GCC Bridge Construction Market Size, Share, Trends and Forecast by Type of Bridge, Material Used, Application, and Country, 2026-2034

GCC Bridge Construction Market Summary:

The GCC bridge construction market size was valued at USD 25.56 Billion in 2025 and is projected to reach USD 40.94 Billion by 2034, growing at a compound annual growth rate of 5.38% from 2026-2034.

The GCC bridge construction market is experiencing robust expansion, driven by ambitious national infrastructure programs, economic diversification initiatives, and rapid urbanization across the region. Government-led investments in transportation networks, mega-project developments, and cross-border connectivity projects are fueling sustained demand for bridge infrastructure. The integration of advanced construction technologies, precast concrete solutions, and sustainable building practices is transforming project delivery across the region, supporting the GCC bridge construction market share.

Key Takeaways and Insights:

-

By Type of Bridge: Beam bridges dominate the market with a share of 52% in 2025, owing to their cost-effectiveness, structural simplicity, and widespread applicability across highway overpasses and urban infrastructure. Government investments in road network expansion are accelerating beam bridge adoption throughout the region.

-

By Material Used: Concrete bridges lead the market with a share of 64% in 2025. This dominance is driven by the material's exceptional durability in extreme desert climates, lower lifecycle maintenance costs, and compatibility with local manufacturing capabilities supporting construction efficiency.

-

By Application: Road and highway comprise the largest segment with a market share of 83% in 2025, reflecting the core infrastructure development priorities across GCC nations focused on enhancing regional connectivity, supporting urban expansion, and facilitating trade logistics.

-

By Country: Saudi Arabia represents the largest country with 38% share in 2025, driven by Vision 2030 mega-projects, substantial government infrastructure investments, and the Kingdom's strategic positioning as the regional hub for transportation and logistics development.

-

Key Players: Key players drive the GCC bridge construction market by expanding project portfolios, advancing engineering capabilities, and strengthening regional partnerships. Their investments in sustainable construction technologies, skilled workforce development, and strategic collaborations with government authorities accelerate infrastructure delivery across diverse bridge applications.

The GCC bridge construction market is witnessing transformative growth, propelled by unprecedented infrastructure development programs across member nations. Governments are channeling substantial investments into modernizing transportation networks, with bridge construction serving as a critical component of regional connectivity initiatives. The Royal Commission for Riyadh City (RCRC) awarded road development contracts worth SAR 13 Billion in August 2024, including construction of 32 bridges for the second southern ring road spanning 56 kilometers, demonstrating the scale of ongoing infrastructure expansion. Advanced construction methodologies, including precast concrete systems and modular bridge components, are gaining prominence, as they enable accelerated project timelines while maintaining stringent quality standards. The market benefits from growing public-private partnerships (PPPs), technological innovations in bridge design and monitoring systems, and increasing focus on sustainable construction practices aligned with regional environmental commitments and long-term infrastructure resilience objectives.

GCC Bridge Construction Market Trends:

Digital Transformation in Bridge Engineering and Construction Management

The adoption of advanced digital technologies is revolutionizing bridge construction across the GCC region. Building information modeling (BIM) and geographic information systems are becoming integral to project planning, design optimization, and construction management. These technologies enable precise structural modeling, real-time progress monitoring, and enhanced collaboration among stakeholders. The integration of smart sensors for structural health monitoring is promoting long-term infrastructure sustainability while reducing maintenance requirements and operational costs throughout bridge lifecycles.

Sustainable Construction Materials and Eco-Friendly Practices

Environmental sustainability is emerging as a defining trend in GCC bridge construction, with governments implementing green building standards and carbon reduction targets. MIG Holding LLC and National Industries Park launched Safetech, the largest precast concrete factory in the Middle East, covering 2.2 Million square feet, in February 2025. The facility features annual production capacity exceeding 700,000 cubic metres, supporting sustainable infrastructure development. Contractors are increasingly incorporating recycled materials, low-carbon concrete formulations, and energy-efficient construction equipment to align with regional environmental commitments.

