Functional Shots Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2025-2033

Functional Shots Market Size and Share:

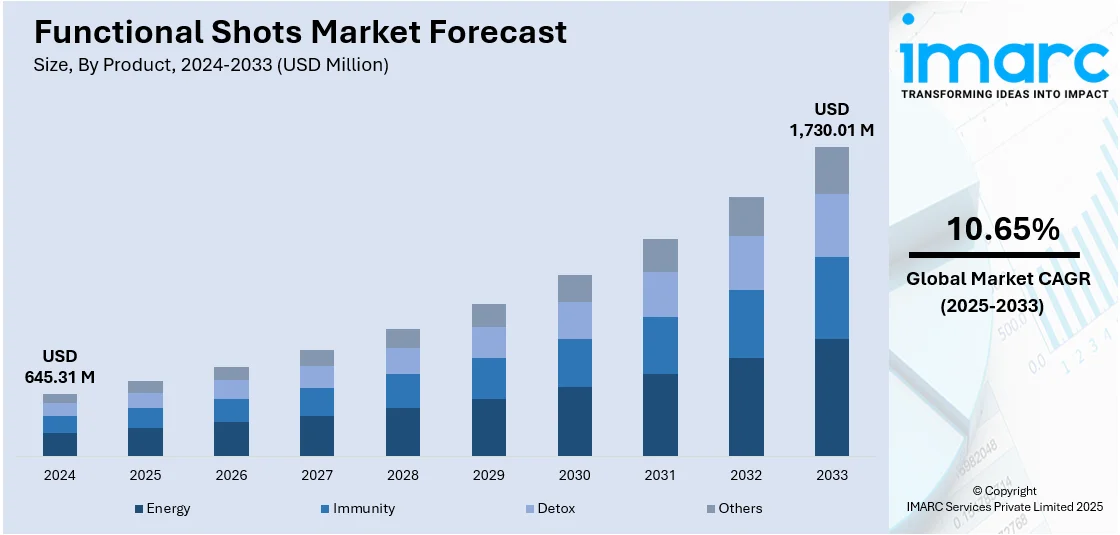

The global functional shots market size was valued at USD 645.31 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,730.01 Million by 2033, exhibiting a CAGR of 10.65% from 2025-2033. North America currently dominates the market, holding a market share of 35.0% in 2024. The market is witnessing robust growth, driven by increasing health consciousness and growing awareness of their benefits in supporting immunity, digestion, energy, and stress relief. Demand is further fueled by an aging population and a rise in chronic health conditions, which have intensified interest in convenient, preventive health solutions. The expansion of e-commerce platforms has enhanced accessibility, while ongoing innovation in flavors, ingredients, and formulations continues to attract a broader, health-focused consumer base, which in turn is propelling the functional shots market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 645.31 Million |

|

Market Forecast in 2033

|

USD 1,730.01 Million |

| Market Growth Rate 2025-2033 | 10.65% |

A prime driver for the functional shots market is increasing consumer emphasis on health, wellness, and convenience. As lifestyles continue to pick up pace and busy lives become the new normal, individuals are increasingly searching for easy, convenient means of maintaining their physical and mental health. Functional shots fill this demand with their concentrated doses of nutrient, vitamin, herb, and natural ingredients formulated to provide specific health benefits like energy, immunity, digestion, or stress relief. Their convenient and ready-to-drink packaging is attractive to consumers who are looking for instant health solutions and do not need to prepare them. The increasing awareness regarding natural and functional ingredients further encourages the consumers to incorporate these shots within their everyday health routine.

Functional shots market in the U.S. is growing rapidly because consumers increasingly desire easy, health-promoting beverages that fit individual needs. Driven by hectic lifestyles and an increase in preventive health consciousness, Americans are heading towards nutrient-dense shots—ranging from energy and immune-boosting to detox and cognitive-enhancing formulas—packaged in ready-to-consume formats. Clean-label, natural ingredients such as ginger, turmeric, elderberry, adaptogens, probiotics, and nootropics characterize these products. Though energy-driven shots lead the U.S. sales, immunity and detox formats are showing robust growth. Flavor innovation and formulation breakthroughs, coupled with broader distribution through convenience stores and online, keep market momentum going.

Functional Shots Market Trends:

Increasing health consciousness and awareness

The increased health consciousness and consumer knowledge of the advantages of incorporating functional shots into daily life are major factors propelling the global market for functional shots. In 19 Indian cities, 84% of respondents to a poll on consumer behavior conducted by Aditya Birla Health Insurance reported feeling more conscious of health and wellness issues during the pandemic. This is additionally complemented by the increasing demand for healthier living, in which customers look for easy and effective means of improving their overall health. Functional shots, due to their strong and nutrient-dense preparations, are attractive to people who focus on health, thereby complementing the functional shots market growth.

