Gabapentin Market Report by Dosage Form (Tablet, Capsule, Oral Solutions), Type (Generic, Branded), Application (Epilepsy, Neuropathic Pain, Restless Legs Syndrome, and Others), Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Online Pharmacy), and Region 2025-2033

Gabapentin Market Overview:

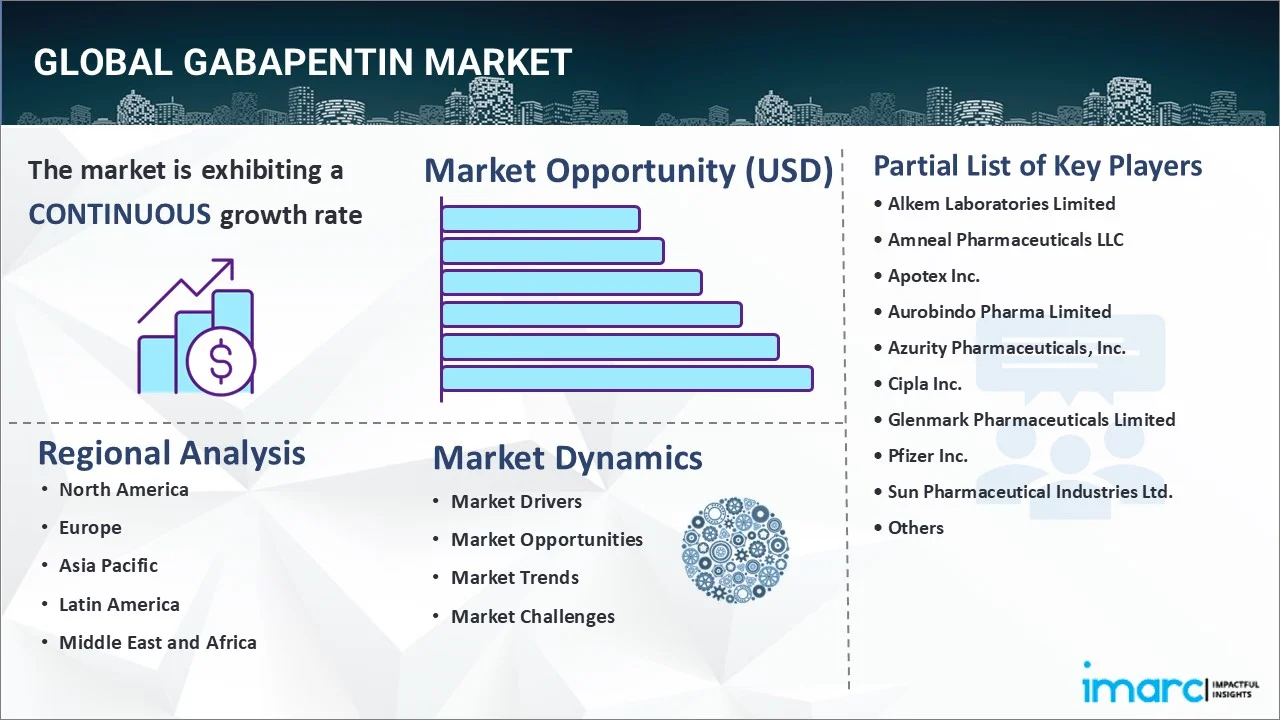

The global gabapentin market size reached USD 2.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.5 Billion by 2033, exhibiting a growth rate (CAGR) of 4.92% during 2025-2033. There are many factors that are driving the market, which include rising neuropathic conditions, increasing drug versatility in treating off-label drugs, ongoing opioid crises, favorable government policies, and technological advancements and ongoing research and development (R&D) efforts.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.3 Billion |

| Market Forecast in 2033 | USD 3.5 Billion |

| Market Growth Rate (2025-2033) | 4.92% |

Gabapentin Market Analysis:

- Major Market Drivers: One of the key market drivers include advancements in pharmaceutical research. Moreover, there is an increase in the geriatric population worldwide, which is acting as another growth-inducing factor.

