GCC Aviation Fuel Market Size, Share, Trends and Forecast by Fuel Type, Aircraft Type, End Use, and Country, 2025-2033

GCC Aviation Fuel Market Size and Share:

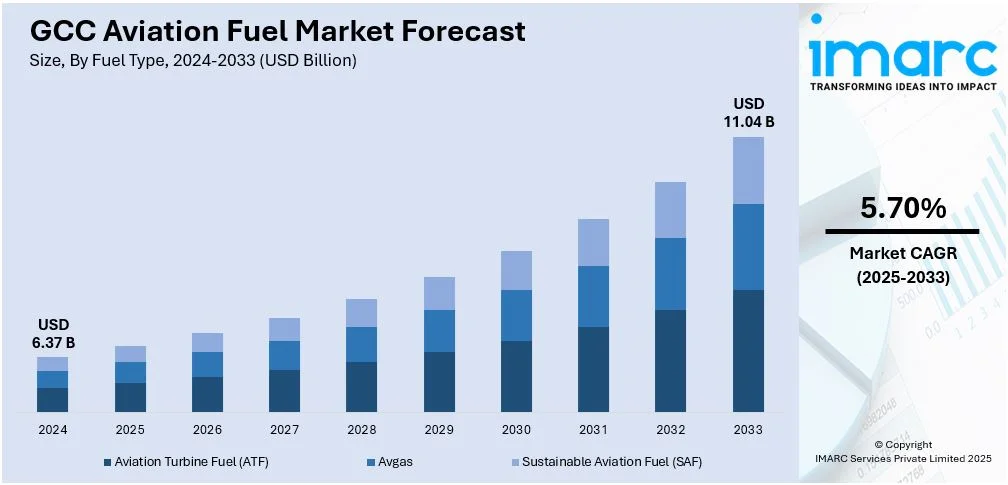

The GCC aviation fuel market size was valued at USD 6.37 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 11.04 Billion by 2033, exhibiting a CAGR of 5.70% from 2025-2033. The market is driven by the rising shift towards green technologies to encourage the development of more sustainable aviation fuels (SAFs), along with the expansion of cargo fleets in the GCC region to accommodate an increase in shipments from e-commerce platforms.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.37 Billion |

| Market Forecast in 2033 | USD 11.04 Billion |

| Market Growth Rate (2025-2033) | 5.70% |

The increasing air traffic is positively influencing the market across the GCC region. Saudi Arabia, the United Arab Emirates (UAE), and Qatar are hubs for both passenger and cargo flights owing to the region's rising development of reliable airline networks. With the region's strategic geographic location between Asia, Europe, and Africa, GCC airports serve as key transit points for international flights, which is catalyzing the demand for aviation fuel. Major carriers are expanding their fleets and routes, which is creating the need for aviation fuel to be utilized in commercial and long-haul flights. Besides this, the growing number of low-cost carriers in the region is making air travel more accessible, further increasing passenger numbers. These budget airlines operate large fleets of narrow-body planes, requiring steady supplies of fuel to meet frequent flight schedules.

The rising demand for military fuel due to the region’s strategic geopolitical importance and military presence is impelling the market growth. Saudi Arabia, the UAE, Qatar, and Kuwait possess some of the most advanced air forces. GCC countries rely heavily on aviation fuel for the operation of their fleet of fighter jets, surveillance aircraft, transport planes, and helicopters. They focus on developing capable air defense systems and airpower to prioritize the modernization and expansion of their military capabilities. The GCC nations’ air forces require fuel for a wide range of operations, from combat missions to humanitarian assistance and peacekeeping roles. Fuel is also essential for military operations, such as air patrols and reconnaissance missions, and refueling operations during extended combat and training sessions. Moreover, the increasing need for military aircraft to conduct rapid airlift operations and enable the quick deployment of troops and military resources is driving the demand for aviation fuel.

GCC Aviation Fuel Market Trends:

Rising adoption of green technology and sustainability

The growing adoption of green technology and sustainable practices is propelling the market growth. With rising concerns about climate change, airlines and fuel manufacturers are focusing on meeting regulatory standards and user expectations. This shift towards green technologies is encouraging the development of more sustainable aviation fuels (SAFs), which lower carbon emissions. SAFs, derived from renewable resources like algae, waste oils, and plant matter, offer a greener alternative to traditional jet fuels. Besides this, advancements in fuel production technologies, such as bio-refining and chemical engineering, are making aviation fuels more economically viable and scalable. Moreover, airlines are investing in more fuel-efficient aircraft that utilize less fuel per passenger and generate fewer emissions. Combined with enhanced engine technologies, improved aerodynamics, and lightweight materials, these innovations are creating a more environment friendly aviation ecosystem. In Saudi Arabia, passengers and businesses are prioritizing airlines that employ green technologies and sustainable fuels. According to the IMARC Group’s report, the Saudi Arabia green technology and sustainability market is expected to exhibit CAGR of 15.90% during 2024-2032.