Impact of COVID-19

The importance of immunity-boosting medications has been brought to light by the current COVID-19 pandemic, which has had a major impact on the global market for functional injections. Globally, people are looking for items that can boost their immune systems, and functional injections frequently contain components like vitamins, minerals, and antioxidants that are proven to support immune function. Customers are actively searching for methods to increase their immunity in reaction to health difficulties, which has increased market demand and made functional injections a widely sought-after choice.

Burgeoning aging population and rising chronic health conditions

The market for functional injections is also driven by the aging population and the rise in chronic illnesses. According to WHO predictions, the global population of people 80 years of age and above would triple to 426 million between 2020 and 2050. Nutrition becomes a problem as people age, and functional injections that target specific health problems, such as joint health or mental function, become more appealing. In addition, consumers are looking for functional shots to supplement their therapeutic dietary practices because to the rising prevalence of chronic conditions including diabetes and cardiovascular disease.

Easy accessibility through e-commerce platforms

The global market for functional shots has grown tremendously as a result of the development of e-commerce platforms. Regardless of regional limitations, e-commerce provides customers with a quick and easy option to obtain a large selection of functional shot items. E-commerce sales forecasts for the first quarter of 2025 grew by 6.1% over the same time in 2024, surpassing the 4.5% growth in overall retail sales, according to U.S. Census Bureau News. Customers can now quickly search, compare, and buy functional shots because to the widespread use of internet shopping, expanding the market reach. In order to promote product availability and convenience for customers looking for functional shot solutions for their health and wellness needs, the driver emphasizes the significance of digitalization and online retail channels.

Functional Shots Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global functional shots market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product and distribution channel.

Analysis by Product:

- Energy

- Immunity

- Detox

- Others

Based on the functional shots market outlook, the energy segment leads in terms of market share with 46.8%, fueled by increasing consumer interest in fast-acting and effective energy-promoting solutions to keep pace with fast-moving, busy lifestyles. Busy consumers, particularly working professionals, students, and bodybuilders, look for immediate energy replenishment to remain focused, active, and productive during the day. Energy shots provide a convenient substitute for conventional caffeinated drinks, being portable, unprepared, and containing concentrated amounts of caffeine, vitamins, and adaptogens that act quickly. The increase in fitness and sporting activities, as well as greater use of screens and longer working hours, also contributes to the rise in energy shot demand. Their ubiquitous presence in convenience stores, gyms, and even online shopping websites also sustains their market leadership.

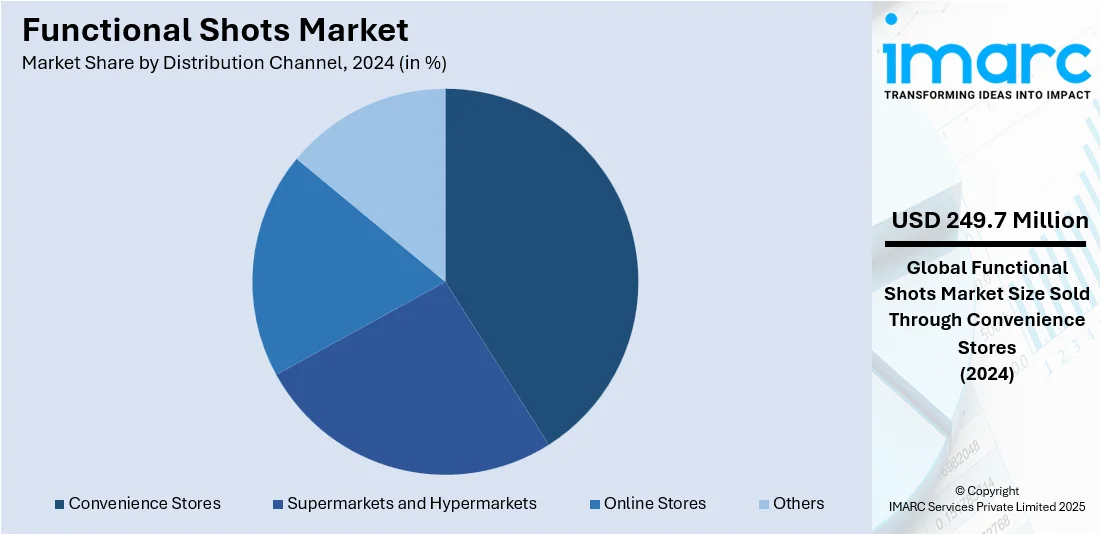

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

Convenience stores lead the functional shots market with a 38.7% share because of their ease of access, ubiquity, and compatibility with the on-the-go trend. They are the perfect fit for busy consumers looking for quick, convenient health options with no elaborate shopping or preparation involved. Functional shots, characterized by their smaller size and single-serve packaging, readily match this store setting, with impulse-buy opportunities on checkout counters or drink coolers. Additionally, convenience stores typically carry a full range of functional shots such as energy and immunity boosters and digestion aids serving diverse customer tastes. The stores' late-night and weekend operation hours add to their allure, making them the go-to channel for impromptu or last-minute wellness shopping.

