Football Market Size, Share, Trends and Forecast by Type, Size, Distribution Channel, and Region, 2026-2034

Football Market Size and Share:

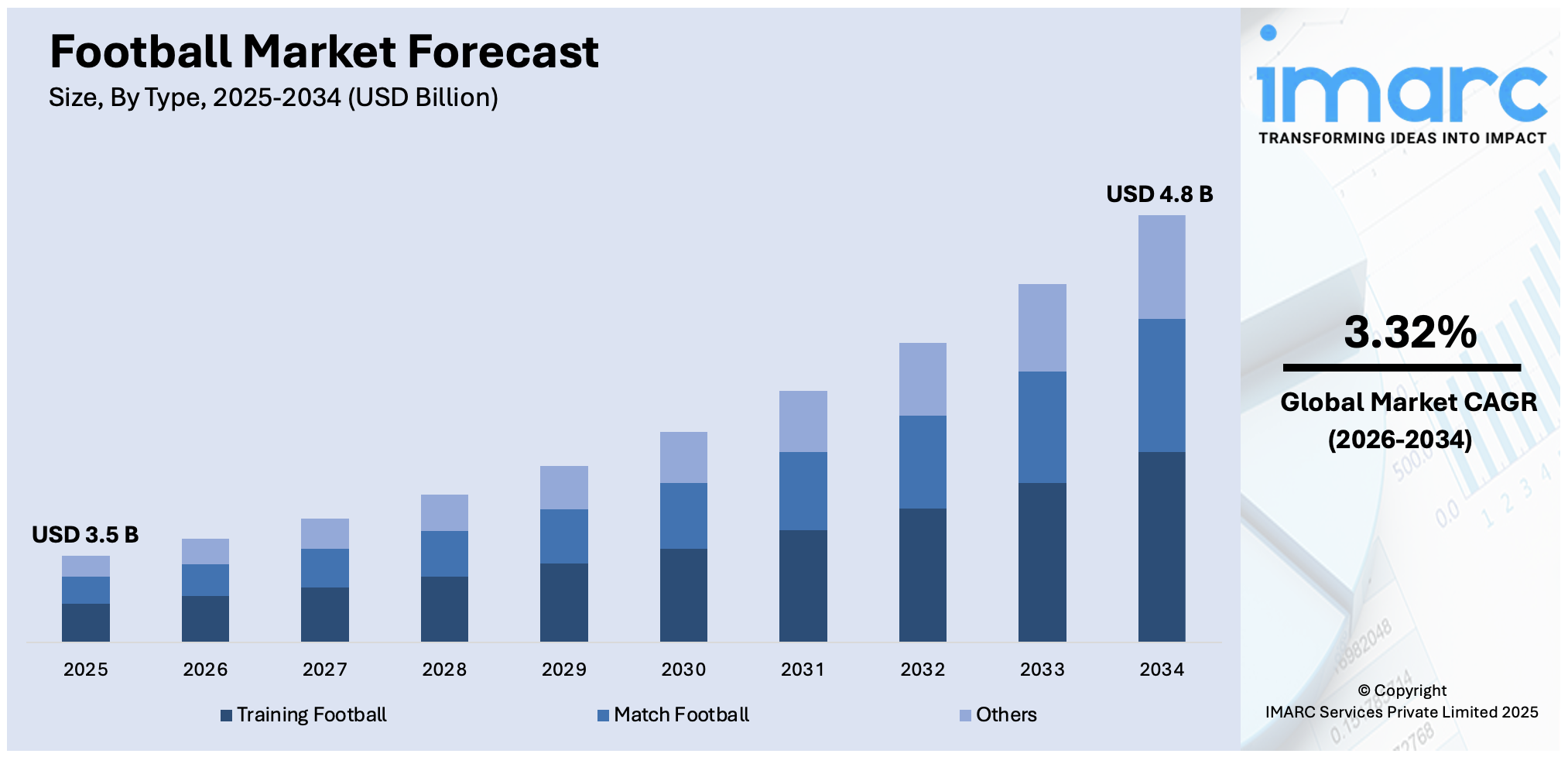

The global football market size was valued at USD 3.5 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 4.8 Billion by 2034, exhibiting a CAGR of 3.32% from 2026-2034. Europe currently dominates the market, holding a market share of over 35.0% in 2025. The football market share is driven by significant advancements in digitization, increasing sponsorships and partnerships between brands and clubs, and growing e-sports and gaming sectors through numerous platforms such as FIFA, and Football PES.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 3.5 Billion |

