Gaming Market Size, Share, Trends and Forecast by Device Type, Platform, Revenue Type, Type, Age Group, and Region, 2026-2034

Gaming Market Size and Share:

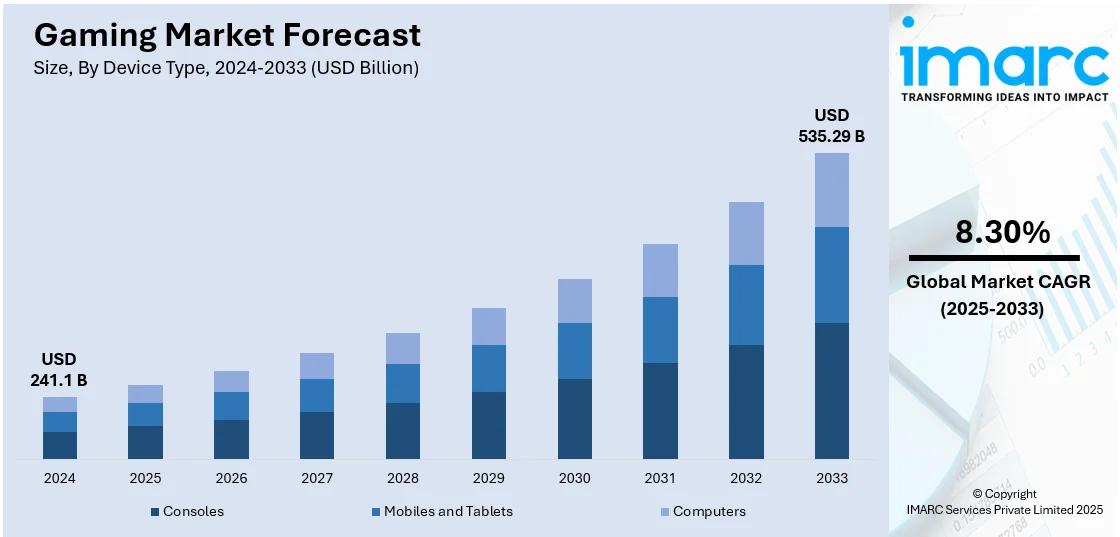

The global gaming market size was valued at USD 241.1 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 535.29 Billion by 2034, exhibiting a CAGR of 8.30% during 2026-2034. Asia-Pacific currently dominates the market, holding a significant market share of over 49.5% in 2024. The rising popularity of gaming, especially among young individuals, the emergence of e-sports and multiplayer video game competitions, and the increasing utilization of smartphones, tablets, and laptops are some of the major factors expanding the gaming market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 241.1 Billion |

|

Market Forecast in 2034

|

USD 535.29 Billion |

| Market Growth Rate 2026-2034 | 8.30% |

The market is driven by the rise of mobile gaming, fueled by smartphone penetration and affordable data plans, expanding accessibility. According to an industry report, mobile gaming continues to lead in India, accounting for 90% of the country’s total gaming revenue. This growth is driven by a tech-savvy youth demographic of over 600 Million individuals below the age of 35. Increasing in-app purchases, along with enhanced smartphone penetration and internet access, are contributing to the growth of mobile gaming. With the Indian gaming community continuously rising, it is expected to create around 250,000 job opportunities in the sector within the next decade, making India a formidable player in the global gaming scene. Along with this, continual technological advancements, such as cloud gaming, VR, AR, further enhance user experiences. Increasing internet connectivity and 5G adoption enable seamless online multiplayer gaming. The growing popularity of esports and live streaming platforms including Twitch improves engagement. Additionally, in-game purchases and subscription models drive revenue growth. The COVID-19 pandemic accelerated gaming adoption as a form of entertainment. Emerging markets in Asia-Pacific and Latin America contribute to expansion, while cross-platform gaming fosters inclusivity. These trends are further creating a favorable gaming market outlook.

