Functional Fluids Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Functional Fluids Market Size and Share:

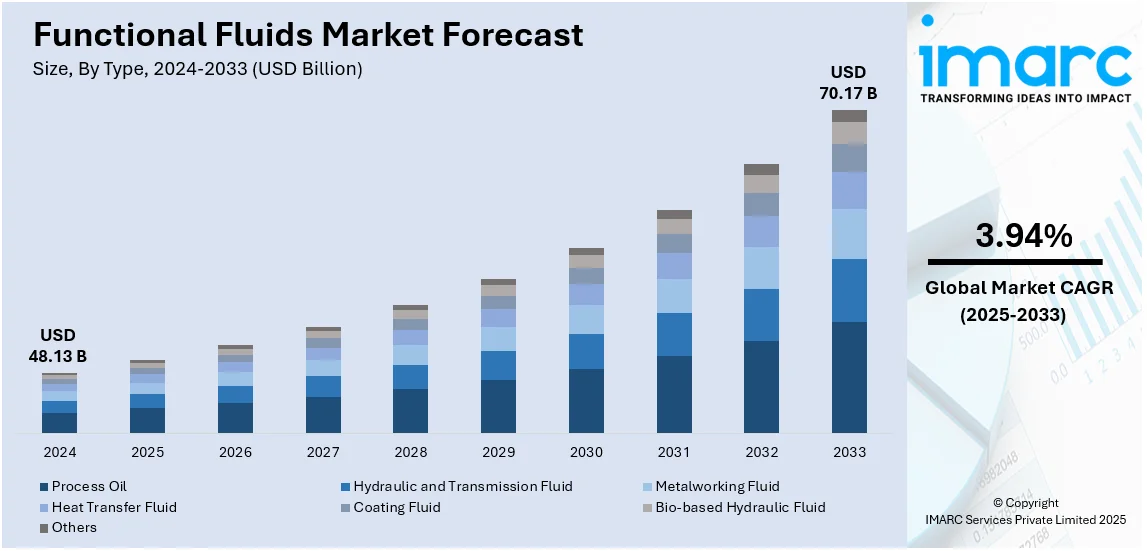

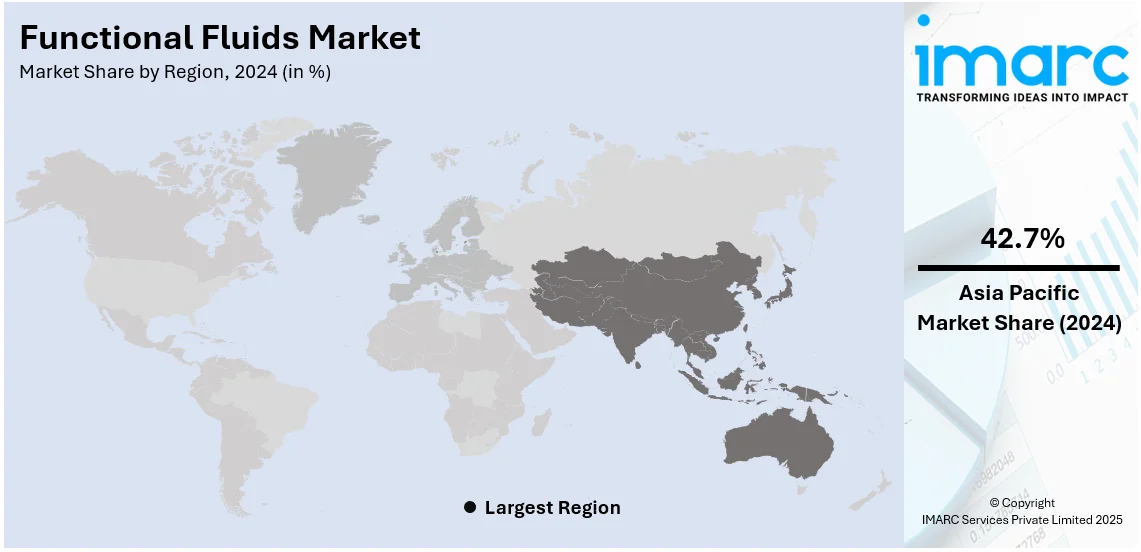

The global functional fluids market size was valued at USD 48.13 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 70.17 Billion by 2033, exhibiting a CAGR of 3.94% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 42.7% in 2024. The market is expanding due to rapid industrialization, expanding automotive production, and infrastructure growth. Additionally, strong demand from manufacturing, metal processing, and construction sectors, along with the widespread adoption of high-performance lubricants and environmentally friendly formulations, drives the functional fluids market demand in the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 48.13 Billion |

|

Market Forecast in 2033

|

USD 70.17 Billion |

| Market Growth Rate (2025-2033) | 3.94% |

The functional fluids market is growing due to rising industrial activity, increasing vehicle production, and manufacturing advancements. The automotive sector drives demand for high-performance lubricants, coolants, and transmission fluids to enhance efficiency and meet emission norms. Additionally, construction growth, fueled by infrastructure investments, boosts demand for hydraulic fluids and gear oils. This growth is contributing to the increasing the functional fluids market share, as industries seek advanced solutions for improved performance. Expanding industries like metal processing, power generation, and chemicals further support market expansion. Moreover, functional fluids reduce equipment wear, improve heat transfer, and enhance efficiency. The shift toward bio-based, eco-friendly fluids, driven by regulations and sustainability goals, is accelerating adoption, with industries prioritizing efficiency and durability in specialized formulations.

In the United States, the functional fluids market is growing due to a strong industrial base, increasing automotive production, and demand for high-performance lubricants. The country’s automotive sector is investing in fuel-efficient technologies, leading to greater use of advanced lubricants and transmission fluids. Rising infrastructure development and increased activity in metal processing and manufacturing industries are also driving the adoption of functional fluids, contributing to the functional fluids market share. Additionally, stricter environmental