Frozen Food Market Report by Product Type (Frozen Vegetable Snacks, Frozen Meat Products, Frozen Vegetables and Fruits), Frozen Vegetable Snacks Type (French Fries, Bites, Wedges and Smileys, Aloo Tikki, Nuggets, and Others), Frozen Meat Products Type (Chicken, Fish, Pork, Mutton, and Others), Frozen Vegetables Type (Green Peas, Corn, Mixed Vegetables, Carrot, Cauliflower, and Others), Frozen Fruits Type (Strawberries, Berries (Raspberries, Blueberries and Blackberries), Cherries, and Others), and Region 2025-2033

Global Frozen Food Market:

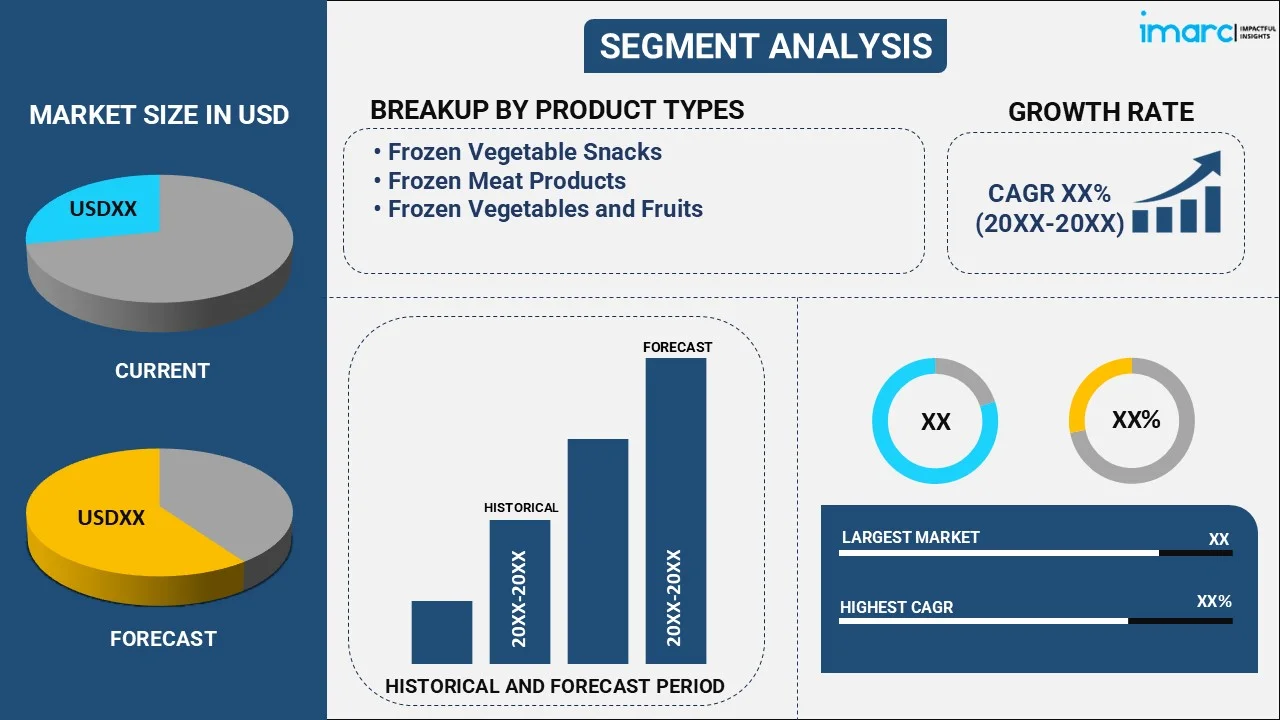

The global frozen food market size reached USD 261.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 360 Billion by 2033, exhibiting a growth rate (CAGR) of 3.59% during 2025-2033. The rising consumer focus on health and wellness, the increasing number of retail distribution channels, the expanding e-commerce industry, the introduction of continuous technological advancements in logistics and product preservation, and the escalating demand for convenience are some of the primary factors positively influencing frozen food market growth across the globe.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 261.9 Billion |

|

Market Forecast in 2033

|

USD 360 Billion |

| Market Growth Rate 2025-2033 | 3.59% |

Frozen Food Market Analysis:

- Major Market Drivers: The growing focus among key players in different countries on minimizing food wastage, the constant developments in freezing technologies, and the widespread usage of convenient food products by the working population are significant opportunities in the frozen food industry across the globe.

