Fuel Cell UAV Market Size, Share, Trends and Forecast by Product Type, Type, Weight, Application, End User, and Region, 2025-2033

Fuel Cell UAV Market 2024, Size and Trends:

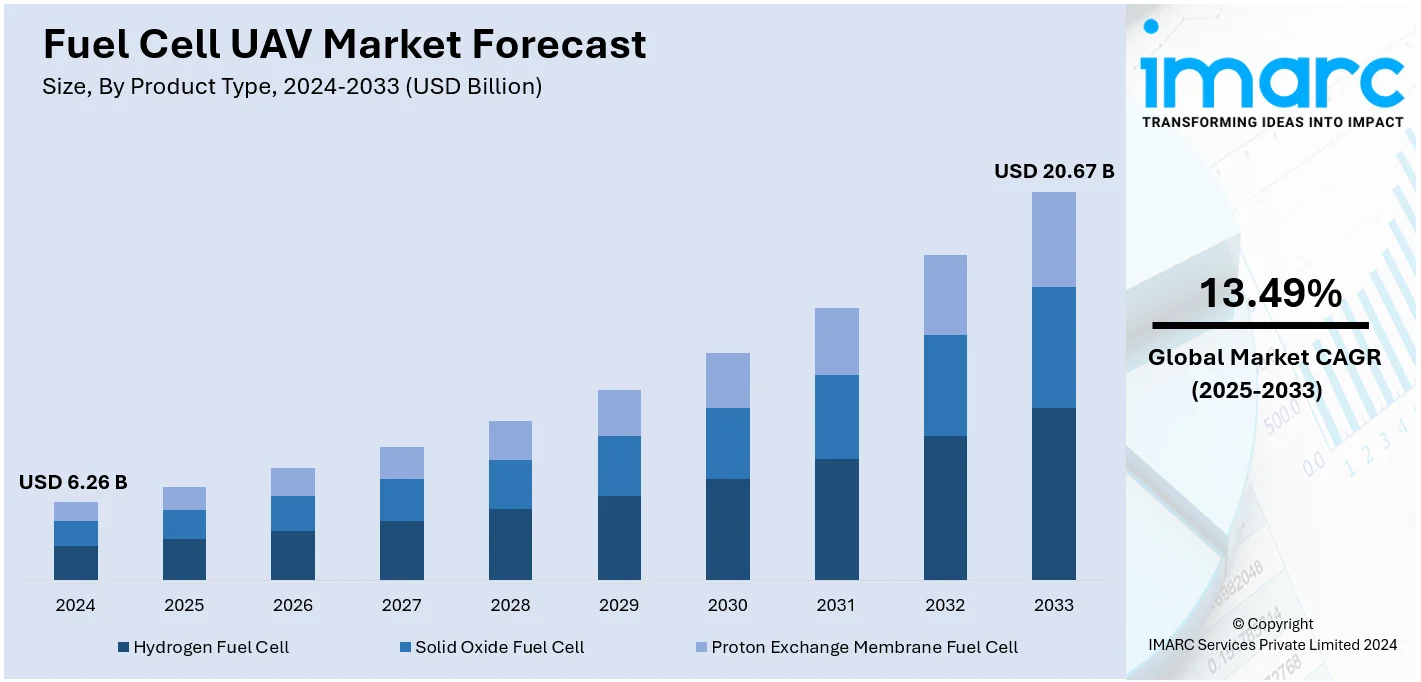

The global fuel cell UAV market size was valued at USD 6.26 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 20.67 Billion by 2033, exhibiting a CAGR of 13.49% during 2025-2033. North America currently dominates the market, holding a significant fuel cell uav market share of over 35.5% in 2024. The increasing incidences of cross-border terrorist activities, rising farming activities, and the growing construction activities represent some of the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.26 Billion |

|

Market Forecast in 2033

|

USD 20.67 Billion |

| Market Growth Rate 2025-2033 | 13.49% |

Key drivers in the fuel cell UAV market include advancements in hydrogen fuel cell technology offering longer flight endurance compared to traditional battery-powered systems. For instance, in December 2024, Delta inaugurated Taiwan's first megawatt-grade R&D lab the "Delta Net Zero Science Lab" in Tainan focusing on hydrogen production and fuel cell technologies. This facility aims to enhance local hydrogen energy capabilities supporting Taiwan's energy transition and contributing to global net-zero carbon emission goals. The rising demand for UAVs in surveillance, delivery, and agricultural applications is pushing the need for energy-efficient solutions. Supportive government policies and funding for clean energy adoption further accelerate market growth. The emphasis on reducing carbon emissions in aviation drives interest in fuel cell technology aligning with global sustainability goals. These factors collectively enhance the market's potential across commercial and military sectors.

