GCC Cybersecurity Market Size, Share, Trends and Forecast by Component, Deployment Type, User Type, Industry Vertical, and Country, 2026-2034

GCC Cybersecurity Market Summary:

The GCC cybersecurity market size was valued at USD 6.03 Billion in 2025 and is projected to reach USD 9.28 Billion by 2034 , growing at a compound annual growth rate of 4.9% from 2026-2034.

The market's expansion is propelled by escalating cyber threats targeting critical infrastructure, accelerated digital transformation initiatives under national vision programs like Saudi Arabia's Vision 2030 and UAE's Digital Government Strategy, and stringent data protection regulations compelling organizations to implement robust cybersecurity frameworks across the region. Government mandates, including Saudi Arabia's National Cybersecurity Authority's Essential Cybersecurity Controls and UAE's mandatory ISO/IEC 27001 compliance for critical sectors, are driving significant investments in advanced security solutions to protect sensitive data and expanding the GCC cybersecurity market share.

Key Takeaways and Insights:

- By Component: Services dominate the market with 54.09% share in 2025, driven by increasing adoption of managed security services and professional consulting.

- By Deployment Type: On-premises lead with 58.15% share in 2025, reflecting stringent data sovereignty requirements in critical sectors.

- By User Type: Large enterprises represent the largest segment with a market share of 70.14% share in 2025, as complex hybrid cloud environments and escalating threats necessitate comprehensive security frameworks.

- By Industry Vertical: BFSI leads the market with a share of 24.18% in 2025, driven by regulatory compliance and the heightened occurrence of various high-frequency cyber threats.

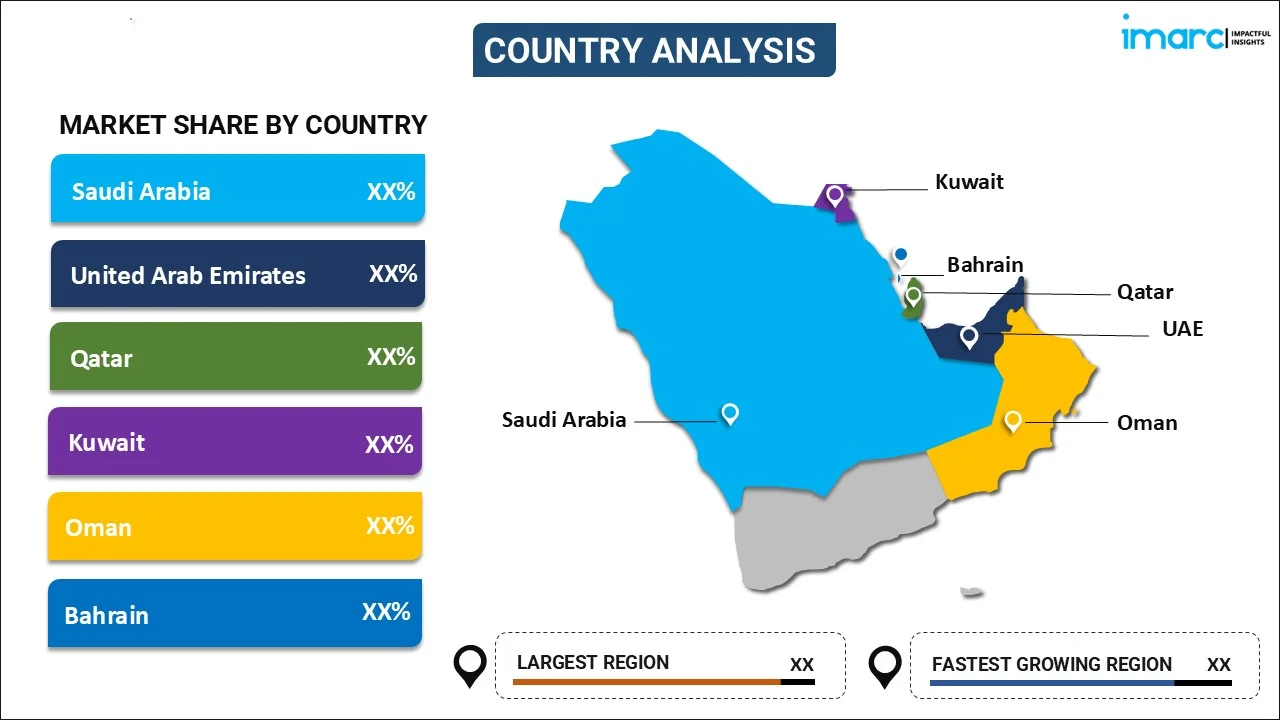

- By Country: Saudi Arabia represents the largest segment with a market share of 31% in 2025, propelled by Vision 2030 digital transformation initiatives and massive infrastructure investments.

