GCC Digital Payment Market Size, Share, and Trends and Forecast by Component, Payment Mode, Deployment Type, End Use Industry, and Country, 2025-2033

GCC Digital Payment Market Size and Share:

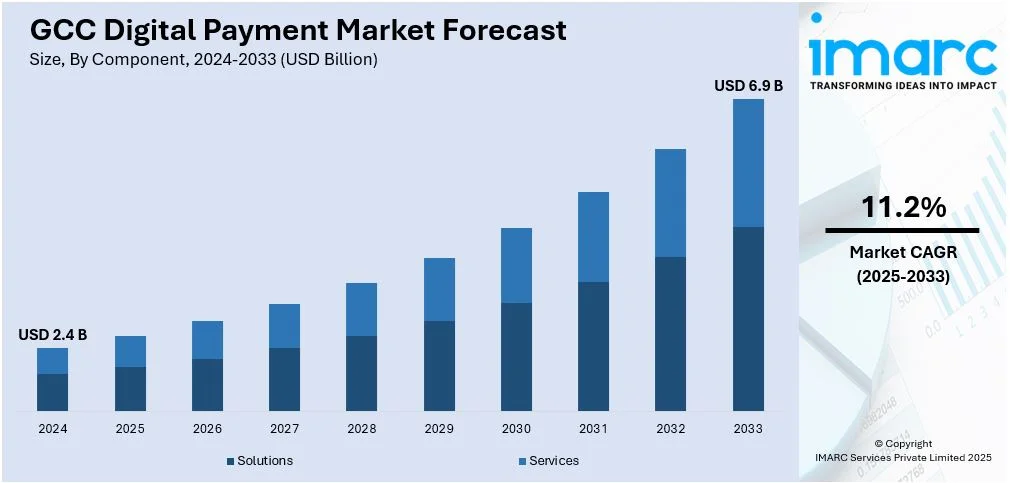

The GCC digital payment market size was valued at USD 2.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6.9 Billion by 2033, exhibiting a CAGR of 11.2% from 2025-2033. The market is primarily propelled by the government initiatives supporting cashless transactions, increased adoption of smartphones and internet access, growth of e-commerce and online shopping platforms, rising consumer preference for secure, contactless payments, and expansion of fintech innovations and digital wallet services.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.4 Billion |

|

Market Forecast in 2033

|

USD 6.9 Billion |

| Market Growth Rate (2025-2033) | 11.2% |

A combination of technological advancements and changing consumer behavior are driving the digital payment market in the GCC region. Increased smartphone penetration, easy internet access, and easier usage have facilitated consumers to embrace various digital payment solutions. According to the IMARC Group, the GCC smartphone market is forecasted to exhibit a CAGR of 5.4% during 2025-2033. Individuals now prefer more rapid and convenient methods such as mobile wallets, online banking, and contactless payments while conducting transactions. The increasing popularity of online shopping has also been a main demand driver of digital payments. These facilities offer greater comfort and are also more secure with various features such as encryption and two-factor authentication, which are fostering adoption in other sectors as well.

Governments across the GCC region are significantly promoting the digital payment sector. The UAE, Saudi Arabia, and Bahrain are implementing policies to make their economies cashless and nudging businesses and customers away from the conventional forms of payments. In the same regard, collaborations between banks, fintech companies, and retailers are creating an integrated, seamless system of payments. Regulatory frameworks are also being established to facilitate safe and efficient digital transactions. As the digital payment infrastructure becomes better and as consumers get accustomed to these technologies, the market is expected to expand at a very rapid pace.

GCC Digital Payment Market Trends:

Rise in mobile payments and digital wallets

The growing use of mobile payments and digital wallets is one of the main trends driving the GCC digital payment market. The widespread availability of smartphones and internet connectivity throughout the region has led to increased mobile payment solutions. With platforms such as Apple Pay and Samsung Pay, and local services such as STC Pay and Qpay services, consumer convenience to make direct mobile payments is significantly rising. This is supported by increasing retailers and service providers accepting mobile payment options to enable ease of making payments by consumers. Digital payments are also becoming particularly popular due to their ease of use and security with several forms of payments stored in a single location.

Contactless and secure payment solutions

Secure contactless payment method is another trend driving the GCC digital payment market growth. Due to growing security concerns and an increasing desire for ease, GCC consumers are gravitating toward contactless payments through NFC-enabled credit cards and smartphone applications. Contactless payment preference is also being advocated for by banks, payment processors, and merchants who are placing infrastructural investments to be supportive of these solutions. In addition, the focus on advanced security features such as encryption, biometric authentication, and two-factor verification ensures that digital payment systems stay safe and fraud-resistant. This focus on security, combined with the ease of contactless payments, is, therefore, fastening the speed of digital payment adoption in the region.

