GCC Dairy Market Size, Share, Trends and Forecast by Product, Distribution Channel, Application and Country, 2026-2034

GCC Dairy Market Summary:

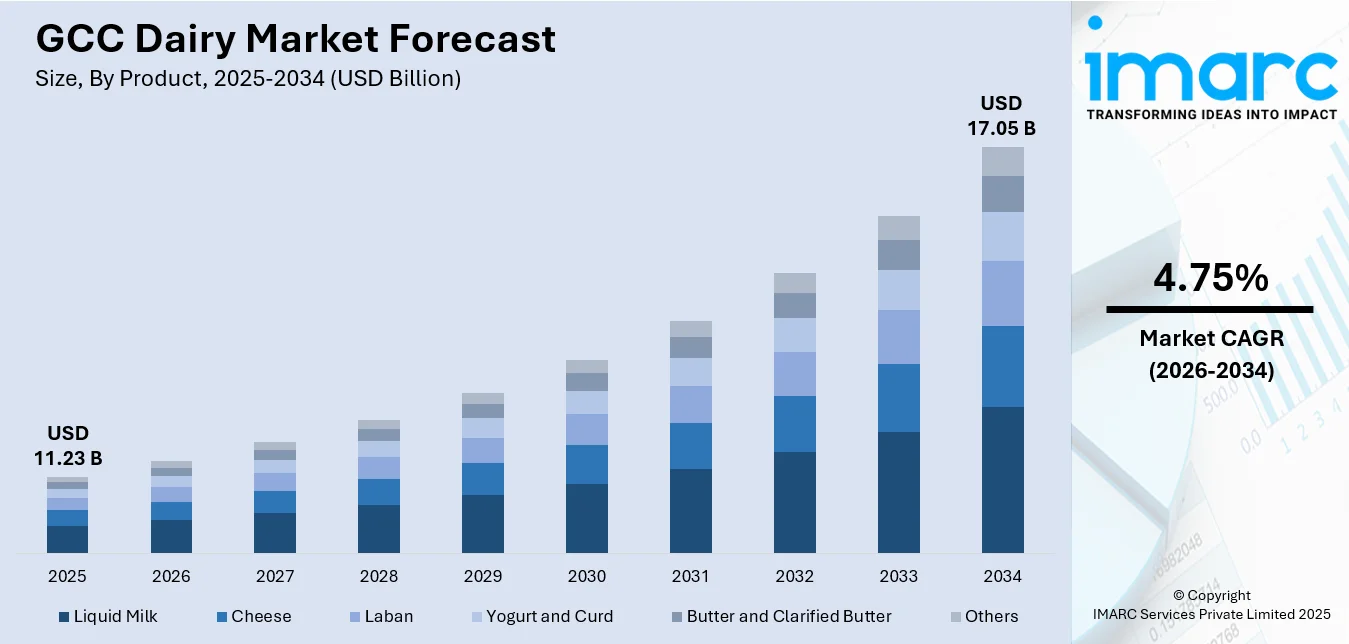

The GCC dairy market size was valued at USD 11.23 Billion in 2025 and is projected to reach USD 17.05 Billion by 2034, growing at a compound annual growth rate of 4.75% from 2026-2034.

The GCC dairy sector plays a crucial role in strengthening regional food security, covering both traditional milk-based products and emerging nutritional offerings. Market growth is supported by population expansion and shifting consumer preferences toward healthier diets. Alongside core dairy categories, producers are increasingly developing specialized products designed to meet dietary needs, wellness goals, and lifestyle-driven consumption patterns across the Gulf economies.

Key Takeaways and Insights:

-

By Product: Liquid milk dominates the market with a share of 26.12% in 2025, reflecting its fundamental role as a dietary staple and its integration into daily consumption patterns across households, hospitality sectors, and food service operations throughout the Gulf region.

-

By Country: Saudi Arabia leads the market with a share of 35% in 2025, benefiting from its substantial population base, established dairy infrastructure, extensive distribution networks, and strategic investments in domestic production capabilities that reduce import dependency.

