Gas Meter Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Gas Meter Market Size and Share:

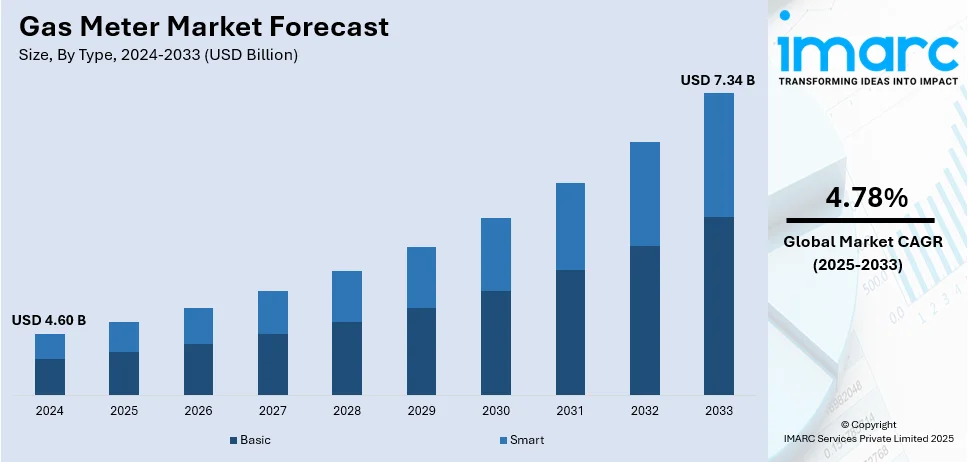

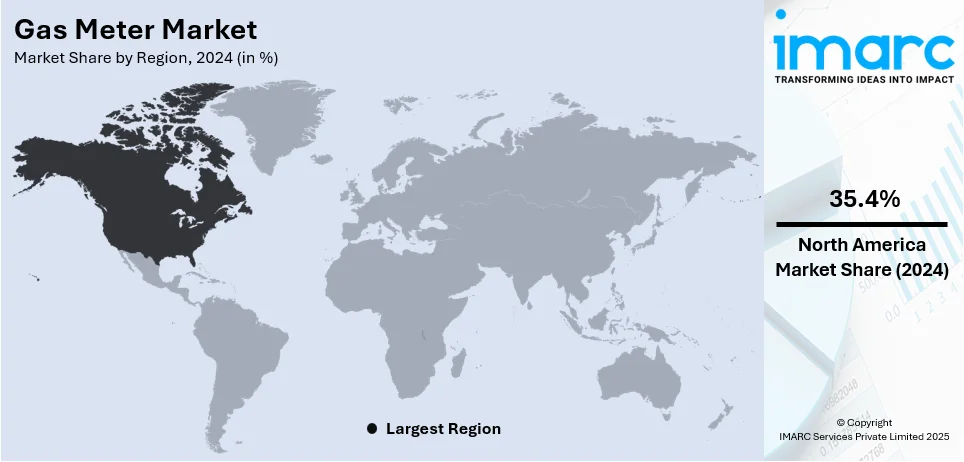

The global gas meter market size was valued at USD 4.60 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 7.34 Billion by 2033, exhibiting a CAGR of 4.78% from 2025-2033. North America currently dominates the market, holding a market share of over 35.4% in 2024. The gas meter market share is expanding, driven by the rising adoption of government regulations, which assist in minimizing waste and emissions, along with the increasing industrial activities that require reliable and modern metering solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.60 Billion |

| Market Forecast in 2033 | USD 7.34 Billion |

| Market Growth Rate (2025-2033) | 4.78% |

At present, the growing energy demand is impelling the market growth. As cities expand and more homes and businesses depend on natural gas, the need for accurate and efficient gas meters keeps increasing. Government agencies and utility companies encourage the usage of gas meters that provide real-time tracking, remote monitoring, and automated billing, making gas usage more efficient. Additionally, advanced gas meters are employed since they help to detect leaks and prevent accidents, which is a huge priority for both users and regulators. Apart from this, technological advancements like the Internet of Things (IoT) integration and data analytics, have made gas meters more user-friendly and reliable.

