Gaskets and Seals Market Size, Share, Trends and Forecast by Product, Material, Application, End-Use, and Region, 2026-2034

Gaskets and Seals Market 2025 Size and Share:

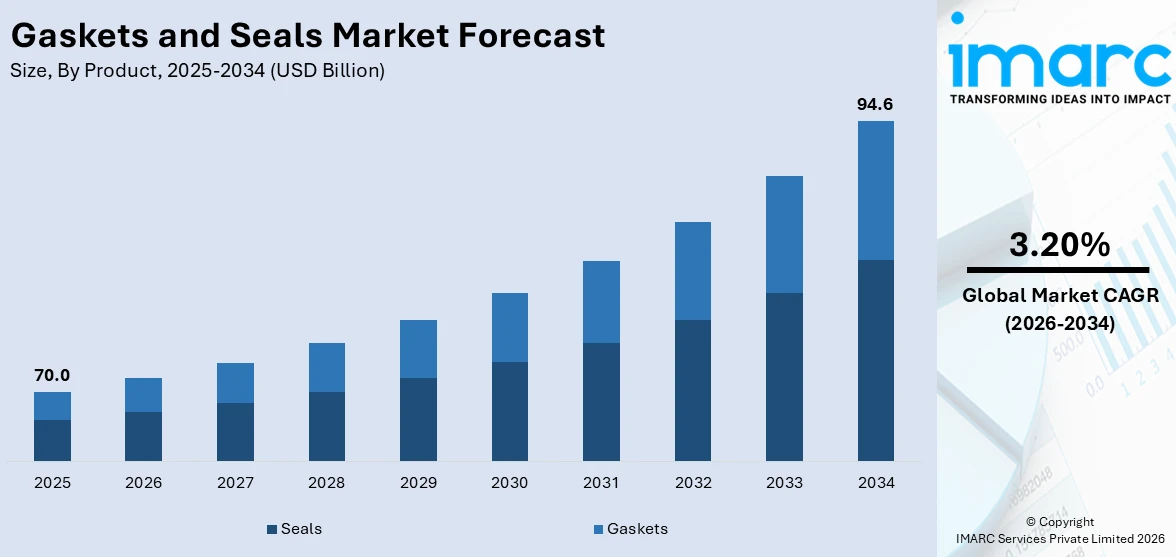

The global gaskets and seals market size was valued at USD 70.0 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 94.6 Billion by 2034, exhibiting a CAGR of 3.20% during 2026-2034. Asia Pacific currently dominates the market. The market is experiencing steady growth driven by the increasing demand from key industries, such as automotive, aerospace, and oil and gas, stringent regulatory standards across various sectors, and continuous technological advancements in material science.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 70.0 Billion |

|

Market Forecast in 2034

|

USD 94.6 Billion |

| Market Growth Rate (2026-2034) | 3.20% |

The global gaskets and seals market is driven by the growing demand for advanced sealing solutions in the automotive and industrial sectors. Increasing industrialization and the expansion of manufacturing activities worldwide are increasing the need for reliable sealing components to enhance equipment efficiency and reduce maintenance costs. Additionally, the rising adoption of gaskets and seals in renewable energy applications, such as wind turbines and solar panels, supports the market growth. Besides this, stricter environmental regulations emphasizing leak prevention and energy conservation further contribute to the demand. Advancements in material technologies, such as high-performance elastomers and thermoplastics, are enabling the development of durable and cost-effective products, meeting industry-specific requirements and fueling market expansion.

To get more information on this market Request Sample

The United States stands out as a key regional market, primarily driven by the increasing focus on infrastructure development and modernization across various sectors, including oil and gas, aerospace, and construction. Along with this, the growing emphasis on energy efficiency and sustainability is encouraging the adoption of advanced sealing solutions to minimize energy losses and prevent environmental contamination. Technological advancements in manufacturing, including 3D printing and precision engineering, are enabling the production of gaskets and seals designed to meet the unique requirements of specific applications. On 12th July 2024, California-based metal 3D printing technology company Mantle secured $20 Million in Series C funding, bringing the company's total funding to date to $61.5 Million. Schooner Capital, a Boston-based firm, led the round with additional support from major investors such as Fine Structure Ventures and Foundation Capital. The funds will further expand market reach, enhance manufacturing capacity, and drive innovation in materials. The rise of reshoring in U.S. manufacturing proves that such progress has relevance in addressing labor shortages as well as achieving efficiencies. Moreover, the robust growth of the automotive sector, fueled by rising consumer demand and electric vehicle production, is significantly supporting the market. Furthermore, government regulations mandating strict compliance with safety and quality standards are further propelling the demand for reliable sealing products.

