GCC Car Rental Market Size, Share, Trends and Forecast by Booking Type, Rental Length, Vehicle Type, Application, End User, and Country, 2026-2034

GCC Car Rental Market Size and Share:

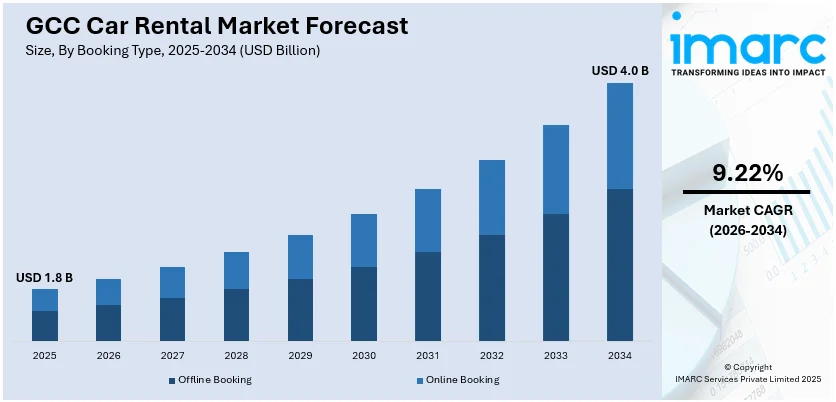

The GCC car rental market size was valued at USD 1.8 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 4.0 Billion by 2034, exhibiting a CAGR of 9.22% from 2026-2034. The market is experiencing robust growth driven by rising tourism, increasing business travel, expanding expatriate populations, advanced infrastructure, government policies, and technological integration.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.8 Billion |

| Market Forecast in 2034 | USD 4.0 Billion |

| Market Growth Rate (2026-2034) | 9.22% |

Every year, millions of people visit the GCC region for business, pleasure, or religious reasons, making it a popular tourist destination. Countries such as the UAE, Saudi Arabia, and Qatar are also making significant investments in tourism by hosting major events such as the Dubai Expo and the FIFA World Cup. These events attract foreign visitors who typically require flexible transportation. Renting a car gives travelers the freedom and convenience they want, particularly in areas with little or no public transportation. Over 9.3 million tourists visited Dubai between January and June of 2024, representing a growth rate of more than 9%. Additionally, the Hajj and Umrah are the main drivers of religious travel in Saudi Arabia, which greatly increases demand for rental cars. Additionally, religious tourism in Saudi Arabia, driven by Hajj and Umrah, contributes significantly to the demand for rental cars. Pilgrims prefer renting vehicles to travel between holy sites, making car rental services essential. The GCC's focus on promoting tourism means this trend will continue to grow, sustaining demand in the car rental market.

To get more information on this market Request Sample

The GCC countries are hubs for business activity, attracting professionals and corporate clients from around the globe. Cities like Dubai, Riyadh, and Doha serve as major hubs for commerce, finance, and conferences. The outlook is impressive, with business travel expected to rise by 11.2% in the Middle East in 2024. Vehicles are one of the most sought-after tools by business travelers to enhance their mobility between meetings, events, and other professional appointments. Business car rentals also respond to this growing demand through executive or luxury categories that suit corporate clientele. Besides, chauffeur services seem to provide an added remoteness to the customers who are not adapted in the local driving conditions.

GCC Car Rental Market Trends:

Increased Spending on Infrastructure Development

With the construction of world-class roads, highways, and airports all throughout the area, the GCC is seeing an unparalleled increase in infrastructure. These initiatives increase the appeal of rental cars by making road travel easier for both residents and tourists. For instance, the accessibility and ease of renting a car are being improved by Saudi Arabia's Vision 2030 initiative to build smart cities and Dubai's sophisticated road networks. Additionally, the area's airports, which are among the busiest in the world, provide easy vehicle rental services directly at the terminals, guaranteeing that visitors can commence driving as soon as they arrive. With continued investments in infrastructure, the car rental market is set to thrive.

Expanding Expat Population

The excellent standard of life and job prospects in the GCC have attracted a sizable and expanding expat population. Expats made up 88.5% of the population of the United Arab Emirates, 87.9% in Qatar, 70.1% in Kuwait, and 53.2% in Bahrain, surpassing the number of local citizens. This has increased the demand for car rentals as they frequently prefer renting a vehicle over new purchases, especially those on temporary assignments or tourists visiting the area. Car rentals have been a top choice for foreigners as they provide flexibility, cost savings, and the ability to upgrade to newer models without making long-term commitments. Additionally, businesses provide long-term leasing alternatives, which are increasingly appreciated among foreigners seeking a hassle-free substitute for owning a car.

