Functional Beverages Market Size, Share, Trends and Forecast by Type, Distribution Channel, End User, and Region, 2025-2033

Functional Beverages Market Size and Share:

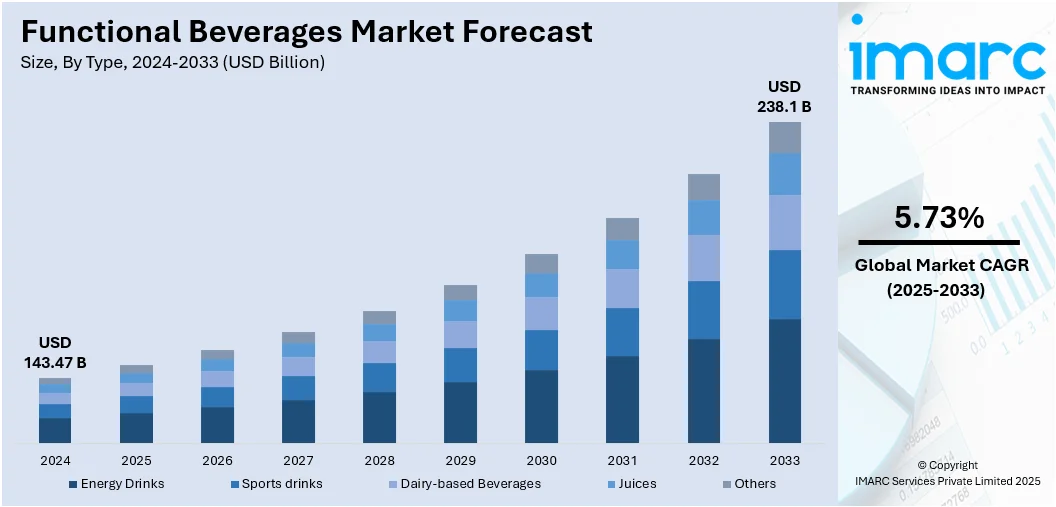

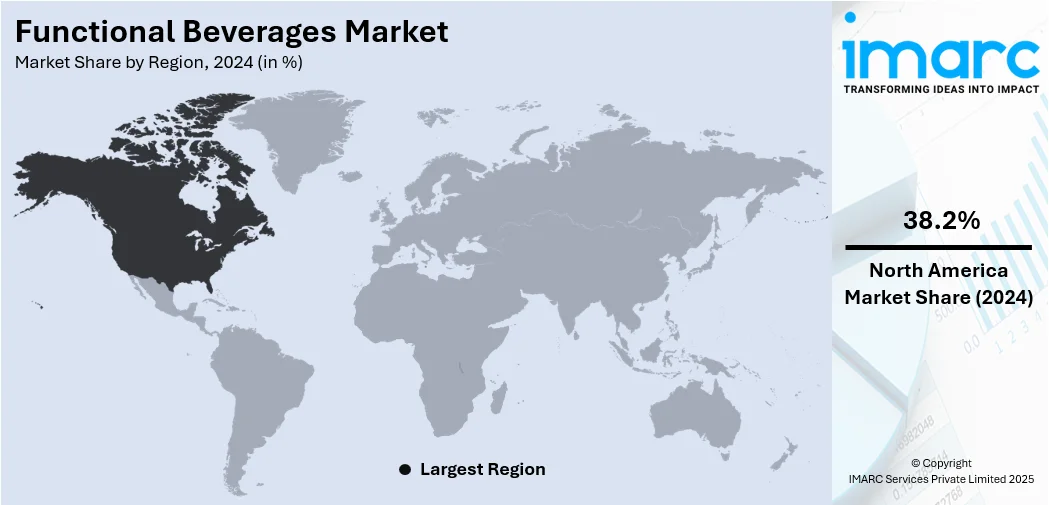

The global functional beverages market size was valued at USD 143.47 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 238.1 Billion by 2033, exhibiting a CAGR of 5.73% from 2025-2033. North America currently dominates the market, holding a market share of 38.2% in 2024. The dominance of the market is because of high consumer awareness about health benefits, strong purchasing power, advanced product innovation, widespread availability through organized retail, well-established distribution networks, and significant investment in research activities that supports continuous growth and competitive advantage in the sector, thereby influencing the functional beverages market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 143.47 Billion |

