Gaming Chair Market Size, Share, Trends and Forecast by Type, Material, Price, Distribution Channel, End User, and Region, 2025-2033

Gaming Chair Market Size and Share:

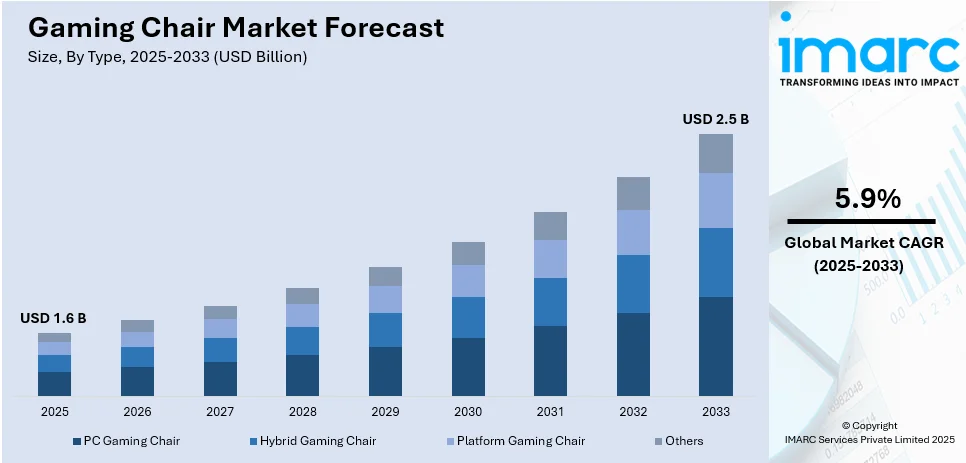

The global gaming chair market size is anticipated to reach USD 1.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 2.5 Billion by 2033, exhibiting a CAGR of 5.9% from 2025-2033. Asia Pacific currently dominates the market due to the significant rise in remote and hybrid work culture, increasing prevalence of chronic disorders, expanding number of professional gamers, and increasing internet penetration.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2025

|

USD 1.6 Billion |

|

Market Forecast in 2033

|

USD 2.5 Billion |

| Market Growth Rate 2025-2033 | 5.9% |

There is a significant increase in remote and hybrid work arrangements across the globe. In 2023, approximately 14% of the U.S. workforce, equating to around 22 million adults, worked entirely from home. Globally, hybrid work models have become a norm, with large-scale adoption in regions such as Europe, where 55% of workers prefer a flexible schedule. This shift has underscored the importance of creating comfortable and ergonomic home office setups. Consequently, there has been a rise in demand for multifunctional furniture that caters to both professional and personal needs. Gaming chairs, known for their ergonomic design and comfort, have become popular choices for home offices, providing support during long working hours and enhancing the overall work-from-home experience. Moreover, gaming chairs appeal to remote workers due to their aesthetic, blending functionality with style, which enhances their living spaces.

To get more information on this market, Request Sample

The gaming chair market in the United States is experiencing significant growth, driven by several key factors. One major contributor is the sustained prevalence of remote work. In August 2023, approximately 19.5% of employed individuals in the U.S. teleworked or worked from home for pay, a trend that has remained consistent since October 2022. This shift has increased demand for ergonomic home office furniture, including gaming chairs that offer comfort during extended work hours. Additionally, the expansion of the gaming industry fuels market growth. Employment in entertainment and sports occupations, which includes gaming-related roles, is projected to grow faster than the average for all occupations from 2023 to 2033. The median annual wage for this group was $53,360 in May 2023, higher than the median for all occupations. This growth reflects increased participation in gaming activities, leading to higher demand for gaming accessories, including chairs.

