Footwear Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, Pricing, End-User, and Region, 2025-2033

Footwear Market Size and Share:

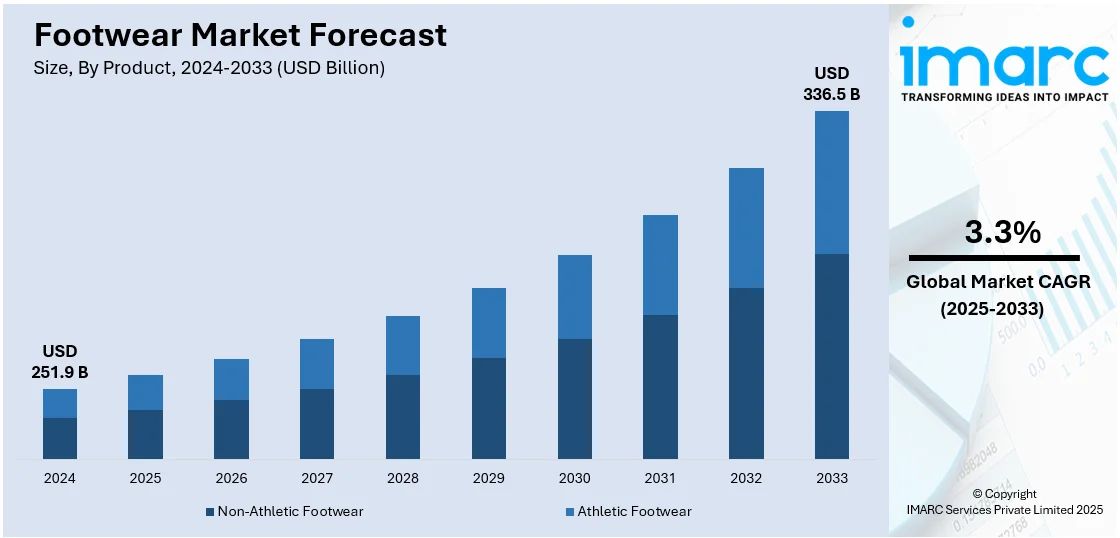

The global footwear market size was valued at USD 251.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 336.5 Billion by 2033, exhibiting a CAGR of 3.3% during 2025-2033. North America currently dominates the market, holding a significant market share of over 39.8% in 2024. The increasing demand for superior quality footwear, easy availability of unique designs, launch of eco-friendly footwear and growing number of organized retail outlets represent some of the key factors contributing to the footwear market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 251.9 Billion |

|

Market Forecast in 2033

|

USD 336.5 Billion |

| Market Growth Rate 2025-2033 | 3.3% |

The global footwear industry is influenced by the increasing population and urbanization, which create a demand for varied types of footwear, ranging from casual to sports footwear. Health awareness increases the sale of athletic and sports shoes, while fashion trends drive demand for style and design. Moreover, the growth of e-commerce has increased the accessibility of footwear, enabling brands to access wider bases. Technological innovations, including smart and sustainable materials, attract environmentally conscious and tech-savvy consumers. Growing disposable income in emerging markets also facilitates increased expenditure on premium and branded footwear. Additionally, celebrity endorsements and social media influence significantly shapes consumer behavior. Seasonal and cultural differences also cause changing demand, especially in markets with prominent festival or weather-driven buying patterns. Apart from this, comfort and customization are still essential factors determining growth, with consumers preferring shoes that express individuality and offer ergonomic advantages. These drivers are expected to influence the global footwear market growth in the near future.

To get more information on this market, Request Sample

The United States stands out as a key market disruptor, driven by innovation, consumer fashion, and market leadership. Hosting brands such as Nike, Skechers, and Under Armour, the US is a world leader in design, performance technology, and marketing standards. American consumers want function and style, and they compel the brands to innovate at lightning speed. Direct-to-consumer (DTC) models and digital platforms have redefined traditional retail, with American firms at the forefront of digitalization. Sustainability movements and customization also fuel faster disruption, as technology-enabled, environmentally aware American consumers drive change. Brand, celebrity, and influencer collaborations reinforce this trend, rewriting brand valuation and reach. Startups in the United States are also adopting 3D printing, artificial intelligence, and reuse, disrupting legacy players and redefining production paradigms. Since global trends frequently begin or are picked up in the US, its influence continues to set the competitive tone for the world's footwear industry.