Gaskets and Seals Market Trends:

Increasing demand for electric vehicles

According to a 2018 article, the United States is not alone in its efforts to promote green transportation. The UK registered over 166,000 electric vehicles, with an expected 49 Million in circulation by 2050. The EV sector is seeing exponential expansion across the globe, with China registering over 1.2 Million EVs and the United States recording 750,000, according to IEA. Gaskets and seals are widely employed in electric vehicle battery systems. The battery packs are enclosed within the panels, forming the upper and lower housing, with gaskets and seals separating the portions. It also keeps dust and liquids out of the housing space. This, in turn, is contributing to the gaskets and seals market growth.

Rising product demand in the aerospace sector

The number of commercial flights decreased significantly during the pandemic but increased after the outbreak. According to the World Economic Forum, the number of commercial flights in the EU increased by 25% between August 2021 and August 2022. This increasing percentage represents growth but remains lower than the pre-pandemic level. However, this gap is closing quickly. Seals and gaskets are used in the aerospace and aviation industries to seal gaps between mating surfaces on aircraft. It also provides environmental sealing, flame or fire barrier, oil and fuel resistance, among other properties. This is resulting in a higher uptake of the product in the construction of aircrafts, which is propelling the gaskets and seals demand over the forecast period.

Rising product applications in the oil and gas industry

The oil and gas industry operates in a difficult environment with high operating efficiency, necessitating maximum equipment uptime. The industry prioritizes controlling the leakage of potentially dangerous petrochemical products in valves. Rising oil and gas exploration activities, as well as an expanding chemical processing sector, are likely to drive the demand for pipeline and heat exchanger gaskets. The global oil and gas market size reached USD 20.3 Billion in 2024. Gaskets and seals are essential in various equipment in the sector to ensure proper functioning since they help prevent leakage of any type of liquid or gas processing, thereby contributing to the growing gaskets and seals market revenue.

Gaskets and Seals Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global gaskets and seals market, along with forecast at the global and regional levels from 2026-2034. The market has been categorized based on product, material, application, and end-use.

Analysis by Product:

- Gaskets

- Metallic Gasket

- Rubber Gasket

- Cork Gasket

- Non-Asbestos Gasket

- Spiral Wound Gasket

- Others

- Seals

- Shaft Seals

- Molded Seals

- Motor Vehicle Body Seals

- Others

Seals stand as the largest component in 2025. This dominance is attributed to its applications, such as industrial plant equipment, automobiles, consumer devices, and rockets. These seals help prevent the leakage of fluid used in the machine. The increasing use of electronics and automobiles further accelerates the adoption of seals. Seals are extensively utilized as they possess excellent heat resistance, chemical resistance, and low seating stress, and high compressive load endurance. They have broad applications in diverse sectors such as electronics, aerospace, and manufacturing. This, in turn, is creating a favorable gaskets and seals market outlook.

Analysis by Material:

- Fiber

- Graphite

- PTFE

- Rubber

- Silicones

- Others

Rubber leads the market in 2025 due to the material's versatility, resilience, and low cost. The use of rubber products finds application in everyday household and even complicated gear in both the automotive and aerospace sectors. Additionally, the possibility of offering tight sealing in a variety of situations plus the durability of the material make it preferable for a variety of applications. The ongoing developments of synthetic rubber versions for meeting specific industrial requirements strengthens rubber's position as the market leader, as per the gaskets and seals market overview.

