Forskolin Market Size, Share, Trends and Forecast by Concentration, End Use, and Region, 2025-2033

Forskolin Market 2024, Size and Trends:

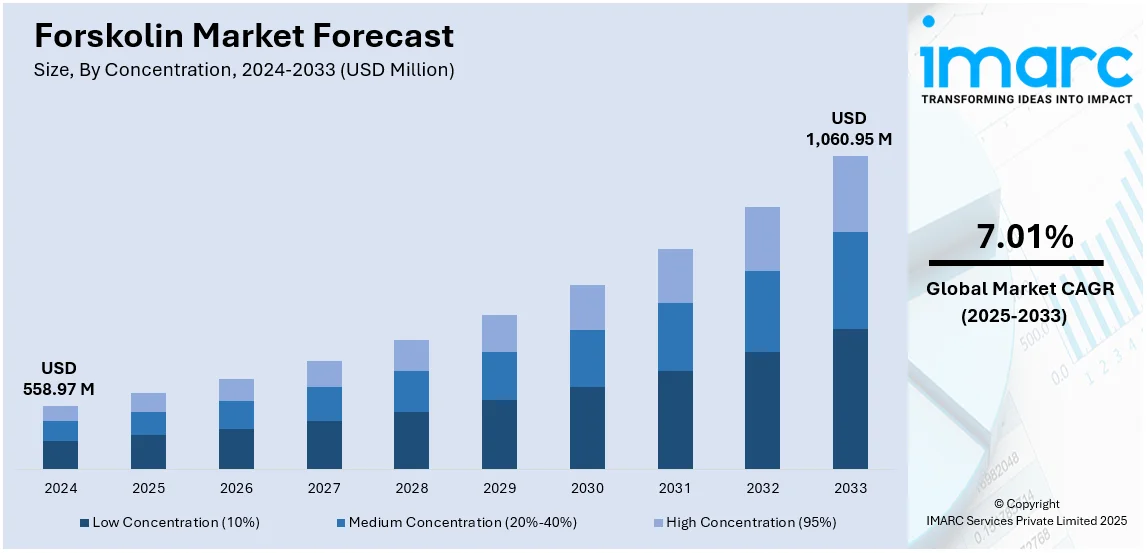

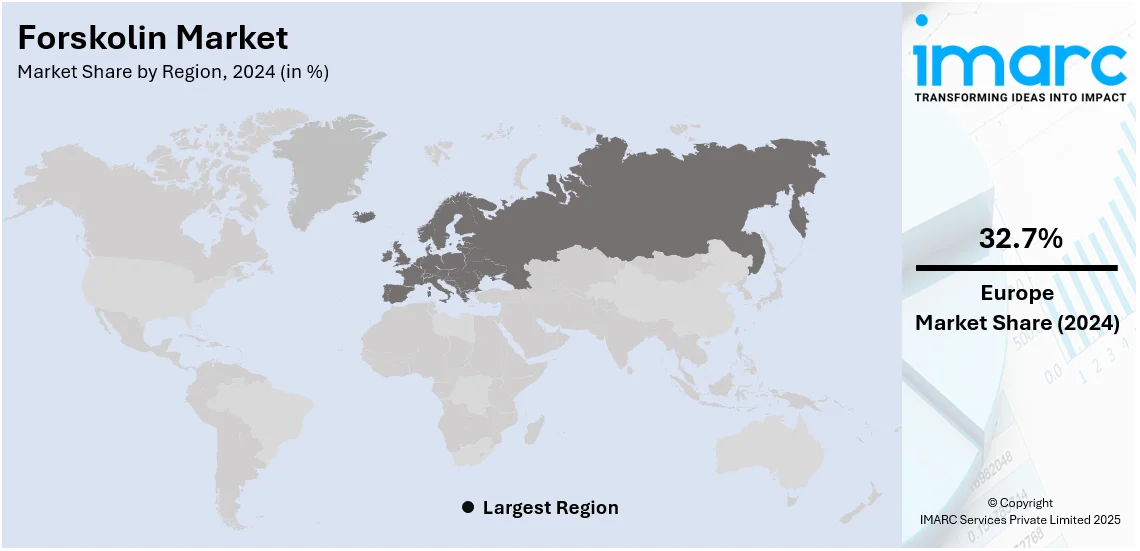

The global forskolin market size was valued at USD 558.97 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,060.95 Million by 2033, exhibiting a CAGR of 7.01% during 2025-2033. Europe currently dominates the market, holding a significant market share of over 32.7% in 2024. The escalating demand for herbal and ayurvedic products, growing usage of forskolin in cosmetics and personal care items and increasing product applications in foods and beverages represent some of the key factors driving the forskolin market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 558.97 Million |