Growth of fintech innovations and integration with traditional banking

The integration of fintech innovations with conventional banking systems is contributing substantially to the market share. In the continuous progress of digital payment solutions, innovation is being driven by fintech companies. Integration between fintech startups and established banks is encouraging the building of seamless digital payment solutions, such as P2P payment systems, blockchain-based payments, and technologies involved in cross-border payments. The rise of these fintech innovations is enhancing the efficiency of transactions, reducing costs, and increasing financial inclusion. Also, governments and regulatory bodies across the GCC are supporting the development of digital payment infrastructures, further enabling the growth of fintech solutions and facilitating overall industry expansion.

GCC Digital Payment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC digital payment market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on component, payment mode, deployment mode, and end use industry.

Analysis by Component:

- Solutions

- Application Program Interface

- Payment Gateway

- Payment Processing

- Payment Security and Fraud Management

- Transaction Risk Management

- Others

- Services

- Professional Services

- Managed Services

The solution segment in the GCC digital payment market comprises all forms of technologies and platforms for conducting digital transactions, such as mobile wallets, point-of-sale systems, and gateways for payment. These solutions have offered a chance for businesses to acquire all the tools to take and process payments without hassle. As there is an increase in online selling, secure and efficient means of payment are in increasing demand, thus increasing the GCC digital payment market share.

This service segment includes professional and managed services that are indispensable to ensure smooth digital transactions. Companies in this segment offer services such as transaction management, cybersecurity, and consulting that enhance the effectiveness of digital payment systems. Since demand for secure, efficient payment systems is increasing day by day, services that make their smooth operation possible are integral in the GCC digital payment ecosystem.

Analysis by Payment Mode:

- Bank Cards

- Digital Currencies

- Digital Wallets

- Net Banking

- Others

The bank cards segment in the GCC digital payment market is comprised of credit and debit cards used for online and offline transactions. Bank cards are a popular payment method because of the wide acceptance of contactless technology, offering security and convenience. The growth in the number of cardholders and the increased acceptance by merchants drive further expansion in this segment in the region.

The digital currencies segment is very rapidly growing in the GCC with the growing popularity of Bitcoin and Ethereum, among other cryptocurrencies. It is an alternative to traditional currencies as it provides cross-border transactions which are faster and safer. In the GCC, governments and financial institutions are keen on the development of blockchain technology and digital currencies to achieve easy transactions with minimal dependency on conventional banking systems.

Digital wallets are becoming highly popular in the GCC digital payment market. The ease of making payments through smartphones has become possible with Apple Pay, Google Pay, and other local services such as STC Pay. The convenience, security due to encryption, and storage of multiple payment methods have contributed to the growth of digital wallets as a popular payment mode in the region.

Analysis by Deployment Mode:

- Cloud-based

- On-premises

The cloud-based deployment model for the GCC digital payment market is growing significantly due to its flexibility, scalability, and cost efficiency. Cloud-based solution provisions enable businesses to utilize these over the Internet while spending less on infrastructure. This deployment allows immediate implementation, easy updates, and provides better security, which is driving its usage within SMEs across the region.

The on-premises deployment mode in the GCC digital payment market is where businesses handle their own payment processing systems and infrastructure. This model offers greater control, security, and customization for large organizations with specific needs. Although it requires higher upfront costs and maintenance, it remains popular among enterprises that prioritize data privacy and have the resources to manage the infrastructure in-house.

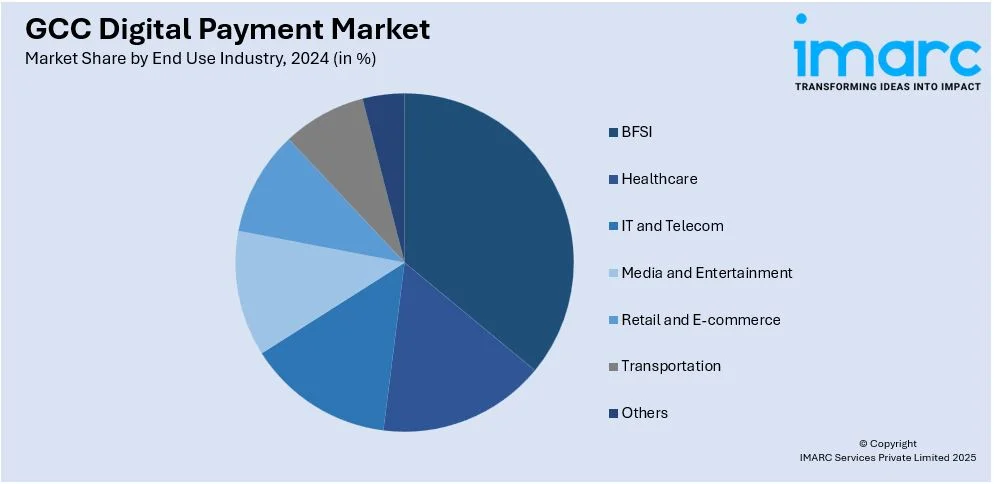

Analysis by End Use Industry:

- BFSI

- Healthcare

- IT and Telecom

- Media and Entertainment

- Retail and E-commerce

- Transportation

- Others

The BFSI segment in the GCC digital payment market is one of the major drivers due to the growing demand for secure and efficient transaction systems. Digital payments enable faster transactions, enhance customer experience, and reduce costs for financial institutions. Online banking adoption, mobile payment solutions, and digital wallet services are driving the growth of this segment.