Rising Popularity of Ride-Sharing and Leasing

On top of conventional car rentals, ride-sharing and leasing are also gaining popularity in the GCC. Hence, its market is expected to reach USD 12 billion by 2033 and flourishing at a rapid growth rate of 16.2% across the forecast period in 2025-2033. Companies like Uber and Careem operate widely in the region, and car rental companies often partner with these platforms to supply vehicles. It also serves as a preferred option without having to bear the maintenance costs for individuals or organizations who want to have a car ownership-like experience. This trend is majorly popular among young professionals and startups who want economical and flexible transport solutions. Rental companies have been diversifying their offerings through ride-hailing options and leasing vehicles, thereby fortifying their positions in the market and appealing to a wider customer base.

GCC Car Rental Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC car rental market, along with forecasts at the country levels from 2026-2034. The market has been categorized based on booking type, rental length, vehicle type, application, and end user.

Analysis by Booking Type:

- Offline Booking

- Online Booking

Offline booking holds a significant share in the GCC car rental market, catering primarily to walk-in customers at rental counters in airports, hotels, and city centers. This segment is especially popular among older customers and those who prefer personal interaction or immediate vehicle availability. Despite the growing trend toward digitalization, offline bookings thrive in regions with limited internet access or among tourists unfamiliar with local apps. Businesses that focus on customer service, loyalty programs, and personalized offerings continue to capture this market segment.

Online booking is rapidly gaining traction, fueled by the increasing adoption of smartphones and internet connectivity across the GCC. This segment offers unparalleled convenience, allowing users to compare prices, view vehicle options, and complete reservations instantly through websites and apps. It caters to tech-savvy customers, including younger travelers and corporate clients, and supports contactless operations, aligning with modern consumer expectations. Online platforms also integrate promotional offers and loyalty benefits, further driving growth in this segment.

Analysis by Rental Length:

- Short Term

- Long Term

Short-term rentals form a major share in the GCC car rental market, appealing primarily to tourists, business travelers, and individuals needing a vehicle for just a few days or weeks. This segment thrives due to the region’s booming tourism sector, major events, and flexible options available at airports, hotels, and city hubs. Companies often offer a diverse fleet ranging from economy to luxury cars, catering to varied customer needs. Seasonal promotions and daily pricing models further enhance the appeal of short-term rentals, making them a preferred choice for temporary transportation.

Long-term rentals are becoming more popular, particularly among residents, businesses, and expatriates looking for affordable alternatives to car ownership. This market reduces the burden of owning an automobile by providing monthly or annual leasing options that frequently include maintenance, insurance, and roadside assistance. Long-term rentals are becoming a crucial component of the industry as companies depend on leased fleets for employee transportation and the number of expatriate workers rises. The flexible terms and affordable pricing compared to outright purchases are significant drivers of this segment's growth.

Analysis by Vehicle Type:

- Luxury

- Executive

- Economy

- SUVs

- Others

High-net-worth (HNW) people, vacationers, and business executives looking for luxury cars for special events, corporate gatherings, or elegant travel are served by the luxury car rental market. Because of the continued high demand for luxury cars, this market is thriving in GCC cities like Dubai, Riyadh, and Doha. In the area, luxury rentals are a mark of elegance and prestige due to their individualized services, chauffeur alternatives, and unique experiences.

Executive rentals serve corporate clients and professionals who require vehicles that balance comfort, style, and functionality. Popular in the business hubs of the GCC, this segment includes mid-to-high-end sedans and SUVs tailored for business meetings, conferences, and professional commutes. Car rental companies often provide chauffeur-driven options and flexible leasing terms, catering to the needs of corporate travelers and enhancing their productivity during their stay.

Economy rentals are the most popular segment in the GCC, catering to budget-conscious visitors, expats, and locals. These cars are practical, cost-effective, and fuel-efficient, which makes them perfect for short-term or everyday travel. The growing number of visitors and locals who value affordable mobility options is advantageous to the industry. Companies frequently run promotions and offer diverse fleet options in this category to maintain competitive pricing.

