Gas Compressors Market Report by Compressor Type (Positive Displacement Compressor, Dynamic Compressor), End Use Industry (General Manufacturing, Construction, Oil and Gas, Mining, Chemicals and Petrochemicals, Power Generation, and Others), and Region 2026-2034

Market Overview:

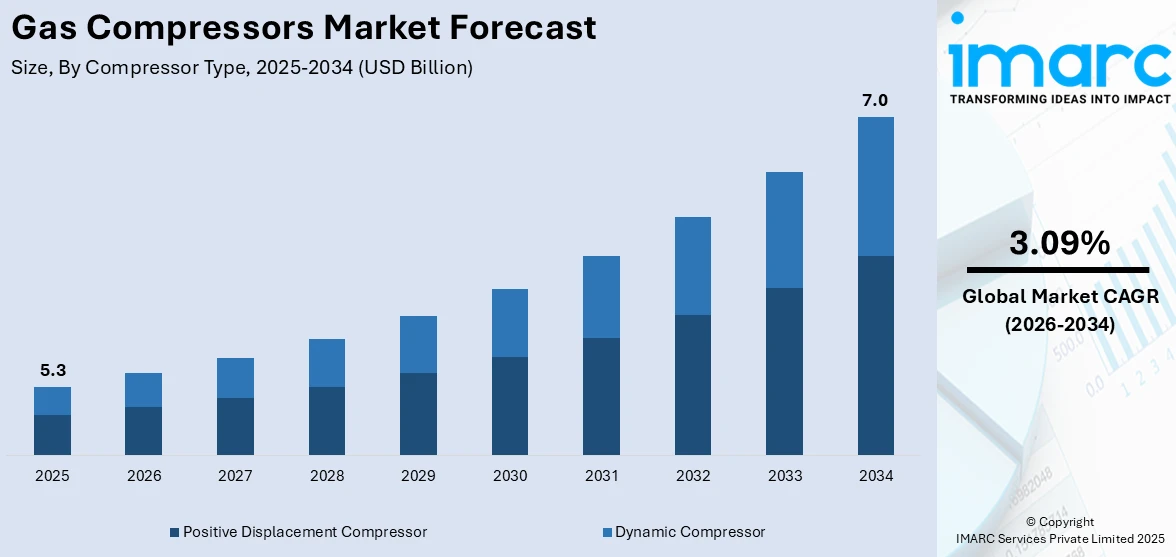

The global gas compressors market size reached USD 5.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 7.0 Billion by 2034, exhibiting a growth rate (CAGR) of 3.09% during 2026-2034. Increasing demand for natural gas as a cleaner energy source, expanding industrial activities, technological advancements in compressor designs, stringent environmental regulations, growing exploration efforts in untapped regions, and rising infrastructure investments are fueling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 5.3 Billion |

| Market Forecast in 2034 | USD 7.0 Billion |

| Market Growth Rate (2026-2034) | 3.09% |

Gas compressors are mechanical devices designed to increase the pressure of a gas by reducing its volume. They play a crucial role in various industries, including energy, manufacturing, and transportation. Gas compressors are typically composed of components such as a motor, compressor unit, and control system. The process involves drawing in gas and subsequently compressing it using either positive displacement or dynamic methods. Positive displacement compressors use mechanisms like reciprocating pistons or rotary screws to trap and reduce gas volume, while dynamic compressors utilize techniques like centrifugal force to accelerate and compress gas. Advantages of gas compressors encompass enhanced transport efficiency, increased storage capacity, and the facilitation of various industrial processes. Their application spans from powering pneumatic tools to aiding in natural gas transportation over long distances. Broadly, gas compressors fall into two main categories: positive displacement and dynamic compressors.

To get more information on this market Request Sample

The global gas compressors market is influenced by the rising demand for natural gas as a cleaner energy source and the expanding industrial activities across sectors, such as oil and gas, manufacturing, and petrochemicals. Moreover, advancements in technology, particularly in reciprocating and centrifugal compressor designs, is augmenting market growth. In line with this, stringent environmental regulations encourage the adoption of compressors that minimize emissions and ensure compliance, further supporting market growth. Apart from this, the growing exploration and production activities in untapped regions, increasing investments in infrastructure development, and the shift towards renewable energy sources are propelling market growth.

Gas Compressors Market Trends/Drivers:

Rising demand for natural gas

The global gas compressors market is significantly propelled by the escalating demand for natural gas as an environmentally friendly energy alternative. As nations strive to reduce their carbon footprint, natural gas has emerged as a key transition fuel due to its lower carbon emissions compared to conventional fossil fuels. This demand surge is driven by the desire to meet energy needs while adhering to climate goals. Gas compressors play a pivotal role in the extraction, transportation, and distribution of natural gas. They ensure efficient compression, enabling seamless movement through pipelines and storage facilities. This driver is expected to remain steadfast as countries continue to transition towards cleaner energy sources.