| Market Forecast in 2033 | USD 1,060.95 Million |

| Market Growth Rate (2025-2033) | 7.01% |

The global forskolin market is driven by increasing consumer interest in natural supplements for weight management and overall wellness. Along with this, growing awareness of forskolin’s potential benefits, such as aiding fat loss and supporting cardiovascular health, is fueling demand. The rising prevalence of obesity and lifestyle-related disorders further enhances market growth. By 2035, an estimated 79% of individuals who are overweight and obese adults, and 88% of children affected will live in LMICs. From 0.81 billion adults with obesity in 2020, it is expected that this number will have increased to 1.53 billion by 2035. These numbers present a deepening public health crisis in LMICs. Expanding applications in pharmaceuticals, cosmetics, and dietary supplements contribute to its widespread adoption. Additionally, the shift toward plant-based and herbal products, along with ongoing research into forskolin’s therapeutic properties, enhances its market potential. Improved distribution channels and e-commerce growth are also key factors supporting the market’s expansion.

The United States stands out as a key regional market, primarily driven by increasing consumer preference for herbal and plant-based supplements. In addition, the rising health consciousness and the demand for non-synthetic weight management solutions have fueled its adoption. The presence of a well-established nutraceutical industry, coupled with rising disposable incomes, supports forskolin market growth. Concurrently, advancements in extraction techniques and product formulations have improved forskolin’s effectiveness, attracting more consumers. Regulatory support for herbal supplements and the growing influence of social media marketing further contribute to market expansion. On 24th June 2024, Teva Pharmaceuticals introduced an authorized generic of Victoza (liraglutide injection 1.8mg) in the United States. The company says that this will provide a new treatment for patients suffering from type 2 diabetes. As SVP of U.S. Commercial Generics, Ernie Richardsen comments, "This is the first generic GLP-1 product available in the U.S. and reinforces Teva's strong generics portfolio. Annual sales for Victoza reached $1.656 billion as of April 2024. The availability of forskolin-based products across retail and online platforms has also enhanced accessibility and sales.

Forskolin Market Trends:

Rising Consumer Preference for Natural and Herbal Products

The global shift toward natural, herbal, and Ayurvedic products is acting as one of the significant forskolin market trends. Along with this, consumers are increasingly opting for naturally derived ingredients over synthetically processed alternatives. This shift is reflected in the projected expansion of the Ayurveda product market, which is expected to grow at a compound annual growth rate (CAGR) of 15% from FY23 to FY28. The high medicinal value of forskolin has fueled its adoption in pharmaceuticals, healthcare, and fitness industries, further accelerating market growth.

Increasing Demand for Forskolin in the Personal Care and Cosmetics Industry

The growing use of high-purity forskolin as a conditioning agent in cosmetics and skincare is leading to a rise in forskolin market demand. Consumers are favoring personal care products infused with natural ingredients that offer active benefits, such as anti-aging properties. This trend is reinforced by the rapidly aging global population. According to the United Nations (UN), the number of individuals aged 65 and older is expected to more than double, rising from 761 million in 2021 to 1.6 billion by 2050. Additionally, factors such as increasing beauty consciousness, changing lifestyles, and the strong influence of social media have further propelled the demand for forskolin-based skincare solutions.

Expanding Applications in Dietary Supplements and Pharmaceuticals

Forskolin’s role in the dietary supplement industry has grown due to its potential benefits in managing lifestyle-related diseases such as obesity, high blood pressure, and cardiovascular disorders. This rising demand has encouraged pharmaceutical companies to integrate forskolin into their formulations. Simultaneously, manufacturers are focusing on sustainable forskolin production through advanced innovations in synthetic biology. Moreover, technological advancements in production processes and introduction of new forskolin-based products continue to drive market expansion. Additional factors such as the growth of the pharmaceutical sector, increasing applications in food and beverages, rising disposable incomes, and ongoing research and development (R&D) activities are further shaping a positive forskolin market outlook.

Forskolin Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global forskolin market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on concentration and end use.