regulations are pushing manufacturers toward biodegradable and low-toxicity formulations to ensure compliance while maintaining performance. For instance, in September 2024, Chevron announced the launch of Clarity Bio EliteSyn AW, an advanced hydraulic fluid for the marine and construction industries. It meets strict environmental regulations with ≥90% renewable carbon while ensuring high performance, durability, and efficiency, supporting sustainability without compromising quality or operational standards.

Functional Fluids Market Trends:

Expansion in the Construction and Automotive Sectors

Significant growth in the construction and automotive industries is one of the key factors driving the growth of the market. The American Institute of Architects projects 4% growth in non-residential construction in 2024 after a 22% increase in 2023. In January 2024, privately-owned housing permits rose 8.6% year-over-year, indicating renewed growth. In line with this, the widespread adoption of automotive functional fluids, such as antifreeze and engine internal cleaner, that aid in maintaining the optimal performance of the vehicle components, is also contributing to the market growth. Furthermore, the rising demand for high-performance process oils in the industrial metal fabrication sector is providing a boost to the market growth. Functional fluids provide smooth surfaces to the processing unit and improve the performance of the equipment used for manufacturing polymers, fibers, and cables, representing one of the key functional fluids market trends.

Government Regulations and Sustainability Initiatives

The development of bio-based oil is acting as another growth-inducing factor. Owing to the implementation of stringent government regulations, manufacturers are developing environment-friendly functional fluids that are manufactured using vegetable oils. For instance, on December 19, 2024, the Indian government highlighted bioenergy growth initiatives, including the National Bioenergy Programme and Pradhan Mantri JI-VAN Yojana. Ethanol blending cut 557 lakh metric tonnes of CO2. INR 908 Crore supports 2G ethanol projects. "No-Go" areas reduced from 1,366,708 SKM to 24,832 SKM, augmenting exploration. Other factors, such as the increasing adoption of these fluids for packaging, printing, and manufacturing specialty paper, along with rapid industrialization across the globe, are projected to drive the market further, influencing the functional fluids market outlook.