Gaming Chair Market Trends:

Rising Prevalence of Chronic Disorders

Prolonged sitting, postural stress, and lack of movement are some of the common effects experienced by gamers. As these issues can lead to serious health problems, such as obesity, muscle complications, and carpal tunnel syndrome, there is a rise in the need for gaming chairs to enable healthy blood flow throughout the body. According to the Centers for Disease Control and Prevention, the prevalence of severe obesity in adults were 9.4% during August 2021–August 2023. Furthermore, work-related musculoskeletal disorders (MSDs), often referred to as ergonomic injuries, are a significant concern in occupational health. These injuries occur when the body is subjected to repetitive motions or awkward positions, leading to discomfort and injury. In 2023, the U.S. Department of Labor's Occupational Safety and Health Administration (OSHA) released injury and illness data highlighting the prevalence of such disorders. This growing awareness has led to an increased emphasis on ergonomic solutions in both workplaces and home environments. As individuals spend more time seated, whether for work or leisure activities like gaming, there is a heightened demand for ergonomically designed furniture, including gaming chairs that provide proper support.

Expanding Number of Professional Gamers

The increasing number of professional gamers is acting as another major factor promoting the adoption of these chairs to improve the player experience. The global e-sports market has experienced significant growth, reflecting the increasing popularity of competitive gaming. In 2024, the market was valued at USD 2.1 billion and is projected to reach USD 10.1 billion by 2033, growing at an annual rate of 17.05% during the forecast period. This expansion is driven by factors such as innovations in gaming technology and the growing popularity of live-streaming platforms. The e-sports audience has also expanded, with millions of viewers worldwide engaging in live tournaments and events. This surge in e-sports popularity has led to increased demand for gaming-related products, including specialized gaming chairs designed to enhance comfort and performance during extended gaming sessions.

Growing Internet Penetration

The emerging trend of motion and virtual reality (VR) games on account of the rising penetration of the internet and easy availability of gaming peripherals is stimulating the market growth. In 2024, the VR gaming market was valued at USD 47.1 billion and is projected to grow at a compound annual growth rate (CAGR) of 24.8% between 2025 and 2033. This expansion is facilitated by the rising number of internet users worldwide, which reached 5.4 billion people, or 67% of the global population, in 2023. The widespread availability of affordable VR headsets and motion controllers has made immersive gaming experiences more accessible to consumers. Advancements in technology have enhanced the realism and interactivity of VR games, attracting a broader audience. Additionally, the proliferation of high-speed internet has enabled seamless online multiplayer experiences, further boosting the appeal of VR gaming.

Gaming Chair Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global gaming chair market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, material, price, distribution channel, and end user.

Analysis by Type:

- PC Gaming Chair

- Hybrid Gaming Chair

- Platform Gaming Chair

- Others

PC gaming chairs dominate the market due to ergonomic design, customized for extended periods of gaming. They offer a feature like an adjustable armrest, lumbar support, and recline ability to enhance comfort while minimizing strain. With the advent of professional gaming, e-sports tournaments, and live streaming platforms, they have received massive support. Versatile usage and often doubling up as a work-from-home seat ensures their dominance in the market. Manufacturers are innovating in terms of premium materials and the integration of technologies such as RGB lighting and sound systems to achieve the needs of consumers. PC gaming chairs are in most demand in regions with strong gaming communities.

Analysis by Material:

- PU Leather

- PVC Leather

- Others

PU leather chairs occupy the leading marketplace due to its low price and durability. The chair comes with the look and finish of real leather and resists wear as well as stain, allowing for its prolonged use. It is smooth and clean-friendly, suitable for both gamers and remote workers looking for functional and aesthetically pleasing products. Since PU leather is inexpensive, the manufacturers produce quality chairs at very competitive prices. Also, in comparison to the genuine leather, its eco-friendly manufacturing process supports the growing preference among consumers for sustainable products that is driving its acceptance globally in multiple markets.

Analysis by Price:

- High-Range

- Medium-Range

- Low-Range

High-range chairs target professional gamers and enthusiasts, offering advanced features like premium materials, integrated speakers, RGB lighting, and superior ergonomic designs. Medium-range chairs balance affordability and functionality, attracting casual gamers and remote workers with essential ergonomic features and durable builds. Low-range chairs appeal to budget-conscious consumers, providing basic comfort and design without advanced features. This segmentation allows manufacturers to target various demographics, ensuring a broad market appeal and driving growth across different income groups and regions.

