GCC Biofertilizer Market Size, Share, Trends and Forecast by Type, Crop, Microorganism, Mode of Application, and Country, 2025-2033

GCC Biofertilizer Market Size and Share:

The GCC biofertilizer market size was valued at USD 36.8 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 107.8 Million by 2033, exhibiting a CAGR of 11.67% from 2025-2033. The market is propelled by the increasing shift toward biofertilizers, escalating demand for organic products due to inflating disposable incomes, continuous investments in research and development (R&D) activities, and improving farming practices.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 36.8 Million |

|

Market Forecast in 2033

|

USD 107.8 Million |

| Market Growth Rate (2025-2033) | 11.67% |

Stringency of the environmental legislations in the GCC are pushing for the use of biofertilizers. With the enhancement of global concerns regarding climate change and the protection of the environment, GCC governments have acted to reduce the environmental impact of agriculture as much as possible. In 2021, Saudi Arabia has unveiled the Green Initiative as a comprehensive strategy to achieve internationally bindings climate goals and improve climate actions in the kingdom. They bear much focus on minimization of synthetic fertilizers and pesticides that are associated with emissions of greenhouse gases and pollutants of water. Biofertilizers are gradually being accepted as suitable replacement as these fertilizers are made from natural substances and they bring about fertility in soils without exploitation of natural resources. Programs like the Green Saudi Initiative and UAE's Sustainable Agriculture Policy promote organic farming practices, thereby creating an easier pathway for the adoption of biofertilizers. The international commitments, as per the Paris Agreement, push GCC countries to adopt the use of sustainable practices throughout their economies, including their agriculture. The resultant regulatory framework is a strong catalyst for the biofertilizer market that drives demand for products in line with environmental goals.

.webp)

As agricultural diversification importance is growing, GCC nations are looking forward to investing more in biofertilizers to boost crop yields and ensure soil health. Traditionally dependent on oil revenues, a country like Saudi Arabia and even the UAE is looking toward diversifying their economies to face the future. The process of modernizing the agricultural sector forms an integral component of this strategy as the need for food security increases daily. Biofertilizers play a very important role in supporting diverse crop production, especially in areas where there is limited arable land and harsh climatic conditions. Through improved nutrient uptake and the stimulation of beneficial microbial activity in the soil, biofertilizers allow farmers to grow a wider variety of crops more effectively. With subsidies, research programs, and collaboration with biofertilizer manufacturers under Vision 2030 and similar initiatives, the GCC governments are taking the necessary steps to push market growth further and to build a strong foundation for sustainable agriculture.

GCC Biofertilizer Market Trends:

Increasing awareness about soil health

The growing awareness about the importance of soil health among GCC farmers and agricultural stakeholders is significantly driving the biofertilizer market. The increasing use of chemical fertilizers has been a cause for concern for declining soil productivity and nutrient depletion, which are alarm bells for long-term agricultural sustainability. Biofertilizers address the concerns by replenishing the essential nutrients, increasing microbial activity, and improving soil structure. Given the fact that the GCC region faces some unique challenges, such as limited arable land and poor soil quality, maintaining soil health while boosting agricultural productivity with biofertilizers presents a viable solution. As stated by Gulf Petrochemicals and Chemicals Association, less than 2% cultivable land is available due to which GCC imports 85% of the total food. Agricultural organizations and government led educational programs and workshops played an important role in spreading the benefits of biofertilizers. The focus on shifting toward organic farming activities also highlights the importance of using biofertilizers toward sustainable agricultural growth in the GCC region.

Technological advancements

Another significant factor that has accelerated the growth of the market is the technological advancements achieved in the production of biofertilizers in the GCC countries. The recent advancements include strain improvement, microencapsulation, and improvements in carrier materials, which have enhanced the effectiveness, stability, and shelf life of biofertilizers. Such advancements allow the biofertilizers to be tolerant of the severe climatic conditions prevailing in the region, such as high temperatures and low moisture levels, thus making it suitable for the local agricultural needs. In addition, the cost of producing biofertilizers through advanced fermentation technology has also been reduced so that the fertilizer is available to the farmers. Moreover, precision agriculture tools and data analytics have made the targeting of the application of the biofertilizers possible. The interactions between the local governments, universities, and private enterprise in the GCC are accelerating these innovations further. As technology continues to address the challenges of biofertilizer adoption, its market potential in the region is expected to grow exponentially.

