Fuel Cell Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Fuel Cell Market Size and Share:

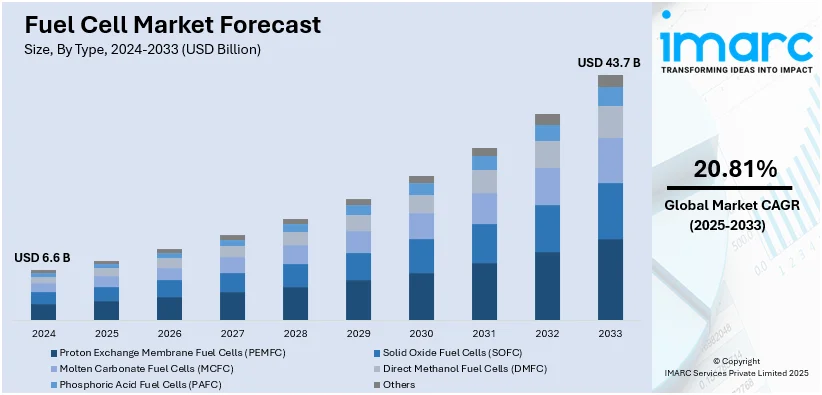

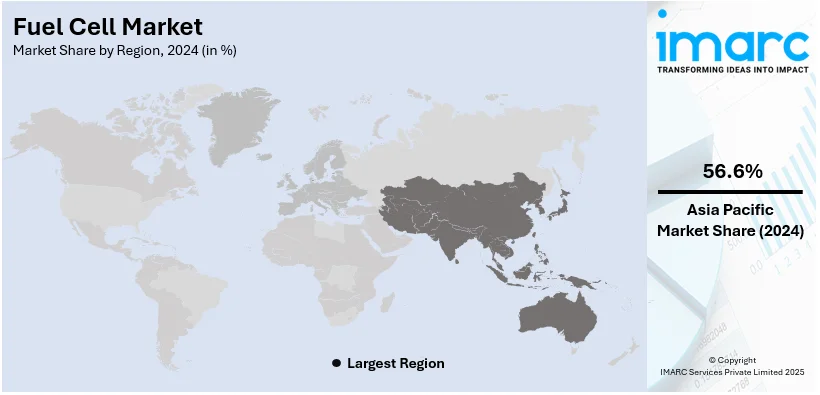

The global fuel cell market size reached USD 6.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 43.7 Billion by 2033, exhibiting a growth rate (CAGR) of 20.81% during 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 56.6% in 2024. The market is driven by the global shift toward clean energy, with fuel cells gaining traction due to their high efficiency, low emissions, and versatility across transportation and stationary power applications. Supportive government policies, tax incentives, and rising investments in hydrogen infrastructure are accelerating adoption, particularly in the U.S. and Europe. Additionally, advancements in R&D and growing demand for zero-emission vehicles are enhancing performance and cost competitiveness, further augmenting the fuel cell market share.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.6 Billion |

|

Market Forecast in 2033

|

USD 43.7 Billion |

| Market Growth Rate (2025-2033) | 20.81% |

One major driver of the fuel cell market is the growing demand for clean and sustainable energy solutions across the globe. For instance, in 2024, Bloom Energy announced an 80 MW fuel cell project with SK Ecoplant to power two ecoparks, starting commercial operations in 2025 for sustainable energy. As governments and industries worldwide prioritize reducing carbon emissions to combat fuel cells present a feasible option to conventional fossil fuels. Their ability to generate electricity with minimal environmental impact, high efficiency, and versatility across sectors, such as transportation, stationary power generation, and portable power applications, has propelled fuel cell market growth. Furthermore, increasing investments in hydrogen infrastructure, coupled with supportive policies and incentives, are accelerating the adoption of fuel cell technologies, positioning them as a cornerstone of the global energy transition.

The United States plays a pivotal role in advancing the fuel cell market through innovation, policy support, and investment in hydrogen infrastructure. Government incentives at both federal and state levels, such as tax credits and R&D funding, are driving the expansion of the U.S. fuel cell market. The Department of Energy’s efforts to advance hydrogen production and storage technologies have further bolstered the industry. According to the fuel cell market forecast, prominent U.S. companies are innovating fuel cell solutions across sectors, including transportation and stationary power systems, solidifying the market's growth trajectory. For instance, in 2025, FuelCell Energy announced plans to build a 7.4 MW fuel cell power plant in Hartford, Conn., providing renewable baseload power to support Connecticut's Renewable Portfolio Standard. Additionally, public-private partnerships and increasing collaborations are driving technological advancements, reinforcing the U.S.'s position as a global leader in the fuel cell market.

