Frozen Pizza Market Report by Crust Type (Thin Crust, Thick Crust, Stuffed Crust, and Others), Size (Small, Medium, Large), Product Type (Regular Frozen Pizza, Premium Frozen Pizza, Gourmet Frozen Pizza), Topping (Cheese, Meat, Fruits and Vegetables, and Others), Distribution (Food Chain Services, Modern Trade, Departmental Stores, Online Stores, and Others), and Region 2025-2033

Frozen Pizza Market Size:

The global frozen pizza market size reached USD 18.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 30.3 Billion by 2033, exhibiting a growth rate (CAGR) of 5.04% during 2025-2033. Increasing consumer demand for convenience foods, the expansion of quick-service restaurants, innovations in pizza flavors and toppings, advancements in freezing and packaging technology, growing e-commerce and online grocery shopping, rising disposable incomes, and changing eating habits among millennials are some of the factors boosting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 30.3 Billion |

| Market Growth Rate (2025-2033) | 5.04% |

Frozen Pizza Market Analysis:

- Major Market Drivers: The rising consumer willingness to spend on convenience foods on account of hectic lifestyles and extended working hours is propelling the market forward. Moreover, advancements in food preservation and freezing technologies have increased the demand for high quality frozen pizza quality with extended shelf-life, which is strengthening the market growth. Additionally, the burgeoning disposable income levels spurring the demand for ready-to-eat (RTE) productsis further aiding in market expansion. Besides this, the expansion of retail channels, such as online platforms, rapid urbanization, and the proliferation of nuclear families are impelling the market growth.

- Key Market Trends: The frozen pizza market forecast shows one of the key trends influencing the market growth is a sudden shift toward premiumization and gourmet choices have surged the demand for high quality ingredients and new flavors. There is also an increasing trend towards vegetarian and vegan frozen pizzas due to the escalating health-consciousness among consumers, which has further compelled the key market players to introduce vegan, organic, and non-genetically modified organisms (GMO) frozen pizzas, which is providing a boost to the market growth. The introduction of various ethnic and regional flavors into frozen pizza and the growing trend of e-commerce have allowed a greater number of individuals to purchase frozen pizza online, which is another growth-inducing factor for the market. Other frozen pizza market growth drivers include escalating celebrity partnerships and collaborations between frozen pizza brands and chefs and influencers and inflating per capita income.

- Geographical Trends: North America leads the market due to a high demand for convenience foods and an extensive retail chain that allows consumers easy access to packaged food products. Frozen pizzas, especially in the United States with its convenience and diversity-inclined consumers, are witnessing a considerable demand. The European market is also witnessing significant thrust due to the presence of countries like Germany, Italy, and France, where there are considerably high levels of pizza consumption. Moreover, growing urbanization, rising disposable incomes, and shifting preference for Western food are creating a positive frozen pizza market outlook in the Asia Pacific.

- Competitive Landscape: Some of the major market players in the frozen pizza industry include Amy's Kitchen, Inc., Atkins Nutritionals Inc. (The Simply Good Foods Company), California Pizza Kitchen, Daiya Foods Inc. (Otsuka Pharmaceutical Co. Ltd.), DiGiorno (Nestlé S.A.), Dr. Oetker, Freiberger Lebensmittel GmbH (Südzucker AG), Giovanni’s Frozen Pizza, Newman's Own, and Red Baron Pizza (Schwan's Consumer Brands, Inc), among many others.

- Challenges and Opportunities: Challenges such as high competition, price fluctuation of raw materials, and strict regulatory standards related to food safety & labeling are expected to create hindrances for the market. There is also the overall consumer perception that frozen food is less healthy than fresh products, which is impeding the market growth. However, opportunities lie in the introduction of healthier and specialty frozen pizzas like gluten-free, organic, as well as plant-based options. Besides this, expansion into emerging markets also offers the potential for increased sales with rapid urbanization and inflating disposable incomes.