| Market Forecast in 2033 | USD 238.1 Billion |

| Market Growth Rate (2025-2033) | 5.73% |

Growing awareness about the connection between diet and overall health is encouraging consumers to choose beverages that provide nutritional and functional benefits. People are more informed about preventive health measures, seeking drinks that support immunity, mental focus, and physical performance, creating sustained demand for functional beverage options worldwide. Besides this, producers are creating sophisticated mixtures that integrate various health advantages into one drink. This involves enrichment with vitamins, minerals, adaptogens, and various bioactive substances. Ongoing advancements in ingredients, flavor, and texture enhances appeal, ensuring products remain relevant and attractive to diverse consumer groups with varying lifestyle needs. Moreover, a wider availability of various functional beverages in supermarkets, specialty shops, convenience stores, and online shopping sites is impelling the market growth. This broad scope enhances product availability and exposure, simplifying the process for consumers to buy functional drinks frequently.

To get more information on this market, Request Sample

The United States plays an essential role in the market, propelled by a robust fitness and wellness culture. Health-focused, busy individuals search for convenient options that integrate effortlessly into their active lifestyles. Functional beverages cater to these priorities, providing immediate, focused health advantages that correspond with the country's focus on performance, productivity, and sustained wellness. Furthermore, businesses in the country are creating innovative formulations and integrating distinctive functional components. Investments in research and development (R&D) are crucial, enabling swift adjustments to new health trends. This continuous innovation cycle keeps the market dynamic and maintains consumer interest through new flavors, benefits, and product formats. In 2025, Celsius launched CELSIUS HYDRATION™, its first caffeine-free functional beverage in the US, in zero-sugar powder stick format. It features electrolytes and B vitamins in five fruity flavors.

Functional Beverages Market Trends:

Increasing Geriatric Population and Health-Centric Consumption

The rising geriatric population is one of the key drivers fueling the market growth. Elderly people are emphasizing more on health, vitality, and independence, and this is catalyzing the demand for health-related beverages that enhance bone strength, cardiovascular well-being, digestion, and mental function. Functional drinks are specifically suited to this age group due to their focused nutrition levels, convenient consumption forms, and conformity to preventive health behaviors. The World Health Organization (WHO) projects that the total population aged 60+ will double and reach 2.1 Billion by the year 2050. With improvements in life expectancy, this consumer segment is growing, establishing a stable and expanding market base. Manufacturers are launching products specifically designed for the requirements of older adults, featuring mild yet potent ingredients and transparent, reliable labeling.

Innovation and Diversification in Product Offerings

Constant product innovation is a significant driver for the functional beverages market, where companies attempt to create new products that respond to specific health goals. This involves the addition of vitamins and minerals, probiotics, plant-based ingredients, and other bioactive compounds that deliver true benefits. Innovation also includes taste profiles, packaging configurations, and suitability for diet, making products more appealing to different target segments. Manufacturers can maintain relevance, increase brand loyalty, and attract new customers by regularly changing their products and paying close attention to new trends so they are not left behind in a rapidly changing and highly competitive market. For instance, in 2025, MANE DRINK introduced a Lion's Mane mushroom-infused nitro cold brew into the US market, with cognitive energy and concentration being its target. The beverage is available in two flavors, Café Noir (unsweet) and Café Vanille (lightly sweetened with monk fruit). It does not contain other mushroom coffees' distinctive bitter taste or jittery production with added sugars.

Expanding Availability Across Retail and Online Channels

The functional beverages market is growing rapidly as products are becoming increasingly available across diverse retail and digital platforms. Supermarkets, hypermarkets, convenience stores, and specialty health shops are expanding shelf space for functional beverages, recognizing rising consumer demand. At the same time, e-commerce platforms are playing a transformative role by offering wide product selections, subscription models, and doorstep delivery. Online retail is enabling smaller brands to compete with established players by directly reaching target consumers without geographic limitations. Digital marketing and social media campaigns are amplifying product visibility, making functional beverages more discoverable and accessible. The integration of data-driven personalization in e-commerce is further allowing brands to recommend functional beverages based on individual health goals, preferences, and lifestyle choices. This omnichannel expansion is strengthening access and accelerating adoption, ensuring that functional beverages are consistently present in both physical and digital shopping journeys. IMARC Gorup predicts that the global e-commerce market is projected to attain USD 214.5 Trillion by 2033.

