Full Body Scanner Market Size, Share, Trends and Forecast by Technology, Application, and Region, 2025-2033

Full Body Scanner Market 2024, Size and Trends:

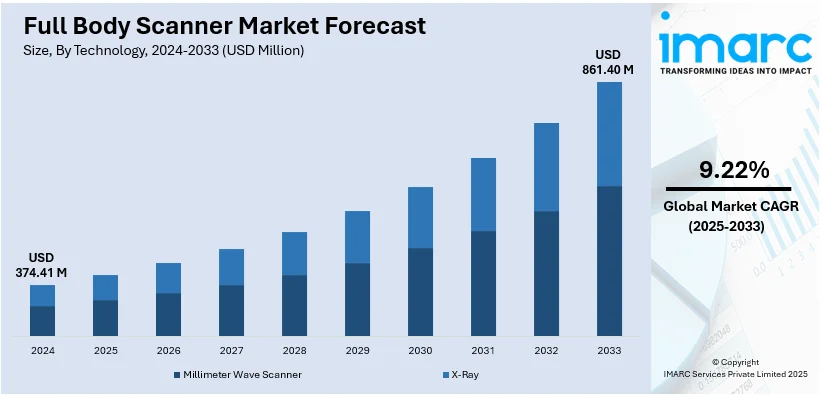

The global full body scanner market size was valued at USD 374.41 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 861.40 Million by 2033, exhibiting a CAGR of 9.22% from 2025-2033. North America currently dominates the full body scanner market share by holding over 32.0% in 2024. The full body scanner market share is expanding, driven by the heightened emphasis on border security and public safety, the increasing addition of artificial intelligence (AI) to improve the accuracy and efficiency of scanning, and the rising concerns about security and the threat of terrorism, particularly in high-security areas.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 374.41 Million |

|

Market Forecast in 2033

|

USD 861.40 Million |

| Market Growth Rate (2025-2033) | 9.22% |

At present, the growing security concerns due to rising threats, such as terrorism, criminal activities, and public safety risks create the need for advanced security solutions in airports, transportation hubs, and public venues. Besides this, technological advancements in scanning systems, such as the integration of millimeter-wave and backscatter technology, have improved detection capabilities, enabling the identification of concealed threats more accurately. Moreover, the increasing demand for faster and more efficient screening processes and high investments in infrastructure development across the globe contribute to the market growth. Apart from this, government regulations and heightened security protocols fuel the full body scanner market growth.

The United States has emerged as a major region in the full body scanner market owing to many factors. The market is driven by rising concerns over security threats like terrorism, organized crime, and smuggling, which encourage the use of advanced screening technologies in airports, government buildings, and high-risk public venues. With more people traveling by air, safety equipment, such as full body scanners, are in high demand. As per the data provided by the United States Department of Transportation, in October 2024, US airlines transported 82.8 million scheduled service passengers across both domestic and international routes. Government regulations and the requirement for complying with security standards further propel the market growth. Besides this, the shift towards contactless security solutions is promoting the employment of body scanners, as they offer a more efficient and non-invasive way to detect concealed items. Apart from this, significant investments in infrastructure development by both public and private sectors are bolstering the full body scanner market demand.

Full Body Scanner Market Trends:

Increased Fear of Terrorism and Security Issues

Rising terror threats and trafficking concerns have driven airports and transportation facilities to adopt full-body scanners as advanced security screening solutions. Public safety remains a key motivator for their implementation. Full body scanner sales are influenced due to the increased level of terrorism threats occurring around the globe and rising security concerns. Every single day, there are individuals or groups with malicious intent from all around the world trying to do unethical things at certain airports, government buildings, and key security-driven areas. These systems are compulsory nowadays for security reasons, as full body scanners can pinpoint when a person has any illegal material hidden in their body. The European Union (EU) revised its regulations to enforce limitations on next-generation C3 scanners for cabin baggage in 2024. In 2024, the UK government further revealed that it will provide various UK airports additional time to put in place security systems for improved and quicker screening procedures. In 2023, Smiths Detection also launched the HI-SCAN 6040 CTiX in India. Besides this, the increasing demand for advanced security systems, along with the compulsion to comply with safety standards is offering a favorable full body scanner market outlook.

