Forklift Battery Market Size, Share, Trends and Forecast by Type, Sales Channel, Application, and Region, 2026-2034

Forklift Battery Market Size and Share:

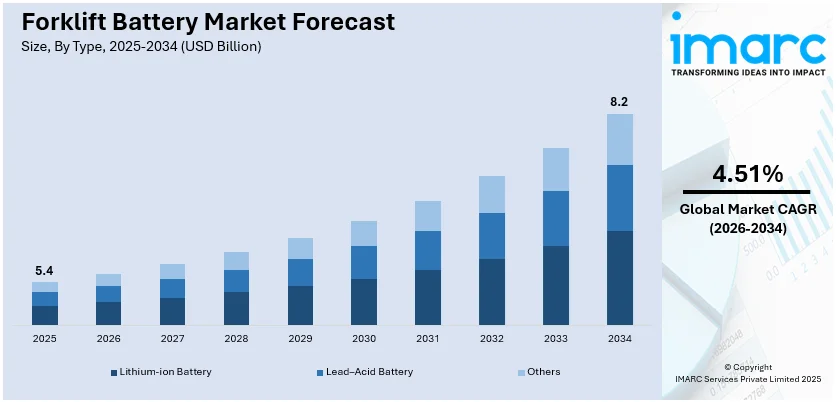

The global forklift battery market size was valued at USD 5.4 Billion in 2025. Looking forward, the market is estimated to reach USD 8.2 Billion by 2034, exhibiting a CAGR of 4.51% during 2026-2034. Asia-Pacific currently dominates the market, holding a significant market share of over 41.8% in 2025. This region’s dominance is driven by rapid industrialization, technological advancements, robust consumer demand, and expanding regional infrastructure investments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 5.4 Billion |

|

Market Forecast in 2034

|

USD 8.2 Billion |

| Market Growth Rate (2026-2034) | 4.51% |

The increasing usage of electric forklifts in industrial and warehouse operations is highly driving the demand for forklift batteries. Companies are more interested in environmentally friendly and cost-effective solutions, making them opt electric models over traditional internal combustion models. For instance, in 2024, Plug Power announced that it will be supplying hydrogen infrastructure and fuel cells to a new US electric vehicle manufacturing plant, set to open in 2025. The site will include over 10 hydrogen dispensers, two liquid hydrogen storage tanks, and a fleet of fuel cell-powered forklifts and tuggers. Additionally, Plug is expanding its partnership with Uline at a Kenosha, Wisconsin campus, featuring an 18,000-gallon hydrogen storage tank, 17 dispensers, and 250 fuel cell forklifts. The shift is further driven by government incentives that encourage energy-efficient machinery use, combined with more stringent environmental rules aimed at reducing emissions. Electric forklifts driven by advanced batteries are less expensive to run, generate less noise, and present a safer work environment. With growing concerns over sustainability and efficient operations, the demand for advanced forklift battery technology is constantly increasing.

To get more information on this market Request Sample

The United States drives innovation, production, and adoption of advanced battery technologies in the forklift battery market. A strong establishment of manufacturing bases with enhanced investment in research and development for the creation of high-capacity and high-energy-efficient batteries are its supports. For instance, in 2024, Terra Supreme Battery stated that it will begin producing its Group 31 composite grid bipolar AGM lead-acid battery at its U.S. plant. In addition, clean energy and environment-friendly government incentives are accelerating the trend toward electric fork-lift trucks and advanced battery-based solutions. The presence of leading manufacturers and a good focus on technology ensures a continuity supply of leading-edge battery-related solutions. Further, increasing demand across e-commerce and logistics end-served industries supports the growth of the market in the country.