The United States has emerged as a major region in the gas meter market owing to many factors. The rising energy needs are offering a favorable gas meter market outlook. With numerous homes and businesses relying on natural gas for heating, cooking, and industrial use, the demand for accurate and effective gas meters is high. These meters improve efficiency, prevent gas wastage, and enhance safety by detecting leaks early. Additionally, the shift toward sustainability and better energy management enables companies to innovate and mount modern gas metering solutions. In August 2024, Iberdrola, a multinational electric utility company, installed more than 700,000 smart meters for electricity and gas users in the state of New York. The company, which operates in the country through its subsidiary Avangrid, aims to improve its customers' readings, which will be based on actual usage rather than estimates.

Gas Meter Market Trends:

Rising concerns about safety

The rising safety concerns are fueling the market growth. As well-being becomes a critical worry in residential and industrial settings, the demand for gas meters with advanced safety features is high. Gas leaks and incidents present major dangers, such as fires, explosions, and health risks. For instance, in 2023, the rate of 8.7 deaths per 1,000 reported home fires was 16% more than the 7.5 rate in 2022 and 22% higher than the 7.1 rate in 1980. Thus, people and industries prioritize safety measures. Gas meters equipped with safety features like leak detection sensors and automatic shut-off systems offer essential protection against possible gas leaks. These attributes improve safety and provide reassurance to both users and businesses. Additionally, regulatory agencies are enforcing strict safety protocols and criteria for gas infrastructure, requiring the use of certified and secure gas meters.

Increasing implementation of government policies and regulations

The increasing government regulations and policies are impelling the gas meter market growth. As per the information provided on the official website of the US Department of Energy, in 2024, DOE’s Grid Deployment Office (GDO) wagered more than USD 5.4 Billion on grid improvement grants and competitive awards to strengthen and expand the US’s grid, including all 50 states, 264 tribes, 5 territories, and the District of Columbia. This acknowledgment has resulted in the establishment of different policies and rules that directly affect the market. A major factor is the mandates for energy efficiency. Government agencies are setting ambitious energy optimization targets to minimize waste and emissions. Gas meters hold importance since they provide real-time data that enables users and utilities to monitor gas usage. Additionally, strict standards are applied to gas distribution setups, highlighting the requirement for reliable and verified gas meters. Conformity with these protocols requires the replacement of obsolete meters with modern and compliant models. Incentive programs offered by government agencies also encourage the adoption of gas meters. These plans create financial appeal for utilities and individuals to invest in advanced metering infrastructure.

Growing natural gas usage in the industrial sector

The extensive use of natural gas in the industrial sector is driving market expansion. Businesses rely on natural gas as an energy source for a range of activities, such as production, heating, and electricity generation. The International Energy Association forecasts that in 2024, global gas demand will rise by 2.5%, amounting to 100 Billion Cubic Meters (BCM). With the growth of industrial activities, the demand for precise and effective gas metering solutions also increases. Accurate measurement of natural gas consumption is crucial for managing costs and adhering to environmental regulations. Gas meters play a crucial role in allowing industrial facilities to track and enhance their gas usage, guaranteeing that resources are used effectively and waste is reduced. Moreover, the industrial sector's dedication to sustainability and lowering carbon emissions has heightened scrutiny over energy consumption. Modern gas meters, especially smart meters, allow industries to gather real-time information, detect inefficiencies, and adopt energy-saving strategies, supporting sustainability objectives.

Gas Meter Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global gas meter market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on type and application.

