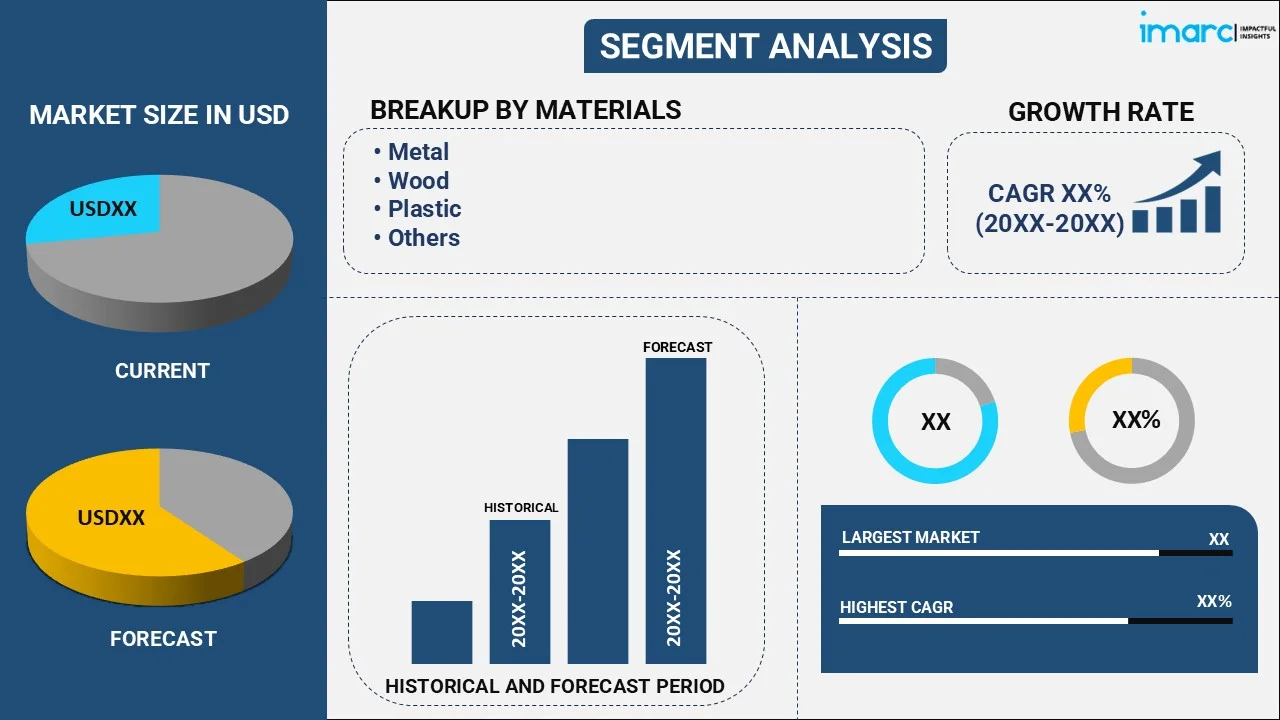

Furniture Market Report by Material (Metal, Wood, Plastic, Glass, and Others), Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online Stores, and Others), End Use (Residential, Commercial), and Region 2025-2033

Furniture Market Statistics Worldwide:

The global furniture market size reached USD 664.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 707.5 Billion by 2033. The increasing demand for ergonomic office chairs and mattresses equipped with sleep-tracking technology, the rapid growth of online retail outlets, and growing partnerships between furniture producers and well-known designers and artists are some major factors contributing to the market growth. North America leads the worldwide market, accounting for the largest furniture market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 664.9 Billion |

| Market Forecast in 2033 | USD 707.5 Billion |

Furniture Market Analysis:

- Major Market Drivers: The furniture market forecast is significantly influenced by multiple factors, including increasing urbanization, growing disposable incomes of the population, and numerous changes in lifestyle. The development of consumer demand is stimulated by the migration of individuals to urban areas and the need to use furniture to equip houses, apartments, and commercial buildings.

- Key Market Trends: Nowadays, green materials including bamboo or reclaimed wood, and the multifunction of furniture solutions are gaining traction, due to the growing environment consciousness and smaller living spaces in urban areas. Moreover, online furniture retail is one of the rapidly developing industries, mostly owing to the convenience and the variety of options for a consumer.

- Geographical Trends: North America is dominating the furniture market demand due to affordable and excellent designer products. Over time, these areas will take second place and emerging markets. Apart from this, Asia-Pacific leads in production and consumption, owing to the rapidly urbanizing countries with fast-growing economies.

