GCC 5G Services Market Size, Share, Trends and Forecast by Communication Type, Industry, End User, and Country, 2025-2033

GCC 5G Services Market Market Size and Share:

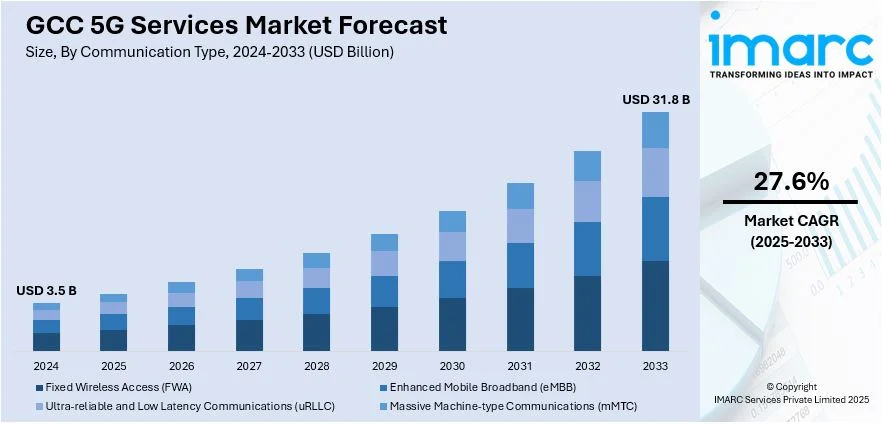

The GCC 5G services market size was valued at USD 3.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 31.8 Billion by 2033, exhibiting a CAGR of 27.6% from 2025-2033. The high-speed connectivity demand, escalating smart city and the Internet of Things (IoT) investments, introduction of government-backed initiatives, rising digital entertainment consumption, industrial automation needs, and enhanced mobile broadband services, are boosting the GCC 5G services market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 31.8 Billion |

| Market Growth Rate (2025-2033) | 27.6% |

The Gulf Cooperation Council (GCC) countries are witnessing an increasing demand for faster and more reliable internet connectivity, thus creating a positive GCC 5G service market outlook. With the growing reliance on digital services ranging from streaming platforms to online education consumers and businesses require connectivity that goes beyond what previous generations of mobile networks could offer. As a result, the total 5G mobile subscriptions in the GCC are estimated to reach 75 million by the year 2029. This surge indicates a growing consumer appetite for faster and more reliable internet services, driven by the widespread use of data-intensive applications such as streaming platforms, online gaming, and remote work tools. The enhanced capabilities of 5G networks cater to these demands by offering higher speeds and lower latency, thereby improving user experiences across various digital platforms.

The GCC region is heavily investing in smart cities and Internet of Things (IoT) projects. Saudi Arabia's NEOM, the UAE’s Smart Dubai initiative, and Qatar’s Lusail City are just a few examples of ambitious projects that rely on 5G infrastructure. Smart cities aim to integrate technology into everyday life, from automated traffic management systems to smart homes. The Internet of Things (IoT) ecosystem, which includes smart devices such as thermostats and industrial sensors, benefits significantly from 5G’s capacity to connect billions of devices at once. For example, during the FIFA World Cup in Qatar, authorities utilized digital twins and gathered data from 40,000 IoT devices to efficiently manage large stadium crowds. Similarly, Dubai's award-winning Enterprise Command and Control Center integrates artificial intelligence (AI), digital cameras, and thermal imaging to monitor a vast network, including 10,000 taxis, 5,000 kilometers of roads, and 11,000 surveillance cameras. 5G meets these demands by delivering faster speeds, lower latency, and greater network capacity. This capability is pushing governments and private players to prioritize 5G rollout as a backbone for these futuristic developments.

GCC 5G Services Market Trends:

Government Initiatives and Policies

As per the GCC 5G services market trends, governments across the region are actively promoting the adoption of 5G technology as part of their broader economic diversification strategies. For instance, Saudi Arabia's Vision 2030 emphasizes technological innovation, with substantial investments in digital infrastructure, including 5G networks. Similarly, the UAE's National Innovation Strategy prioritizes advancements in information and communication technologies, facilitating partnerships between government entities and telecom operators to expedite 5G deployment. These policy frameworks not only support the rapid rollout of 5G services but also encourage the development of new applications across various sectors, such as healthcare, education, and manufacturing.