Fuel Cell Market Trends:

Thriving Automotive Industry

The California Air Resources Board approved Nikola Corporation's request on February 7, 2023, for its Tre hydrogen fuel cell electric vehicle (FCEV) must qualify for CARB's hybrid and zero-emission truck and bus voucher incentive program, referred to as HVIP. Nikola Corporation is the leading company in the world of zero-emission transportation, energy supply, and infrastructure solutions. The initiative is special in that it does not necessitate the retirement and scrapping of an existing diesel vehicle, rather it accelerates the take-up of zero tailpipe emission commercial cars on a first-come, first-served basis. Fuel cells have numerous advantages over the traditional internal combustion engines (ICEs) which include lower emissions, improved economy, and lesser noise. They are also employed in APUs that provide supply energy for vehicle accessories like air conditioning and heating in commercial trucks and buses, which is driving the demand of the fuel cell market. There is also a growing trend in the use of FCEVs by individuals around the world. These vehicles consume hydrogen gas, which can be generated from renewable energy sources through processes.

Rising Demand for Clean and Sustainable Energy Sources

The increasing concerns over climate change, air pollution, and the reduction in greenhouse gas (GHG) emissions are driving people to need cleaner sources of energy. Fuel cells represent advanced energy conversion system that generates electricity via electrochemical processes, eliminating the need for combustion and enabling minimal to no emissions. Owing to its productivity in conveniently injecting intermittent renewable energy sources into the grid by effectively transforming stored hydrogen or other sustainable fuels into electricity, it is providing a positive fuel cell market outlook across all regions worldwide. Supporting measures with the implementation of these measures tend to boost the adoption of clean energy technologies. The product lines are also their focus from key players who aim to be consistent by reducing carbon emissions and upholding sustainability. For example, Kohler Energy unveiled a new hydrogen KDI engine along with its hydrogen fuel cell power system on 13 November 2023, expanding their range of eco-friendly energy products. This announcement speeds up Kohler Energy's plan to offer a wide array of clean energy and hydrogen-compatible products for off-highway machinery and backup and primary power solutions for both residential and industrial purposes, ranging from 20 kW to more than 5 MW.

Extensive Research and Development (R&D) Activities

Extensive R&D activities are continuously changing the market, which is triggering wide innovations to improve their performance, durability, and cost-effectiveness. Additionally, advanced modeling and simulation tools have been launched lately to improve the fundamental processes that are optimal designs to enhance the growth of the fuel cell market. According to the fuel cell market overview, the adoption of advanced materials and design methods to enhance product's strength and longer usage is also a growth-promoting factor. Moreover, manufacturers are using CFD modeling, multi-physics simulation, and control strategy for efficient and reliable operation. They are signing many agreements for the introduction of modern technology in the market. For instance, Bloom Energy entered a deal with Perenco on June 7, 2023, whereby the latter ordered 2.5 MW of Bloom's solid oxide fuel cells for installation in England. A prominent independent hydrocarbon firm generates 500,000 BOE of oil and gas daily from 14 partner nations, Perenco functions. This is the final step showing how the firm's solid oxide fuel cell technology will support its resilience and sustainability goals. The increasing focus on decarbonization and energy security has propelled interest in fuel cells in transportation and stationary power markets. Policies related to hydrogen infrastructure development and government incentives are being developed and can help establish new markets. Fuel cells are also becoming more efficient and durable; thus, improvements can be scaled. Therefore, increased investment in green hydrogen is expected to lead to significant growth in this market.

Fuel Cell Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global fuel cell market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on type and application.

Analysis by Type:

- Proton Exchange Membrane Fuel Cells (PEMFC)

- Solid Oxide Fuel Cells (SOFC)

- Molten Carbonate Fuel Cells (MCFC)

- Direct Methanol Fuel Cells (DMFC)

- Phosphoric Acid Fuel Cells (PAFC)

- Others

Proton exchange membrane fuel cells lead the market with around 57.3% of the market share in 2024. Proton exchange membrane fuel cells are used in applications like automotive vehicles because they can withstand a variety of environmental conditions and provide fast refilling periods. This makes them suitable for use in buses, passenger cars, and other modes of transportation. Due to the relatively long life that PEMFCs have in comparison with batteries and the quick refueling capability by hydrogen or methanol cartridges, they are also employed in portable electronic appliances such as laptops, cellphones, tablets, and cameras. Further, it is a clean and reliable source of power for the remote areas, as a backup power supply during emergency situations, and for outdoor applications, which are all expected to have a positive outlook for the fuel cell market. On 13 October 2023, TECO 2030 has created hydrogen fuel cells that allow ships and various heavy-duty applications to operate without emissions, and the company is currently working on setting up Europe's first Giga production site for hydrogen PEM fuel cell stacks and modules in Narvik, Norway.