Increasing outbound travel and tourism

The rising outbound travel and tourism activities in the GCC region are fueling the market growth. With more citizens and residents traveling abroad for leisure, business, and educational purposes, the demand for outbound flights is increasing, and, hence, the need for aviation fuel is being created. Airlines based in the GCC region are expanding their international networks to offer more direct flights that are fuel intensive. Furthermore, tourism initiatives aim to diversify the economy and attract millions of international visitors, which is catalyzing the demand for air travel. With more visitors flying into the region for tourism, the burgeoning aviation industry is benefitting from both inbound and outbound air traffic. The region’s luxury tourism and high-net-worth individuals also support long-haul flights, which require large amounts of aviation fuel. The data published on the website of the IMARC Group shows that the GCC outbound travel and tourism market is expected to reach USD 138.1 Billion by 2033.

Expansion of e-commerce platforms

The expansion of e-commerce platforms is bolstering the market growth in the GCC region. With more people preferring online shopping, the need for air freight to meet user expectations for quick delivery is increasing, which is creating the need for aviation fuel. Since Dubai and Doha are major logistics hubs, e-commerce companies are utilizing them to streamline their worldwide supply chains. These platforms require air transportation for high-value and time-sensitive products, such as electronics and fashion items. In response, the region’s airports are experiencing a rise in the number of cargo flights, which enables higher fuel usage. Furthermore, the GCC is noted for its leading airlines, which are expanding their cargo fleets to accommodate the increase in shipments from e-commerce platforms. This is leading to high fuel demand, as airlines and logistics companies are catering to buyers’ needs for safe and early delivery. IMARC Group’s report predicted that the GCC e-commerce market will exhibit a growth rate (CAGR) of 9.26% during 2024-2032.

GCC Aviation Fuel Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC aviation fuel market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on fuel type, aircraft type, and end use.

Analysis by Fuel Type:

- Aviation Turbine Fuel (ATF)

- Avgas

- Sustainable Aviation Fuel (SAF)

Aviation turbine fuel (ATF) is widely used by commercial airlines and cargo carriers. With the region being an aviation hub, major airports in Saudi Arabia, UAE, and Qatar utilize ATF to power their extensive fleets. It ensures high performance, efficiency, and safety for long-haul and short-haul flights. It is also employed in military jets for defense operations and private jets for business travel.

Avgas caters to general aviation, flight schools, and recreational pilots. It provides reliable performance for general aviation, including short-distance travel, pilot training, and personal flying. It is used in agricultural aviation for crop dusting, firefighting planes for aerial suppression, and certain military training aircraft. It remains crucial for maintaining operations in non-commercial aviation activities.

Sustainable aviation fuel (SAF) is gaining traction in the GCC region, as it is adopting greener aviation solutions. It is produced from renewable sources like waste oils, agricultural residues, and non-food crops, making it sustainable. It reduces carbon emissions and helps airlines and government agencies to meet environmental goals. It is used as an eco-friendly alternative to conventional jet fuel in commercial, military, and private aviation.

Analysis by Aircraft Type:

- Fixed Wing

- Rotary Wing

Fixed wing aircraft are extensively operated by major airline companies of the GCC region, which encourages the use of aviation fuel. They are important for enabling surveillance, reconnaissance, troop transport, and combat missions. They are utilized for medical evacuations, firefighting, agricultural spraying, and search-and-rescue operations.

Rotary wing aircraft, commonly known as helicopters, serve a variety of purposes due to their maneuverability and ability to take off, land, and hover vertically. In commercial applications, they are used for short-distance passenger transport, air tours, and VIP travel, especially in urban regions with difficult terrain where fixed-wing aircraft cannot operate. They are also essential for combat operations, troop transport, and search-and-rescue missions.

Analysis by End Use:

.webp)

- Commercial

- Military

- Others

The commercial airlines employ ATF because it is an energy-dense and efficient fuel. This fuel is very essential for long-range and short-range commercial flights, which are used to supply the required amount of thrust for the engines to work at the high altitude and over a long duration. It assists in the effective functioning of commercial passenger airlines, cargo planes, and charter services.

The military segment holds significant importance in the GCC region due to high defense spending and strategic operations. Countries like Saudi Arabia, the UAE, and Qatar invest in advanced fighter jets and rotary-wing aircraft for defense purposes. Aviation fuel is crucial for military applications, powering fighter jets, transport aircraft, helicopters, and drones. It ensures high performance, reliability, and operational efficiency in combat, surveillance, and logistics missions.