Frozen Pizza Market Trends:

Increasing Consumer Demand for Convenience Foods

One of the primary factors behind the growth of the frozen pizza market is an increasing percentage of consumers buying convenience or ready-to-eat food products. As per the industry report, in the US, the number of users for ready-to-eat meals is expected to amount to 38.6 million users by 2029. Frozen pizza is a quick, convenient option for busy people and families, which is further attracting the interest of busy working professionals, students, and parents. As consumer preferences continue to shift towards convenient and time-saving food solutions, the frozen pizza market is likely to see sustained growth driven by this demand for convenience.

Expansion of Quick-Service Restaurant (QSR) Sector

According to the frozen pizza market overview, the expansion of the quick-service restaurant (QSR) sector is acting as another significant growth-inducing factor. As per our industry report, in the US, the QSR market is estimated at USD 406.17 billion in 2024 and is expected to reach USD 662.53 billion by 2029, growing at a CAGR of 10.28%. QSRs, which are known for their fast, affordable, and readily available food offerings, have increasingly included frozen pizza in their menus. This trend is driven by the need for QSRs to diversify their product offerings and cater to a wide range of consumer tastes. By incorporating frozen pizza, QSRs can leverage its convenience and popularity while managing operational efficiencies and cost-effectiveness.

Innovations in Pizza Flavors and Toppings

As consumer preferences evolve, there is a growing demand for different pizza experiences, which is strengthening the market growth. Key manufacturers are introducing new, creative flavors, including exotic international staples that carry high-perceived value and gourmet ingredients to provide customized toppings combinations. Additionally, they are introducing premium product offerings to broaden their portfolios, which is further providing a considerable thrust to the market growth. This rising focus on expanding frozen pizza market segments, such as by crust type and dietary options, reflects the industry's adaptation to consumer trends.

Frozen Pizza Market Segmentation:

