GCC Ceramic Tiles Market Size, Share, Trends and Forecast by Type, Application, and Country, 2026-2034

GCC Ceramic Tiles Market Summary:

The GCC ceramic tiles market size was valued at USD 10.74 Billion in 2025 and is projected to reach USD 15.42 Billion by 2034, growing at a compound annual growth rate of 4.10% from 2026-2034.

The GCC ceramic tiles market is experiencing robust expansion driven by accelerating construction activities across residential, commercial, and infrastructure sectors. Rising urbanization, government-led mega projects, and increasing private sector investments in real estate development are propelling demand for high-quality floor and wall tiles. The region’s focus on sustainable construction practices, coupled with technological advancements in tile manufacturing, such as digital printing and eco-friendly production methods, is strengthening the GCC ceramic tiles market share.

Key Takeaways and Insights:

- By Type: Floor tiles dominate the market with a share of 52.12% in 2025, driven by extensive use in residential flooring, commercial spaces, and replacement applications across the GCC region.

- By Application: Residential applications lead the market with a share of 55.08% in 2025, supported by surging housing construction projects and homeowner preferences for durable, aesthetically appealing tiles.

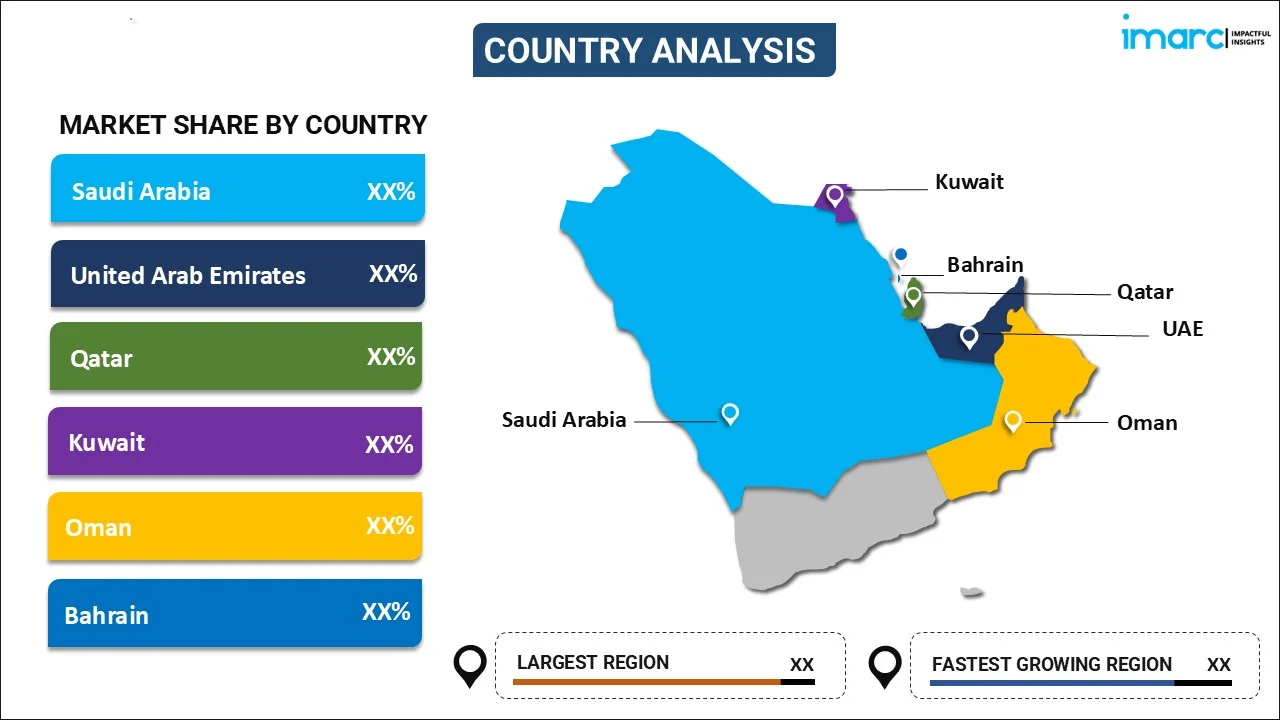

- By Country: Saudi Arabia represents the largest share at 43% in 2025, fueled by Vision 2030 mega projects and substantial government infrastructure investments.

- Key Players: The GCC ceramic tiles market exhibits moderate competitive intensity, with established regional manufacturers and international brands competing through product innovation, design aesthetics, sustainability initiatives, and strategic distribution partnerships to capture growing construction demand.