Expansion of Trade, Logistics, and Industrial Corridors

The GCC’s strategic position as a global trade hub drives investments in logistics corridors linking ports, airports, and industrial zones. UAE's foreign trade hit AED5.23 Trillion in 2024, an increase from AED3.5 Trillion in 2021. Bridges are essential components of freight routes supporting regional and international trade flows. Industrial expansion zones require heavy-load bridges capable of supporting commercial traffic. Enhanced cross-border connectivity initiatives further stimulate bridge construction, strengthening regional supply chain efficiency and economic integration.

Market Outlook 2026-2034:

The GCC bridge construction market outlook remains highly favorable, as regional governments continue to prioritize infrastructure development as a cornerstone of economic diversification strategies. Mega-projects across Saudi Arabia, the UAE, Qatar, and other member states are generating sustained demand for bridge infrastructure supporting transportation networks, urban development, and cross-border connectivity initiatives. The market generated a revenue of USD 25.56 Billion in 2025 and is projected to reach a revenue of USD 40.94 Billion by 2034, growing at a compound annual growth rate of 5.38% from 2026-2034. Technological advancements, workforce development, and sustainable construction practices will define market evolution. Increasing adoption of smart bridge technologies, modular construction methods, and climate-resilient designs is expected to enhance the market presence.

GCC Bridge Construction Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type of Bridge |

Beam Bridges |

52% |

|

Material Used |

Concrete Bridges |

64% |

|

Application |

Road and Highway |

83% |

|

Country |

Saudi Arabia |

38% |

Type of Bridge Insights:

- Beam Bridges

- Arch Bridges

- Suspension Bridges

- Cable-Stayed Bridges

Beam bridges dominate with a market share of 52% of the total GCC bridge construction market in 2025.

Beam bridges maintain market leadership due to their structural efficiency, cost-effectiveness, and versatility across diverse infrastructure applications throughout the GCC region. These bridges are particularly suited for highway overpasses, urban flyovers, and pedestrian crossings where moderate span lengths are required. The straightforward construction methodology reduces project complexity while enabling faster deployment timelines essential for meeting ambitious regional development schedules.

Beam bridges are highly adaptable to varying load requirements, making them suitable for both vehicular and pedestrian traffic. Their modular design allows incremental expansion or retrofitting to accommodate future traffic growth without extensive reconstruction. The use of prefabricated segments accelerates installation, reduces on-site labor, and minimizes disruption to existing infrastructure. In addition, beam bridges integrate well with modern safety features, drainage systems, and aesthetic enhancements, aligning with urban planning and regulatory standards. These advantages collectively reinforce their dominance in the GCC bridge construction market.

Material Used Insights:

- Concrete Bridges

- Steel Bridges

- Composite Bridges

Concrete bridges lead with a share of 64% of the total GCC bridge construction market in 2025.

Concrete bridges dominate the GCC market owing to the material's exceptional performance in extreme desert environmental conditions characterized by high temperatures, sandstorms, and humidity variations. Concrete's inherent durability, corrosion resistance, and thermal stability make it ideally suited for regional infrastructure applications. The availability of local raw materials and established manufacturing capabilities further strengthen concrete's market position across bridge construction projects.

NEOM partnered with Asas Al-Mohileb in October 2024 to establish a SAR 700 Million ready-mix concrete plant with daily capacity of 20,000 cubic meters, supporting mega-project construction requirements. Precast concrete bridge elements offer enhanced quality control, reduced construction timelines, and superior lifecycle performance essential for regional infrastructure development. Additionally, ongoing innovations in high-performance and self-compacting concrete formulations are improving structural strength, workability, and sustainability, further solidifying concrete bridges as the preferred choice across GCC projects. The combination of durability, cost-efficiency, and adaptability ensures their continued dominance in both urban and intercity bridge construction initiatives.

Application Insights:

- Road and Highway

- Railway

Road and highway exhibit a clear dominance with an 83% share of the total GCC bridge construction market in 2025.