Growth of Digital Entertainment and Media Consumption

The digital entertainment sector in the GCC is experiencing rapid expansion, with a notable increase in the consumption of streaming services, online gaming, and virtual reality experiences. As per the IMARC Group, the GCC OTT services market reached USD 12.02 Million in 2024 and is said to exhibit a growth rate of 15.10% from 2025 to 2033. This trend is driving the demand for high-speed and low-latency internet connections that 5G networks provide. For example, platforms like Netflix and Shahid have reported significant user growth in the region, underscoring the need for robust 5G infrastructure to support seamless content delivery and enhanced user experiences.

Rapid Growth of Cloud Computing and AI Applications

As per the GCC 5G service market forecast, the adoption of cloud computing and artificial intelligence (AI) applications is accelerating in the GCC, which necessitates the use of high-speed and reliable connectivity that 5G networks offer. For instance, forecasts indicate that cloud market could exceed USD 6 Billion by the year 2025 in Saudi Arabia. Businesses are increasingly utilizing cloud services for data storage and analytics, while AI applications are being deployed across various sectors, including finance, healthcare, and retail. The low latency and high bandwidth of 5G networks facilitate the efficient functioning of these technologies, enabling real-time data processing and decision-making capabilities that are critical for modern enterprises.

GCC 5G Services Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC 5G services market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on communication type, industry, and end user.

Analysis by Communication Type:

- Fixed Wireless Access (FWA)

- Enhanced Mobile Broadband (eMBB)

- Ultra-reliable and Low Latency Communications (uRLLC)

- Massive Machine-type Communications (mMTC)

Fixed wireless access is an alternative to traditional fixed broadband connections in the GCC 5G market and is gaining great momentum. High-speed internet on 5G networks without any huge fiber-optic infrastructure makes FWA suitable for suburban and rural areas with a lack of connectivity. Businesses and households enjoy good internet for video conferencing, streaming, and remote work; hence, it has been a big reason for GCC 5G services market demand.

The most widely rolled out 5G communication type is enhanced mobile broadband (eMBB), meeting the ever-growing demand for high-speed internet and seamless mobile connectivity in metropolitan cities. This, in turn, supports data intensive applications like 4K video streaming, immersive gaming, and augmented/virtual reality. GCC region has high smartphone penetration and increasing use of mobile apps which has resulted in a requirement for eMBB, and, therefore, telecom operators are rolling this out in populated cities.

Ultra-reliable and low latency communications (uRLLC) transform industries in the GCC by introducing applications that depend on real-time functionality and minimal lagging. Critical sectors include remote healthcare, telesurgeries, and industrial automation; uRLLC is envisioned to take central stage through Saudi Arabia's smart city initiative of NEOM and other similar projects backed by governments across sectors.

Massive machine-type communications (mMTC) supports the GCC’s growing IoT ecosystem by connecting billions of low-power devices across smart cities, agriculture, logistics, and manufacturing. This segment facilitates data collection from sensors, meters, and smart devices, ensuring efficient resource management and automation. With ongoing investments in IoT-based infrastructure, mMTC is poised to underpin long-term technological advancements in the region.

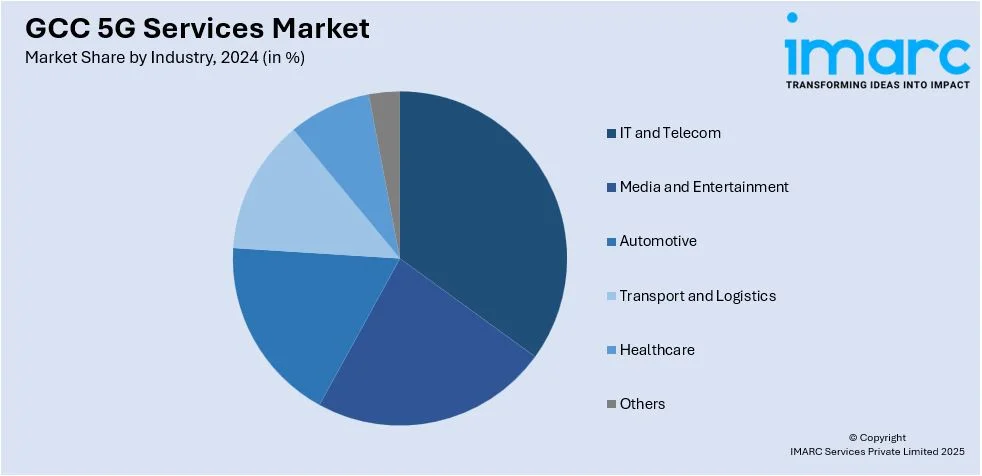

Analysis by Industry:

- IT and Telecom

- Media and Entertainment

- Automotive

- Transport and Logistics

- Healthcare

- Others

On of the largest adopters of 5G services in the GCC is the IT and telecom sector, as this sector is widely using high-speed connectivity and low latency for improving network performance and cloud computing. 5G adoption is driven by telecom operators, who are constantly upgrading their infrastructure. The IT firms also are using the technology for data centers, edge computing, and AI applications. Digital transformation and government-backed tech initiatives are driving the growth of this segment.