Functional Beverages Market Growth Drivers:

Growing Demand for Premiumization

Functional beverages market is being driven by very strong growth, primarily driven by a growing consumer trend towards more health-benefiting beverages along with flavor. This shift reflects a greater awareness about wellness, as consumers actively seek out beverages that contribute to energy enhancement, immune system wellness, stress alleviation, and overall vitality. Premiumization is emerging as a significant trend, which is characterized by growing demand for better, innovative, and health-based products. Buyers are more willing to pay for beverages that contain natural ingredients, unique blends, and scientifically proven functional benefits, recognizing their value as more than just hydration.

Rising Popularity of Natural and Plant-Based Ingredients

The market for functional beverages is witnessing growth as consumers are preferring products made from natural, plant-based, and clean-label ingredients. Plant-based diets are gaining traction, driven by ethical, environmental, and health considerations. Functional beverages infused with botanicals, herbal extracts, adaptogens, and plant proteins are becoming highly appealing, particularly to younger demographics such as millennials and Gen Z. These consumers are associating plant-based ingredients with authenticity, sustainability, and superior nutritional value. The growing demand for dairy alternatives, such as oat, almond, and soy-based beverages, is further fueling this shift. Companies are responding by formulating beverages that combine plant-based bases with additional functional properties like protein enrichment or stress relief. The clean-label movement is reinforcing this trend, as consumers are increasingly avoiding artificial additives, preservatives, and synthetic sweeteners. As a result, natural and plant-based functional beverages are continuously gaining market share, positioning themselves as a long-term growth driver for the industry.

Increasing Demand for Convenience and On-the-Go Nutrition

The functional beverages market is driven by consumer lifestyles that are becoming increasingly fast-paced and mobile. Urbanization in emerging economies, long working hours, and busy schedules are leading people to seek convenient, ready-to-consume options that deliver both nutrition and functionality. Functional beverages are fitting this need by offering portable, single-serve packaging that allows consumers to consume health-boosting nutrients anytime and anywhere. This trend is particularly evident among working professionals, students, and fitness enthusiasts who are prioritizing efficiency without compromising on health. Energy drinks, protein shakes, and fortified waters are gaining traction as practical solutions for those balancing active routines. Retail formats such as convenience stores, vending machines, and online platforms are expanding accessibility, reinforcing the demand for on-the-go options. The appeal of functional beverages lies in their ability to combine practicality with health benefits, making them a preferred choice as consumers are continuing to integrate wellness into their everyday routines.

Functional Beverages Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global functional beverages market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, distribution channel, and end user.

Analysis by Type:

- Energy Drinks

- Sports drinks

- Dairy-based Beverages

- Juices

- Others

Energy drinks lead the market, accounting 53.2%, attributed to their high consumer attraction, immediate consumption advantages, and compatibility with energetic, performance-oriented lifestyles. They are well-known for providing instant functional advantages, making them a popular option for those looking for improved alertness and stamina. The category gains from ongoing product innovation, integrating enhanced formulations, a range of flavors, and functional components that address various consumer requirements. Robust brand awareness and focused marketing approaches are solidifying their status, fostering loyal consumer bases and consistent demand. Their presence in various retail outlets, such as supermarkets, convenience stores, and online platforms, facilitates easy access for consumers. The segment's ability to adjust to evolving preferences, along with appealing packaging and marketing efforts, maintains its significance and market presence. This dominance is expected to continue, with functional beverages market trends reflecting sustained demand for energy drinks driven by innovation, accessibility, and alignment with active consumer lifestyles.

