Forklift Trucks Market Size, Share, Trends and Forecast by Product Type, Technology, Class, Application, and Region, 2025-2033

Forklift Trucks Market 2024, Size And Trends:

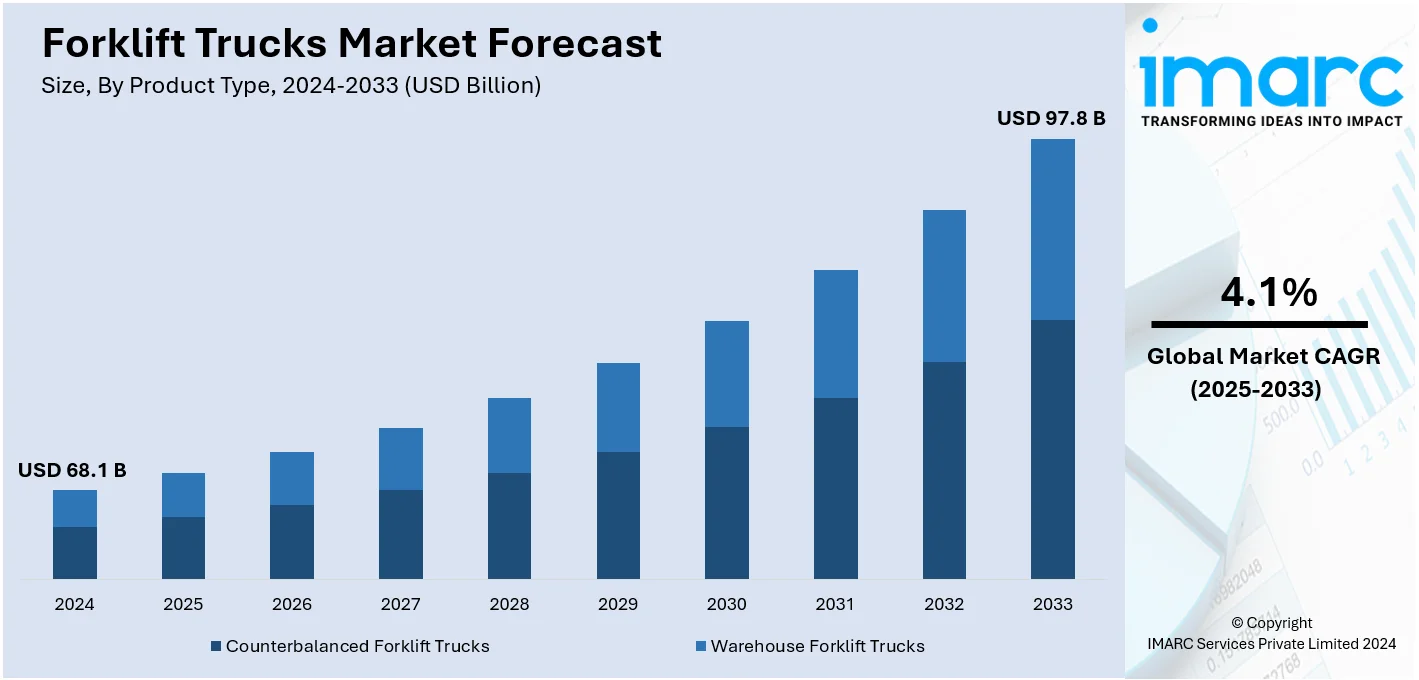

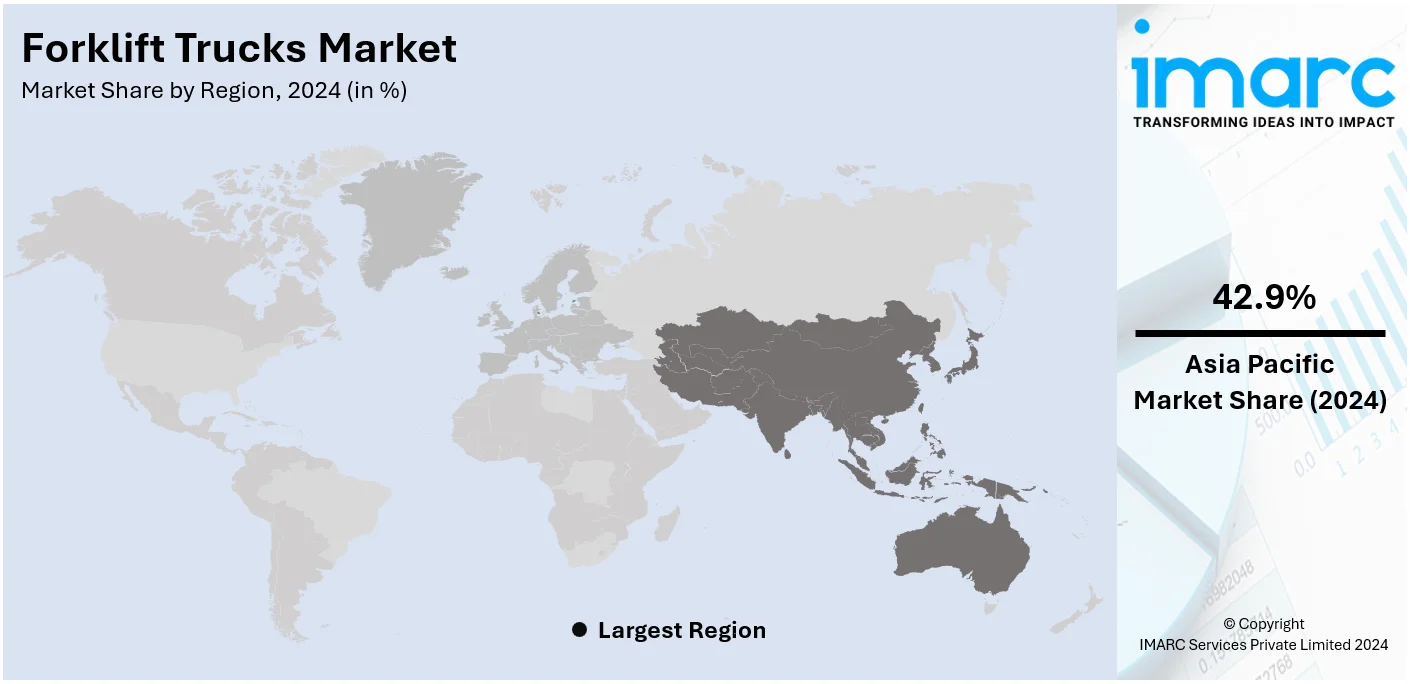

The global forklift trucks market size reached USD 68.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 97.8 Billion by 2033, exhibiting a growth rate CAGR of 4.1% during 2025-2033. Asia Pacific currently dominates the forklift trucks market share with 42.9% in 2024. Rapid industrialization, the growth of e-commerce, a rise in construction projects, and an increasing demand for advanced material handling solutions are driving this dominance across the region.

Key Market Highlights:

- A primary driver of the forklift truck market is the rapid growth of e-commerce and warehouse automation, which increases demand for efficient, labor‑saving material handling equipment.

- Counterbalanced forklift trucks leads the market with around 57.5% of the market share owing to high versatility, load capacity, and suitability for varied applications.

- Internal combustion engine powered leads the market with around 56.5% of market share driven by the higher power output, durability, and suitability for heavy-duty operations.

- Class V lead the market with around 50.2% of the market share in 2024 as they are very durable and are widely used in lumberyards and construction industries where heavy-duty equipment is required for efficient operations.