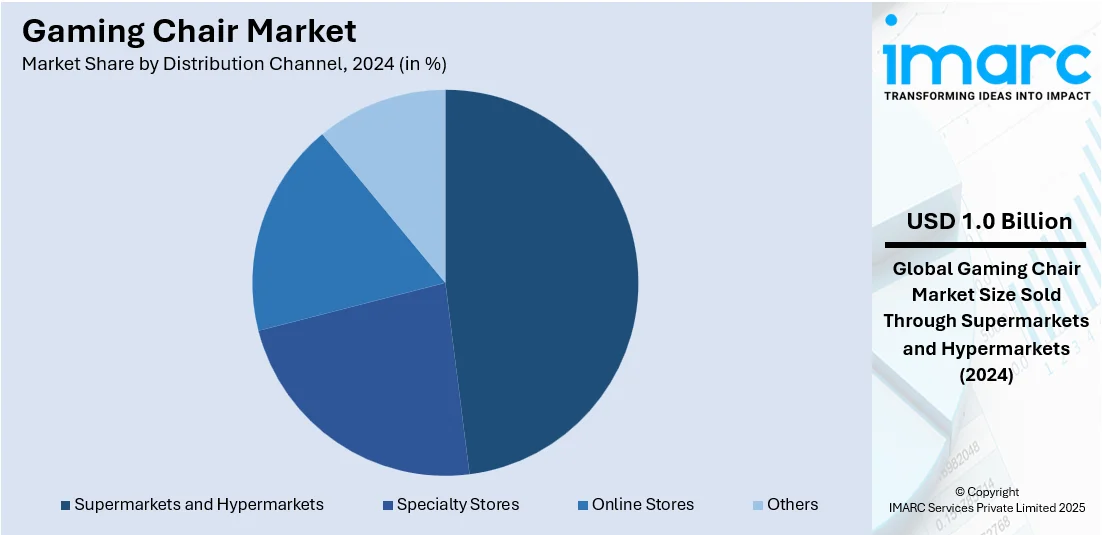

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

Supermarkets and hypermarkets dominate the distribution channel for gaming chairs, driven by their ability to offer a diverse product range in a single location. These retail spaces provide consumers with the advantage of physically experiencing products before purchase, aiding in informed decision-making. Additionally, supermarkets leverage promotional campaigns and bundled offers to attract buyers. Their extensive networks and established supply chains enable easy accessibility, particularly in urban areas. As a result, they remain a preferred choice for consumers seeking convenience and immediate product availability, solidifying their position as a leading distribution channel in the gaming chair market.

Analysis by End User:

- Residential

- Commercial

The residential segment dominates the gaming chair market, fueled by the rising popularity of gaming as a hobby and the increase in remote working arrangements. Home gamers and remote workers prioritize ergonomic seating to enhance comfort during extended usage, making gaming chairs a preferred choice. The multifunctional design, which suits both work and leisure, drives their adoption in households. Additionally, growing disposable incomes and advancements in affordable gaming equipment have expanded the residential consumer base, particularly in developing regions. The shift toward home-centric activities further cements the residential sector's dominance in the gaming chair market

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The market for gaming chairs is dominated by the Asia-Pacific area because of its fast developing middle class and gaming culture. Gaming accessories are in great demand due to the prevalence of e-sports and online gaming in nations like Japan, China and South Korea. The younger population in the area and rising internet usage also help the industry. Additionally, users may now purchase high-end gaming seats because of growing disposable incomes in developing nations like India. Asia Pacific's dominance of the industry is being cemented as both domestic and foreign manufacturers are taking advantage of this demand with reasonably priced products and regional marketing approaches.

Key Regional Takeaways:

North America Gaming Chair Market Analysis

North America enjoys a strong growth prospect for its gaming chair business due to several factors. The region's booming e-sports industry and gaming culture, which has been led by the U.S., has allowed many gamers in the region to compete in tournaments, encouraging the development of professional teams and communities. This gaming activity has driven demand among users for high-quality products that enhance performance and allow gamers to spend long durations on their PCs. This increased awareness of health and ergonomics is changing the behavior of consumers. In North America, the prevalence of remote work and hybrid models of work increases the demand for multifunctional chairs that can serve purposes both at work and at gaming. Gaming chairs are becoming the first choice in home offices with lumbar support, adjustable armrests, and recliner functionality.