- Key Market Trends: The rising prevalence of neuropathic pain, along with the enhanced product versatility, are main trends in the market.

- Geographical Trends: North America exhibits a clear dominance, accounting for the biggest market share owing to the well-established healthcare system and availability of health insurance and medical care programs.

- Competitive Landscape: Numerous players in the gabapentin industry are Alkem Laboratories Limited, Amneal Pharmaceuticals LLC, Apotex Inc., Aurobindo Pharma Limited, Azurity Pharmaceuticals, Inc., Cipla Inc., Glenmark Pharmaceuticals Limited, Pfizer Inc., Sun Pharmaceutical Industries Ltd., Teva Pharmaceutical Industries Ltd., Viatris Inc., Zydus Pharmaceuticals (USA) Inc. (Zydus LifeScience), among many others.

- Challenges and Opportunities: The availability of alternative therapies like other antiepileptic drugs and newer medications for neuropathic pain is a key market challenge. Nonetheless, the rising focus on pain management, along with collaborations and partnerships among key players, is projected to overcome these challenges and offer market opportunities.

Gabapentin Market Trends:

Increasing Prevalence of Neuropathic Pain

There is a rise in the incidence of neuropathic pain among individuals across the globe. Neuropathic pain is a complex, chronic pain state that typically follows conditions like diabetes, shingles, and certain types of injuries. Moreover, the market is growing because of the rising prevalence of shingles, which can result in post-herpetic neuralgia, a type of neuropathic pain. Additionally, the growing geriatric population is leading to a high rate of chronic conditions, necessitating effective treatment options, thereby catalyzing the gabapentin demand. The ability of gabapentin to offer relief with a relatively low risk of dependency makes it a preferred choice among clinicians as well as patients worldwide. The market is also growing as a result of the advancement of better diagnostic methods for neuropathic pain identification such as enhanced imaging technology. On 5 March 2024, Strides Pharma Science Limited received approval for gabapentin tablets USP, in strengths of 600 mg and 800 mg, from the United States Food & Drug Administration (USFDA). This announcement is a step towards expanding Strides' product portfolio and catering to the needs of patients suffering from neurological conditions.

Growing Product Versatility

The widespread utilization of gabapentin in treating off-label conditions such as anxiety disorders is contributing to the market growth. Physicians often prescribe gabapentin for conditions like restless leg syndrome, migraine prophylaxis, and various anxiety disorders. Besides this, several smaller-scale studies and clinical reports have cited its efficacy in reducing symptoms of anxiety, which is supporting the market growth. Furthermore, the growing drug utilization in substance abuse treatment programs including alcohol withdrawal management and as an adjunct in the treatment of opioid addiction is creating a positive gabapentin market outlook. Furthermore, key players in the market are receiving product approvals, which is impelling the market growth. For instance, on 29 March 2023, Granules India received approval from the US health regulator for its generic gabapentin tablets indicated for management of postherpetic neuralgia in adults. The approval by the US Food & Drug Administration (USFDA) is for the abbreviated new drug application (ANDA) for gabapentin tablets of strengths 600 mg and 800 mg.

Rising Product Utilization in Opioid Crises

The increasing opioid crisis is bolstering the gabapentin market growth. There is a rise in the utilization of gabapentin as an alternative to opioids since it is a safer option that offers an effective treatment for chronic and neuropathic pain without the opioid-associated risk of dependency. Moreover, governing authorities and healthcare organizations of various countries are encouraging the utilization of gabapentin as a frontline treatment for certain types of pain. Besides this, the increasing adoption of gabapentin as an alternative to opioids, particularly crucial in chronic care settings and among patients who require long-term pain management, is contributing to the market growth. Furthermore, the shift towards safer alternatives away from opioids is impelling the market growth. Besides this, top players in the market are gaining product approvals, which further impels the market growth. For example, on 27 June 2023, Sun Pharma got the go-ahead from the Subject Expert Committee (SEC) functional under the Central Drug Standard Control Organization (CDSCO) to manufacture and market gabapentin extended released (ER) tablets 300mg/600mg for the treatment of neuroleptic pain as an additional indication.