Technological Advancements and Integration of AI

Continuous disruptions and critical innovations like imaging and AI are influencing the full body scanner market trends. In addition to this, full body scanners utilize advanced technology, including low-dose radiation, for effective people screening. Despite controversies surrounding radiation safety, research, and expert claims support their harmlessness, enabling steady technological advancements in security solutions. The integration of advanced systems inside full body scanners allows the devices to detect hidden objects more accurately and quickly so that fewer false alarms are generated while passengers can pass through checkpoints faster. The US Transportation Security Administration announced in a news release on January 12, 2024, that it processed over 858 million travelers in 2023, establishing a new record. These screeners stopped 6,737 firearms (93% of which were loaded), stopping various forms of contraband from entering secure zones at the airports and boarding planes. This showed how crucial it is to use full-body scanners to avoid emergencies.

Growing Adoption in Public Safety and Correctional Facility

Full body scanners are becoming more common in airports and their usage is extending further in other areas as well. They are widely employed in retaining public safety in correctional facilities, courthouses, and transit hubs. While initial resistance and protests against transmission X-ray scanners hindered adoption, increasing public safety demands and applications in correctional facilities have supported the gradual integration of these solutions. These are the places where the smuggling of weapons, drugs, and other contraband items is high, thereby making the use of full body scanners a necessary safety measure. The increasing number of institutions that have implemented whole-body scanners shows the heightened appreciation for these devices to maintain security and safety in general, with more attention being paid to this type of screening technology. In 2023, the Delhi Airport declared that full-body scanners would be installed by May 2024, along with CT X-ray (CTX) machines, enabling passengers to retain electronic devices in their hand luggage during security screenings.

Full Body Scanner Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global full body scanner market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology and application.

Analysis by Technology:

- Millimeter Wave Scanner

- X-Ray

- Backscatter X-Ray

- Transmission X-Ray

Millimeter wave scanner leads the market with 66.8% of the full body scanner market share in 2024. Millimeter wave scanners offer non-invasive features and the ability to detect any metal with high accuracy. Unlike traditional scanners, millimeter wave technology uses radio waves to create a 3D image of the body, which can highlight hidden threats without the need for physical contact. These scanners are fast, allowing security personnel to screen large crowds quickly, which is crucial in places like airports, stadiums, and government buildings. They also provide high detection accuracy, identifying weapons, explosives, and other contraband with minimal false alarms. Additionally, millimeter wave scanners are privacy-friendly because they do not reveal personal body details, only identifying objects on the body. Their advanced features, like automated threat detection, make them even more appealing. Millimeter wave scanners are easy to deploy in both fixed and mobile configurations, offering flexibility in use across different environments.

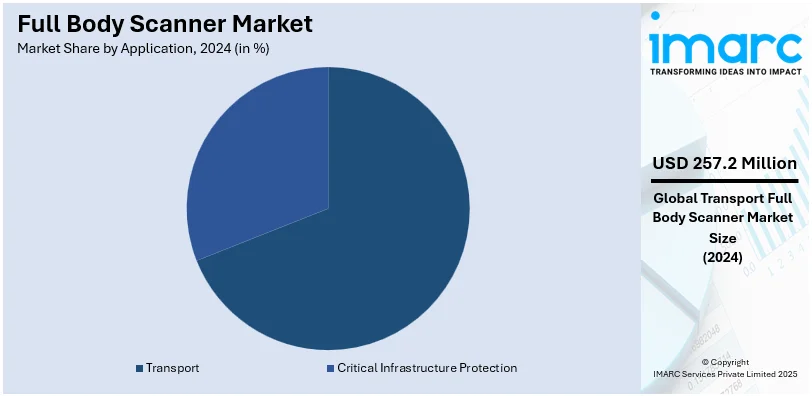

Analysis by Application:

- Transport

- Critical Infrastructure Protection

Transport leads the market with 68.7% of the market share. The growing need for tighter security at airports, train stations, bus terminals, and other transit hubs creates the need for full body scanners. With increasing worldwide travel, there is a greater focus on preventing threats like terrorism, weapons smuggling, and criminal activity. Full body scanners provide an efficient and non-intrusive way to screen large numbers of passengers quickly without causing delays. Airports, in particular, are critical areas, where security regulations require thorough and fast screening of passengers. Full body scanners are crucial for improving both security effectiveness and passenger experience. They can detect hidden weapons, explosives, and other contraband that might be missed by traditional methods. They also help to reduce the requirement for physical pat-downs, making the process smoother for travelers. As security concerns continue to increase, more transportation authorities are turning to these scanners to meet higher security standards and keep people safe while ensuring a smooth travel experience.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 32.0%. The market is driven by the high demand for advanced security solutions in public spaces like airports, government buildings, and transportation hubs. The United States has stringent security regulations, especially after past security threats, driving the adoption of full body scanners. Security agencies in the region wager on the latest technology to improve screening efficiency and ensure safety. There are also significant government investments in public safety infrastructure, which includes the widespread deployment of body scanners. Additionally, North America has a high focus on technological innovations. Companies in the region are constantly working on enhancing scanning technology to make it faster, more accurate, and more discreet. With the growing safety concerns, especially at high-risk venues like airports, public events, and government buildings, the demand for full body scanners continues to rise. In July 2024, The Texas Department of Criminal Justice chose LINEV Systems US to provide HEXWAVE millimeter wave full body scanners. The scanners will be utilized for security checkpoint screening at correctional institutions throughout Texas.

