GCC Automotive Lead-Acid Battery Market Size, Share, Trends and Forecast by Vehicle Type, Product, Type, Customer Segment, and Country 2025-2033

GCC Automotive Lead-Acid Battery Market Size and Share:

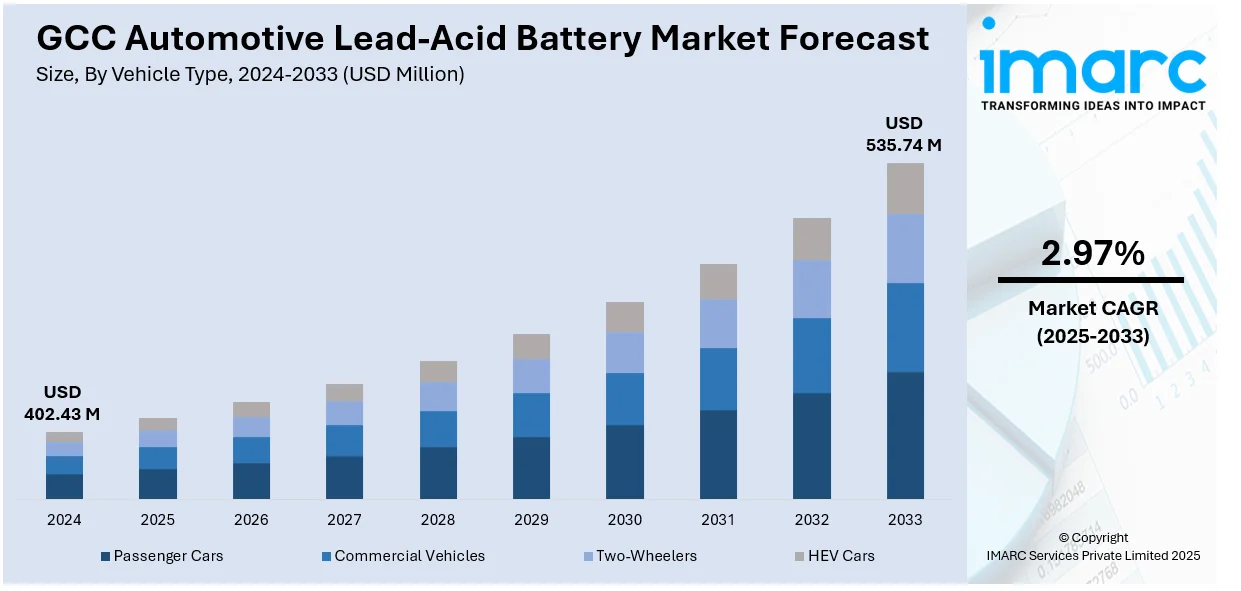

The GCC automotive lead-acid battery market size was valued at USD 402.43 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 535.74 Million by 2033, exhibiting a CAGR of 2.97% from 2025-2033. The rising vehicle ownership, extreme climatic conditions leading to frequent replacements, and increased commercial vehicle use in industries like construction and logistics are some factors driving the market demand in this region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 402.43 Million |

|

Market Forecast in 2033

|

USD 535.74 Million |

| Market Growth Rate (2025-2033) | 2.97% |

The GCC automobile lead-acid battery market is expanding due to the increasing adoption of automobiles, which is driven by the rising disposable income, and infrastructure facilities. In addition to this, factors such as severe heat result in more frequent replacement of batteries, which is aiding the market growth. Moreover, the surging construction activities, expanding logistics, and the rapid growth of oil and gas businesses, are contributing to the market expansion, as they require commercial vehicles, driving the demand for lasting and high-performing batteries in the region. For instance, 93,199 cars were imported in 2023, boosting the demand for automotive lead-acid batteries in the region. Besides this, the increase in government investments for broadening the road infrastructures and spurring the economic diversification schemes, utilize a wide range of automobiles in the network, thereby impelling the market growth for lead-acid batteries in the region.