- Key Market Trends: Some of the prominent emerging trends in the global market include the shifting consumer preferences towards nutritious and healthier product variants, including low-sodium and low-calorie frozen food items. In line with this, the expanding consumer palate is elevating the popularity of gourmet and ethnic frozen foods, which is providing a positive frozen food market outlook.

- Competitive Landscape: Some of the major market players in the frozen food industry include Ajinomoto Co. Inc., Aryzta A.G., Associated British Foods plc, Bellisio Foods Inc. (Charoen Pokphand Foods), Cargill Incorporated, Conagra Brands Inc., General Mills Inc., The Kraft Heinz Company, JBS S.A., Jeanie Marshal Foods Ltd, Kellogg Company, McCain Foods Limited, Nestlé S.A., Wawona Frozen Foods, among many others.

- Geographical Trends: Europe accounts for the largest market share, on account of the changing lifestyle preferences of individuals across the region and the elevating inclination among consumers towards high-quality and diverse frozen foods. Besides this, the rising retail infrastructures across the region are acting as significant growth-inducing factors.

- Challenges and Opportunities: According to the frozen food market statistics, the global market is facing some challenges, including the difficulty in addressing concerns related to nutritional content and the rising complexities in supply chains and maintaining the quality of frozen food during transportation. Nevertheless, the emerging e-commerce platforms that provide wider market access and the rising popularity of ethically sourced and plant-based frozen food items will bolster the global market in the coming years.

Frozen Food Market Trends:

The Inflating Need for Time-Saving and Convenient Meals

The expanding working population living in urban areas requires easy-to-cook frozen food, which includes ready-to-eat snacks, meals, vegetables, etc. The ability of these products to reheat without any extensive preparations and longer cooking times will continue to bolster the global market. For instance, according to the World Bank, it is estimated that 56% of the world's population is anticipated to live in urban areas and will continue to reach 68% by 2050. Consequently, the hectic lifestyles of individuals are projected to drive the demand for frozen food products to cater to their diverse dietary requirements and needs.

The Rising Consumer Awareness Towards the Long Shelf Life of Frozen Food Products

Frozen foods are gaining extensive traction, owing to their long shelf-life. Consequently, key players across the globe are also developing novel freezing processes and eco-friendly packaging to preserve these products for extended periods without requiring any preservatives. For example, Nomad Foods collaborated and partnered with Innoget, an innovation network, to introduce clean-label and paper-based packaging for frozen food items, including frozen potato fries. Moreover, Nature Fresh Farms launched an innovative initiative to minimize plastic use by utilizing a proprietary compostable wrap. The wrap is usually made from a starch-based PLA derived and plant-based resources, including non-GMO corn starch. It dissolves naturally into CO2 and water and breaks down in any household compost without leaving behind microplastics. The company also said that" every 5 million cucumbers wrapped in its compostable film saves the equivalent of 23 million plastic straws from landfills." These packaging innovations keep frozen food products safe and cold while in transit, which is further stimulating the market growth.

Continuous Advancements in Advanced Freezing Technologies

Some of the major key players across several countries are developing novel freezing technologies, including flash freezing, to preserve color, nutritional content, texture, etc., better than their traditional counterparts, thereby augmenting the global market. For example, SPATULA Foods Inc. claimed to deliver restaurant-quality dishes in no time. They have the fastest meal kit in the market, where their chefs cook every dish to 90% ready and then flash-freeze meals so that the flavor, nutrients, and quality remain intact without the usage of preservatives. In addition to this, these advancements also provide employment opportunities and reduce food wastage. For instance, Mix-Detroit, a woman-owned Black business, has been using flash-freezing produce from Highland Park, Detroit, and Hamtramck farmers. This, in turn, has provided significant growth opportunities in the global market. In addition to this, numerous leading smart packaging manufacturers across the globe are adopting novel technologies, including printed QR codes, radio frequency identification (RFID), the Internet of Things (IoT) sensors, etc., in cold supply chains to offer real-time monitoring and tracking of frozen food products, which is propelling the global market. For example, LMI Technologies (LMI), the manufacturer of 3D scanning and inspection solutions, introduced novel packaging features that were connected to a webpage with all the product quick start guides (QSG) that were available. With the help of these features customers could quickly download the PDF version corresponding to their new LMI product by scanning the QR code on the box through their smartphone.