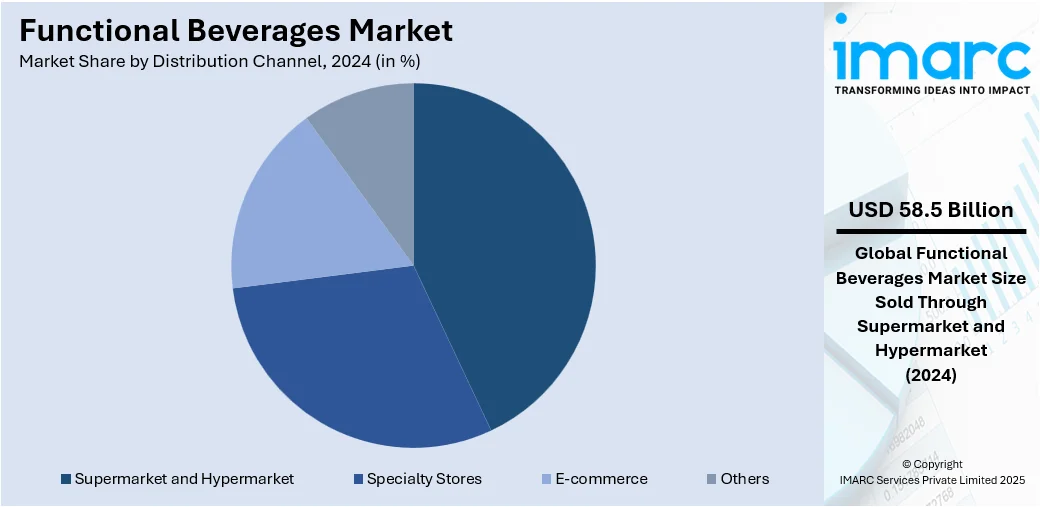

Analysis by Distribution Channel:

- Supermarket and Hypermarket

- Specialty Stores

- E-commerce

- Others

Supermarket and hypermarket hold the biggest market share with 40.8%, owing to their wide reach, structured retail framework, and capacity to provide a variety of products in one location. These stores offer shoppers easy access to various brands and product types, allowing for informed buying choices through transparent product presentations and comprehensive labeling. Their robust supply chains guarantee steady product availability, upholding buyer trust and satisfaction. Pricing strategies that are competitive, promotional strategies, and loyalty schemes help draw in a consistent user base. The spacious layouts and modern infrastructure of supermarkets and hypermarkets improve the shopping experience, promoting return visits. Their solid connections with manufacturers enable early access to new product releases, ensuring that offerings remain innovative and attractive. The blend of accessibility, diverse products, and improved buyer interaction positions supermarkets and hypermarkets as the foremost distribution channel in the functional beverages sector.

Analysis by End User:

- Athletes

- Fitness Lifestyle Users

- Others

Fitness lifestyle users represent the largest segment because of their continual commitment to health, physical performance, and overall wellness. This group of consumers exhibits a significant understanding about the advantages of functional beverages, proactively looking for items that enhance their exercise habits and dietary objectives. Their strong purchasing intent is supported by a willingness to invest in premium, specialized products that align with personal wellness objectives. The dedication of fitness lifestyle users to frequent consumption generates consistent market demand, promoting ongoing product innovation aligned with their requirements. The impact of fitness lifestyle enthusiasts goes beyond individual purchases, as their choices frequently influence larger market trends. Their involvement in wellness communities, along with a proactive stance on health management, improves brand recognition and fosters ongoing growth. This pattern is anticipated to persist, with the functional beverages market outlook indicating robust growth driven by the sustained influence and purchasing strength of fitness lifestyle users.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America dominates the market with 38.2%, because of its established infrastructure, sophisticated manufacturing capabilities, and a knowledgeable user base that actively pursues health and wellness products. The area enjoys significant purchasing power, allowing consumers to readily access high-quality products. Ongoing investment in research operations promotes creativity in formulations, packaging, and distribution, guaranteeing a consistent supply of attractive products. Broad retail networks, both in physical stores and online, guarantee widespread accessibility of products. In 2024, GURU Organic Energy launched its Zero Sugar line in the US via Amazon and Life Time, targeting the fast-growing sugar-free energy drink segment. The drinks were organic, contained no sucralose or aspartame, and offered natural caffeine with metabolism-boosting EGCG. Three flavors, including Wild Berry, Strawberry Watermelon, and Ruby Red, were part of the initial launch. Furthermore, marketing approaches are skillfully customized to meet varied consumer demands, boosting brand loyalty and potential for sustained functional beverages market growth.

Key Regional Takeaways:

United States Functional Beverages Market Analysis

In North America, the market portion held by the United States was 87.60%, supported by rising consumer interest in health-focused, convenient, and functional drink alternatives. The market is experiencing increased demand for functional waters, teas, and plant-based, lactose-free choices as individuals in the country are progressively looking for drinks that provide more than simple hydration, emphasizing extra advantages like boosted energy, better hydration, and support for digestion. Millennials and Gen Z lead this trend, fueling innovation in the industry with an expanding variety of healthier options that feature functional ingredients. Reports indicate that the total millennial, Gen Z, and younger generations made up 50.7% of the country's population in 2019. Ongoing investments from leading global firms in these areas ensure that the US functional beverages sector is set for ongoing expansion, presenting varied opportunities for both emerging and established brands. As interest in energizing, non-caffeinated beverages are growing, the sector is quickly adapting to fulfill varied and specialized consumer needs.

