Freeze-Drying Equipment Market Size, Share, Trends and Forecast by Dryer Type, Scale of Operation, Application, and Region, 2025-2033

Freeze-Drying Equipment Market Size and Share:

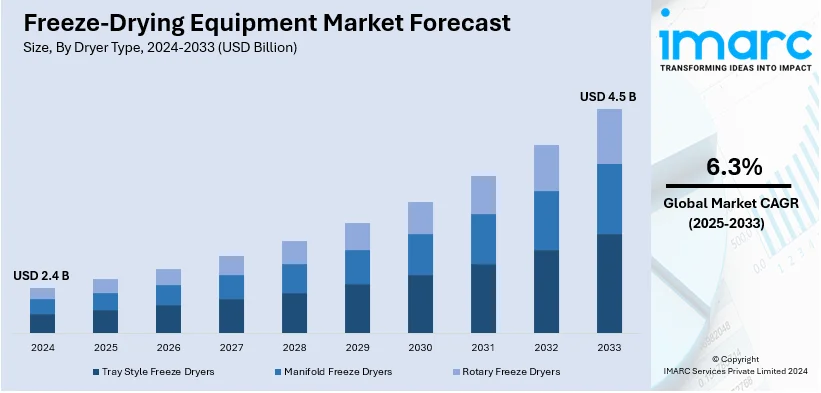

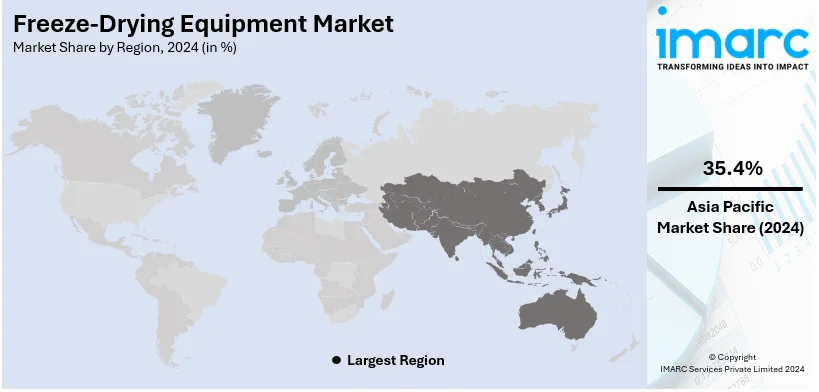

The global freeze-drying equipment market size was valued at USD 2.44 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.49 Billion by 2033, exhibiting a CAGR of 6.30% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of 35.4% in 2024. Asia Pacific region’s strong food, biotechnology, and pharmaceutical sectors are making it the market leader for freeze-drying equipment. The adoption of these equipment is fueled by a rapidly expanding population and an increase in the demand for processed and preserved goods.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.44 Billion |

|

Market Forecast in 2033

|

USD 4.49 Billion |

| Market Growth Rate 2025-2033 | 6.30% |

Freeze-drying enables easy storage of pharmaceuticals, vaccines, and biologics for long durations, increasing their stability. The freeze-drying technology is also promoted in the food and beverage (F&B) sector because people prefer flavored and nutritious ready-to-eat (RTE) and preserved products. Rising research activities and investments in health infrastructure are supporting the growth of the market. Technology development and applications, such as automated and energy-efficient freeze-drying systems, add value in terms of operational efficiency and scalability. Finally, the expansion of the application of freeze-drying equipment in pet food, cosmetics, and nutraceuticals drives the growth of this market as those end-users search for better ways of protecting their sensitive products.