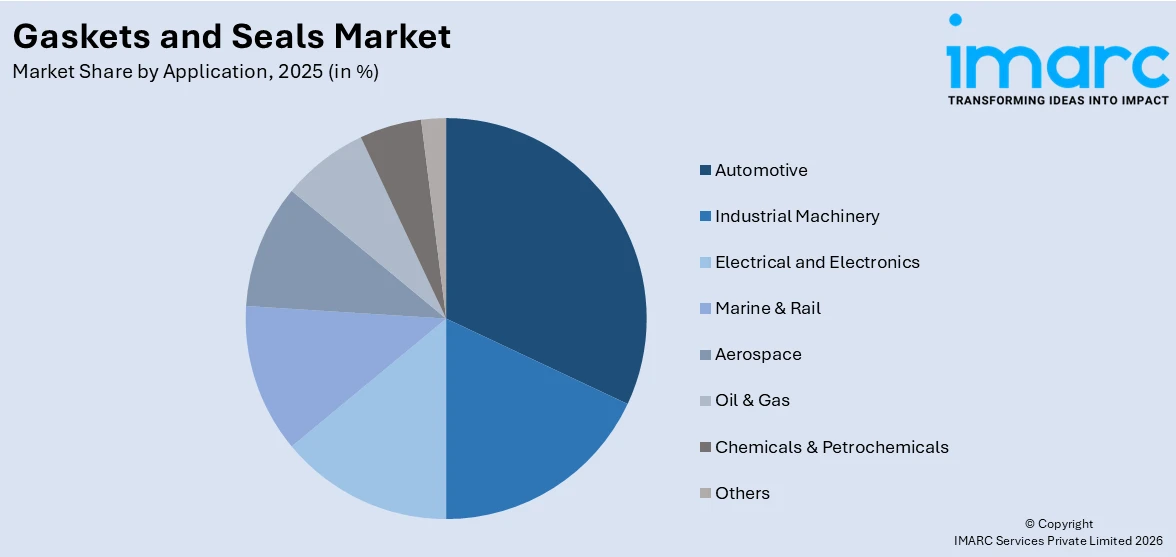

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Automotive

- Industrial Machinery

- Electrical and Electronics

- Marine & Rail

- Aerospace

- Oil & Gas

- Chemicals & Petrochemicals

- Others

Automotive leads the market in 2025 and offers numerous gaskets and seals market recent opportunities. Automotive gaskets and seals are extensively used in engine-related applications, including powertrain, chassis, exhaust manifolds, and various other components. They are also employed in interior automotive applications, such as sealing instrument panels, sunroofs, headliners, interior door panels, visor mirror glass, and fuse boxes. Thus, the widespread use of seals in interiors, combined with consumers' growing affinity for electronics in automobiles, is expected to fuel the product uptake. In automobiles, they are used in numerous applications, including engines, transmissions, and fluid conveyance systems.

Analysis by End-Use:

- OEM

- Aftermarket

OEM leads the market in 2025 as they require a wide range of gaskets and seals in various thicknesses to meet different product criteria. The augmenting need for a wide range of products in different thicknesses and material compositions is driven by the necessity to meet stringent product criteria, ensuring optimal performance and reliability. This demand is particularly pronounced in industries such as automotive, aerospace, and heavy machinery, where gaskets and seals must provide superior fluid or water resistance, endure physical shocks, withstand weather vibrations, and tolerate intense temperature fluctuations to protect industrial-duty applications.

Regional Analysis:

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

In 2025, Asia Pacific accounted for the largest market share. A substantial portion of the gaskets and seals market growth can be attributed to the expansion in the automotive sector across the Asia Pacific region. According to OICA, automobile output in China and India is expected to expand by 3% and 24% respectively in 2022 when compared to the same time in 2021. China is a chemical processing powerhouse, producing a large portion of the world's chemicals. With the growing global need for various chemicals, the demand for the product in this sector is anticipated to grow during the forecast period. China intends to extend its network of inter-country pipelines, including additional connections to Central Asia and Russia. The China National Petroleum Corporation (CNPC), for instance, intends to finish substantial sections of Russia's huge oil and gas pipelines in Heilongjiang, the country's northeast. Furthermore, the rising industrial, electrical, and electronics sectors in developing economies, such as China, India, and ASEAN countries, are likely to increase the regional demand for gaskets and seals.

Key Regional Takeaways:

United States Gaskets and Seals Market Analysis

The gaskets and seals market in the United States is driven by increasing demand across various industries, including automotive, aerospace, oil & gas, and manufacturing. Manufacturing alone contributed USD 2.3 Trillion to the U.S. GDP in 2023, accounting for 10.2% of the total GDP, as per Bureau of Economic Analysis (BEA) data. This highlights the critical role of manufacturing in the U.S. economy, creating a strong foundation for the demand for sealing solutions. The automotive sector requires advanced seals to meet growing fuel efficiency standards and environmental regulations, especially with the rise of electric vehicles (EVs). The energy sector, particularly oil and gas, also relies heavily on high-performance gaskets and seals to ensure safety and system integrity. Furthermore, innovative machinery and equipment in the manufacturing sector are increasing demand for sealing products that would be reliable. Government legislation directed at minimizing leakage and raising safety levels further propels growth in the market. Innovations and expansion in the industry further enhance the demand for better sealing solutions, making gaskets and seals a prime U.S. market.