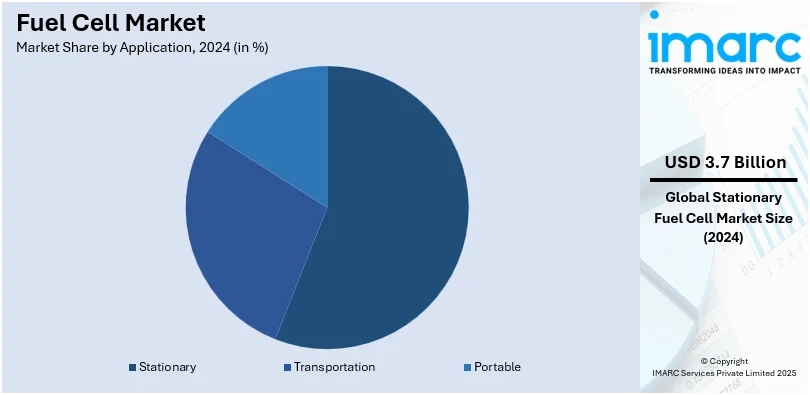

Analysis by Application:

- Stationary

- Transportation

- Portable

Stationary leads the market with around 55.9% of market share in 2024. Stationary systems are designed for non-mobile applications and provide reliable and continuous power generation for residential, commercial, and industrial purposes, which makes it the largest in the fuel cell market share. They are used in industrial environments including manufacturing plants, warehouses, and industrial parks. They are ideal for a variety of stationary applications due to their high efficiency, low emissions, fuel flexibility, and modularity, among other benefits. Ballard Power Systems said on May 3, 2023, that it placed an order with a European supplier of clean energy solutions for essential stationary power applications for 3.6 megawatts (MW) of fuel cell systems. The fuel cell systems manufactured by Ballard will be incorporated into stationary power units, which offer zero-emission electricity for a variety of uses such as data centers, EV charging stations, and construction sites. As a result, these steps undertaken by key players influence the fuel cell market statistics.

Regional Analysis:

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

In 2024, Asia Pacific accounted for the largest market share of over 56.6%. According to the (CEIC), the motor vehicle production in India was 5,851,507 units in December 2023. The growing automotive industry, especially in India and Japan, is driving the market forward. Besides, governing agencies in the Asia Pacific region are encouraging the adoption of clean and sustainable energy solutions, which is contributing to the market growth. Fuel cell manufacturers in the region are investing in research and development (R&D) and infrastructure development, which is bolstering the market growth. Except for this, the application of fuel cells in backup power systems of critical infrastructure, including data centers and telecommunication facilities, further pushes the market growth in the Asia Pacific region. Besides this, widespread usage of the product in distributed power generation systems and applications for backup power also enhances the development of hydrogen refueling stations and, thus, affects the market positively in the region.

Key Regional Takeaways:

United States Fuel Cell Market Analysis

US accounts for 75% share of the market in North America. The main drivers for the fuel cell market in the United States are increased use of clean energy technologies, federal financing programs, and growing applications in portable, stationary, and automotive power. In a push to significantly lower the cost of clean hydrogen, the US Department of Energy (DOE) announced USD 750 Million in funding for 52 projects spread across 24 states. With the introduction of fuel cell electric vehicles (FCEVs) by Toyota, Honda, and Hyundai, fuel cells are increasingly becoming more popular in the automotive industry. With approximately 60 hydrogen refuelling stations in service and plans to add 100 more by 2030, California alone had over 13,000 FCEVs on the road by 2023, as per the report by California Air Resources Board (CARB or Board).

With thousands of units installed by business houses like Bloom Energy, stationary fuel cells are gaining popularity for grid stability and backup power, especially in data centers and other important installations. Fuels cells are further supported as the renewable energy industry grows because the electrolysed hydrogen can hold excess energy. Massive efforts are also displaying growth in industrial deployment. The examples are seen through USD 290 million worth of green hydrogen facility unveiled by Plug Power in New York. Fuel cell deployment within manufacturing and transportation is further fostered through public-private collaborations, as seen through the H2@Svcale initiative.