The key drivers in the United States fuel cell UAV market are the increasing demand for clean energy solutions in defense, logistics and commercial applications. Hydrogen storage and fuel cell efficiency advancements allow for longer flight times and reduced operational costs making fuel cell UAVs attractive for surveillance and delivery industries. For instance, in February 2024, GenH2 successfully demonstrated its mobile liquid hydrogen technology by fueling a six-foot unmanned aerial vehicle (UAV) at its Titusville headquarters. The UAV capable of flying significantly longer than battery-powered drones marked a milestone as the first of its kind in Florida to use liquid hydrogen for flight. Government incentives and investments in renewable energy technologies further supporting the fuel cell UAV market growth aligning with sustainability goals. Due to increased demand for zero-emission alternatives of military operations and disaster management fuel cell UAVs are becoming more acceptable while ensuring high performance through adherence to environmental regulations.

Fuel Cell UAV Market Trends:

Increased Adoption in Commercial Applications

Fuel cell UAVs are becoming the preferred choice in commercial sectors, such as logistics, agriculture, and infrastructure monitoring because they can stay airborne for longer periods than their battery-powered counterparts. In logistics, they make long-range deliveries efficient especially in remote areas thereby reducing operational costs and carbon footprints. In agriculture these UAVs support precision farming through extended aerial monitoring for crop health, irrigation, and pest control. Their durability to inspect large-scale projects such as pipelines, power lines and bridges is beneficial to infrastructure monitoring. This trend is further highlighted by significant innovations in the field showcasing the potential of fuel cell UAVs to revolutionize commercial applications. For instance, in September 2024, AvironiX Drones launched the Avi-MALE India’s first hydrogen fuel cell-powered VTOL drone. Featuring a 5-metre wingspan it offers up to 4 hours of near-silent flight at 6000 metres and a 900 km BVLOS range. This innovation marks a significant advancement in sustainable drone technology in India. The low environmental impact of hydrogen fuel cells makes them more suitable for the applications with the global sustainability goals.

Military and Defense Utilization

Fuel cell UAVs are critical tool for military and defense applications especially in ISR missions. They enable longer flight endurance as compared to traditional battery-powered drones thus assisting in the extended monitoring of high-risk or remote areas without frequent refueling or recharging. For instance, in September 2024, Aurora Flight Sciences announced its plans to launch the Skiron-XLE a hydrogen-powered military drone. This long-endurance aircraft boasts a range of 47 miles and a flight time of seven hours. Fuel cells also have quiet operation which adds stealthiness making them appropriate for covert operations. These UAVs can also carry advanced sensors and communication equipment which provide real-time data for strategic decision-making. Their ability to operate in diverse terrains and extreme conditions increases their utility further ensuring operational effectiveness in border security, disaster response and combat scenarios.

Growing Demand for Long Endurance UAVs

The demand for long-endurance UAVs is fueling the adoption of fuel cell-powered systems particularly in delivery, agriculture and surveillance. In contrast to battery-powered drones fuel cell UAVs offer much longer flight times making them ideal for tasks that require extended operations without frequent recharging. For instance, in July 2024, Polar Technology and Intelligent Energy launched a groundbreaking hydrogen storage solution for UAVs. The new cylinder enhances fuel capacity by 25% without added weight enabling UAVs to triple their range. This innovation promises cleaner operations and significant industry applications transforming logistics and energy surveying. In delivery they enable efficient transport over vast distances especially in remote areas. In agriculture fuel cell UAVs enable long-term crop and soil health monitoring for increased productivity. For surveillance their endurance allows continuous real-time data collection in critical operations. These capabilities combined with superior energy efficiency position fuel cell UAVs as a reliable solution for diverse sectors.

Fuel Cell UAV Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global fuel cell UAV market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, type, weight, application, and end user.