Footwear Market Trends:

Sustainability and Eco-Friendly Materials

Sustainability has become a prominent factor governing the footwear market, with companies making ensuring the use of environmentally friendly materials and manufacturing processes. Customers today are more conscious, while looking for products that reflect their environment-friendly policies. This has resulted in companies using biodegradable plastics, mushroom leather, and algae-based foams, which are environmentally friendly and also meet the increasing demand for sustainable and recyclable products. In addition, companies are also adopting circular economy strategies by initiating take-back programs and modularity in product design to support repair and reuse, enhancing further sustainability. For example, in March 2025, Metro Brands Limited, a top and highly regarded footwear retailer in India, launched an intriguing campaign to showcase its continuous dedication to sustainability via shoe recycling. This initiative seeks to tackle urgent environmental issues caused by thrown-away shoes, providing footwear with a new purpose while transforming industry standards concerning waste and accountability. Apart from this, using digital tools like blockchain improves transparency within supply chains so that customers can check the sustainability claims of their purchases. Hence, this digital revolution establishes trust with customers, while also widening the base and scope of sustainability initiatives which further defines the footwear market outlook.

Personalization and Smart Footwear Integration

There has been a rising demand for personalized shoes, which has simultaneously increased with the growth in technology and a need for uniqueness. According to the IMARC Group, the global smart shoes market size reached USD 357.9 Million in 2024 and is further expected to reach USD 1,186.4 Million by 2033, exhibiting a growth rate (CAGR) of 13.53% during 2025-2033. Companies are now providing customization features that enable customers to choose colors, fabrics, and even create custom shoes that are made to their individual specifications. Advances in technology, including 3D scanning and printing, facilitate the production of bespoke shoes that conform to the shape of the wearer's foot, providing added comfort and performance. At the same time, the incorporation of smart technology within footwear is changing the user experience. Smart shoes with sensors allow for monitoring activity levels, assessment of running form, and instant feedback, suiting both athletic and technologically oriented consumers. While, this blending of customization and intelligent technology raises the performance of footwear, it also meets the changing demands of contemporary consumers.

Digital Revolution and Online Store Expansion

The shoe industry is experiencing a digital revolution, with online stores becoming the focal point for assessment of consumer shopping behavior. Companies are heavily investing in digital channels, providing seamless shopping experiences through virtual try-ons, augmented reality capabilities, and AI-based recommendations. For instance, in 2023 alone, Nike spent USD 4.06 Billion on advertising and promotion. This online transformation is making shopping experiences more convenient while also giving brands precious information to customize marketing and enhance customer interaction. Moreover, social media sites are playing a crucial role in shaping consumer behavior, with user-generated content and influencers dictating trends and brand awareness. In addition, the emergence of direct-to-consumer (DTC) models enables brands to build closer connections with their consumers, circumventing conventional retail intermediaries and having greater brand narrative and customer experience control. This comprehensive digital overhaul is transforming the footwear industry, making it more consumer-friendly and responsive.

Footwear Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global footwear market, along with forecasts at the global and regional levels from 2025-2033. The market has been categorized based on product, material, distribution channel, pricing, and end-user.

Analysis by Product:

- Non-Athletic Footwear

- Athletic Footwear

Non-athletic footwear stands as the largest component in 2024, holding around 67.6% of the market. According to the report, non-athletic footwear increasing adoption due to the increasing influence of fashion trends, celebrity endorsements, and social media promotion. In addition, the demand for non-athletic footwear is largely influenced by the introduction of innovative designs and features that offer more comfort.

Analysis by Material:

- Rubber

- Leather

- Plastic

- Fabric

- Others

Rubber leads the market share in 2024. According to the report, rubber on account of its various benefits, such as protection against harsh chemicals and high temperatures, reduced fatigue, and strong grip on the ground. Moreover, rubber footwears are extremely cost-effective and available in a wide variety of sizes.