To get more information on this market, Request Sample

The United States stands out as a key regional market, primarily driven by increasing demand for interactive entertainment and social connectivity. The popularity of free-to-play and live-service games encourages continuous player engagement, while advancements in graphics and AI enhance realism. Major console releases and exclusive titles drive hardware and software sales. Growing diversity in gaming audiences, including older adults and women, expands the consumer base. Advertising and brand partnerships within games create new revenue streams. Additionally, the integration of gaming with social media platforms strengthens community interaction. Investments in indie game development and digital distribution platforms such as Steam and Epic Games Store further stimulate industry growth. On 28th August 2024, Underdog Fantasy announced a new investment from its GuardDog fund, which will invest in The Game Safety Institute (GSI), which aims to help improve product safety and responsible gaming education among players. Founded in 2023 with an initial investment of USD 1 Million, GuardDog strives to harness innovation in responsible gaming and address product risks in a changing landscape. This investment is a critical step forward for improving gaming safety standards throughout the U.S. market, with GSI working to establish solutions that facilitate safer experiences for players.

Gaming Market Trends:

Rising Mobile Gaming

The growing usage of smartphones, along with improvements in mobile internet connectivity is making gaming accessible to a broader demographic, which is acting as a major growth-inducing factor in the market. According to industry reports, in just five years, the number of Internet users is expected to increase 47% from 5.35 Billion users in 2024 to 7.9 Billion users in 2029. The amount of time users spend on the Internet varies by age group, but on average, individuals spend 6.5 hours on the Internet every day, according to the Global Web Index. However, individuals between the ages of 16 and 24 spend an additional 2.5 hours more time online than those between the ages of 55 and 64. When it comes to having access to the Internet around the world, 75% of those between the ages of 15 and 24 have Internet access, compared to 65% of those ages 25 and over. As of 2024, the Internet is accessible to nearly 95% of the United States population, or about 322, 563, 519 individuals, according to the US Census. This is further driving the gaming market statistics significantly.

Growing Esports and Online Multiplayer Games

The increasing interest and investment in esports, along with the popularity of online multiplayer games, is driving engagement and creating a thriving community of players and spectators, which is improving the overall gaming industry. As per a report by the IMARC Group, the global esports market is expected to reach USD 10.1 Billion by 2033, growing at a CAGR of 17.05% during 2025-2033. In addition to this, in March 2024, Saudi Arabia’s National Development Fund (NDF) created two venture investment funds worth a combined USD 120 Million targeting the gaming and esports sectors. The first fund run by Merak Capital is valued at SR300 Million (USD 80 Million). It is focused on creating a gaming accelerator to help Saudi companies become leaders in the esports field. The second investment fund managed by Impact46 will have SR150 Million (USD 40 Million). It will aim to encourage private investment in the local gaming and esports industry.

Significant Technological Advancements

The rising innovations in gaming hardware, such as high-performance consoles, virtual reality (VR), and augmented reality (AR), are influencing the gaming market growth. According to an industry report, the global virtual reality (VR) market reached USD 15.9 Billion in 2024 and is expected to grow at a CAGR of 21.1% from 2025-2033. For instance, in March 2024, Virtuix, the developer of the “Omni One” full-body virtual reality (VR) treadmill and gaming system announced a lineup of 35 games for the Omni One’s consumer launch in the late quarter second of 2024. Omni One is a complete entertainment system that features a proprietary 360-degree treadmill that enables players to physically run around inside virtual reality games while remaining in the same spot in their play space. The system also comes with a customized Pico 4 Enterprise headset, as well as a dedicated game store with titles optimized for Omni One. This is expected to enhance the gaming market forecast over the coming years.

Gaming Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global gaming market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on device type, platform, revenue type, type, and age group.

Analysis by Device Type:

- Consoles

- Mobiles and Tablets

- Computers

Mobiles and tablets stand as the largest component in 2024, holding around 51.4% of the market. The demand for mobile and tablets in gaming is driven by widespread smartphone and tablet adoption, improved mobile internet connectivity, and the convenience of gaming on the go. Moreover, enhanced mobile processing power and graphics capabilities enable high-quality gaming experiences are further fueling the growth of the market. In addition to this, a vast array of affordable and free-to-play games, along with social and multiplayer features, attract a diverse audience. The increasing popularity of mobile esports and in-game purchases also contribute to the growing demand for mobile and tablet gaming.