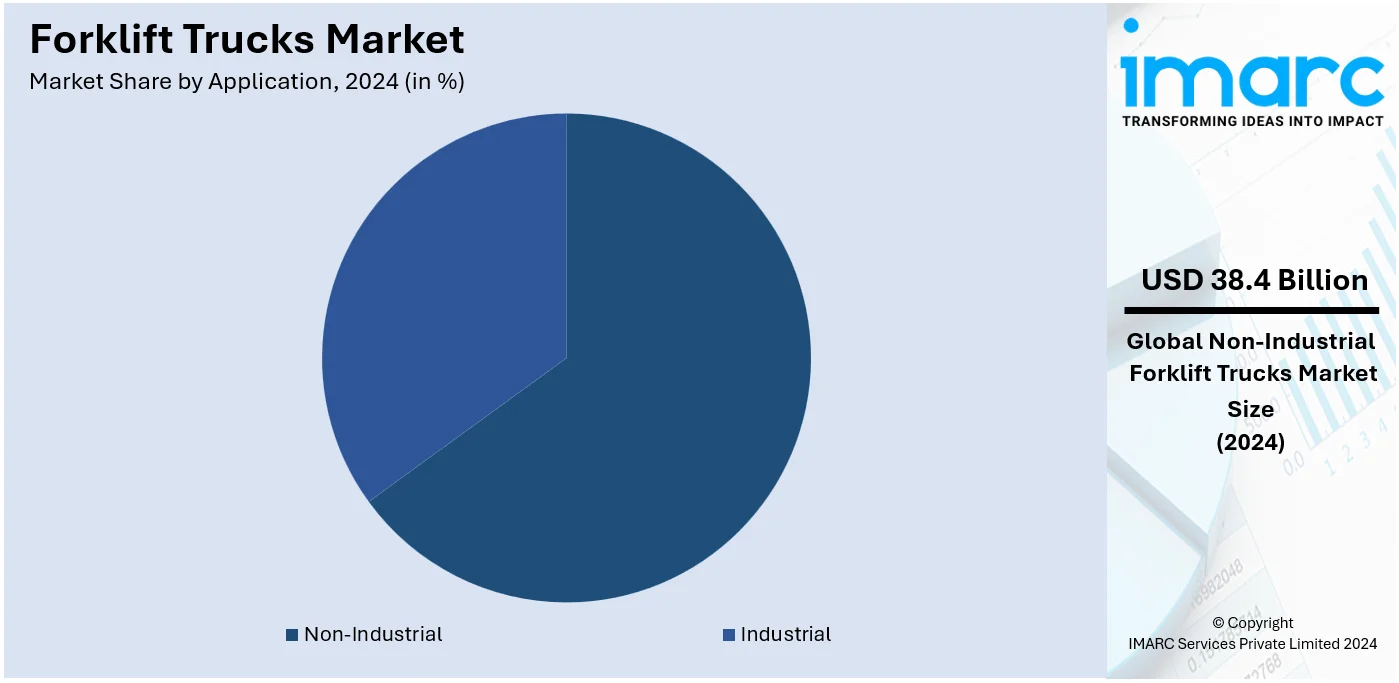

- Non-industrial leads the market with around 56.4% of market share in 2024 owing to rising e-commerce, retail expansion, and increasing warehouse storage demand.

- In 2024, Asia Pacific accounted for the largest market share of over 42.9% due to rapid industrialization, urbanization, and growth in manufacturing sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 68.1 Billion |

|

Market Forecast in 2033

|

USD 97.8 Billion |

| Market Growth Rate (2025-2033) | 4.1% |

The forklift trucks market share is growing mainly because of rapid e-commerce and warehousing expansions. With the growth of online retail, companies are making significant investments in advanced material-handling equipment to enhance inventory management and boost operational efficiency. For example, in 2024, CLARK Material Handling launched the SE25-35, a 5,000-7,000-pound indoor/outdoor forklift, powered by 48V lead-acid or 80V lithium-ion batteries, offering versatile, durable, and reliable performance in diverse environments. The rising demand for automation in the logistics sector and the pressure for flexible and rugged pieces of equipment continue to drive its demand. All these aspects highlight the necessity of forklift trucks in catering to the evolving demands of modern supply chains and logistics networks.

To get more information on this market, Request Sample

Advanced manufacturing capabilities and a strong industrial base make the United States a significant contributor to the forklift trucks market. As an innovation hub, U.S. manufacturers are producing technologically advanced forklift trucks featuring aspects such as automation, fuel efficiency, and enhanced safety systems. The robust demand from warehousing, construction, and retail sectors further fuels domestic production and imports. Besides this, the country's extensive supply chain infrastructure and focus on modernizing material handling processes position it as both a significant market and supplier. For instance, in December 2024, Hiab, part of Cargotec, entered a key dealer agreement with Ring Power Lift Trucks in Florida, strengthening its presence in the US market. The agreement covers MOFFETT truck-mounted forklifts, supported by Ring Power’s robust sales and service network. This dynamic helps the U.S. forklift trucks industry gain global competitiveness.