To get more information on this market, Request Sample

The United States stands out as a key market disruptor, driven by the sophisticated pharmaceutical and biotechnology industries in the country, which place a high priority on the research of novel drugs and the manufacturing of biologics. The need for freeze-drying to guarantee product stability is increased by rising investments in vaccine development, especially for mRNA-based treatments. Market expansion is supported by the booming food and beverage (F&B) sector as well as rising customer preferences for natural and minimally processed items. The adoption of freeze-drying equipment is also fueled by the US government's emphasis on bolstering healthcare infrastructure and guaranteeing emergency readiness, which includes stockpiling essential medications and vaccinations. This market growth is also aided by the rising acceptance in specialized industries like pet food and high-end cosmetics.

Freeze-Drying Equipment Market Trends:

Heightened demand in the pharmaceutical industry

The freeze-drying equipment market is propelled by the ever-increasing focus of the pharmaceutical industry on safe preservation of sensitive biological materials, such as vaccines, blood products as well as antibiotics. In order to enhance the shelf life of these important materials, there is a need to ensure their stability through freeze-drying techniques especially where refrigeration is not an option. This technology becomes even more necessary when dealing with temperature-controlled products which have short shelf life. An environment of chronic diseases, increased elderly population, and shift towards personalized medicine are increasing the demand for such efficient preservation techniques. The rigid regulatory requirements that govern the pharmaceutical sector in relation to safety and quality of the product equally creates the need for advanced freeze-drying equipment. The global demand for reliable and efficient solutions for freeze-drying is growing in tandem with the expansion of research and development (R&D) efforts of pharmaceutical companies, and the entry of new biological drugs in the market.

Rising consumption of processed and convenience food products

The growing preferences for processed and convenience food products is another significant driver in the market. As lifestyles become increasingly hectic, the demand for easy-to-prepare and long-lasting food options is heightening. Freeze-drying technology provides a method for preserving food products without sacrificing essential nutrients, texture, or flavor. This method allows for an extended shelf life, easy storage, and convenience in preparation, making it highly appealing to both manufacturers and consumers, thereby strengthening the growth of the market. Given that the food and beverage (F&B) industry is a large and continuously growing market, the increasing adoption of freeze-drying technologies for food preservation underscores the equipment's indispensable role in meeting contemporary consumer needs.

Rapid technological advancements

Advancements in automation, energy efficiency, and scalability of equipment are attracting substantial investments and interest from various industries. For instance, modern freeze-dryers are equipped with programmable logic controllers (PLCs) and touch-screen interfaces that simplify the operation and monitoring processes. Such technological innovations reduce the need for manual intervention, thereby lowering the risk of error and increasing overall efficiency. Energy-efficient systems also offer cost savings in the long term, making them an attractive option for companies looking to optimize operational expenses, which is impelling the growth of the market. Moreover, these advancements improve the efficiency and reliability of freeze-drying processes and expand the range of applications where freeze-drying can be effectively utilized, further fueling the market growth.

Freeze-Drying Equipment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on dryer type, scale of operation, and application.

Analysis by Dryer Type:

- Tray Style Freeze Dryers

- Manifold Freeze Dryers

- Rotary Freeze Dryers

Tray-style freeze dryers are predominantly used in the pharmaceutical and biotech industries due to their capacity to handle large volumes and compatibility with batch processing. These dryers come with shelves that can be either static or adjustable, allowing for the effective dehydration of materials laid out in trays. Their design is particularly suited for products that require a stable and uniform drying process, making them the go-to choice for pharmaceutical formulations and biological samples.

Manifold freeze dryers are generally utilized for small-volume applications and are highly popular in laboratories and pilot research. These dryers work by connecting multiple flasks to a single chamber, enabling the drying of various samples simultaneously. They are ideal for applications that require quick drying and are often used in academic research, small-scale production, and even food preservation on a limited scale.

Rotary freeze dryers are less common than the other types but find diverse applications in situations where the material needs to be agitated during the drying process. These dryers rotate the product container to ensure uniform drying. They are particularly useful for materials that are sensitive to heat or need to be dried without clumping.