Analysis by Platform:

- Online

- Offline

Offline leads the market with around 53.6% of market share in 2024. Offline gaming is often associated with single-player experiences, where players can enjoy immersive and narrative-driven games on their own. These games offer rich storytelling, character development, and exploration, allowing players to engage with the game world at their own pace without the need for an internet connection. In addition, offline gaming allows players to enjoy gaming experiences without interruptions or reliance on online services in regions with limited internet access or unstable connections. Moreover, offline gaming is particularly relevant for portable gaming devices, such as handheld consoles or mobile devices. These devices allow players to enjoy gaming experiences while traveling or in situations where an internet connection may not be available, such as during flights or in remote areas.

Analysis by Revenue Type:

- In-Game Purchase

- Game Purchase

- Advertising

In-game purchase leads the market with around 63.4% of market share in 2024. In-game purchases have proven to be a highly lucrative revenue stream for game developers and publishers. This revenue model has become increasingly prevalent, particularly in free-to-play games, as it allows developers to monetize their games by offering additional content, cosmetic items, virtual currency, or gameplay advantages for a price. Besides, in-game purchases can enhance player engagement and retention. By offering desirable in-game items or content, developers provide incentives for players to continue playing and invest in the game. Moreover, some in-game purchases offer gameplay advantages or power-ups, allowing players to progress faster or gain an edge in multiplayer matches. As a result, the desire to gain a competitive advantage or improve gameplay efficiency can drive players to make in-game purchases, thus increasing the market share of this segment.

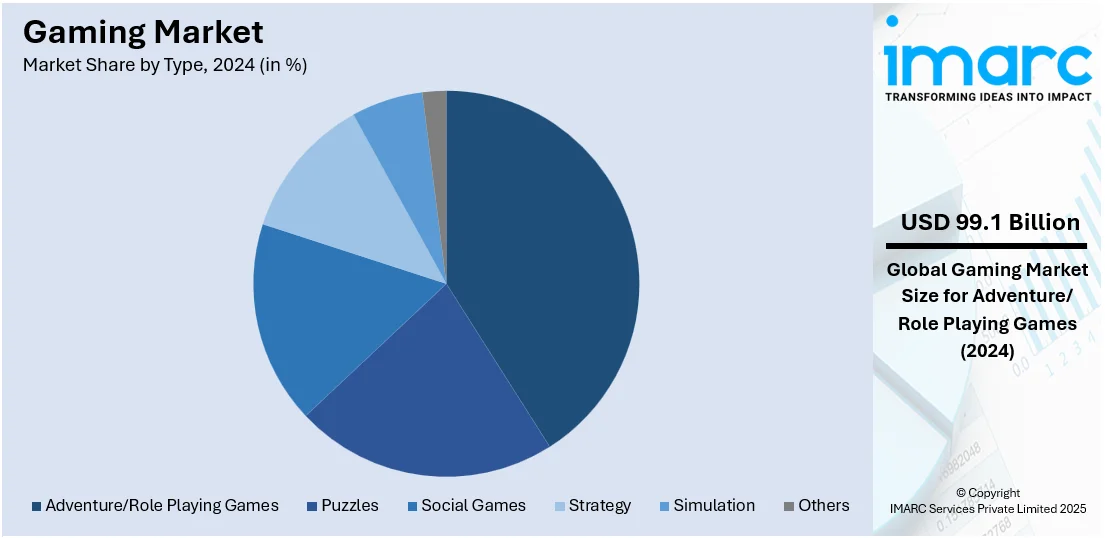

Analysis by Type:

- Adventure/Role Playing Games

- Puzzles

- Social Games

- Strategy

- Simulation

- Others

Adventure/role-playing games leads the market with around 41.1% of market share in 2024. Adventure/role-playing games are often known for their immersive storytelling and narrative-driven experiences. These games provide players with compelling storylines, well-developed characters, and intricate worlds to explore. The depth of storytelling and the ability for players to shape their character's journey appeal to a wide audience, attracting players who enjoy rich narratives and engaging storytelling experiences. They also offer extensive gameplay with vast open worlds, numerous quests, and a variety of gameplay mechanics. These games can provide hours of content, encouraging players to invest significant time and effort in the game world. Moreover, RPG elements in adventure games allow players to customize their characters, choose their abilities or skills, and progress through a leveling system. This customization and progression offer a sense of achievement and personalization, thus increasing the popularity of this genre.