Analysis by Product Type:

- Hydrogen Fuel Cell

- Solid Oxide Fuel Cell

- Proton Exchange Membrane Fuel Cell

Hydrogen fuel cell stand as the largest product type in 2024, holding around 58.9% of the fuel cell UAV market share. Hydrogen fuel cells are dominating the fuel cell UAV market with their unmatched energy efficiency and long operational durations. These cells have high energy density that enables UAVs to fly significantly longer than the traditional battery-powered ones hence making them highly suitable for delivery, surveillance and agricultural monitoring applications. They are also very light in weight which enables UAVs to carry heavier payloads while maintaining their efficiency. Hydrogen storage and refueling technologies have improved significantly and become more pragmatic and scalable. Considering the growing fuel cell UAV market demand for clean energy and zero-emission vehicles on a global level hydrogen fuel cells become the most preferred choice in the fuel cell UAV market.

Analysis by Type:

- Hybrid

- Fixed Wing

- Rotary Wing

Rotatory wing leads the market with around 37.8% of market share in 2024. Rotary-wing UAVs dominates fuel cell UAV market primarily due to their flexibility and agility. They can take off and land vertically, making them appropriate for operations in enclosed or uneven spaces. Their hovering and precise movement capabilities make them useful in applications such as surveillance, inspection, and delivery where detailed or localized coverage is required. Fuel cell technology further enhances their capabilities by increasing flight duration and payload capacity compared to battery-powered counterparts.

Analysis by Weight:

- Less Than 50 Kg

- More Than 50 Kg

Based on the fuel cell UAV market forecast, Fuel cell UAVs weighing less than 50 kg are mainly used for commercial applications, such as photography, surveillance, and small-scale delivery. Its lightweight design makes it agile and convenient to implement in urban and remote environments. The benefits of fuel cell technology include longer flight times without adding weight. The segment is increasing because of the demand for portable and cost-effective solutions in the agriculture, environmental monitoring, and inspection services industries.

Fuel cell UAVs weighing more than 50 Kg offer heavy-duty operation such as military surveillance and cargo delivery along with disaster responses. They are larger in size and can therefore carry heavier payload and advanced equipment such as high-resolution cameras and communication systems. These kinds of UAVs operate on long-endurance missions through demanding conditions on the basis of their endurance and efficiency of fuel cells. The market is expanding with increases in defense investments and the need for sustainable high-performance solutions in logistics and critical infrastructure monitoring.

