GCC Construction Vehicles Market Size, Share, Trends and Forecast by Vehicle Type, Propulsion Type, Application, and Country, 2025-2033

GCC Construction Vehicles Market Size and Share:

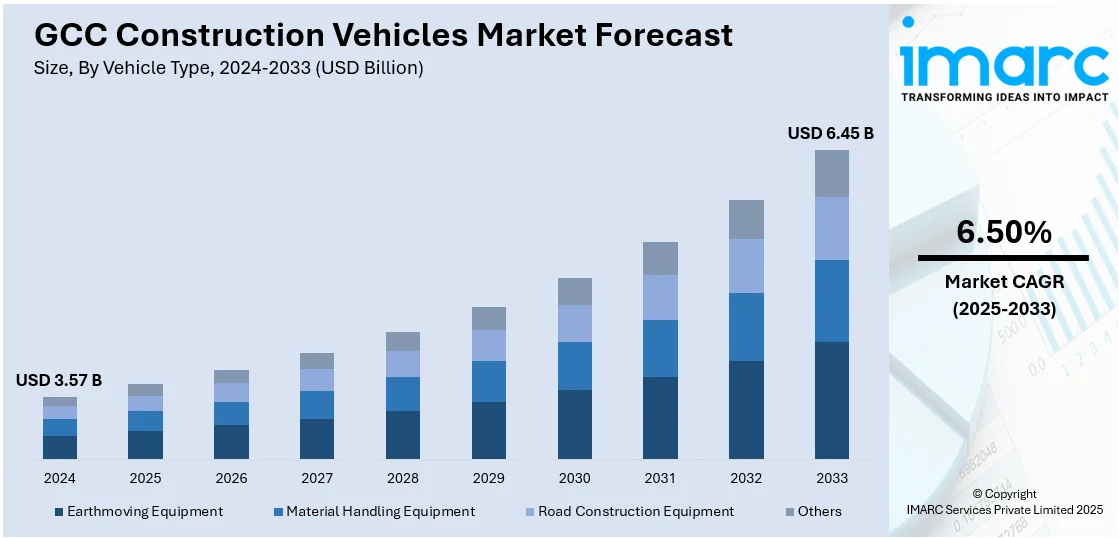

The GCC construction vehicles market size was valued at USD 3.57 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6.45 Billion by 2033, exhibiting a CAGR of 6.50% from 2025-2033. The market is mainly influenced by considerable investments in infrastructure and construction projects throughout the region. Policies supporting economic diversification away from oil also contribute to the sustained demand for construction vehicles. Additionally, technological advancements in construction machinery, aimed at increasing efficiency and reducing environmental impact, are bolstering the market growth in the GCC region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.57 Billion |

| Market Forecast in 2033 | USD 6.45 Billion |

| Market Growth Rate (2025-2033) | 6.50% |

Governing bodies are focusing on expanding transportation networks, building utilities, and creating industrial zones to support economic growth and urbanization. These projects require a wide range of construction vehicles, including excavators, loaders, and dump trucks, to handle diverse tasks efficiently. The emphasis on improving infrastructure to support trade, logistics, and connectivity is making construction vehicles essential for completing these large-scale initiatives. Apart from this, advancements in construction vehicle technology are positively influencing the market. Features such as automated controls, global positioning systems (GPS) tracking, and energy-efficient engines are enhancing the performance and appeal of these machines. Additionally, key players are focusing on sustainability by launching electric and hybrid construction vehicles that align with environmental goals.

Moreover, the rising focus on expanding energy infrastructure, including oil refineries, natural gas plants, and renewable energy projects, which requires specialized construction vehicles, is bolstering the market growth. The construction of pipelines, solar farms, and wind energy facilities adds to the growing demand for heavy machinery capable of operating efficiently in diverse terrains and challenging environments. Besides this, the increasing need to develop resilient and disaster-ready infrastructure in response to climate challenges is leading to a rise in construction activities. Projects involving flood control systems, sustainable drainage solutions, and durable road networks require advanced construction vehicles designed for precision and long-term performance. Furthermore, mining and quarrying activities, essential for supplying raw materials to the construction industry, are contributing to the demand for heavy-duty vehicles like excavators, loaders, and dump trucks.

