Food Tech Market Size, Share, Trends and Forecast by Component, Application, Industry, and Region, 2025-2033

Food Tech Market 2024, Size and Trends:

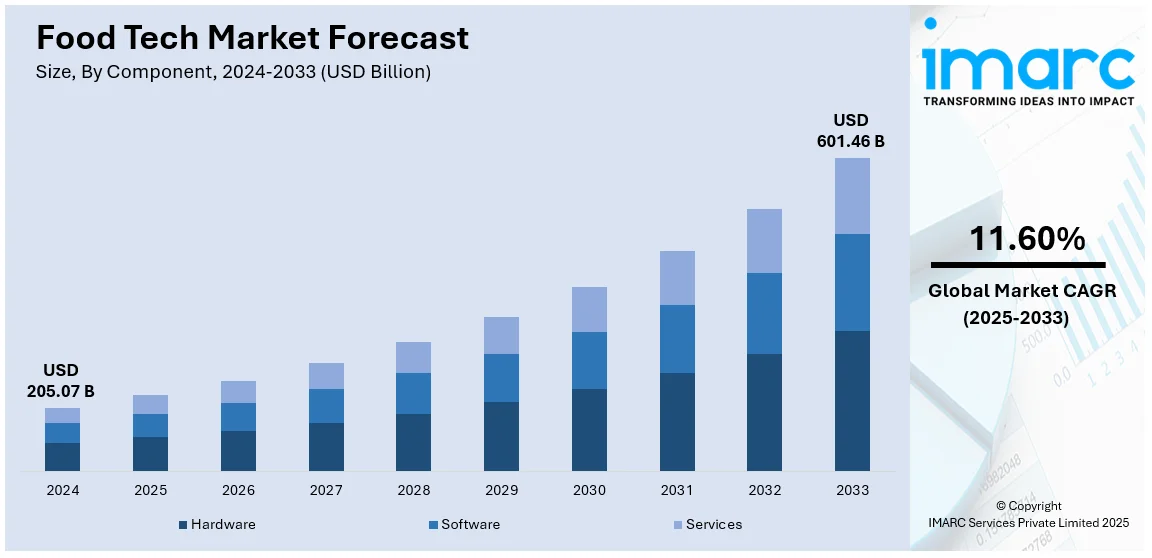

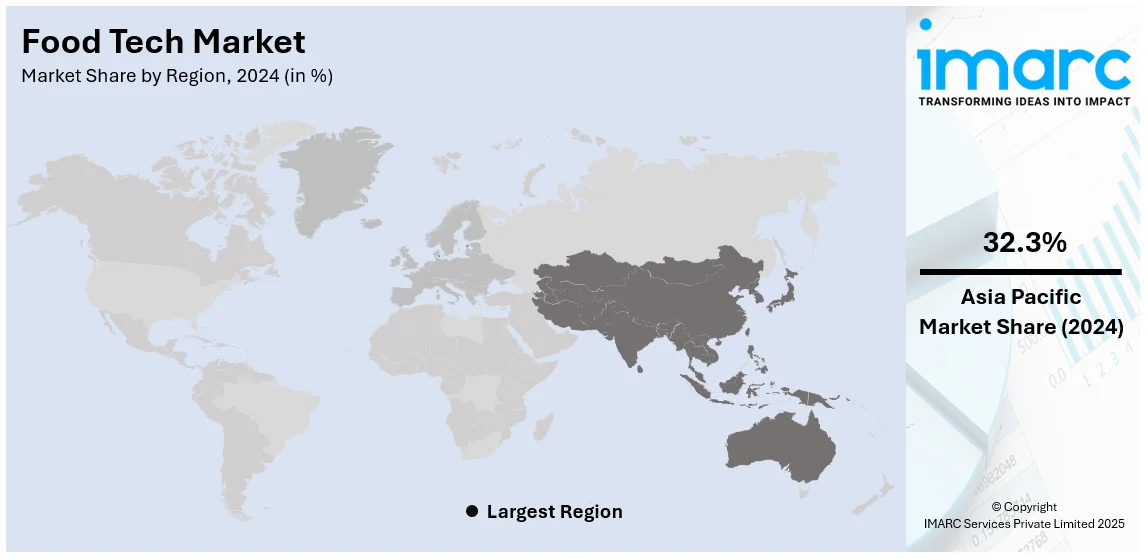

The global food tech market size was valued at USD 205.07 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 601.46 Billion by 2033, exhibiting a CAGR of 11.60% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 32.3% in 2024. The market is driven by the rapid adoption of food delivery services, increasing demand for plant-based alternatives, and the growing trend of digitalization in food production and distribution across major economies in the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 205.07 Billion |

