GCC Blockchain Technology Market Report by Type (Public, Private, Hybrid), Component (Application and Solution, Infrastructure and Protocols, Middleware), Application (Digital Identity, Exchanges, Payments, Smart Contracts, Supply Chain Management, and Others), Enterprise size (Large Enterprise, Small Enterprise, Middle Enterprise), End Use (Financial Services, Government, Healthcare, Media and Entertainment, Retail, Transportation and Logistics, and Others) and Country 2025-2033

Market Overview:

The GCC blockchain technology market size to grow at a growth rate (CAGR) of 67.4% during 2025-2033. The increasing implementation of favorable government policies and regulations, growing digitization efforts, rapid technology adoption in banking and financial sectors, growing prevalence of cyber threats and the increasing private-public collaborations are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate (2025-2033) | 67.4% |

Blockchain technology is a decentralized digital ledger system that enables multiple parties to have simultaneous access to a constantly updated database secured through cryptographic principles. There are primarily three types of blockchains: public, private, and consortium, each offering varying levels of accessibility and control. Blockchain technology is employed across various sectors like finance, healthcare, and supply chain management for diverse applications, such as cryptocurrency trading, secure data sharing, and tracking goods. It offers transparency as all transactions are publicly recorded, encouraging parties to conduct direct transactions without the need for central authority. Blockchain technology utilizes cryptography and consensus algorithms, making it challenging to alter existing data. Furthermore, it offers increased efficiency and reduced costs by eliminating mediators. Blockchain technology can potentially revolutionize numerous industries by providing a secure, transparent, and more efficient method for conducting transactions and managing data.

The increasing implementation of government policies and regulations in the region that support blockchain technology, encouraging its adoption and investment, is one of the major factors driving the market growth. Besides this, the growing initiatives on the adoption of digitization in the regions, leading to the rising demand for blockchain technology, are creating a positive outlook for the market growth. Moreover, the widespread adoption of blockchain technology in the banking and finance industries for applications, such as fraud prevention, secure transactions, and digital identity verification is providing a thrust to the market growth. In addition to this, the growing utilization of technology in oil & gas and trade sectors for enhanced transparency and efficiency in supply chain operations is positively impacting the market growth. Apart from this, the increasing cyber threats, leading to a growing need for secure and tamper-proof systems, are also providing an impetus to the market growth. Furthermore, the increasing collaboration between government entities and private firms, accelerating the adoption of blockchain technology across different sectors, is providing remunerative growth opportunities for the market.

GCC Blockchain Technology Market Trends/Drivers:

Increasing regulatory support

The increasing support by the government and regulatory bodies in shaping the landscape of technological innovation and the adoption of blockchain technology is creating a positive outlook for the market growth. In line with this, the implementation of favorable policies that favor the adoption of blockchain technology, leading to an environment conducive to innovation and investment, is providing a thrust to the market growth. In addition to this, the widespread initiatives taken by countries in the region to transition various governmental operations onto blockchain, attracting entrepreneurs and technology firms to the region and encouraging existing businesses to explore blockchain-based solutions, are providing an impetus to the market growth. Moreover, the increasing implementation of policies that offer grants, financial incentives, and sandbox environments where blockchain projects can be safely tested and iterated is anticipated to drive the market growth. Furthermore, the rising integration of blockchain technology in businesses, encouraging governments to loosen regulatory constraints, and making the region attractive for blockchain ventures are propelling the market growth.

Growing initiatives for digitization

The increasing push for digital transformation in the region is one of the major factors contributing to the market growth. In line with this, the widespread awareness about the importance of technology in future economic growth, leading to the introduction of comprehensive digital roadmaps in the region, is also propelling the market growth. These strategies aim to foster innovation and modernize public services, thereby increasing efficiency and global competitiveness that utilize blockchain technology, owing to its innate attributes of security, transparency, and decentralization. Moreover, the growing development of large-scale regional projects, such as smart cities that require the secure and efficient handling of massive volumes of data, is creating a positive outlook for the market growth. Additionally, the increasing digitization initiatives that involve the collaboration of multiple sectors, from healthcare to energy, opening up a plethora of applications for blockchain to revolutionize is strengthening the market growth.

GCC Blockchain Technology Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC blockchain technology market report, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on type, component, application, enterprise size, and end use.

Breakup by Type:

- Public

- Private

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the type. This includes public, private, and hybrid.

Public blockchains are open, decentralized networks where anyone can join and participate. These blockchains are generally used for cryptocurrencies and offer high transparency and security. Moreover, they are ideal for systems that require trust among disparate parties, as a distributed network of nodes maintains them.

Private blockchains are permitted networks where access is granted only to specific, vetted participants, making them ideal for businesses and organizations that must maintain confidentiality while sharing data among internal departments or trusted partners. Additionally, in a private blockchain, the organization controls the network's rules and protocols, allowing for high levels of customization, beneficial for enterprises that require unique features or specific compliances.

Hybrid blockchains offer a blend of public and private features. These blockchains are often chosen in scenarios requiring transparency and privacy, such as supply chain management or health records. Additionally, they offer the best of both blockchains by allowing companies to publicize certain data while keeping other information private.