Road and highway bridge construction maintains overwhelming market dominance, reflecting regional infrastructure priorities centered on enhancing road network connectivity, supporting urban expansion, and facilitating trade logistics across GCC nations. Government investments in expressway development, ring road construction, and urban flyover projects generate sustained demand for bridge infrastructure serving vehicular traffic requirements. The segment benefits from comprehensive national road development programs aligned with economic diversification objectives.

Dubai's Roads and Transport Authority (RTA) awarded an AED 786 Million contract in April 2025 for constructing a 1,425-metre bridge connecting Dubai Islands to Bur Dubai, featuring four lanes in each direction with capacity for 16,000 vehicles per hour. Such major road bridge projects exemplify the significant investments driving market growth. These initiatives not only improve regional mobility but also enhance safety, reduce congestion, and support long-term economic growth. Continued prioritization of strategic road connectivity projects ensures sustained opportunities for bridge construction contractors across the GCC.

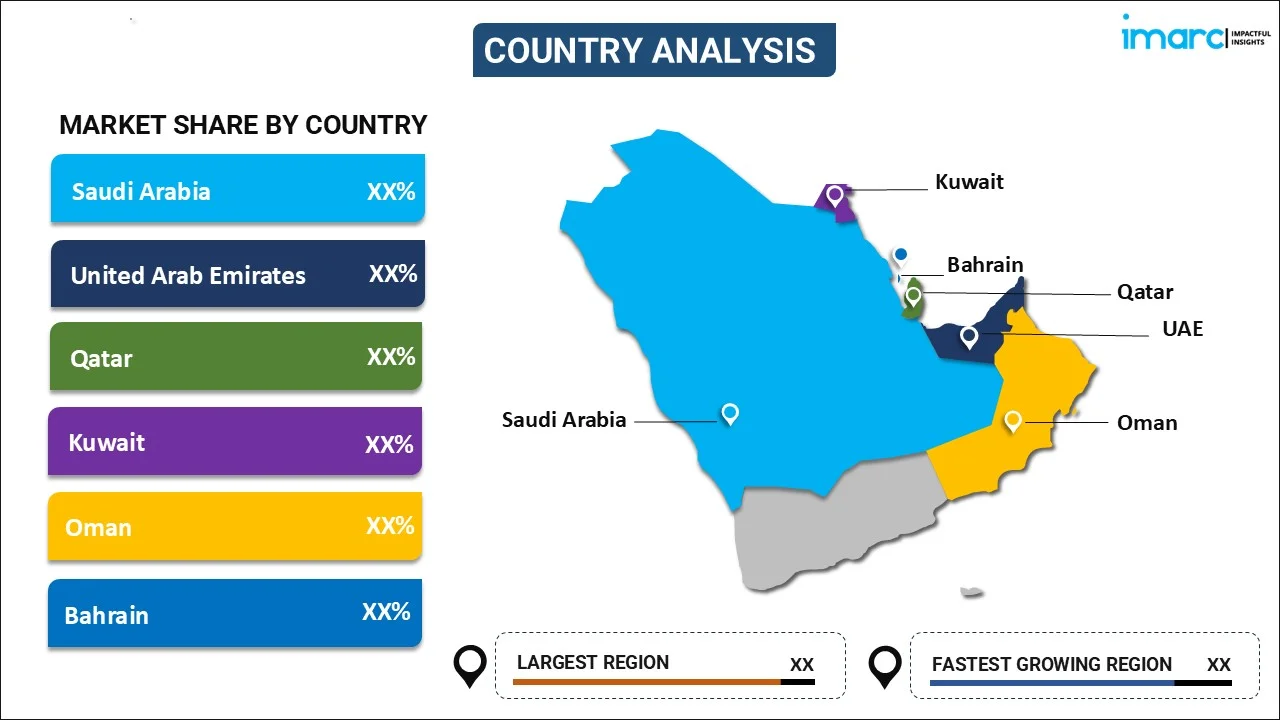

Country Insights:

- Saudi Arabia

- United Arab Emirates

- Qatar

- Kuwait

- Oman

- Bahrain

Saudi Arabia prevails the market with a 38% share of the total GCC bridge construction market in 2025.