- Competitive Landscape: Some of the major market players in the furniture industry trends include Durham Furniture Inc., Haworth Inc. (Haworth International Ltd.), HNI Corporation, Inter IKEA Systems B.V. (Interogo Foundation), Kimball International Inc., Kohler Co., Masco Corporation, Okamura Corporation, Steelcase Inc., and Stickley Furniture Inc., etc. among many others.

- Challenges and Opportunities: The market is characterized by fierce competition, volatility in the prices of raw materials, and rapidly changing consumer preferences. These issues can be viewed as challenges and opportunities. Specifically, firms can develop new sustainable materials and utilize digital marketing strategies to expand to new customer segments. Moreover, entering emerging markets and launching additional products can help furniture companies reduce risks and benefit from new growth prospects.

Furniture Market Trends:

Sustainability and eco-friendly practices

Increasing individual awareness of environmental issues and their growing choice of responsible and ethical purchases is contributing to the market growth. In addition, furniture producers are dedicated to harvesting lumber and other resources from certified forests to reuse and recycle material, which is projected to enhance the furniture market sales. They are also utilizing environmentally responsible processes for production, such as water-based adhesives, low VOC finish, and low power consumption production processes which reduce the carbon footprint of the manufacturers. Besides this, various key players are also offering buy back services for furniture to promote sustainable living. For instance, IKEA in the US offers a Buy Back & Resell service to prolong furniture life, promote sustainability, and affordability by buying back used furniture for store credit and reselling them at a more affordable price.

Growth of the e-commerce industry

The other factors driving the growth of the market include the rapid expansion of online retail channels and the continuous rise of the e-commerce industry. As per the report published by the IMARC GROUP, the global e-commerce market size reached US$ 21.1 Trillion in 2023. At present, the market is anticipated to reach US$ 183.8 Trillion by 2032, exhibiting a growth rate (CAGR) of 27.16% during 2024-2032. The growing reliance of individuals on online shopping platforms, as it enables them to browse through a vast range of furniture, read reviews, compare prices, and purchase all from the comfort of their own homes without actually visiting stores, fuels the growth of the market. Additionally, the increasing popularity of augmented reality and virtual reality aids in boosting online furniture market revenue. Furthermore, numerous furniture companies have adopted a direct-to-customer model, eliminated intermediaries and selling directly to the customer at competitive prices.

Increasing demand for smart and advanced furniture

The rising preference among individuals to buy furniture that can be connected to their smartphones and other smart home applications is propelling market growth. For instance, such connections will enable, one to manage lighting, heating, and in-house entertainment systems regardless of the user's location.. Moreover, intelligent furniture helps save energy, increases comfort, and better understand the user's well-being. According to the National Library of Medicine, the adoption of height-adjustable desks (HAD) aids in minimizing sitting time during work, as longer sitting time is associated with the growing risk of all-cause mortality. A meta-analysis of 19 field-based trials and investigations reported the use of activity-permissive workstations, including HAD or treadmill desks that minimize sitting time in desk-based workers by approximately 77 minutes of sitting time per 8-hour workday and productivity.

Furniture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on material, distribution channel, and end use.

Breakup by Material:

- Metal

- Wood

- Plastic

- Glass

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes metal, wood, plastic, glass, and others.

Metal furniture has a polished finish and offers optimal durability as they are manufactured from aluminum, wrought iron, and steel. In addition, it is used in exterior settings owing to its resistance to elements.

Wood furniture is a classic option that never loses its appeal, due to its timeless charm, warmth, and natural beauty. According to the IMARC GROUP, the global wood furniture market growth is anticipated to reach US$ 413.5 Billion by 2032.

Plastic furniture is characterized by its lightness, affordability, and a vibrant range of color options. It is produced from materials such as polypropylene or polycarbonate.

Glass furniture is imbued with elegance, lightness, and spaciousness. It is suitable for several designs from modern, loft, and minimalist to classic. Along with this, glass creates an illusion of openness and lightness in the interior that is perfect for small rooms.

Breakup by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

Specialty stores hold the largest share of the industry

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, online stores, and others. According to the report, specialty stores accounted for the largest market share.