Rising Demand in Industrial and Manufacturing Applications

The industrial sector’s need for high-performance functional fluids is growing, particularly in metalworking, polymer processing, and power generation. Process oils improve the performance of manufacturing units producing fibers, cables, and specialty polymers. Additionally, metal fabrication relies on advanced cutting and cooling fluids to enhance machining precision and reduce wear. Industrial expansion and rapid technological advancements are also fueling the adoption of heat transfer and dielectric fluids in energy systems. For instance, as per industry reports, China experienced continued manufacturing expansion with a 1.1% increase in the third quarter of 2024. Furthermore, with industries prioritizing efficiency and durability, the functional fluids market demand in equipment maintenance and process optimization continues to grow, supporting productivity across multiple high-performance manufacturing environments.

Functional Fluids Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global functional fluids market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and application.

Analysis by Type:

- Process Oil

- Hydraulic and Transmission Fluid

- Metalworking Fluid

- Heat Transfer Fluid

- Coating Fluid

- Bio-based Hydraulic Fluid

- Others

Process oil leads the functional fluids market share in 2024, fueled by its extensive use in manufacturing, polymer processing, and rubber production. It plays a crucial role in enhancing material properties, improving lubrication, and ensuring smooth processing in industries such as automotive, textiles, and plastics. The rising demand for high-performance materials, particularly in tire and polymer manufacturing, is accelerating market growth. Additionally, increasing environmental regulations are pushing manufacturers toward low-toxicity and sustainable process oils. Advancements in refining technologies are also improving the quality and efficiency of these oils, making them essential for modern industrial applications that require superior stability, reduced volatility, and enhanced compatibility with advanced materials.

Analysis by Application:

- Automotive

- Metals and Mining

- Construction

- Transportation

- Industrial Machinery

- Others

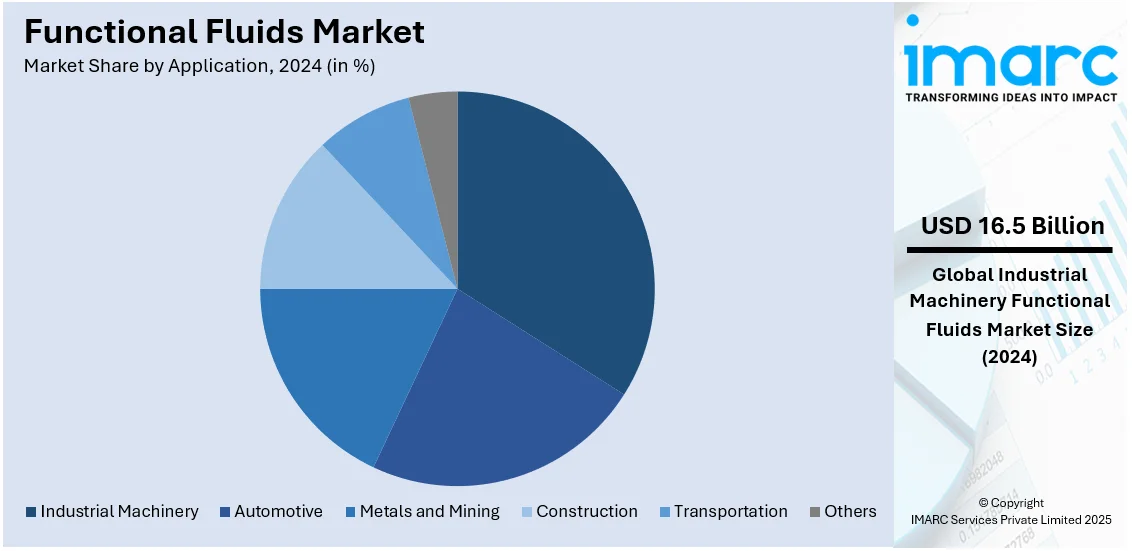

Industrial machinery leads the market with around 34.2% of market share in 2024, driven by rising manufacturing activities and technological advancements. Functional fluids, including hydraulic fluids, metalworking fluids, and heat transfer fluids, are essential for maintaining machinery efficiency, reducing wear, and enhancing thermal stability. Moreover, expanding industries such as metal fabrication, power generation, and chemical processing are increasing demand for high-performance fluids to improve equipment longevity and operational reliability. Additionally, the shift toward automation and precision engineering is driving the need for specialized lubricants and cooling fluids. With industrial expansion and stringent maintenance standards, the demand for functional fluids in machinery applications continues to grow, ensuring optimal performance and energy efficiency across manufacturing sectors.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 42.7%, propelled by rapid industrialization, expanding automotive production, and significant infrastructure investments. The region's strong manufacturing base, particularly in metal processing, power generation, and chemical industries, increases demand for high-performance lubricants, hydraulic fluids, and heat transfer fluids. Additionally, growing construction activities, supported by urbanization and government infrastructure projects, further contribute to the functional fluids market growth. Stricter environmental regulations and rising awareness of sustainable solutions are accelerating the adoption of bio-based and low-toxicity functional fluids. Furthermore, advancements in automotive technology and the push for fuel efficiency drive demand for specialized lubricants and transmission fluids, solidifying Asia-Pacific’s position as the dominant market for functional fluids globally.

Key Regional Takeaways:

United States Functional Fluids Market Analysis

In 2024, United States accounted for 83.20% of the market share in North America. The functional fluids market in the United States is growing due to strong demand from the automotive, aerospace, and manufacturing industries. Increased vehicle production and stringent emission regulations drive the need for high-performance lubricants and hydraulic fluids. The electric vehicle (EV) sector further accelerates the market, particularly with innovations in dielectric fluids for battery cooling. According to the U.S. Energy Information Administration, in 2Q 2024, U.S. electric and hybrid vehicle sales increased to 18.7% from 17.8% in 1Q24. Hybrid sales grew by 30.7% year over year, reaching 9.6% of the market, while plug-in hybrid sales rose to 2.0%. BEVs maintained a 7.1% share, with luxury EVs accounting for 32.8% of luxury vehicle sales. Luxury vehicles comprised 73.8% of BEV sales, 8.3% of hybrid sales, and 29.2% of plug-in hybrid sales. The oil and gas sector contributes significantly to the demand for drilling and transmission fluids, while bio-based alternatives gain traction due to sustainability goals. With advancements in industrial automation and machinery, the need for high-performance functional fluids in metalworking and heat transfer applications continues to rise. Key players focus on research and development (R&D) to meet changing efficiency and environmental standards, ensuring long-term market expansion.

North America Functional Fluids Market Analysis

The North America functional fluids market is expanding due to strong industrial growth, rising vehicle production, and increasing infrastructure development. For instance, according to industry reports, in 2024, motor vehicle production in North America totaled 15.6 Million units, reflecting a 9.6% increase from 2022. The automotive sector is a key driver, with demand for advanced lubricants, coolants, and transmission fluids to improve efficiency and comply with stringent emission standards. Moreover, expanding manufacturing activities, particularly in metal processing, power generation, and aerospace, further boost market demand. Stringent environmental regulations are also accelerating the adoption of bio-based and low-toxicity fluids. Additionally, technological advancements in synthetic lubricants and heat transfer fluids are enhancing equipment performance, driving market growth across industrial, automotive, and construction applications in the region.

Europe Functional Fluids Market Analysis

The functional fluids market in Europe is expanding, given the strict environmental regulations and a growing emphasis on sustainability and energy efficiency. The automotive sector, particularly in Germany, France, and the UK, significantly influences demand for lubricants, transmission fluids, and heat transfer fluids. The increasing adoption of electric vehicles (EVs) is driving research into advanced thermal management fluids. Germany produced 4.1 million passenger cars in 2024, maintaining the same levels as 2023, according to the German automobile association VDA. Domestic orders from German manufacturers rose by 12% year-over-year, with December showing a 35% increase. The industrial sector, including metal processing and manufacturing, also fuels the demand for functional fluids, with biodegradable and low-toxicity formulations gaining traction. The European Union’s carbon reduction policies drive innovation in synthetic and bio-based fluids, encouraging investments in circular economy initiatives that promote recycling and reuse, ensuring long-term market sustainability.