Analysis by Type:

- Basic

- Smart

Basic stands as the largest component in 2024, holding 62.5% of the market. Standard gas meters are commonly noted for their dependability, ease of use, and cost-effectiveness, which makes them a favored option for many clients and uses. They serve individuals who value affordability and simple functionality. These meters are perfect for home owners and small enterprises seeking an affordable metering option without the intricacies of advanced functionalities. In addition, they are selected for their simple installation and upkeep. This aids in lowering installation expenses and makes them available to a wider range of customers. Furthermore, the fundamental segment stays pertinent because of its suitability with current gas distribution systems. Different utilities choose basic meters as they facilitate a smooth shift from previous metering technologies. Additionally, fundamental meters serve as the basis for early setups in areas with growing gas distribution systems, thus facilitating market expansion as infrastructure progresses.

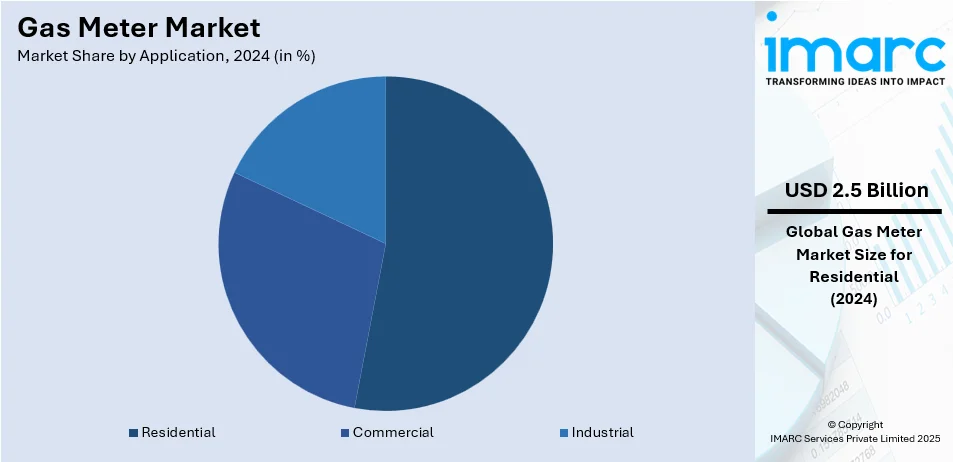

Analysis by Application:

- Residential

- Commercial

- Industrial

Residential leads the market with 53.5% of the market share. Residential gas meters cater to the energy needs of households and play an important role in ensuring efficient gas usage and billing accuracy. Various of households depend on natural gas for heating, cooking, and water heating. As cities expand and more homes are built, the demand for gas meters grows. Homeowners and landlords require reliable and accurate meters to track gas utilization and manage bills effectively. Smart gas meters have also become popular in homes, allowing real-time monitoring and automatic readings, which eliminate the need for manual meter checks. These advanced meters help to detect leaks and check gas wastage, making them a preferred choice for both users and utility companies. Governments and energy providers promote the adoption of modern gas meters to improve effectiveness and safety in residential areas. Regulations and sustainability goals also enable upgrades from traditional meters to smart ones.

Regional Analysis:

- North America

- Europe

- Asia-Pacific

- Middle East and Africa

- Latin America

North America, accounting for 35.4%, enjoys the leading position in the market. The region is noted for its well-established energy infrastructure, high gas usage, and focus on smart technology. This area has a well-developed natural gas distribution network, with millions of households and industries depending on gas for heating, cooking, and power. Another big factor is the shift towards the employment of smart gas meters. Utility companies in the US and Canada invest heavily in advanced metering systems that improve accuracy, prevent leaks, and enable remote monitoring. People also prefer smart meters for better control over their gas usage and billing. Moreover, government agencies in the US also wager on clean energy projects that promote the utilization of gas meters. According to the International Energy Agency (IEA), In the United States, funding for clean energy was projected to rise to over USD 300 billion in 2024. Strict regulations on energy efficiency and safety further enable upgrades to modern gas meters.