GCC Construction Vehicles Market Trends:

Adoption of Electric and Eco-Friendly Construction Vehicles

The increasing focus on sustainability and environmental responsibility in the GCC region is accelerating the adoption of electric and eco-friendly construction vehicles. Governing bodies and private developers are seeking solutions that align with national and international goals for reducing carbon emissions and achieving net-zero targets. Electric construction vehicles offer a promising alternative to traditional machinery, combining high performance with benefits like zero emissions, reduced noise levels, and improved energy efficiency. These features make them particularly suitable for urban and environmentally sensitive projects, where minimizing environmental impact is a priority. In 2024, Volvo Construction Equipment (Volvo CE) successfully tested the L120H Electric wheel loader in Abu Dhabi, UAE, in collaboration with FAMCO and ALAS Emirates Ready Mix. This marks Volvo CE's first electric construction equipment trial in the UAE, aiming towards a net-zero future with a focus on sustainable construction practices. The L120H Electric claims to offer performance, which is equivalent to its conventional counterpart, but along with zero emissions benefits, near-silent operation, and enhanced operator comfort.

Modernization of Logistics Infrastructure

With increasing international trade and regional connectivity initiatives, ports, customs points, and transportation hubs are being redeveloped to handle larger volumes and operate more efficiently. This requires advanced construction machinery for building warehouses, loading bays, and maintenance facilities, alongside specialized vehicles for upgrading existing structures. Governing bodies are also leveraging innovative funding models, such as public-private partnerships (PPP), to accelerate these projects while integrating modern technologies into operations. The push to modernize logistics not only supports trade but also drives the demand for construction vehicles equipped to handle large-scale projects. For instance, in 2024, Saudi Arabia's Zakat, Tax, and Customs Authority (ZATCA), in collaboration with the National Centre for Privatisation & PPP (NCP), has initiated a tender for the establishment and management of customs warehouses at 38 entry points throughout the Kingdom. This initiative aims to design, construct, finance, maintain, operate, and ultimately transfer 13 warehouses, employing a Public-Private Partnership approach and requesting qualifications to be submitted by November 14, 2024. The scope covers loading, unloading, and maintenance activities, along with enhancing the facilities with new equipment.

Increase in Maritime Infrastructure Projects

The GCC countries are enhancing their maritime infrastructure to boost trade and economic growth, with significant investments in port development and expansion. Projects like the expansion of Saudi Arabia’s King Abdulaziz Port and the construction of new terminals in Oman’s Duqm Port require heavy-duty construction vehicles for dredging, land reclamation, and port construction. This rise in maritime projects is driving the demand for construction vehicles, particularly for those machines designed for marine and coastal construction environments. In 2024, King Abdulaziz Port in Dammam, Saudi Arabia, enhanced its crane capacity by 9.7% with a $1.86 billion investment, adding three automated quay cranes and three rubber-tired gantry cranes. This improvement, stemming from a collaboration between the Saudi Ports Authority (Mawani) and Saudi Global Ports Co., boosts the port's ability to host larger ships and strengthens its aim of becoming a leading maritime hub.

GCC Construction Vehicles Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC construction vehicles market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on vehicle type, propulsion type, and application.

Analysis by Vehicle Type:

- Earthmoving Equipment

- Excavators

- Bulldozers

- Loaders

- Motor Graders

- Material Handling Equipment

- Cranes

- Forklifts

- Telehandlers

- Road Construction Equipment

- Asphalt Pavers

- Road Rollers/Compactors

- Concrete Pavers

- Others

The earthmoving equipment segment (excavators, bulldozers, loaders, and motor graders) is integral to numerous construction tasks such as grading, digging, and moving large quantities of earth. These vehicles are critical for foundation work, landscaping, and any construction task requiring significant earth manipulation. This segment benefits from consistent demand driven by a broad array of construction projects, ranging from residential to large-scale infrastructure developments.

Material handling equipment (cranes, forklifts, and telehandlers) is essential for lifting and transporting materials across construction sites. Equipment for material handling is essential for upholding safety and efficiency standards, aiding in the management of construction materials on both limited and expansive project sites. These vehicles are adaptable and serve a crucial function in both minor constructions and extensive industrial endeavors.

Road construction equipment (asphalt pavers, road rollers/compactors, and concrete pavers) is specifically designed for creating and maintaining roadways. This equipment is essential in constructing structures that link cities and improve accessibility. The dependence on these devices is continuous since they are specially designed to meet the unique requirements of road building and upkeep, guaranteeing durability and adherence to transportation regulations.

Others include machines like trenchers, pile drivers, and concrete mixers, which are designed for specific construction tasks that require unique capabilities. These vehicles cater to niche markets within the construction industry, offering solutions for specialized or less common construction activities.

Analysis by Propulsion Type:

- Internal Combustion

- Electric

- Others

The internal combustion segment includes vehicles powered by diesel engines. This engine is favored for its robust performance and reliability in harsh construction environments. Internal combustion is crucial for tasks requiring high power output and extended operation periods, making it a staple in large-scale construction projects where electric alternatives may not yet match their endurance and power.

