Full-Service Carrier Market Size, Share, Trends and Forecast by Service, Application, and Region, 2025-2033

Full-Service Carrier Market Size and Share:

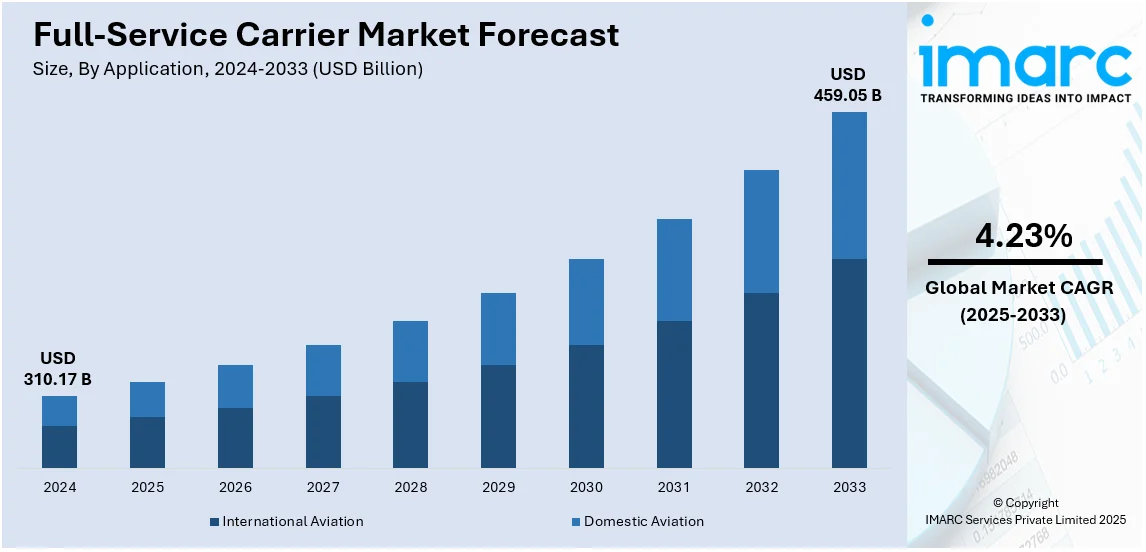

The global full-service carrier market size was valued at USD 310.17 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 459.05 Billion by 2033, exhibiting a CAGR of 4.23% from 2025-2033. North America currently dominates the market, holding a market share of over 34.0% in 2024. The growing advancements in the aviation industry and globalization of aviation business, increasing integration of implementation of biometrics and digital identification systems at airports, and rising number of strategic alliances and code-sharing agreements between aviation companies are some of the factors impelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 310.17 Billion |

|

Market Forecast in 2033

|

USD 459.05 Billion |

| Market Growth Rate (2025-2033) | 4.23% |

The full-service carrier market growth is primarily driven by the increasing global air travel, technological advancements, and shifting passenger expectations. Rising disposable incomes, particularly in emerging markets, are driving the demand for premium travel options with enhanced services. Moreover, business and leisure travelers continue to prioritize comfort, in-flight entertainment, and flexible ticketing, sustaining FSCs' appeal over budget alternatives. Investments in fuel-efficient aircraft and digital technologies, such as AI-powered customer support and improved connectivity, are optimizing operations and enhancing customer experiences. Furthermore, expanding airline partnerships, including alliances and code-sharing agreements, are strengthening global networks and revenue potential, further contributing to the growth of the full-service carrier market size.

In the United States, the market benefits from a strong business travel sector and the demand for international connectivity. For instance, as per industry reports, the number of United States's domestic flight passengers in 2024 is expected to surpass 2019 levels by 6%. Premium services and upgraded cabins attract high-yield travelers, while fleet modernization efforts improve fuel efficiency and cost control. These factors contribute to the expansion of the full-service carrier market share, despite challenges such as labor shortages, fluctuating fuel prices, and evolving regulations requiring proactive cost management and operational flexibility.