Forklift Trucks Market Trends:

Expanding Construction Sector

The major forklift truck market growth driver is the increasing number of construction projects both residential and commercial. The forklift truck has widely been accepted in the construction industry to receive pallets of bricks, constructions materials, and steel joist from delivery trucks and offload these pallets for transportation into the job site. Government bodies of different countries have also invested heavily in developing the infrastructure and new ports so as to increase the demand of forklift trucks within the construction industry. For example, from 2015 to 2035, in India, more than 610 projects with an estimated total cost of USD 10.5 Million would be undertaken in the areas of modernization and new construction of ports, port connectivity, port-linked industrialization, and upgradation of coastal communities. Besides this, the rate of urbanization is also exponentially increasing. According to World Bank statistics, it is estimated that 55% of the world's population resides in cities. This trend is expected to continue over the coming years, with the urban population doubling worldwide by 2050, where nearly seven out of 10 people will live in cities. With such a huge increase in the urban population, demand for residential establishments is increasing, which in turn is boosting the revenue of the forklift trucks market.

Introduction of Electric-Powered Forklift Trucks

The growth of the market can significantly be contributed by one of its fundamental factors, a rise in electric forklift truck demands for material movement, transportation, and lifting applications, predominantly in the e-commerce industries. About 2.1 million forklifts were sold globally in 2021 according to an industry report. In 2021, battery electric vehicles accounted for more than half of all forklifts sold worldwide. The sales of forklifts are estimated to be about 2.4 million units in 2030, with BEVs at around 1.5 million units. Apart from that, in China itself, the production of forklifts in China is anticipated to be more than 80 thousand units by 2030. Furthermore, the preference of changing from IC engine forklift trucks to electric forklift trucks because they do not require the storing of their fuel at their place of operation is favorably affecting the forklift trucks market forecast. Besides this, numerous significant market players are releasing new models which focus on sustainability concerns. For example, in June 2022, Mitsubishi Logisnext introduced the MX2 and MXL Series 4-wheel electric pneumatic forklifts, offering capacities ranging from 5,000 to 7,000 lbs and 9,000 to 12,000 lbs.

Increasing Product Offerings

Various key manufacturers are investing more in research and development activities, as well as forming partnerships and collaborations to expand and offer forklift trucks with improved productivity and safety to various industries. For instance, in May 2022, Mitsubishi Logisnext expanded its dealership network in the United States by naming Wiese USA as the representative for its three brands—Cat lift trucks, Mitsubishi forklift trucks, and Jungheinrich warehouse products—in Alabama and Northwestern Florida. Along with this, the forklift trucks market statistics by IMARC also mentions that different concerned regulatory authorities are also undertaking steps for the safety of forklift operators, which is positively affecting the market growth. For example, the Industrial Truck Association (ITA), in association with its organizations across Asia Pacific and Europe, is encouraging the development of safer products by conducting engineering and statistical programs. Besides, it also supports the training of forklift operators in accordance with the guidelines issued by the Occupational Safety and Health Administration (OSHA) to minimize the occurrence of accidents.

Forklift Trucks Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global forklift trucks market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, technology, class, and application.

Analysis by Product Type:

- Counterbalanced Forklift Trucks

- Warehouse Forklift Trucks

Counterbalanced forklift trucks leads the market with around 57.5% of the market share in 2024. Counterbalanced forklifts have a counterweight design to distribute the weight of the load evenly. In addition to this, they are considered as a multi-purpose utility truck and aid in reducing carbon emissions. As a result, various manufacturers are also increasingly investing in the development of counterbalanced forklift trucks. For instance, in January 2023, Crown Equipment Corporation introduced the C-B series, an electric counterbalance forklift featuring 80-volt motors. Designed with application-oriented ergonomics, the forklifts are equipped with a full suspension adjustable seat, an intuitive control system, a compact mast, and an overhead guard. These enhancements are aimed at improving safety and productivity while minimizing operator strain and fatigue.