Gabapentin Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on dosage form, type, application, and distribution channel.

Breakup by Dosage Form:

- Tablet

- Capsule

- Oral Solutions

Capsule accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the dosage form. This includes tablet, capsule, and oral solutions. According to the report, capsule represented the largest segment.

Compared to tablets, capsules are usually simpler to swallow, which is particularly useful for elderly patients or those who have swallowing issues. Gabapentin capsules are made to dissolve and absorb quickly in the gastrointestinal system. Because of their quick start of action, they are especially helpful for illnesses like acute neuropathic pain episodes or seizures that call for speedy alleviation. In addition, capsules frequently come in different strengths, enabling personalized dosing based on each patient's requirements. This helps medical professionals optimize treatment programs while enhancing patient results. The industry is also being supported by consumers' preferences for capsules over other dose forms like tablets or liquids because of their tasteless nature and ease of consumption. Furthermore, capsules have a longer shelf life and are less sensitive to environmental factors like humidity compared to other forms like oral solutions, which makes them more convenient for suppliers and end-users and can provide a positive gabapentin market forecast.

Breakup by Type:

- Generic

- Branded

Generic holds the largest share of the industry

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes generic and branded. According to the report, generic represented the largest segment.

Generic gabapentin is far more affordable than its branded equivalents, making it more accessible to a larger patient population. To ensure their efficacy, generic copies of pharmaceuticals exhibit bioequivalence to branded counterparts by providing identical active component, potency, dosage form, and method of administration. In addition, the market is expanding due to the wide availability of generic medications, which are produced by several producers. In addition to this, many healthcare insurance plans encourage or mandate the use of generic medications as first-line treatment options in their formularies, incentivizing healthcare providers and consumers to opt for generic gabapentin. Apart from this, the increasing focus on healthcare affordability, encouraging consumers to become more knowledgeable about generic drugs' efficacy and cost benefits is contributing to the market growth.

Breakup by Application:

- Epilepsy

- Neuropathic Pain

- Restless Legs Syndrome

- Others

Epilepsy represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes epilepsy, neuropathic pain, restless legs syndrome, and others. According to the report, epilepsy accounted for the largest market share.

The efficacy of gabapentin in managing seizures, makes it a trusted option among healthcare providers. Gabapentin is often used as an adjunctive therapy along with other antiepileptic drugs, allowing clinicians to better tailor treatment regimens for individual patients. It has a relatively mild side-effect profile that makes it a preferred option for long-term treatment plans and contributes to higher patient adherence. Moreover, it is effective in pediatric populations to treat partial seizures, further enlarging its market share within the epilepsy segment. Furthermore, it is effective in managing various types of seizures including partial seizures and generalized seizures, which is increasing its applicability and making it a go-to option for multiple epilepsy subtypes. Apart from this, the widespread availability of generic versions makes gabapentin a cost-effective solution, facilitating its general use in treating epilepsy.

Breakup by Distribution Channel:

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

Hospital pharmacy exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hospital pharmacy, retail pharmacy, and online pharmacy. According to the report, hospital pharmacy represented the largest segment.

The increasing utilization of gabapentin in hospital pharmacies, especially for conditions like epilepsy or severe neuropathic pain, as doctors prefer to prescribe the medication where it can be closely monitored initially, is supporting the market growth. Hospital pharmacies are often highly regulated and subject to stringent quality control measures, ensuring that the medication dispensed is stored correctly and is of the highest quality. Moreover, the immediate availability of drugs for acute conditions that require prompt medication, makes hospital pharmacies a preferred distribution channel in urgent situations. These pharmacies are part of an integrated care system, where prescriptions can be filled immediately following a consultation or treatment, offering convenience to patients and ensuring medication adherence.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest gabapentin market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for gabapentin.