Analysis by Distribution Channel:

- Footwear Specialists

- Supermarkets and Hypermarkets

- Departmental Stores

- Clothing Stores

- Online Sales

- Others

Footwear specialists lead the market share in 2024. According to the report, footwear specialists on account of the rising prevalence of medical conditions related to feet, ankles, calves, and legs. Apart from this, footwear reduces the risk of developing corns, blisters, and calluses and minimizes foot fatigue.

Analysis by Pricing:

- Premium

- Mass

As per the footwear market forecast, mass pricing leads the market share in 2024. According to the report, mass accounts of the easy availability of footwear through online and offline distribution channels, coupled with secured payment gateways. In addition, increasing investments in the marketing strategies, such as social media promotion and celebrity endorsements are augmenting the growth of the market.

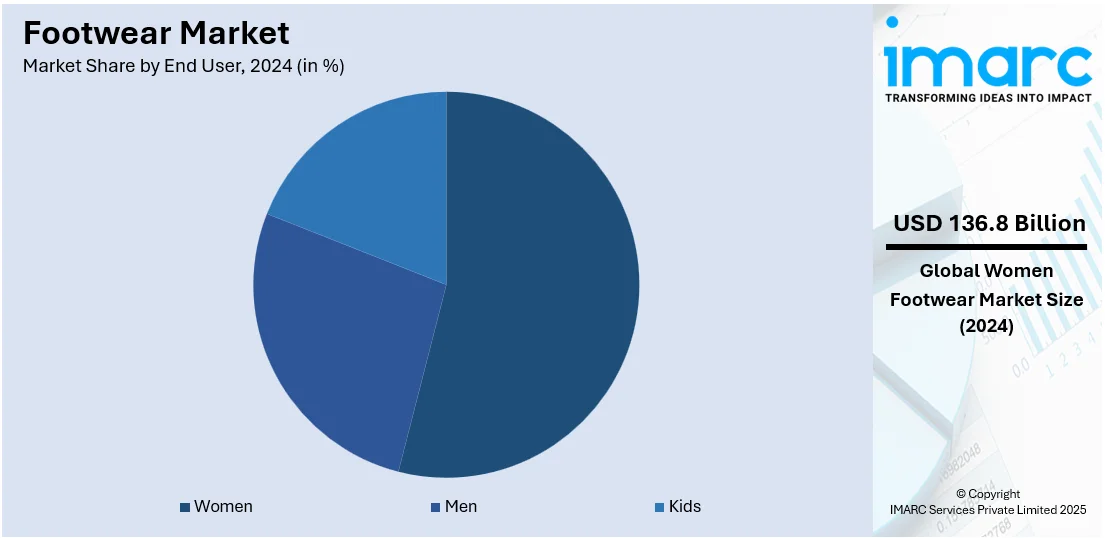

Analysis by End User:

- Men

- Women

- Kids

Women leads the market with around 54.3% of market share in 2024. According to the report, women due to the increasing influence of fashion and shifting preferences for wearing different types of footwear to work, sports, and casual meetings Besides this, the increasing popularity of orthopedic footwear among women individuals is positively influencing the market growth.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

In 2024, North America accounted for the largest market share of over 39.8%. Some of the factors driving the North American footwear market include the launch of innovative product designs, coupled with the high disposable income levels of the consumers that positively influence the sales of premium products in the region. Furthermore, North America, being the early adopter of the latest fashion trends, gets easy access to all the trending designs and styles of footwear. Also, the easy availability of a wide range of footwear online or in the well-developed retail channels of the region is propelling the market growth.

Key Regional Takeaways:

United States Footwear Market Analysis

In 2024, the United States accounted for over 87.30% of the footwear market in North America. The United States experiences rising footwear demand driven by increasing participation in sports activities and events across various age groups. Athletic awareness and a shift toward fitness-focused lifestyles have intensified interest in performance-oriented shoes. Local sports leagues, marathons, and wellness programs contribute significantly to the adoption of diverse footwear categories. Consumers now seek specialized products for running, training, and walking, creating steady demand across multiple segments. Growing participation in sports activities and events also influences brand collaborations with athletes, which further enhances consumer preference. The inclination toward comfort and durability aligns with the needs of sports enthusiasts, while seasonal sports events boost temporary surges in sales. This evolving trend reflects how sports engagement plays a pivotal role in shaping footwear adoption patterns in this region.