Asia Pacific Functional Fluids Market Analysis

Asia Pacific leads the global market, driven by rapid industrialization and strong automotive manufacturing in China, India, Japan, and South Korea. The expanding construction sector fuels demand for hydraulic and metalworking fluids, while urbanization supports growth in refrigeration and heat transfer applications. Furthermore, the rising middle-class population augments vehicle ownership, increasing demand for high-performance lubricants. Reports estimates the middle-class population in emerging markets will double from 354 million households in 2024 to 687 million by 2034, with China accounting for nearly 50%. India’s middle class will be than double in five years. In addition to this, China’s push for EV adoption fosters research into dielectric and thermal management fluids. Governments are promoting sustainable industrial practices, increasing demand for bio-based and low-emission functional fluids. Besides this, international companies are expanding their production capacities to meet growing domestic and export demand, ensuring sustained market growth.

Latin America Functional Fluids Market Analysis

Latin America's functional fluids market flourishes on demand from the automotive, mining, and oil and gas industries, especially in Brazil, Mexico, and Argentina. Expanding manufacturing and heavy industries drive the need for hydraulic and metalworking fluids, while increasing vehicle ownership augments lubricant consumption. The region's vast natural resources support growth, with Latin America and the Caribbean holding nearly 20% of global oil reserves, 25% of some strategic metals, and over 30% of the world’s virgin forests, according to a UN report. Natural resource-based activities contribute 12% of value added, 16% of employment, and 50% of exports. Environmental concerns encourage biodegradable and synthetic alternatives, while government regulations push for sustainable solutions. Companies invest in local production to reduce import dependency and improve supply chain efficiency.

Middle East and Africa Functional Fluids Market Analysis

The market in the Middle East and Africa (MEA) is propelled by the oil and gas sector, supporting demand for drilling fluids, hydraulic oils, and transmission fluids. Industrialization and infrastructure growth in the UAE, Saudi Arabia, and South Africa fuel have increased consumption of lubricants and heat transfer fluids. Although smaller than other regions, the automotive market is expanding, encouraging demand for engine and transmission fluids. Sustainability efforts and regulations promote bio-based and synthetic alternatives. For example, on November 26, 2024, Saudi Arabia launched its first national energy and petrochemicals committee under FSC. With USD 600 Billion in projected investments by 2030, it targets 50% renewable energy capacity and 75% local content. The petrochemical sector, producing 118 million tons annually, contributes 40% to Saudi Arabia’s GDP. Thus, favoring the market for functional fluids.

Competitive Landscape:

The market for functional fluids is very competitive, with major players focusing on product development, sustainability, and strategic alliances. Key players invest in state-of-the-art formulations to maximize performance and efficiency. Moreover, increasing demand for bio-based and low-emission fluids is fueling research and development activities. However, mergers and acquisitions, and joint ventures enhance market presence and increase global outreach. For instance, in May 2024, LEHVOSS Functional Fluids announced partnership to distribute Emery Oleochemicals products across Europe. The collaboration focuses on biogenic esters, primarily used in lubricants, greases, EV fluids, and metalworking fluids, under the DEHYLUB and EMEROX brands. Additionally, regional players compete by providing niche solutions customized for industrial and automotive uses. Besides this, regulatory compliance and sustainability objectives are informing market strategies, with producers focusing on environmentally friendly formulations to address the changing industry standards as well as customer expectations.

The report provides a comprehensive analysis of the competitive landscape in the functional fluids market with detailed profiles of all major companies, including:

- BASF SE

- BP International Limited

- Chevron Corporation

- Croda International Plc

- Exxon Mobil

- FUCHS PETROLUB SE

- Huntsman International LLC (Indorama Ventures Public Co. Ltd.)

