Forage Seed Market Report by Product (Alfalfa, Clover, Ryegrass, Chicory, and Others), Livestock (Poultry, Cattle, Pork, and Others), Species (Legumes, Grasses), and Region 2025-2033

Market Overview:

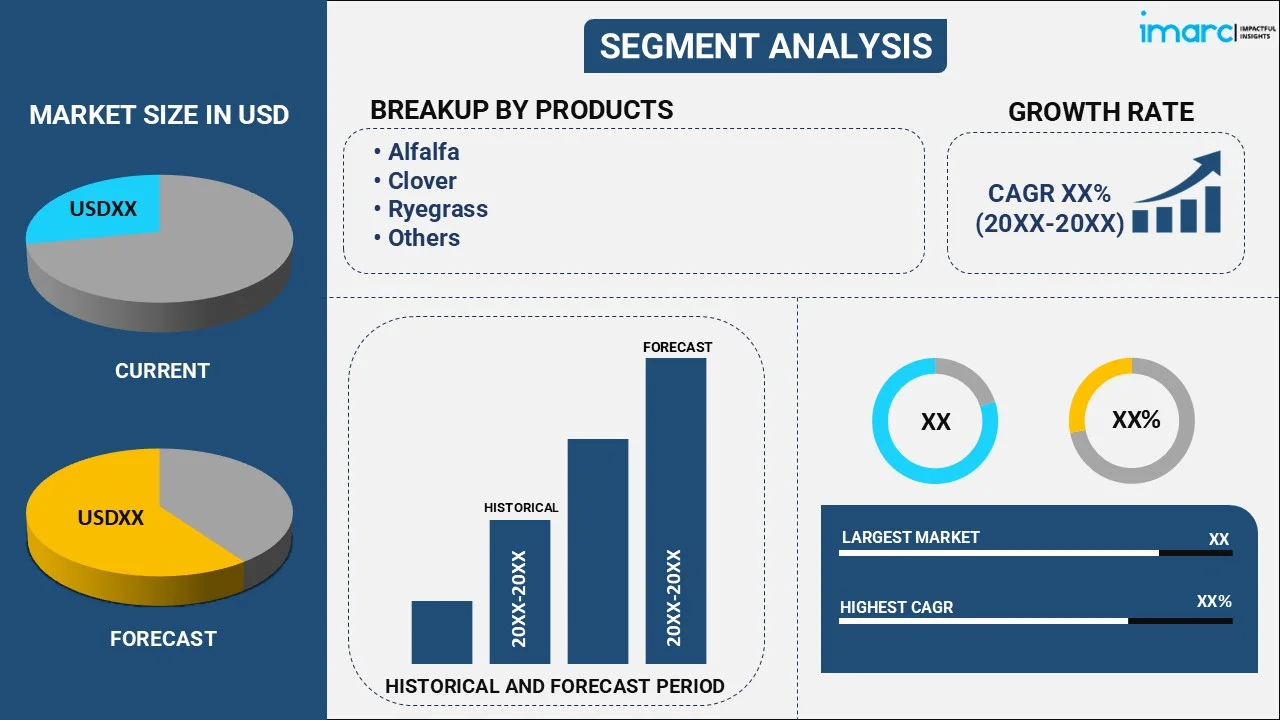

The global forage seed market size reached USD 20.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 41.1 Billion by 2033, exhibiting a growth rate (CAGR) of 7.7% during 2025-2033. The growing number of supportive policies and subsidies to promote forage seed cultivation is driving the market demand. This, coupled with the rising adoption of precision techniques to manage soil health, water usage, and crop development and increasing investment in research and development (R&D) to produce better quality seeds, is impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 20.4 Billion |

| Market Forecast in 2033 | USD 41.1 Billion |

| Market Growth Rate (2025-2033) | 7.7% |

Forage seeds are specifically grown to feed livestock, such as cattle, horses, and sheep, to provide animals with a balanced and nutritious diet. These seeds are a rich source of protein, fiber, and other essential nutrients necessary for proper animal growth and development. As a result, they are widely used across the livestock industry to ensure the health and well-being of animals. In addition to this, forage legumes can also help improve soil fertility and prevent erosion. A wide variety of forage seeds is available in the market, each with unique characteristics and benefits. Some of the standard product variants include alfalfa, clover, ryegrass, and fescue. They can be planted alone or in combination with other forage crops to provide a diverse and balanced diet for livestock.

Forage Seed Market Trends:

Growing Adoption of Precision Agriculture

Precision agriculture is transforming the farming landscape by using data-driven technologies to optimize crop production. Farmers are relying on precision techniques to manage soil health, water usage, and crop growth. This approach allows for the precise application of inputs such as seeds, fertilizers, and water, reducing waste and improving yield. The market benefits from this trend, as farmers can select and plant forage seeds tailored to specific soil types, climates, and livestock needs with greater accuracy. The rising adoption of precision agriculture is driving the demand for forage seeds that perform well under these optimized conditions. In 2023, the size of the precision agriculture market worldwide reached USD 8.5 Billion, according to the data provided by the IMARC Group.