Concurrent with this, the cost-effectiveness and dependability of lead-acid batteries, make them the preferred choice for automotive applications, leading to the emergence of advanced battery technologies and fostering the market growth. In confluence with this, lead-acid batteries are essential in supporting auxiliary systems in electric and hybrid electric vehicles, driven by sustainability goals, thus providing an impetus to the market. Apart from this, the rising awareness of battery recycling and environmental safety regulations is spurring the production of eco-friendly lead-acid battery variants, aligning with global green initiatives, and propelling the market forward. For example, the Saudi Standards, Metrology, and Quality Organization (SASO) issued 1,505 fuel efficiency labels for new light vehicles, demonstrating a strong commitment to encouraging sustainable transportation solutions. As a result, these factors ensure robust demand for automotive lead-acid batteries in the GCC region.

GCC Automotive Lead-Acid Battery Market Trends:

Shift towards eco-friendly solutions

The GCC automotive lead-acid battery market is witnessing a shift toward eco-friendly and sustainable solutions. In line with this, with the growing environmental awareness and stringent regulations on waste management and recycling, manufacturers are investing in greener production methods and enhanced recycling processes. This shift further aims to minimize the environmental impact and improve battery life cycles, aligning with global sustainability goals. Furthermore, advanced recycling technologies are enabling better recovery of lead, reducing the need for new resources, and decreasing pollution. Moreover, the growing demand for environmentally friendly lead-acid batteries is driving market growth, as it helps the industry comply with increasingly stringent regulations.

Integration with hybrid and electric vehicles

The increasing adoption of hybrid and electric vehicles (EVs) in the GCC region has spurred growth in the use of lead-acid batteries, especially for auxiliary functions. For instance, SASO issued a significant 465% increase in certificates for EVs in 2023. In addition to this, these vehicles employ lithium-ion batteries for motive power, whereas a lead-acid battery is necessary for accessories such as lighting, cooling, and other electrical equipment. Apart from this, this rising trend emphasizes decarbonizing the transport vehicles, making it a wider choice of the car market in the region. Besides this, lead-acid batteries are relatively cheap, dependable, and meet certain needs for auxiliary power utilization, thus contributing to the market expansion.

Technological advancements and battery life enhancement

The ongoing advancements in automotive technology are primarily driving the GCC automotive lead-acid battery market. The increased developments such as advanced grid patterns, enhanced electrolyte solution preparation, and the use of non-corrosive materials are impelling the market growth. For example, in 2024, the United Arab Emirates (UAE) unveiled its first integrated battery recycling plant, Dubatt, invested in by Dubai Industrial City. These aim at increasing the battery life, power output, and overall life cycle, as they are efficient in high-temperature regions. Furthermore, the improved charging and discharging systems reduce maintenance requirements and increase reliability, making lead-acid batteries more suitable for a range of applications. Apart from this, these serve better value to consumers as vehicle owners require batteries that can work well in extreme conditions, thereby providing an impetus to the market.

GCC Automotive Lead-Acid Battery Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC automotive lead-acid battery market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on vehicle type, product, type, and customer segment.

Analysis by Vehicle Type:

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers

- HEV Cars

The commercial vehicles hold the largest market, driven by the increase in logistics, construction activities, and transportation. In addition, surging developments in economic diversification and expanding infrastructure projects have promoted the requirement for strong and long-lasting batteries in commercial vehicles. Moreover, lead-acid batteries are cost-effective and have a highly reliable performance in extreme climatic conditions, which is necessary for vehicles operating in hot climates or winter conditions. Furthermore, commercial vehicles require dependable power sources for constant performance and productivity to maintain the longest battery life, boosting the market expansion.

