Gas Analyzer Market Report by Application (Oil and Gas, Power, Chemicals, Food and Beverages, Pharmaceuticals, and Others), and Region 2025-2033

Gas Analyzer Market Size:

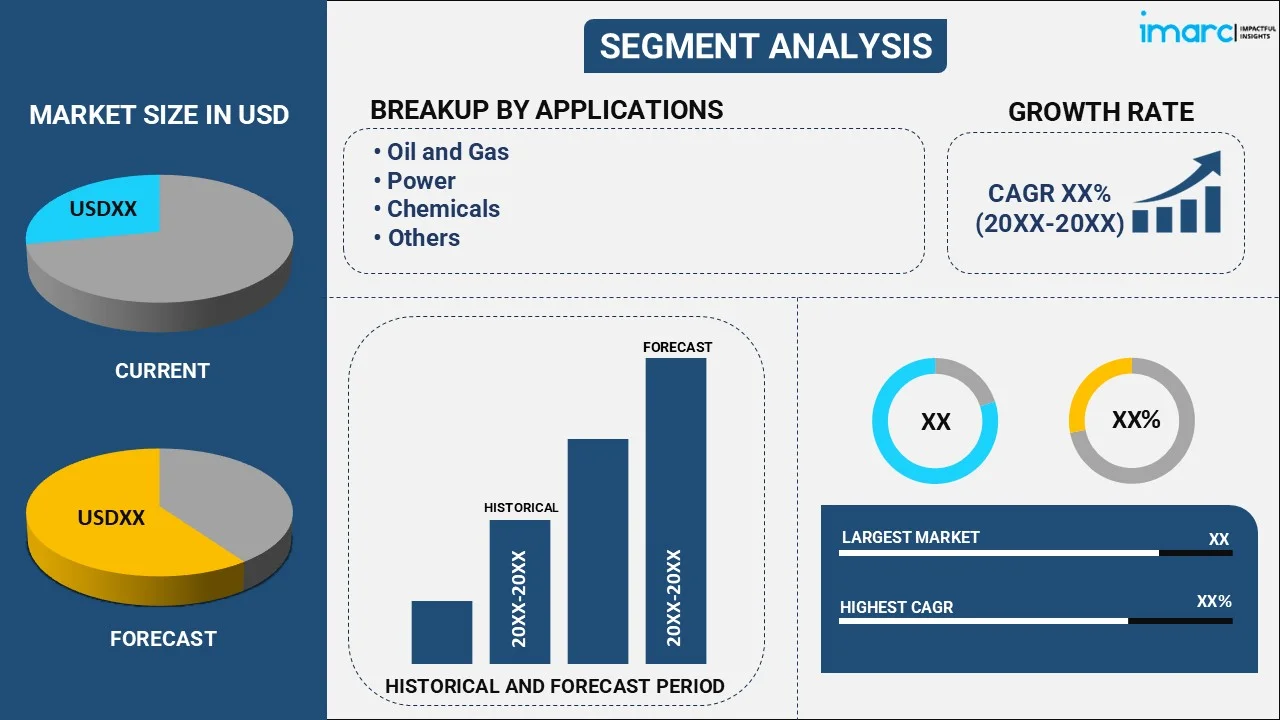

The global gas analyzer market size reached USD 671.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,107.7 Million by 2033, exhibiting a growth rate (CAGR) of 5.43% during 2025-2033. The market is experiencing steady growth driven by the rising environmental regulations, expansion of the industrial sector, increasing product utilization in healthcare applications, rapid technological advancements, and a growing focus on workplace safety.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 671.6 Million |

| Market Forecast in 2033 | USD 1,107.7 Million |

| Market Growth Rate (2025-2033) | 5.43% |

Gas Analyzer Market Analysis:

- Major Market Drivers: The gas analyzer market trend indicates that stringent environmental regulations that mitigate the negative effects of air pollution as well as the ongoing expansion in industrial activities are fueling the expansion of the market. Moreover, the increasing product adoption in healthcare settings, coupled with the rising demand for process optimization and compliance with emission standards are fueling the market growth.