- Idemitsu Kosan Co., Ltd.

- Petroliam Nasional Berhad (PETRONAS)

- Shell International B.V.

- The Dow Chemical Company

Latest News and Developments:

- January 2025: TotalEnergies Lubrifiants acquired Fluid Competence’s fire-resistant hydraulic fluid lines, Corsave and Lubsave, expanding its sustainable portfolio. These HFA and HFC-E fluids enhance safety in steel, mining, and tunneling. The acquisition supports TotalEnergies’ strategy to reduce its carbon footprint while improving operational reliability in high-temperature, high-pressure environments.

- November 2024: ABC Technologies announced an all-cash acquisition of TI Fluid Systems for EUR 1,831 Million. TI Fluid Systems, a global leader in thermal and fluid system solutions, operates in 27 countries. The merger enhances fluid system offerings for vehicle architecture, expands global reach, and strengthens ties with major automotive OEMs.

- September 2024: HT Materials Science (HTMS) raised USD 5.9 Million in Series A funding led by Saudi Aramco Energy Ventures (SAEV) and Progress Tech Transfer Fund. HTMS specializes in heat transfer fluid additives that improve energy efficiency in water and glycol systems. The funds will support manufacturing, projects, and global distribution expansion.

- June 2024: Perstorp and Intel’s Open IP Advanced Liquid Cooling team developed a synthetic thermal management fluid for AI data centers. Showcased at COMPUTEX 2024, the fluid enhances chip cooling from 500W to 1500W. It is PFAS-free, biodegradable, and supports future renewable sourcing. The collaboration improves data center efficiency and sustainability for next-generation AI chips.

- May 2024: HT Materials Science (HTMS) deployed Maxwell heat transfer fluid at Almatis GmbH’s Ludwigshafen plant in Germany. Maxwell increased the cooling system capacity by 20%, enhancing operational output. The nanofluid improves heat transfer efficiency, reducing maintenance and energy consumption.

Functional Fluids Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Process Oil, Hydraulic and Transmission Fluid, Metalworking Fluid, Heat Transfer Fluid, Coating Fluid, Bio-based Hydraulic Fluid, Others |

| Applications Covered | Automotive, Metals and Mining, Construction, Transportation, Industrial Machinery, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BASF SE, BP International Limited, Chevron Corporation, Croda International Plc, Exxon Mobil, FUCHS PETROLUB SE, Huntsman International LLC (Indorama Ventures Public Co. Ltd.), Idemitsu Kosan Co., Ltd., Petroliam Nasional Berhad (PETRONAS), Shell International B.V. and The Dow Chemical Company |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the functional fluids market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global functional fluids market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the functional fluids industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The functional fluids market was valued at USD 48.13 Billion in 2024.

IMARC estimates the global functional fluids market to reach USD 70.17 Billion in 2033, exhibiting a CAGR of 3.94% during 2025-2033.

The functional fluids market is driven by rising industrial activity, increasing vehicle production, and growing infrastructure development. The demand for high-performance lubricants, coolants, and hydraulic fluids is expanding across automotive, manufacturing, and energy sectors. Additionally, stricter environmental regulations and the shift toward bio-based, eco-friendly formulations are accelerating market growth and innovation.

Asia Pacific currently dominates the market, holding a market share of over 42.7% in 2024. This competitive edge is due to rapid industrialization, growing automotive production, and expanding infrastructure. Moreover, strong demand from manufacturing, power generation, and construction sectors, along with increasing adoption of high-performance and eco-friendly fluids, continues to drive market growth in the region.

Some of the major players in the functional fluids market include BASF SE, BP International Limited, Chevron Corporation, Croda International Plc, Exxon Mobil, FUCHS PETROLUB SE, Huntsman International LLC (Indorama Ventures Public Co. Ltd.), Idemitsu Kosan Co., Ltd., Petroliam Nasional Berhad (PETRONAS), Shell International B.V. and The Dow Chemical Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)