Electric is gaining traction within the GCC as part of the shift towards sustainability. Electric construction vehicle offers significant advantages, such as reduced emissions and lower operational noise, making it ideal for projects in urban settings or environmentally sensitive areas. The adoption of electric vehicle is encouraged by advancements in battery technology and increasing environmental regulations, positioning this segment for growth as more constructors prioritize green building practices.

Others include hybrid and alternative fuel vehicles that combine internal combustion engines with electric motors or run on non-traditional fuels like natural gas. This segment caters to a niche market looking for environmental efficiency without compromising on power and operation time. Hybrid vehicles, in particular, provide a practical compromise, offering lower emissions than traditional vehicles while maintaining performance, which is critical for the demanding tasks typical in construction settings.

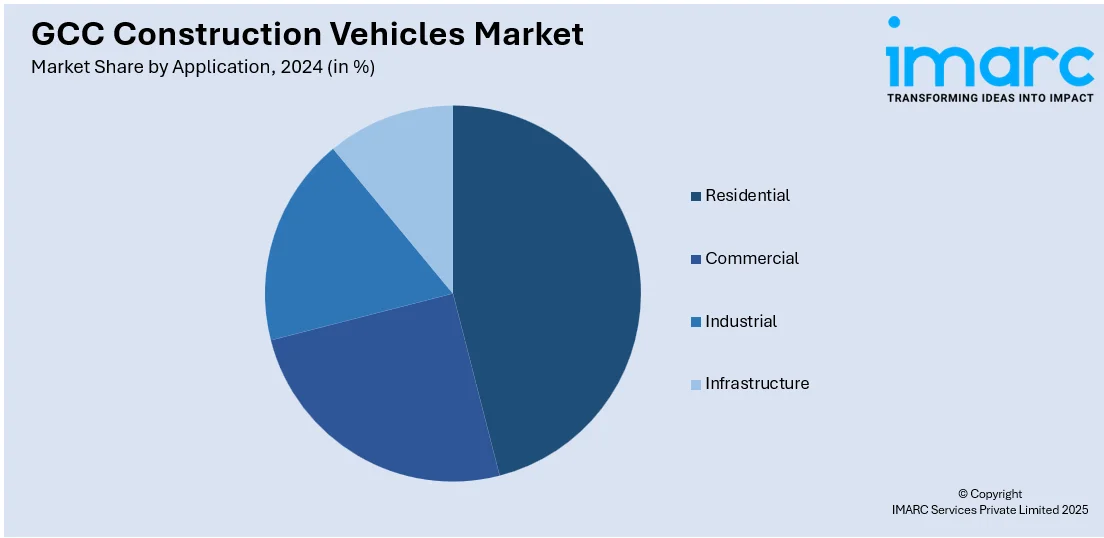

Analysis by Application:

- Residential

- Commercial

- Industrial

- Infrastructure

In the residential segment, the demand for construction vehicles is primarily driven by the increasing need for housing units to accommodate growing populations across the GCC. Construction companies utilize a range of vehicles, such as excavators and cranes, to expedite the building of high-rise apartments, housing complexes, and individual dwellings. This segment focuses on the efficient completion of housing projects, utilizing advanced machinery to meet tight deadlines and quality standards.

The commercial segment is bolstered by the expansion of retail spaces, offices, and hospitality facilities. As the region enhances its commercial infrastructure to attract businesses and tourists, the need for construction vehicles that can handle complex builds and renovations grows. This sector demands versatile and robust machinery capable of supporting the diverse needs of commercial construction.

The industrial segment includes the construction of facilities like factories, processing plants, and warehouses. The demand in this sector is driven by the need for specialized vehicles that can perform in demanding environments and handle heavy-duty tasks. Construction vehicles used in this segment are typically designed for high efficiency and durability to accommodate the rigorous demands of industrial construction.

Infrastructure projects like bridges, roads, and public transit systems, require a specialized set of construction vehicles. This segment's growth is supported by investments by governing bodies in infrastructure development to enhance connectivity and support economic growth. The vehicles used in this sector are often heavy-duty machines capable of earthmoving, paving, and lifting heavy materials, essential for large-scale infrastructure projects.

Country Analysis:

- Saudi Arabia

- United Arab Emirates

- Qatar

- Kuwait

- Oman

- Bahrain

Saudi Arabia holds a notable GCC construction vehicles market share, driven by its large-scale public sector investments in construction and infrastructure. The commitment of the governing body to enhancing transportation networks and building commercial and residential units supports market growth.