Analysis by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

According to the functional shots market forecast, the North America holds the leading position in the functional shots market with a 35.0% market share, primarily driven by strong consumer awareness of health, wellness, and preventive care. The region's busy, fast-paced lifestyle encourages demand for convenient, on-the-go nutritional solutions such as functional shots that address energy boosting, immunity support, digestion, and mental clarity. Growing interest in natural, clean-label ingredients like adaptogens, probiotics, and herbal extracts further fuels product innovation. Furthermore, these products are widely available through a variety of distribution channels, including as supermarkets, convenience stores, and internet platforms, making them easily accessible to a large range of consumers. The region's market domination is also a result of marketing techniques that emphasize immunity, fitness, and cognitive function, making North America a major force behind the expansion of the global market.

Key Regional Takeaways:

United States Functional Shots Market Analysis

The focus on preventative healthcare and expanding wellness awareness are driving growth in the US functional shot market. Overall, a considerable increase from 42 percent in 2020 to over 50 percent of US consumers now say that wellbeing is a high priority in their daily life. These convenient, nutrient-rich beverages are popular among health-conscious individuals, particularly in urban areas with busy lifestyles. Additionally, the U.S. market benefits from widespread access to advanced retail infrastructure, including specialty health stores and digital platforms that support rapid product availability and consumer outreach. Innovation in ingredients and flavor combinations continues to fuel demand, with consumers increasingly seeking functional benefits like detoxification, immune support, and mental clarity. A significant institutional push toward health and nutrition is also reinforcing this growth. The presence of a tech-savvy population enhances the adoption of new product formats, including plant-based and adaptogenic formulations. Moreover, the fitness and gym culture prevalent across the U.S. further accelerates the consumption of energy-boosting and performance-enhancing shots. Influencer marketing and digital campaigns contribute significantly to brand visibility and consumer engagement. Altogether, these factors are shaping a robust functional shots market, poised for sustained expansion.

Europe Functional Shots Market Analysis

The functional shots market in Europe is expanding steadily, supported by a growing emphasis on sustainable consumption and clean-label preferences. European consumers exhibit a strong inclination toward natural and organic ingredients, prompting manufacturers to align formulations with ethical and transparent sourcing practices. A rising aging population across several European regions has contributed to the demand for functional products that support joint, heart, and cognitive health. The increasing adoption of flexitarian diets has also boosted interest in plant-based functional beverages. With 29% of Boomers, 27% of Gen X, 26% of Gen Z, and 28% of Millennials identifying as flexitarian, the flexitarian diet is reportedly cross-generational in Europe and reflects a widespread consumer shift toward healthier and more sustainable options. Regulatory support for fortified food products and enhanced consumer education around micronutrient deficiencies further stimulate the market. Functional shots are gaining prominence as part of holistic wellness routines, linked to mindfulness and balanced living. The growth of wellness tourism and retail chains presents opportunities for functional shot brands to connect with lifestyle-oriented consumers in Europe.

Asia Pacific Functional Shots Market Analysis

The Asia Pacific functional shots market is witnessing rapid growth, fueled by rising disposable incomes and increasing adoption of Western wellness habits. Urbanization and fast-paced lifestyles have prompted a shift toward compact, functional beverages that cater to energy, focus, and general well-being. The influence of traditional health practices and the region’s long-standing use of herbal and botanical ingredients provide a unique advantage for localized product development. The growing interest in sports nutrition and enhanced awareness about the importance of immunity and digestion are contributing to product diversification. Notably, 7 in 10 urban Indians experience gut health issues according to a recent survey conducted by Country Delight and the Indian Dietetic Association. Moreover, the expanding middle-class demographic is driving demand for affordable, yet effective health-enhancing solutions. Functional shots are increasingly being integrated into daily routines, particularly among younger populations who seek accessible health upgrades.

Latin America Functional Shots Market Analysis

Latin America's functional shots market is gaining momentum, propelled by rising health awareness and shifting consumer preferences toward preventive wellness. A growing segment of urban consumers is embracing functional beverages as part of a balanced lifestyle. The popularity of natural remedies and traditional health practices supports the acceptance of shots formulated with botanical and nutrient-rich ingredients. According to reports, Brazil’s USD 96 Billion wellness economy highlights the region’s growing alignment with global health and wellness trends, reinforcing consumer interest in innovative, functional formats. Additionally, the influence of fitness culture and evolving consumer habits around healthier food choices are prompting greater experimentation with wellness products. Marketing through local events and digital channels has further improved visibility and product uptake across the region.