Breakup by Component:

- Application and Solution

- Infrastructure and Protocols

- Middleware

A detailed breakup and analysis of the market based on the component has also been provided in the report. This includes application and solution, infrastructure and protocols and middleware.

Application and solution focus on the end-user applications that run on a blockchain framework, ranging from financial services apps to supply chain tracking solutions. Businesses and consumers directly interact with these applications to avail of various services enabled by blockchain technology.

Infrastructure and protocols refer to the underlying technologies that make blockchain systems operational. Infrastructure includes hardware like servers and nodes, while protocols define data transmission and storage rules. These components are essential for any blockchain network's stable and secure functioning.

Middleware acts as the connective layer between different applications and services within the blockchain ecosystem. It enables efficient data exchange and communication among various applications, streamlining operations. Middleware solutions include APIs, SDKs, and other tools that facilitate interoperability between blockchain-based systems.

Breakup by Application:

- Digital Identity

- Exchanges

- Payments

- Smart Contracts

- Supply Chain Management

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes digital identity, exchanges, payments, smart contracts, supply chain management and others.

Digital identity focuses on secure and immutable identity verification. It aims to replace traditional identification methods with a more secure and tamper-proof system, providing increased protection against identity theft.

Blockchain is widely used in cryptocurrency exchanges for seamless and secure transactions, as these platforms rely on the technology's decentralized and transparent nature to ensure fair trading and trust among users.

Payments enhance transaction speeds and reduce costs, especially in cross-border transactions, providing a more efficient, transparent, and secure way to transfer funds than traditional methods.

Smart contracts are self-executing contracts where the contract terms are directly written into code. Smart contracts automate complex processes, reducing the need for intermediaries and making transactions more efficient.

Furthermore, the increasing utilization of blockchain in supply chain management offers a transparent and immutable ledger system for tracking goods that move from manufacturer to distributor to retailer, enhancing accountability and allowing for more effective monitoring of product quality and authenticity.

Breakup by Enterprise Size:

- Large Enterprise

- Small Enterprise

- Middle Enterprise

A detailed breakup and analysis of the market based on the enterprise size has also been provided in the report. This includes large enterprise, small enterprise and middle enterprise.

Large enterprises have the resources to invest in customized, complex solutions that enable them to deploy blockchain technology across multiple departments or for various applications, from supply chain management to data security.

Small enterprises may adopt blockchain to solve specific problems or streamline certain aspects of their business, benefiting from more specialized or out-of-the-box, less resource-intensive solutions.

Middle enterprises have unique needs that can be addressed by blockchain technology, including the increasing demand for scalable solutions. Middleware solutions and hybrid blockchains are popular choices for these companies.

Breakup by End Use:

- Financial Services

- Government

- Healthcare

- Media and Entertainment

- Retail

- Transportation and Logistics

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes financial services, government, healthcare, media and entertainment, retail, transportation and logistics and others.

Financial Services are a key end user of blockchain technology, employing it for transactions, fraud prevention, and smart contracts. The technology's security and transparency features make it a perfect fit for financial applications.

Blockchain is increasingly being adopted for public services, including identity verification and voting systems. It helps in making government operations more transparent, efficient, and secure.

The technology's immutable ledgers can securely store patient records, enabling better data interoperability between healthcare providers. It also has the potential to streamline the pharmaceutical supply chain, ensuring authenticity and safety.

Blockchain technology offers new ways to handle digital rights management and royalty distribution in the media and entertainment sector. It provides an immutable record of ownership, thereby reducing piracy and ensuring fair compensation for creators.

Blockchain is also transforming the retail sector owing to its ability to provide transparent and unchangeable ledgers which makes it valuable for both retailers and consumers.

The blockchain technology can enhance the efficiency of transport and logistics through better tracking of goods and vehicles. It promises to minimize costs, reduce delays, and mitigate the risk of counterfeit goods.