Analysis by Technology:

- Electricity Powered

- Internal Combustion Engine Powered

Internal combustion engine powered leads the market with around 56.5% of market share in 2024. The IC engine-powered forklift trucks have a lower cost of investment compared to the electric forklift trucks. Besides this, they have a higher load-carrying capacity, and thus, they can be used in different environments. Moreover, innovations in the IC engine forklift trucks are also enhancing the growth of the forklift trucks market in this segment. For example, Mitsubishi Logisnext Americas launched the SCX N2 Series of Electric Stand-up Counterbalanced Lift Trucks in September 2023. They offer a base capacity of 3,000 to 4,000 lbs, 16 hours of runtime on a single charge, and 1000-hour maintenance intervals. The trucks offer improved maneuverability with a reduced turning radius and enhanced visibility. They also feature customizable performance modes and advanced safety controls. The series is backed by a 2-year unlimited hour warranty and supports a network of nearly 250 dealerships across the Americas.

Analysis by Class:

- Class I

- Class II

- Class III

- Class IV

- Class V

Class V lead the market with around 50.2% of the market share in 2024. Class V forklifts are very durable and are widely used in lumberyards and construction industries where heavy-duty equipment is required for efficient operations. Their robust design and ability to handle rough terrains contribute to their dominance in the market. Additionally, their adaptability to various outdoor applications and high reliability further solidify their popularity, positioning Class V forklifts as the preferred choice in demanding industrial and construction settings worldwide.

Analysis by Application:

- Non-Industrial

- Warehouses and Distribution Centers

- Construction Sites

- Dockyards

- Snow Plows

- Industrial

- Manufacturing

- Recycling Operations

Non-industrial leads the market with around 56.4% of market share in 2024. The report states that the highest market share was held by non-industrial (warehouses and distribution centers, construction sites, dockyards, snow plows). Forklift trucks are widely used in economic activities, including warehouses and distribution centers, construction sites, dockyards, and snow plowing. Additionally, the increasing demand for forklift trucks because of the growing e-commerce industry is driving the growth of the market. Increasingly, different blue-chip retailers are incorporating forklift trucks for material movement, transportation, and lifting applications. This is demonstrated by the fact that in January 2024, Amazon installed its first low-carbon hydrogen electrolyzer at a fulfillment center in Aurora, Colorado, in partnership with Plug Power. This one-megawatt system produces hydrogen to power 225 fuel cell-powered forklifts, with potential support for up to 400. Amazon aims to decarbonize operations by 2040, leveraging its 480 renewable energy projects, which will generate over 71,900 GWh of clean energy annually once operational.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 42.9%. The report states that Asia Pacific including China, Japan, India, South Korea, Australia, Indonesia, and other region has been the biggest market for forklift trucks. Growing demand for forklift trucks due to lower costs of manufacturing, rapidly widening supply chain network, suitable government policies in respect to forklift trucks uptake, and replacement of the erstwhile traditional forklift trucks are some the chief reasons for this growing of the market in this area. By 2030, forklift production in China is projected to exceed 80 thousand units. Additionally, the growing number of construction and infrastructure projects in the Asia Pacific region is driving market growth. For example, the Airports Authority of India (AAI) plans to invest USD 338 million over the next four to five years to develop new airports and expand and upgrade several existing ones. Such plans for expansion are anticipated to propel the demand for forklift trucks in the market.

Key Regional Takeaways:

United States Forklift Trucks Market Analysis

US accounts for 86.2% share of the market in North America. The forklift truck market demand is being driven in the US by the strong expansion of the manufacturing, e-commerce, and logistics industries. The US logistics sector plays a large role as businesses are depending increasingly on efficient material handling to meet consumer needs. Forklift adoption is necessary for warehouse operations due to the increasing business of e-commerce. According to industry statistics, US internet sales were at USD 1.16 Trillion annually, accounting for 20% of all retail sales. Additionally, the USD 2 Trillion construction industry, as per the data by Associated General Contractors of America, relies heavily on forklift trucks to transfer materials across building sites. Innovations in technology, such as automation in forklifts and the Internet of Things, are increasing demand and improving operating efficiency. Electric forklifts, due to their federal subsidies and more restrictive pollution standards, are now above the 50% market-share mark owing to the current drive toward sustainability. It is a fact that such companies as Toyota, Crown Equipment, and Hyster-Yale Group have been investing enormously in research and development to capitalize on the increasing demand of electric and autonomous forklifts.