|

Market Forecast in 2034

|

USD 4.8 Billion |

| Market Growth Rate (2026-2034) | 3.32% |

The increasing popularity of football globally is a major catalyst for the growth of the football market demand, and recent data underscores this trend. As of 2024, football continues to be the most followed sport worldwide, with over 4 billion fans, according to 2024 statistics. The sport is deeply ingrained in the cultures of Europe, South America, and Africa, while its presence in Asia and North America has seen significant growth. In China, for instance, the government’s initiative to make football a national priority has led to increased grassroots participation. Furthermore, UEFA’s 2024 statistics show that Euro 2024 saw approximately 2.67 million fans. Football is increasingly viewed not just as a sport but as a cultural phenomenon, transcending national borders and engaging fans from all walks of life. This growing fan base, fueled by media exposure and local development programs, continues to drive football market growth worldwide.

To get more information on this market Request Sample

The United States football market holds a total share of 84% and is being driven by several key factors. A primary contributor is the increasing popularity of soccer among youth and adult populations. According to a latest report, participation in soccer reached nearly 14.1 million players among those 6 or older throughout 2023, making it one of the top youth sports in the country. This surge is part of a broader trend of greater engagement with football, particularly as international leagues like the English Premier League and La Liga gain traction with American audiences. The U.S. is also experiencing growing interest in Major League Soccer (MLS), which has seen a 14% increase in attendance since 2022, with an average of over 23234 fans per match in 2024. The 2026 FIFA World Cup, which will be co-hosted by the U.S., Mexico, and Canada, is expected to have a massive impact, further accelerating the growth of the sport. Moreover, U.S. cities are investing in state-of-the-art stadiums and facilities in preparation for the tournament, which will boost local economies and inspire greater grassroots participation.

Football Market Trends:

Growing Digitalization

The digital revolution has reshaped the landscape of football consumption, with clubs leveraging digital platforms, social media, and content creation to engage with fans worldwide. According to reports, a significant 90% of small businesses incorporate social media as a key element of their marketing approach. In today's interconnected world, football clubs recognize the immense potential of digital channels to expand their reach, build brand loyalty, and monetize fan engagement. Nowadays, the football industry involves various key players investing in technologies to stay ahead of the competition. According to PwC's sports industry outlook for 2023, significant transformations are underway in sports sponsorship. Among these, the emergence of new media platforms is notably guiding football sponsorship more than any other aspect. Also, the surge in online streaming and video platforms, along with the easy availability of cost-effective smartphones, has enabled football to extend its influence beyond conventional fan demographics. Sponsors are using this shift to access new markets, pinpoint particular fan segments, and assess the effectiveness of their sponsorship arrangements. For instance, In March 2021, Sky Sports secured a three-year agreement, valued in the multimillions, to broadcast English Women’s Super League matches, as stated by the Football Association (FA) in a press release which hailed as a milestone in women’s sports broadcasting.

Increasing Sponsorship and Partnerships

The allure of football as a global phenomenon has led to a surge in sponsorship and partnerships between brands and clubs, driven by the desire to enhance brand visibility and connect with a vast audience of passionate fans. Football sponsorship offers brands unparalleled exposure and engagement opportunities, allowing them to align their brand values with the passion and emotion associated with the sport. The airline industry invested over USD 521 Million in football sponsorships, including PSG's USD 80 Million deal with Qatar Airways and Real Madrid's USD 68.1-70 Million agreement with Emirates. Currently, the football market values key players investing in sponsorship and partnership to stay ahead of the competition. For instance, In August 2022, Nike disclosed a multi-year collaboration with The Football Association (FA), establishing itself as the Official Ball Supplier for the Barclays Women’s Championship (BWC), Barclays Women’s Super League (BWSL), and The FA Women’s Continental Tyres League Cup, where Nike Flight ball technology will make its debut.