Full-Service Carrier Market Trends:

Technological Advancements and Innovation

Continuous advancements and innovations are supporting the market growth. Additionally, biometrics and electronic identification systems in air terminals are leading to streamlined check-in procedures at the terminal in order to decrease the waiting period. These technological advancements are critical for enabling FSCs to stay competitive and meet the evolving full-service carrier demands of modern travelers. Rapid integration of new technologies including advanced aircraft models and improved customer service platforms, is contributing to full-service carrier market growth. These improvements help to lower operating costs while also appeal to the eco-oriented travelers. In addition, by leveraging artificial intelligence (AI) and data analytics airlines are shifting how they manage customer relationships that also get new services tailored to them, such as never offered before. The global artificial intelligence market size was valued at USD 115.62 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 854.51 Billion by 2033, exhibiting a CAGR of 23.64% from 2025-2033. Lufthansa Innovation Hub, for example, launched AI assistant customer service chatbots in 2023 that expedited the business travel booking process.

Increased Global Travel Demand

The growing demand for global travel services is one of the key forces strengthening the market growth. The United Nations World Tourism Organization (UNWTO) reported that international tourism receipts reached USD 1.4 trillion in 2023. As a result, FSCs are positioned to benefit significantly. Moreover, as per the full-service carrier market insights, airlines are capitalizing on the growing middle class, particularly in emerging markets, where disposable incomes are rising, and people are increasingly opting for international travel. This trend is driving full-service carrier market demand, especially as business class travel rebounds, leading to higher demand for premium services. The change is evident in the product offerings of major airlines like Air India, which in 2024 unveiled a new A320neo aircraft with top-class luxury seating for business class and premium economy cabin features.

Strategic Alliances and Code-Sharing Agreements

Strategic alliances and code-sharing agreements are vital to FSCs because they allow them to expand while meeting the demand for convenient travel experiences. FSCs can offer passengers a wider range of destinations, smooth connections, and extra frequent flyer program advantages by partnering with other airlines. In 2023, Air India and Japanese airline All Nippon Airways signed a codeshare agreement to join their networks and provide more travel opportunities to customers of both the airline companies. UNWTO 2023 reports that international tourist arrivals reached approximately 235 Million in Q1, more than twice the number in 2022. In order to promote the development of these alliances and enable carriers to collaborate across national borders, regulators in some areas are also modifying the regulations. Additionally, they are giving these airlines greater chances to optimize fleet utilization and resource allocation, which improves operational efficiency and cost-effectiveness. These factors are shaping the full-service carrier market outlook, as partnerships continue to strengthen global connectivity, drive passenger convenience, and enhance revenue potential for FSCs.

High focus on business connectivity and corporate travel

The increasing globalization of business activities and the inter-twine nature of the global economy are catalyzing the need for business travel. With services such as business class seats, dedicated lounges, and convenient flight times, FSC providing companies are delivering the immediately required solutions for corporate travelers. Given the increasing number of businesses expanding globally, companies need efficient and reliable air transit more. FSCs capitalize on this by providing a more premium and convenient experience for corporate passengers. The addition of next-gen technologies such as in-flight internet further make corporate travelers choose advanced FSCs. As part of full-service carrier market trends, airlines are introducing premium business offerings to attract high-value travelers. IndiGo originally unveiled its ambitious bespoke business product, IndiGo Stretch, in 2024. It will become available on all of the aforementioned 12 key routes from Delhi.

Full-Service Carrier Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global full-service carrier market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on service and application.