Middle East and Africa Functional Shots Market Analysis

The Middle East and Africa region is showing a growing interest in functional shots, driven by a heightened focus ontic well-being and evolving consumer lifestyles. According to a report, wellness tourism is being prioritized to boost GDP contributions from 3% to 10% by 2030, creating an ecosystem that promotes health-focused products and services. Increasing participation in wellness-focused activities and rising health consciousness among younger demographics are key contributors to market growth. The appeal of convenience and the growing demand for functional hydration solutions are influencing product adoption. In addition, the emergence of wellness-oriented retail spaces and the rising popularity of dietary supplements in liquid form are creating new avenues for market expansion.

Competitive Landscape:

The functional shots industry's competitive environment is dominated by high innovation, high frequency of product launches, and a focus on clean-label, natural formulations. Manufacturers are innovating to create multifunctional shots that meet multiple health requirements like energy, immunity, digestion, and stress relief, targeting the increasing health-aware consumer base. The marketplace is also seeing high-level competition as companies try to differentiate based on novel blends of ingredients, organic or plant-based statements, and eco-friendly packaging. Distribution strategies themselves are changing, with growth across online channels, grocery stores, and convenience stores. In addition, marketing campaigns emphasizing scientific support, functional benefit, and lifestyle compatibility are key to achieving consumer trust and loyalty. This dynamic environment fosters ongoing development of products and responsiveness to changing consumer demands.

The report provides a comprehensive analysis of the competitive landscape in the functional shots market with detailed profiles of all major companies, including:

- AriZona Beverages USA

- EBOOST

- Hardcell LLC

- Hawaiian OLA

- Kuli Kuli Inc.

- Living Essentials LLC

- LXR Biotech LLC

- PepsiCo Inc.

- Royal Pacific Foods

Latest News and Developments:

- May 2025: Dallas-based Ryde: launched its 2-ounce wellbeing supplement shots nationwide, featuring Heidi Montag in a comedic campaign challenging extreme wellness trends. The shots targeted energy, focus, and relaxation using natural ingredients. Ryde: positioned its products as simple, effective, and convenient alternatives to complicated routines, available online and in select stores.

- May 2025: Plenish expanded its functional shots range by launching Kids Shots, Ginger Energy shots, and a new 420ml multi-serve dosing bottle. Kids Shots targeted children’s growth with essential vitamins, while Ginger Energy offered natural caffeine and vitamins. The launches aimed to drive category growth and attract new consumer segments.

- May 2025: Moju expanded into France via Carrefour, offering cold-pressed ginger and turmeric shots in multi-serve and on-the-go formats. Co-founder Charlie Leet-Cook highlighted the category’s early stage, emphasizing growth potential driven by consumer demand for convenience, quality ingredients, and health-focused products targeting busy adults and active younger consumers.

- February 2025: VIVID by Verita Health launched Multi-Vitamin Shots in sachet form for busy men and women in Thailand. The formulations targeted energy, immunity, and specific health needs, using ingredients like Coenzyme Q10, Korean red ginseng, and seaweed-derived minerals, offering convenient, on-the-go nutritional support for health-conscious consumers.

- January 2025: Vadasz, the UK’s top chilled kimchi brand, launched the first-ever naturally fermented Kimchi Shot, combining gut-health benefits with a savory, sugar-free flavor. The plant-based shot features live probiotics and fiber, targeting health-conscious consumers seeking convenient, functional, and natural on-the-go wellness options.

Functional Shots Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Energy, Immunity, Detox, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AriZona Beverages USA, EBOOST, Hardcell LLC, Hawaiian OLA, Kuli Kuli Inc., Living Essentials LLC, LXR Biotech LLC, PepsiCo Inc., Royal Pacific Foods., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the functional shots market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global functional shots market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the functional shots industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The functional shots market was valued at USD 645.31 Million in 2024.

The functional shots market is projected to exhibit a CAGR of 10.65% during 2025-2033, reaching a value of USD 1,730.01 Million by 2033.

The functional shots market is driven by growing consumer focus on health, wellness, and convenient nutrition solutions. Demand for products offering energy, immunity support, and stress relief fuels innovation in natural ingredients and flavors. Easy portability and quick consumption further increase their popularity among busy, health-conscious individuals.

North America currently dominates the functional shots market, accounting for a share of 10.65% due to strong consumer interest in health and wellness products, busy lifestyles favoring convenient nutrition, and widespread availability of innovative formulations. The region’s focus on clean-label, plant-based, and functional ingredients further supports the growth and popularity of functional shots across various demographics.

Some of the major players in the functional shots market include AriZona Beverages USA, EBOOST, Hardcell LLC, Hawaiian OLA, Kuli Kuli Inc., Living Essentials LLC, LXR Biotech LLC, PepsiCo Inc., Royal Pacific Foods., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)