in the Eastern port of Khobar, which spans approximately 268,000 square meters, consists of residences, workplaces, hotels, parks, roads, shopping centers, movie theaters, and other entertainment facilities. These projects need effective facility management to maintain and manage assets, which is expected to facilitate the GCC facility management market demand.

The real estate industry grows to handle more homes businesses and factories that serve the expanding population and mixed economy. More properties throughout the region create extra demand for professional service providers who maintain and secure these spaces. GCC leadership supports eco-friendly building development and energy-conservation techniques. The real estate sector is also boosting the market as more residential, commercial, and industrial properties are built to meet the needs of a growing population and diverse economy. This increases demand for services like cleaning, maintenance, and security. GCC governments focus on sustainable development and smart technologies, encouraging green building standards and energy-efficient practices. For instance, in July 2024, the Ministry of Municipal, Rural Affairs, and Housing (MOMRAH) released updated requirements for residential building construction to improve public health and safety and the urban environment. This is a part of their efforts to streamline the process, standardize the rules about new construction permits, and bring them into compliance with the Saudi Building Code. This creates opportunities for facility management companies to offer specialized solutions, which represents one of the key GCC facility management market trends.

GCC Facility Management Market Trends:

Growing Real Estate Sector

The expanding real estate market in the GCC is a key factor driving the facility management demand. With a growing population and economic diversification, the region has seen an increase in residential, commercial, and industrial properties. According to industry reports, in 2024, developers in the Abu Dhabi emirate started 43 housing projects, 10 of which are owned by Aldar Properties. The projects include the development of around 10,000 homes and are primarily centered on islands off the emirate. Real estate owners and developers increasingly rely on facility management providers for cleaning, security, and maintenance services to maintain property value and enhance tenant satisfaction. Moreover, the shift toward integrated facility management solutions grants property managers to streamline operations and reduce costs. This trend, coupled with government initiatives promoting affordable housing and urban development, creates a positive GCC facility management market outlook.

Government Initiatives and Sustainability Focus

The governments of the GCC region support sustainable growth by pushing green building practices which in turn promotes specialized facility management solutions. The Saudi Vision 2030 and the UAE Green Economy projects push for energy-saving infrastructure alongside renewable power adoption. The facility management supports organizations in their sustainable projects by putting in place energy-saving tools and procedures to conserve water and handle waste responsibly. According to GCC facility management market analysis, companies that specialize in facility management can gain business by helping clients meet their building requirements and environmental standards. For instance, in January 2025, The United Arab Emirates (UAE) started the first renewable energy plant in the world that can supply clean power continuously. This plant ensures a steady supply of 1 GW of renewable baseload electricity by combining 5.2 GW of solar power with 19 GWh of energy storage. The facility tackles the issue of intermittent renewable energy and is a collaboration with the Emirates Water and Electricity Company. This highlighting on sustainability aligns with worldwide trends, placing the GCC as a hub for environmentally conscious facility management practices.

Technological Advancements and Smart Solutions

The adoption of advanced technologies, such as IoT, AI, and automation, is transforming the GCC facility management market. For instance, in April 2024, Auberon Technologies, a leader in Software as a Service (SaaS) solutions that enhance facility management, announced the release of its third-generation computer-aided facility management (CAFM) solution, called Optima. By utilizing state-of-the-art Artificial Intelligence (AI) technology, Optima will surpass its predecessor, AuberonSpace, a software that established industry standards more than ten years ago, to provide productivity and insight. These advances increase operational efficiency, reduce costs, and enhance service quality. Smart systems support real-time monitoring and predictive maintenance, ensuring optimized asset performance. IoT sensors can track energy usage, while AI-driven platforms streamline workflows and decision-making. Consumers growing interest in smart cities and networked buildings leads companies to develop technology-centered facility management solutions. Companies use technology tools to give clients data-based solutions that match the GCC's push for advanced sustainable infrastructure networks.

GCC Facility Management Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC facility management market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on service, mode of facility, and end user.

Analysis by Service:

- Property

- Heating, Ventilation and Air Conditioning (HVAC) Maintenance

- Mechanical and Electrical Maintenance

- Cleaning

- Security

- Catering

- Support

- Environmental Management

Property management leads the market, holding the majority of the GCC facility management market share due to rapid real estate expansion, urbanization, and mega-projects like NEOM and Lusail City. The rising need for commercial, and residential properties enhances the need for better property services. In the GCC region, the government launched strategic action plans such as Saudi Vision 2030 and Oman Vision 2040 to help invest in real estate. The rising emphasis on sustainability goals, smart buildings, and integrated facility management strengthens the demand for top-tier property management services to lead in the industry.

Analysis by Mode of Facility:

- In-house

- Outsourced

- Integrated

- Bundled

- Single

Outsourced facility management holds the majority of the market share and is growing rapidly due to cost-efficiency, access to specialized expertise, and reduced administrative burdens. Organizations in the GCC increasingly rely on third-party providers to streamline operations while focusing on core business activities. Sectors like real estate, hospitality, and retail benefit from outsourced services for scalability and efficiency. The adoption of advanced technologies by service providers, such as IoT and AI, further enhances the value of outsourcing, making it a preferred option across various industries.

