Formic Acid Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition

Formic Acid Trend, Index and Forecast

Track real-time and historical formic acid prices across global regions. Updated monthly with market insights, drivers, and forecasts.

Formic Acid Prices January 2026

| Region | Price (USD/Kg) | Latest Movement |

|---|---|---|

| Northeast Asia | 0.4 | -2.4% ↓ Down |

| Europe | 0.82 | 6.5% ↑ Up |

| India | 0.73 | -35.4% ↓ Down |

| North America | 0.93 | 10.7% ↑ Up |

Formic Acid Price Index (USD/KG):

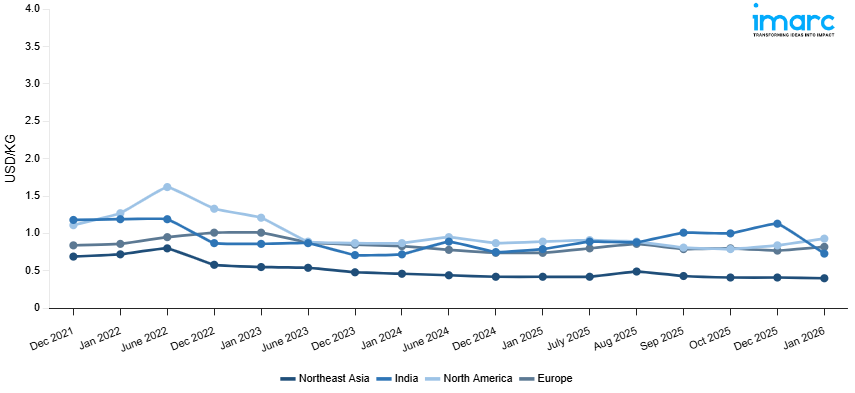

The chart below highlights monthly formic acid prices across different regions.

Get Access to Monthly/Quarterly/Yearly Prices, Request Sample

Market Overview Q3 Ending September 2025

Northeast Asia: Northeast Asia experienced significant downward pressure on formic acid pricing, reflecting oversupply conditions and weakened demand fundamentals. Supply-side dynamics were heavily influenced by methanol feedstock cost reductions, which provided margin relief for producers but translated into competitive pricing pressure. The region's export-oriented strategy intensified price competition, particularly as European and North American markets reduced import volumes due to logistical cost considerations. Domestic logistics costs rose due to fuel price volatility and regulatory compliance requirements for hazardous material transportation.

Europe: European formic acid markets demonstrated price resilience, reflecting structural market dynamics and supply chain adjustments. The region's import-dependent market structure faced challenges from elevated methanol feedstock costs, influenced by ongoing energy transition policies and carbon pricing mechanisms. Demand-side factors showed mixed patterns, with agricultural applications experiencing seasonal variations while pharmaceutical and chemical synthesis industries maintained steady consumption levels. Germany's automotive sector provided stable demand for formic acid in leather processing applications, though overall industrial activity moderated due to economic uncertainties. Supply chain costs remained elevated due to enhanced environmental compliance requirements under REACH regulations, particularly affecting smaller importers and distributors.

India: India's formic acid market demonstrated exceptional price strength, driven by robust domestic demand and supply constraints across multiple sectors. The agricultural sector's strong demand for formic acid as a silage preservative and animal feed additive coincided with favorable monsoon conditions and increased livestock production activities. Supply-side constraints emerged from raw material availability issues, particularly carbon monoxide and methanol feedstock costs that remained elevated due to import dependency and currency pressures. The strengthening of the Indian rupee against regional Asian currencies made imports more expensive while supporting domestic pricing power. Domestic logistics costs increased significantly due to infrastructure bottlenecks and fuel price volatility, particularly affecting transportation from coastal production facilities to interior consumption centers.

North America: North American formic acid markets experienced a moderate price correction, reflecting balanced supply-demand dynamics and competitive market conditions. The United States market faced mixed demand patterns, with agricultural applications showing seasonal strength due to favorable crop conditions and livestock production growth, while industrial applications remained stable. Canada's market benefited from steady demand in forest products industries and agricultural preservative applications, though overall pricing followed regional trends. Supply conditions were characterized by stable domestic production and competitive import availability from Asian suppliers, creating downward pricing pressure. Methanol feedstock costs remained relatively favorable due to competitive natural gas pricing and efficient domestic production capabilities. International shipping costs from alternative supply regions normalized, reducing import cost pressures and enhancing supply security. Domestic logistics faced challenges from trucking capacity constraints and rising labor costs, though rail transportation alternatives provided cost-effective distribution options for bulk consumers.