North America Fuel Cell Market Analysis

The North America fuel cell market is experiencing significant growth, driven by increasing adoption of clean energy technologies and supportive government policies. The United States leads the region, supported by substantial investments in hydrogen infrastructure and incentives like tax credits under the Inflation Reduction Act. Canada complements this growth with strong innovation in hydrogen production and storage technologies. Key applications driving market expansion include fuel cell vehicles, stationary power generation, and portable power systems. For instance, in 2024, Ballard Power Systems, a Canadian manufacturer of fuel cell products, secured orders from two bus manufacturers to deliver over 90 fuel cell engines, totaling approximately 6.4 MW of power, for city buses in Europe and the UK. Collaborations between public and private sectors, alongside advancements in hydrogen fueling stations, have further strengthened the market. The region's focus on reducing carbon emissions and achieving energy security positions North America as a key player in the global fuel cell industry.

Europe Fuel Cell Market Analysis

Improvement in fuel cell technology, huge investments into infrastructure for hydrogen, and severe carbon-neutrality requirements are all factors that promote the European fuel cell business. The European Union's Green Deal aims to support the use of fuel cells and hydrogen in transportation, energy, and industry in achieving net-zero emissions by 2050. As per an industry report, Germany leads the world with Euro 9 Billion (USD 9.36 Billion) dedicated to green hydrogen projects, such as large-scale implementation of fuel cells in industrial and transportation applications, thanks to its massive investments under its National Hydrogen Strategy. The demand for fuel cells is driven by the automotive industry, with firms such as Daimler and BMW manufacturing hydrogen-powered automobiles, which are supported by more than 250 hydrogen refuelling stations in Europe, according to data by Hydrogen Europe. Public transportation systems, like the hydrogen buses in France and the UK, also support the expansion of the market. Fuel cells are implemented in the stationary segment for combined heat and power (CHP) systems for decentralized power generation, particularly in Scandinavian countries. Cooperative initiatives like European Fuel Cell and Hydrogen Joint Undertaking and Clean Hydrogen Partnership promote innovation and adoption.

Asia Pacific Fuel Cell Market Analysis

Asia-Pacific is the biggest market for fuel cells, driven by robust government support, extensive manufacturing, and growing applications in power generation and transportation. Japan, which leads the world in fuel cell use, has more than 400,000 Ene-Farm residential units installed. Plans call for 5.3 Million by 2030, and the Tokyo Metropolitan Government is making use of fuel cell buses for urban transit, establishing Japan as a leader in hydrogen-powered public transportation. According to the China Association of Automobile Manufacturers, China is growing its FCV market with more than 1,586 FCVs sold in 2023 and aims to sell 50,000 by 2025. By 2040, South Korea targets around 1,200 hydrogen refuelling stations, coupled with 6.2 million fuel cell electric cars, and 41,000 hydrogen buses, under the Hydrogen Economy Roadmap, as reported by the International Energy Agency. Stationary fuel cells are growing fast, with an increasing significant contribution toward the overall demand from industrial energy systems and grid support; these fuel cells are specifically being considered in power-greedy industries, such as chemical plants and steel.

Latin America Fuel Cell Market Analysis

Low-emissions government initiatives, transportation use cases, and increased demand to incorporate more renewable energy contribute to the growing interest in Latin America. As part of its decarbonisation policy, Brazil, a regional leader, promotes hydrogen through initiatives centered on green hydrogen production. In cities like São Paulo, hydrogen-powered buses and other fuel cell vehicles are being tested. Reports indicate that Chile and Brazil's focus on renewable energy presents fuel cells with potential uses in energy storage and grid stability, as over 25% of their electricity comes from solar and wind. In addition, industrial sectors in Argentina and Mexico are also researching fuel cell technology to enhance operational sustainability and energy efficiency.

Middle East and Africa Fuel Cell Market Analysis

The main driver for the fuel cell industry in the Middle East and Africa is the emphasis on diversifying energy sources and reducing reliance on fossil fuels. Saudi Arabia's NEOM project aims to produce more than 4 GW of green hydrogen by 2026, and other nations like the United Arab Emirates are also making significant investments in green hydrogen projects. South Africa is positioned as a strategic centre for fuel cell development in Africa due to its abundance of platinum, a crucial component in fuel cell catalysts. In regions with scarce energy resources, fuel cells are increasingly being used for off-grid power applications and as reserve power sources for critical infrastructure.