Analysis by Scale of Operation:

- Industrial Scale Freeze Dryer

- Pilot Scale Freeze Dryer

- Laboratory Scale Freeze Dryer

Industrial scale freeze dryer leads the market with 34.9% of market share in 2024. Industrial-scale freeze dryers cater to high-volume production needs prevalent in major industries like pharmaceuticals and food processing. These large-scale units are engineered to handle substantial quantities of material efficiently, providing economies of scale essential for commercial viability. As regulatory standards in sectors, such as pharmaceuticals, demand stringent quality and preservation methods, industrial-scale freeze dryers offer the consistency and reliability required to meet these specifications, which is offering lucrative growth opportunities to industry investors. Additionally, these dryers are often integrated into automated production lines, allowing for seamless, large-scale manufacturing and packaging operations. Their capability to operate continuously for extended periods makes them indispensable for fulfilling the ever-growing market demand. Moreover, the long-term cost-efficiency of industrial-scale units represents another major factor supporting the market growth. Although they require a significant initial investment, their lower operational costs per unit of output render them economically favorable over time.

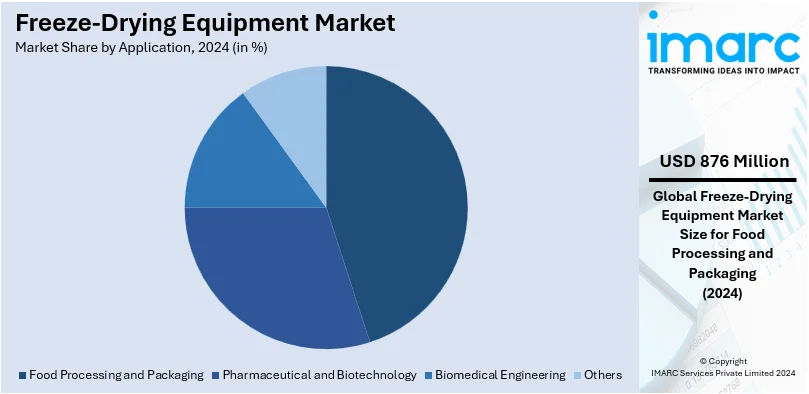

Analysis by Application:

- Food Processing and Packaging

- Pharmaceutical and Biotechnology

- Biomedical Engineering

- Others

Food processing and packaging leads the market with 35.9% of market share in 2024. The main factors that are driving the growth of this segment include the ever-increasing consumer demand for convenience food products with extended shelf life and retained nutritional value. Freeze-drying meets these needs by preserving the taste, texture, and nutrients in food items, making it a preferred technology for processed food products, including fruits, vegetables, meats, and ready-to-eat (RTE) meals. Furthermore, the expansion of the global food and beverage (F&B) industry, fueled by rising population and changing lifestyle patterns, necessitates robust food preservation techniques capable of sustaining large-scale production. The high-volume processing capacity as well as the exceptional results in terms of preserving products are the advantages which make freeze drying equipment ideal for this purpose. Additionally, the equipment's efficiency in reducing weight of the food items thus making transportation and storage less expensive is spurring the segment growth. This is important especially for those developing nations which are dependent on foreign food items or have long supply chains.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounts for the largest market share of 35.4%. Asia Pacific holds the biggest market share as the region is experiencing rapid industrialization and economic growth, creating fertile ground for high-tech equipment across various sectors. This includes the expanding pharmaceutical and food processing industries, both of which are significant users of freeze-drying technology. In addition to this, Asia Pacific region has a large population which leads to an increased consumption for medicines as well as processed food items. There is an increasing requirement of meeting this demand through effective and large scale manufacturing which in effect propels the trend of using industrial freeze-drying equipment. Several Asia-Pacific nations such as India and China are witnessing rising development of medical facilities and more focus on pharmacological development which are also contributing to the market expansion. Apart from this, positive government measures and policies in the region are motivating industrial sectors to integrate more sophisticated technologies, including freeze-drying systems.