One-on-one customer service is available at specialty stores. Most of the time, employees will be able to provide a more specialized level of service based on the qualities consumers are searching. Many of these individuals are genuinely interested in their area of expertise and are eager to engage with customers who share their passion. Furthermore, customers frequently find many local, handmade, or other goods that they would not likely see in a big-box shop, which allows them to discover unique products and even diamonds in the rough they would not have otherwise.

Breakup by End Use:

- Residential

- Commercial

Residential represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the end use. This includes residential and commercial. According to the report, residential represented the largest segment.

The residential segment dominates the market due to rapid urbanization, the growth of single-person households, and changing family arrangements. Moreover, the basic human need for shelter and a desirable living space has caused an uptick in the demand for furniture across residential settings. More so, the growing global population and expansion in the construction and renovation of residential structures are boosting this market. In addition, the growing elderly population in the world has created a need for furniture that focuses on comfort and usability, including ergonomic chairs and adjustable beds. Besides, the emergence of remote work models and the need for a home office scene are positively influencing furniture market outlook. As per FORBES MAGAZINE, according to a March 2023 Pew Research Center report, 35% of workers in the United States with the option to work remotely do so full-time. An additional 41% use a hybrid work model, and most of these hybrid workers say they prefer their at-home environment to the office.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest furniture market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for furniture.

North America region is home to one of the most developed and efficient furniture manufacturing industries. It offers a diverse range of products that target different lifestyles from traditional, and modern, to high-end designs. Moreover, local manufacturing facilities are well-equipped with advanced technology, automation, and product quality control measures. This allows them to provide customers with long-lasting and sustainable furniture. Additionally, North America has a large retail base, including many furniture stores, showrooms, and e-commerce platforms. Furthermore, countries like the United States and Canada export their products to many regions worldwide. Besides, the growing popularity of remote working models is also escalating the demand for office furniture in countries like the United States. According to IMARC Group, the United States home office furniture market size reached US$ 6.2 Billion in 2023 and is expected to reach US$ 9.5 Billion by 2032, exhibiting a growth rate (CAGR) of 4.93% during 2024-2032.

Competitive Landscape:

- The furniture market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the furniture industry include Durham Furniture Inc., Haworth Inc. (Haworth International Ltd.), HNI Corporation, Inter IKEA Systems B.V. (Interogo Foundation), Kimball International Inc., Kohler Co., Masco Corporation, Okamura Corporation, Steelcase Inc., Stickley Furniture Inc., etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Currently, leading players in the market are carrying out strategies and creative designs to match the changing consumer tastes. Leading manufacturers such as IKEA, Ashley Furniture, and Wayfair are investing in technology, particularly virtual reality (VR) and augmented reality (AR) to create customer visualization when they intend to make purchases. Furthermore, the furniture market forecast indicates players are investing in units that can be fixed and self-assembled as the consumer’s taste develops in customizing everything around them. For instance, in September 2022, Durham Furniture Inc. collaborated with three-dimensional (3D) tech company Intiaro to focus on 3D strategy and tools with realistic features that improve the new website and retail experience.

Furniture Market News:

- In March 2022: BRC announced their latest open space office furniture, Islands, which is a collection of lockers, closed and open storage, and bases that work together to build media centers, meeting areas, permanent work areas, and lunch room stations.

- March 2024: Ashley Home, Inc., and Resident Home Inc. entered into a definitive agreement whereby Ashley Home, Inc., a branch of Ashley Global Retail, LLC, will acquire Resident Home Inc. With Ashley’s affiliated entity, Ashley Furniture Industries, LLC, Residents will benefit from enhanced sourcing and operational efficiencies, which are expected to support further expansion in its direct-to-consumer and wholesale operations.

Furniture Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Metal, Wood, Plastic, Glass, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| End Uses Covered | Residential, Commercial |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Durham Furniture Inc., Haworth Inc. (Haworth International Ltd.), HNI Corporation, Inter IKEA Systems B.V. (Interogo Foundation), Kimball International Inc., Kohler Co., Masco Corporation, Okamura Corporation, Steelcase Inc., Stickley Furniture Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global furniture market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global furniture market?

- What is the impact of each driver, restraint, and opportunity on the global furniture market?

- What are the key regional markets?

- Which countries represent the most attractive furniture market?

- What is the breakup of the market based on the material?

- Which is the most attractive material in the furniture market?

- What is the breakup of the market based on the distribution channel?

- Which is the most attractive distribution channel in the furniture market?

- What is the breakup of the market based on the end use?

- Which is the most attractive end use in the furniture market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global furniture market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the furniture market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global furniture market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the furniture industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)