Rising E-sports and Gaming Sector

The convergence of football and gaming represents a burgeoning trend in the sports industry, with clubs increasingly embracing e-sports and gaming to engage with younger audiences and diversify their revenue streams. Recognizing the immense popularity of gaming among fans, football clubs have established e-sports teams, partnered with gaming organizations, and organized gaming tournaments to tap into the lucrative gaming market. Through platforms including FIFA and eFootball PES, fans can experience the thrill of virtual football and compete against players globally, blurring the lines between the digital and physical realms of the sport. Besides, the football market growth is also attributed to leading players investing in the gaming sector to stay ahead of the competition. For example, in June 2023, One Future Football (1FF) inaugurated a global digital football league, marking a historic milestone in the realm of sports which witnessed the participation of more than 250 players representing 12 clubs from various corners of the globe. Notably, all teams and athletes have been exclusively crafted for the virtual platform, underscoring the innovative nature of this event. Top of Form Moreover, in March 2020, Adidas, FIFA, and Google collaborated to create a smart football boot technology that enhances FIFA rating by playing in real-life by users.

Football Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global football market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on type, size, and distribution channel.

Analysis by Type:

- Training Football

- Match Football

- Others

As per the football market outlook, training football is the largest segment, holding 45.0% market share in 2025. It serves various stakeholders, including amateur or professional players, coaches, and training facilities. Training football is particularly designed to endure vigorous training thus having a higher level of performance sustainability. Moreover, leading players are investing in the market to stay ahead of the competition which will positively impact the football market forecast in coming years. For example, In October 2020, the FIFA Quality and FIFA Quality Pro labels underwent a rebranding and redesign with the introduction of the new FIFA Basic standard. It aims to facilitate the recognition of products, technologies, and surfaces that provide feasible and cost-effective options for grassroots-level and higher-tier entities with constrained budgets. Presently, these three FIFA quality designations (Basic, Quality, and Quality Pro) continue to serve as certifications for football products that have undergone testing.

Analysis by Size:

- Size 1

- Size 2

- Size 3

- Size 4

- Size 5

Size 1 footballs are primarily designed for young children under the age of 5. These mini-footballs are used in early development programs and are typically smaller in diameter, making them easier for toddlers to handle. Their market is driven by demand from youth academies and recreational leagues focused on skill development.

Size 2 footballs are slightly larger than Size 1 and are commonly used for children aged 5 to 7. This size helps children refine their control and passing skills. The market for Size 2 footballs is growing as more schools and sports clubs introduce football to younger age groups in developmental programs.

Size 3 footballs are typically used by children aged 8 to 12. This size is important in transitioning from mini footballs to full-sized balls, supporting skill refinement like dribbling, passing, and shooting. The market for Size 3 balls is expanding as youth leagues and football academies emphasize more structured training.

Size 4 footballs are generally used by players aged 12 to 14. These balls are a key step toward professional-level play and are common in youth leagues and competitive training. As youth football continues to grow in popularity globally, the demand for Size 4 balls is increasing, especially in developing football markets.

Size 5 footballs are the standard size used in professional and adult football, including international competitions like the FIFA World Cup. As the primary ball used in top-tier leagues and events, Size 5 holds the largest market share. Demand is driven by professional teams, leagues, and global football fans.