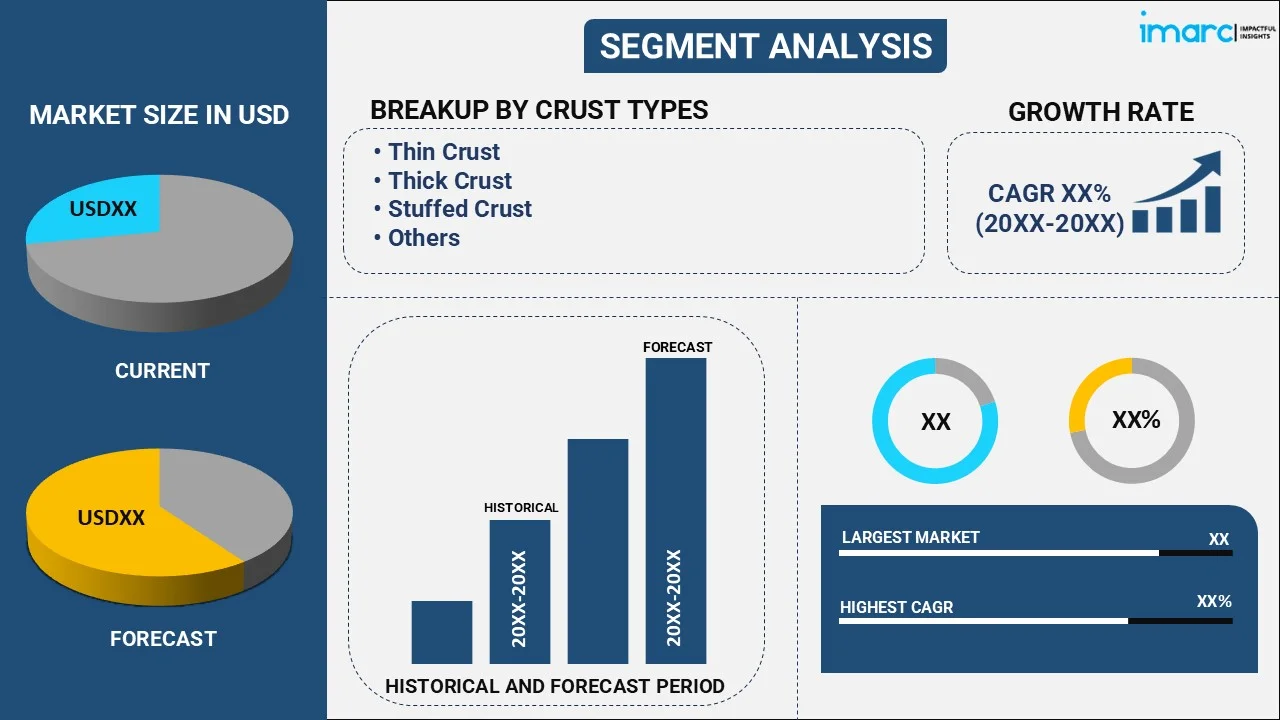

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on crust type, size, product type, topping, and distribution.

Breakup by Crust Type:

- Thin Crust

- Thick Crust

- Stuffed Crust

- Others

Thin crust pizza accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the crust type. This includes thin crust, thick crust, stuffed crust, and others. According to the report, thin crust pizza represented the largest segment.

The thin crust pizza segment in the frozen pizza market is driven by increasing health consciousness among consumers, who are increasingly seeking lower-calorie and lower-carb food options. As awareness of the health impacts of diet choices grows, many people are opting for thin crust pizzas as a healthier alternative to traditional thick crusts, which typically contain more calories and carbohydrates. Thin crust pizzas offer a lighter, less doughy option while still delivering the familiar taste and convenience of pizza. This shift in consumer preferences is supported by the rising trend of clean eating and the desire to maintain a balanced diet without sacrificing indulgent foods. Additionally, the popularity of low-carb and gluten-free diets has boosted the demand for thin crust options, as they often cater to these dietary requirements. Apart from this, the development of innovative thin crust varieties that use alternative, nutritious ingredients such as whole grains and vegetable-based flours that appeal to health-conscious consumers is presenting remunerative growth-inducing business opportunities in the frozen pizza market.

Breakup by Size:

- Small

- Medium

- Large

Medium holds the largest share of the industry

A detailed breakup and analysis of the market based on the size have also been provided in the report. This includes small, medium, and large. According to the report, medium accounted for the largest market share.

The medium segment is driven by the increasing demand for balanced options that cater to both taste and nutritional value. Consumers in this segment are increasingly seeking frozen pizzas that offer a compromise between indulgence and health. This growing interest is reflected in the rising popularity of pizzas made with wholesome, high-quality ingredients that are not overly processed. As health awareness increases, consumers are gravitating towards options that feature whole grains, reduced-fat cheeses, and higher vegetable content, thus satisfying their desire for a more balanced meal. Furthermore, the medium segment benefits from innovation in recipe formulations that include a variety of toppings and crusts catering to diverse dietary preferences, such as gluten-free or low-carb options. This diversification allows the medium segment to appeal to a broader audience who are not necessarily looking for premium, gourmet experiences but still want quality and healthier choices.

Breakup by Product Type:

- Regular Frozen Pizza

- Premium Frozen Pizza

- Gourmet Frozen Pizza

Regular frozen pizza represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the product type. This includes regular frozen pizza, premium frozen pizza, and gourmet frozen pizza. According to the report, regular frozen pizza represented the largest segment.

The regular frozen pizza segment is driven by the increasing consumer demand for convenience and affordability. As busy lifestyles become more common, many individuals and families seek quick and easy meal solutions that do not require extensive preparation or cooking time. Regular frozen pizza provides a practical option that fits well into these fast-paced routines, offering a ready-to-eat meal with minimal effort. Additionally, regular frozen pizza is often priced lower than premium or specialty varieties, making it an attractive choice for budget-conscious consumers. The combination of convenience and cost-effectiveness makes regular frozen pizza a popular choice for a wide range of consumers, from working professionals to students and families. This segment’s affordability and ease of storage further contribute to its appeal, as it allows consumers to stock up on meals and have a dependable option available at all times.