United States Gaming Chair Market Analysis

Increasing popularity of e-sports and online streaming services like Twitch have given rise to demand for professional-level gaming chairs. Along with this, a huge demand for high-quality gaming chairs is emitted from a huge base population of gamers, especially situated in the US. According to the International Trade Administration, around 190.6 Million Americans are associated with some kind of video gaming activity. Furthermore, 78% of all US households were engaged with at least one gaming device in the year 2022. In 2023, the US video game industry created more than 350000 jobs and contributed roughly USD 66 billion to the country's GDP. Besides this, growing awareness among gamers about the health-related posture issues is actually fueling the demand for the ergonomic comfort gaming chair. The Centers for Disease Control and Prevention states that back pain was ever increasing in the adults as would an age. For instance, 28.4% of people aged between 18 and 29 said they experienced back pain, while the same risk increased to 35.2% among 30- to 44-year-olds. Cases grew even more in the 45-64 age segment to 44.3% and 45.6% for persons aged 65 and over.

Europe Gaming Chair Market Analysis

The market of gaming chairs is rapidly expanding in Europe, especially in countries like the UK, Germany, and France. Further, the market has increased as gaming is also turning from just being an amusement to a sport competing in which many people get themselves indulged. In line with this, European consumers are now focusing on ergonomically designed furniture from the standpoint of health considerations, such as gaming chairs that can support them over long periods of gaming. In a report by the UK government, 18.5% of those aged 18 or above reported experiencing some MSK condition, which include long term conditions for joints or chronic back pains as per 2020; whereas there was a statistically meaningful fall from 2018 and 2019 (19.0%). A wider range of gaming chairs features such as adjustable seating position and lumbar support is provided by companies within the Europe region for professionals to home players. For example, in 2020, global leader in gaming chair innovation, X Rocker™ entered a new partnership with Nintendo of Europe to design, produce, and distribute officially licensed gaming chairs featuring the Super Mario brand.

Asia Pacific Gaming Chair Market Analysis

In countries like India, the expanding middle class is increasingly spending on gaming-related products, including comfortable and durable gaming chairs. As per the India Brand Equity Foundation, the earnings of India's middle-class population have grown from USD 1.06 Million in 2016 to USD 1.8 Million in 2021. Consequently, the western region has emerged as the leader in terms of the highest number of affluent households, with Maharashtra at the forefront, followed by Delhi, Gujarat, Tamil Nadu, and Punjab. Additionally, middle-class households in India exhibit significantly higher expenditure patterns, spending eight times more than their low-income counterparts. In line with this, innovative features such as multi-functionality, including adjustable armrests, reclining mechanisms, and built-in speakers, are becoming increasingly popular among consumers in this region.

Latin America Gaming Chair Market Analysis

The Latin American region is still in its growing stages of the gaming chair market. In line with this, gaming chair manufacturers are currently focusing on offering affordable models, which is essential in a price-sensitive region like Latin America. Moreover, with internet penetration and mobile gaming growing, Latin America is shifting towards console and PC gaming, driving the demand for dedicated gaming chairs. According to the Brazilian Institute of Geography and Statistics, 92.5% of Brazilian households, equivalent to 72.5 Million, had internet access, reflecting a 1.0 percentage point increase compared to 2022.

Middle East and Africa Gaming Chair Market Analysis

The Middle East and Africa region are experiencing gradual but consistent growth in the gaming chair market, with countries like the UAE and Saudi Arabia witnessing a rapidly expanding gaming community and the rising popularity of e-sports. In line with this, a young and tech-savvy population is currently driving the demand for gaming chairs in the region. According to the government of the United Arab Emirates, in 2020, the age group of 25 to 29 years ranked second in terms of population distribution in Dubai, accounting for 16.64% of the total census. Within this group, males represented 74.48%, totaling 415,773 individuals, while females comprised 25.52%, with a population of 142,489.

Competitive Landscape:

Leading players in the gaming chair market are focusing on innovation, strategic partnerships, and regional expansion to strengthen their market position. They are investing in advanced ergonomic designs that cater to both gamers and remote workers, incorporating features like adjustable lumbar support, customizable armrests, and memory foam cushions. Many companies are also integrating smart technologies such as built-in speakers and Bluetooth connectivity to enhance the user experience and appeal to tech-savvy consumers. To expand their global footprint, manufacturers are collaborating with e-sports organizations, gaming influencers, and streaming platforms, leveraging these partnerships for product endorsements and wider market reach. Companies are also targeting emerging economies with budget-friendly models to capitalize on the growing gaming culture.