-

Key Players: The competitive environment features a blend of established multinational corporations and regional dairy specialists, with market participants competing through product innovation, distribution network expansion, quality assurance protocols, and strategic partnerships to capture growing consumer demand. Some of the key players operating in the market include Arla Foods amba, Al Safi - Danone, Fonterra Co-operative Group Limited, GCMMF, Nestle S.A., Al Ain Farms, Al Rawabi Dairy Company, Almarai Company, Lactalis Group, National Agricultural Development Company (NADEC), and Saudia Dairy & Foodstuff Company (SADAFCO).

To get more information on this market Request Sample

The GCC dairy landscape has evolved significantly from its traditional foundations, transforming into a sophisticated market characterized by advanced processing technologies, diversified product portfolios, and increasing emphasis on nutritional value. The region's unique climatic challenges have spurred innovations in supply chain management and cold storage infrastructure, while cultural preferences for fresh, high-quality dairy products continue to shape market dynamics. Rising urbanization, coupled with growing expatriate populations, has expanded the consumer base beyond traditional demographic segments, creating opportunities for both conventional and specialty dairy categories. The market benefits from government initiatives promoting food security, agricultural development, and local production capabilities that aim to reduce reliance on imports while ensuring consistent product availability across distribution channels.

GCC Dairy Market Trends:

Premiumization and Functional Dairy Innovation

Consumer sophistication across the Gulf region has catalyzed demand for premium dairy products enriched with functional ingredients that deliver specific health benefits beyond basic nutrition. This trend manifests through growing interest in probiotic-enhanced formulations, vitamin-fortified varieties, and products featuring reduced sugar content alongside added protein concentrations, reflecting educated consumer preferences for dairy that supports immunity, digestive health, and active lifestyles. For instance, in December 2025, French food-tech firm Nutropy is advancing its presence in Saudi Arabia through Business France’s Booster Grow Global program, leveraging precision fermentation to develop next-generation, animal-free dairy proteins. As part of a multi-city immersion tour spanning Riyadh, Jeddah, and Dammam, the company met with government agencies, industry stakeholders, and leading dairy producers to explore strategic collaborations that support the Kingdom’s Vision 2030 goals for food security and sustainable development.

Localized Production and Desert Dairy Development

Strategic initiatives to enhance regional food security have accelerated investments in domestic dairy farming operations, particularly camel breeding enterprises that leverage indigenous livestock adapted to harsh climatic conditions. This shift toward localized production reduces supply chain vulnerabilities, creates employment opportunities within agricultural sectors, and promotes dairy varieties culturally resonant with Gulf populations while addressing environmental sustainability concerns through reduced transportation requirements. For instance, in April 2025, Saudi Arabia unveiled a large-scale dairy industrial cluster in Al-Kharj, underscoring its drive to position itself as a regional center for dairy processing and food manufacturing. Revealed at the Saudi Dairy Forum held in Al-Kharj, around 90 kilometers southeast of Riyadh, the project forms part of the Kingdom’s wider National Industrial Strategy. Covering nearly one million square meters, the cluster features modern, purpose-built infrastructure designed to serve dairy producers and associated value-chain industries.

Digital Commerce and Direct-to-Consumer Distribution

Technological adoption across retail landscapes has transformed dairy procurement patterns, with consumers increasingly embracing online platforms for convenient home delivery of temperature-sensitive products. The GCC e-commerce market size reached USD 507.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2,020.6 Billion by 2033, exhibiting a growth rate (CAGR) of 15.3% during 2025-2033. This digital transition enables access to broader product assortments, facilitates subscription-based purchasing models, and provides manufacturers with direct consumer engagement channels that inform product development while accommodating busy urban lifestyles demanding flexible shopping options.

Market Outlook 2026-2034:

The GCC dairy market trajectory reflects robust fundamentals anchored in demographic growth, urbanization momentum, and evolving nutritional awareness that positions the sector for sustained expansion throughout the forecast horizon. Rising disposable incomes across Gulf economies enable consumers to prioritize quality and nutritional value over price considerations, while younger demographics demonstrate willingness to experiment with innovative dairy formats including lactose-free alternatives, organic certifications, and specialty beverages. Government support for agricultural diversification and food security initiatives continues to strengthen production infrastructure, reducing import dependencies and enhancing market resilience against global supply disruptions. The market generated a revenue of USD 11.23 Billion in 2025 and is projected to reach a revenue of USD 17.05 Billion by 2034, growing at a compound annual growth rate of 4.75% from 2026-2034.