In the United Arab Emirates, the market is driven by ongoing construction activities, particularly in Dubai and Abu Dhabi. The emphasis on developing hospitality and leisure facilities, alongside residential and commercial buildings, drives the demand for various construction vehicles.

Qatar's market is primarily driven by its national vision, which focuses on sustainable development and infrastructure readiness for international events. Investments in transportation infrastructure and commercial projects play a crucial role.

Kuwait sees a steady demand for construction vehicles because of its development plan, which includes upgrades to transportation networks and construction of healthcare and educational facilities. Government spending in these areas ensures that the market for construction vehicles remains active, responding to the needs for infrastructure expansion and modernization.

Oman's market is influenced by its ongoing efforts to enhance tourist facilities and improve public infrastructure. The construction sector’s growth is supported by investments by governing bodies in these areas, maintaining steady demand for construction vehicles necessary for these developments.

In Bahrain, the market benefits from the strategic infrastructure projects, which include significant investments in the real estate sector and public works. Bahrain’s focus on enhancing its hospitality and real estate sectors contributes to the steady demand for construction machinery and vehicles.

Competitive Landscape:

Major participants in the market are diligently improving their product lines and increasing their market visibility through strategic collaborations and acquisitions. Furthermore, they are enhancing their distribution channels and post-sales services to boost customer satisfaction and expand their presence in the market. They are concentrating on technological innovations to satisfy the growing need for effective and eco-friendly construction equipment. These firms are similarly allocating resources to research initiatives aimed at developing and producing equipment that satisfies the particular needs of the local construction sector. In 2024, JCB declared the introduction of a new generation of construction equipment in the UAE, featuring state-of-the-art excavators and backhoe loaders. These machines include notable enhancements designed to improve efficiency, comfort, and cost-effectiveness.

The report provides a comprehensive analysis of the competitive landscape in the GCC construction vehicles market with detailed profiles of all major companies.

Latest News and Developments:

- January 2025: Zoomlion Heavy Industry Science & Technology held a strategic event in Riyadh, Saudi Arabia, where they launched 24 localized innovative products and smart solutions spanning seven categories of construction equipment. The offerings consist of mobile cranes, tower cranes, and earthmoving machinery.

- October 2024: Kemsolid BY KEMROC, a German leader in rock cutting technology, announced the launch of two new excavator attachment models, the 'KSI Twin 16000' and 'KSI Hydra,' designed for railway and specialized foundation projects. These models are part of Kemsolid's innovative approach to soil stabilization, using their Trench Soil Mixing technology to inject and mix concrete into soils for more robust construction applications. The innovative technology will be presented at the IGIC exhibition in Dubai on October 30-31, 2024, underscoring its capability to greatly enhance efficiency and lower expenses in construction initiatives.

- September 2024: Yuksel Saudia celebrated over 40 years of partnership with Volvo Construction Equipment, highlighting their fleet of 35 EW205D wheeled excavators, which are pivotal in major urban infrastructure projects across Saudi Arabia. These excavators are known for their durability, efficiency, and advanced technology features like ECO mode and Volvo’s CareTrack system.

- August 2024: Yuksel Saudia commemorated more than 40 years of collaboration with Volvo Construction Equipment, showcasing their fleet of 35 EW205D wheeled excavators that play a crucial role in significant urban infrastructure initiatives throughout Saudi Arabia. The machinery will be utilized in the Riyadh Ring Road project, which seeks to improve the transportation infrastructure in the Riyadh area by 2027.

GCC Construction Vehicles Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Billion |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered |

|

| Propulsion Types Covered | Internal Combustion, Electric, Others |

| Applications Covered | Residential, Commercial, Industrial, Infrastructure |

| Countries Covered | Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, Bahrain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC construction vehicles market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC construction vehicles market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC construction vehicles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Construction vehicles are specialized machines designed for building and infrastructure projects. They include excavators for digging, bulldozers for pushing materials, backhoe loaders for versatile tasks, and cranes for lifting heavy loads. They are essential, significantly enhancing efficiency and enabling tasks that manual labor alone could not accomplish.

The GCC construction vehicles market was valued at USD 3.57 Billion in 2024.

IMARC estimates the GCC construction vehicles market to exhibit a CAGR of 6.50% during 2025-2033.

The GCC construction vehicles market is driven by extensive infrastructure development, economic diversification efforts away from oil, and increased investment in smart city projects. The initiatives of governing bodies are promoting tourism and public infrastructure are also driving the demand for advanced construction machinery in the region.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)