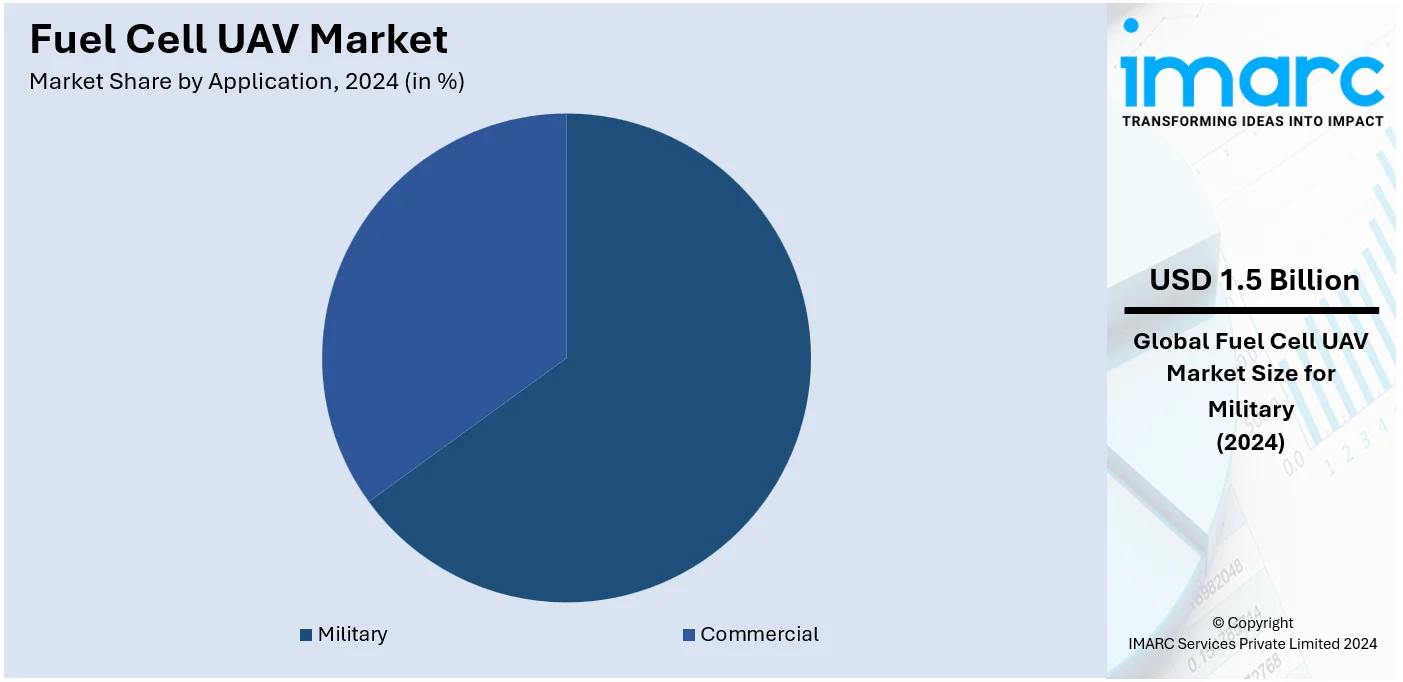

Analysis by Application:

- Commercial

- Military

Military leads the market with around 23.8% of market share in 2024. The military sector is leading the fuel cell UAV market because the sector requires high-endurance advanced drones for ISR missions. Fuel cell UAVs offer extended flight durations which enables continuous monitoring of critical areas without frequent refueling. Their stealth capabilities supported by quiet operation and low thermal signatures make them ideal for covert operations. Their functionality in extreme conditions and carrying advanced payloads adds to their utility in border security, combat support and disaster response applications.

Analysis by End User:

- Passenger UAV

- Cargo UAV

- Others

With urban air mobility on the rise passenger UAVs powered by fuel cells are seen as a future sustainable solution offering zero-emission transport with long flight durations. Fuel cell technology ensures reliability and safety in transporting humans but lightweight designs further optimize efficiency. These UAVs are being designed for applications like air taxis and emergency medical transport. With gradual investment in infrastructure of advanced air mobility and increased focus on sustainable transport passenger UAVs are poised for significant growth in fuel cell UAV market.

Cargo UAVs are a major segment in the fuel cell UAV market. They help address the demand for efficient and sustainable logistics solutions. Fuel cells provide long-range operation capabilities making them suitable for delivering goods to remote or inaccessible areas. They can carry heavier payloads compared to battery-powered alternatives which increases their utility in ecommerce, humanitarian aid and industrial supply chains. Increasing demand for faster more ecofriendly delivery solutions and advances in hydrogen refueling infrastructure are driving the adoption of cargo UAVs across a range of industries.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America holds the largest share of over 35.5% in the fuel cell UAV market, primarily due to its advanced technological infrastructure and substantial investments in UAV development. The region’s strong defense sector plays a key role in driving demand for high-endurance unmanned aerial vehicles (UAVs) used in critical intelligence, surveillance, and reconnaissance (ISR) operations. Additionally, the growing adoption of UAVs in commercial sectors such as logistics, agriculture, and environmental monitoring is contributing to market expansion. North America's dominance is further supported by favorable government policies and funding directed at hydrogen technologies, which are integral to fuel cell UAVs. These policies encourage research and development, as well as the implementation of hydrogen refueling infrastructure, making it easier to deploy and scale fuel cell UAVs for various applications. The region's well-established hydrogen infrastructure, combined with advancements in fuel cell technology, positions North America as a leader in the fuel cell UAV market outlook.