Europe Forklift Trucks Market Analysis

The European forklift trucks market trends are prompted by the region's focus on greening practices and the adoption of advanced material handling technologies. Forklifts form the backbone of warehouse functions as well as the process of transporting goods in the logistics industry of Europe, which, based on industry reports, already stood at USD 1 Trillion in 2024. The region has now seen electric forklifts account for over 50% of new sales mainly as a result of very stringent emission rules such as the EU's Green Deal that aims to achieve carbon neutrality by 2050. Germany, the UK, and France are the top markets in these three countries because their strong manufacturing bases and large degrees of industrial automation support a big demand for forklifts. Moreover, the market is expanding due to the rapidly growing construction industry with numerous projects in the pipeline. For example, by 2026, over 1.5 Million housing units will have been built in Europe, as indicated by the IFO Institute for Economic Research. In addition, the development of smart warehouses and the adoption of robotics and artificial intelligence in material handling are fueling the demand for advanced forklift solutions.

Asia Pacific Forklift Trucks Market Analysis

With their combined sales of surpassing 50% in the region, China and India control the market, as per an industry report. Especially in the retail, construction, and automotive industries, rapid urbanization and industrialization are major forces. The region's growing construction industry and its multiple infrastructure projects is another factor contributing to the rise in the popularity of forklifts. For example, work on the 4,800 MW Shidaowan Nuclear Power Plant was underway in the third quarter of 2024 in Rongcheng, Weihai, Shandong, China. And according to an industry report, Indonesia began constructing a new MRT line in Jakarta in September 2024 with more than USD 1 Billion worth of loan from Japan. The market is changing as electric forklifts are gaining acceptance, coupled with regulations to encourage a more environment-friendly operation. In addition, organized retail and e-commerce have spurred investment in sophisticated material handling and warehousing technologies, while regional sales reached over USD 1 Trillion.

Latin America Forklift Trucks Market Analysis

The expanding manufacturing and agricultural industries in Latin America, especially in Brazil and Mexico, are the main drivers of the forklift truck market. The region's logistics and warehousing sector is growing, which is driving up the use of forklifts for material handling. Brazil is spearheading this transformation, aiming to attract approximately BRL 180 billion (USD 34.03 billion) in private capital for new rail and highway projects from 2024 to 2026. A significant development in this effort was the Inter-American Development Bank's (IDB) approval in 2023 of a USD 480 million loan for the State of São Paulo's Highway Investment Program. Government programs to cut carbon emissions are driving up demand for reasonably priced electric forklifts. According to an industrial report, Mexico's automotive sector, which produced more than 3.5 million cars in 2023, is another important factor driving up demand for forklifts.

Middle East and Africa Forklift Trucks Market Analysis

Investments in the oil and gas, logistics, and infrastructure industries support the forklift truck market in the Middle East and Africa. Saudi Arabia and United Arab Emirates are key markets, and demand is coming from infrastructure projects such as Expo City Dubai and Saudi Vision 2030. Forklifts are part of the logistics industry in the region, which uses them extensively in distribution and warehousing, and the industry is booming. For example, the Saudi government has contracted agreements to build 18 logistics zones that are set to attract more than USD 26.6 Billion investments. Electric forklifts, on the other hand, make up 30% of all new sales as businesses strive to adopt greener strategies. Also, the material handling activities involving forklifts in Africa rely a lot on mining and agricultural undertakings.

Competitive Landscape:

The competitive landscape of the forklift trucks market is marked by the existence of established global players as well as regional manufacturers attempting to capture market share with innovation and strategic expansion. Industry majors are focusing on energy-efficient and automated forklifts, which form a major chunk of evolving customer demands. Common strategies include partnerships, mergers, and acquisitions to strengthen their market position and improve their product portfolios. Besides, significant R&D investments are pushing the electrical and hybrid forklift truck technologies ahead. Competitive prices, after-sales services, and distribution network further intensifies the competition, thus paving the way for a dynamic environment in this market. For instance, in 2024, CLARK Material Handling relocated its Global Headquarters to the US, uniting with North American operations to strengthen its brand, drive innovation, and launch a global growth strategy from its home base.