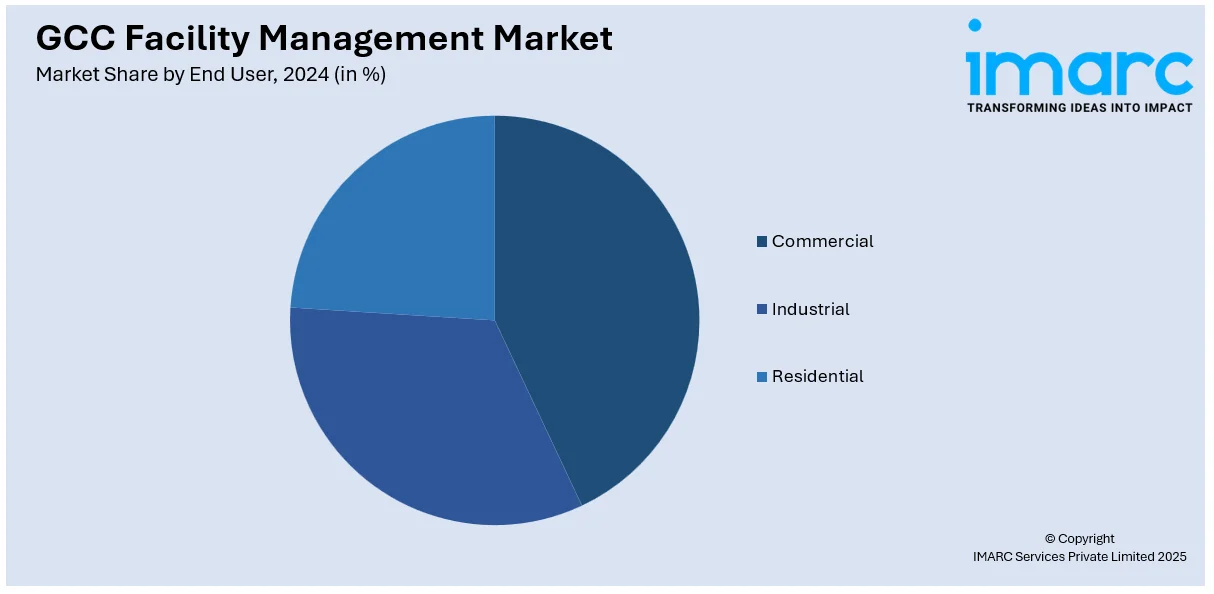

Analysis by End User:

- Commercial

- Industrial

- Residential

The commercial sector dominates the GCC facility management market due to the rapid growth of office spaces, retail malls, and hospitality projects. Urbanization, tourism, and mega-events like Expo 2020 Dubai have driven demand for high-quality facility management services. Advanced property management solutions, energy-efficient systems, and a focus on enhancing customer experience further boost growth. With significant investments in business hubs and commercial real estate, the need for integrated facility management and maintenance services continues to rise in the region.

Country Analysis:

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

Saudi Arabia represents the largest region in the GCC facility management market. The facility management market in Saudi Arabia is driven by Vision 2030, fostering rapid infrastructure development, tourism, and urbanization. Mega-projects such as Red Sea Project, NEOM, and Qiddiya amplify demand for facility services. Increased investments in commercial, healthcare, and education sectors further boost growth. Rising focus on energy efficiency coupled with sustainability, and advancements in technology like smart buildings, drives innovation. Expanding urban populations and a thriving real estate market also contribute significantly to market expansion.

Competitive Landscape:

The GCC facility management market is highly competitive, with key players including Emrill, EFS Facilities Services, Imdaad, Khidmah, and Saudi Oger. Companies are focusing on expanding service portfolios, technological integration, and sustainable practices to gain a competitive edge. For instance, in March 2023, Emrill, a top provider of facilities management services in the United Arab Emirates, created and introduced TECHSPHERE, a cutting-edge digital FM solution, to improve communication between Emrill staff and clients, optimize operations, and increase technical capabilities. Based on in-depth study and customer input, Emrill created the integrated solution to offer a more advanced and sophisticated system that would boost FM landscape efficiencies. By using TECHSPHERE, clients can benefit from greater openness and information availability at no extra expense. The market is fragmented, with both regional and international players competing to capitalize on opportunities in sectors like real estate, hospitality, healthcare, and infrastructure. Strategic partnerships, mergers, and acquisitions are common strategies to enhance market presence. Additionally, the growing demand for integrated facility management services and digital transformation is pushing companies to adopt innovative solutions, such as IoT and AI-based systems.

Latest News and Developments:

- In October 2024, Gulaid Holding and Trascent, the key players in facilities management advisory services, announced their partnership to form Trascent Arabia, a joint venture intended to offer value-added and unique services targeted at the Kingdom's facilities management (FM) sector. The new organization will offer creative solutions in line with Saudi Vision 2030, which aims to revolutionize the delivery of FM services throughout the nation and the Gulf.

- In August 2023, The Public Investment Fund (PIF) of Saudi Arabia announced the creation of the Saudi Facility Management Company (FMTECH), which will provide a wide range of services, such as maintenance, housekeeping, security, landscaping, utilities management, energy management, and waste management.

- In May 2023, Saned Facility Management and Solution Company, in collaboration with Greenhouse, Chalhoub Group's innovation and entrepreneurship hub, opened the "Innovation in Integrated Facilities Management" center and program. By encouraging and expanding the use of technology, artificial intelligence, software, and novel ideas both internally and throughout the UAE's facilities management business, the center hopes to make the sector more inventive and efficient.

GCC Facility Management Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Services Covered |

|

| Modes of Facility Covered | In-house, Outsourced, Integrated, Bundled, Single |

| End Users Covered | Commercial, Industrial, Residential |

| Countries Covered | Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, Oman |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC facility management market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC facility management market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC facility management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The facility management market in the GCC was valued at USD 1.53 Billion in 2024.

The GCC facility management market is driven by rapid urbanization, infrastructure development, government initiatives like Vision 2030, and a growing focus on sustainability. Increasing demand for integrated services, technological advancements, and a thriving real estate sector further boost the market, supported by rising investments in tourism, healthcare, and commercial projects.

The GCC facility management market is projected to exhibit a CAGR of 8.70% during 2025-2033, reaching a value of USD 3.44 Billion by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)