- Key Players: Leading players enhance competitiveness by investing in artificial intelligence (AI) driven threat detection, expanding managed security services, forming regional partnerships, acquiring local expertise, aligning with government regulations, localizing solutions, strengthening cloud security, and building workforces to support digital transformation across GCC markets.

The GCC region witnessed a initial access broker activity in the Middle East during 2024, while UAE public sector organizations encounter approximately 50,000 cyberattacks daily, demonstrating the urgent and escalating need for advanced cybersecurity measures across government and commercial entities. The implementation of national cybersecurity strategies, particularly Saudi Arabia's Vision 2030 and UAE's Digital Government Strategy 2025, is compelling organizations to invest heavily in comprehensive security solutions to protect critical infrastructure and support economic diversification goals. Financial institutions face particularly acute risks, as they are targeted by cyberattacks 300 times more frequently than other sectors, with average data breach costs reaching USD 6.08 million in 2024. For instance, in 2025, Mastercard has inaugurated its Cyber Resilience Center, a project that unites essential participants from the financial industry to encourage teamwork and assist common objectives in creating a secure commerce and payment environment in the Kingdom. This marks Mastercard’s initial effort in the Middle East, expanding the company’s worldwide network of cyber resilience centers that features sites in Europe and the United States.

GCC Cybersecurity Market Trends:

AI-Powered Threat Detection and Automated Security Operations

AI and machine learning (ML) technologies are revolutionizing cybersecurity operations across the GCC, enabling real-time threat detection with unprecedented accuracy and speed through analysis of vast datasets to identify patterns and anomalies. Organizations are deploying AI-driven security operations centers that reduce incident response times from hours to minutes, while predictive security analytics help GCC organizations stay ahead of emerging cyber threats with preventive measures rather than reactive responses. Saudi Arabia's NEOM project exemplifies this transformation, integrating AI-driven security operations centers for proactive threat management, while automated incident response systems streamline processes through machine learning algorithms. The 2025 SANS Gulf Region event demonstrated high demand for GenAI and LLM Security courses, reflecting rapid adoption across government and enterprises, as cybersecurity professionals seek to understand AI-driven phishing attacks, adversarial AI manipulation, and secure deployment of LLM-based applications throughout the region.

Cloud Security and Zero Trust Architecture Adoption Accelerate Across Enterprises

The rapid migration to cloud-based solutions to enhance operational efficiency and scalability is necessitating implementation of comprehensive cybersecurity strategies, as GCC countries expand toward public and private cloud investments with organizations gravitating toward understanding multi-cloud security, identity governance, and zero trust architecture implementation. Zero Trust has become a foundational requirement rather than optional approach for organizations managing extensive cloud and identity ecosystems, with companies deploying micro-segmentation and least-privilege access models to prevent unauthorized network access and lateral movement. In 2024, Qatar’s National Cyber Security Agency (NCSA) released the Guidelines for the Secure Adoption and Usage of Artificial Intelligence, as the agency leads Qatar’s regulatory initiatives to safely implement AI solutions in the public and private sectors. UAE's smart city initiatives showcase integrated AI cybersecurity frameworks across critical infrastructure, with financial institutions, petroleum companies, and government agencies adopting cloud security solutions to guard against data losses and ensure business continuity through low-latency, AI-ready workloads.

Integration of IoT and Smart City Cybersecurity Infrastructure Creates New Security Paradigms

Large-scale smart city developments and IoT proliferation across the GCC are fundamentally reshaping cybersecurity requirements, as landmark projects including NEOM, The Line, Red Sea Project, and Qiddiya showcase the Kingdom's ambition to redefine modern urban living through smart technologies including artificial intelligence, cloud computing, and smart grids optimizing traffic, energy, water, waste, security, and citizen engagement. By 2024, the Saudi government allocated over USD 500 billion for the construction of megacity and smart infrastructure projects under Vision 2030. The exponential growth of sensitive data being collected and processed from interconnected digital platforms including personal information of residents, critical infrastructure operations, and real-time monitoring systems presents attractive targets for cyberattacks, necessitating comprehensive approaches including legislative measures, technological safeguards, and public awareness campaigns to foster secure digital urban environments across the region.