The media and entertainment industry in the GCC is undergoing a digital revolution with 5G, enabling ultra-high-definition video streaming, virtual reality (VR) experiences, and real-time gaming. Platforms like Shahid and Netflix see rising viewership in the region, while live events and sports rely on 5G for augmented reality (AR) overlays and enhanced audience engagement. This sector’s growth aligns with increasing consumer demand for immersive content.

The automotive industry in the GCC benefits from 5G's low latency and reliable communications, particularly for autonomous vehicles and connected car technologies. Vehicle-to-everything (V2X) communication enables safer and smarter mobility solutions, which are integral to the region’s smart city projects like Saudi Arabia’s NEOM. Automotive companies are adopting 5G for real-time diagnostics, over-the-air updates, and advanced driver-assistance systems (ADAS).

Transport and logistics in the GCC are being transformed by 5G-enabled solutions like fleet management, real-time tracking, and smart warehouses. The technology enhances supply chain visibility, allowing for better inventory management and efficient delivery operations. With the GCC's strategic location as a logistics hub, 5G adoption supports its competitiveness in global trade, especially through ports and free zones.

The healthcare sector is using 5G for telemedicine, remote diagnostics, and robotic surgeries in the GCC. Low-latency communications ensure high-quality video consultations, and connected devices allow real-time monitoring of patient health. Hospitals are adopting smart medical equipment that relies on 5G for data transmission, thus improving patient outcomes. Government initiatives to modernize healthcare infrastructure further support the integration of 5G technology in the sector.

Analysis by End User:

- Individual

- Enterprises

The individual user segment is a major driver in the GCC 5G market growth as the adoption of 5G-enabled smartphones and data-intensive applications like video streaming, online gaming, and social media increases. Enhanced mobile broadband services allow consumers to download things faster, use high-definition video calls, and experience augmented and virtual reality immersion. High smartphone penetration rates, along with populations that are technically savvy, have further accelerated growth in this segment.

Many GCC enterprises are now embracing 5G to achieve digital transformation and improve business processes. Enterprises are exploiting 5G for smart manufacturing, real-time analytics, cloud computing, and IoT integration purposes. High-value segments such as logistics, healthcare, and retail employ ultra-reliable and low-latency communications for automation and connected devices. Government-led initiatives and smart city projects are enhancing the demand for 5G connectivity among enterprises.

Country Analysis:

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

The Saudi region holds an important place in the GCC 5G market share as it receives investments on a massive scale through the Vision 2030 project along with others, such as NEOM and The Line. It is collaborating very actively with telecom operators in this process to enhance the 5G infrastructure. There is full-scale adoption of 5G-enabled solutions by various industries such as manufacturing, healthcare, and logistics, thus becoming a hot spot for innovation and advanced technology adaptation in the region.

Being highly advanced in infrastructural development with economy driven by innovations, the UAE is one of the GCC 5G market leaders, which has moved forward with huge initiatives like Smart Dubai and healthy partnerships between other telecom giants- Etisalat and Du- and leads the way concerning 5G deployment. Intensive consumer requirements for enhanced mobile broadband and higher enterprise adoption on IoT and AI applications further complement the UAE 5G's leadership position among services.

Qatar has made significant strides in 5G deployment, especially with preparations for global events like the FIFA World Cup 2022 boosting its digital infrastructure. Telecom operators such as Ooredoo and Vodafone Qatar provide extensive 5G coverage, catering to consumer and enterprise needs. The country focuses on smart city projects, advanced logistics, and healthcare modernization, driving further adoption of 5G-enabled technologies.

Bahrain is rapidly upgrading its 5G infrastructure to enhance connectivity for both consumers and businesses. Batelco and Zain Bahrain, among other telecom operators in the country, are rolling out 5G services to further enhance digital entertainment and industrial automation capabilities. Fintech and digital transformation strategy further drive enterprise adoption of 5G in Bahrain, setting it up as a rising player in the regional market.