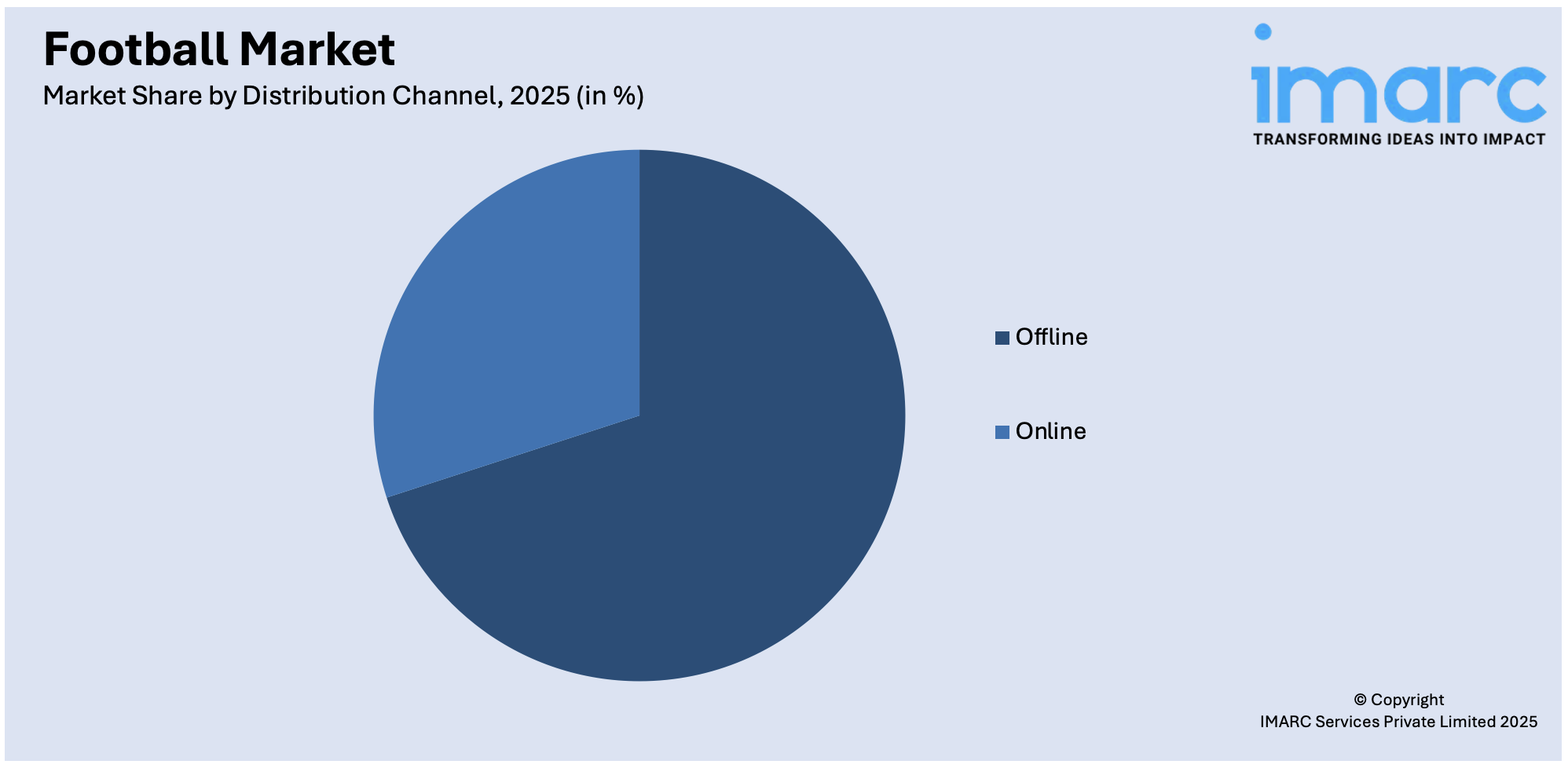

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

Based on the football market forecast, offline leads the market with around 70.0% of market share in 2025. The primary offline channels are brick-and-mortar shops, sports-specific retailers, and pop-up shops at stadiums and sports arenas which offer clients the ability to interact with the items in physical space and receive tailored guidance from well-informed personnel. Additionally, the offline segment appeals to a wider consumer base, including customers who prefer physical stores and areas with inadequate access to the Internet, thus creating a positive football market outlook.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe is the largest segment, holding 35.0% market share due to its diverse football culture. Europe has leagues such as the English Premier League, La Liga in Spain, Serie A in Italy, and the Bundesliga in Germany. Fans across Europe prove to be one of the largest numbers of fans in the world of football. Moreover, Millions of fans worldwide watch the game in different lines of games. Europe has played a pivotal role in the creation of the sport. As a result, the football market outlook involves various key players investing in advanced technologies to stay ahead of the competition. For example, In June 2022, PUMA, a leading global sports brand, and Lega Serie disclosed a fresh long-term collaboration. Commencing from the 2022/23 football season, PUMA assumes the role of the league's official technical partner and will supply the official match balls for all Serie A, Primavera 1, Coppa Italia, Supercoppa, and eSerie A matches.