Formic Acid Price Trend, Market Analysis, and News

IMARC's latest publication, “Formic Acid Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition,” presents a detailed examination of the formic acid market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of formic acid at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed formic acid prices trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting formic acid pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

Formic Acid Industry Analysis

The global formic acid industry size reached 944.41 Kilo Tons in 2025. By 2034, IMARC Group expects the market to reach 1,232.24 Kilo Tons, at a projected CAGR of 2.85% during 2026-2034. The market is driven by the rising demand for engineered wood and construction materials, expanding use in automotive and furniture applications, and increasing adoption of formaldehyde-based resins and derivatives across agriculture, textiles, and consumer goods due to cost-effectiveness and versatility.

Latest developments in the Formic Acid Industry:

- June 2025: BASF introduced formic acid sales through its eAuction digital platform, giving customers in China a more transparent and efficient way to manage purchases. The platform was designed to simplify procurement, improve price visibility, and enhance convenience for industries that rely on formic acid, such as leather processing, agriculture, food preservation, and pharmaceuticals.

- July 2024: Scientists from Argonne National Laboratory and the University of Chicago unveiled new tin-based catalysts capable of converting CO2 into valuable chemicals like ethanol, acetic acid, and formic acid. The electrocatalytic process uses electricity to drive this conversion, with a focus on renewable energy sources like wind and solar.

- July 2024: Researchers at AIST and the University of Tsukuba developed an efficient method for directly synthesizing formic acid from CO2 and hydrogen using an iridium catalyst in hexafluoroisopropanol (HFIP). This breakthrough eliminates the need for formate intermediates, making the process simpler and more cost-effective.

- November 2023: Carbon conversion startup OCOchem announced that it has secured USD 5 million in Seed funding led by TO VC. INPEX Corp. (IPXHF.NaE), the LCY Lee Family Office and MIH Capital Management also participated in this funding round. They are now a part of Halliburton Labs, which is an energy and climate tech accelerator from the Halliburton Company. The Richland Washington-based firm is leveraging its distinctive skill to commercialize a new technique for generating highly versatile carbon neutral platform molecules by electrochemically transforming recycled carbon dioxide (CO2), water, and clean electricity into formic acid and formate chemicals.

- May 2023: Researchers at IIT Guwahati have developed a "pincer" catalyst that efficiently produces hydrogen and formic acid from wood alcohol, significantly reducing carbon dioxide emissions. This process operates at a lower temperature of 100 °C compared to the typical 300 °C required for traditional methods, and under lower pressure conditions. The catalyst can be reused multiple times, enhancing its commercial viability.

Product Description

Formic acid, commonly known as methanoic acid, is a colorless liquid, with the chemical formulation HCOOH. The acid possesses a pungent smell similar to that of vinegar. It is a common carboxylic acid which occurs naturally in numerous organisms including ants. Formic acid is mainly procured by the catalytic oxidation of methanol. This procedure includes the reaction of methanol with carbon monoxide in the presence of a catalyst, such as palladium or rhodium. Besides this, this acid is also produced through the hydrolysis of methyl formate, which is collected from methanol and carbon monoxide. Some of the most common industries where formic acid is put to use include leather tanning, rubber and textile industries, oil and gas industry, and preservation of animal feed. In the leather tanning industry, formic acid acts as a coagulant in chrome tanning procedures in order to precipitate collagen fibers and convert raw hides into leather.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Formic Acid |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Formic Acid Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of formic acid pricing, covering global and regional trends, spot prices at key ports, and a breakdown of FOB and CIF prices.

- The study examines factors affecting formic acid price trend, including input costs, supply-demand shifts, and geopolitical impacts, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The formic acid price charts ensure our clients remain at the forefront of the industry.

Key Questions Answered in This Report

The formic acid prices in January 2026 were 0.4 USD/Kg in Northeast Asia, 0.82 USD/Kg in Europe, 0.73 USD/Kg in India, and 0.93 USD/Kg in North America.

The formic acid pricing data is updated on a monthly basis.

We provide the pricing data primarily in the form of an Excel sheet and a PDF.

Yes, our report includes a forecast for formic acid prices.

The regions covered include North America, Europe, Asia Pacific, Middle East, and Latin America. Countries can be customized based on the request (additional charges may be applicable).

Yes, we provide both FOB and CIF prices in our report.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)