The Rising Consumer Awareness Towards Health and Wellness

The wide availability of frozen meals, including frozen fruits and vegetables that generally cater to specific dietary needs, is also positively influencing the global market. For example, a study analyzed by RaboBank states that the import of frozen sweet potatoes in the European Union, particularly from the United States, has tripled over the last four years, thereby indicating the growing consumer inclination towards these frozen variants. Apart from this, the increasing participation of individuals in outdoor activities is escalating the demand for freeze-dried vegetable and fruit ingredients, which is acting as another significant growth-inducing factor. For instance, 53% of Americans of age 6 and over participated in outdoor recreation at least once. The rise in outdoor activities will create a positive outlook for the frozen food market.

The Increasing Number of Retail Distribution Channels

The rising need for accessibility among consumers is elevating the popularity of retail distribution channels, as they help in improving the visibility and availability of a wide array of frozen food products. This will provide a considerable boost to the global market. For example, according to BBC, consumers in the U.S. significantly used online retailing platforms during the sudden outbreak of the COVID-19 pandemic, which, in turn, increased the sales of these products. In addition to this, the introduction of user-friendly apps, on account of the growing internet penetration, is further catalyzing the market across the globe. For example, according to the American Frozen Food Institute (AFFI), a wide array of online retail customers were adding frozen food to their digital carts.

Frozen Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional and country levels for 2025-2033. Our report has categorized the market based on product type, frozen vegetable snacks type, frozen meat products type, frozen vegetables type, and frozen fruits type.

Breakup by Product Type:

- Frozen Vegetable Snacks

- Frozen Meat Products

- Frozen Vegetables and Fruits

The report has provided a detailed breakup and analysis of the market based on the product type. This includes frozen vegetable snacks, frozen meat products, and frozen vegetables and fruits. According to the report, frozen meat products represented the largest segment. The escalating demand for frozen meat products, such as frozen chicken nuggets, sausages, meatballs, etc., owing to their consistent quality, minimal preparation time, long preservation life, etc., is acting as a significant growth-inducing factor. For example, according to the American Frozen Food Institute (AFFI), sales of frozen meals, such as chicken and seafood, were 21.0% higher than in 2019, with double-digit sales of all sorts of frigid or chilled meals. Furthermore, the inflating expenditure capacities of individuals on frozen meat products will continue to fuel the global market in the coming years. For instance, as per the data generated from the Bureau of Labor Statistics, the average annual expenditure on frozen meals per consumer unit in the United States in 2020 was US$ 53.81. The growing disposable incomes are expected to drive the frozen food market over the forecasted period.

Breakup by Frozen Vegetable Snacks Type:

- French Fries

- Bites, Wedges and Smileys

- Aloo Tikki

- Nuggets

- Others

The report has provided a detailed breakup and analysis of the market based on the frozen vegetable snacks type. This includes french fries, bites, wedges and smileys, aloo tikki, nuggets, and others.

Breakup by Frozen Meat Products Type:

- Chicken

- Fish

- Pork

- Mutton

- Others

The report has provided a detailed breakup and analysis of the market based on the frozen meat products type. This includes chicken, fish, pork, mutton, and others.

Breakup by Frozen Vegetables Type:

- Green Peas

- Corn

- Mixed Vegetables

- Carrot

- Cauliflower

- Others

The report has provided a detailed breakup and analysis of the market based on the frozen vegetables type. This includes green peas, corn, mixed vegetables, carrot, cauliflower, and others.