Market Outlook 2026-2034:

Government-led digital transformation initiatives, including Saudi Arabia's allocation of funds for AI and digital innovation, coupled with UAE's comprehensive National Cybersecurity Strategy implementation, will continue driving market expansion as organizations prioritize protection of critical assets and compliance with evolving regulatory frameworks. The market generated a revenue of USD 6.03 Billion in 2025 and is projected to reach a revenue of USD 9.28 Billion by 2034, growing at a compound annual growth rate of 4.9% from 2026-2034. The integration of AI into cybersecurity operations, expansion of cloud-native security platforms with heightened adoption across enterprises, and proliferation of IoT devices in smart city developments will necessitate continuous innovation in threat detection capabilities, automated response mechanisms, and zero trust architecture deployment throughout the forecast period.

GCC Cybersecurity Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Component |

Services |

54.09% |

|

Deployment Type |

On-premises |

58.15% |

|

User Type |

Large Enterprises |

70.14% |

|

Industry Vertical |

BFSI |

24.18% |

|

Country |

Saudi Arabia |

31% |

Component Insights:

To get Detailed analysis of this market, RequestSample

- Solutions

- Identity and Access Management (IAM)

- Infrastructure Security

- Governance, Risk and Compliance

- Unified Vulnerability Management Service Offering

- Data Security and Privacy Service Offering

- Others

- Services

- Professional Services

- Managed Services

Services dominate with a market share of 54.09% of the total GCC cybersecurity market in 2025.

Organizations across the GCC are increasingly adopting managed security services to address the acute shortage of skilled cybersecurity professionals, with service providers offering 24/7 monitoring, threat detection, and incident response capabilities that enable enterprises to maintain robust security postures without extensive in-house expertise. Managed security services dominate as AI-powered security operations center operations reduce response times from hours to minutes, exemplified by Saudi Arabia's NEOM project integrating AI-driven SOCs for proactive threat management, while professional services see growing demand for implementing advanced threat detection systems, compliance frameworks, and training programs mandated by regulatory authorities.

Professional services encompass consulting, system integration, training, and support activities, helping organizations design and implement tailored cybersecurity architectures aligned with their specific risk profiles and regulatory requirements, while managed services provide ongoing monitoring, threat intelligence, incident response, and vulnerability management on subscription or outcome-based pricing models that allow organizations to scale security operations efficiently. By 2024, a major percentage of GCC enterprises rely on managed service providers for critical security functions, as the demand for skilled cybersecurity experts projected to exceed 50,000 far outpaces regional supply, compelling organizations to outsource complex security operations to specialized providers with access to advanced technologies including AI-powered analytics, automated response systems, and global threat intelligence networks that individual enterprises cannot maintain cost-effectively.

Deployment Type Insights:

- Cloud-based

- On-premises

On-premises lead with a share of 58.15% of the total GCC cybersecurity market in 2025.

The prevalence of on-premise cybersecurity deployments is propelled by the need for data privacy and regulatory compliance in industries including healthcare, finance, and government where sensitive data cannot be hosted externally due to national security considerations and strict data localization mandates enforced by regional authorities. Organizations maintain control over security infrastructure to meet low-latency requirements for critical applications while ensuring compliance with sector-specific regulations, including Dubai International Financial Center's stringent policies based on GDPR principles and Saudi Arabian Monetary Authority's cybersecurity framework requiring financial institutions to implement comprehensive on-premise security controls for protecting customer data and transaction systems.

Financial institutions across the GCC maintain on-premise deployments as cyberattacks target them more frequently than other sectors, necessitating robust security infrastructures that enable real-time monitoring, immediate threat mitigation, and continuous protection of high-value assets without dependence on external cloud service providers whose infrastructure may not meet stringent regulatory standards for critical financial data protection. Large enterprises operating complex hybrid and multi-cloud environments prefer on-premise security solutions for core infrastructure protection, utilizing advanced network security equipment, unified threat management platforms, and integrated security operations centers that provide comprehensive visibility across attack surfaces while maintaining compliance with evolving data protection regulations.