Key Regional Takeaways:

United States Gas Meter Market Analysis

In the United States, the demand for advanced gas meters is significantly driven by the need to upgrade aging infrastructure. For instance, between 2021 and 2023, the 117th Congress wagered more than USD 120 Billion in the US infrastructure. Many areas depend on outdated systems that cannot effectively manage current energy usage patterns. As infrastructure projects aim to modernize gas distribution networks, the introduction of smart meters enables more accurate measurements, enhances operational efficiency, and minimizes service disruptions. Additionally, these advanced systems help utilities to better manage supply and demand, improving grid stability. Upgrading to new gas meters not only addresses the issues with the current infrastructure but also supports sustainable energy goals, as these systems are capable of providing detailed utilization data, allowing smarter resource management. As cities invest in revamping their gas networks, there is an increased encouragement for the adoption of these meters, making them crucial for advancing energy systems.

Europe Gas Meter Market Analysis

In Europe, the adoption of advanced gas meters is being accelerated by the increasing focus on reducing energy waste and carbon emissions. For instance, emissions have steadily declined from 1990 to 2023. It was projected that in 2023, EU emissions decreased by 37% compared to 1990. With growing regulatory pressure and user requirements for greener solutions, energy-efficient technologies are in high demand. These meters are important for providing real-time data that helps both residential and commercial customers to monitor their usage patterns and eliminate waste. By offering precise measurements, they enable better decision-making in both industrial and residential settings, leading to reduced energy utilization. As this region sets ambitious climate goals, advanced gas meters are integral in ensuring that energy employment aligns with carbon minimization targets, making them a central part of the green transition.

Asia Pacific Gas Meter Market Analysis

In the Asia-Pacific region, the adoption of advanced gas meters is largely enabled by the expansion of industrial manufacturing activities. For instance, India's year-over-year growth rate for the industrial production index is updated monthly, with data spanning from April 2006 to October 2024 and an average rate of 4.4%. As industrial infrastructure in these regions develops rapidly, there is a high need for effective energy management. Gas meters that provide precise data are essential for optimizing energy utilization, reducing operational costs, and ensuring energy efficiency. This requirement is enhanced by increasing investments in large-scale manufacturing and infrastructure projects where gas consumption plays a critical role. As companies seek to optimize their processes and improve environmental sustainability, modern gas meters are being recognized as an important tool in managing energy usage and contributing to operational upgrades.

Latin America Gas Meter Market Analysis

In Latin America, rapid urbanization activities create the need for gas meters in residential areas. As urban populations expand, there is a heightened demand for efficient utility management, and gas meters play a vital role in ensuring accurate billing and optimized energy use. According to reports, by 2050, 89% of the population in Latin America and the Caribbean will reside in urban areas. The shift towards more densely populated urban environments increases the complexity of utility distribution networks, making advanced metering systems essential. These meters provide more reliable and accurate data, allowing residents and utilities alike to monitor utilization patterns, control costs, and reduce waste. As more people move to cities, the integration of these advanced systems in residential homes is becoming crucial for catering to the high energy requirements.

Middle East and Africa Gas Meter Market Analysis

In the Middle East and Africa region, there has been a notable increase in investments in commercial sectors, which is encouraging the adoption of advanced gas meters. For instance, in 2023, foreign investors held 45% of the total commercial property transactions in Dubai. As businesses expand, especially in sectors, such as hospitality, manufacturing, and commercial real estate, the demand for efficient gas usage becomes more prominent. Smart meters provide precise monitoring, helping businesses to optimize energy utilization and reduce costs while also aligning with sustainability goals. This area's focus on modernizing infrastructure and promoting economic diversification has resulted in a surge in the installation of these meters, supporting the market growth in both urban and industrial areas. The high reliance on commercial energy in these regions necessitates the employment of more advanced and modern systems to manage resources effectively.