SUV rentals are popular in the GCC due to the region’s desert landscapes and road conditions that require robust vehicles. They attract tourists exploring off-road attractions, families needing spacious vehicles for group travel, and residents seeking versatility. This segment includes both luxury and economy SUVs, offering choices that suit different budgets. With rising interest in adventure tourism and outdoor activities, the demand for SUV rentals is steadily increasing.

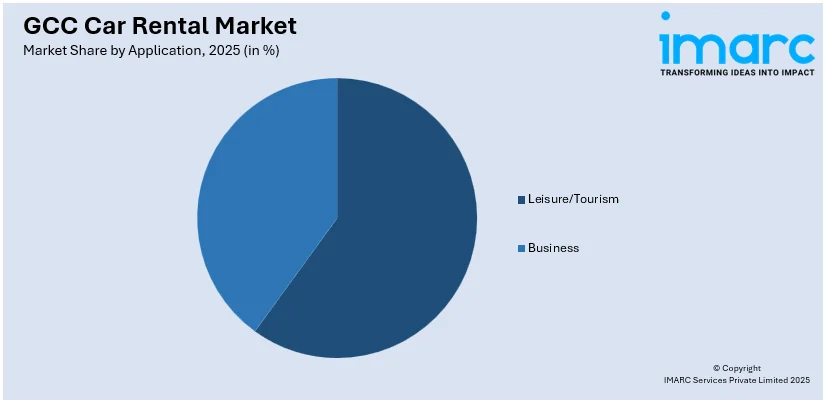

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Leisure/Tourism

- Business

The leisure and tourism sector, which serves travelers who need flexible transportation alternatives for sightseeing and visiting both urban and rural locations, accounts for a significant portion of the GCC car rental industry. As the GCC becomes a major travel destination, there is a strong demand for visitor-specific short-term rentals in places like Dubai, Riyadh, and Doha. From budget vehicles to SUVs, this market offers a wide range of alternatives, frequently combined with travel guides and GPS services. Millions of leisure visitors' demands are met each year by the segment's expansion, which is bolstered by partnerships with travel agents, seasonal specials, and easy booking systems.

Business rentals, which cater to professionals attending meetings, seminars, and events as well as business travelers, are a mainstay of the GCC car rental market. This market niche specializes on providing executive automobiles, such as luxury cars and sedans, with chauffeur-driven service choices. The region's status as a global commercial hub, with major international firms and events held in places like Dubai and Riyadh, is driving the demand for business rentals. In order to draw in and keep business clients, rental firms in this market place a strong emphasis on dependability, customizable corporate packages, and flexible pick-up and drop-off choices.

Analysis by End User:

- Self-Driven

- Chauffeur-Driven

Self-driven rentals, which provide freedom and independence to residents, visitors, and expats, account for a sizeable portion of the GCC car rental industry. This market is popular among tourists who prefer visiting places independently without having to pay for a driver. Customers on a tight budget frequently choose self-driven rentals since they provide a variety of vehicles, like SUVs and economy automobiles. By offering GPS-enabled cars, user-friendly booking tools, and round-the-clock customer service, businesses increase the appeal of this market sector and guarantee a smooth experience for clients who want flexibility in their transportation options.

Chauffeur-driven rentals appeal to high-net-worth people, business professionals, and tourists that value ease and luxury. This market is especially well-known in commercial centers like Dubai and Riyadh, where corporate customers often require transportation for events, meetings, and airport transfers. Additionally, travelers who are not aware with local traffic regulations or road conditions are drawn to chauffeur-driven rentals. To provide a relaxing and stress-free travel experience, companies in this market focus on providing high-end cars, skilled drivers, and individualized services. The region's focus on hospitality and luxury contributes to the appeal of this niche.

Country Analysis:

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

Religious tourism has a significant impact on Saudi Arabia's car rental industry, as over two million pilgrims visit Hajj each year. People frequently use short-term rentals to travel between holy towns like Medina and Mecca. Additionally, in major cities like Riyadh and Jeddah, the demand for rental cars has surged due to the Vision 2030 project, which aims to diversify the economy and enhance leisure travel. Saudi Arabia is a key market in the GCC because of the growing number of expatriates, which also helps to drive long-term rental growth.