Analysis by Age Group:

- Adult

- Children

Adult leads the market with around 75.1% of market share in 2024. The gaming market demand among adults is driven by advanced, immersive game designs and storytelling that cater to mature audiences. The growth of online multiplayer games and esports provides social and competitive opportunities. In line with this, improved accessibility through mobile and console gaming, along with flexible gaming schedules, appeals to adult lifestyles. In addition to this, nostalgia for classic games and stress relief benefits contribute to adult engagement. Moreover, increased disposable income also enables adults to invest in gaming hardware, subscriptions, and in-game purchases.

Regional Analysis:

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

In 2024, Asia-Pacific accounted for the largest market share of over 49.5%. The Asia Pacific region is home to a significant portion of the global population, including densely populated countries such as China and India. The region has experienced rapid growth in mobile gaming, driven by the widespread adoption of smartphones and increasing internet connectivity. Esports has gained immense popularity in the Asia Pacific region as countries such as South Korea and China are known for their expanding esports scenes, attracting professional players, sponsors, and spectators. For instance, in 2024, South Korea unveils a plan to increase its share in the global console game market. A major focus on the console game sector will be undertaken by South Korea over the next five years as they share details of a new plan to revive and bolster their game industry. As reported by Yonhap News Agency, the Ministry of Culture, Sports and Tourism will work on expanding the country’s share in the global console game market by 2028.

Key Regional Takeaways:

United States Gaming Market Analysis

In 2024, the US accounted for around 92.10% of the total North America gaming market. The United States gaming market is primarily driven by technological advancements, increasing consumer demand, and changing cultural trends. Mobile gaming has also become a major driver, as smartphones offer easy access to a vast range of games, catering to a broad demographic. Furthermore, the growth of streaming platforms such as Twitch and YouTube has contributed substantially to industry expansion, with competitive gaming and content creation becoming increasingly popular among younger audiences. For instance, in 2024, the United States contributed significantly to the global gaming market, with over 3.32 Billion active gamers worldwide. In addition to this, the rise of virtual reality (VR) and augmented reality (AR) technology is shaping the future of gaming, offering immersive experiences that attract both casual and hardcore players. Social gaming is further expanding the market, as multiplayer online games such as Fortnite, Call of Duty, and Roblox allow players to engage with friends and communities in virtual worlds. Other than this, the cultural shift toward gaming as a mainstream entertainment medium, combined with the increasing presence of gaming in pop culture, solidifies its place as a dominant force in entertainment, appealing to diverse age groups and interests.

Asia Pacific Gaming Market Analysis

The Asia Pacific gaming market is expanding due to the region's large and growing population of tech-savvy consumers. Mobile gaming is particularly popular, with smartphones offering affordable and accessible gaming options for a wide range of players. The rapid growth of internet infrastructure and penetration, particularly in urban areas, has enabled seamless online multiplayer experiences, fueling demand for both mobile and PC games. For instance, in India, 954.4 Million individuals have access to the Internet, with 556.05 Million of these individuals living in urban areas. Moreover, 82.7% of total internet connections are 4G, while 5G accounts for 16.9%, highlighting the increasing expansion of high-speed internet access across the country. Additionally, localized content tailored to regional preferences, including language support and culturally relevant themes, improves game popularity across diverse markets, which is a significant gaming market trend. Cultural trends, such as the popularity of anime, manga, and fantasy themes, also play a role in shaping game development and player preferences, further enhancing the gaming market in the Asia Pacific region.