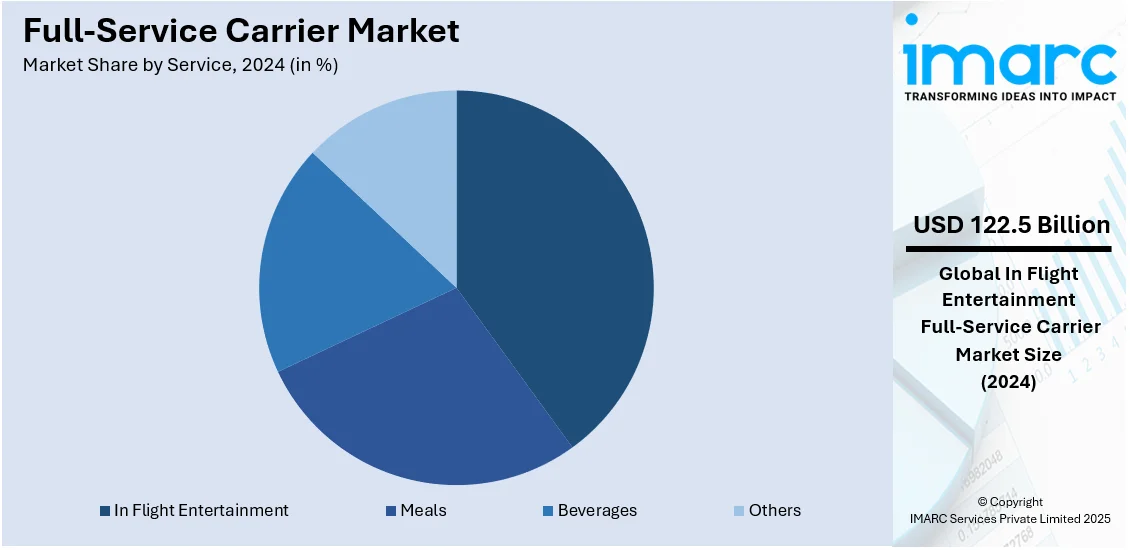

Analysis by Service:

- Meals

- Beverages

- In Flight Entertainment

- Others

In flight entertainment stand as the largest service in 2024, holding around 39.5% of the market. FSCs pay special effort to ensure a vast and up-to-date range of entertainment capabilities for their passengers. This includes individual seatback screens, a diverse selection of movies, television (TV) shows, music, and interactive games. High-quality IFE smoothens the overall flight experience and brings more pleasure to the travel process, thereby offering a favorable full-service carrier industry outlook. Advances in technologies such as the IFE platform have prompted FSCs to view it as not only a means of entertainment but also as a communication, information, and service-interface. In 2024, Air India announced the implementation of a manifold library of content for its modern IFE system. This system was designed to generate a captivating experience for passengers during a long-haul direct flight on the route.

Analysis by Application:

- International Aviation

- Domestic Aviation

Domestic aviation leads the market in 2024, highlighting the significance of full-service carriers in catering to the needs of passengers within a country. These carriers operate on shorter routes, connecting major cities and regions within a nation. Domestic flights are often characterized by frequent departures, high passenger volumes, and a focus on efficiency. FSCs in the domestic aviation segment offer a range of services, including premium cabins, to cater to both business and leisure travelers. The ability to provide a seamless and comfortable travel experience on short-haul routes is a key factor in offering a favorable full-service carrier market outlook. In 2024, India carriers added over 49 international routes to expand the domestic carriers’ network.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 34.0%. North America market is characterized by the presence of a well established aviation industry featuring major legacy carriers that operate extensive domestic and international networks in the region. The high demand for premium services offered by FSCs like business in first class seating is bolstering the market growth. According to the full-service carrier statistics, technological advancements in customer service, including the adoption of AI for personalized travel experiences and the installation of biometric systems for faster boarding processes, are enhancing customer satisfaction and loyalty. The market is also driven by strategic alliances and code sharing agreements, which are expanding root networks and presenting passengers with more travel options. For instance, in 2024, United announced the expansion of its global route network by adding new non-stop flights between New York/Newark-Marrakesh, Morocco; Tokyo/Narita-Cebu, Philippines and Houston-Medellin, Colombia.

Key Regional Takeaways:

United States Full-Service Carrier Market Analysis

In 2024, United States accounted for 87.5% of the market share in North America. The full-service carrier market in the United States is driven by growing consumer demand for premium services, expanding air travel post-pandemic, and increasing disposable income. The Federal Aviation Administration’s (FAA) Air Traffic Organization (ATO) handles over 45,000 flights and 2.9 Million passengers daily, covering more than 29 Million square miles of airspace, highlighting the scale of the market. Business travel recovery also contributes to the demand for full-service carriers, offering extensive flight networks, loyalty programs, and superior amenities. Innovations in in-flight experiences, such as enhanced connectivity, entertainment, and meal options, improve customer satisfaction. Moreover, continuous development of major airports and introduction of new routes foster growth. Robust competition among top carriers like Delta and American Airlines drives service enhancements and price adjustments, benefiting passengers. The industry is also focused on sustainability, with carriers adopting fuel-efficient fleets and eco-friendly practices to align with evolving consumer expectations. Long-haul international travel, particularly to key business hubs, further fuels growth. Government regulations and safety policies on air travel also influence market dynamics, positioning the U.S. full-service carrier market for steady growth in the years ahead.