Government Support and Subsidies

Governments across various regions are offering support and subsidies to promote forage seed cultivation. These incentives are aimed at encouraging farmers to adopt sustainable agricultural practices and improve livestock productivity. Financial aid, technical guidance, and seed subsidies are helping farmers transition to forage-based livestock systems. In many cases, this support is part of broader agricultural development programs aimed at enhancing food security and rural livelihoods. These initiatives are encouraging more farmers take advantage of these benefits to improve their operations, thereby bolstering the forage seed market growth. In 2024, the U.S. Department of Agriculture (USDA) announced expanded crop insurance options for specialty and organic growers for the 2025 crop year. This encompasses eligibility of enterprise units for different crops like alfalfa and forage production, as well as policy revisions for improved risk management in agriculture.

Advancements in Seed Technology and Innovation

Seed companies are investing in research and development (R&D) to produce seeds that are more resistant to pests, diseases, and environmental stresses. Genetic modification and hybridization techniques are allowing the creation of forage seeds that offer higher yields and better nutritional content while being more adaptable to changing climate conditions. These innovations are enabling farmers to improve their forage crop productivity, which helps reduce input costs and enhances profitability. The increasing adoption of new technologies in the agricultural sector is driving the demand for advanced forage seeds. In 2024, Renovo Seed unveiled OptiHarv, a new forage blend, at the World Dairy Expo. This combination of millets, peas, beans, barley, and brassicas provides top-notch feed for dairy and cattle farmers, offering great productivity for baleage, haylage, or grazing with several harvests from one field.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global forage seed market, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on product, livestock, and species.

Product Insights:

- Alfalfa

- Clover

- Ryegrass

- Chicory

- Others

The report has provided a detailed breakup and analysis of the forage seed market based on the product. These include alfalfa, clover, ryegrass, chicory, and others. According to the report, clover represented the largest segment.

Livestock Insights:

- Poultry

- Cattle

- Pork

- Others

A detailed breakup and analysis of the forage seed market based on the livestock has also been provided in the report. This includes poultry, cattle, pork, and others. According to the report, poultry accounted for the largest market share.

Species Insights:

- Legumes

- Grasses

The report has provided a detailed breakup and analysis of the forage seed market based on the species. This includes legumes and grasses. According to the report, legumes represented the largest segment.

Regional Insights:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America holds the biggest forage seed market share. Some of the factors driving the North America forage seed market included the growing consumption of animal protein, the thriving livestock industry, and innovative technological advancements in the industry.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global forage seed market. Detailed profiles of all major companies have also been provided. Some of the companies covered include:

- Advanta Seeds (UPL Limited)

- Allied Seed LLC (Growmark Inc.)

- Ampac Seed Company

- Brett-Young Seeds Limited

- Corteva Agriscience

- Dlf Seeds A/S (Dansk Landbrugs Frøselskab Amba)

- KWS SAAT SE & Co. KGaA

- RAGT Semences (RAGT Group)

- Royal Barenbrug Group

- S&W Seed Co.

Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Forage Seed Market Report News:

- June 2023: Advanta and nurture.farm launched the Nutrifeed Germination Scheme, offering risk cover for forage crops such as Sorghum, Millet, and Corn. This scheme compensated farmers if seeds fail to germinate within 15 days, helping to protect against financial losses due to environmental stress.

- September 2023: DLF acquired Corteva Agriscience's alfalfa breeding program, including its forage seed assets such as Hi-Gest alfalfa technology and other alfalfa varieties. This acquisition strengthens DLF's global presence in alfalfa breeding and enhances its forage portfolio.

Forage Seed Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Products Covered | Alfalfa, Clover, Ryegrass, Chicory, Others |

| Livestocks Covered | Poultry, Cattle, Pork, Others |

| Species Covered | Legumes, Grasses |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Advanta Seeds (UPL Limited), Allied Seed LLC (Growmark Inc.), Ampac Seed Company, Brett-Young Seeds Limited, Corteva Agriscience, Dlf Seeds A/S (Dansk Landbrugs Frøselskab Amba), KWS SAAT SE & Co. KGaA, RAGT Semences (RAGT Group), Royal Barenbrug Group, S&W Seed Co., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global forage seed market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global forage seed market?

- What is the impact of each driver, restraint, and opportunity on the global forage seed market?

- What are the key regional markets?

- Which countries represent the most attractive forage seed market?

- What is the breakup of the market based on the product?

- Which is the most attractive product in the forage seed market?

- What is the breakup of the market based on the livestock?

- Which is the most attractive livestock in the forage seed market?

- What is the breakup of the market based on the species?

- Which is the most attractive species in the forage seed market?

- What is the competitive structure of the global forage seed market?

- Who are the key players/companies in the global forage seed market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the forage seed market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global forage seed market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the forage seed industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)