Analysis by Concentration:

- Low Concentration (10%)

- Medium Concentration (20%-40%)

- High Concentration (95%)

High concentration (95%) stands as the largest component in 2024, holding around 68.0% of the market. The 95% concentration segment dominates the forskolin market, accounting for the largest share due to its widespread applications in pharmaceuticals, dietary supplements, and cosmetics. This high-purity extract is preferred for its enhanced potency and effectiveness, making it ideal for formulations targeting weight management, cardiovascular health, and skincare. The demand for 95% forskolin is driven by increasing consumer awareness of natural health solutions and the rising prevalence of lifestyle-related diseases. Additionally, advancements in extraction techniques have improved production efficiency, ensuring a stable supply. The segment’s growth is further supported by the expanding nutraceutical industry and growing investments in research and development (R&D).

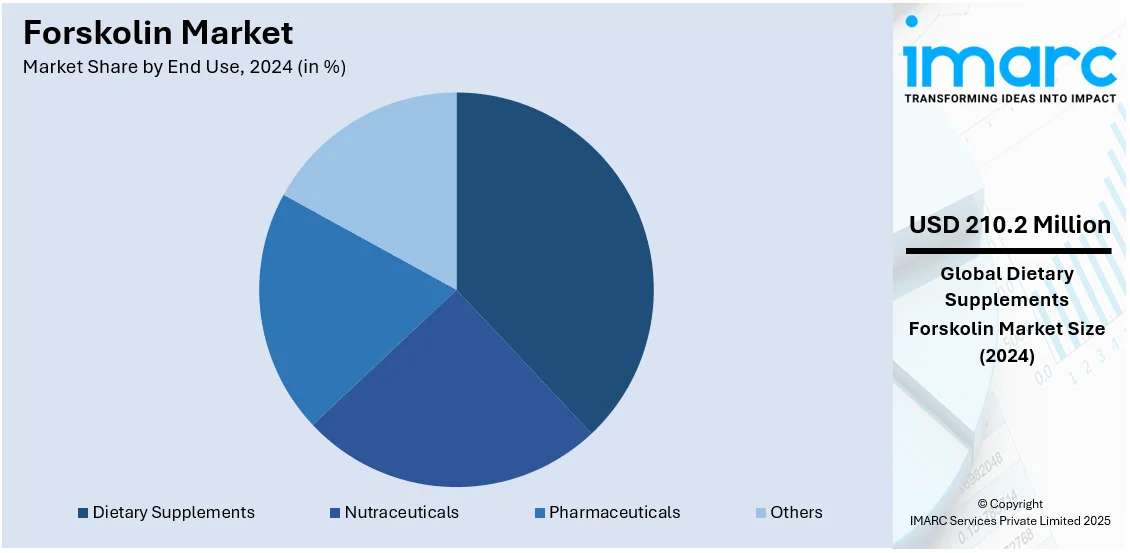

Analysis by End Use:

- Nutraceuticals

- Pharmaceuticals

- Dietary Supplements

- Others

Dietary supplements lead the market with around 37.6% of market share in 2024. The dietary supplements segment holds the largest share in the forskolin market, driven by increasing consumer demand for natural health solutions. Forskolin is widely used in weight management supplements due to its potential to enhance metabolism and promote fat loss. Additionally, its benefits in supporting cardiovascular health, reducing high blood pressure, and enhancing overall wellness have further fueled its adoption. The rising prevalence of lifestyle-related diseases, such as obesity and hypertension, has accelerated demand for forskolin-based supplements. Growing health consciousness, coupled with higher disposable incomes and the influence of social media, has also contributed to market expansion.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 32.7%, driven by the rising demand for natural and plant-based health solutions. Consumers in the region are more focusing on herbal supplements, functional foods, and clean-label products. This trend drives the usage of forskolin in dietary supplements and pharmaceuticals. The region is also dominated by a high level of obesity, cardiovascular diseases, and hypertension. This is helping to fuel usage in weight management and heart health formulations. There is an increased cosmetics and personal care market in Europe that further increases the usage of forskolin as a conditioning agent in skincare products. Strict regulatory standards guarantee quality production, thereby reinforcing consumer confidence in forskolin-based products.

Key Regional Takeaways:

United States Forskolin Market Analysis

In 2024, the US accounted for around 92.50% of the total North American forskolin market. The increasing allocation of resources toward drug development is driving a rise in forskolin utilization. According to reports, in the US pharmaceutical industry, there were 25 private equity deals announced in Q3 2024, worth a total value of USD 2.3 Billion. As medical research advances, the exploration of plant-derived compounds has gained traction, leading to greater incorporation of botanical extracts in therapeutic formulations. The establishment of research laboratories dealing with natural ingredients is driving innovative applications in respiratory, cardiovascular, and weight management solutions. The further development of extraction techniques increases the purity and potency of bioactive compounds, advancing the efficiency of formulation. Clinical tests involving herbal extracts are gaining funding, leading to an increase in the demand for well-researched botanical components. The integration of these compounds into prescription and over-the-counter formulations is widening their accessibility, further improving their presence in various treatments. Additionally, rising consumer confidence in scientifically validated plant-based interventions is reinforcing the market position of these extracts, ensuring sustained adoption in therapeutic applications.

