GCC Esports Market Size, Share, Trends, and Forecast by Revenue Model, Platform, Games, and Country, 2025-2033

GCC Esports Market Size and Share:

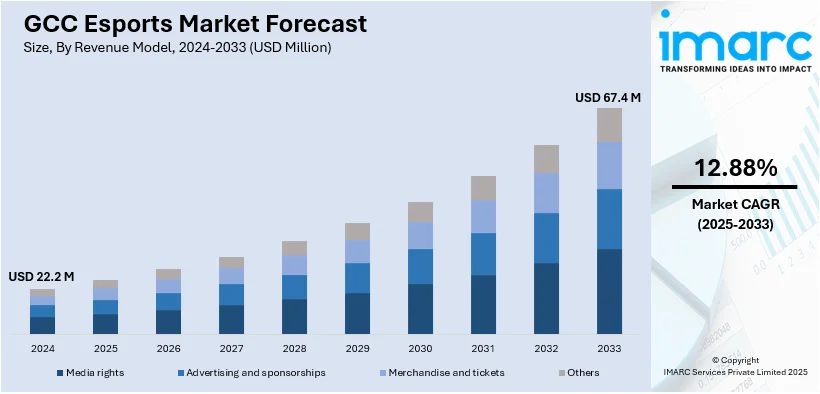

The GCC esports market size was valued at USD 22.2 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 67.4 Million by 2033, exhibiting a CAGR of 12.88% from 2025-2033. The market is expanding swiftly, fueled by strategic government initiatives, a tech-savvy youth population, and increasing global interest. Key developments, including the establishment of the GCC Esports Federation and large-scale tournaments, are enhancing regional competitiveness, and positioning the GCC as a significant player in the global esports industry.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 22.2 Million |

| Market Forecast in 2033 | USD 67.4 Million |

| Market Growth Rate (2025-2033) | 12.88% |

The GCC esports market is witnessing robust growth driven by significant government support and strategic investments aimed at diversifying economies beyond oil. Countries like Saudi Arabia and the UAE are prioritizing esports as part of their national agendas, with initiatives such as the establishment of the GCC Esports Federation and large-scale tournaments like the Esports World Cup in Riyadh. For instance, in 2024, Saudi Arabia hosted the inaugural Esports World Cup from July to August. The event featured 22 tournaments across 21 titles and attracted 500 million global viewers over two months, marking a significant milestone in the global gaming and esports industry. These efforts are complemented by state-of-the-art gaming infrastructure, fostering regional and global participation, while attracting sponsorships and partnerships with major gaming organizations.

The growing youth population and high internet penetration rates are driving the adoption of esports across the GCC. For instance, according to industry reports, Saudi Arabia recorded 36.84 million internet users in January 2024. The country’s internet penetration rate reached 99.0% of the total population at the start of the year, reflecting a highly connected society and widespread digital accessibility. Moreover, the region’s young demographic, coupled with their increasing engagement in digital entertainment, is fueling demand for competitive gaming platforms and tournaments. The rising popularity of mobile gaming and the integration of esports into mainstream sports ecosystems are broadening the market’s appeal and growth potential.

GCC Esports Market Trends:

Government-Driven Investments and Strategic Initiatives

The GCC esports market is witnessing significant growth due to active government involvement. The formation of the GCC Esports Federation in 2023 exemplifies the region's commitment to fostering collaboration and hosting competitive events. Major tournaments like the Esports World Cup, offering record-breaking prize pools, highlight the strategic push to position the GCC as a global esports’ hub. For instance, in 2024, the inaugural Esports World Cup at Boulevard Riyadh City offered a record-breaking USD 60 million prize pool, the largest in esports history. The event highlighted the country’s strategic focus on becoming a global esports leader. Moreover, this trend underscores the governments' focus on building state-of-the-art infrastructure, attracting sponsorships, and creating a thriving esports ecosystem to drive regional and international engagement.