Key Regional Takeaways:

United States Full Body Scanner Market Analysis

The United States holds 88.60% share in North America. The US leads in the market since increased security threats have been occurring in commercial buildings, government sectors, and airport terminals. According to the information published on the TSA's official site, they are screening approximately 2.9 million travelers each day at their commercial airports, which generates a significant need for effective and efficient scanning systems. The commitment of the federal government to improve security protocols after 9/11 resulted in the introduction of advanced scanners, such as millimeter-wave and backscatter. Reports indicate that law enforcement agencies are progressively utilizing full body scanners to identify contraband in correctional facilities. They supervise over 18,000 police departments. According to the released statistics, the Transport Security Administration seized over 6,737 firearms in 2023, highlighting the necessity for enhanced screening technologies because of rising terrorism risks and smuggling incidents. The adoption is further promoted by innovations in non-intrusive technologies that increase productivity while maintaining privacy. The embedding of advanced technology in most high-security sites is further driven by investments in research and development (R&D) activities that are funded by public and private partnerships.

Europe Full Body Scanner Market Analysis

The rising adoption of stringent security laws for checking the increasing threats of terrorism and illegal trafficking is enabling the market in Europe to grow. The European Aviation Safety Agency states that more than 2,000 airports, which served over 950 million passengers in 2023, are required to accept enhanced screening protocols. It is used in various nations like the UK, Germany, and France because of their significant international hubs and large travel numbers. According to the guidelines of the Department for Transport, various airports in the UK, including Heathrow and Gatwick, have been updating their security systems so as to incorporate millimeter-wave scanners. In addition, according to the European Commission, full-body scanners are currently being set up at border control points throughout the 29-member Schengen area to improve efficiency in managing the 700 million yearly cross-border movements. Innovations are further driven by privacy-focused solutions that satisfy GDPR requirements and strengthened demand by the increasing use of public spaces, such as train stations, after high-profile security events.

Asia Pacific Full Body Scanner Market Analysis

The market for full body scanners in the Asia-Pacific region is expanding significantly as a result of the high security concerns, more air travel, and rapid urbanization. Airports in nations like China, India, and Japan are making significant investments in cutting-edge security equipment, leading to an expected 1.8 billion rise in the number of air passengers in the next 20 years, as per reports. China ranks among the top adopters, having more than 250 commercial airports as per reports, largely due to government initiatives, such as the "13th Five-Year Plan," which focuses on enhancing transportation security. India boasts nearly 150 active airports and is enhancing its infrastructure through the UDAN initiative, which employs advanced screening technologies to guarantee the safety of passengers. Additionally, Japan has introduced advanced scanners in public spaces because of the 2020 Tokyo Olympics. The high number of terrorist attacks, such as the 2019 Sri Lanka bombings, has increased the demand for advanced security systems in crowded areas. Local manufacturer investments and international collaborations are also supporting the market growth.

Latin America Full Body Scanner Market Analysis

The motivation behind the requirement for full body scanners comes from the infrastructure modernization plans and rising security concerns in Latin America. Major suppliers include Mexico and Brazil. Brazil alone manages over 250 airports according to reports, and the major events, including the 2024 Carnival and international sporting events, are hosted there. Millions of people need to be managed by such events, hence, there is a necessity for effective security systems. Mexican border crossings and penal facilities are beginning to use scanners to detect contraband in their efforts to combat drug trafficking. With more than 80% of the population living in cities, as per reports, urbanization drives the demand for improved security measures in busy areas and transportation centers. This industry is further encouraged by government-private sector partnerships for the upgrading of existing security infrastructures, and regional trade agreements like MERCOSUR promote cross-border technology deployment collaborations.