Competitive Landscape:

Key players in the market work on creating innovative, effective, and smart technology oriented products to meet the high gas meter market demand. They develop advanced meters with features, such as remote monitoring, real-time data tracking, and automated billing, making gas usage more transparent for users and utility companies. Big companies wager on smart gas meters that improve safety by detecting leaks and preventing gas wastage. They also work closely with government agencies and energy providers to upgrade outdated systems and support sustainable energy management. Expanding into new markets, improving accuracy, and integrating IoT technology help them to stay ahead of the competition. Additionally, they spend resources on customer-friendly designs and easy installations to encourage widespread adoption. By continuously enhancing technology and reliability, these key players promote the employment of gas meters. For instance, in February 2024, IGL Genesis Technologies purchased smart meter production technology from the Chinese company Hangzhou Beta Meter for about USD 2.4 Million. This acquisition aims to improve India's gas meter production abilities, aiding the creation of advanced metering technologies. The joint venture, consisting of Indraprastha Gas Limited (IGL) and Genesis Gas Solutions Pvt Ltd, plans to set up a manufacturing plant in India. The agreement intends to enhance the nation's energy framework through intelligent gas meters.

The report provides a comprehensive analysis of the competitive landscape in the gas meter market with detailed profiles of all major companies, including:

- Honeywell International Inc.

- Itron Inc.

- Apator SA

- Diehl Stiftung & Co. KG

- Sensus Worldwide Holdings Limited

Latest News and Developments:

- December 2024: IntelliSmart Infrastructure aims to venture into the gas distribution metering sector, seeking to win tenders for 50,000 smart gas meters in this fiscal year. The firm also finalized a pilot project in Assam, seeking to lower expenses and minimize human involvement. Smart meters will help utilities enhance efficiency and permit users to control gas usage more efficiently.

- November 2024: Iskrameco invested around USD 120 Million to create Bengal's inaugural integrated hardware and software center for smart metering solutions in New Town's Silicon Valley. Occupying 5 acres, the 11-story building is set to manufacture smart meters for electricity, gas, and water. This signifies Bengal's initial significant hardware investment, with anticipated completion in three years.

- August 2024: Kaynes Technologies India Ltd. opened a new manufacturing plant in Hyderabad for smart meters, anticipated to produce around USD 48 Million in revenue this fiscal year. The facility can manufacture 4 million units each year and has the potential to diversify into automotive and aerospace markets. The Indian government's initiative for smart meters, which includes gas meters, indicates a considerable growth opportunity in the market, with a requirement for 250 million meters.

- August 2024: GAIL is set to open a state-of-the-art Natural Gas Meter Prover Facility in Dibiyapur, Uttar Pradesh. The facility promises to offer calibration services for gas meters utilized by minor gas users, such as city gas distribution (CGD) companies and small industrial enterprises. Aiming to enhance gas management and increase consumer trust, it emphasizes precise gas evaluation. Created in partnership with RMA Germany, the facility is capable of calibrating different gas meters, guaranteeing accurate measurements.

Gas Meter Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Basic, Smart |

| Applications Covered | Residential, Commercial, Industrial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Honeywell International Inc., Itron Inc., Apator SA, Diehl Stiftung & Co. KG, Sensus Worldwide Holdings Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the gas meter market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global gas meter market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the gas meter industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The gas meter market was valued at USD 4.60 Billion in 2024.

The gas meter market is projected to exhibit a CAGR of 4.78% during 2025-2033, reaching a value of USD 7.34 Billion by 2033.

The expanding cities and new residential and commercial developments are driving the demand for modern gas metering systems. Besides this, technological advancements like IoT integration, data analytics, and remote-controlled meters are enhancing accuracy and user control, making gas usage more efficient. The rising adoption of sustainability, with companies focusing on reducing gas wastage and carbon footprints, is encouraging the utilization of gas meters.

North America currently dominates the gas meter market, accounting for a share of 35.4% in 2024, driven by its strong energy infrastructure, high gas utilization rates, and rapid adoption of smart meters. Government regulations, safety concerns, and a focus on energy efficiency drive the demand for advanced metering solutions across homes and industries.

Some of the major players in the gas meter market include Honeywell International Inc., Itron Inc., Apator SA, Diehl Stiftung & Co. KG, Sensus Worldwide Holdings Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)