The GCC ceramic tiles market continues to benefit from unprecedented construction investment as regional governments diversify economies beyond oil dependence. Saudi Arabia’s Vision 2030 initiative has generated a project pipeline exceeding USD 1.5 trillion, with residential, commercial, and mega-city developments driving substantial tile demand. For instance, the NEOM project alone represents a USD 500 billion investment in sustainable urban development requiring extensive ceramic and porcelain tile installations. The UAE’s real estate sector recorded 180,987 property transactions worth USD 142.3 billion in 2024, reflecting strong residential and commercial development momentum. Manufacturers are responding with advanced digital printing technologies, large-format tiles, and eco-friendly production methods that align with the region’s sustainability goals and evolving architectural preferences.

GCC Ceramic Tiles Market Trends:

Digital Printing and Design Innovation

Advanced inkjet printing technologies are transforming ceramic tile design across the GCC, allowing manufacturers to create detailed patterns, lifelike wood and marble finishes, and highly customized visual effects. These innovations enhance design flexibility for both residential and commercial projects, enabling tailored aesthetic solutions without significantly increasing production costs. As demand rises for premium, visually sophisticated interiors, inkjet printing supports manufacturers in delivering high-end looks efficiently, thereby strengthening product differentiation and contributing to the continued growth of the GCC ceramic tiles market.

Sustainable and Eco-Friendly Tile Production

Sustainability has emerged as a key focus in the GCC ceramic tiles industry, with manufacturers increasingly embracing environmentally responsible production practices. Companies are integrating energy-efficient kiln technologies, reducing water usage, and incorporating recycled materials into their manufacturing processes. These efforts reflect a broader commitment to circular economy principles and eco-friendly operations, allowing brands to differentiate themselves in a competitive market. As demand grows for sustainable building materials, such practices not only reduce environmental impact but also enhance the appeal of ceramic tiles among environmentally conscious consumers across residential and commercial projects. For instance, in August 2024, MAPEI Group, a leading Italian producer of chemical solutions for the construction industry, introduced its sustainable ZERO product line in the Middle East and Africa (MEA) region. The global demand for environmentally friendly solutions is evident, with the ZERO range achieving significant growth in sales in 2023. In the UAE and surrounding markets, MAPEI’s ZERO portfolio offers a comprehensive selection of construction products, including solutions for ceramics and natural stone, surface cleaning and maintenance, waterproofing, concrete repair, and other key construction applications.

Large-Format and Porcelain Slab Adoption

Large-format tiles and porcelain slabs are increasingly popular in GCC construction projects, providing a sleek, seamless appearance and minimal grout lines that suit modern architectural styles. Their durability, stain resistance, and versatility make them a preferred choice for a wide range of applications. These oversized formats are commonly used in luxury residential, hospitality, and commercial developments, aligning with designers’ preference for contemporary, minimalist interiors and exterior spaces. Their aesthetic appeal and functional benefits continue to drive adoption across the region.

Market Outlook 2026-2034:

The GCC ceramic tiles market is expected to witness robust growth throughout the forecast period, supported by extensive infrastructure development and continuous expansion in the real estate sector. Large-scale urban projects, housing developments, and commercial construction across the region are driving consistent demand for ceramic tiles. Government-backed modernization initiatives, rising population, and increasing urbanization further strengthen market momentum. Additionally, growing preference for durable, aesthetically appealing, and sustainable building materials is encouraging wider adoption of ceramic tiles across residential, commercial, and institutional applications. The market generated a revenue of USD 10.74 Billion in 2025 and is projected to reach a revenue of USD 15.42 Billion by 2034, growing at a compound annual growth rate of 4.10% from 2026-2034.

GCC Ceramic Tiles Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Floor Tiles |

52.12% |

|

Application |

Residential Applications |

55.08% |

|

Country |

Saudi Arabia |

43% |

Type Insights:

To get detailed analysis of this market, Request Sample

- Floor Tiles

- Wall Tiles

- Others

Floor tiles dominate the GCC ceramic tiles market with a 52.12% share of total market revenue in 2025.

Floor tiles command the largest market share in the GCC ceramic tiles industry, driven by extensive application across residential, commercial, and industrial construction projects. The segment benefits from consumer preferences for durable, low-maintenance flooring solutions that offer aesthetic versatility. High-traffic areas in malls, airports, hotels, and residential complexes increasingly specify ceramic and porcelain floor tiles due to their wear resistance and design flexibility. Production advancements using micro-crystal technology have enhanced floor tile appeal through lower manufacturing costs, improved corrosion resistance, and superior glossy finishes.