Middle East and Africa Full Body Scanner Market Analysis

Increasing security issues, especially at airports and in public places, encourage the adoption of full body scanners in the Middle East and Africa (MEA) region. The UAE is at the forefront of the region in terms of using advanced scanning technologies, with major hubs, such as Dubai International Airport handling over 90 million people yearly, according to media reports. Saudi Arabia, which hosts religious pilgrimages including the Hajj and Umrah, needs sophisticated screening measures to protect the more than two million pilgrims who go there each year. With the growing smuggling and trafficking, African countries, including South Africa, are securing their borders and airports. Some African countries need to have robust security measures at governmental buildings because of political instability. The full body scanners across the MEA region can be further backed by cooperative efforts between regional governments and international organizations, as well as increasing expenditures in infrastructure and tourism.

Competitive Landscape:

Key players are engaging in strategic partnerships to expand their market presence and enhance their product offerings. These collaborations are assisting companies to leverage each other’s strengths and bring more innovative products to the market. Leading companies also focus heavily on technological innovations to improve the performance of full-body scanners. They are integrating AI and machine learning (ML) algorithms to enhance detection accuracy and reduce false alarms. Companies work on developing new products to meet the evolving full body scanner market demand by designing them for high-security environments like prisons and government buildings. This product offers advanced imaging capabilities and improved user interfaces, catering to the specific needs of critical infrastructure protection. For instance, in 2023, Leidos secured a contract from the Transportation Security Administration (TSA) to begin enhancing the agency’s airport checkpoint body scanner fleet with a new AI-driven algorithm that can greatly reduce false alarms.

The report provides a comprehensive analysis of the competitive landscape in the full body scanner market with detailed profiles of all major companies, including:

- 3F Advanced Systems

- Braun & Co. Limited

- Brijot Imaging Systems Inc.

- Leidos

- Nuctech Company Ltd (Tsinghua Tongfang Co. Ltd.)

- ODSecurity B.V.

- Rohde & Schwarz GmbH & Co KG

- Smiths Group plc

- Tek84 Inc.

- Westminster Group Plc

Latest News and Developments:

- December 2024: The US Advanced Research Projects Agency for Health (ARPA-H) granted a significant contract to the Australian tech firm Micro-X to develop a portable and lightweight full-body CT scanner. With potential renewals, the initial contract's value of USD 8.2 Million could increase to USD 25 million. This advancement aims to enhance the flexibility and accessibility of medical imaging.

- April 2024: ODSecurity revealed that it will present its complete contraband detection solutions, featuring the Sotor RS full-body scanner, THEIA automatic threat recognition software, and Central Database, at the International Corrections and Prisons Association event in Antwerp, Belgium, from October 22 to 27, 2023.

- February 2023: Germany's Frankfurt Airport set up the Ledos ClearScan computed tomography (CT) scanner at the new security lane being implemented in Terminal 1, Concourse A.

Full Body Scanner Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered |

|

| Applications Covered | Transport, Critical Infrastructure Protection |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3F Advanced Systems, Braun & Co. Limited, Brijot Imaging Systems Inc., Leidos, Nuctech Company Ltd (Tsinghua Tongfang Co. Ltd.), ODSecurity B.V., Rohde & Schwarz GmbH & Co KG, Smiths Group plc, Tek84 Inc., Westminster Group Plc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the full body scanner market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global full body scanner market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the full body scanner industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The full body scanner market was valued at USD 374.41 Million in 2024.

IMARC estimates the full body scanner market to exhibit a CAGR of 9.22% during 2025-2033, reaching a value of USD 861.40 Million by 2033.

Governments and private sectors are investing in modernizing security infrastructure, which includes the deployment of advanced scanning technologies. Besides this, the rising adoption of full body scanners in public events like concerts, sports games, and political gatherings, where large crowds are present, is impelling the market growth. Moreover, innovations in millimeter-wave and backscatter X-ray technologies are improving the accuracy and efficiency of full body scanners, making them more reliable for detecting hidden threats.

North America currently dominates the market, accounting for a share exceeding 32.0% in 2024. This dominance is fueled by stringent security regulations, high government investments in infrastructure, advanced technological innovations, increasing public safety concerns, and widespread adoption of full body scanners in airports and transportation hubs.

Some of the major players in the full body scanner market include 3F Advanced Systems, Braun & Co. Limited, Brijot Imaging Systems Inc., Leidos, Nuctech Company Ltd (Tsinghua Tongfang Co. Ltd.), ODSecurity B.V., Rohde & Schwarz GmbH & Co KG, Smiths Group plc, Tek84 Inc., Westminster Group Plc, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)