Breakup by Topping:

- Cheese

- Meat

- Fruits and Vegetables

- Others

Meat exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the topping have also been provided in the report. This includes cheese, meat, fruits and vegetables, and others. According to the report, meat accounted for the largest market share.

The meat segment is driven by the increasing consumer preference for meat toppings on frozen pizza, which reflects a broader trend toward hearty and satisfying meal options. As consumers seek more substantial and flavorful food choices, meat toppings such as pepperoni, sausage, and bacon have become popular selections for frozen pizza. This preference is largely influenced by the desire for richer taste experiences and the indulgence factor associated with meat products. Meat toppings also offer a sense of comfort and familiarity, which appeals to a wide demographic, from families to individuals who enjoy traditional pizza varieties. Additionally, the versatility of meat toppings allows for a variety of product offerings, catering to diverse tastes and preferences, including combinations like meat lovers’ pizzas that feature multiple types of meat. This growing demand has prompted frozen pizza manufacturers to enhance their meat offerings, incorporating high-quality ingredients and innovative recipes to meet consumer expectations.

Breakup by Distribution:

- Food Chain Services

- Modern Trade

- Departmental Stores

- Online Stores

- Others

Food chain services dominate the market

The report has provided a detailed breakup and analysis of the market based on the distribution. This includes food chain services, modern trade, departmental stores, online stores, and others. According to the report, food chain services represented the largest segment.

The food chain services segment in the frozen pizza market is driven by the increasing demand for quick and convenient meal solutions. With busy lifestyles and a growing preference for on-the-go eating, consumers are increasingly turning to food chains that offer fast, ready-to-eat options. Frozen pizza fits seamlessly into this trend, providing a convenient solution that meets the needs of consumers seeking both speed and satisfaction. Food chains, including pizza delivery services and quick-service restaurants (QSRs), leverage frozen pizza for its ease of preparation and consistency, allowing them to maintain high standards of quality and operational efficiency. The ability to store and rapidly prepare frozen pizza helps these establishments cater to high customer volumes without compromising service speed or food quality. Additionally, the expansion of food chains into new geographic areas, coupled with the rise of delivery platforms and apps, has enhanced the accessibility and frozen pizza demand.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest frozen pizza market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for frozen pizza.

The North American frozen pizza market is driven by the increasing demand for convenience foods, reflecting the fast-paced lifestyle of its consumers. With busy work schedules, growing urbanization, and heightened social commitments, consumers are seeking quick and easy meal solutions. Frozen pizza perfectly aligns with these needs, offering a convenient option that requires minimal preparation and cooking time. Its ready-to-eat nature allows individuals and families to enjoy a satisfying meal with little effort, making it especially popular among working professionals, busy parents, and students. Additionally, the versatility of frozen pizza as a meal solution for various occasions, from weeknight dinners to last-minute gatherings, further boosts its appeal. The product’s long shelf life and ease of storage contribute to its attractiveness, allowing consumers to stock up and have a meal ready at any time. As convenience continues to be a priority in modern lifestyles, the frozen pizza market in North America benefits from this shift towards quick and accessible food options, driving market growth.

Competitive Landscape:

Key frozen pizza companies in the market are actively enhancing their competitive edge through various strategic initiatives. They are investing heavily in product innovation to cater to evolving consumer preferences, such as developing new and unique flavors, premium ingredients, and specialized options like gluten-free or plant-based pizzas. These innovations help meet the demand for diverse and high-quality meal solutions. Additionally, companies are improving their production technologies and packaging processes to enhance product freshness and shelf life, which is crucial for maintaining consumer satisfaction and minimizing waste. To address the growing trend of e-commerce and online grocery shopping, major players are expanding their digital presence and partnering with online retailers to facilitate easier access and purchase options for consumers. Marketing strategies are also evolving, with an emphasis on digital advertising, social media engagement, and targeted promotions to reach a broader audience and boost brand visibility.

The report provides a comprehensive analysis of the competitive landscape in the global frozen pizza market with detailed profiles of all major companies, including:

- Amy's Kitchen, Inc.