GCC Dairy Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

Liquid Milk |

26.12% |

|

Country |

Saudi Arabia |

35% |

Product Insights:

- Liquid Milk

- Cheese

- Laban

- Yogurt and Curd

- Butter and Clarified Butter

- Others

The liquid milk dominates with a market share of 26.12% of the total GCC dairy market in 2025.

Liquid milk maintains its commanding position as the foundational dairy category throughout the Gulf region, deeply embedded in daily consumption rituals spanning breakfast routines, beverage preparations, and cooking applications across residential and commercial foodservice environments. Its versatility as both standalone refreshment and culinary ingredient ensures consistent demand across demographic segments, while cultural preferences for fresh milk consumption over extended shelf-life alternatives sustain market primacy. The segment benefits from established cold chain infrastructure that guarantees product freshness, alongside diversification into fat content variants catering to health-conscious consumers seeking options ranging from full-fat traditional preferences to reduced-fat and skim formulations.

Product innovation within the liquid milk category has expanded beyond conventional offerings to encompass fortified varieties enriched with vitamins, minerals, and supplementary nutrients targeting specific consumer needs including children's growth, adult bone health, and immune system support. Flavor innovations introducing chocolate, strawberry, and vanilla variants attract younger demographics while maintaining nutritional profiles, and specialized formulations addressing lactose intolerance enable market access for previously excluded consumer segments. The increasing availability of organic and hormone-free liquid milk options reflects growing consumer sophistication regarding production methods and ingredient transparency, positioning the segment for continued dominance as manufacturers balance traditional preferences with evolving wellness expectations.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialist Retailers