Rise of Regional Esports Organizations and Tournaments

Regional esports organizations are playing a pivotal role in advancing the GCC esports market. By hosting large-scale tournaments and introducing inclusive initiatives, these organizations are promoting broader participation and engagement. Events like the Esports World Cup and regional leagues are attracting global audiences, showcasing the GCC’s potential to become a competitive esports destination. These tournaments not only provide platforms for regional talent but also draw international attention, fostering partnerships with global gaming entities and elevating the region's status in the esports ecosystem. For instance, in 2024, the International Olympic Committee (IOC) and Saudi National Olympic Committee (NOC) announced that Saudi Arabia will host the inaugural Olympic Esports Games in 2025. This 12-year partnership supports Vision 2030 and aims to elevate esports globally, complementing the kingdom’s growing portfolio, including the annual Esports World Cup launched in 2024.

Increasing Popularity of Mobile Gaming and Digital Connectivity

The widespread adoption of mobile gaming is a defining trend in the GCC esports market, driven by high smartphone penetration and robust internet infrastructure. With extensive internet penetration in Saudi Arabia and across the GCC, the region is well-positioned to cater to the growing demand for accessible gaming platforms. Mobile gaming tournaments are gaining popularity, supported by advancements in 5G technology, which enhance gaming experiences. For instance, according to the Nokia Mobile Broadband Index Report 2024, 5G adoption in the region is accelerating, with 90% of mobile subscriptions projected to be 5G by 2029. This reflects the region’s commitment to advanced connectivity and high-speed broadband expansion.

GCC Esports Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC esports market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on revenue model, platform, games, and country.

Analysis by Revenue Model:

- Media rights

- Advertising and sponsorships

- Merchandise and tickets

- Others

Media rights are a significant revenue model in the GCC esports market, driven by the increasing popularity of competitive gaming. Streaming platforms, broadcasters, and digital media channels acquire exclusive rights to air esports events, attracting global audiences. This segment is further bolster by local content, high-quality productions, and partners with top international platforms, thereby providing huge revenue opportunities. Additionally, with the recent rise of esports, it is also growing demand for broadcasting rights. GCC-based tournaments, such as Saudi Arabia's Esports World Cup, attract viewership from around the world and position the region as a major player in esports media distribution.

Advertising and sponsorships remain the major revenue generators within the GCC esports market, driven by growing audience engagement with competitive gaming. Major brands partner with esports teams, tournaments, and platforms to reach a young and tech-savvy demographic. Global sponsor partnerships offer increased global tournament visibility with in-game ads and influencer collaborations drive additional streams to scale on the revenue side. Meanwhile, with the increasing investments in technology, consumer goods, and financial services, advertising and sponsorships continue to be the most important driving factors for global recognition and financial growth of the GCC's esports ecosystem.

Merchandise and ticket sales form an integral part of the GCC esports market’s revenue model, capitalizing on fan loyalty and event attendance. Branded apparel, gaming accessories, and exclusive collectibles generate significant revenue, while live event ticketing boosts audience engagement. The region's large-scale tournaments, such as the Esports World Cup, attract substantial crowds, enhancing both ticket sales and on-ground merchandise opportunities. As esports culture continues to thrive in the GCC, this segment is expected to grow further, contributing to the overall financial success of the market.

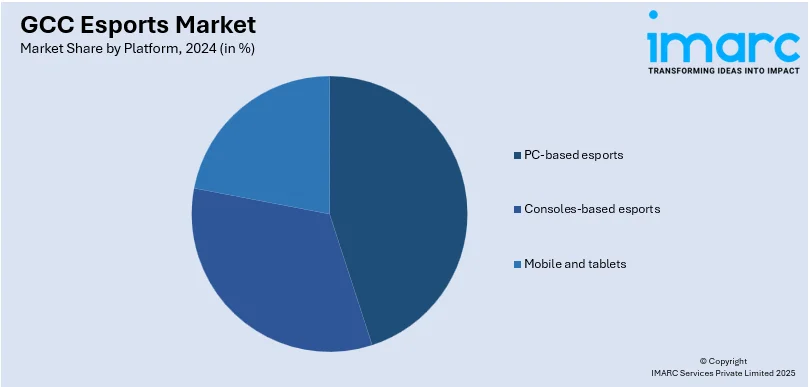

Analysis by Platform:

- PC-based esports

- Consoles-based esports

- Mobile and tablets

PC-based esports hold significant prominence in the GCC market, offering high-performance gaming experiences for popular titles like Counter-Strike, League of Legends, and Dota 2. This platform is preferred for its superior graphics, customization, and competitive edge, appealing to professional players and gaming enthusiasts. This segment is further encouraged by growth in the number of dedicated gaming arenas and investment in high-end PC infrastructure. With its leading regional position in PC-based gaming tournaments, the platform strongly contributes to the development, growth, and competitiveness of the GCC esports market in the world arena.

