Gas Dryer Market by Product Type (With Steam Function, Without Steam Function), Capacity (Less Than 7 Cu.ft., 7 – 8 Cu.ft., More Than 8 Cu.ft.), Price Range (Less Than US$ 300, US$ 300 – US$ 500, US$ 500 – US$ 700, US$ 700 – US$ 900, More Than US$ 900), Distribution Channel (Online, Offline), End Use (Residential, Commercial), and Region 2026-2034

Market Overview:

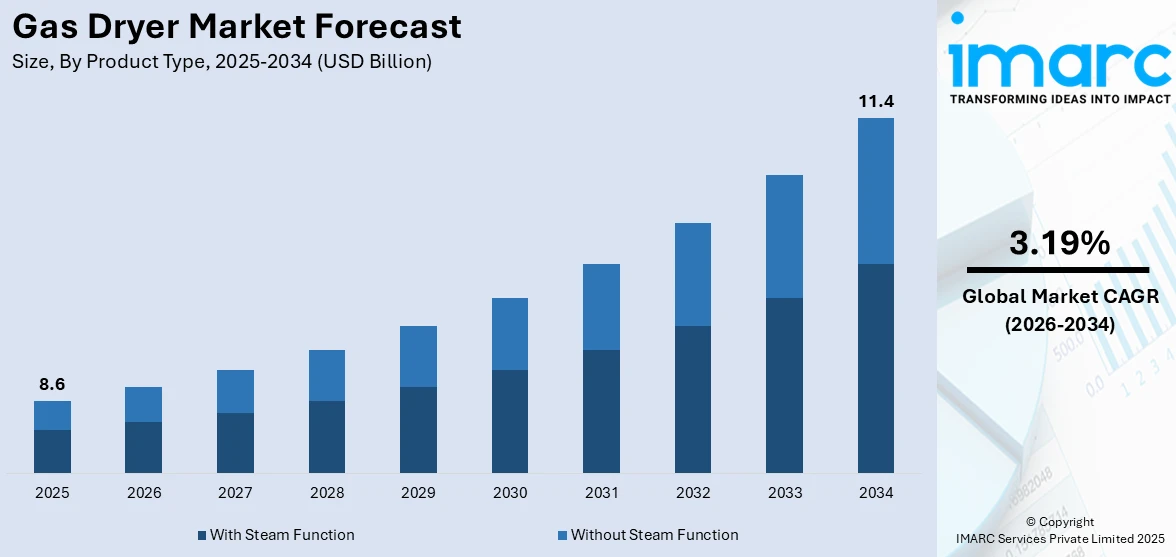

The global gas dryer market size reached USD 8.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 11.4 Billion by 2034, exhibiting a growth rate (CAGR) of 3.19% during 2026-2034. The increasing product use in residential areas, the launch of advanced product variants, and the rising awareness about energy labels represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 8.6 Billion |

|

Market Forecast in 2034

|

USD 11.4 Billion |

| Market Growth Rate (2026-2034) | 3.19% |

A gas dryer is a home appliance that assists in drying wet laundry using natural gas and propane. It comprises a gas jet, sensor, igniter, and control valve with solenoids. It is also equipped with a burner assembly and aids in automatically setting the optimum heating intensity according to the fabric type for drying purposes. It is highly efficient, environment friendly, and costs effective for running per load as compared to electric dryers. At present, product manufacturers are launching smart gas dryers that can be connected to smartphones via applications and are integrated with the internet of things (IoT) and artificial intelligence (AI) solutions for sending real-time alerts and providing remote access to the user.

To get more information on this market Request Sample

Gas Dryer Market Trends:

Rapid urbanization, growing global population, improving living standards, and inflating income levels are among the major factors driving the demand for gas dryers at homes across the globe. Moreover, the increasing adoption of gas dryers on account of their numerous advantages is currently favoring the market growth. In addition, leading players operating worldwide are financing research and development (R&D) activities to incorporate advanced technologies in gas dryers and introduce product variants that are highly efficient and helps in saving water and electricity. These players are also integrating features like steam refresh, sanitize cycle, and moisture sensors that prevent over drying and end the process correctly. Leading players are focusing on investing in various marketing strategies, including celebrity endorsements and social media campaigns, to increase their overall sales. Apart from this, the rising consumer inclination towards on-demand laundry and dry-cleaning services that provide doorstep pick-up and delivery facilities for enhanced convenience for the consumer is contributing to the market growth. Furthermore, the growing number of laundry service stores is presently catalyzing the demand for gas dryers worldwide. Besides this, the easy availability of gas dryers through offline and online distribution channels with different variants, colors, capacities, and loads is strengthening the growth of the market. Additionally, the increasing awareness among people about energy labels like energy star to buy energy efficient and certified appliances is creating a positive outlook for the market.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global gas dryer market, along with forecasts at the global, regional, and country level from 2026-2034. Our report has categorized the market based on product type, capacity, price range, distribution channel, and end use.

Product Type Insights:

- With Steam Function

- Without Steam Function

The report has provided a detailed breakup and analysis of the gas dryer market based on the product type. This includes with steam function and without steam function. According to the report, with steam function represented the largest segment.

Capacity Insights:

- Less Than 7 Cu.ft.

- 7 – 8 Cu.ft.

- More Than 8 Cu.ft.

A detailed breakup and analysis of the gas dryer market based on the capacity has also been provided in the report. This includes less than 7 Cu.ft., 7 – 8 Cu.ft., and more than 8 Cu.ft. According to the report, 7 – 8 Cu.ft. accounted for the largest market share.