Country Analysis:

- Saudi Arabia

- United Arab Emirates

- Qatar

- Kuwait

- Oman

- Bahrain

Saudi Arabia is noted for its well-built aviation infrastructure and airports. Moreover, there is an increase in the number of domestic and international flights in the region due to rising tourism and business travel activities, which is creating the need for aviation fuel. Initiatives by government agencies to further modernize and expand airports are also impelling the market growth.

The United Arab Emirates is a major hub for global aviation, as there is an extensive network of airlines. The regional airports are one of the busiest airports, which ensures high demand for aviation fuel. Apart from this, airline companies spend on advanced technologies to promote the use of aviation fuel.

Qatar has a well-established airway infrastructure and famous regional airports. The country’s strategic focus on being a transit hub for worldwide travelers creates the need for aviation fuel. Here, large-scale sports events are being hosted, which increases air traffic significantly. Moreover, government agencies invest in sustainable aviation fuel to align with worldwide trends.

Kuwait has major airport upgrades and high passenger traffic, which encourages the use of aviation fuel for fleets. Besides this, government agencies are investing in new terminals and enhanced services. There is a rise in the number of low-cost carriers and business travel activities, which further creates the need for aviation fuel. The country also focuses on improving fuel supply chains to meet the growing aviation needs in the GCC region.

In Oman, airlines are expanding routes, which is driving the demand for aviation fuel. Investments to support airport infrastructure and tourism activities, especially in coastal regions, promote the use of aviation fuel. Apart from this, government agencies emphasize the strengthening of logistics and air transport, which requires aviation fuel.

In Bahrain, there is an extensive airline network with a high number of modern airports. Being a transit hub for regional and international flights, the country is experiencing high aviation fuel demand. Government initiatives to modernize the aviation sector, improve cargo handling, and expand airline networks further promote the usage of aviation fuel.

Competitive Landscape:

Key players are placing bets on enhancing distribution networks and investing in advanced technologies. Major oil producers are leveraging the region's rich oil reserves to meet the increasing aviation requirements. Key airlines are utilizing aviation fuel by expanding fleets and worldwide operations. Additionally, key players are collaborating with international fuel suppliers to promote the adoption of SAFs and align with environmental goals. Government agencies are also focusing on infrastructure developments, including airport expansions, thereby bolstering the market growth. Moreover, fuel service providers are teaming up with regional stakeholders to improve fuel logistics and ensure smooth supply chain operations across airports. For instance, in July 2024, Emarat, a leading fuel services company, collaborated with the Emirates Airline Group to supply aviation fuel for its freight activities at Al Maktoum International Airport, Dubai. The agreement strengthens the company’s commitment to offer a wide range of services with improved quality.

The report provides a comprehensive analysis of the competitive landscape in the GCC aviation fuel market with detailed profiles of all major companies, including:

- ADNOC Distribution

- BP Middle East LLC (BP plc)

- Emarat

- ENOC Company

- Oman Oil Marketing Company SAOG (OQ SAOC)

Latest News and Developments:

- November 2024: Mercantile and Maritime Group, a prominent energy and commodities trading company, announced the expansion of its operated facility, MENA Terminals by developing a biofuel processing plant at Fujairah, UAE. This project promises to produce 150 million liters of sustainable aviation fuel and decrease carbon emissions.

GCC Aviation Fuel Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fuel Types Covered | Aviation Turbine Fuel (ATF), Avgas, Sustainable Aviation Fuel (SAF) |

| Aircraft Types Covered | Fixed Wing, Rotary Wing |

| End Uses Covered | Commercial, Military, Others |

| Countries Covered | Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, Bahrain |

| Companies Covered | ADNOC Distribution, BP Middle East LLC (BP plc), Emarat, ENOC Company, Oman Oil Marketing Company SAOG (OQ SAOC) etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC aviation fuel market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC aviation fuel market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC aviation fuel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Aviation fuel is a specialized type of petroleum-based fuel used to power aircraft. It supports air cargo operations, aerial firefighting, agricultural aviation, and emergency services like air ambulances. It is utilized to meet the high-performance requirements of aviation engines, ensuring safety, efficiency, and reliability during flights.

The GCC aviation fuel market was valued at USD 6.37 Billion in 2024.

IMARC estimates the GCC aviation fuel market to exhibit a CAGR of 5.70% during 2025-2033.

GCC government agencies are investing in the aviation sector and supporting regulations to promote air travel, trade, and tourism, which is impelling the market growth. Moreover, infrastructure development, including the construction of new terminals and the expansion of cargo facilities, is catalyzing the demand for aviation fuel. Besides this, new technologies aimed at increasing fuel efficiency and reducing costs are helping airlines to optimize fuel use, thereby propelling the market growth.

Some of the major players in the GCC aviation fuel market include ADNOC Distribution, BP Middle East LLC (BP plc), Emarat, ENOC Company, Oman Oil Marketing Company SAOG (OQ SAOC), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)