Europe Full-Service Carrier Market Analysis

The full-service carrier market in Europe is experiencing robust growth, driven by rising international arrivals and urbanization. According to UN Tourism, in 2024, Europe saw 747 million international arrivals, marking a 1% increase from 2019 and a 5% rise from 2023, fueled by strong intraregional demand. Urbanization in key cities such as London, Paris, and Frankfurt is boosting travel demand, with these airports acting as vital hubs for connectivity and strengthening Europe’s aviation sector. With growing disposable incomes, travelers are seeking premium services, including luxury seating, in-flight connectivity, upscale lounges, and gourmet dining. Airlines like Lufthansa and Air France-KLM are investing in eco-friendly, fuel-efficient aircraft to meet sustainability targets while enhancing the passenger experience. Expanded business class options and loyalty programs cater to high-end customers, promoting customer retention and satisfaction. Digital services, such as biometric screening and self-check-ins, are improving efficiency and streamlining the customer journey. Strategic partnerships, such as Star Alliance, further extend the global reach of European carriers. These developments position Europe’s full-service carrier market for continued expansion, offering a premium, eco-conscious travel experience that meets the needs of increasingly affluent and demanding travelers. The combination of convenience, luxury, and sustainability is setting the stage for sustained market growth.

Asia Pacific Full-Service Carrier Market Analysis

The full-service carrier market in the Asia-Pacific region is buoyed by rapid economic growth and increasing middle-class affluence. According to reports, middle class has grown at 6.3% annually, reaching 338 Million people between 1995 and 2021. It now represents 31% of the population and is projected to rise to 38% by 2031 and 60% by 2047. This growing demographic, combined with rising disposable income, fuels greater demand for both leisure and business travel. Major economies like China and India continue to expand, contributing to higher international travel. Enhanced connectivity within the region and improvements in airport infrastructure support the development of full-service airlines. The competitive landscape also drives innovation, with airlines focusing on premium services, including in-flight connectivity, dining, and entertainment options. Additionally, government investments in modern airports and air traffic systems support the industry’s growth, ensuring that air travel becomes increasingly accessible and appealing to a larger number of consumers in the region.

Latin America Full-Service Carrier Market Analysis

The full-service carrier market in Latin America is expanding due to rising demand for both domestic and international air travel. As urban centers grow, there is an increasing need for air connectivity, which is driving investments in infrastructure. Additionally, the growth in disposable incomes has led to higher demand for premium services, particularly business-class travel. With 80% of the population living in cities, according to reports, urbanization is playing a key role in the expansion of this market, as more people in metropolitan areas seek convenient, high-quality travel options. These factors collectively contribute to the sustained growth of the airline industry in the region.

Middle East and Africa Full-Service Carrier Market Analysis

The full-service carrier market in the Middle East and Africa is supported by the region’s 64% urbanization rate, according to World Bank, driving higher demand for both domestic and international air travel. Urban centers’ increased access to air travel and ongoing investments in modern airport infrastructure contribute to growth. The region’s focus on luxury travel services, including premium offerings and enhanced in-flight experiences, is further strengthening the market. This strategic emphasis on both business and leisure travel, along with advanced aviation infrastructure, positions the Middle East and Africa as a key player in the global aviation industry.

Competitive Landscape:

The full-service carrier market is highly competitive, driven by global airline alliances, regional dominance, and premium service differentiation. Carriers compete on route networks, in-flight experiences, loyalty programs, and operational efficiency. Market consolidation through mergers and strategic partnerships strengthens competitive positioning, while investments in fleet modernization and digital transformation enhance customer retention. For instance, in March 2024, LATAM introduced free Disney+ content on its LATAM Play inflight entertainment. This agreement covers 300 aircraft across 147 destinations in 25 countries, reflecting the digital expansion in inflight services. Profitability is affected by regulatory issues, fuel price volatility, and economic trends, necessitating cost-controlling measures. FSCs are constrained by competition from low-cost carriers to keep premium offerings in balance while reducing costs. Furthermore, sustainable aviation projects, such as alternative fuels and reducing carbon emissions are emerging as competitive drivers as environmental regulations become stricter.