Asia Pacific Footwear Market Analysis

Asia-Pacific continues to witness a surge in footwear purchases supported by expanding digital infrastructure and mobile penetration. Growing e-commerce platforms are redefining the shopping experience, offering wide selections, convenience, and competitive pricing. Online platforms now serve as primary retail channels, enabling easy access to global and local footwear brands. Creative payment options, including digital wallets and mobile banking, have rendered online shopping smooth and secure. Digital wallets have become the leading choice for e-commerce payment methods, surpassing credit cards. E-commerce allows consumers to easily shop online from home, evident in certain Asia Pacific nations where over 50% of consumer expenditures occurred digitally. Flash sales, influencer promotions, and digital advertisements further increase product visibility and consumer engagement. As e-commerce expands, footwear brands optimize their digital presence through improved delivery systems and user-friendly interfaces. Urban consumers prefer quick access to trendy designs and functional products, leading to repeat purchases. This digital transformation, paired with increasing trust in online payments and return policies, amplifies footwear adoption across both metropolitan and smaller cities in Asia-Pacific.

Europe Footwear Market Analysis

Europe’s footwear market growth is fueled by the steady expansion of branded and multi-brand footwear and clothing outlets. These physical stores offer consumers direct interaction with products, personalized fitting, and in-store promotions, encouraging increased purchases. Growing footwear and clothing outlets across both urban and suburban locations improve accessibility to global and regional brands. For instance, in 2024, Germany's footwear sector experienced a modest nominal sales increase of 2.4%, reaching 2.12 billion euros. Store formats, including concept stores and fashion chains, appeal to varied consumer preferences. Enhanced merchandising techniques and seasonal collections influence buying decisions, while in-store experiences drive brand loyalty. These outlets play a key role in showcasing style trends, reinforcing brand image, and strengthening customer engagement. The physical retail landscape remains central to footwear sales in Europe, especially as consumers value tactile product experiences supported by strategic retail expansion.

Latin America Footwear Market Analysis

In Latin America, the footwear market is experiencing robust growth driven by shifting consumer preferences toward fashion-forward, comfortable, and performance-enhancing designs. The rising popularity of local and international sporting events, such as Copa Libertadores and FIFA qualifiers, fuels demand for athletic footwear. International partnerships between Latin American brands and global players like Adidas, Nike, and Puma are boosting regional product availability and marketing influence. For instance, The Brazilian Football Federation (CBF) extended its partnership with Nike for 12 years, worth USD 100 million annually. The deal, starting in 2027, includes royalties from jersey sales, licensing opportunities, and a focus on growing women’s soccer, inclusion, and youth participation. These collaborations also promote co-branded collections tailored to local tastes.

Middle East and Africa Footwear Market Analysis

The Middle East and Africa observe a consistent increase in shoe purchases linked to demographic and retail shifts. Growing urban population and international footwear outlets contribute to wider product availability and changing fashion expectations. As urbanization accelerates, access to global brands through premium outlets and importing becomes easier, introducing consumers to newer styles. In 2023, the United Arab Emirates imported USD 966 Million of leather footwear, becoming the 14th largest importer of Leather Footwear (out of 224) in the world. This wide distribution channel development fuels interest in both casual and formal footwear as urban residents seek versatile and modern footwear solutions.