Breakup by Frozen Fruits Type:

- Strawberries

- Berries (Raspberries, Blueberries, Blackberries)

- Cherries

- Others

The report has provided a detailed breakup and analysis of the market based on the frozen fruits type. This includes strawberries, berries (raspberries, blueberries and blackberries), cherries, and others.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe accounted for the largest market share. In Europe, numerous key players in the global frozen food market are introducing new product variants to cater to evolving consumer preferences for different cuisines. For instance, in June 2023, Frosta AG, a German-based company, introduced a plant-based frozen food range, including Vegan Fish Fingers (Veggie Fish Stabchen). The company also claimed to utilize protein replacement ingredients from a reliable source. Furthermore, consumers in numerous countries, such as France, Italy, Spain, Germany, the United Kingdom, etc., in the region are widely adopting frozen seafood, which is acting as another significant growth-inducing factor. As per the Eurobarometer Poll 2021, 64% of Europeans continued to consume fish regularly at home, and frozen items were the most popular, slightly ahead of fresh and canned goods. As per the poll, nearly 80% of individuals bought fish or seafood items at the grocery store, supermarket, or hypermarket, considerably outnumbering any other location. Apart from this, the development of single-serving options also catalyzed the regional market. For example, Bell & Evans introduced uncooked and frozen chicken meatballs. Various flavors were also added, including buffalo seasoned, parmesan breaded with mozzarella, and a traditional and savory chicken meatball. All three variants were prepared from a blend of dark meat chicken and were uncooked and nitrogen-choked to lock in natural juices and freshness.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the major market players in the Frozen Food industry include Ajinomoto Co. Inc., Aryzta A.G., Associated British Foods plc, Bellisio Foods Inc. (Charoen Pokphand Foods), Cargill Incorporated, Conagra Brands Inc., General Mills Inc., The Kraft Heinz Company, JBS S.A., Jeanie Marshal Foods Ltd, Kellogg Company, McCain Foods Limited, Nestlé S.A., Wawona Frozen Foods, among many others.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Frozen Food Market News:

- April 2023: Nestle came to an agreement with private equity firm PAI Partners to establish a joint venture focused on Nestle frozen pizza business in Europe.

- July 2023: Conagra Brands, Inc. introduced over 50 new products spanning their grocery, frozen, and snacks divisions. Within Conagra's frozen meal portfolio, there is a wide variety of flavors and price points commonly available across their brands and entrees.

- March 2024: Thai Union Group, a major marketer and producer of canned tuna, frozen shrimp, and other seafood, introduced a program aimed at significantly minimizing greenhouse gas (GHG) emissions within the shrimp supply chain.

Frozen Food Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Frozen Vegetable Snacks, Frozen Meat Products, Frozen Vegetables and Fruits |

| Frozen Vegetable Snacks Types Covered | French Fries, Bites, Wedges and Smileys, Aloo Tikki, Nuggets, Others |

| Frozen Meat Products Types Covered | Chicken, Fish, Pork, Mutton, Others |

| Frozen Vegetables Types Covered | Green Peas, Corn, Mixed Vegetables, Carrot, Cauliflower, Others |

| Frozen Fruits Types Covered | Strawberries, Berries (Raspberries, Blueberries, Blackberries), Cherries, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ajinomoto Co. Inc., Aryzta A.G., Associated British Foods plc, Bellisio Foods Inc. (Charoen Pokphand Foods), Cargill Incorporated, Conagra Brands Inc., General Mills Inc., The Kraft Heinz Company, JBS S.A., Jeanie Marshal Foods Ltd, Kellogg Company, McCain Foods Limited, Nestlé S.A., Wawona Frozen Foods, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the frozen food market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global frozen food market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the frozen food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

We expect the global frozen food market to exhibit a CAGR of 3.59% during 2025-2033.

The expanding working population, along with the increasing adoption of frozen food items, as they are easy to prepare, retain nutritional content, help in saving time and money, can be stored for an extended period, etc., is primarily driving the global frozen food market.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of frozen food products.

Based on the product type, the global frozen food market can be bifurcated into frozen vegetable snacks, frozen meat products, and frozen vegetables and fruits. Currently, frozen meat products hold the largest market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where Europe currently dominates the global market.

Some of the major players in the global frozen food market include Ajinomoto Co. Inc., Aryzta A.G., Associated British Foods plc, Bellisio Foods Inc. (Charoen Pokphand Foods), Cargill Incorporated, Conagra Brands Inc., General Mills Inc., The Kraft Heinz Company, JBS S.A., Jeanie Marshal Foods Ltd, Kellogg Company, McCain Foods Limited, Nestlé S.A., and Wawona Frozen Foods.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)