The rising demand for large-format floor tiles mirrors modern architectural trends that favor seamless surfaces and minimalist aesthetics. Innovative tile designs now incorporate advanced features such as anti-skid and anti-scratch technologies, improving durability in high-traffic commercial spaces. Digital printing advancements allow realistic reproductions of natural stone and wood, catering to style-conscious consumers. These developments enhance both functionality and visual appeal, making large-format tiles a preferred choice for contemporary residential, commercial, and institutional projects across the GCC.

Application Insights:

- Residential Applications

- Commercial Applications

- Replacement Applications

Residential applications lead the GCC ceramic tiles market with a 55.08% revenue share in 2025.

Residential applications constitute the largest segment in the GCC ceramic tiles market, supported by surging housing construction, renovation activities, and population growth across the region. Ceramic tiles remain the preferred flooring and wall covering choice for homeowners due to their durability, water resistance, and ease of maintenance. The segment benefits from rising disposable incomes enabling premium tile selections, along with homeowner preferences for aesthetically versatile designs that enhance interior spaces. Although the majority of real estate transactions in Dubai, around 93%, are valued below AED 5 million, the luxury segment has experienced remarkable growth since the pandemic. Sales of properties exceeding AED 10 million have surged dramatically, increasing from 469 deals in 2020 to 4,670 in 2024. In the first quarter of 2025 alone, more than 1,300 high-end homes were sold, marking a 31% year-on-year rise and underscoring the accelerating demand in the city’s premium property market.

Government housing initiatives across GCC countries are accelerating residential tile demand. Ongoing residential construction in Saudi Arabia and the UAE is boosting demand for building materials. Housing developments and urban expansion are driving opportunities for suppliers, supporting real estate growth, and increasing requirements for essential construction products like tiles and cement. Consumer preferences increasingly favor porcelain tiles for living areas and ceramic tiles for bathrooms and kitchens, with growing interest in sustainable products featuring recycled content that align with regional environmental goals.

Regional Insights:

To get detailed analysis of this market, Request Sample

- Saudi Arabia

- UAE

- Qatar

- Oman

- Kuwait

- Bahrain

Saudi Arabia represents the largest country segment with a 43% market share in the GCC ceramic tiles market in 2025.

Saudi Arabia leads the GCC ceramic tiles market, driven by ambitious infrastructure and construction initiatives under Vision 2030. Extensive residential, commercial, and large-scale urban projects are creating strong demand for ceramic tiles across the Kingdom. Continued government focus on infrastructure development is encouraging investment in manufacturing capacity, with new tile production facilities being established to meet growing market needs. These efforts not only ensure a steady supply of high-quality ceramic tiles but also reinforce Saudi Arabia’s position as the dominant player in the regional market.

Mega projects including NEOM, Qiddiya, and the Red Sea Project, are driving substantial ceramic tile requirements. NEOM is a massive development project centered around The Line, a 170-kilometer linear city planned to accommodate millions of residents, representing a transformative investment in futuristic urban infrastructure. Strong economic diversification in Saudi Arabia is driving growth in the construction sector, creating rising demand for building materials, including ceramic tiles. To meet this increasing local demand, manufacturers are investing in expanding production capacity within the Kingdom, ensuring efficient supply and timely delivery for residential, commercial, and infrastructure projects. Trade incentives and supportive policies further enhance competitiveness in the market, encouraging new entrants and fostering industry expansion. These developments collectively strengthen the regional ceramic tiles industry and position Saudi Arabia as a key hub for construction material production.

Market Dynamics:

Growth Drivers:

Why is the GCC Ceramic Tiles Market Growing?

Massive Infrastructure Investment and Mega-Project Development

The GCC region is experiencing significant infrastructure growth driven by government-led economic diversification and large-scale mega-projects. Ambitious developments across residential, commercial, and hospitality sectors are fueling strong demand for premium ceramic and porcelain tiles. Iconic projects and urban expansion initiatives are creating opportunities for tile manufacturers to supply high-quality, durable, and aesthetically appealing products. This ongoing construction momentum is directly boosting ceramic tile consumption, as both new developments and renovation projects increasingly rely on tiles for functional and design-focused applications throughout the region. For instance, in May 2025, Qatar’s Public Works Authority (Ashghal) announced its largest development initiative to date, a five-year plan valued at QR81 billion ($22.2 billion) running from 2025 to 2029. The programme is designed to modernize the nation’s infrastructure through extensive investment in transportation networks, government buildings, water management systems, and urban development projects, marking a significant step toward enhancing public facilities and supporting long-term national growth.