Kuwait is embracing the 5G technology to provide support for an increasingly digital economy and promote consumer experience. Telecom operators in the country like Zain Kuwait and Ooredoo Kuwait are investing in improving 5G networks, especially in gaming and streaming, among other IoT uses. The government, through smart infrastructure and industrial innovations, is interested in the fast-growing enterprise requirement for 5G services in the market.

Oman is slowly developing its 5G market, which is focused on expanding coverage to the underserved areas and aligning with its Vision 2040 goals. Telecom operators such as Omantel and Ooredoo Oman are deploying 5G networks to enhance connectivity for individual users and enterprises. The adoption of 5G in sectors like logistics, agriculture, and oil and gas reflects the country's effort to integrate advanced technologies into its economy and diversify its revenue streams.

Competitive Landscape:

Key players in the market are leading the region to digital transformation through aggressive investment in infrastructure, innovative services, and strategic partnerships. These players are expanding the coverage of their 5G networks mainly in urban centers and enhancing network performance through spectrum acquisition and technology upgradation. These players are collaborating with global technology providers to introduce advanced 5G solutions based on consumer and enterprise needs. For the organizations, use cases in 5G, specific to the industry, such as smart manufacturing, telemedicine, and autonomous vehicles, are being built for the realization of the potential of 5G. For customers, affordable 5G data plans and devices enabled with 5G have been provided. In conjunction, operators have provided infrastructure support to various government initiatives like Saudi Arabia's Vision 2030 and Smart Dubai of the UAE through 5G connectivity to smart cities and IoT deployments. These combined efforts help them strengthen their competitive positioning and enable the shift of the GCC region towards a fully connected digital ecosystem.

The report provides a comprehensive analysis of the competitive landscape in the GCC 5G services market with detailed profiles of all major companies.

Latest News and Developments:

- In January 2025, Nokia signed a partnership with Zain KSA to bridge mobile coverage gaps and optimize connectivity for enterprise customers. This collaboration is focused on providing the first 4G/5G Femtocell solution in the Kingdom of Saudi Arabia and the MEA region. The Femtocell solution involves deploying 4G and 5G Smart Nodes, complemented by a comprehensive suite of Nokia's advanced products and services. This includes an IP Security Gateway, Femto Manager, and end-to-end delivery services.

- In November 2024, Radisys Corporation and Advanced Communications and Electronic Systems Company (ACES) inked a Memorandum of Understanding (MOU) to work together on developing cutting-edge 5G small cell and open radio access network (ORAN) technologies. For both businesses, this strategic alliance represents a major turning point in their dedication to expanding the capacity of 5G telecommunications globally, with a focus on creating open and interoperable solutions.

- In May 2024, Zain KSA invested USD 0.43 billion into infrastructure, 5G network, and digital services ecosystem in Saudi Arabia. It forms part of the integrated expansion plan aligned with the strategy of achieving digital inclusion in the country for Zain KSA. The initiative seeks to enhance digital infrastructure and elevate the customer experience by expanding the 5G network from 66 to 122 cities and governorates.

- In March 2024, Ericsson and Du, part of Emirates Integrated Telecommunication Company, have formed a strategic partnership to deliver advanced wireless network solutions in the UAE. This collaboration will enable Ericsson to provide intelligent services to enterprise and government sectors. Together, they aim to develop cutting-edge private 4G and 5G networks, enhancing connectivity and driving Industry 4.0 adoption across the country.

GCC 5G Services Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Communication Types Covered | Fixed Wireless Access (FWA), Enhanced Mobile Broadband (eMBB), Ultra-reliable and Low Latency Communications (uRLLC), Massive Machine-type Communications (mMTC) |

| Industries Covered | IT and Telecom, Media and Entertainment, Automotive, Transport and Logistics, Healthcare, Others |

| End Users Covered | Individual, Enterprises |

| Countries Covered | Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, Oman |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC 5G services market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC 5G services market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC 5G services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The GCC 5G services market was valued at USD 3.5 Billion in 2024.

The GCC 5G services market is growing due to rising demand for high-speed connectivity, smart city and IoT investments, supportive government policies, increased digital entertainment consumption, enterprise digital transformation, advancements in cloud computing and AI applications, and enhanced mobile broadband adoption among consumers and businesses.

IMARC Group estimates the market to reach USD 31.8 Billion by 2033, exhibiting a CAGR of 27.6% from 2025-2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)