Rapid urbanization and food demand

Rapid urbanization in the GCC region has led to increasing demand for food, creating pressure on the agricultural sector to increase productivity. According to Bahrain Food Monitor, the per capita consumption in the GCC is estimated to reach from 872.5 kg in 2022, to 904.1 kg by 2027, growing at a CAGR of 0.7%. With scarce natural resources and cultivable land, farmers are looking towards biofertilizers to increase crop yield in a sustainable manner. The increasing urban population results in the demand for high-quality food produced organically, and biofertilizers can achieve this. Moreover, in an urbanized area, cultivable land is scarce, thus requiring efficient farming practices. Biofertilizers increase nutrient use efficiency and allow for high crop yields from smaller areas, thus meeting the requirements of urban farming initiatives and vertical agriculture projects. Governments are also investing in modern farming technologies to ensure food security for their growing populations, thus further fueling the adoption of biofertilizers. This trend highlights the dual role of biofertilizers in meeting food security challenges and supporting sustainable agricultural growth in the face of rapid urban development.

GCC Biofertilizer Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC biofertilizer market, along with forecasts at the country levels from 2025-2033. The market has been categorized based on type, crop, microorganism, and mode of application.

Analysis by Type:

- Nitrogen-Fixing Biofertilizers

- Phosphate-Fixing Biofertilizers

- Others

Nitrogen-fixing biofertilizers dominate the market as it contains microorganisms like Rhizobium, Azotobacter, and Azospirillum that can transform atmospheric nitrogen into plant forms that can readily absorb. This process significantly improves soil fertility and boosts crop productivity without the need for synthetic fertilizers, which can be expensive and environmentally harmful. Besides, leguminous crops, such as chickpeas, lentils, and soybeans, are widely grown in the GCC as part of efforts to diversify agricultural production. These crops thrive with nitrogen-fixing biofertilizers, as the bacteria form symbiotic relationships with plant roots, enhancing nitrogen uptake and supporting robust plant growth. The preference for legumes due to their higher nutrient content further strengthens demand for nitrogen-fixing biofertilizers.

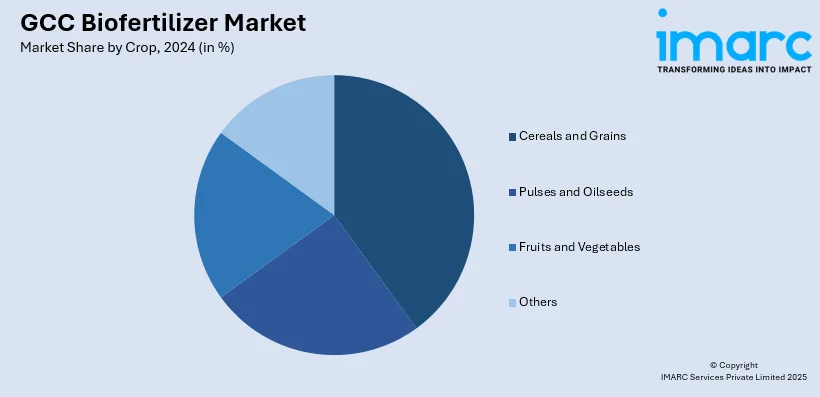

Analysis by Crop:

- Cereals and Grains

- Pulses and Oilseeds

- Fruits and Vegetables

- Others

Cereals and grains hold the largest market share due to their critical role in regional food security and agricultural practices. These crops, such as wheat, barley, and rice, are staple foods in the GCC and form the backbone of dietary consumption. With rising population and urbanization, the demand for cereals and grains has grown steadily, necessitating sustainable farming practices to boost production. Biofertilizers are particularly effective in enhancing the growth and yield of cereals and grains by improving nutrient uptake and soil fertility. These crops require high levels of essential nutrients like nitrogen and phosphorus, which biofertilizers efficiently provide through nitrogen-fixing and phosphate-solubilizing microbes.

Analysis by Microorganism:

- Cyanobacter

- Rhizobium

- Phosphate Solubilizing Bacteria

- Azotobacter

- Others

Cyanobacter accounts for the largest market share. Cyanobacteria are particularly well-suited for the extreme climatic conditions prevalent in the GCC, such as intense sunlight, high temperatures, and limited water resources. These microorganisms can survive and thrive in arid and semi-arid environments, making them ideal for enhancing soil fertility in the region. Their ability to fix atmospheric nitrogen even in nutrient-poor soils further contributes to their dominance, as they can significantly improve soil productivity under challenging circumstances. Besides, the ability of cyanobacteria to enhance soil organic matter and promote microbial activity further underscores their value in improving overall soil health.