Saudi Arabia leads the GCC bridge construction market due to its strategic focus on infrastructure development under Vision 2030, which aims to diversify the economy and modernize urban and transport networks. The Kingdom’s vast geographic area and rapidly expanding population necessitate extensive bridge networks to connect urban centers, industrial zones, and emerging economic cities. Government investments in mega-projects such as the Riyadh Metro, King Salman Road Expansion, and the NEOM city development include significant bridge construction components, creating consistent demand for high-quality engineering and construction services.

The Kingdom’s leadership is further reinforced by a combination of technical expertise, international contractor participation, and adoption of modern construction technologies. Use of precast and modular construction methods, high-performance concrete, and durable steel materials allows Saudi Arabia to deliver large-scale bridge projects efficiently while ensuring longevity under harsh desert climates. Rapid urbanization, industrial expansion, and tourism-driven infrastructure development, particularly in cities such as Riyadh, Jeddah, and Dammam, continue to drive substantial demand for road, highway, and pedestrian bridges. In 2024, Saudi Arabia attracted 116 Million tourists, surpassing its yearly visitor goal for the second consecutive year, as per the annual statistical report from the Ministry of Tourism.

Market Dynamics:

Growth Drivers:

Why is the GCC Bridge Construction Market Growing?

Government Infrastructure Investments and National Vision Programs

The GCC bridge building market is primarily driven by government-led infrastructure development. In 2024, Abu Dhabi planned to allocate approximately USD 18 Billion towards 144 new infrastructure projects across diverse sectors, such as housing, education, tourism, and natural resources. Transportation networks are given top priority in national vision programs in Saudi Arabia, the United Arab Emirates, Qatar, and other GCC nations as the cornerstones of regional integration, urban mobility, and economic diversification. Highways, expressways, rail corridors, and intercity roads that necessitate substantial bridge building are supported by large budgetary commitments. In order to cross geographical obstacles like wadis, coastal zones, and densely populated places, bridges are essential. Contractors can spend with confidence in capacity growth and cutting-edge construction technologies because long-term planning frameworks guarantee project continuation. Additionally, solid finance methods are supported by public sector dominance, which lowers project risk. Bridge construction projects are increasingly using advanced engineering standards, as governments prioritize resilient, future-ready infrastructure that is in line with environmental goals.

Growth of Trade, Logistics, and Industrial Connectivity

Bridge construction demand is heavily supported by the GCC's goal to solidify its position as a worldwide hub for trade and logistics. As per IMARC Group, the GCC logistics market size reached USD 109.0 Billion in 2024. Seamless transportation connections that can handle high commercial traffic are necessary for the expansion of ports, airports, free zones, and industrial clusters. Bridges are crucial for enhancing supply chain efficiency, enabling freight transit, and joining logistical corridors. The requirement for load-bearing bridge constructions is further increased by the growth of the mining, manufacturing, and petrochemical industries. Demand is also influenced by regional connection projects and cross-border trade initiatives, as nations invest in roadways that connect nearby markets. Improved freight mobility boosts economic competitiveness by cutting operating expenses and transit times. As a result, building bridges continues to be a strategic priority for promoting trade-driven infrastructure development throughout the GCC. In addition, government policies promoting regional trade agreements and economic corridors further amplify the urgency for robust bridge infrastructure, ensuring seamless movement of goods across key industrial hubs.

Technological Advancements and Construction Innovations

The GCC bridge building methods are changing due to technological advancements. Using precast and modular building techniques speeds up project completion while preserving structural integrity. High-performance concrete, corrosion-resistant steel, and composite materials are examples of advanced materials that increase endurance in challenging weather. Digital techniques that improve design accuracy and lifetime management include BIM and structural health monitoring systems. These advancements enhance safety results and lower maintenance expenses. Automation and prefabrication are being used by contractors to increase production and solve the skilled labor shortage. Adoption of technology makes it possible to construct intricate bridge structures that satisfy contemporary traffic and sustainability standards. Technology-driven building methods continue to propel market expansion, as governments seek robust, efficient infrastructure solutions. Furthermore, ongoing research into smart monitoring systems and sustainable construction techniques is enabling bridges to achieve longer lifespans while minimizing environmental impact.