Console-based esports is gaining traction in the GCC market, driven by the popularity of games like FIFA, Call of Duty, and Fortnite. Consoles provide an accessible gaming experience, attracting both casual and professional players. The segment is driven by the growing numbers of events and tournaments that have an orientation to console gaming, while partnerships between gaming brands and regional organizations also help boost this area. With advancements in console technology and expanding esports communities, this platform is poised for sustained growth, contributing to the diversity and appeal of the GCC esports ecosystem.

Mobile and tablet-based esports represent a rapidly expanding segment in the GCC, driven by high smartphone penetration and a growing trend toward mobile gaming. The most popular titles include PUBG Mobile, Free Fire, and Clash Royale, attract large player populations and viewership. Mobile gaming tournaments and an increase in 5G have further facilitated access to and interaction with the sector. Cost-efficient entry and widespread appeal will ensure that mobile and tablet-based esports play a vital role in driving overall growth and inclusivity in the GCC esports market.

Analysis by Games:

- Multiplayer online battle arena (MOBA)

- Player vs players (PvP)

- First person shooters (FPS)

- Real time strategy (RTS)

Multiplayer online battle arena (MOBA) games are a cornerstone of the GCC esports market, featuring globally popular titles like League of Legends and Dota 2. These strategy team-based games require coordination and tactical skills, which made them an instant favorite among both professional gamers and audiences. Many regional tournaments feature titles of MOBA, attracting considerable sponsorships and viewership. With increasing investments in esports infrastructure and events, MOBA games play a vital role in enhancing the GCC’s presence on the global esports stage, driving growth and competitive participation.

Player vs players (PvP) games are a dynamic segment in the GCC esports market, characterized by competitive, skill-driven gameplay in titles like Fortnite and Tekken. These games attract players across skill levels, from casual gamers to seasoned professionals. PvP tournaments include high levels of individual performances and strategy, attracting wide sponsorships and audience interest. With improving digital infrastructure and community building, this segment itself is a very active and lucrative market, making the GCC an upcoming hub for diverse forms of competitive gaming.

First-person shooter games are also one of the prominent titles gaining much attention in the GCC esports arena, with game franchises such as call of duty and counter-strike contributing much to player interest and audience viewership. These games feature action-packed, fast-paced gameplay, making them highly popular for esports tournaments. The region’s FPS events, often backed by sponsors and professional leagues, attract significant viewership. With advancements in gaming technology and infrastructure, FPS games continue to be a critical contributor to the growth and evolution of the GCC esports market.

Real time strategy (RTS) games occupy a niche yet impactful space in the GCC esports market, offering titles like StarCraft II and Age of Empires. These games require the highest levels of tactical thinking and real-time decision-making; hence, they are more appealing to strategy-oriented gamers. Although much smaller compared to other audience segments, RTS tournaments held in the GCC delineate the region's diversity in gaming preference. As esports develops further in the GCC, the RTS segment has become a beacon of strategic depth and complexity for competitive gaming within the region.

Country Analysis:

- Saudi Arabia

- UAE

- Qatar

- Oman

- Kuwait

- Bahrain

Saudi Arabia leads the GCC esports market, driven by substantial government investments and initiatives such as Vision 2030. Events like the Esports World Cup and the establishment of the GCC Esports Federation highlight its commitment to becoming a global esports hub. Saudi Arabia's advanced infrastructure, significant prize pools, and growing esports community attract international attention. Moreover, partnerships with global gaming companies further enhance the country’s market position.