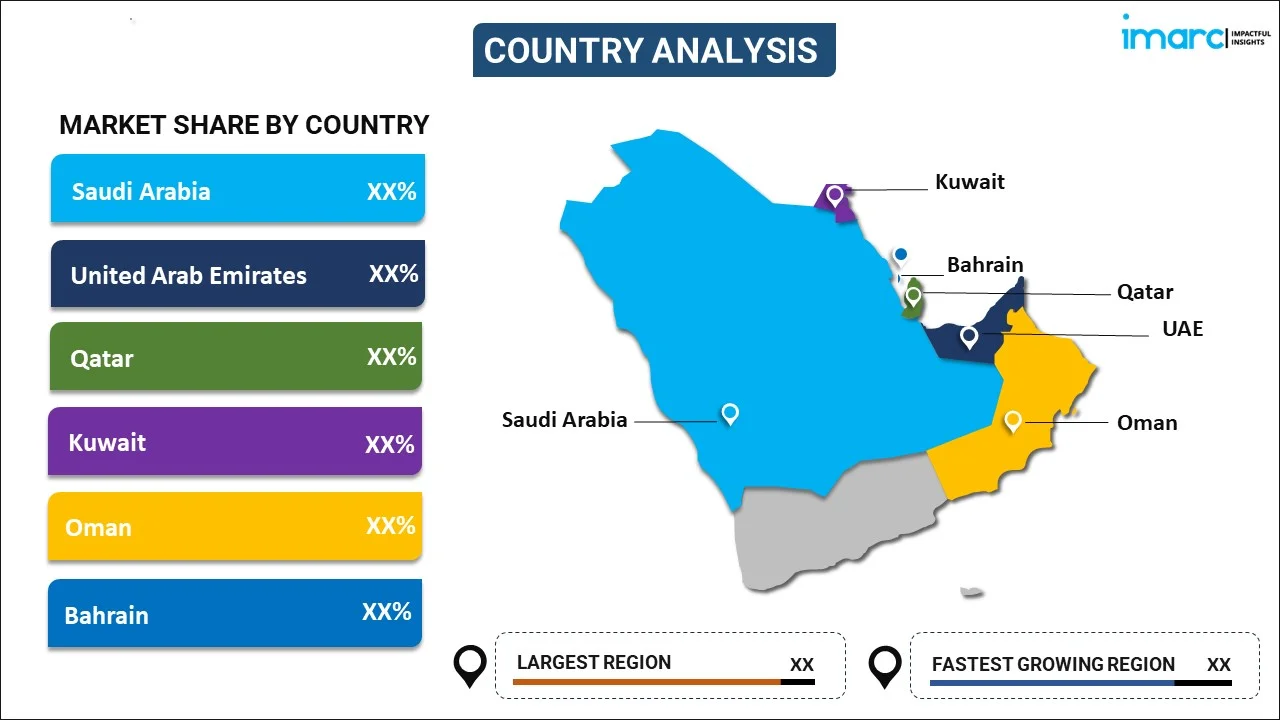

Breakup by Country:

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

The report has also provided a comprehensive analysis of all the major regional markets, which include Saudi Arabia, the UAE, Qatar, Bahrain, Kuwait and Oman.

Saudi Arabia is the largest economy in the GCC region, that invest heavily in blockchain technology, focusing on sectors like finance and government services. The country's strategic framework has identified blockchain as a key technology for future development.

The United Arab Emirates (UAE) is known for its progressive stance on technology, initiating several blockchain projects, particularly in Dubai, aiming to become a global blockchain hub.

Qatar has been exploring blockchain to improve its financial and healthcare sectors. The country's growing fintech scene also positions it as an emerging player in the blockchain technology market within the GCC.

Bahrain is a fintech hub, actively encouraging blockchain startups, and has introduced regulatory sandboxes for blockchain experimentation, aiming to become a blockchain leader in financial services and e-governance.

Kuwait has shown interest in using this technology for financial services and public records. Furthermore, Oman is focused on using blockchain to improve supply chain management and verify goods' authenticity.

Competitive Landscape:

The leading companies in the blockchain technology market focus on developing blockchain platforms that serve specific industries and aim to simplify processes like transactions, record-keeping, and contract execution. Moreover, firms are offering consulting services that guide other businesses on blockchain adoption, from strategy and proof of concept to actual implementation. Besides this, some companies are involved in financial technology solutions, such as creating digital wallets, payment gateways, and decentralized finance (DeFi) applications. Furthermore, key companies are creating smart contract solutions to automate and streamline legal and business processes, reducing the need for intermediaries. In addition to this, some companies are developing identity verification solutions that could replace traditional methods, making the process more secure and less prone to fraud. Along with this, the major companies are also developing blockchain systems to securely store and manage healthcare data, aiming to improve the interoperability of health records across various platforms. Apart from this, companies are also collaborating with governmental bodies to implement blockchain in public services, which could range from electoral systems to public records management.

The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

GCC Blockchain Technology Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Public, Private, Hybrid |

| Components Covered | Application and Solution, Infrastructure and Protocols, Middleware |

| Applications Covered | Digital Identity, Exchanges, Payments, Smart Contracts, Supply Chain Management, Others |

| Enterprise sizes Covered | Large Enterprise, Small Enterprise, Middle Enterprise |

| End Uses Covered | Financial Services, Government, Healthcare, Media and Entertainment, Retail, Transportation and Logistics, Others |

| Countries Covered | Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, Oman |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the GCC blockchain technology market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the GCC blockchain technology market?

- What is the impact of each driver, restraint, and opportunity on the GCC blockchain technology market?

- What is the breakup of the market based on the type?

- Which is the most attractive type in the GCC blockchain technology market?

- What is the breakup of the market based on the component?

- Which is the most attractive component in the GCC blockchain technology market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the GCC blockchain technology market?

- What is the breakup of the market based on the enterprise size?

- Which is the most attractive enterprise size in the GCC blockchain technology market?

- What is the breakup of the market based on the end use?

- Which is the most attractive end use in the GCC blockchain technology market?

- What is the competitive structure of the GCC blockchain technology market?

- Who are the key players/companies in the GCC blockchain technology market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC blockchain technology market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the GCC blockchain technology market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC blockchain technology industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)