Key Regional Takeaways:

United States Fuel Cell UAV Market Analysis

In 2024, the United States captured 83.70% of revenue in the North American market. For instance, U.S. defense expenditure intensified by USD 55 Billion from 2022 to 2023. The rapid advancement of military technology and the growing demand for efficient, sustainable, and long endurance unmanned aerial vehicles (UAVs) are key elements pushing the adoption of fuel cell technology in UAVs. Fuel cells offer several advantages for defense applications, such as extended flight time, reduced carbon footprints, and enhanced operational efficiency. As military organizations seek to strengthen their surveillance and reconnaissance capabilities, fuel cell UAVs present a valuable solution. With several initiatives supporting eco-friendly technology integration into defense programs, the adoption of fuel cell-powered UAVs is expected to increase significantly. Furthermore, the rising focus on reducing the dependency on conventional energy sources and the move towards more sustainable operations further boost the growth of these UAVs within the sector.

Asia Pacific Fuel Cell UAV Market Analysis

In the Asia-Pacific region, the agricultural sector's rapid expansion is a major driving force behind the growing adoption of fuel cell UAVs. As per the India Brand Equity Foundation, the agricultural sector in India is expected to grow to USD 24 billion by 2025.As the need for precision farming grows to meet the demands of increasing food production, UAVs powered by fuel cells are being adopted for crop monitoring, pesticide spraying, and soil analysis. The efficiency of fuel cell technology ensures longer operation periods, allowing UAVs to cover large agricultural areas, improving productivity, and reducing operational costs. As the region grapples with environmental challenges and seeks sustainable farming methods, fuel cell UAVs are seen as a green alternative to traditional aerial systems. In addition, the increase in investments and technological developments in the agricultural UAV space is accelerating the demand for fuel cells, further facilitating the sector’s growth and environmental goals.

Europe Fuel Cell UAV Market Analysis

In Europe, the growing production and demand for cargo services are significantly contributing to the increasing adoption of fuel cell UAVs. According to reports, the EU's industrial production in 2021 is increased by 8.5% compared with 2020. There was a rise of 0.4% in 2022 when compared to 2021. With the rise in e-commerce and international trade, the need for efficient, eco-friendly cargo transportation is growing. Fuel cell UAVs offer advantages such as longer flight times and reduced emissions, making them a desirable solution for transporting goods over short to medium distances. The expansion of the logistics sector, particularly in last-mile delivery services, has created a strong demand for autonomous and environmentally friendly UAV solutions. Fuel cells provide these UAVs with the necessary endurance to transport parcels efficiently, while their low environmental impact aligns with the European Union’s sustainability goals. As industries in Europe continue to modernize and streamline their logistics operations, fuel cell UAVs are poised to play a pivotal role in reducing the carbon footprint of the cargo services sector, leading to a significant market opportunity.

Latin America Fuel Cell UAV Market Analysis

In Latin America, the growing adoption of fuel cell UAVs is driven by the increasing demand for advanced military equipment. For instance, Military spending in Central America and the Caribbean in 2023 was 54 per cent higher than in 2014. As defense forces in the region focus on modernizing their military capabilities and enhancing operational efficiency, fuel cell UAVs offer an ideal solution. Their ability to operate for longer periods and provide efficient surveillance and reconnaissance capabilities is critical for various military applications. Additionally, fuel cells contribute to reducing the operational costs associated with traditional UAVs, making them an attractive choice for defense organizations seeking both performance and sustainability. As regional military strategies evolve, fuel cell UAVs are expected to play a vital role in strengthening defense systems by providing greater autonomy and longer missions.

Middle East and Africa Fuel Cell UAV Market Analysis

In the Middle East and Africa, the rapid development of smart cities is accelerating the adoption of fuel cell UAVs. For instance, says the UAE and Saudi Arabia will invest a staggering USD 50 Billion in smart city projects by 2025. With an increasing number of cities focusing on advanced infrastructure, urban management, and sustainability, fuel cell-powered UAVs are becoming integral to smart city initiatives. These UAVs provide valuable services such as surveillance, monitoring of urban spaces, traffic management, and environmental monitoring, all while minimizing carbon footprints. The long flight duration of fuel cell UAVs is particularly useful for monitoring large areas, enhancing security, and ensuring the efficient functioning of various smart city systems. As governments and urban planners continue to prioritize green technologies in their smart city projects, fuel cell UAVs are expected to become a significant component in enhancing urban infrastructure and sustainability efforts across the region.