Key Regional Takeaways:

United States Freeze-Drying Equipment Market Analysis

In 2024, US accounts for 88.90% of the total North America freeze-drying equipment market share. The US market is experiencing robust growth, driven by its critical role in the pharmaceutical, biotechnology, and food processing sectors. Freeze-drying technology plays a crucial role in ensuring the stability, potency, and extended shelf life of essential products, making it indispensable in healthcare advancements. Additionally, the rising consumer preference for minimally processed, nutrient-rich freeze-dried foods is further fueling the demand, particularly in the food processing industry. This country also benefits from a strong research and development (R&D) ecosystem and government regulations that encourage innovations in preservation technologies. The growing use of lyophilization in cosmetics for product stability and the expanding trend of outsourcing production to contract manufacturing organizations (CMOs) further highlight the market's upward trajectory. The presence of leading manufacturers and technological advancements also make the United States a key market for freeze-drying equipment.

Asia Pacific Freeze-Drying Equipment Market Analysis

The booming of pharmaceutical, biotechnology and food processing industries contribute to the positive performance of the Asia Pacific freeze-drying equipment market. Shift towards the usage of freeze-drying technologies, especially for biologics, vaccines and other important pharmaceutical products is fueled by China and India's tremendous outlays towards production, research and development, and health infrastructure. Moreover, increasing consumer emphasis on portable, health-oriented and extended shelf-life food products is contributing to the growing acceptance of freeze dried products and nutraceuticals, thus enhancing the size of the market. The prioritization of local manufacturing of medicines in China and the Make in India framework also augments the market. The region's low production costs facilities likewise make it a center for pharmaceutical outsourcing attracting many investors in the industry.

Europe Freeze-Drying Equipment Market Analysis

This region is experiencing steady growth in the market as industries like pharmaceutical, biotechnology, and food and beverage (F&B) are major consumer of freeze-drying equipment. There is an increase in the demand for biologics, vaccines, and other healthcare products, as geriatric population is rising in the region. European Medicines Agency (EMA) is emphasizing on following regulatory standards in the healthcare sector, which is further accelerating the adoption of advanced preservation technologies. The region is also increasingly investing in energy-efficient and sustainable freeze-drying solutions to meet both environmental goals and consumer demand for high-quality, minimally processed food products. Furthermore, the growing trend of convenience and health-conscious eating is driving the popularity of freeze-dried food products, adding to the demand. With substantial research and development (R&D) activities and the presence of leading pharmaceutical manufacturers, Europe remains a key player in the global freeze-drying equipment market.

Latin America Freeze-Drying Equipment Market Analysis

The freeze-drying equipment market in the Latin America region is showcasing growth due to burgeoning pharmaceutical and food processing industries. Advanced preservation technologies are required because investments are increasing in healthcare products like biologics and vaccines. People are highly interested towards convenient and shelf-stable food products, which can only sustain through freeze-dried processes. Governing bodies in the region are developing healthcare infrastructure and planning to invest more in advanced technologies that can help preserve medications for a long period of time.

Middle East and Africa Freeze-Drying Equipment Market Analysis

The market in this region is growing because people are paying attention towards healthcare and food security measures. Due to the prevalence of infectious diseases, trials for these diseases are high, thereby creating attractive growth opportunities for investors in the industry. The upward trend in the utilization of biologics and vaccines, which requires freeze-drying process for their stability and shelf life, is further responsible for the expansion of the market. This has brought a requirement for more advanced food preservation solutions due to the extreme climate in the region. The result is increased usage of lyophilization techniques both in pharmaceuticals and food processing.

Competitive Landscape:

To stay competitive, major companies in market are concentrating on innovations, strategic alliances, and global development. To improve performance and save operating costs, businesses are investing in cutting-edge technologies like automated and energy-efficient freeze-drying equipment. For increased accuracy and scalability, many are also implementing smart controls and IoT-enabled monitoring. Customized solutions are highly preferred by the people, and so pharmaceutical and food and beverage (F&B) sectors are working in this direction. Developing regions like Asia Pacific are providing attractive opportunities for leading key players, as these regions are showcasing high demand. Mergers and acquisitions are some other strategies followed by key players to expand their product offering and geographic coverage. R&D efforts are enabling key players to introduce small and portable freeze-drying equipment for SMEs.