North America has a highly developed healthcare system that accommodates extensive medical research and drug development programs. Moreover, the growing consumer awareness about healthcare and medication options due to the emphasis on health is offering a positive market outlook. Apart from this, the competitive generic pharmaceutical sector in the region promotes the use of cost-effective medications, thereby increasing the gabapentin market value. Furthermore, North America invests heavily in pharmaceutical research and development (R&D), allowing for constant innovation and new applications for drugs like gabapentin, broadening its market scope. Additionally, the wide availability of health insurance and medical care programs in the region helps to make medications like gabapentin more accessible to the population while increasing the usage rate. According to the IMARC Group, the United States health insurance market is projected to exhibit a growth rate (CAGR) of 3.9% during 2024-2032.

Competitive Landscape:

- The gabapentin market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the gabapentin industry include Alkem Laboratories Limited, Amneal Pharmaceuticals LLC, Apotex Inc., Aurobindo Pharma Limited, Azurity Pharmaceuticals, Inc., Cipla Inc., Glenmark Pharmaceuticals Limited, Pfizer Inc., Sun Pharmaceutical Industries Ltd., Teva Pharmaceutical Industries Ltd., Viatris Inc., and Zydus Pharmaceuticals (USA) Inc. (Zydus LifeScience).

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- The leading companies in the market are investing in R&D activities to discover new applications for gabapentin and improve its formulation. They are entering emerging markets where the healthcare infrastructure is developing, offering growth potential due to rising healthcare needs. Moreover, some firms are acquiring or partnering with other companies to expand their product portfolios or to accelerate the R&D process, aiming to combine expertise and resources as well as enhance their gabapentin market revenue. Furthermore, many pharmaceutical companies are producing generic versions of gabapentin, allowing them to quickly capture a share of the market due to the lower cost of generic medications. Key companies are also working on improving the quality of gabapentin by adopting the latest manufacturing techniques, ensuring compliance with regulatory guidelines, and undertaking rigorous quality checks. For instance, on 18 September 2023, Adalvo announced the launch of gabapentin ER 300/600 mg in South Korea, in collaboration with its sister company, Lotus. The product is based on the reference brand, Neurontin Hard Capsule 300mg, and Neurontin Film Coated Tablet 600mg, and would be used in the treatment of postherpetic neuralgia (PHN), offering significant patient convenience with one daily dosing.

Gabapentin Market News:

- 25 January 2024: Zydus Lifesciences Limited secured the final approval from the United States Food and Drug Administration (USFDA) for manufacturing and marketing gabapentin tablets (once-daily), available in 300 mg and 600 mg variants. Gabapentin is primarily prescribed for managing postherpetic neuralgia, and Zydus will produce these tablets at its Moraiya-based formulation manufacturing facility in Ahmedabad. In line with this, the company also said that this adds to Zydus’ record, comprising 384 approvals and over 448 filed abbreviated new drug applications (ANDAs).

Gabapentin Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Dosage Forms Covered | Tablet, Capsule, Oral Solutions |

| Types Covered | Generic, Branded |

| Applications Covered | Epilepsy, Neuropathic Pain, Restless Legs Syndrome, Others |

| Distribution Channels Covered | Hospital Pharmacy, Retail Pharmacy, Online Pharmacy |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alkem Laboratories Limited, Amneal Pharmaceuticals LLC, Apotex Inc., Aurobindo Pharma Limited, Azurity Pharmaceuticals, Inc., Cipla Inc., Glenmark Pharmaceuticals Limited, Pfizer Inc., Sun Pharmaceutical Industries Ltd., Teva Pharmaceutical Industries Ltd., Viatris Inc., Zydus Pharmaceuticals (USA) Inc. (Zydus LifeScience), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global gabapentin market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global market?

- What is the impact of each driver, restraint, and opportunity on the global market?

- What are the key regional markets?

- Which countries represent the most attractive market?

- What is the breakup of the market based on the dosage form?

- Which is the most attractive dosage form in the market?

- What is the breakup of the market based on the type?

- Which is the most attractive type in the market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the market?

- What is the breakup of the market based on the distribution channel?

- Which is the most attractive distribution channel in the market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global gabapentin market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the gabapentin industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)