Asia Pacific Forskolin Market Analysis

The increasing preference for plant-based wellness solutions is significantly influencing the demand for forskolin. According to a survey, the value of Ayurvedic manufacturing in India stood at USD 11 Billion in FY22. Traditional practices emphasizing botanical extracts are experiencing heightened interest, with consumers seeking natural alternatives for metabolic and cardiovascular health. Expanding awareness of time-tested formulations is prompting formulators to incorporate well-documented plant derivatives into various health solutions. Manufacturers are diversifying product offerings by integrating botanical components into functional beverages, capsules, and topical applications, further broadening accessibility. The rising inclination toward chemical-free compositions is encouraging innovation in formulation techniques, leading to enhanced bioavailability and efficacy. In addition, rising educational campaigns advocating the benefits of herbal supplementation further strengthen the market for natural ingredients. As a result of this changing regulatory scenario that encourages the standardization of plant-based health solutions, the extracts are finding their way to a broader market of consumers, who seek these extracts as integral parts of their wellness practices.

Europe Forskolin Market Analysis

The rising demographic shift toward an older population is contributing to increasing forskolin applications in wellness solutions. According to WHO, the population aged 60 and older is rapidly growing in the WHO European Region. In 2021, there were 215 Million; by 2030, it is projected to be 247 Million, and by 2050, over 300 Million. With a greater emphasis on maintaining vitality, individuals are exploring botanical alternatives for addressing age-related concerns, including metabolic health and respiratory function. Research-driven advancements in the study of plant-derived compounds have led to improved formulations catering to diverse age groups. The growing emphasis on preventive approaches is fostering interest in natural extracts, particularly among individuals seeking non-invasive wellness solutions. Additionally, innovations in bioavailability-enhancing technologies are making plant-based supplements more effective, further driving adoption. Healthcare practitioners are increasingly incorporating botanical components into holistic wellness plans, reinforcing consumer trust in their benefits. Regulatory frameworks supporting evidence-based plant-derived interventions are also enabling broader market penetration, leading to greater accessibility for consumers exploring natural alternatives to synthetic formulations.

Latin America Forskolin Market Analysis

The increasing purchasing power of consumers is leading to greater adoption of forskolin-infused wellness products. According to reports, Latin America's total disposable income is expected to grow by nearly 60% from 2021 to 2040. As individuals prioritize functional health solutions, botanical ingredients are being integrated into daily routines, particularly in formulations designed for weight management and cardiovascular support. The expansion of channels of natural wellness retailing improves access for the broader consumers who are going ahead to adopt the plant-based alternative. Changing lifestyles are driving the adoption of preventive supplementation through an emphasis on the origin of natural sourcing. Growing awareness of long-term benefits through herbal extracts leads to the creation of new products responding to changes in consumer preference. The growing contribution of wellness-led initiatives is increasing the relevance of plant-based supplements as an intrinsic part of newer health regimens.

Middle East and Africa Forskolin Market Analysis

The growing forskolin adoption in the Middle East and Africa is primarily attributed to the increasing prevalence of obesity, high blood pressure, and cardiovascular disorders. For instance, in 2021, the United Arab Emirates had the highest age-standardized prevalence rate of CVD, with 11066.8 (10490.2 to 11668.2) cases per 100,000 individuals. Countries in the Gulf region and parts of Africa are experiencing a rise in lifestyle-related health conditions, leading to higher demand for natural health supplements. Forskolin’s recognized benefits in weight management and blood pressure regulation are making it a sought-after herbal solution. Additionally, the increasing awareness of plant-based alternatives in healthcare is encouraging forskolin supplement consumption. Expanding healthcare initiatives focusing on lifestyle disease management in the region further support forskolin’s market growth.

Competitive Landscape:

The forskolin market is highly competitive, with numerous companies striving to expand their market presence through product innovation, strategic partnerships, and research-driven advancements. Manufacturers are focusing on high-purity forskolin extraction to meet the rising demand in pharmaceuticals, dietary supplements, and cosmetics. Increasing investments in sustainable production techniques and biotechnology innovations have further intensified competition. Additionally, companies are enhancing their global reach through expansion strategies, mergers, and acquisitions to strengthen distribution networks. The growing emphasis on quality assurance and regulatory compliance has prompted key players to adopt advanced manufacturing processes. Furthermore, continuous R&D efforts to explore new applications for forskolin in functional foods and medical formulations are shaping the competitive dynamics of the market, driving sustained growth.