Europe Functional Beverages Market Analysis

In Europe, the market for functional drinks is progressing consistently, driven by increasing awareness about preventive health and longevity. Consumers are progressively adopting beverages that enhance heart health, joint mobility, and bone durability into their habits, particularly within older age groups. A report from the Government of the Netherlands emphasizes that clean-label products are set to lead the European food and beverage sector, with predictions that they will make up more than 70% of company portfolios by 2025 and 2026. This change is strengthening the demand for drinks derived from natural components. The emphasis on bioactive compounds from natural sources is increasing interest in herbal infusions and enhanced botanical formulations. Moreover, the rising urban stress among the masses is catalyzing the demand for soothing drinks that are high in magnesium or contain herbal relaxants. Seasonal and climate changes in the area influence choices for immune-boosting drinks, especially in the winter months. Functional drinks are progressively viewed as integral to comprehensive wellness practices, intertwined with trends in fitness, mindfulness, and nutrition.

Asia Pacific Functional Beverages Market Analysis

The functional beverages market in the Asia Pacific is experiencing growth, supported by the growing health awareness and swift urban development. A study revealed that over half, approximately 67.3%, of Chinese citizens demonstrate elevated health awareness, underscoring the increasing desire for functional products throughout the area. A rise in the demand for energy-boosting beverages is clear among youth and working individuals with hectic lifestyles. Beverages formulated for skin health, beauty improvement, and anti-aging effects are becoming more popular, especially among beauty-conscious user groups. The area's deep-rooted knowledge of conventional health components encourages creativity with native tastes and herbal mixtures. Moreover, rising disposable income and a heightened interest in fitness culture are resulting in increased consumption of protein-rich and recovery-oriented drinks. As tech-savvy individuals interact more with digital wellness platforms, functional beverages are integrating into wider health-monitoring practices.

Latin America Functional Beverages Market Analysis

The market for functional drinks in Latin America is growing as people look for options that boost natural energy and strength. Items fortified with vitamins and antioxidants are gaining popularity, particularly those that promote everyday vitality and overall health. A significant shift is emerging towards drinks that support detoxification and metabolic equilibrium, catering to lifestyle modifications and health-conscious consumers. Natural components and regionally inspired formulas are becoming popular, providing cultural resonance while meeting contemporary health standards. Moreover, functional beverages are becoming more common in everyday life, particularly among younger groups prioritizing active and preventive habits. At present, there are 106 million individuals aged 15 to 24 residing in Latin America. The total population includes America and the Caribbean, accounting for up to 20%. This positive momentum is expected to continue, with the functional beverages market forecast predicting steady expansion supported by growing health awareness and a youthful, wellness-focused demographic in the region.

Middle East and Africa Functional Beverages Market Analysis

The market for functional beverages in the Middle East and Africa is growing due to the rising interest in products aimed at enhancing performance and promoting hydration. A regional report indicates that almost 50% of the population now participates in weekly physical activity, increasing from only 13%, while female involvement has risen significantly by 149%. This change in lifestyle habits is catalyzing the demand for drinks that enhance endurance, stamina, and recovery. Functional beverages that provide benefits for spiritual or mental clarity are gaining attention, resonating with holistic wellness views. Moreover, the growing influence of worldwide wellness movements is driving the demand for drinks enhanced with vital micronutrients and natural enhancers. As more people focus on enhancing their health daily, functional drinks are becoming integral to new wellness routines among various consumer demographics.

Competitive Landscape:

Major participants in the market are concentrating on product development, aiming for particular health and wellness advantages to cater to evolving consumer tastes. They are focusing on innovative formulations, natural components, and eco-friendly sourcing methods to improve product attractiveness. For example, in 2024, London-based start-up Adapt launched two science-backed functional beverages, including Adapt Focus and Adapt Relax, targeting cognitive clarity and relaxation. Formulated with clinically proven adaptogens like lion’s mane and reishi mushrooms, the drinks offered a caffeine- and alcohol-free approach to stress relief. The launch aligned with the growing demand for healthier, evidence-based alternatives in the functional beverage market. Besides this, businesses are broadening their influence via strategic alliances, collaborations, and mergers to enhance distribution channels and market visibility. Ongoing investment in research operations guarantees uniqueness, while initiatives to enhance packaging sustainability and operational efficiency bolster lasting competitiveness and brand allegiance.