- Online Stores

- Others

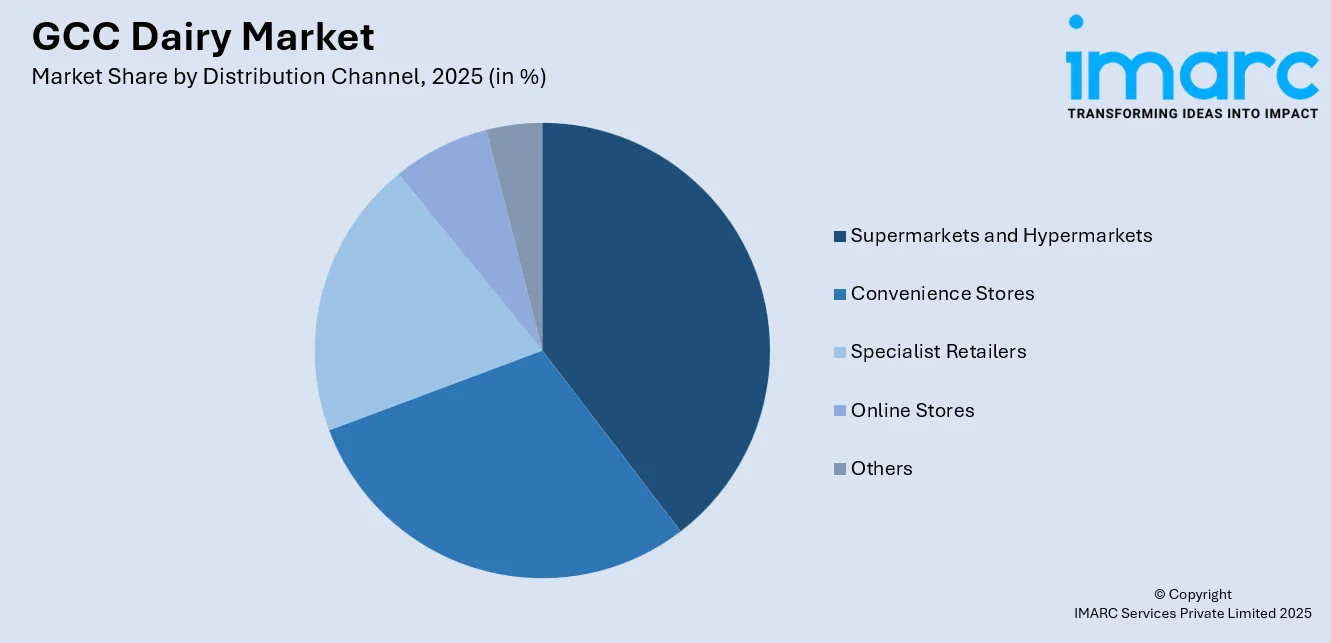

Supermarkets and hypermarkets are expected to dominate the GCC dairy market due to their wide product assortments, strong cold-chain infrastructure, and ability to stock both mass-market and premium dairy products. Their high footfall, promotional capabilities, and trusted brand presence support consistent consumer demand.

Convenience stores play a key role in the GCC dairy market by catering to on-the-go consumption and frequent, small-basket purchases. Their extensive urban presence, extended operating hours, and proximity to residential and commercial areas make them ideal for fresh milk, yogurt, and single-serve dairy products.

Specialist retailers are gaining traction by offering premium, organic, lactose-free, and functional dairy products tailored to health-conscious and niche consumer segments. Their focus on quality, product knowledge, and curated assortments attracts consumers seeking differentiated dairy options and higher-value purchases.

Online stores are increasingly influential in the GCC dairy market due to rising digital adoption and demand for home delivery convenience. Advanced cold-chain logistics, subscription models, and access to a broader product range enable consumers to purchase fresh and specialty dairy products with greater flexibility.

Application Insights:

- Bakery and Confectionary

- Clinical Nutrition

- Frozen Food

- Others

Bakery and confectionary applications are expected to lead the GCC dairy market due to strong consumption of baked goods, desserts, and sweets across the region. Dairy ingredients enhance taste, texture, and shelf life, while premiumization trends and growing café culture continue to boost demand from commercial bakeries and confectioners.

Clinical nutrition is gaining prominence as rising lifestyle-related health conditions and an aging population drive demand for specialized nutritional products. Dairy-based proteins, probiotics, and fortified formulations are widely used in medical nutrition, infant nutrition, and elderly care, supporting recovery, immunity, and overall health outcomes.

Frozen food demand is expanding rapidly in the GCC due to urbanization, busy lifestyles, and the popularity of convenience foods. Dairy plays a critical role in frozen desserts, ready meals, and bakery items, while improved cold-chain infrastructure supports consistent quality and extended product availability.

Country Insights:

- Saudi Arabia

- UAE

- Qatar

- Oman

- Kuwait

- Bahrain

Saudi Arabia exhibits a clear dominance with a 35% share of the total GCC dairy market in 2025.

The dairy market in Saudi Arabia is highly motivated by the government-led food security policies that prioritize decreasing the level of imports and empowering local production. Vision 2030 investments are promoting large-scale dairy fields, modern processing units, and industrial belts. These programs enhance the resilience of the supply chains, the involvement of the private sector, and the implementation of effective technologies that will suit the arid climate. Consequently, the domestic dairy production is growing, allowing for its stable supply and helping the country diversify its economy, and creating jobs.

The changing consumer lifestyle and their increasing health consciousness are transforming the consumption habits of dairy products in Saudi Arabia. There is increased demand in the value added products including fortified milk, high protein yogurts, lactose free products and functional dairy drinks. The trend of premiumization is being fast-tracked by younger demographics, rising rates of fitness adoption, and rising disposable incomes. Meanwhile, the advancement of urbanization and the introduction of modern retail penetration are enhancing the accessibility of products, which allows brands to offer new products that meet the nutrition-oriented, convenience-oriented consumption behaviors.

Market Dynamics:

Growth Drivers:

Why is the GCC Dairy Market Growing?