Price Range Insights:

- Less Than US$ 300

- US$ 300 – US$ 500

- US$ 500 – US$ 700

- US$ 700 – US$ 900

- More Than US$ 900

The report has provided a detailed breakup and analysis of the gas dryer market based on the price range. This includes less than US$ 300, US$ 300 – US$ 500, US$ 500 – US$ 700, US$ 700 – US$ 900, and more than US$ 900. According to the report, less than US$ 300 represented the largest segment.

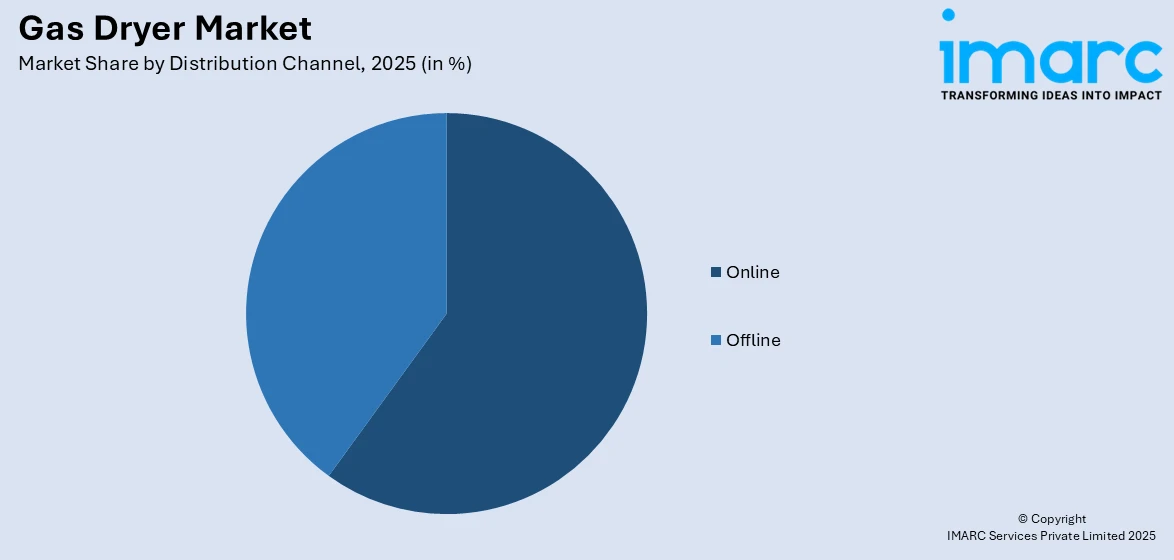

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- E-Commerce Websites

- Company-Owned Websites

- Offline

- Hypermarkets and Supermarkets

- Departmental Stores

- Others

A detailed breakup and analysis of the gas dryer market based on the distribution channel has also been provided in the report. This includes online (e-commerce websites and company-owned websites) and offline (hypermarkets and supermarkets, departmental stores, and others). According to the report, offline (hypermarkets and supermarkets, departmental stores, and others) accounted for the largest market share.

End Use Insights:

- Residential

- Commercial

- Laundry Services

- Washing and Dry-Cleaning Centers

- Hotels

- Hospitals and Nursing Homes

The report has also provided a detailed breakup and analysis of the gas dryer market based on the end use. This includes residential and commercial (laundry services, washing and dry-cleaning centers, hotels, and hospitals and nursing homes). According to the report, commercial (laundry services, washing and dry-cleaning centers, hotels, and hospitals and nursing homes) represented the largest segment.

Regional Insights:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The report has also provided a comprehensive analysis of all the major regional markets that include North America (the United States and Canada), Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others), Europe (Germany, France, United Kingdom, Italy, Spain, Russia, and others), Latin America (Brazil, Mexico, and others), and the Middle East and Africa. According to the report, North America was the largest market for gas dryer. Some of the factors driving the North America gas dryer market included the increasing number of laundromats and dry cleaning services, launch of advanced products, integration of latest technologies, etc.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global gas dryer market. Detailed profiles of all major companies have also been provided. Some of the companies covered include Alliance Laundry Systems LLC, Electrolux AB, GE Appliances (Haier Group Corporation), LG Electronics Inc. (LG Corporation), Rinnai Corporation, Samsung Electronics Co. Ltd., Transform SR Brands LLC, Whirlpool Corporation, etc. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Product Types Covered | With Steam Function, Without Steam Function |

| Capacities Covered | Less Than 7 Cu.ft., 7 – 8 Cu.ft., More Than 8 Cu.ft. |

| Price Ranges Covered | Less Than US$ 300, US$ 300 – US$ 500, US$ 500 – US$ 700, US$ 700 – US$ 900, More Than US$ 900 |

| Distribution Channels Covered |

|

| End Uses Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alliance Laundry Systems LLC, Electrolux AB, GE Appliances (Haier Group Corporation), LG Electronics Inc. (LG Corporation), Rinnai Corporation, Samsung Electronics Co. Ltd., Transform SR Brands LLC, Whirlpool Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global gas dryer market performed so far and how will it perform in the coming years ?

- What are the drivers, restraints, and opportunities in the global gas dryer market ?

- What are the key regional markets ?

- Which countries represent the most attractive gas dryer markets ?

- What is the breakup of the market based on the product type ?

- What is the breakup of the market based on the capacity ?

- What is the breakup of the market based on the price range ?

- What is the breakup of the market based on the distribution channel ?

- What is the breakup of the market based on the end use ?

- What is the competitive structure of the global gas dryer market ?

- Who are the key players/companies in the global gas dryer market ?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the gas dryer market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global gas dryer market.

- The study maps the leading as well as the fastest growing regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the gas dryer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)