Europe Gaming Market Analysis

The Europe gaming market is growing, fueled by demographic shifts and changing consumer preferences. A key factor is the region’s strong gaming development ecosystem, with countries such as the UK, Germany, and France housing numerous game studios that produce globally recognized titles. This has led to increased local production and innovation, strengthening the position of Europe as a gaming hub. Moreover, the increasing penetration of next-generation consoles, such as the PlayStation 5 and Xbox Series X, has stimulated demand for high-performance gaming hardware and exclusive titles. The popularity of esports in Europe has also witnessed a significant rise, with major tournaments and professional leagues gaining recognition, creating new opportunities for both players and viewers. In fact, according to a report by the IMARC Group, the Europe esports market reached USD 1.7 Billion in 2024 and is expected to grow at a CAGR of 11.04% from 2025-2033. Additionally, the rise of game streaming services such as Google Stadia and NVIDIA GeForce Now has made gaming more accessible, enabling players to enjoy high-quality games without the need for expensive hardware. Furthermore, the increasing emphasis on inclusivity, with games offering diverse characters and stories, has expanded the appeal of gaming to a broader, more diverse audience across Europe.

Latin America Gaming Market Analysis

The Latin America gaming market is growing rapidly due to increased internet connectivity, which has made gaming more accessible to a wide audience. As per industry reports, in Q3 2024, there were 11 Million new 5G internet connections in Latin America, rising to 67 Million in total, recording a growth of 19% and highlighting the increasing penetration of high-speed internet connections in the region. Moreover, the rise of free-to-play models and microtransactions has also fueled industry growth, allowing players to access games without upfront costs while offering in-game purchases. Additionally, the increasing popularity of gaming communities is driving the market, with more tournaments and local events taking place across the region. The expanding middle class, growing disposable income, and cultural affinity for entertainment also contribute to the market's development, with gaming becoming a mainstream form of leisure.

Middle East and Africa Gaming Market Analysis

The Middle East and Africa gaming market is being increasingly propelled by rising smartphone adoption, high-speed internet availability, and growing disposable incomes in numerous countries. For instance, according to recent industry reports, 72.8% of the population of Saudi Arabia uses smartphones. As such, mobile gaming has become a dominant force, as smartphones provide an accessible platform for a wide range of consumers. Moreover, with a young and dynamic population, gaming has become a key form of social interaction and entertainment. Additionally, the region’s growing infrastructure, including advancements in cloud gaming and digital payment systems, has made it easier for consumers to access and purchase games. Partnerships between international gaming companies and local developers are also helping to foster the growth of the industry across the region.

Competitive Landscape:

The competitive landscape of the gaming market is characterized by rapid innovation and strategic investments. Leading players are expanding their portfolios through exclusive game titles and partnerships with developers to secure unique content. Many are investing heavily in cloud gaming infrastructure to offer seamless, subscription-based experiences. Market players are enhancing their platforms with advanced social features, cross-play capabilities, and immersive technologies including VR and AR to attract diverse audiences. Monetization strategies, such as microtransactions and battle passes, are being refined to maximize revenue. Additionally, acquisitions of studios and intellectual properties are common tactics to strengthen market dominance. The rise of indie developers is also intensifying competition, pushing established firms to prioritize creativity and player engagement. Esports investments and live-service game models further differentiate key players in this dynamic industry.

The report provides a comprehensive analysis of the competitive landscape in the gaming market with detailed profiles of all major companies, including:

- Activision Publishing, Inc.

- Apple Inc.

- Bandai Namco Entertainment America Inc

- Electronic Arts Inc.

- Epic Games Inc.

- KRAFTON, Inc

- Microsoft Corporation

- NetEase, Inc.

- Nintendo Co., Ltd.

- Rovio Entertainment Ltd.

- Sega of America, Inc.

- Sony Corporation

- Tencent Holdings Limited

Latest News and Developments:

- March 2025: Morrocco and France launched the ‘Video Game Incubator’ program, aiming to support nine video game startups in the industry. During the span of five months, the startup incubator program will offer an extensive training course covering key subjects such as business administration, production supervision, brand and marketing strategies, video game testing, and financial and commercial planning.