Competitive Landscape:

The fuel cell UAV market is characterized by intense competition driven by advancements in hydrogen fuel cell technology and increasing demand for long-endurance and sustainable UAV solutions. Companies are focusing on innovation to enhance performance, payload capacity and flight duration while reducing operational costs. Strategic partnerships and acquisitions are emerging as key strategies to accelerate R&D and expand market reach. For instance, in December 2024, Doosan Corporation announced its plans to acquire Doosan Fuel Cell Power from Doosan Mobility Innovation to strengthen its hydrogen business. This acquisition aims to improve DMI's financial situation focusing on hydrogen drones and fuel cells. DMI plans a 134 billion won capital increase. The growing adoption of fuel cell UAVs across defense, logistics and commercial applications intensifies the competitive environment. Investment in hybrid power systems and infrastructure development for hydrogen refueling further shapes market dynamics. Regional players are leveraging local policies and incentives to strengthen their positions while global participants focus on scalability and cutting-edge technologies to maintain their competitiveness.

The report provides a comprehensive analysis of the competitive landscape in the fuel cell UAV market with detailed profiles of all major companies, including:

- Doosan Corporation

- ISS Aerospace

- EnergyOR Technologies

- Horizon Fuel Cell Technologies

- Boeing

- Barnard Microsystems Ltd.

- Plug Power Inc.

- Textron Inc.

- AeroVironment Inc.

- Northrop Grumman

- Elbit Systems Ltd.

Latest News and Developments:

- November 2024: BonV Aero, an Odisha-based deep-tech start-up, has launched India’s first fully autonomous logistics drone, Air Orca. The drone, designed to address logistical challenges in remote areas, was unveiled with the support of prominent venture capitalist Tim Draper. Air Orca’s advanced autonomous capabilities mark a significant step forward in India’s drone and logistics technology sector.

- September 2024: Hogreen Air has revealed the world's first hydrogen-powered drone with a 5,800-mile range at the H2 Mobility Energy Environment Technology conference in Seoul. The drone can fly for up to 14 hours, equipped with a radio frequency and LTE/5G communication system. It is designed for long-duration surveillance and reconnaissance missions. This breakthrough aims to enhance UAV capabilities with hydrogen fuel cell technology.

- August 2024: Blueflite's partnership with Charles Darwin University and the Northern Territory Government is driving a breakthrough in long-range UAV technology. By integrating hydrogen fuel cell tech, the company is set to revolutionize sectors like healthcare, agriculture, and logistics in Australia. This innovation is poised to extend the capabilities of UAVs, unlocking new opportunities for industries across vast landscapes. The project highlights the growing potential of clean energy in aviation.

- July 2024: Intelligent Energy (IE) has introduced the IE-FLIGHT family of fuel cells at FIA24, designed for sub-regional and regional aircraft. These high-performance fuel cells, featuring the company's patented high-temperature operation architecture, are a major advancement in sustainable aviation. The launch represents a leap toward cleaner, more efficient aviation solutions. Additionally, IE-FLIGHT emphasizes the importance of metal cleaning in fuel cell technology for enhanced performance and durability.

- May 2024: Electric passenger drones are set for a year-end launch in Saudi Arabia, with Front End collaborating with Chinese developer EHang to bring the service to the Kingdom. Majid Al-Ghaslan, chairman of Front End, highlighted the company's efforts to push the boundaries of air and urban traffic management systems in coordination with the Civil Aviation Authority and Ministry of Transport.

Fuel Cell UAV Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Hydrogen Fuel Cell, Solid Oxide Fuel Cell, Proton Exchange Membrane Fuel Cell |

| Types Covered | Hybrid, Fixed Wing, Rotary Wing |

| Weights Covered | Less Than 50 Kg, More Than 50 Kg |

| Applications Covered | Commercial, Military |

| End Users Covered | Passenger UAV, Cargo UAV, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Doosan Corporation, ISS Aerospace, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the fuel cell UAV market from 2019-2033.

- The fuel cell UAV market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the fuel cell UAV industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global fuel cell UAV market was valued at USD 6.26 Billion in 2024.

IMARC estimates the global fuel cell UAV market to exhibit a CAGR of 13.49% during 2025-2033.

Key drivers include significant advancements in hydrogen fuel cell technology, the demand for zero-emission UAVs, favorable government policies, and the widespread adoption in commercial and military applications.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the global fuel cell UAV market include Doosan Corporation, ISS Aerospace, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)