Population Growth and Demographic Transformation

The GCC region experiences sustained population expansion driven by high birth rates among national populations alongside continuous influx of expatriate workers supporting economic development across multiple sectors. By the end of 2024, the combined population of the GCC nations had risen to 61.2 million, reflecting an increase of more than 2.1 million from 2023. This represents a growth rate of 3.6%, according to the most recent data published by the GCC Statistical Center. This demographic growth directly translates into enlarged consumer bases requiring consistent dairy supplies for household consumption, while younger population segments demonstrate heightened nutritional awareness and willingness to explore innovative dairy formats beyond traditional offerings. The presence of diverse expatriate communities introduces varied dairy consumption preferences spanning different cultural backgrounds, compelling market participants to diversify product portfolios accommodating ethnic cuisines, dietary customs, and regional flavor profiles that expand overall market size. Urbanization trends concentrating populations in metropolitan centers facilitate efficient distribution network development while creating concentrated demand nodes supporting specialized retail formats and premium dairy categories.

Rising Health Consciousness and Nutritional Awareness

Educational initiatives promoting balanced nutrition coupled with increasing awareness of dairy's health benefits have elevated consumer perceptions regarding milk products' essential role in maintaining wellness across life stages. Recognition of calcium's importance for bone health, protein's muscle-building properties, and dairy's contribution to balanced dietary patterns drives consumption frequency among health-conscious segments, while concerns regarding nutrient deficiencies particularly prevalent in sun-limited climates motivate vitamin-fortified dairy purchases. The growing prevalence of lifestyle-related health conditions including obesity and diabetes has paradoxically increased demand for specialized dairy formulations featuring reduced sugar content, lower fat levels, and enhanced protein concentrations that align with dietary management protocols. Parents increasingly prioritize children's nutritional development, viewing dairy as indispensable for growth during formative years, while aging populations recognize dairy's role in preventing osteoporosis and maintaining muscle mass throughout senior years.

Food Security Initiatives and Agricultural Development

Government strategies emphasizing food self-sufficiency have catalyzed substantial investments in domestic dairy production infrastructure, reducing vulnerability to global supply disruptions while creating employment opportunities within agricultural sectors. Financial incentives supporting dairy farming operations, technological transfers enabling advanced breeding techniques, and research programs developing climate-adapted livestock varieties collectively enhance regional production capabilities. These initiatives particularly focus on camel dairy development, leveraging indigenous species naturally suited to harsh desert environments while producing milk with distinctive nutritional profiles appealing to health-conscious consumers. Public-private partnerships facilitating knowledge exchange, supply chain modernization, and processing facility development strengthen the entire value chain from farm operations through retail distribution, while strategic reserves and cold storage investments ensure consistent product availability regardless of seasonal production variations or international trade disruptions affecting imported dairy supplies. For instance, in December 2025, Sheikh Dr. Sultan bin Muhammad Al Qasimi, Ruler of Sharjah, inaugurated the Mleiha Dairy Factory and Farm, a sprawling 20,000-square-metre facility capable of producing 100,000 litres of milk daily. Described as a vision over half a century in the making, the project is set to play a key role in strengthening the emirate’s food security and boosting sustainable local dairy production.

Market Restraints:

What Challenges the GCC Dairy Market is Facing?

Climatic Constraints and Production Limitations

The Gulf region's extreme temperatures and arid conditions fundamentally challenge conventional dairy farming operations, limiting natural forage availability and increasing livestock stress that reduces milk yields while elevating production costs. Water scarcity constrains agricultural expansion and intensifies competition between livestock operations and other economic priorities, while dependency on imported animal feed subjects local production to global commodity price fluctuations. High cooling requirements for maintaining animal comfort and preserving product quality throughout distribution significantly increase operational expenses and environmental footprints.

Import Dependency and Supply Chain Vulnerabilities

Despite localization efforts, the GCC dairy market remains substantially reliant on imported products and raw materials, exposing the region to international price volatility, currency exchange fluctuations, and geopolitical tensions that can disrupt supply continuity. Transportation costs for refrigerated goods add significant expense burdens, while regulatory complexities regarding cross-border trade, varying quality standards, and certification requirements create administrative challenges. Extended supply chains from major dairy-producing regions increase vulnerability to global disruptions ranging from pandemic-related logistics constraints to climate events affecting international production zones.

