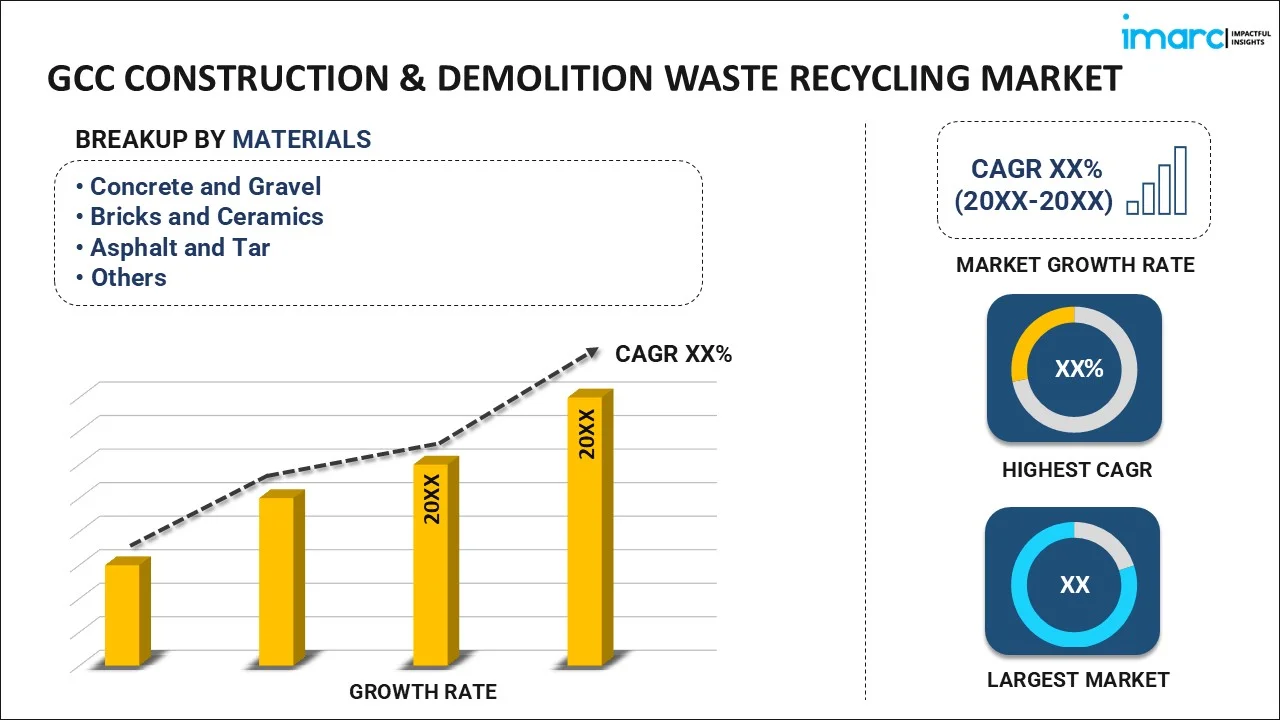

GCC Construction & Demolition Waste Recycling Market Report by Material (Concrete and Gravel, Bricks and Ceramics, Asphalt and Tar, Timber and Wood Products, Metals, and Others), Source (Demolition, Construction, Renovation), Service (Disposal, Collection), and Country 2025-2033

Market Overview:

GCC construction & demolition waste recycling market size reached USD 7.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 12.3 Billion by 2033, exhibiting a growth rate (CAGR) of 4.7% during 2025-2033. The rising cost of raw materials and a desire to conserve natural resources, which increase the demand for recycled materials in construction projects, is driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.9 Billion |

| Market Forecast in 2033 | USD 12.3 Billion |

| Market Growth Rate (2025-2033) | 4.7% |

Construction and demolition (C&D) waste recycling is a sustainable practice aimed at minimizing the environmental impact of construction-related activities. It involves collecting, processing, and repurposing waste generated during construction, renovation, or demolition projects. Common materials recycled include concrete, wood, metal, and asphalt. Through advanced sorting and processing technologies, these materials are separated and transformed into reusable products, reducing the burden on landfills and conserving natural resources. Recycling C&D waste not only mitigates environmental pollution but also contributes to energy savings and the reduction of greenhouse gas emissions associated with manufacturing new construction materials. Government regulations and increased awareness within the construction industry have spurred the adoption of C&D waste recycling practices, promoting a more circular and sustainable approach to construction activities.

GCC Construction & Demolition Waste Recycling Market Trends:

The construction & demolition (C&D) waste recycling market in GCC is experiencing robust growth, primarily driven by escalating environmental concerns and stringent regulations. Governments and regulatory bodies are increasingly emphasizing sustainable waste management practices, urging the construction industry to adopt recycling measures. Furthermore, the rising awareness of the finite nature of natural resources is compelling stakeholders to explore alternatives, propelling the demand for recycled materials in construction projects. In addition to regulatory pressures, economic factors are contributing significantly to the market's upward trajectory. The cost-effectiveness of utilizing recycled C&D waste materials compared to traditional raw materials is becoming evident to construction companies. This financial incentive acts as a compelling driver for the industry's shift towards sustainable practices. Moreover, technological advancements in waste sorting and recycling processes are streamlining operations, making it more feasible for companies to integrate recycling into their construction workflows. Collaborative efforts across the construction value chain are fostering innovation and knowledge exchange, further bolstering the C&D waste recycling market in GCC. The momentum is expected to persist as the industry recognizes the long-term benefits of minimizing environmental impact while simultaneously optimizing resource utilization in construction activities.