Key Regional Takeaways:

United States Football Market Analysis

The U.S. football market is bolstered by strong fan engagement, widespread participation, and expanding commercial opportunities. According to reports, 41% of U.S. adults claim football as their favorite sport, reflecting its cultural significance. The National Football League (NFL) is the central pillar, driving high viewership ratings, lucrative television contracts, and extensive sponsorship deals. The increasing popularity of college football and other regional leagues complements the NFL’s dominance, while fantasy football contributes to deeper fan involvement, creating additional revenue streams and engagement opportunities. Grassroots football programs are also seeing growing investments, ensuring the continued development of the sport and its future fanbase. Moreover, the rapid growth of digital platforms and e-sports provides new ways for fans to interact with football, further enhancing the market’s reach. Corporate sponsorships, which span multiple sectors—from traditional industries like retail and automotive to emerging areas like technology and wellness—continue to fuel football’s expansion. Major events, including the 2026 FIFA World Cup hosted by the U.S., also play a significant role in elevating the country’s global football profile. Football’s rising popularity among youth and diverse demographic groups strengthens its position in the U.S. sports market. With increasing investments in infrastructure, player development, and digital engagement, the U.S. football market is set to maintain its growth trajectory.

Europe Football Market Analysis

Europe remains a powerhouse in the global football market, driven by a rich football heritage, passionate fanbases, and a thriving industry infrastructure. Europe is home to some of the most renowned football clubs, including FC Barcelona, Manchester United, and Bayern Munich, as well as elite leagues like the English Premier League, La Liga, and Serie A. According to UEFA's European Club Talent and Competition Landscape report, the 2023/24 season set a new attendance record, with 229 million fans attending matches. This highlights the continued attraction of live stadium events, despite the growing influence of streaming services and social media platforms like TikTok and Instagram in football engagement. The robust attendance and viewership numbers underscore football's entrenched position in European culture. Furthermore, sponsorships, media rights, and merchandise sales continue to fuel the growth of European football, while youth development programs ensure a steady influx of talent. The region's diverse fanbase drives significant demand for both domestic and international competitions, such as the UEFA Champions League. As football evolves, Europe remains central to shaping global trends, offering significant commercial opportunities and sustained growth in the sport's ecosystem.

Asia Pacific Football Market Analysis

The football market in the Asia-Pacific (APAC) region is being shaped by rapid urbanization, with East Asia and the Pacific emerging as the world’s most rapidly urbanizing regions, with an average annual urbanization rate of 3%. This shift has led to higher disposable incomes, increasing interest in sports, and greater accessibility to football, particularly in emerging markets like China and India. As cities grow, the demand for sports infrastructure, including football stadiums and training facilities, rises. The popularity of international football events such as the FIFA World Cup further fuels fan engagement and media consumption. Furthermore, domestic leagues are receiving increased investment, raising the profile of local football clubs and improving overall competitiveness. Youth participation in football is on the rise across the region, signaling long-term growth potential. The presence of international football clubs expanding their footprint in the region through tours and sponsorships continues to drive commercial opportunities and expand the fanbase. This growth positions APAC as a significant market in the global football ecosystem.

Latin America Football Market Analysis

The Latin American football market is driven by the region's strong cultural affinity for the sport, particularly in countries like Brazil, Argentina, and Mexico. With urbanization now around 80% in Latin America, higher engagement with media and increased participation in football are driving market growth. This urbanization trend boosts accessibility to football events, broadcasts, and youth development programs, making the sport even more ingrained in local cultures. The passionate fanbase contributes to high engagement levels, while broadcasting deals and sponsorships continue to fuel industry expansion, ensuring that Latin America remains a key player in the global football market.

Middle East and Africa Football Market Analysis

The Middle East and Africa (MEA) region’s football market is expanding due to rising urbanization, with the Middle East and North Africa (MENA) region already 64% urbanized. This urban shift has bolstered demand for sports entertainment, particularly football, which enjoys immense popularity in countries like Saudi Arabia, Qatar, and the UAE. Investments in football leagues, both locally and internationally, have fueled growth, with top-tier clubs attracting high-profile players. Major global football events such as the FIFA World Cup 2022 further raised the region’s profile. With increasing youth participation and infrastructure development, the football market in MEA is poised for continued growth.