The healthcare sector in the GCC is now embracing digital payments to ensure smooth billing processes, insurance claims, and patient transactions. As a result of the growing demand for cashless transactions, digitized payment systems now provide services that offer convenience, low fraud cases, and improved operational efficiency in health centers. Digital payments also allow faster completion of billing and enable patients to pay more securely and more conveniently.

Digital payment systems are increasingly being used for subscription-based services, online purchases, and mobile top-ups in the IT and telecom sector. The expansion of e-commerce and mobile services in the GCC is growing the demand for seamless payment solutions. Digital payments are providing telecom operators with an efficient and secure means of transaction management, improving customer satisfaction, and providing better service delivery across the region.

Analysis by Country:

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

Country-wise, the market has been classified into Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, and Oman. Saudi Arabia is a leading player in the GCC digital payment market. Driven by government initiatives, such as Vision 2030, which focuses on digital transformation and financial inclusion, digital payment adoption in the region is being driven by an increased use of mobile wallets, e-commerce, and digital banking services. Saudi Arabia is also characterized by a youth that is tech-savvy, contributing to the growing usage of online payment solutions.

The UAE is a leading market in the GCC and stands among the more sophisticated for digital payments. Strong internet penetration and soundly built financial infrastructure increase its acceptance of digital payment solutions, particularly in the form of mobile wallets and contactless cards. Backed by governmental initiatives such as the Dubai Blockchain Strategy and a cashless economy target, there is expected to be sustained growth in the market.

The rapid expansion of the digital payment market in Qatar can be attributed to its efforts at diversifying the economy, along with an expanding sector for digital services. Numerous individuals in the country have started adopting mobile payment systems and online business platforms, thus propelling forward the market growth. Innovations and developments in technologies, according to government objectives in the Qatar National Vision 2030, emphasize such advancements.

Competitive Landscape:

Key players in the GCC digital payment market are leading the growth through strategic investments in technology and partnerships. Major banks and financial institutions have been launching mobile wallet solutions and digital banking platforms that allow easier, more secure online payments. Local companies are working on adding enhanced security features, such as biometric authentication and encryption, to the digital payment ecosystem. In addition, fintech startups are working closely with traditional banks to develop cashless services in underserved areas. Besides this, governments in the GCC region are also promoting cashless payments, promoting the adoption of digital payment solutions, which in turn fosters growth in the market.

The report provides a comprehensive analysis of the competitive landscape in the GCC digital payment market with detailed profiles of all major companies.

Latest News and Developments:

- 4 December 2024: Mastercard and Crypto.com have established a strategic partnership to expand the digital payments sector in the GCC region. After obtaining a primary network license, Crypto.com will first introduce a card in Bahrain directly through Mastercard’s network before extending the initiative throughout the GCC.

- 11 September 2024: Paymob, a leading digital payment facilitator based in Cairo, plans to expand its market presence in Egypt and the GCC. For this project, the company has raised USD 22 Million in order to broaden its product offerings in the Egypt and GCC markets.

GCC Digital Payment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Payment Modes Covered | Bank Cards, Digital Currencies, Digital Wallets, Net Banking, Others |

| Deployment Modes Covered | Cloud-Based, On-Premises |

| End Use Industries Covered | BFSI, Healthcare, IT and Telecom, Media and Entertainment, Retail and E-Commerce, Transportation, Others |

| Countries Covered | Saudi Arabis, UAE, Qatar, Bahrain, Kuwait, Oman |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC digital payment market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC digital payment market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC digital payment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Digital payment refers to the process of completing financial transactions through electronic means, using devices such as smartphones, computers, or tablets. It includes methods such as online banking, mobile wallets, and credit card payments. Digital payment is used in e-commerce, bill payments, and peer-to-peer transfers, where it offers convenience, speed, and security, allowing users to make transactions anytime, anywhere.

The GCC digital payment market was valued at USD 2.4 Billion in 2024.

IMARC estimates the GCC digital payment market to exhibit a CAGR of 11.2% during 2025-2033.

The increasing smartphone and internet penetration, rising demand for e-commerce and online transactions, government initiatives promoting cashless payments, growth of mobile wallet adoption, and enhanced security features and fraud prevention technologies are the primary factors driving the GCC digital payment market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)