Forklift Battery Market Trends:

Environmental Sustainability and Stringent Emission Regulations

As the issues related to climate change and air pollution continue to rise, companies are facing increased pressure to become more environmentally friendly. Forklifts are extensively used in material handling activities. Traditionally, these forklifts use fossil fuel-based internal combustion engines, which emit harmful gases including carbon dioxide, nitrogen oxides, and particulate matter. In response to this, there has been a strong shift toward electric forklifts that use forklift batteries. According to study, electric forklifts offer 75% lower operating costs compared to propane and reduce maintenance expenses by 40%, delivering superior efficiency and sustainability. Their reliance on energy-efficient forklift batteries eliminates on-site fuel storage, optimizing productivity and cost-effectiveness. These batteries produce no emissions when in use, which reduces their environmental impact. Governments and regulatory agencies are also encouraging the use of electric forklifts through tax credits, rebates, and favorable policies. This, in turn, is enhancing the growth of the forklift battery market as industries seek cleaner and more sustainable solutions to comply with environmental regulations and reduce their carbon footprint.

Continual Advancements in Battery Technology and Energy Efficiency

With advancements in research and development in battery chemistry, newer and more efficient types of batteries are being introduced. Lithium-ion batteries have gained popularity because they have higher energy density, longer lifespan, and faster charging capabilities compared to traditional lead-acid batteries. For instance, in 2024, EP North America rolled out CPD45F8/50F8, an IPX4-rated pneumatic forklift, that supports as much as 10,000 lbs. It features an 80V lithium-ion battery, offering zero maintenance, reduced fuel costs, and enhanced outdoor performance. All these developments have improved the forklift battery's performance and its dependability, making it serve longer and then again charged. The enhanced energy efficiency can contribute to higher productivity and reduced costs in operations for businesses using electric forklifts. In addition, continued work in alternative materials and emerging battery technologies promises even greater improvements in the future, fostering increased adoption of electric forklifts, which will drive the need for forklift batteries.

E-commerce Expansion and Warehouse Modernization

Electric forklifts have become the most-preferred choice for indoor material handling in warehouses and fulfillment centers, driven by advanced technology forklift batteries. The forklift battery makes electric forklifts operate silently and with no emissions, ideal for indoor use. The application of automation technologies in warehouses has also increased the demand for electric forklifts. For instance, as of 2024, 25% of warehouses globally have adopted automation, with 10% leveraging advanced technologies, driving demand for efficient forklift batteries to power robotics and AGVs. This aligns with a 20% budget increase in automation investments, as 60% of warehouses prioritize AI and autonomous systems for operational efficiency. Apart from powering the electric lift trucks deployed in warehouses, batteries for forklift play a significant role in running the automated guided vehicles or other systems. AGVs and other robotic systems operating with forklifts need good and high-power batteries for smooth operation. The realization of companies with regard to optimizing warehouse operations in the quest for rapid order fulfillment speed as well as for overall efficiency would drive demand for electric forklifts and its associated batteries.

Forklift Battery Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global forklift battery market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on type, sales channel, and application.

Analysis by Type:

- Lithium-ion Battery

- Lead–Acid Battery

- Others

Lead-acid battery stands as the largest type in 2025, holding around 77.2% of the market. Their wide adoption can be attributed to their low cost, reliability, and extensive manufacturing infrastructure. They are particularly favored because they are durable and offer stable power for material handling activities in storage facilities, production plants, and supply hubs. Despite increasing interest in lithium-ion batteries, lead-acid batteries maintain a leadership position because of the lower cost and compatibility with the existing forklift models. Moreover, the advanced technologies in recycling further increase the sustainability appeal of these technologies in consonance with the emphasis being placed on eco-friendly solutions within industries. This strong market presence, therefore, underlines their critical role in powering forklift operations worldwide.

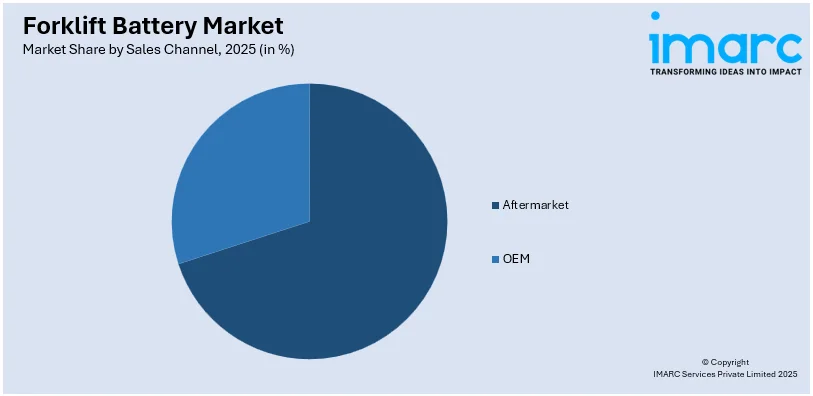

Analysis by Sales Channel:

Access the comprehensive market breakdown Request Sample

- OEM

- Aftermarket

Aftermarket leads the market with around 73.1% of the market share in 2025. This is driven by increasing replacement battery demand from wear and tear of forklift operations in industries like logistics, manufacturing, and retail. Companies prefer aftermarket solutions due to their cost-effective, available, and compatible nature with existing equipment. It is further supported by the growth of e-commerce and warehouse operations, where battery replacements are required at frequent intervals to maintain operational efficiency. Advancements in reconditioning and recycling technologies have also increased the attractiveness of aftermarket batteries, which are not only eco-friendly but also cost-effective and help the overall growth of this segment in the forklift battery market.

Analysis by Application:

- Warehouses

- Manufacturing

- Construction

- Retail and Wholesale Stores

- Others

Manufacturing leads the market with around 30% of market share in 2025. This leadership is prompted by the heavy use of forklifts in manufacturing operations, where high efficiency in material handling is critical. Advanced battery-powered forklifts can easily move raw materials, components, and finished products around factories without interruption to streamline production processes. The pressure to maintain operational efficiency and cost-effectiveness while embracing sustainability in the manufacturing sector adds to the demand for high-performance forklift batteries. Also, automation and smart technologies integration into the manufacturing facilities push more for a robust energy delivery solution that confirms the fact that this industry is strongly associated with forklift battery market growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia-Pacific accounted for the largest market share of over 41.8%. This dominance is due to the swift industrial growth and urban development in nations such as China, India, and Japan, which demand a large quantity of material handling equipment. The strong growth in the manufacturing, e-commerce, and logistics sectors throughout the region is further pushing the uptake of forklifts based on advanced battery technologies. Governments in Asia-Pacific are also promoting the use of eco-friendly solutions, encouraging a shift toward electric forklifts. Further, the leading battery manufacturers are based in this region, which with low production costs, positions it at a strategic level in the forklift battery market.

Key Regional Takeaways:

United States Forklift Battery Market Analysis

US accounts for 86.4% of the share in the market in North America. The demand for forklift batteries in the United States is steadily growing, driven by the surge in e-commerce and logistics activities. For instance, e-commerce growth continues to surge, with online sales accounting for 22.2% of total retail sales in Q3 2024, driving 54.2% of retail growth. This rapid expansion boosts demand for forklift batteries, essential for warehouse operations supporting the e-commerce supply chain. Warehousing facilities are expanding to meet rising consumer expectations for quick delivery, necessitating efficient material handling solutions. Forklift batteries are increasingly adopted due to their compatibility with advanced electric forklifts that align with sustainability initiatives. Additionally, regulations encouraging the transition to cleaner energy sources are accelerating the adoption of electric-powered equipment, including forklifts. The shift from traditional internal combustion forklifts to electric models further strengthens this demand. Manufacturers are also introducing innovative battery technologies, such as lithium-ion, which provide extended runtime, reduced charging intervals, and lower maintenance requirements. The trend of automation in supply chains and the adoption of automated guided vehicles complement the rising demand for electric forklift batteries. Corporate commitments to reduce carbon footprints and enhance workplace safety are also playing a pivotal role in the market's growth.

Asia Pacific Forklift Battery Market Analysis

The forklift battery market in Asia-Pacific is witnessing rapid growth due to the rising industrialization and expansion of manufacturing facilities. With a growing focus on productivity and cost efficiency, industries are increasingly integrating electric forklifts powered by advanced batteries. The robust development of infrastructure and the construction sector is contributing significantly to material handling needs. According to reports, India's growing infrastructure investment, projected to rise from 5.3% of GDP in FY24 to 6.5% by FY29, is driving increased demand for forklift batteries to support efficient material handling in expanding industrial and logistics sectors. Forklift battery adoption is further propelled by investments in renewable energy and energy storage solutions, creating opportunities for manufacturers to cater to diverse end-user demands. Competitive labour costs and the establishment of new manufacturing hubs are encouraging the deployment of energy-efficient material handling equipment, including battery-operated forklifts. Innovations in battery technology, including enhanced energy density and safety features, are attracting investments and accelerating market expansion.