Expanding industrial activities

The expansion of industrial activities across sectors such as oil and gas, manufacturing, and petrochemicals acts as a substantial driver for the global gas compressors market. These industries heavily rely on compressed gases for various processes, such as pneumatic tools, air conditioning, refrigeration, and more. As industrialization continues to flourish, the demand for compressed gases escalates, necessitating reliable and efficient compression solutions. Gas compressors ensure the optimal functioning of essential processes, supporting increased production capacities. This driver underscores the essential role that gas compressors play in maintaining the smooth operation of industrial activities worldwide.

Advancements in compressor technology

Advancements in compressor technology, particularly in reciprocating and centrifugal compressor designs, are instrumental in shaping the trajectory of the global gas compressors market. Engineers and manufacturers are continuously innovating to enhance compressor efficiency, performance, and reliability. Cutting-edge designs incorporate features like variable speed drives, improved materials, and enhanced sealing mechanisms, resulting in higher efficiency and reduced maintenance requirements. These technological advancements not only boost the overall efficiency of compression processes but also enable customization to meet specific industry needs. As industries increasingly demand compressors that deliver superior performance while minimizing energy consumption, the evolution of compressor technology remains a pivotal driver in the market's growth and development.

Gas Compressors Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global gas compressors market report, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on compressor type and end use industry.

Breakup by Compressor Type:

- Positive Displacement Compressor

- Dynamic Compressor

Positive displacement compressor dominates the market

The report has provided a detailed breakup and analysis of the market based on the compressor type. This includes positive displacement compressor and dynamic compressor. According to the report, positive displacement compressor represented the largest segment.

The positive displacement compressor segment is influenced by several key factors, which includes its inherent ability to deliver a consistent flow of compressed gas regardless of discharge pressure variations. Moreover, the versatility of positive displacement compressors in handling a wide range of gases, including viscous and high-pressure gases, expands their applicability across diverse sectors such as petrochemicals, manufacturing, and pharmaceuticals. In line with this, the simplicity of design and ease of maintenance of positive displacement compressors attract industries looking for efficient yet straightforward solutions. Furthermore, their capability to deliver high compression ratios makes them suitable for applications requiring specific pressure levels. Additionally, the segment benefits from ongoing technological advancements, which enhance their efficiency and performance while addressing environmental concerns.

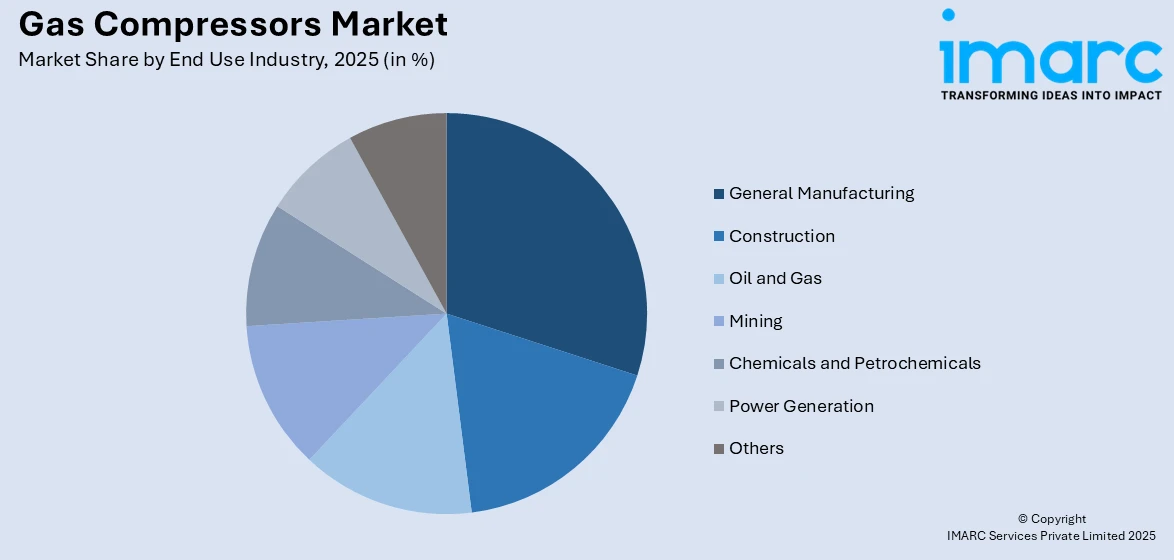

Breakup by End Use Industry:

Access the comprehensive market breakdown Request Sample

- General Manufacturing

- Construction

- Oil and Gas

- Mining

- Chemicals and Petrochemicals

- Power Generation

- Others

Oil and gas dominates the market

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes general manufacturing, construction, oil and gas, mining, chemicals and petrochemicals, power generation, and others. According to the report, oil and gas represented the largest segment.