User Type Insights:

- Large Enterprises

- Small and Medium Enterprises

Large enterprises exhibit a clear dominance with a 70.14% share of the total GCC cybersecurity market in 2025.

Large enterprises across the GCC face escalating challenges from hybrid and multi-cloud infrastructures creating greater attack surfaces, while sophisticated cyber threats including data breaches and ransomware operations push organizations to invest significantly in comprehensive, advanced cybersecurity frameworks encompassing endpoint protection, network security, cloud application security, and integrated threat intelligence platforms. The complexity of managing security across diverse technology stacks, multiple geographical locations, and interconnected supply chains requires large enterprises to deploy enterprise-grade security solutions featuring centralized management consoles, automated threat detection and response systems, and continuous compliance monitoring capabilities that smaller organizations typically cannot justify from cost-benefit perspectives or effectively manage without specialized cybersecurity teams.

Large financial institutions across the BFSI sector maintain the most comprehensive cybersecurity infrastructures, as they are targeted by cyberattacks more frequently than other sectors with average breach costs reaching USD 6.08 million in 2024, necessitating continuous investment in advanced security technologies including behavioral analytics, fraud detection systems, encrypted communications platforms, and secure cloud environments that protect sensitive customer financial data while ensuring transaction integrity and business continuity for critical payment and settlement systems. Major enterprises operating in Saudi Arabia's Vision 2030 ecosystem, including participants in NEOM, The Line, and other giga-projects, require enterprise-scale security solutions addressing unique challenges of protecting smart city infrastructure, IoT devices, AI-driven systems, and interconnected digital ecosystems where traditional security perimeters no longer exist and threats can propagate rapidly across integrated platforms serving millions of residents and critical national functions.

Industry Vertical Insights:

- IT and Telecom

- Retail

- BFSI

- Healthcare

- Defense/Government

- Manufacturing

- Energy

- Others

BFSI leads with a share of 24.18% of the total GCC cybersecurity market in 2025.

The Banking, Financial Services, and Insurance sector faces disproportionate cyber risks as financial institutions are targeted by cyberattacks 300 times more frequently than other sectors, with sophisticated threat actors deploying advanced techniques including ransomware, phishing, account takeover fraud, and payment system compromises that resulted in average data breach costs reaching USD 6.08 million in 2024 across the region. Financial institutions must protect sensitive customer financial data, maintain transaction integrity, and ensure business continuity for critical payment and settlement systems while complying with stringent regulatory frameworks imposed by authorities including Saudi Arabian Monetary Authority, which introduced cyber threat intelligence principles in March 2022 mandating financial institutions achieve compliance with SAMA's cybersecurity framework through implementation of comprehensive security controls. Dubai International Financial Center enforces stringent cybersecurity policies based on GDPR principles, requiring financial organizations to implement advanced identity and access management, encryption protocols, continuous monitoring systems, and incident response capabilities, while central banks across the GCC mandate regular security audits, penetration testing, and compliance certifications demonstrating adherence to international standards including ISO/IEC 27001 and PCI DSS for organizations handling payment card data.

The healthcare sector demonstrates the highest growth trajectory as GCC healthcare providers rapidly adopt cybersecurity solutions to safeguard sensitive patient data, ensure regulatory compliance with emerging health information privacy regulations, and protect critical infrastructure from evolving cyber threats including ransomware attacks that disrupt patient care and compromise vital medical systems. Healthcare organizations deploy endpoint protection, identity and access management, and threat detection systems to secure networks and patient information, while relying on secure cloud environments and encrypted communications platforms to maintain data integrity and confidentiality especially in smart hospitals and national health information exchanges being established across GCC countries to enable digital health services, telemedicine platforms, and integrated patient records systems supporting Vision 2030 healthcare transformation objectives. Government and critical infrastructure sectors also command substantial cybersecurity investments as they face persistent threats from state-sponsored actors and sophisticated criminal organizations, with UAE public sector organizations encountering approximately 50,000 cyberattacks daily requiring implementation of comprehensive security architectures including network security solutions with firewalls, intrusion detection systems, and unified threat management platforms protecting government data, citizen information, and critical national infrastructure supporting economic and security functions.

Country Insights:

To get Detailed analysis of this market, RequestSample

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

Saudi Arabia exhibits a clear dominance with a 31% share of the total GCC cybersecurity market in 2025.