The UAE's thriving business and tourism travel industries make it a significant market for car rentals. Millions of tourists visit cities like Dubai and Abu Dhabi every year; in 2023, 17.15 million foreign visitors came to Dubai alone. Both short-term and luxury rentals are popular among tourists and corporate clients. The UAE is a major center for domestic and foreign tourists, and the country's sophisticated infrastructure, easy-to-use digital booking systems, and growing expatriate community all contribute to the growth of the car rental sector.

Qatar’s car rental market is growing steadily, bolstered by its status as a global business and tourism hub. The successful hosting of the FIFA World Cup in 2022 positioned Qatar as a top destination, leading to sustained demand for short-term rentals. Additionally, the country’s strategic investments in infrastructure and hosting of international events continue to attract tourists and business travelers who often prefer rental cars for flexibility and convenience.

Bahrain’s car rental market benefits from its strong tourism sector and strategic location as a regional travel hub. The country attracts visitors for leisure, shopping, and business, with short-term rentals dominating due to its compact size. The growing expatriate workforce and rising business activity further drive demand for rental vehicles. Rental companies in Bahrain focus on offering economy and executive cars to meet diverse customer needs, supported by convenient airport and city-based rental services.

Kuwait's growing expat community and business travel activities influence the country's car rental sector. Long-term rentals are particularly well-liked by foreigners looking for hassle-free and reasonably priced alternatives to owning a car. Professionals and tourists traveling to Kuwait City for business or pleasure are served by short-term rentals. The industry is anticipated to expand gradually as a result of the government's emphasis on tourism and corporate diversification, as well as advancements in transportation and infrastructure.

The distinctive scenery of Oman draws adventurous travelers and locals looking for cars for road trips and off-road excursions, which fuels the country's car rental industry. Because of the country's extensive deserts and hilly areas, SUVs and long-term rentals are especially popular. With the help of government programs to promote cultural and natural assets, Oman's expanding tourist industry has raised demand for short-term rentals.

Competitive Landscape:

To increase their market presence and satisfy changing customer needs, major companies in the industry are engaging in partnerships, technology-driven solutions, and fleet diversity. Businesses are increasingly using mobile applications and digital platforms to serve the tech-savvy people in the area by facilitating booking, payments, and customer support. In keeping with the GCC's sustainability objectives and the rising demand for environmentally friendly transportation, they are also increasing the number of electric and hybrid cars in their fleets. Partnerships with hotels, ride-sharing services, and airports are additionally improving visibility and accessibility, especially in places with strong demand like Doha, Dubai, and Riyadh. In order to draw in both corporate and individual customers, players are also emphasizing customized services like chauffeur-driven choices, long-term leasing, and loyalty programs. Furthermore, these businesses are benefiting from localization strategies like providing bilingual customer service and region-specific packages.

The report provides a comprehensive analysis of the competitive landscape in the GCC car rental market with detailed profiles of all major companies.

Latest News and Developments:

- In October 2024, Strong Rent a Car formed a partnership with Skyline Automotive in Qatar. In this collaboration, Strong Rent a Car signed a fleet deal under which Skyline Motors will provide them with 150 new Geely vehicles.

- In September 2024, Finalrentals forged a partnership with Key Rent A Car in Saudi Arabia. This agreement is part of Finalrentals' Middle East growth, which includes successful entry in Jordan and the United Arab Emirates. Through the arrangement, Finalrentals will be able to provide its clients with unmatched access to a wide range of cars at 51 sites in 15 areas of Saudi Arabia.

GCC Car Rental Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Booking Types Covered | Offline Booking, Online Booking |

| Rental Lengths Covered | Short Term, Long Term |

| Vehicle Types Covered | Luxury, Executive, Economy, SUVs, Others |

| Applications Covered | Leisure/Tourism, Business |

| End-Users Covered | Self-Driven, Chauffeur-Driven |

| Countries Covered | Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, Oman |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC car rental market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC car rental market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC car rental industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Car rental is a service that allows individuals or businesses to temporarily hire vehicles for personal or professional use. It provides flexible transportation options for travel, commuting, or special occasions, catering to tourists, business travelers, and locals without the need for vehicle ownership.

The GCC car rental market was valued at USD 1.8 Billion in 2025.

IMARC estimates the GCC car rental market to exhibit a CAGR of 9.22% during 2026-2034.

The GCC car rental market is driven by rising tourism, growing expatriate populations, increasing business travel, advanced infrastructure development, government initiatives supporting mobility, and technological advancements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)