Europe Forklift Battery Market Analysis

Europe's forklift battery market is expanding as industries prioritize sustainable practices and environmental regulations. Increasing adoption of green technologies is driving the shift toward battery-powered forklifts that offer zero emissions. Technological advancements in battery performance, including longer lifespans and faster charging capabilities, are enhancing the utility of electric forklifts. The automation of logistics and the integration of smart technologies in warehouses are supporting the adoption of advanced battery solutions. Moreover, regional policies favoring energy efficiency and workplace safety standards further fuel the transition from traditional forklifts to electric alternatives. The market is further being propelled by rising e-commerce in the region, which in turn is driving the warehousing demand in the region. According to the ITA, Europe is the third biggest retail ecommerce market globally, with total revenues of US$631.9 billion.

Latin America Forklift Battery Market Analysis

The forklift battery market in Latin America is growing due to the rising warehousing in the region. For instance, Maersk has more than 195,000 SQM of warehouses across the West Coast of South America and is continuing its expanding its footprint in Latin America. Rising awareness of cost savings associated with battery-powered forklifts is thus influencing their adoption. The ongoing modernization of warehouses and supply chains is creating opportunities for advanced forklift batteries that support automation and optimized energy use. Manufacturers are focusing on providing durable and low-maintenance battery options, which are gaining traction in the market. The shift toward renewable energy sources and sustainable practices is another key factor contributing to the market's growth.

Middle East and Africa Forklift Battery Market Analysis

The Middle East and Africa are experiencing rising demand for forklift battery due to the increasing retail and wholesale market in the region. According to the IMARC Group, Middle East retail market size is projected to exhibit a growth rate (CAGR) of 4.21% during 2024-2032. The rising retail industry in the region is thus driving the market for forklifts and consecutively the batteries in the region. Also, as e-commerce in the region continues to increase, the need for modern, reliable forklift systems powered by advanced battery technologies is relatively increasing. Additionally, the market is further supported by ongoing infrastructural development, particularly in countries like the UAE, Saudi Arabia, and South Africa, where large-scale industrial projects and ports are becoming more prominent.

Competitive Landscape:

The forklift battery market is extremely competitive with the presence of well-established global and regional players, fighting to increase their share of the market. Major firms emphasize innovations in battery technology, such as lithium ion and hydrogen fuel cells to keep pace with growing needs for energy-efficient solutions. Strategic partnerships, mergers, and acquisitions are all very common, as a means of improving the firm's product offerings and increasing geographic presence. The market also witnesses extreme competition in pricing and after-sales services to retain and attract customers. Furthermore, new entrants offering advanced and cost-effective solutions increase the competitive intensity of the forklift battery industry. For instance, in November 2024, Amara Raja Energy and Mobility Ltd launched a lead-acid battery recycling plant in Cheyyar, Tamil Nadu, aiming to provide 25-30% of its recycled lead raw material needs.

The report provides a comprehensive analysis of the competitive landscape in the forklift battery market with detailed profiles of all major companies, including:

- Accumulatorenwerke HOPPECKE Carl Zoellner & Sohn GmbH

- Amara Raja Batteries Ltd.

- Camel Group Co. Ltd.

- Crown Equipment Corporation

- East Penn Manufacturing Company

- Enersys

- Exide Industries Limited

- Flux Power

- Microtex Energy Private Limited

- Northland Industrial Truck Co. Inc. (Alta Enterprises LLC)

- Storage Battery Systems LLC

- Systems Sunlight S.A.

Latest News and Developments:

- September 2024: Flux Power has entered a strategic partnership with a prominent provider of electric material handling equipment to deliver cutting-edge lithium-ion battery solutions for forklifts and other industrial vehicles. This collaboration focuses on boosting the performance and energy efficiency of electric forklifts, providing users with batteries that last longer and charge more quickly.