The UAE is a prominent contributor to the GCC esports market, leveraging its strategic location and advanced digital infrastructure. Dubai-based organizations like Galaxy Racer drive the industry by hosting global tournaments and fostering inclusivity. The country’s focus on technology-driven initiatives supports the growth of competitive gaming. With active government support and a strong esports ecosystem, the UAE attracts investments, sponsorships, and a growing player base, establishing itself as a vital esports’ hub in the region.

Qatar is emerging as a growing market in GCC esports, supported by its focus on technology and youth engagement. The country’s infrastructure and experience in hosting international events, such as the FIFA World Cup, provide a foundation for esports development. Investments in gaming arenas and partnerships with global organizations position Qatar to expand its presence in the competitive gaming space, catering to its digitally connected audience.

Oman’s esports market is steadily growing, driven by increasing youth engagement and government-backed Oman’s esports market is steadily growing, due to increasing youth engagement and government-backed initiatives to promote digital transformation. The country’s focus on developing gaming communities and hosting regional tournaments supports the growth of competitive gaming. Oman’s efforts to enhance digital infrastructure and introduce esports in educational programs aim to build a sustainable ecosystem, contributing to the GCC esports market’s overall development.

Kuwait plays a crucial role in the GCC esports market with increasing gaming community and growing popularity of competitive tournaments. The involvement of the government and private players in the development of gaming infrastructure also contributes to market growth. Moreover, with a strong emphasis on youth engagement and various collaborations with regional and global gaming entities, Kuwait becomes a prominent name as an emerging player in the esports arena.

Bahrain is advancing its esports market through government support and a focus on digital innovation. The country’s robust internet infrastructure and initiatives to promote esports among youth contribute to the sector’s growth. Bahrain’s strategic hosting of tournaments and its collaborations with regional gaming organizations position it as a competitive player in the GCC esports market, attracting local and international attention.

Competitive Landscape:

The GCC esports market is highly competitive, driven by government investments, strategic partnerships, and regional initiatives. Major players contribute to the industry’s growth through tournaments and community-building efforts. For instance, in September 2024, Galaxy Racer (GXR), a Dubai-based transmedia company, acquired media rights for top European soccer leagues, including LaLiga, Serie A, and Ligue 1, across the Indian subcontinent. Through a 15-year partnership with LaLiga, GXR integrates esports expertise with sports broadcasting, enhancing fan engagement via its Super App. This collaboration strengthens GXR’s position in esports and sports content in the region. Moreover, the market’s rapid expansion is driven by high youth engagement and increasing digital connectivity, with regional entities vying to establish dominance. This dynamic environment positions the GCC as a rising global hub for esports innovation and competition.

The report provides a comprehensive analysis of the competitive landscape in the GCC esports market with detailed profiles of all major companies.

Latest News and Developments:

- In April 2024, Astra Nova, the GCC’s first Web3 RPG, raised USD 1 million, targeting MENA and Asian gaming audiences, and contributing to the esports ecosystem.

GCC Esports Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Revenue Models Covered | Media Rights, Advertising and Sponsorships, Merchandise and Tickets, Others |

| Platforms Covered | PC-based Esports, Consoles-based Esports, Mobile and Tablets |

| Games Covered | Multiplayer Online Battle Arena (MOBA), Player vs Players (PvP), First Person Shooters (FPS), Real Time Strategy (RTS) |

| Countries Covered | Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, Oman |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC esports market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC esports market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC esports industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Esports, short for electronic sports, involves organized, competitive video gaming where players or teams compete in tournaments across various game genres. It combines entertainment, technology, and professional competition, driving audience engagement, sponsorship opportunities, and revenue growth

The GCC esports market was valued at USD 22.2 Million in 2024.

IMARC estimates the GCC esports market to exhibit a CAGR of 12.88% during 2025-2033.

The GCC esports market is driven by government initiatives, such as Saudi Arabia’s Vision 2030, significant investments in gaming infrastructure, and the region’s young, tech-savvy population. Increasing digital connectivity, high smartphone penetration, and global partnerships further enhance the market’s growth, positioning the GCC as a prominent hub for competitive gaming.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)