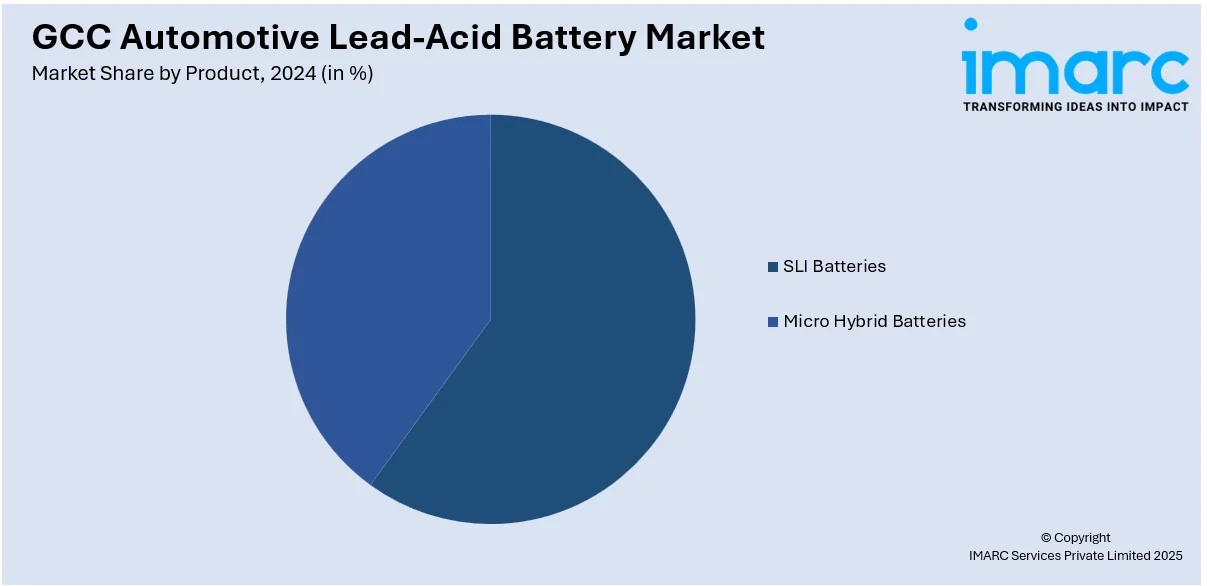

Analysis by Product:

- SLI Batteries

- Micro Hybrid Batteries

SLI or Starting, Lighting, and Ignition batteries dominate the GCC automotive lead-acid battery market due to their essential role in conventional vehicles. These batteries provide reliable starting power, facilitate lighting, and support the ignition system, making them indispensable for everyday vehicle operation. Besides this, the robust demand for SLI batteries is fueled by the high vehicle ownership rate and the climate in the region, which impacts battery life and requires frequent replacements. In line with this, their affordability, ease of availability, and proven technology continue to make SLI batteries the most widely used type, propelling the market forward.

Analysis by Type:

- Flooded Batteries

- Enhanced Flooded Batteries

- VRLA Batteries

Flooded lead-acid batteries represent the largest segment in the GCC due to their affordability, reliability, and ease of maintenance. These batteries are widely used in various vehicle types, especially in commercial and passenger vehicles, owing to their ability to withstand high temperatures, which is crucial in the climate of the region. Moreover, flooded batteries are known for their robust performance and cost-effectiveness, making them a popular choice among consumers. Additionally, the ability to refill and maintain these batteries extends their lifespan, making them an ideal solution for many vehicle owners seeking reliable power sources in challenging environments, thereby fueling the market demand.

Analysis by Customer Segment:

- OEM

- Replacement

The OEM or original equipment manufacturer segment is the largest in the GCC automotive lead-acid battery market, driven by the continuous growth of vehicle production in the region. OEMs rely on lead-acid batteries due to their established reliability and cost-effectiveness, which meet the essential power needs of vehicles at the manufacturing stage. Apart from this, a preference for lead-acid batteries in new vehicle models for proven, economical, and high-performance energy solutions is increasing their adoption in the region. Concurrently, partnerships between OEMs and battery manufacturers help ensure a steady supply of quality products, supporting vehicle functionality and long-term performance, which is aiding the market growth.