The oil and gas segment is accelerated by a confluence of key factors, including the burgeoning global energy, especially in sectors such as transportation, manufacturing, and power generation. As economies grow and modernize, the need for these fuels remains essential. Moreover, exploration and production activities in untapped regions, including deep-sea reserves and unconventional sources like shale, drive investments in the oil and gas sector. Apart from this, geopolitical factors, such as supply disruptions and political tensions, influence market volatility and pricing. Furthermore, advancements in drilling technologies enhance efficiency, enabling the extraction of oil and gas from increasingly challenging environments. In line with this, the ongoing demand for petrochemical products fuels the need for feedstock, further anchoring the oil and gas segment.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance, accounting for the largest gas compressors market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.

The Asia Pacific gas compressors market is being propelled by a confluence of factors, including rapid industrialization in countries like China, India, and Southeast Asian nations, which is driving demand for efficient compression solutions across manufacturing, petrochemicals, and energy sectors. This trend is reinforced by the shift towards clean energy, with gas compressors playing a vital role in distributing natural gas as a substitute for coal. The region's expanding energy sector, encompassing exploration, production, and refining, further augments compressor demand, ensuring a steady gas supply to power plants and industries. The burgeoning liquefied natural gas (LNG) industry in the region relies heavily on compressors for production, storage, and transportation. Technological advancements in compressor designs and digital solutions, such as IoT integration and data analytics, are fostering innovation and optimizing operational efficiency in the market. Manufacturers are actively tailoring compression solutions to regional needs, driving sustainable growth in the Asia Pacific gas compressors market.

Competitive Landscape:

The competitive landscape of the global gas compressors market is characterized by intense rivalry among key industry players striving to secure a significant market share. Companies compete not only based on product quality and performance but also on factors such as technological innovation, pricing strategies, and comprehensive after-sales services. The industry's growth is further fueled by a constant drive for research and development, leading to the introduction of advanced and energy-efficient compressor technologies. Market participants focus on enhancing their global footprint through strategic partnerships, collaborations, and acquisitions to expand their market presence and customer base. As the demand for cleaner energy solutions continues to rise, competition is driven by the need to offer environmentally sustainable compressor solutions that align with evolving regulatory standards. Amidst these factors, differentiation through product diversification and a strong emphasis on customer relationships remain central to gaining a competitive edge in this dynamic and evolving market landscape.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Ariel Corporation

- Atlas Copco AB

- Bauer Compressors Inc.

- Burckhardt Compression

- Chart Industries

- HAUG Sauer Kompressoren AG

- IDEX Corporation

- Ingersoll Rand

- Kobelco Compressors America Inc.

- Siemens Energy

Recent Developments:

- In January 2023, Enerflex closed its $735 million acquisition of Exterran, a major natural gas processing company.

- In August 2023, Atlas Copco’s announced a new factory in Talegaon that will manufacture air and gas compressor systems for the local market, and for export. It encompasses a manufacturing plant and office building of approximately 25,000 m2.

- In August 2023, Siemens AG announced to have entered into an agreement to acquire Heliox, a Netherlands-based company.

Gas Compressors Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Compressor Types Covered | Positive Displacement Compressor, Dynamic Compressor |

| End Use Industries Covered | General Manufacturing, Construction, Oil and Gas, Mining, Chemicals and Petrochemicals, Power Generation, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ariel Corporation, Atlas Copco AB, Bauer Compressors Inc., Burckhardt Compression, Chart Industries, HAUG Sauer Kompressoren AG, IDEX Corporation, Ingersoll Rand, Kobelco Compressors America Inc., Siemens Energy |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the gas compressors market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global gas compressors market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the gas compressors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global gas compressors market was valued at USD 5.3 Billion in 2025.

We expect the global gas compressors market to exhibit a CAGR of 3.09% during 2026-2034.

The widespread adoption of gas compressors for the processing and transportation of renewable energy resources, such as natural gas, over long distances is primarily driving the global gas compressors market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in the temporary closure of numerous end-use industries for gas compressors.

Based on the compressor type, the global gas compressors market has been segmented into positive displacement compressor and dynamic compressor. Currently, positive displacement compressor holds the majority of the total market share.

Based on the end use industry, the global gas compressors market can be bifurcated into general manufacturing, construction, oil and gas, mining, chemicals and petrochemicals, power generation, and others. Among these, the oil and gas industry exhibits a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where Asia-Pacific currently dominates the global market.

Some of the major players in the global gas compressors market include Ariel Corporation, Atlas Copco AB, Bauer Compressors Inc., Burckhardt Compression, Chart Industries, HAUG Sauer Kompressoren AG, IDEX Corporation, Ingersoll Rand, Kobelco Compressors America Inc., and Siemens Energy.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)