- Atkins Nutritionals Inc. (The Simply Good Foods Company)

- California Pizza Kitchen

- Daiya Foods Inc. (Otsuka Pharmaceutical Co. Ltd.)

- DiGiorno (Nestlé S.A.)

- Dr. Oetker

- Freiberger Lebensmittel GmbH (Südzucker AG)

- Giovanni’s Frozen Pizza

- Newman's Own

- Red Baron Pizza (Schwan's Consumer Brands, Inc)

Frozen Pizza Market News:

- In 2024, Nestlé announced a new product line targeting users of weight-loss drugs such as Wegovy and Ozempic. These new offerings, branded as Vital Pursuit, include $5 frozen pizzas and protein-enriched pasta designed to complement the nutritional needs of individuals on GLP-1 medications.

- In 2024, Newman's Own Inc. expanded its frozen pizza offerings with the introduction of new sourdough and stone-fired crust pizzas. The new sourdough crust pizzas feature thick, crispy bases and are available in flavors such as Uncured Pepperoni & Ricotta, Meatball, and Five Cheese. These pizzas are made with premium ingredients and baked in a brick oven to ensure an airy yet crispy texture. Additionally, Newman's Own added two new stone-fired crust varieties imported from Italy: Italian Salami and Roasted Garlic & Mushroom.

Frozen Pizza Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Crust Types Covered | Thin Crust, Thick Crust, Stuffed Crust, Others |

| Sizes Covered | Small, Medium, Large |

| Product Types Covered | Regular Frozen Pizza, Premium Frozen Pizza, Gourmet Frozen Pizza |

| Toppings Covered | Cheese, Meat, Fruits and Vegetables, Others |

| Distributions Covered | Food Chain Services, Modern Trade, Departmental Stores, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amy's Kitchen, Inc., Atkins Nutritionals Inc. (The Simply Good Foods Company), California Pizza Kitchen, Daiya Foods Inc. (Otsuka Pharmaceutical Co. Ltd.), DiGiorno (Nestlé S.A.), Dr. Oetker, Freiberger Lebensmittel GmbH (Südzucker AG), Giovanni’s Frozen Pizza, Newman's Own, Red Baron Pizza (Schwan's Consumer Brands, Inc), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the frozen pizza market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global frozen pizza market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the frozen pizza industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global frozen pizza market was valued at USD 18.5 Billion in 2024.

We expect the global frozen pizza market to exhibit a CAGR of 5.04% during 2025-2033.

The growing demand for ready-to-eat food products, along with the introduction of gluten- and dairy- free variants to cater to the changing consumer dietary patterns, is currently driving the global frozen pizza market.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of frozen pizza.

Based on the pizza crust type, the global frozen pizza market can be segmented into thin crust, thick crust, stuffed crust, and others. Currently, thin crust holds the majority of the total market share.

Based on the size, the global frozen pizza market has been divided into small, medium, and large. Among these, medium-sized frozen pizza currently exhibits a clear dominance in the market.

Based on the product type, the global frozen pizza market can be categorized into regular frozen pizza, premium frozen pizza, and gourmet frozen pizza. Currently, regular frozen pizza accounts for the majority of the global market share.

Based on the topping, the global frozen pizza market has been segregated into cheese, meat, fruits and vegetables, and others. Among these, meat holds the largest market share.

Based on the distribution, the global frozen pizza market can be bifurcated into food chain services, modern trade, departmental stores, online stores, and others. Currently, food chain services exhibit a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global frozen pizza market include Amy's Kitchen, Inc., Atkins Nutritionals Inc. (The Simply Good Foods Company), California Pizza Kitchen, Daiya Foods Inc. (Otsuka Pharmaceutical Co. Ltd.), DiGiorno (Nestlé S.A.), Dr. Oetker, Freiberger Lebensmittel GmbH (Südzucker AG), Giovanni’s Frozen Pizza, Newman's Own, Red Baron Pizza (Schwan's Consumer Brands, Inc), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)