Competitive Landscape:

Several major players in the footwear industry are aggressively embracing innovative strategies to fuel growth and meet changing consumer needs. Large brands are investing significantly into research and development to create technologically sophisticated, comfortable, and performance-based footwear. They are using environmentally friendly materials like recycled rubber, plant fibers, and biodegradable synthetics to ensure environment-friendliness and respond to increased demand for sustainable products. Partnerships with designers, athletes, and influencers enable brands to connect with broader audiences and remain current in fashion and streetwear cultures. Furthermore, companies are embracing digital disruption through virtual try-ons, AI-powered personalization, and e-commerce optimization, allowing customers to shop online more confidently. Penetration into growing markets through local marketing, aggressive pricing, and region-specific designs is another prominent strategy. Several players are also improving supply chain effectiveness and investing in intelligent manufacturing to decrease costs and increase agility. Options for customization, limited edition launches, and loyalty programs also strengthen consumer involvement and build brand loyalty. These collaborative efforts from top footwear corporations are making them compete in a competitive market while also allowing them to align with emerging trends, from athleisure and lifestyle to sustainability and technological convenience.

The report provides a comprehensive analysis of the competitive landscape in the footwear market with detailed profiles of all major companies, including:

- Adidas AG

- ASICS Corporation

- Crocs, Inc.

- ECCO Sko A/S

- Geox S.p.a

- New Balance

- Nike, Inc.

- Puma SE

- SKECHERS USA, Inc.

- Timberland

- Under Armour Inc.

- Wolverine World Wide, Inc.

Latest News and Developments:

- April 2025: Nike and Hyperice launched the “Hyperboot”, a high-tech recovery shoe that features heated massage and dynamic air-compression. Designed to target muscles and tissues in the feet and ankles, the Hyperboot promised faster warm-ups and quicker recovery.

- March 2025: Adidas announced a new Originals Golf line, blending streetwear and golf culture. The collection, featuring sneakers like the Coursecup and Gazelle Golf, was inspired by the growing influence of streetwear in golf. Released ahead of the 2025 Master’s Tournament, the line showcased apparel in vibrant blues, greens, yellows, and whites.

- January 2025: Joe Foster, the co-founder of Reebok, partnered with entrepreneur Ben Weiss to launch Syntilay, a new AI-powered shoe brand. They introduced their first product, a USD 150 pair of futuristic slides, claiming it to be the world's first commercial shoe designed using AI.

- January 2025: PUMA revealed its SS25 HYROX collection, marking the debut of co-branded PUMA x HYROX footwear. The collection included performance and lifestyle apparel featuring CLOUDSPUN and THERMOADAPT technologies. Footwear options came in Deviate NITRO™ 3, Deviate NITRO™ Elite 3, and Velocity NITRO™ 3 silhouettes.

Footwear Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Non-Athletic Footwear, Athletic Footwear |

| Materials Covered | Rubber, Leather, Plastic, Fabric, and Others |

| Distribution Channels Covered | Footwear Specialists, Supermarkets and Hypermarkets, Departmental Stores, Clothing Stores, Online Sales, and Others |

| Pricings Covered | Premium, Mass |

| End-Users Covered | Men, Women, Kids |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Adidas AG, ASICS Corporation, Crocs, Inc., ECCO Sko A/S, Geox S.p.a, New Balance, Nike, Inc., Puma SE, SKECHERS USA, Inc., Timberland, Under Armour Inc., Wolverine World Wide, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the footwear market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global footwear market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the footwear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The footwear market was valued at USD 251.9 Billion in 2024.

The footwear market is projected to exhibit a CAGR of 3.3% during 2025-2033, reaching a value of USD 336.5 Billion by 2033.

Footwear market drivers include rising fashion consciousness, growing health and fitness trends, increasing demand for comfort and performance and innovations in sustainable materials, customization, and smart technology. E-commerce expansion and influencer-driven marketing further accelerate consumer engagement, shaping purchasing behaviors across diverse demographics and lifestyles.

North America currently dominates the footwear market, driven by high consumer spending, strong brand loyalty, and a focus on innovation. Trends like athleisure, eco-conscious products, and smart technologies fuel demand. E-commerce growth, celebrity endorsements, and a shift toward personalized, comfortable footwear also significantly influence market expansion and consumer preferences.

Some of the major players in the footwear market include Adidas AG, ASICS Corporation, Crocs, Inc., ECCO Sko A/S, Geox S.p.a, New Balance, Nike, Inc., Puma SE, SKECHERS USA, Inc., Timberland, Under Armour Inc., Wolverine World Wide, Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)