- Key Market Trends: The gas analyzer market size is expanding as a result of the rising technological advancements, including portable and wireless gas analyzers with multi-gas detection capabilities. Besides this, the burgeoning product integration with the Internet of Things (IoT) for remote monitoring and predictive maintenance, together with the shift towards miniaturization and enhanced sensor capabilities, is boosting the market growth.

- Geographical Trends: North America is leading the market due to strict environmental laws and industrial growth. Other regions are also seeing growth due to the increasing industrialization and stringent air quality standards.

- Competitive Landscape: Some of the major market players in the gas analyzer industry include ABB Group, Emerson Electric, General Electric, Figaro Engineering Inc., Thermo Fishers Scientific, among many others.

- Challenges and Opportunities: The gas analyzer market outlook indicates that high equipment costs and technical complexities are impeding the market growth. However, rising environmental consciousness, greater product use in industrial safety, and improvements in gas detection technologies that provide more accurate and user-friendly solutions are creating growth prospects for the market.

Gas Analyzer Market Trends:

Rising Regulatory Compliance and Environmental Policies

The implementation of environmental standards to prevent the harmful consequences of air pollution is one of the most significant drivers boosting the gas analyzers market share. In 2023, around 66 million tons of pollutants were released into the atmosphere in the United States. These pollutants primarily lead to ozone and particle production, acid deposition, and reduced visibility. To mitigate these harmful effects, governments and international organizations are establishing severe standards for air quality and emissions in a variety of industries, including manufacturing, automobile, and energy. These rules require regular monitoring and reporting of specified gas concentrations, making the use of gas analyzers necessary and legally obligatory. In addition, gas analyzers enable companies to continuously monitor emissions and ensure that their operations adhere to prescribed limits, which, in turn, is facilitating their utilization across industries.

Growing Adoption of Gas Analyzers in the Healthcare Sector

The increasing utilization of gas analyzers in the healthcare sector to ensure the safety and effectiveness of various medical procedures and environments is another major factor driving the market growth. Hospitals and medical facilities require precise control and monitoring of gases such as oxygen, nitrous oxide, and anesthetic agents during surgeries and other medical treatments. Moreover, the establishment of organizations and government bodies to regulate the quality of medical devices is fostering the adoption of gas analyzers. For instance, the Care Quality Commission (CQC) in England regulates the quality and safety of the care delivered within all healthcare, medical, health and social care, and voluntary care settings across the country. The CQC is known to provides best practice details for the administering of oxygen to patients and the proper measurement and recording of levels, storage, and training about the application of oxygen and other medical gases. In this context, gas analyzers help in measuring the concentration of these gases, ensuring that the administered levels are safe for patients.

Increasing Awareness of Workplace Safety and Health Standards

The ongoing expansion of various industrial sectors, such as petrochemical, power generation, mining, and chemicals, is positively impacting the market growth. Industrial processes emit a variety of gases, which must be accurately monitored to guarantee safety, efficiency, and environmental compliance. In this context, increased awareness about occupational health and safety among enterprises is boosting the gas analyzer market share. For example, gas leaks or exposure to poisonous gasses can pose major health dangers to workers, as well as accidents or explosions in industrial facilities. Gas analyzers assist in continuously monitoring the quantities of dangerous and combustible gases, ensuring that they remain below acceptable limits and alerting operators to any deviations. Moreover, the emphasis on strengthening workplace safety regulations has greatly boosted the gas analyzers demand.

Gas Analyzer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, and regional levels for 2025-2033. Our report has categorized the market based on application.

Breakup by Application:

- Oil and Gas

- Power

- Chemicals

- Food and Beverages

- Pharmaceuticals

- Others

Oil and gas accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the application. This includes oil and gas, power, chemicals, food and beverages, pharmaceuticals, and others. According to the report, oil and gas represented the largest segment.