GCC Construction & Demolition Waste Recycling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on material, source, and service.

Material Insights:

- Concrete and Gravel

- Bricks and Ceramics

- Asphalt and Tar

- Timber and Wood Products

- Metals

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes concrete and gravel, bricks and ceramics, asphalt and tar, timber and wood products, metals, and others.

Source Insights:

- Demolition

- Construction

- Renovation

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes demolition, construction, and renovation.

Service Insights:

- Disposal

- Collection

The report has provided a detailed breakup and analysis of the market based on the service. This includes disposal and collection.

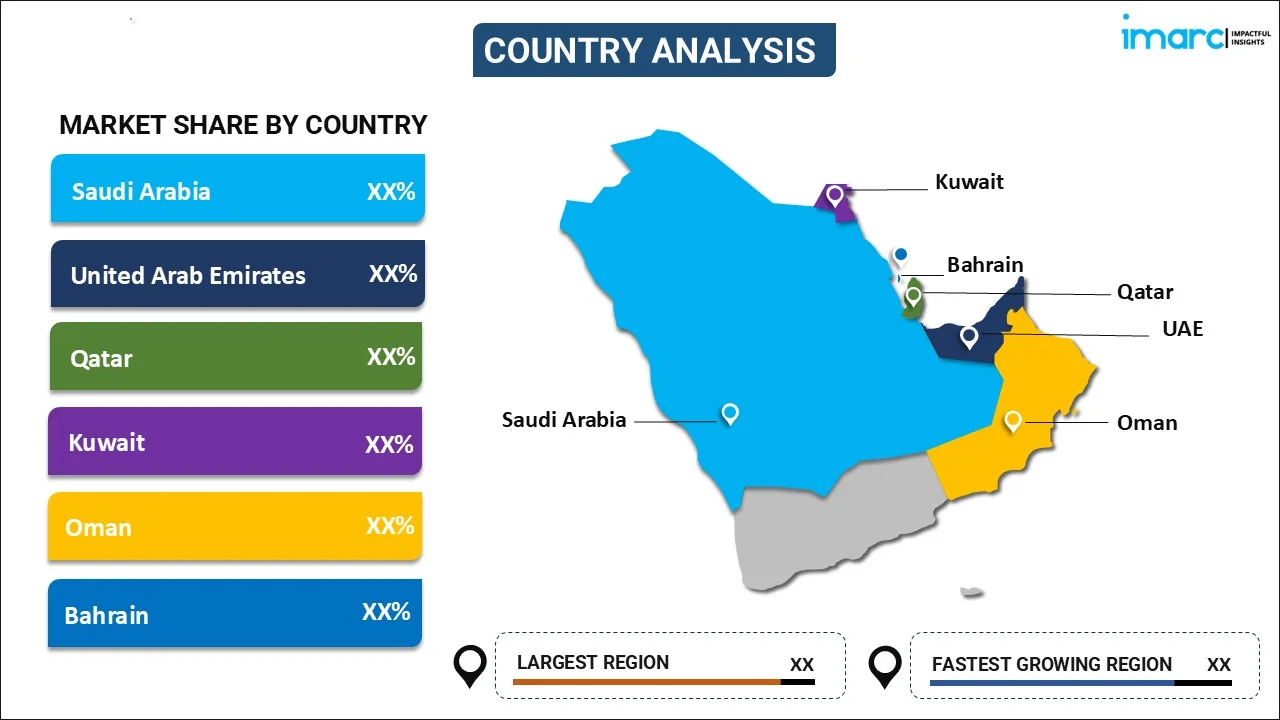

Country Insights:

- Saudi Arabia

- United Arab Emirates

- Qatar

- Kuwait

- Oman

- Bahrain

The report has also provided a comprehensive analysis of all the major regional markets, which include Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, and Bahrain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

GCC Construction & Demolition Waste Recycling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Concrete and Gravel, Bricks and Ceramics, Asphalt and Tar, Timber and Wood Products, Metals, Others |

| Sources Covered | Demolition, Construction, Renovation |

| Services Covered | Disposal, Collection |

| Countries Covered | Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, Bahrain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the GCC construction & demolition waste recycling market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the GCC construction & demolition waste recycling market?

- What is the breakup of the GCC construction & demolition waste recycling market on the basis of material?

- What is the breakup of the GCC construction & demolition waste recycling market on the basis of source?

- What is the breakup of the GCC construction & demolition waste recycling market on the basis of service?

- What are the various stages in the value chain of the GCC construction & demolition waste recycling market?

- What are the key driving factors and challenges in the GCC construction & demolition waste recycling?

- What is the structure of the GCC construction & demolition waste recycling market and who are the key players?

- What is the degree of competition in the GCC construction & demolition waste recycling market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC construction & demolition waste recycling market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the GCC construction & demolition waste recycling market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC construction & demolition waste recycling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)