Competitive Landscape:

Several manufacturers in the market are investing in research and development (R&D) projects to enhance their product performance, durability, and cost-effectiveness. In line with this, manufacturers are focusing on introducing new catalyst compositions to expand their product application and increase their fuel cell market revenue. Apart from this, prominent players are developing advanced manufacturing processes and techniques that help lower the production costs of components and systems, which in turn, is supporting the market growth. On 21 March 2023, Plug Power Inc., a prominent supplier of comprehensive hydrogen solutions for the global green hydrogen sector, stated that it has broadened its GenKey offering to facilitate fuel cell usage for warehouses utilizing fewer than 100 electric forklifts. For the first time, this portion of the forklift market will gain access to affordable hydrogen fuel cells and the enhanced productivity they enable.

The report provides a comprehensive analysis of the competitive landscape in the fuel cell market with detailed profiles of all major companies, including:

- Ballard Power Systems Inc.

- Bloom Energy Corporation

- Toshiba Fuel Cell Power Systems Corporation

- FuelCell Energy Inc.

- Plug Power Inc.

- Nuvera Fuel Cells Inc.

- AFC Energy plc

- SFC Energy AG

- Mitsubishi Hitachi Power Systems Ltd.

- Panasonic Corporation

- Intelligent Energy Limited

- Doosan Fuel Cell America Inc.

Latest News and Developments:

- December 2024: The French company EODev (Energy Observer Developments) has partnered with Greenzo Energy India Limited (GEIL), the only producer of 100% Made-in-India alkaline electrolysers in India, to market EODev's GEH2 hydrogen fuel cell power generators in India and Nepal.

- November 2024: With an emphasis on fusing advanced EV capabilities with hydrogen fuel cell technology, Hyundai Motor has introduced a new hydrogen-based electric vehicle (EV) concept. By fusing cutting-edge automobile engineering with environmentally benign hydrogen energy, this invention seeks to improve sustainable mobility.

- March 2023: Ballard Power Systems and First Mode, a worldwide carbon reduction firm, revealed a purchase order for Ballard to provide First Mode with 30 hydrogen fuel cell modules, amounting to 3 megawatts, to energize various hybrid hydrogen and battery ultra-class mining haul trucks. This is roughly equal to about 4,000 horsepower. The 30 Ballard hydrogen fuel cell units will be incorporated into clean energy power plants constructed in Seattle, Washington, and fitted into ultra-class haul trucks to be utilized at First Mode's Proving Grounds in Centralia, Washington. These trucks are projected to conserve 2,600 tons of diesel fuel annually.

Fuel Cell Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Proton Exchange Membrane Fuel Cells (PEMFC), Solid Oxide Fuel Cells (SOFC), Molten Carbonate Fuel Cells (MCFC), Direct Methanol Fuel Cells (DMFC), Phosphoric Acid Fuel Cells (PAFC), Others |

| Applications Covered | Stationary, Transportation, Portable |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Ballard Power Systems Inc., Bloom Energy Corporation, Toshiba Fuel Cell Power Systems Corporation, FuelCell Energy Inc, Plug Power Inc, Nuvera Fuel Cells Inc, AFC Energy plc, SFC Energy AG, Mitsubishi Hitachi Power Systems, Ltd., Panasonic Corporation, Intelligent Energy Limited, Doosan Fuel Cell America Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the fuel cell market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global fuel cell market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the fuel cell industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fuel cell market was valued at USD 6.6 Billion in 2024.

IMARC estimates the fuel cell market to reach USD 43.7 Billion by 2033, exhibiting a CAGR of 20.81% during 2025-2033.

Key factors driving the fuel cell market include increasing demand for clean energy, stringent emission regulations, advancements in hydrogen infrastructure, and government incentives. The versatility of fuel cells across transportation, stationary power, and portable applications, coupled with growing investments in research and development, further accelerates market growth and adoption globally.

Asia Pacific currently dominates the market with 56.6% share. This leadership is driven by robust government initiatives, growing investments in hydrogen infrastructure, and rising adoption of fuel cell technologies in transportation and stationary power sectors. Key markets like Japan, South Korea, and China spearhead this regional dominance.

Some of the major players in the fuel cell market include Ballard Power Systems Inc., Bloom Energy Corporation, Toshiba Fuel Cell Power Systems Corporation, FuelCell Energy Inc, Plug Power Inc, Nuvera Fuel Cells Inc, AFC Energy plc, SFC Energy AG, Mitsubishi Hitachi Power Systems, Ltd., Panasonic Corporation, Intelligent Energy Limited, Doosan Fuel Cell America Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)