Market Restraints:

What Challenges the GCC Bridge Construction Market is Facing?

Harsh Climatic and Environmental Conditions

Building bridges in the GCC region encounters major difficulties due to harsh desert conditions, which involve elevated temperatures, sandstorms, and sporadic flash floods. These factors influence material performance, necessitate specialized construction methods, and raise maintenance requirements. Concrete curing, steel corrosion, and machinery performance are affected, necessitating meticulous planning and quality management. Contractors need to use climate-resilient materials and put protective measures in place to maintain structural integrity. These environmental challenges prolong schedules and require ongoing oversight to ensure safety and longevity throughout the lifespan of bridges.

Elevated Project Expenses and Financial Limitations

Building bridges on a large scale requires significant financial investment, encompassing expenses for materials, workforce, equipment, and advanced technology. Increasing costs of raw materials and inflation place additional pressure on project budgets, especially for intricate or extended bridges. Although government financing aids significant projects, budget overruns may arise from design modifications, environmental remediation, or logistical issues. Budget limitations might postpone smaller projects or necessitate compromises in material choices, leading to greater long-term upkeep requirements. Maintaining cost efficiency while ensuring quality is a significant challenge in the GCC bridge construction market.

Skilled Labor Shortages

The GCC bridge construction sector relies heavily on specialized engineering and building expertise, yet skilled labor shortages pose significant challenges. Complex bridge designs require trained personnel for structural analysis, quality control, and safety management. High demand across simultaneous infrastructure projects intensifies competition for experienced engineers, supervisors, and technicians. Labor shortages can lead to project delays, higher wages, and reliance on expatriate workforce, complicating project management. Contractors must invest in training programs and knowledge transfer to build local capacity while ensuring timely delivery of high-quality bridge structures.

Competitive Landscape:

The GCC bridge construction market exhibits a moderately fragmented competitive structure with participation from international engineering conglomerates, regional construction groups, and specialized infrastructure contractors. Major players compete on project capabilities, technical expertise, regional experience, and established relationships with government clients. Companies are differentiating through advanced engineering solutions, sustainable construction practices, and integrated project delivery capabilities. Strategic partnerships between international firms and local contractors enhance market access while meeting localization requirements. The growing project pipeline is attracting increased participation from Asian and European construction groups, expanding regional presence through joint ventures and consortium arrangements.

Recent Developments:

-

In December 2025, Dubai’s RTA inaugurated two new bridges as part of the Trade Centre Roundabout Development Project, representing an important advancement in the initiative to alleviate traffic at a key transport hub in the city. Every bridge offers two lanes for traffic in each direction, stretching a total of 2,000 meters and accommodating roughly 6,000 vehicles each hour, notably enhancing capacity during busy times.

GCC Bridge Construction Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | USD Billion |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types of Bridge Covered | Beam Bridges, Arch Bridges, Suspension Bridges, Cable-Stayed Bridges |

| Material Used Covered | Concrete Bridges, Steel Bridges, Composite Bridges |

| Applications Covered | Road and Highway, Railway |

| Countries Covered | Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, Bahrain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The GCC bridge construction market size was valued at USD 25.56 Billion in 2025.

The GCC bridge construction market is expected to grow at a compound annual growth rate of 5.38% from 2026-2034 to reach USD 40.94 Billion by 2034.

Beam bridges dominated the market with a share of 52%, owing to their cost-effectiveness, structural simplicity, and widespread applicability across highway overpasses and urban infrastructure projects throughout the GCC region.

Key factors driving the GCC bridge construction market include Vision 2030 infrastructure investments, regional connectivity initiatives, rapid urbanization and population growth, government-led mega-project developments, and increasing adoption of sustainable construction technologies.

Major challenges include rising construction material costs and supply chain volatility, skilled labor shortages in specialized bridge engineering, complex regulatory and permitting processes, intense competition among contractors reducing profit margins, and coordination requirements across multiple government authorities and project stakeholders.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)