- August 2024: Godrej Industries has unveiled India’s first lithium-ion-powered forklift, representing a landmark achievement in the nation’s material handling sector. This eco-friendly forklift promises enhanced efficiency, lower operational costs, and faster charging compared to conventional lead-acid models. The initiative underscores the company's dedication to sustainability and energy-efficient technologies, supporting India’s shift toward greener solutions.

- In March 2023, Systems Sunlight S.A. launched Li.ON FORCE Lite battery, ideal for Class III industrial vehicles. This expansion of their innovative energy storage solutions portfolio to the US market includes a comprehensive lineup, spanning from lithium-ion and lead-acid products to Sunlight ElectroLiFe semi-traction batteries, PowerBox chargers, and Sunlight IoT solutions.

- In March 2022, Flux Power introduced an advanced lithium-ion battery pack tailored for walkie pallet jacks. This innovation supports demanding applications, ensuring reliable performance throughout extended work shifts. It aims to enhance operational efficiency for customers in heavy-duty material handling tasks. The launch reflects Flux Power’s commitment to addressing industrial energy needs with sustainable solutions.

- In November 2022, Exide Industries and Advanced Battery Concepts announced a partnership to commercialize Box-BE™ Battery Energy Storage Systems. This initiative focuses on manufacturing and distributing sustainable energy storage solutions for various applications. The collaboration leverages ABC's innovative technology and Exide's manufacturing expertise. It marks a significant step toward advancing energy storage markets globally.

Forklift Battery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Lithium-Ion Battery, Lead-Acid Battery, Others |

| Sales Channels Covered | OEM, Aftermarket |

| Applications Covered | Warehouses, Manufacturing, Construction, Retail and Wholesale Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accumulatorenwerke HOPPECKE Carl Zoellner & Sohn GmbH, Amara Raja Batteries Ltd., Camel Group Co. Ltd., Crown Equipment Corporation, East Penn Manufacturing Company, Enersys, Exide Industries Limited, Flux Power, Microtex Energy Private Limited, Northland Industrial Truck Co. Inc. (Alta Enterprises LLC), Storage Battery Systems LLC and Systems Sunlight S.A. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the forklift battery market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global forklift battery market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the forklift battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A forklift battery is a critical power source used to operate electric forklifts, providing energy for lifting, moving, and maneuvering heavy loads. These batteries are typically lead-acid or lithium-ion, designed for durability and efficiency. They also contribute to sustainability by reducing emissions compared to internal combustion engine-powered forklifts.

The forklift battery market was valued at USD 5.4 Billion in 2025.

IMARC estimates the global forklift battery market to exhibit a CAGR of 4.51% during 2026-2034.

Key factors driving the global forklift battery market include the growing adoption of electric forklifts for sustainability, advancements in lithium-ion technology offering higher efficiency and longer life, increasing demand for warehouse automation, and stringent environmental regulations encouraging the shift from diesel-powered equipment to cleaner, battery-operated alternatives in industrial and logistics sectors.

According to the report, lead-acid battery represented the largest segment by type, driven by its cost-effectiveness, reliability, widespread availability, and suitability for a range of industrial applications, particularly in material handling and warehouse operations.

Aftermarket leads the market by sales channel as businesses prioritize replacing and upgrading forklift batteries to enhance performance, reduce downtime, and extend equipment lifespan.

Manufacturing leads the market by application as industries increasingly rely on forklifts powered by efficient batteries to streamline material handling, improve productivity, and meet the growing demand for automated and sustainable operations.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market due to rapid industrialization and high forklift adoption rates.

Some of the major players in the global Forklift Battery market include Accumulatorenwerke HOPPECKE Carl Zoellner & Sohn GmbH, Amara Raja Batteries Ltd., Camel Group Co. Ltd., Crown Equipment Corporation, East Penn Manufacturing Company, Enersys, Exide Industries Limited, Flux Power, Microtex Energy Private Limited, Northland Industrial Truck Co. Inc. (Alta Enterprises LLC), Storage Battery Systems LLC and Systems Sunlight S.A.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)