The report provides a comprehensive analysis of the competitive landscape in the forskolin market with detailed profiles of all major companies, including:

- Alchem International Pvt. Ltd.

- Alpspure Lifesciences Pvt. Ltd.

- Bioprex Labs

- Cymbio Pharma Pvt Ltd

- Flavour Trove

- Glentham Life Sciences Limited

- Nutra Green Biotechnology Co. Ltd.

- Sabinsa Corporation

- Varion Lifesciences Pvt. Ltd.

Latest News and Developments:

- September 2023: Sabinsa, a globally recognized supplier of forskolin and other nutraceutical ingredients, expanded its presence in Europe. The company opened a new office in Montpon-Ménéstérol, southwest France, to strengthen forskolin distribution. This strategic move enhances accessibility to forskolin products across European markets. Sabinsa's expansion reflects increasing global demand for forskolin in health and wellness applications.

- May 2023: Sami-Sabinsa Group, a leading manufacturer of forskolin, partnered with O2 Renewable Energy to utilize solar power. This initiative aims to enhance the sustainability of its forskolin production at manufacturing plants in Karnataka, India. By integrating renewable energy, the company reduces its carbon footprint while maintaining high-quality forskolin output. This move aligns with the growing demand for eco-friendly production in the forskolin industry.

- March 2023: Sanofi S.A. announced the upcoming launch of its new forskolin-based drug, Eurekaflox. The drug has demonstrated promising results in clinical trials, particularly for treating asthma and other respiratory diseases. This new product highlights the potential of forskolin in pharmaceutical applications. The launch is expected to offer a novel treatment option for patients with respiratory conditions.

- January 2022: Sabinsa Corporation introduced Forslean 95%, a forskolin extract designed to support healthy weight management and enhance metabolism. This extract provides a high concentration of forskolin to optimize metabolic processes, helping users manage their weight more effectively.

- September 2021: HERBLIFE NUTRITION launched the Herbalife SKIN Clearify Acne Kit, which includes forskolin as a key ingredient. The formulation targets acne by supporting healthy skin and promoting a clear complexion, leveraging forskolin’s properties to enhance skin health.

- August 2021: NutraBio Labs released Forskolin 250, a forskolin-based supplement intended to aid weight management. With a potent dose of forskolin, the supplement is designed to help individuals maintain a healthy weight while contributing to overall health improvement.

Forskolin Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Concentrations Covered | Low Concentration (10%), Medium Concentration (20%-40%), High Concentration (95%) |

| End Uses Covered | Nutraceuticals, Pharmaceuticals, Dietary Supplements, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alchem International Pvt. Ltd., Alpspure Lifesciences Pvt. Ltd., Bioprex Labs, Cymbio Pharma Pvt Ltd, Flavour Trove, Glentham Life Sciences Limited, Nutra Green Biotechnology Co. Ltd., Sabinsa Corporation, Varion Lifesciences Pvt. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the forskolin market from 2019-2033.

- The forskolin market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the forskolin industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The forskolin market was valued at USD 558.97 Million in 2024.

IMARC estimates the forskolin market to exhibit a CAGR of 7.01% during 2025-2033, reaching a value of USD 1,060.95 Million by 2033.

The forskolin market is driven by rising consumer interest in natural and herbal supplements, increasing awareness of forskolin’s benefits in weight management and cardiovascular health, and its expanding applications in pharmaceuticals, cosmetics, and dietary supplements. Additionally, e-commerce growth, advancements in extraction techniques, and regulatory support for herbal supplements contribute to market expansion.

Europe currently dominates the forskolin market, accounting for a share exceeding 32.7% in 2024. This dominance is fueled by the region’s strong demand for plant-based health solutions, growing prevalence of lifestyle-related diseases, and the expanding cosmetics and personal care industry.

Some of the major players in the forskolin market include Alchem International Pvt. Ltd., Alpspure Lifesciences Pvt. Ltd., Bioprex Labs, Cymbio Pharma Pvt Ltd, Flavour Trove, Glentham Life Sciences Limited, Nutra Green Biotechnology Co. Ltd., Sabinsa Corporation, and Varion Lifesciences Pvt. Ltd., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)