Competitive Landscape:

Leading players in the global football market are actively investing in several strategic areas to strengthen their position and drive growth. Major brands continue to innovate and develop high-performance footballs to meet the growing demands of players across all levels. These companies are focusing heavily on product innovation, incorporating advanced materials and technologies to improve durability, grip, and aerodynamics. In addition to innovation, leading players are expanding their market reach by strengthening partnerships with top football clubs, leagues, and tournaments. Sponsorships and collaborations with high-profile teams help these brands maintain visibility and credibility. Further, many of these companies are increasing their focus on emerging markets such as Asia and Africa, where football's popularity is surging. They are investing in grassroots programs, local football academies, and youth engagement initiatives to cultivate future talent and create brand loyalty at an early stage.

The report provides a comprehensive analysis of the competitive landscape in the football market with detailed profiles of all major companies, including:

- Adidas Ag

- Baden Sports

- Decathlon Sports India Pvt Ltd

- Franklin Sports Inc.

- Mitre International

- molten Corporation

- Nike, Inc.

- Niviasports

- PUMA India Ltd

- SELECT Sport International

- Umbro

- Wilson Sporting Goods Company

Latest News and Developments:

- December 2024: PUMA’s new AI Creator tool, powered by DEEPOBJECTS, offers football fans an exciting opportunity to design their own Manchester City kits. This generative AI platform allows users to customize kits with text prompts, intuitive sliders, and creative tools, empowering them to create unique patterns and bold designs.

- August 2024: Sony and the National Football League announced a technology partnership, with Sony becoming the official technology partner and headphones provider. The collaboration expanded Sony’s Hawk-Eye Innovations to enhance officiating and on-field technologies, including new coach’s sideline headsets for the 2025 season. Powered by Verizon’s 5G network, these headsets enable coach-to-coach communication. Sony’s Hawk-Eye also improved critical football measurements, and its Beyond Sports division contributed to engaging future NFL fans.

- February 2024: Nike pledges USD 3.2 Million to support football initiatives for Indigenous youth, and native Americans forming collaborations with NFL clubs through substantial investment of USD 3.2 Million over five years. Nike aims to allocate USD 20,000 annually to each NFL club which will facilitate partnerships with local Indigenous nonprofits and other community organizations to support football-centric programs tailored for youth within Native American communities.

- April 2023: EA Sports has unveiled its new football video game brand, EA Sports FC, marking the end of its 30-year partnership with FIFA. The rebranding, announced last year, retains key features such as Ultimate Team, Pro Clubs, Career Mode, and VOLTA Football while establishing a distinct, independent identity. Cam Weber, Executive Vice President of EA Sports, emphasized that fans can expect the same leagues, tournaments, clubs, and athletes.

-

June 2022: PUMA, a leading global sports brand, and Lega Serie disclosed a fresh long-term collaboration. Commencing from the 2022/23 football season, PUMA assumes the role of the league's official technical partner and will supply the official match balls for all Serie A, Primavera 1, Coppa Italia, Supercoppa, and eSerie A matches.

Football Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Training Football, Match Football, Others |

| Sizes Covered | Size 1, Size 2, Size 3, Size 4, Size 5 |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Adidas Ag, Baden Sports, Decathlon Sports India Pvt Ltd, Franklin Sports Inc., Mitre International, molten Corporation, Nike, Inc., Niviasports, PUMA India Ltd, SELECT Sport International, Umbro, Wilson Sporting Goods Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the football market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global football market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the football industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The football market was valued at USD 3.5 Billion in 2025.

IMARC estimates the football market to exhibit a CAGR of 3.32% during 2026-2034, reaching USD 4.8 Billion by 2034.

The market is driven by significant advancements in digitization, increasing sponsorships and partnerships between brands and clubs, and growing e-sports and gaming sector through numerous platforms such as FIFA, and Football PES.

Europe currently dominates the market, driven by its diverse football culture and presence of various leagues such as the English Premier League, La Liga in Spain, Serie A in Italy, and the Bundesliga in Germany. Moreover, Millions of fans worldwide watch the game in different lines of games.

Some of the major players in the football market include Adidas Ag, Baden Sports, Decathlon Sports India Pvt Ltd, Franklin Sports Inc., Mitre International, molten Corporation, Nike, Inc., Niviasports, PUMA India Ltd, SELECT Sport International, Umbro, Wilson Sporting Goods Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)