The Kingdom's comprehensive regulatory framework, including the National Cybersecurity Authority's Essential Cybersecurity Controls updated in 2024 and applicable to government entities and organizations operating critical national infrastructure, creates substantial demand for advanced cybersecurity solutions across all sectors. Large-scale projects including NEOM, The Line representing revolutionary linear city concepts, and expansive 5G deployments covering urban areas generate unprecedented cybersecurity demands requiring protection of smart city infrastructure, IoT ecosystems, AI-driven systems, and interconnected digital platforms serving massive populations. By 2024, the Saudi government allocated over USD 500 billion to megacity and smart infrastructure projects, with funds invested specifically in AI and digital innovation.

Saudi Arabia's cybersecurity market is further driven by investments from critical infrastructure sectors, reflecting recognition that cybersecurity is fundamental to sustained economic growth as the Kingdom transitions toward a fully digital economy. Moreover, Saudi Arabia launched a comprehensive cyber resilience program for critical infrastructure mandating advanced threat detection systems across energy, healthcare, and financial sectors, driving significant cybersecurity investments as organizations implement AI-powered security operations centers, zero trust architectures, and comprehensive incident response capabilities required to protect sensitive data and maintain operational continuity for critical national functions.

Market Dynamics:

Growth Drivers:

Why is the GCC Cybersecurity Market Growing?

Government Digital Transformation Initiatives and National Cybersecurity Strategies

National vision programs including Saudi Arabia's Vision 2030 and UAE's Digital Government Strategy 2025 are fundamentally transforming the cybersecurity landscape through establishment of comprehensive regulatory frameworks, massive digital infrastructure investments, and mandatory compliance requirements compelling organizations across all sectors to implement robust cybersecurity measures protecting critical assets and sensitive data. The National Cybersecurity Authority issued updated Essential Cybersecurity Controls in 2024 applicable to government entities and organizations operating critical national infrastructure. In 2025, Rubrik, Inc., the Security and AI Operations Company, declared its official entry into the Kingdom of Saudi Arabia via a strategic alliance with Echelon Digital Group, a technology holding firm aimed at developing and expanding partnerships that promote digital transformation throughout Saudi Arabia and neighboring regions.

Escalating Cyber Threats and Stringent Regulatory Compliance Requirements

The frequency, sophistication, and impact of cyberattacks targeting GCC organizations have intensified dramatically, while the public sector organizations encounter approximately 50,000 cyberattacks daily, demonstrating the persistent and evolving nature of threats facing governments, enterprises, and critical infrastructure operators requiring continuous investment in advanced security technologies and expert services. Government mandates including UAE's requirement for ISO/IEC 27001 compliance across critical infrastructure sectors, Saudi Arabia's Essential Cybersecurity Controls for national infrastructure operators, and sector-specific regulations for healthcare, energy, and telecommunications are driving organizations to invest heavily in security solutions, professional consulting services, and managed security providers possessing expertise to navigate complex regulatory landscapes while implementing controls addressing sophisticated cyber threats targeting the region's strategically important and economically valuable digital assets. In 2024, ransomware attacks in the UAE rose by 32% compared to the prior year, according to data from the UAE Cyber Security Council.

Large-Scale Infrastructure and Smart City Development Projects

Massive investments in smart city developments, critical infrastructure modernization, and digital ecosystem creation are generating extraordinary cybersecurity requirements as governments and enterprises deploy interconnected systems, IoT devices, AI-powered platforms, and cloud-based services supporting smart transportation, intelligent energy grids, digital healthcare, connected buildings, and citizen services across urban environments serving millions of residents. In May 2025, Google Cloud and Saudi Arabia's Public Investment Fund advanced a USD 10 billion partnership to build and operate a global AI hub bringing advanced AI technology and cloud infrastructure to the Kingdom, requiring implementation of comprehensive cybersecurity measures protecting AI model training data, algorithmic integrity, cloud platforms, and customer workloads from sophisticated threats targeting high-value AI systems and computational infrastructure supporting the region's digital transformation ambitions and economic diversification objectives.

Market Restraints:

What Challenges the GCC Cybersecurity Market is Facing?

Acute Shortage of Skilled Cybersecurity Professionals Hinders Effective Implementation

The GCC faces a critical shortage of cybersecurity professionals, with demand for skilled experts projected to exceed while supply remains insufficient, posing significant impediments to effective implementation and management of advanced security solutions across organizations. The scarcity of talent with specialized expertise in areas including AI-powered threat detection, zero trust architecture, cloud security, incident response, and compliance management inhibits adoption of sophisticated technologies, leaving organizations vulnerable due to insufficient expertise to configure, monitor, and maintain complex security infrastructures.