The report provides a comprehensive analysis of the competitive landscape in the gaming chair market with detailed profiles of all major companies, including:

- Ace Casual Furniture

- AK Racing Australia

- Arozzi Gaming Distribution Inc.

- Corsair

- DXRacer

- GT Omega

- Herman Miller, Inc.

- Noblechairs

- Razer Inc.

- Secretlab

- Thermaltake Technology Co., Ltd.

- ThunderX3

- Vertagear

Latest News and Developments:

- June 2024: KI, a leading provider of innovative solutions for the dynamic educational sector, has introduced two cutting-edge additions to its esports furniture collection: the Nav and Cheevo esports chairs. Designed to enhance comfort and support during extended gaming sessions, these new offerings cater to the evolving demands of the esports market.

- September 2024: Esports organization Fnatic has revealed a strategic partnership with gaming furniture brand Blacklyte, with a particular emphasis on gaming chairs. This association designates Blacklyte as the official Gaming Chair and Desk Partner for Fnatic, allowing the organization to utilize Blacklyte’s products for both competitive and training purposes. Furthermore, the two parties will collaborate on the development of content and exclusive, limited-edition products in the future.

- September 2023: Herman Miller (MillerKnoll), a global leader in furniture manufacturing, has entered into a strategic partnership with esports organization G2 Esports to co-develop a bespoke gaming chair. The collaboration has resulted in the creation of a limited-edition Herman Miller Gaming Embody chair, featuring exclusive G2 branding. A total of 250 units of this customized chair will be available for purchase through G2 Esports' official website.

- March 2022: Gamers can now experience enhanced seating comfort with the introduction of Argon, the world's first gaming chair featuring integrated cooling technology. Moreover, it is developed by Com4Gaming, a corporate start-up of the automotive supplier and thermal management specialist MAHLE.

Gaming Chair Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | PC Gaming Chair, Hybrid Gaming Chair, Platform Gaming Chair, Others |

| Materials Covered | PU Leather, PVC Leather, Others |

| Prices Covered | High-Range, Medium-Range, Low-Range |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| End Users Covered | Residential, Commercial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ace Casual Furniture, AK Racing Australia, Arozzi Gaming Distribution Inc., Corsair, DXRacer, GT Omega, Herman Miller, Inc., Noblechairs, Razer Inc., Secretlab, Thermaltake Technology Co., Ltd., ThunderX3, Vertagear, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the gaming chair market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global gaming chair market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the gaming chair industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market

Key Questions Answered in This Report

A gaming chair is a type of chair specifically designed to enhance the comfort and support of individuals who spend long hours gaming. These chairs are ergonomically designed to provide better posture, reduce fatigue, and prevent strain during extended gaming sessions. Gaming chairs typically feature adjustable components, such as armrests, backrests, seat height, and lumbar support, allowing users to customize the chair to their preferences.

The gaming chair market size is anticipated to reach USD 1.6 Billion in 2025.

IMARC estimates the global gaming chair market to exhibit a CAGR of 5.9% during 2025-2033.

The significant rise in remote and hybrid work culture, increasing prevalence of chronic disorders, expanding number of professional gamers, and increasing internet penetration.

In 2024, PC gaming chair represented the largest segment by type due to ergonomic design, customized for extended periods of gaming.

PU leather leads the market by material owing to its low price and durability. The material comes with the look and finish of real leather and resists wear as well as stain, allowing for its prolonged use.

The supermarkets and hypermarkets are the leading segment by distribution channel, driven by their ability to offer a diverse product range in a single location.

The residential is the leading segment by end user, fueled by the rising popularity of gaming as a hobby and the increase in remote working arrangements.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global gaming chair market include Ace Casual Furniture, AK Racing Australia, Arozzi Gaming Distribution Inc., Corsair, DXRacer, GT Omega, Herman Miller, Inc., Noblechairs, Razer Inc., Secretlab, Thermaltake Technology Co., Ltd., ThunderX3, Vertagear, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)