Asia Pacific Gaskets and Seals Market Analysis

The Asia Pacific (APAC) region is witnessing rapid growth in the gaskets and seals market, driven by strong industrialization and significant investments in infrastructure. Countries such as China, India, and Japan are leading demand in sectors such as automotive, construction, and manufacturing. In the automotive industry, the rise in electric vehicles (EVs) is a major driver. According to a Business Standard article, China leads with an EV penetration of 27.1%, while South Korea has achieved 10.3%, despite a slower start. Meanwhile, countries such as Indonesia, Vietnam, Malaysia, the Philippines, and Thailand have EV penetration rates ranging from just 0.1% to 2.5%. This growing demand for EVs, especially in China and South Korea, is influencing the need for high-performance sealing solutions. The growing region of oil and gas, energy, and aerospace fields further enhances the demand for strong gaskets and seals in the region. Industrial automation and innovative methods of manufacture are further responsible for growth in the APAC market to make the region a strong position in the global gaskets and seals market.

Europe Gaskets and Seals Market Analysis

In Europe, the gaskets and seals market is driven by stringent regulatory standards and increasing requirement for high-performance sealing solutions across numerous end-use industries. The automotive sector plays a pivotal role, particularly with the rising demand for electric vehicles (EVs). According to the International Energy Agency (IEA), new electric car registrations in Europe reached nearly 3.2 Million in 2023, reflecting an increase of almost 20% compared to 2022. In the European Union, sales amounted to 2.4 Million, with similar growth rates, highlighting the shift towards EVs and the need for advanced sealing solutions that offer greater durability and performance. The aerospace sector is marked by high-quality standards; hence, remains one of the major marketplaces for specialized seals designed to tolerate extreme conditions. Furthermore, the oil and gas industries drive demand for reliable sealing products used offshore for the exploration and production process. The growing focus on sustainability and eco-friendly materials has increased innovation in the market. Seals made of recyclable and biodegradable materials are developed to respond to the demand. Furthermore, the pressures from regulations, advancements in technology, and expansion in the industry make Europe an important market for gaskets and seals, mainly automotive and energy sectors.

Latin America Gaskets and Seals Market Analysis

The gaskets and seals market in Latin America is driven by growth in the automotive, industrial manufacturing, and energy sectors. According to the National Association of Sustainable Mobility of Colombia (Andemos), 118,191 hybrid and electric vehicles were registered in 2021, more than double the 57,078 units registered in 2020. This rise in EV registrations reflects a growing demand for high-performance sealing solutions in the automotive sector. Additionally, the region’s expanding infrastructure and energy industries, particularly in oil and gas, continue to drive the need for reliable gaskets and seals, supporting overall market growth in Latin America.

Middle East and Africa Gaskets and Seals Market Analysis

The gaskets and seals market in the Middle East and Africa is primarily driven by the growth in the oil and gas sector, particularly in countries such as Saudi Arabia. According to the U.S. Energy Information Administration (EIA), Saudi Arabia accounted for nearly 40% of the Middle East's oil consumption in 2023 and was the world’s fifth-highest consumer of liquid fuels, following the United States, China, India, and Russia. Total liquid fuels consumption in Saudi Arabia rose 2% year over year, from 3.6 Million b/d in 2022 to 3.7 Million b/d in 2023. This growing demand for energy fuels the need for reliable gaskets and seals in the region's oil and gas infrastructure.

Competitive Landscape:

The global market for gaskets and seals is highly competitive, where some key players are emphasizing innovation along with strategic expansion to improve their market positions. Most companies are investing hugely in the research and development processes to formulate high-performance, long-lasting, and application-specific products that can address new demands in the industry. Geographical reach and product portfolio expansion are common practices that include partnerships, mergers, and acquisitions. Manufacturers also pay attention to sustainability by formulating eco-friendly and energy-efficient sealing solutions in response to environmental regulations. Advanced manufacturing technologies such as automation and 3D printing are being accepted for streamlined production and saving costs to stay competitive in business. After-sales services and their focus have also created significant importance among companies to build customer loyalty and differentiate offerings.