Country Analysis:

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Oman

- Kuwait

Saudi Arabia holds the largest share in the GCC automotive lead-acid battery market as it is the largest producer and consumer of automobiles in the region. The region has a relatively large population of vehicles compared with the rest of the GCC countries. Moreover, rapid urbanization and infrastructure developments require efficient means of transport, which integrates the use of lead-acid batteries in the region. For instance, the Saudi Arabia four-wheeler battery market was USD 476.8 Million in 2024, heightening the demand for effective battery solutions. Besides this, the extreme heat prevalent in the region promotes the need for robust lead-acid batteries capable of withstanding such conditions. Furthermore, the government initiatives to diversify its economy are promoting the demand for commercial vehicles and automotive power solutions, thus providing an impetus to the market.

Competitive Landscape:

The competitive landscape of the GCC automotive lead-acid battery market is characterized by a mix of established international manufacturers, regional companies, and new market entrants. Leading global players are investing in advanced technologies and strategic partnerships to strengthen their position and meet the rising demands of the automotive industry. Moreover, regional manufacturers focus on cost-effective, reliable products tailored to local market conditions, capitalizing on their deep understanding of regional needs. Additionally, innovative small players are deploying sustainable practices and adapting to consumer preferences, driving more competition in the market. Besides this, the market is shifting towards eco-friendly and advanced battery solutions, driven by rising environmental standards and regulations. This dynamic environment is encouraging firms to invest in research and development (R&D), improving battery performance, longevity, and eco-friendliness to align with the changing landscape.

The report provides a comprehensive analysis of the competitive landscape in the GCC automotive lead-acid battery market with detailed profiles of all major companies.

Latest News and Developments:

- In 2024, Exide Industries Ltd launched a new Absorbent Glass Mat (AGM) battery, offering superior starting power, durability, and lifespan, catering to modern automotive demands.

GCC Automotive Lead-Acid Battery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles, Two-Wheelers, HEV Cars |

| Products Covered | SLI Batteries, Micro Hybrid Batteries |

| Types Covered | Flooded Batteries, Enhanced Flooded Batteries, VRLA Batteries |

| Customer Segments Covered | OEM, Replacement |

| Countries Covered | Saudi Arabia, UAE, Qatar, Bahrain, Oman, Kuwait |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC automotive lead-acid battery market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC automotive lead-acid battery market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC automotive lead-acid battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

An automotive lead-acid battery is a type of rechargeable battery used to power vehicles, providing electrical energy to start the engine, operate lights, and power accessories. It is widely used in cars, trucks, motorcycles, and commercial vehicles, and as an auxiliary system in hybrid and electric vehicles.

The GCC automotive lead-acid battery market was valued at USD 402.43 Million in 2024.

IMARC estimates the GCC automotive lead-acid battery market to exhibit a CAGR of 2.97% during 2025-2033.

Key factors driving the GCC automotive lead-acid battery market include high vehicle ownership, the region's harsh climate increasing battery wear, the growing demand for commercial vehicles, cost-effectiveness, reliability, advancements in battery recycling, increased vehicle production, and the adoption of hybrid models.

In 2024, commercial vehicles represented the largest segment by vehicle type, driven by the rising demand for freight transportation, public transit expansion, and robust fleet management systems.

SLI batteries lead the market by product owing to their essential role in ignition systems, reliability, and compatibility with diverse vehicle types.

The flooded lead-acid batteries are the leading segment by type, due to affordability, high recyclability, and widespread application in traditional internal combustion engine vehicles.

The OEM is the leading segment by customer segment, driven by consistent and bulk demand for high-quality, factory-installed batteries in newly manufactured vehicles across the automotive industry.

On a regional level, the market has been classified into Saudi Arabia, UAE, Qatar, Bahrain, Oman, and Kuwait, wherein Saudi Arabia currently dominates the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)