The report provides a comprehensive analysis of the competitive landscape in the forklift trucks market with detailed profiles of all major companies, including:

- Anhui Heli Co., Ltd.

- Clark Material Handling Company

- Crown Equipment Corporation

- Doosan Corporation

- EP Equipment

- HD Hyundai Co., Ltd.

- Jungheinrich AG

- Komatsu Ltd.

- Linde Material Handling GmbH (KION Group)

- Lonking Holdings Limited

- Manitou Group

- Mitsubishi Heavy Industries, Ltd.

- Toyota Industries Corporation

Recent Developments:

- February 2024: KION North America introduced the Linde Series 1293, featuring electric counterbalance forklifts E20BHP and E25BHP with capacities of 4,000-5,000 lbs, powered by Linde Li-ION batteries. Designed for both indoor and outdoor applications, these models offer water-resistant features and enhanced durability. Operators benefit from a full suspension seat, easy-to-reach controls, and a 4.5-inch color display for monitoring functions.

- October 2023: HD Hyundai Construction Equipment India launched a range of new products including four new excavator models, two forklift models, and two wheel loaders. The two new electric forklift models (2.5-ton and 3.0-ton) developed by Hyundai's Global R&D center in South Korea emphasize productivity and safety.

- July 2023: HC Forklift America Corporation launched the XE Series Electric Lithium-Ion Pneumatic Forklift, featuring a capacity range of 4,000-7,600 lbs. This forklift incorporates an 80V lithium-ion design, offering advantages such as a maintenance-free battery, up to 11 hours of runtime, and three battery options.

Forklift Trucks Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Counterbalanced Forklift Trucks, Warehouse Forklift Trucks |

| Technologies Covered | Electricity Powered, Internal Combustion Engine Powered |

| Classes Covered | Class I, Class II, Class III, Class IV, Class V |

| Applications Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Anhui Heli Co., Ltd., Clark Material Handling Company, Crown Equipment Corporation, Doosan Corporation, EP Equipment, HD Hyundai Co., Ltd., Jungheinrich AG, Komatsu Ltd., Linde Material Handling GmbH (KION Group), Lonking Holdings Limited, Manitou Group, Mitsubishi Heavy Industries, Ltd., Toyota Industries Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the forklift trucks market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global forklift trucks market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the forklift trucks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Forklift trucks are industrial vehicles fitted with powered forks to lift, move, and stack materials over short distances. These machines are commonly used in warehouses, construction sites, and manufacturing facilities. Versatile machines that improve productivity, help in efficient handling of heavy loads, enhance operational safety, and facilitate the transportation of materials in different types of industrial and commercial setups.

The forklift trucks market was valued at USD 68.1 Billion in 2024 expected to reach a value of USD 97.8 Billion by 2033, exhibiting a growth rate CAGR of 4.1% during 2025-2033.

The forklift trucks market outlook is positive, driven by rapid industrialization, the growth of e-commerce, and a rising need for efficient material handling solutions. Technological advancements in electric and autonomous forklifts are further fueling market growth. Additionally, increasing construction activities and the automation of warehouses are expected to drive higher adoption of forklifts across various industries globally.

According to the report, counterbalanced forklift trucks represented the largest segment by product type, driven by their versatility, ability to handle heavy loads, and suitability for both indoor and outdoor material handling operations.

Internal combustion powered engine leads the market by technology, driven by their high power, durability, and capability to handle heavy loads in demanding outdoor environments such as construction sites and warehouses.

The class V is the leading segment by class, driven by its robust design, suitability for outdoor use, ability to operate in puncture-prone areas, and widespread application in industries like construction and lumberyards.

Non-industrial is the dominating segment by application, driven by increasing demand in sectors such as retail, logistics, and warehousing, where efficient material handling and transportation are essential for streamlined operations and productivity.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global forklift trucks market include Anhui Heli Co., Ltd., Clark Material Handling Company, Crown Equipment Corporation, Doosan Corporation, EP Equipment, HD Hyundai Co., Ltd., Jungheinrich AG, Komatsu Ltd., Linde Material Handling GmbH (KION Group), Lonking Holdings Limited, Manitou Group, Mitsubishi Heavy Industries, Ltd., Toyota Industries Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)