The report provides a comprehensive analysis of the competitive landscape in the gaskets and seals market with detailed profiles of all major companies, including:

- BRUSS Sealing Systems GmbH

- Dana Limited

- Freudenberg & Co. KG

- Garlock Sealing Technologies (Enpro Company)

- Hennig Gasket & Seals, Inc.

- AB SKF

- Parker-Hannifin Corporation

- Saint-Gobain S.A.

- John Crane (Smiths Group plc)

- Hi-Tech Seals Inc.

- Trelleborg AB

Latest News and Developments:

- February 2024: John Crane (Smiths Group plc), a prominent player in rotating equipment solutions and energy transition technologies Part of Smiths Group plc, it has obtained contracts to provide dry gas seals for three supercritical CO2 compressors of a large-scale blue hydrogen project in Texas and wet seals for a battery manufacturing facility in Tennessee, USA, thereby establishing its position as an energy transition technology provider.

- December 2023: Freudenberg & Co. KG announced the production of one million units of its new foldable gasket for battery electric vehicles at its Langres, France facility. This achievement marks a pivotal moment for the company, as its innovative gasket design plays a crucial role in enhancing the reliability and durability of battery systems, essential for the sustainable mobility landscape of the future.

- September 2023: Dana Limited unveiled a new line of Victor Reinz Victor-Lock reusable differential gaskets tailored for severe-duty applications. According to the company, these high-end gaskets incorporate a durable FoamFlex facing material fused to a steel core, complemented by strategic silicone beading. This design aims to bolster sealing effectiveness under stress, optimizing load distribution in crucial zones for a superior, leak-resistant seal.

- February 2023: Safcon Seals Pvt Ltd, a Kolkata-based manufacturer with over 25 years of expertise in tamper-resistant security seals, has launched the RevGuard Meter Seal. Designed for the smart metering era, it features a robust locking mechanism, encrypted coding to prevent counterfeiting, and enhanced seal number visibility, ensuring higher protection against tampering and power theft.

Gaskets and Seals Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Materials Covered | Fiber, Graphite, PTFE, Rubber, Silicones, Others |

| Applications Covered | Automotive, Industrial Machinery, Electrical and Electronics, Marine & Rail, Aerospace, Oil & Gas, Chemicals & Petrochemicals, Others |

| End-Uses Covered | OEM, Aftermarket |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | BRUSS Sealing Systems GmbH, Dana Limited, Freudenberg & Co. KG, Garlock Sealing Technologies (Enpro Company), Hennig Gasket & Seals, Inc., AB SKF, Parker-Hannifin Corporation, Saint-Gobain S.A., John Crane (Smiths Group plc), Hi-Tech Seals Inc., Trelleborg AB, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the gaskets and seals market from 2020-2034.

- The gaskets and seals market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the gaskets and seals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Gaskets and seals are components designed to prevent leakage of fluids or gases by filling the space between two mating surfaces in various applications. They are widely used across industries such as automotive, aerospace, oil and gas, and manufacturing for enhanced safety and operational efficiency.

The gaskets and seals market was valued at USD 70.0 Billion in 2025.

IMARC estimates the global gaskets and seals market to exhibit a CAGR of 3.20% during 2026-2034.

The global gaskets and seals market is driven by the rising demand for advanced sealing solutions in the automotive and industrial sectors, stringent regulatory standards emphasizing leak prevention, and technological advancements in material science for durable and efficient products.

Seals represented the largest segment by product, driven by their broad applications in industrial machinery, electronics, and automotive sectors.

Rubber leads the market by material due to its versatility, durability, and ability to offer tight sealing under various conditions.

The automotive sector is the leading segment by application, driven by the extensive use of gaskets and seals in engines, transmissions, and fluid conveyance systems.

OEM represented the largest segment by end-use, driven by the need for custom products in varying thicknesses and material compositions to meet stringent product criteria.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa, wherein Asia Pacific currently dominates the market.

Some of the major players in the global gaskets and seals market include BRUSS Sealing Systems GmbH, Dana Limited, Freudenberg & Co. KG, Garlock Sealing Technologies (Enpro Company), Hennig Gasket & Seals, Inc., AB SKF, Parker-Hannifin Corporation, Saint-Gobain S.A., John Crane (Smiths Group plc), Hi-Tech Seals Inc., and Trelleborg AB, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)