Analysis by Mode of Application:

- Seed Treatment

- Soil Treatment

- Others

Seed treatment dominates the market. It has been a dominant application of GCC biofertilizers market since it is efficient and economical while being appropriate for agricultural problems of the region. Farmers precoat seeds with biofertilizers before planting, in that way, beneficial microorganisms directly become available to aid in the process of germination and early growth of a plant. The targeted approach thus reduces waste and amounts of biofertilizers applied in the process, so this will be an economical alternative in large-scale farming. The arid climate and nutrient less soils common in the GCC further enhance the appeal of seed treatment and increase the demand for fertilizers. As per Gulf Petrochemicals and Chemicals Association, only 2% of GCC land is cultivable. Hence, Agritech technologies, are essential for overcoming arid landscapes and boosting food production. The seed treatment method provides seeds with a protective environment against harsh conditions, boosting resilience and ensuring better survival rates. Furthermore, seed treatment facilitates quicker nutrient uptake by crops, improving root development and promoting higher yields.

Country Analysis:

- Saudi Arabia

- UAE

- Qatar

- Oman

- Kuwait

- Bahrain

Saudi Arabia accounts for the largest market share. Saudi Arabia's Vision 2030 program has placed a strong focus on the need to minimize dependence on oil revenue by expanding the economy. Agriculture is identified as a significant sector, and policies and subsidies have been initiated for sustainable farming practices. This includes biofertilizers, as in the case of the Sustainable Agricultural Rural Development Program (SARDP), which encourages organic farming and the adoption of eco-friendly inputs for improving soil health and productivity. These policies have created a robust framework for biofertilizer adoption, positioning Saudi Arabia as a market leader. Moreover, Saudi Arabia boasts the largest agricultural sector in the GCC, supported by significant investments in technology and modern farming methods. As per IMARC Group, Saudi Arabia agriculture market size is projected to exhibit a growth rate (CAGR) of 5.50% during 2024-2032.

Competitive Landscape:

Many companies are entering partnerships with governments, research institutions, and agricultural organizations to expand their reach and influence. These collaborations often involve joint ventures for localized production, research projects, and farmer training programs. For instance, partnerships with GCC governments help secure contracts for large-scale agricultural projects, while alliances with distributors ensure wider market penetration. Moreover, to meet the diverse needs of farmers, key players are broadening their product lines to include a variety of biofertilizers suited for different crops and soil types. This includes nitrogen-fixing, phosphorus-solubilizing, and potassium-mobilizing biofertilizers, as well as multi-functional blends. By offering comprehensive solutions, companies aim to become one-stop providers for sustainable agricultural inputs.

The report provides a comprehensive analysis of the competitive landscape in the GCC biofertilizer market with detailed profiles of all major companies.

Latest News and Developments:

- In September 2024, Qatar Energy has announced plans to develop a new, world-scale urea production complex, which will more than double Qatar's urea production and play an important role in improving global food production and security. The new megaproject calls for the construction of three ammonia production lines in Mesaieed Industrial City, which will supply feedstock to four new world-scale urea manufacturing trains.

GCC Biofertilizer Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Nitrogen-Fixing Biofertilizers, Phosphate-Fixing Biofertilizers, Others |

| Crops Covered | Cereals and Grains, Pulses and Oilseeds, Fruits and Vegetables, Others |

| Microorganisms Covered | Cyanobacter, Rhizobium, Phosphate Solubilizing Bacteria, Azotobacter, Others |

| Mode of Applications Covered | Seed Treatment, Soil Treatment, Others |

| Countries Covered | Saudi Arabia, UAE, Qatar, Oman, Kuwait, Bahrain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC biofertilizer market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC biofertilizer market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC biofertilizer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A biofertilizer is a natural substance that contains living microorganisms which, when applied to soil or plants, promote growth by increasing the availability of nutrients. These microorganisms can include bacteria, fungi, and algae, which help plants by fixing nitrogen, breaking down organic matter, or enhancing nutrient uptake.

The GCC biofertilizer market was valued at USD 36.8 Million in 2024.

IMARC estimates the GCC biofertilizer market to exhibit a CAGR of 11.67% during 2025-2033.

The market is propelled by the escalating demand for organic products due to inflating disposable incomes, continuous investments in research and development (R&D) activities, and improving farming practices.

Nitrogen-fixing biofertilizers dominate the market as they contain microorganisms like Rhizobium, Azotobacter, and Azospirillum that convert atmospheric nitrogen into forms that plants can readily absorb.

Cereals and grains lead the market as these crops, such as wheat, barley, and rice, are staple foods in the GCC and form the backbone of dietary consumption.

Cyanobacteria lead the market as they are particularly well-suited for the extreme climatic conditions prevalent in the GCC, such as high temperatures, intense sunlight, and limited water resources.

Seed treatment holds the largest market share as farmers precoat seeds with biofertilizers before planting, in that way, beneficial microorganisms directly become available to aid in the process of germination and early growth of a plant.

On a regional level, the market has been classified into Saudi Arabia, UAE, Qatar, Oman, Kuwait, Bahrain, wherein Saudi Arabia currently dominates the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)