Robust Real Estate and Housing Construction Expansion

Rapid expansion in real estate and housing construction across GCC countries is driving strong demand for ceramic tiles. Both residential and commercial projects are increasing, with developers focusing on new builds and renovation initiatives. The UAE real estate market size reached USD 36.92 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 49.96 Billion by 2033, exhibiting a growth rate (CAGR) of 3.07% during 2025-2033. With the increasing pace of construction, floor and wall tiles are still a fundamental part of the present-day trend, as they have aided in architectural beauty and longevity. This evolving construction pace is generating enormous business prospects for the ceramic tile producers, such that they are in a position to meet the increasing demands of high-quality, practical, and attractive building materials in the region.

Technological Innovation and Product Development

Continuous innovation in the production and design of ceramic tiles is driving the growth of the market by responding to the shifting consumer tastes as well as the construction requirements of today. Digital printing can be used to create sophisticated designs with detailed patterns and the effects of realistic natural stone and wood, and high-scale tiles can be used to conform to the modern architectural demands on clean faces and minimalism. The technologies used in the optimization of production increase efficiency and accuracy and minimize waste. Simultaneously, efficient production using recycled resources will appeal to those consumers who are environmentally aware, which contributes to the regional sustainability goals and opens new prospects to enter the market.

Market Restraints:

What Challenges the GCC Ceramic Tiles Market is Facing?

Volatile Raw Material and Energy Costs

Ceramic tile manufacturing faces significant cost pressures from fluctuating raw material and energy prices. The energy-intensive firing processes required for tile production are susceptible to fuel cost volatility, while raw material price variations affect manufacturing margins. These cost fluctuations create pricing uncertainty and can squeeze profit margins, particularly for manufacturers lacking vertical integration or economies of scale.

Intensified Competition and Market Oversupply

The GCC ceramic tiles market faces challenges from intensified competition and periodic oversupply conditions. Price competition from local manufacturers and cheaper Asian imports creates margin pressure for established players. Some markets experience oversupply situations that affect pricing power and profitability. RAK Ceramics reported that the Saudi Arabian market continues facing challenges owing to intensified competition and oversupply from local tile manufacturers.

Supply Chain and Logistics Constraints

Supply chain disruptions and logistics challenges affect the GCC ceramic tiles industry, particularly for imported products and raw materials. Rising transportation costs impact manufacturer margins and final product pricing. Equipment lead times extending up to 25 weeks create procurement pressures, while geopolitical tensions affecting shipping routes add uncertainty to supply chain planning and inventory management for regional distributors.

Competitive Landscape:

The GCC ceramic tiles market exhibits moderate competitive intensity with a mix of established regional manufacturers and international players competing for market share. Leading companies focus on product innovation, design differentiation, and sustainability initiatives to maintain competitive positioning. Manufacturers are investing in advanced digital printing technologies, large-format tile production capabilities, and sustainable manufacturing processes to address evolving customer preferences. Strategic partnerships and distribution network expansion enable market penetration across diverse GCC countries. Local production investments and vertical integration strategies strengthen competitive positioning, while customs exemptions and trade agreements influence import competition dynamics.

Recent Developments:

- October 2025: RAK Ceramics participated in Saudi Build 2025 at the Riyadh International Convention and Exhibition Center, showcasing its latest tile, sanitaryware, and faucet collections designed to support Saudi Arabia’s mega projects and urban development initiatives under Vision 2030.

- June 2025: RAK Ceramics set a new benchmark in eco-friendly surface innovation with the introduction of Re-Use, the world’s first porcelain tile range produced using 100% pre-consumer recycled materials. Marking a significant advance in circular production practices, this innovative collection reshapes industry standards by combining high-performance durability, refined aesthetics, and strong environmental credentials within a single, best-in-class solution.

GCC Ceramic Tiles Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Segment Coverage |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Floor Tiles, Wall Tiles, Others |

| Applications Covered | Residential Applications, Commercial Applications, Replacement Applications |

| Regions Covered | Saudi Arabia, UAE, Qatar, Oman, Kuwait, Bahrain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The GCC ceramic tiles market size was valued at USD 10.74 Billion in 2025.

The GCC ceramic tiles market is expected to grow at a compound annual growth rate of 4.10% from 2026-2034 to reach USD 15.42 Billion by 2034.

Floor tiles represent the largest revenue share at 52.12% in 2025, driven by extensive application across residential, commercial, and industrial construction projects requiring durable, low-maintenance, and aesthetically versatile flooring solutions.

Key factors driving the GCC ceramic tiles market include massive infrastructure investment under Vision 2030, robust real estate development, technological innovations in tile manufacturing, rising urbanization, and growing consumer preference for sustainable and aesthetically appealing building materials.

Major challenges include volatile raw material and energy costs, intensified competition from local manufacturers and Asian imports, supply chain disruptions affecting logistics, extended equipment lead times, and periodic market oversupply conditions impacting pricing dynamics.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)