Integration Complexity with Multi-Vendor Security Solutions

Organizational reliance on security solutions from diverse vendors introduces substantial challenges in integration and compatibility, resulting in complex and inefficient security environments that hamper ability to maintain comprehensive views of threats and vulnerabilities while coordinating responses across disparate systems, platforms, and technologies deployed throughout enterprise infrastructures. Many GCC enterprises operate multi-cloud and hybrid cloud setups complicating security management, as lack of standardized protocols, incompatible management interfaces, and siloed security tools prevent unified threat detection, centralized policy enforcement, and coordinated incident response capabilities essential for addressing sophisticated attacks leveraging multiple attack vectors simultaneously.

Data Privacy, Sovereignty, and Standardization Concerns

The regulatory environment around data sovereignty and privacy across the GCC is still maturing, posing challenges to seamless deployment of international smart city technologies, cloud services, and security platforms as organizations balance innovation requirements with compliance to emerging local data protection laws requiring coordinated efforts between government entities, private sector participants, and technology providers to navigate evolving regulatory frameworks. Lack of standardized cybersecurity protocols across sectors hinders integration of disparate systems within smart city ecosystems, critical infrastructure networks, and enterprise environments.

Competitive Landscape:

Key market players in the GCC cybersecurity market are improving their business by focusing on innovation, localization, and service expansion. They are investing heavily in advanced technologies such as artificial intelligence, machine learning, and automation to enhance threat detection, prevention, and response capabilities. Many are expanding managed security services to support organizations facing skill shortages and growing cyber risks. Localization is a major priority, with solutions tailored to regional regulations, data residency requirements, and national cybersecurity strategies. Players are also strengthening partnerships with government entities, telecom operators, and technology ecosystems to expand market reach and build trust. Workforce development through training programs and regional cybersecurity centers is another focus area, helping address talent gaps and improve service quality. Additionally, vendors are developing sector-specific solutions for critical industries such as government, finance, energy, and healthcare. These combined strategies help companies increase resilience, competitiveness, and long-term growth across GCC markets.

Recent Developments:

-

In December 2025, MBME Group, a prominent technology and digital services provider based in the UAE, and ZENDATA, a global expert in cybersecurity, declared that they have finalized a joint venture agreement to create ZENDATA Cyber Defense, a new cybersecurity firm dedicated to providing sophisticated, comprehensive cyber defense solutions throughout the region.

-

In October 2025, ESET, a worldwide leader in cybersecurity, is restating its dedication to safeguarding the Middle East’s digital framework at GITEX 2025, held at the Dubai World Trade Center, Dubai, UAE. At this year's event, ESET is revealing its newest AI-based technologies aimed at addressing today's most sophisticated cyber threats.

GCC Cybersecurity Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered |

|

| Deployment Types Covered | Cloud Based, On-Premises |

| User Types Covered | Large Enterprises, Small and Medium Enterprises |

| Industry Verticals Covered | IT and Telecom, Retail, BFSI, Healthcare, Defense/Government, Manufacturing, Energy, Others |

| Countries Covered | Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, Oman |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The GCC cybersecurity market size was valued at USD 6.03 Billion in 2025.

The GCC cybersecurity market is expected to grow at a compound annual growth rate of 4.9% from 2026-2034 to reach USD 9.28 Billion by 2034.

Services dominate the market with 54.09% share, as organizations increasingly adopt managed security services and professional consulting to address the acute shortage of skilled cybersecurity professionals while implementing advanced threat detection systems, compliance frameworks, and continuous monitoring capabilities required to protect against sophisticated cyber threats targeting critical infrastructure and sensitive data across the region.

Key factors include government digital transformation initiatives like Saudi Arabia's Vision 2030, escalating cyber threats with UAE facing daily attacks, stringent regulatory compliance mandates, and massive smart city investments in the region generating unprecedented security demands.

Major challenges include acute shortage of skilled cybersecurity professionals with demand exceeding while supply remains insufficient, integration complexity from multi-vendor security solutions creating operational inefficiencies, and evolving data sovereignty regulations complicating deployment of international technologies across maturing regulatory frameworks.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)