The report provides a comprehensive analysis of the competitive landscape in the functional beverages market with detailed profiles of all major companies, including:

- Amway Corp.

- Monster Energy Company

- National Beverage Corp.

- Nestlé S.A

- Otsuka Pharmaceutical Co., Ltd.

- PepsiCo, Inc.

- Red Bull GmbH

- Suntory Holdings Limited

- The Campbell's Company

- Yakult Honsha Co., Ltd

Latest News and Developments:

- July 2025: NutriLeads launched Benicaros F&B, a new ingredient made from upcycled carrot pomace for food and beverage applications. It provides pH- and heat-stable, water-soluble support for gut and immune health at just one gram per day, enabling developers to achieve clean-label integration across various formats, including powders, bars, and dairy products.

- July 2025: O’Neill Vintners & Distillers launched Catalyst, a low-calorie, no-sugar energy drink infused with nootropics and B vitamins. With 120mg plant-based caffeine, Catalyst targeted health-focused consumers seeking sustained performance without sugar spikes, marking the company’s strategic expansion into functional beverages beyond wine and spirits.

- March 2025: Snoop Dogg partnered with Harmony Craft Beverages to launch Iconic Tonics, a range of cannabis- and adaptogen-infused functional drinks. Designed for wellness-minded consumers, the beverages aimed to deliver both flavour and health benefits, expanding Snoop’s growing portfolio of hemp-infused and functional drink brands across major U.S. retailers.

- March 2025: Benefit Juice launched a functional juice line addressing women’s health across menstruation, pregnancy, and menopause. Each variant, Menosupport, Wellness, and Pregnancy, was formulated with targeted vitamins and minerals, including B12, iron, and folic acid, to support cognitive, hormonal, and immune functions during various life stages, with a clean-label appeal.

- February 2025: Coca-Cola introduced Simply Pop, a prebiotic soda line under its Simply brand, containing 6g of prebiotic fiber, zinc, and vitamin C. With five fruity flavors, it targeted wellness-conscious consumers amid surging demand for gut-health beverages, competing with brands like Poppi and Olipop in the evolving functional soda space.

Functional Beverages Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Energy Drinks, Sports Drinks, Dairy-Based Beverages, Juices, Others |

| Distribution Channels Covered | Supermarket And Hypermarket, Specialty Stores, E-Commerce, Others |

| End Users Covered | Athletes, Fitness Lifestyle Users, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amway Corp., Monster Energy Company, National Beverage Corp., Nestlé S.A, Otsuka Pharmaceutical Co., Ltd., PepsiCo, Inc., Red Bull GmbH, Suntory Holdings Limited, The Campbell's Company, Yakult Honsha Co., Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the functional beverages market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global functional beverages market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the functional beverages industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The functional beverages market was valued at USD 143.47 Billion in 2024.

The functional beverages market is projected to exhibit a CAGR of 5.73% during 2025-2033, reaching a value of USD 238.1 Billion by 2033.

The functional beverages market is driven by rising health consciousness, the growing demand for products that offer nutritional benefits, and busy lifestyles boosting preference for convenient wellness options. The market also benefits from the increasing awareness about preventive healthcare, innovation in ingredients, and marketing strategies targeting specific health needs, along with expanding availability across diverse retail and online distribution channels.

North America currently dominates the functional beverages market, accounting for a share of 38.2%. The dominance of the market is because of high consumer awareness about health benefits, strong purchasing power, advanced product innovation, widespread availability through organized retail, well-established distribution networks, and significant investment in research activities that supports continuous growth and competitive advantage in the sector.

Some of the major players in the functional beverages market include Amway Corp., Monster Energy Company, National Beverage Corp., Nestlé S.A, Otsuka Pharmaceutical Co., Ltd., PepsiCo, Inc., Red Bull GmbH, Suntory Holdings Limited, The Campbell's Company, Yakult Honsha Co., Ltd, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)