Based on the gas analyzer market trend, the oil and gas industry represented the largest market as gas analyzers play a critical role in ensuring operational efficiency, safety, and regulatory compliance. They are used to monitor and analyze the composition of gases at various stages of production, from exploration to refining. For instance, gas analyzers help in detecting the presence of methane, hydrogen sulfide, and other potentially hazardous gases, thereby ensuring the safety of workers and minimizing environmental impact. They are also essential in process optimization, allowing for better control over variables like combustion efficiency in furnaces and boilers. Furthermore, accurate gas composition analysis is vital for quality control in the production of petrochemical products. Regulatory compliance is another key area where gas analyzers are used to monitor emissions and ensure that they are within permissible limits.

Breakup by Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest gas analyzer market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. According to the report, Asia Pacific represents the largest regional market for gas analyzer.

Based on the gas analyzer market outlook, the Asia-Pacific region accounted for the largest share, due to rapid industrialization. Emerging economies like China and India are experiencing substantial growth in sectors, such as petrochemicals, automotive, and manufacturing, which require robust gas analysis solutions. Stricter environmental regulations are also coming into effect in various countries, necessitating better emission control measures which is contributing to the market growth. Technological advancements in gas analyzers cater to the evolving needs of these industries, which is further propelling the demand for gas analyzers.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the gas analyzer industry include ABB Group, Emerson Electric, General Electric, Figaro Engineering Inc., Thermo Fishers Scientific, etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Key players in the gas analyzer market are adopting various strategies to maintain or increase their market share. Technological innovation is at the forefront, with companies investing heavily in research and development (R&D) to produce more accurate, reliable, and user-friendly devices. Many firms are focusing on miniaturization and real-time analytics to cater to a broader range of applications, from industrial settings to portable uses for field research. Collaborations and partnerships are also common, as companies look to integrate complementary technologies or expand their geographical reach. Acquisitions and mergers are another avenue that enables companies to rapidly enhance their product portfolios or enter new markets. Firms are also seeking certifications to comply with international quality and environmental standards, reinforcing their commitment to providing value-added products. Companies are increasingly aware of the importance of after-sales services and are offering comprehensive maintenance and calibration services to retain customers. These multifaceted approaches demonstrate the dynamic efforts key players are making to stay relevant and competitive in the gas analyzer market.

Gas Analyzer Market News:

- In August 2023, ABB and Samsung Engineering announced that they will collaborate on gas analyzers for Saudi Arabia’s energy industries. ABB became a single-source vendor for gas analyzer system integration for Samsung in Saudi Arabia with this collaboration.

- In February 2023, Thermo Fischer Scientific announced the launch of the MAX-iR FTIR Gas Analyzer. It is designed to meet the challenges of inline process monitoring, batch sampling, gas purity/certification, and more. The product is combined with Thermo Scientific StarBoost Enhanced Optical Technology and enables users to achieve single-digit ppb detection limits for many applications.

Gas Analyzer Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Oil and Gas, Power, Chemicals, Food and Beverages, Pharmaceuticals, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | ABB Group, Emerson Electric, General Electric, Figaro Engineering Inc., Thermo Fishers Scientific, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the gas analyzer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global gas analyzer market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the gas analyzer industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The gas analyzer market was valued at USD 671.6 Million in 2024.

We expect the global gas analyzer market to exhibit a CAGR of 5.43% during 2025-2033.

The rising integration of gas analyzers with smartphones and other wireless devices to provide real-time monitoring, remote-control, and backing up data logs, is primarily driving the global gas analyzer market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of numerous end-use industries for gas analyzer.

Based on the application, the global gas analyzer market can be segmented into oil and gas, power, chemicals, food and beverages, pharmaceuticals, and others. Among these, oil and gas holds the majority of the total market share.

On a regional level, the market has been classified into North America, Europe, Asia Pacific, Latin America, and Middle East and Africa, where Asia Pacific currently dominates the global market.

Some of the major players in the global gas analyzer market include ABB Group, Emerson Electric, General Electric, Figaro Engineering Inc., Thermo Fishers Scientific, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)