The report provides a comprehensive analysis of the competitive landscape in the full-service carrier market with detailed profiles of all major companies, including:

- Air China Limited

- Air France

- All Nippon Airways Co. Ltd.

- American Airlines

- British Airways Plc (International Airlines Group)

- China Southern Airlines Company Limited

- Delta Air Lines Inc.

- Deutsche Lufthansa AG

- Emirates (The Emirates Group)

- Qatar Airways Company Q.C.S.C.

- Turkish Airlines

- United Airlines Inc.

Latest News and Developments:

- November 2024: Vistara merged with Air India, reducing India's full-service carriers to one from five in 17 years. Singapore Airlines, Vistara's 49% stakeholder, acquired a 25.1% stake in Air India post-merger. This marked the end of another Indian airline with foreign ownership since the 2012 FDI liberalization.

- February 2024: The new brand of ANA Holding Inc. for medium-haul international flights took the initiative of starting its service, with the hopes of attracting more foreign visitors to Japan.

- July 2024: Delta Air Lines and Riyadh Air have announced that they signed the Strategic Cooperation Memorandum of Understanding to provide increased benefits for travelers between North America, Saudi Arabia, and other destinations, boosting connectivity and services across both airlines' networks.

- November 2023: United Airlines, Lufthansa Group, and Deutsche Bahn launched a commercial partnership on November 22, 2023, enhancing connectivity between Germany and the U.S. United passengers can book integrated rail and air journeys via Frankfurt Airport with a single transaction, fare, and ticket. The agreement covers 25 German cities, Basel, and United’s U.S. hubs. Benefits include seamless check-in, priority baggage handling, MileagePlus mile accrual, and Deutsche Bahn lounge access.

- February 2023: Air India Group, under its Vihaan.AI transformation, integrated Air India and Vistara (full-service) and Air India Express and AirAsia India (low-cost). The group now operates only Air India and Air India Express to streamline operations and enhance service differentiation. This consolidation strengthens synergy between full-service and low-cost segments.

Full-Service Carrier Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Meals, Beverages, In Flight Entertainment, Others |

| Applications Covered | International Aviation, Domestic Aviation |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Air China Limited, Air France, All Nippon Airways Co. Ltd., American Airlines, British Airways Plc (International Airlines Group), China Southern Airlines Company Limited, Delta Air Lines Inc., Deutsche Lufthansa AG, Emirates (The Emirates Group), Qatar Airways Company Q.C.S.C., Turkish Airlines, United Airlines Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the full-service carrier market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global full-service carrier market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the full-service carrier industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The full-service carrier market was valued at USD 310.17 Billion in 2024.

IMARC estimates the global full-service carrier market to reach USD 459.05 Billion in 2033, exhibiting a CAGR of 4.23% during 2025-2033.

The market is driven by increasing air travel demand, higher disposable incomes, and strong corporate travel recovery. Advancements in fuel-efficient aircraft, digital services, and premium offerings enhance competitiveness. Expanding airline partnerships, infrastructure investments, and sustainability initiatives further support market expansion and long-term profitability.

North America currently dominates the market, holding a market share of over 34.0% in 2024. This competitive edge is due to strong business travel demand, extensive airline networks, and advanced aviation infrastructure. Additionally, high disposable incomes, frequent long-haul travel, and continuous investments in fleet modernization and digitalization further strengthen the region’s market dominance and growth potential.

Some of the major players in the full-service carrier market include Air China Limited, Air France, All Nippon Airways Co. Ltd., American Airlines, British Airways Plc (International Airlines Group), China Southern Airlines Company Limited, Delta Air Lines Inc., Deutsche Lufthansa AG, Emirates (The Emirates Group), Qatar Airways Company Q.C.S.C., Turkish Airlines, United Airlines Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)