GCC Construction Scaffolding Rental Market Report by Product Type (Supported Scaffolding, Suspended Scaffolding, Mobile Scaffolding), Application (New Construction, Refurbishment, Demolition), End User (Residential, Infrastructure, Non-Residential), and Country 2026-2034

Market Overview:

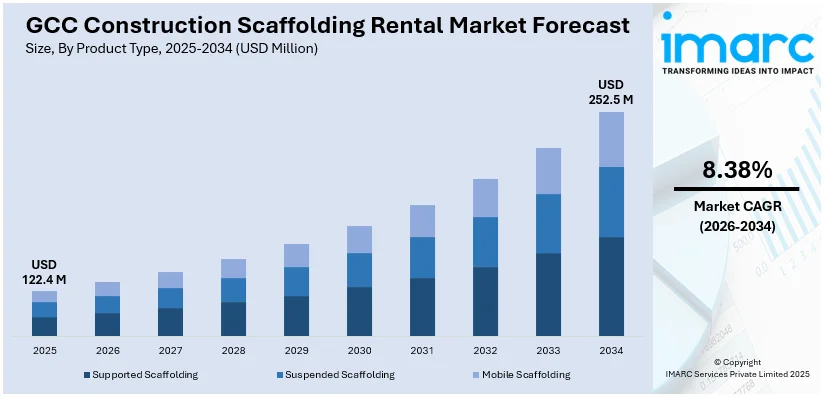

GCC construction scaffolding rental market size reached USD 122.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 252.5 Million by 2034, exhibiting a growth rate (CAGR) of 8.38% during 2026-2034. The increasing innovations in scaffolding design and materials, such as lightweight and durable materials, advanced safety features, and modular systems, that can enhance demand as construction companies seek more efficient and effective solutions, are driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 122.4 Million |

| Market Forecast in 2034 | USD 252.5 Million |

| Market Growth Rate (2026-2034) | 8.38% |

Construction scaffolding rental provides a cost-effective and flexible solution for contractors and builders in need of temporary support structures during construction projects. This service allows companies to access a variety of scaffolding types, such as frame, system, or tube and clamp scaffolds, without the long-term commitment of ownership. Rental options often include delivery, setup, and dismantling services, streamlining the construction process. By opting for scaffolding rental, businesses can tailor their equipment to specific project requirements, ensuring safety and efficiency on-site. This approach also eliminates the need for storage and maintenance, reducing overall project costs. Construction scaffolding rental is a practical choice for enhancing construction site accessibility, enabling workers to perform tasks at various heights with stability and security.

To get more information on this market Request Sample

GCC Construction Scaffolding Rental Market Trends:

The construction scaffolding rental market in GCC is experiencing robust growth driven by various factors. Firstly, the expanding regional construction industry is a primary catalyst for the increased demand for scaffolding rental services. As construction projects multiply across residential, commercial, and infrastructure sectors, the need for safe and efficient temporary structures becomes paramount. Additionally, stringent safety regulations implemented by governing bodies in GCC are compelling construction companies to opt for reliable scaffolding solutions, thereby boosting the rental market. Furthermore, the escalating trend of urbanization and the subsequent surge in high-rise building constructions contribute significantly to the scaffolding rental market's upward trajectory. Moreover, the rise of specialized scaffolding solutions tailored to diverse construction needs enhances market expansion. Concurrently, the adoption of advanced materials and technology in scaffolding systems facilitates efficiency and safety, fostering market growth. In conclusion, the symbiotic relationship between regional construction trends, safety regulations, and technological advancements acts as a cohesive force, propelling the regional construction scaffolding rental market forward. This interplay, marked by sentence connectors, highlights the multifaceted nature of the market drivers shaping its dynamic trajectory.

GCC Construction Scaffolding Rental Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on product type, application, and end user.

Product Type Insights:

- Supported Scaffolding

- Suspended Scaffolding

- Mobile Scaffolding

The report has provided a detailed breakup and analysis of the market based on the product type. This includes supported scaffolding, suspended scaffolding, and mobile scaffolding.

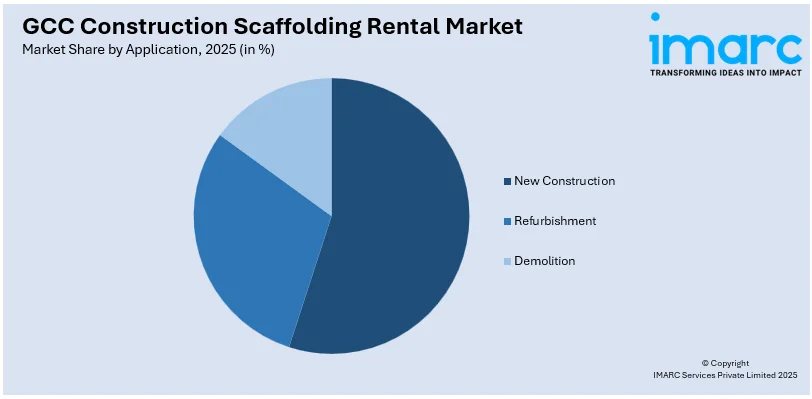

Application Insights:

Access the comprehensive market breakdown Request Sample

- New Construction

- Refurbishment

- Demolition

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes new construction, refurbishment, and demolition.

End User Insights:

- Residential

- Infrastructure

- Non-Residential

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential, infrastructure, and non-residential.

Country Insights:

- Saudi Arabia

- United Arab Emirates

- Qatar

- Kuwait

- Oman

- Bahrain

The report has also provided a comprehensive analysis of all the major regional markets, which include Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, and Bahrain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

GCC Construction Scaffolding Rental Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Supported Scaffolding, Suspended Scaffolding, Mobile Scaffolding |

| Applications Covered | New Construction, Refurbishment, Demolition |

| End Users Covered | Residential, Infrastructure, Non-Residential |

| Countries Covered | Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, Bahrain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the GCC construction scaffolding rental market performed so far and how will it perform in the coming years?

- What is the breakup of the GCC construction scaffolding rental market on the basis of product type?

- What is the breakup of the GCC construction scaffolding rental market on the basis of application?

- What is the breakup of the GCC construction scaffolding rental market on the basis of end user?

- What are the various stages in the value chain of the GCC construction scaffolding rental market?

- What are the key driving factors and challenges in the GCC construction scaffolding rental?

- What is the structure of the GCC construction scaffolding rental market and who are the key players?

- What is the degree of competition in the GCC construction scaffolding rental market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC construction scaffolding rental market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the GCC construction scaffolding Rental market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC construction scaffolding rental industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)