Price Sensitivity and Economic Fluctuations

Consumer purchasing behavior demonstrates sensitivity to dairy pricing particularly among mid-to-lower income segments where dairy represents discretionary spending subject to economic pressures. Petroleum price volatility affecting Gulf economies creates household budget uncertainties impacting consumption patterns, while subsidy reductions on essential goods increase end-user costs potentially constraining demand growth. Competition from plant-based alternatives offering lower price points appeals to budget-conscious consumers, while imported products leveraging economies of scale sometimes undercut locally-produced dairy challenging domestic producers' market positions despite government support initiatives.

Competitive Landscape:

The GCC dairy market is highly competitive, driven by established regional producers leveraging local expertise and multinational corporations applying global knowledge and diverse product portfolios. Competition spans product innovation, with functional ingredients and specialized formulations, extensive distribution networks for broad retail reach, and brand strategies highlighting quality, nutritional benefits, and cultural relevance. Companies invest in cold chain infrastructure, processing technologies, and marketing to build loyalty among discerning consumers. Strategic partnerships between international and regional players enable technology transfers and market access. The market also sees consolidation, with large players acquiring regional brands, while niche producers differentiate through premium, organic, or specialty dairy offerings, catering to evolving Gulf consumer preferences.

Some of the key players are:

- Arla Foods amba

- Al Safi - Danone

- Fonterra Co-operative Group Limited

- GCMMF

- Nestle S.A.

- Al Ain Farms

- Al Rawabi Dairy Company

- Almarai Company

- Lactalis Group

- National Agricultural Development Company (NADEC)

- Saudia Dairy & Foodstuff Company (SADAFCO)

Recent Developments:

-

In February 2025, Sharjah Agriculture and Livestock Production (Ektifa) has broadened its dairy brand Meliha portfolio with the launch of a laban beverage, responding to growing consumer interest in organic products across the UAE. This expansion comes after the strong popularity of its organic full-fat milk, which has reportedly attracted long lines at retail outlets nationwide.

-

In February 2025, Lulu Qatar unveiled its latest collection of premium British dairy products this week, in collaboration with the Agriculture and Horticulture Development Board (AHDB) and the Department for Business and Trade (DBT). In addition to its existing UK offerings, the retailer has introduced an expanded, market-leading range of dairy products now available in most of its larger stores, further enhancing consumer access to high-quality British dairy across Qatar.

GCC Dairy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Liquid Milk, Cheese, Laban, Yogurt and Curd, Butter and Clarified Butter, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialist Retailers, Online Stores, Others |

| Applications Covered | Bakery and Confectionary, Clinical Nutrition, Frozen Food, Others |

| Countries Covered | Saudi Arabia, UAE, Oman, Kuwait, Qatar, Bahrain |

| Companies Covered | Al Ain Farms, Al Rawabi Dairy Company, Almarai Company, Arla Foods amba, Fonterra Co-operative Group Limited, Lactalis Group, National Agricultural Development Company (NADEC), Nestlé S.A., Saudia Dairy & Foodstuff Company (SADAFCO), Al Safi - Danone and GCMMF |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The GCC dairy market size was valued at USD 11.23 Billion in 2025.

The GCC dairy market is expected to grow at a compound annual growth rate of 4.75% from 2026-2034 to reach USD 17.05 Billion by 2034.

Liquid milk dominated the product segment with the market share of 26.12% in 2025, maintaining its position as the fundamental dairy category throughout the Gulf region due to its essential role in daily consumption patterns, versatility across culinary applications, and deep cultural integration within household dietary practices.

Key factors driving the GCC dairy market include sustained population expansion and demographic transformation, creating enlarged consumer bases, rising health consciousness promoting nutritional awareness of dairy benefits, and comprehensive government food security initiatives supporting domestic agricultural development and production infrastructure enhancement.

Major challenges include extreme climatic conditions limiting conventional dairy farming operations and natural forage availability, persistent import dependency exposing the market to global supply chain vulnerabilities and price volatility, and consumer price sensitivity particularly among mid-to-lower income segments where economic fluctuations impact discretionary dairy spending patterns.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)