- March 2025: AMD’s latest Zen 5 Ryzen 9000 3D V-Cache gaming processors, the Ryzen 9 9950X3D and Ryzen 9 9900X3D, will be commercially available from March 12, 2025. These new chips are an improved version of the 9800X3D, which is generally regarded as the most advanced gaming CPU. The latest models also boast second-generation 3D V-Cache technologies and 16 Zen 5 cores.

- February 2025: HP released its most recent Victus 15 gaming laptop in India. The novel laptop is equipped with improved AI features to enhance overall performance and functioning. Additionally, the laptop's AMD Ryzen 9 Hawkpoint 8945HS NPU processor promises intelligent adaptability, along with increased speeds, for the best possible gaming experience.

- January 2025: Acer launched its new Nitro V line in a range of screen sizes, displaying a potent portfolio of entry-level laptops for gaming in order to increase the accessibility of AI-driven gaming. The Nitro V laptops combine outstanding flexibility, stutter-free graphics, and abundant storage, making them perfect for students, developers, and serious gamers looking for enhanced comprehensive performance.

- October 2024: SuperGaming, a leading video game developer based in India, announced the release of its new warfare game for mobiles, Indus. With its double winning condition, Indus Battle Royale will give the classic battle royale gaming genre a distinctive twist. Moreover, the game is also equipped with a new in-game feature, ‘Grudge,’ that will enable players to find competitors who have previously defeated them.

- June 2024: Apple introduced a new feature aimed at enhancing the gaming experience on iPhones: Game Mode in a surprising addition to iOS 18 announced at WWDC. This innovative mode promises to optimize the performance of your device during intense gaming sessions, offering a smoother and more immersive experience.

- May 2024: Solana Labs announced an expanded partnership with Google Cloud to bring GameShift, its powerful Web3 gaming platform, to customers to Google Cloud. The collaboration will expand and simplify developer access to Web3 gaming technology enabling game studios to seamlessly layer the cutting-edge Web3 capabilities into their games.

- May 2024: Microsoft Corp. announced to launch of its online store for mobile-game consumables, creating an alternative to Apple Inc. and Google’s app stores and their fees.

Gaming Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered | Consoles, Mobiles and Tablets, Computers |

| Platforms Covered | Online, Offline |

| Revenue Types Covered | In-Game Purchase, Game Purchase, Advertising |

| Types Covered | Adventure/Role Playing Games, Puzzles, Social Games, Strategy, Simulation, Others |

| Age Groups Covered | Adult, Children |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Activision Publishing, Inc., Apple Inc., Bandai Namco Entertainment America Inc, Electronic Arts Inc., Epic Games Inc., KRAFTON, Inc, Microsoft Corporation, NetEase, Inc., Nintendo Co., Ltd., Rovio Entertainment Ltd., Sega of America, Inc., Sony Corporation, Tencent Holdings Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the gaming market from 2020-2034.

- The gaming market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the gaming industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The gaming market was valued at USD 241.1 Billion in 2024.

IMARC estimates the gaming market to exhibit a CAGR of 8.30% during 2025-2033, reaching a value of USD 535.29 Billion by 2033.

The gaming market is driven by the rise of mobile gaming, the increasing popularity of esports, technological advancements such as VR, AR, and cloud gaming, growing internet connectivity, and the adoption of 5G. In-game purchases and subscription models also contribute to revenue growth, with emerging markets in Asia-Pacific and Latin America expanding the consumer base.

Asia-Pacific currently dominates the gaming market, accounting for a share exceeding 49.5%. This dominance is fueled by the widespread adoption of smartphones, increasing internet connectivity, and the booming esports industry, particularly in countries including China, South Korea, and India.

Some of the major players in the gaming market include Activision Publishing, Inc., Apple Inc., Bandai Namco Entertainment America Inc, Electronic Arts Inc., Epic Games Inc., KRAFTON, Inc, Microsoft Corporation, NetEase, Inc., Nintendo Co., Ltd., Rovio Entertainment Ltd., Sega of America, Inc., Sony Corporation, and Tencent Holdings Limited, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)