The report has also analyzed the competitive landscape of the market with some of the key players being:

- Azbil Corporation

- Cuddon Freeze Dry

- GEA Group Aktiengesellschaft

- Harvest Right, LLC

- HOF Sonderanlagenbau GmbH

- Labconco Corporation

- Martin Christ Gefriertrocknungsanlagen GmbH

- Millrock Technology, Inc.

- OPTIMA packaging group GmbH

- Shanghai Tofflon Science and Technology Co. Ltd.

- Thermo Fisher Scientific

Latest News and Developments:

- February 2025: MedTEC Pharma, based in South Australia, emerged as one of the initial Australian companies to manufacture freeze-dried items from plants cultivated locally. The firm spent a significant amount of money on innovative post-harvesting technologies for creating live rosin vapes, freeze-dried live flower, and live rosin gummies. The funding enabled the company to obtain a large-scale freeze dryer from New Zealand and cryo-trimming machinery from the United States.

Freeze-Drying Equipment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Dryer Types Covered | Tray Style Freeze Dryers, Manifold Freeze Dryers, Rotary Freeze Dryers |

| Scales of Operations Covered | Industrial Scale Freeze Dryer, Pilot Scale Freeze Dryer, Laboratory Scale Freeze Dryer |

| Applications Covered | Food Processing and Packaging, Pharmaceutical and Biotechnology, Biomedical Engineering, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Azbil Corporation, Cuddon Freeze Dry, GEA Group Aktiengesellschaft, Harvest Right, LLC, HOF Sonderanlagenbau GmbH, Labconco Corporation, Martin Christ Gefriertrocknungsanlagen GmbH, Millrock Technology, Inc., OPTIMA packaging group GmbH, Shanghai Tofflon Science and Technology Co. Ltd., Thermo Fisher Scientific, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the freeze-drying equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global freeze-drying equipment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the freeze-drying equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Freeze-drying equipment is specialized machinery that removes moisture from perishable objects by freezing them and then sublimating the ice into vapor while vacuuming. It protects the product's structure, nutrients, and shelf life. It is commonly used in medicines, biotechnology, food, and cosmetics products to assure their stability and quality.

The freeze-drying equipment market was valued at USD 2.44 Billion in 2024.

IMARC estimates the global freeze-drying equipment market to exhibit a CAGR of 6.30% during 2025-2033.

The market is driven by the increasing demand in pharmaceuticals for preserving biologics and vaccines, and in food products for retaining nutrients and flavors. Technological advancements, such as energy-efficient systems, support the adoption. The growing consumer preference for ready-to-eat (RTE) and minimally processed food products, along with expanding applications in cosmetics and pet food products, further propelling the market growth worldwide.

According to the report, industrial scale freeze dryer represents the largest segment because industrial-scale freeze dryers cater to high-volume production needs across pharmaceuticals, food and beverage (F&B), and biotechnology industries, meeting large-scale preservation demands efficiently.

Food processing and packaging account for the majority of the market share as the food and beverage (F&B) industry leverages freeze-drying for extending shelf life and preserving the nutritional value and taste of processed and packaged foods.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global market include Azbil Corporation, Cuddon Freeze Dry, GEA Group Aktiengesellschaft, Harvest Right, LLC, HOF Sonderanlagenbau GmbH, Labconco Corporation, Martin Christ Gefriertrocknungsanlagen GmbH, Millrock Technology, Inc., OPTIMA packaging group GmbH, Shanghai Tofflon Science and Technology Co. Ltd., Thermo Fisher Scientific, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)