| Market Forecast in 2033 | USD 601.46 Billion |

| Market Growth Rate (2025-2033) | 11.60% |

The global food tech market growth is accelerating the demand for sustainability. As the world seeks to address ecological issues, both consumers and companies are looking to sustainable food choices. This pertains to various innovations that bring about reduced food waste, optimized resource use, and sustainable production means. Plant-based foods, cultured meat, and alternative proteins have become highly popular with time as people seek more sustainable food choices. It is also using technology that optimizes all aspects of the food supply chain-from production and delivery-to have less energy and carbon footprint in the process. For instance, in May 2024, Swiss startup Nectariss, founded by truffle expert Richard Splivallo, introduced a revolutionary fermentation-based method to create authentic truffle flavor concentrates, leading to 300% growth in its B2B customer base. Moreover, governments and other regulatory bodies also implement stricter guidelines regarding sustainability for food industries to take up environment-friendly practices. Heightening awareness among the public toward environmental issues boost the demand for sustainable food technologies, which consequently drive up the growth in the global food tech market.

In the United States, one of the primary drivers of the food tech market share is increasing consumer demand for convenience. With fast-paced lifestyles, american consumers are turning towards technology to make their food choices and dining experience easier. For example, in June 2024, Alameda-based Eat Just, Inc. unveiled JUST Egg v5, an innovative plant-based egg formulation with improved flavor, texture, and functionality, now available at major U.S. retailers nationwide. Furthermore, meal kit delivery services, smart kitchen appliances, and on-demand food delivery platforms have taken off in response to these demands. The convenience and efficiency of having healthy meals delivered right to the door which are often personalized to meet a consumer's diet, has become highly popular. Along with smart kitchen technologies, smart ovens, and cooking assistants, also make it easier for people to cook at home with minimal effort. As a result, the U.S. food tech market continue its growth, responding to changing consumer preferences for time-saving solutions.

Food Tech Market Trends:

Growth of Delivery and Meal Kit Services

Consumers highly favor convenient and time-saving dining solutions, which is a significant growth for meal kit delivery services and food delivery platforms. Meal kit companies offer pre-portioned ingredients in curated packages, enabling an individual to cook home-cooked meals easily. These services accommodate different preferences towards diet and nutrition, giving customized and healthy meal options. For example, in January 2024, Blue Apron launched its "Prepared & Ready" meal kits, offering fresh, pre-made meals delivered directly to consumers. This new service caters to busy individuals seeking convenient, nutritious options with dietician-approved meals available for customization. Moreover, various features in this platform that include real-time tracking, contactless delivery, and personalized recommendations have made ordering food easier than before. The rising demand for convenience is answered by an ever-increasing order for delivery and meal kit services, further ensuring their place within the modern food culture. The move towards greater ease, efficiency, and streamlined options for dining resonates with this busy lifestyle.

Rise of Smart Kitchen Appliances

There's fast growth in demand for intelligent appliances designed for smart kitchen applications. This trend includes consumers exploring innovative and sleek ways to prepare meals using artificial intelligence (AI) in collaboration with the Internet of Things (IoT). These technologies introduce products ranging from smart versions of traditional home refrigerators and stovetop ovens to other cooking assistant appliances. Smart refrigerators track items that are running out or nearing their expiration dates. Similarly, smart ovens and cooking assistants provide real-time guides to help users cook with greater precision. Consumers are increasingly drawn to the time- and effort-saving advantages these technologies offer. These appliances simplify kitchen tasks, enhance the cooking experience, and free up time. This growing interest reflects a desire for more convenience, efficiency, and accuracy in food preparation. As smart kitchen appliances continue to evolve, their popularity among consumers is rapidly amplifying.

Plant-Based and Sustainable Foods

The plant-based food trend continues to gain popularity as consumers boost demand for sustainability, ethics, and healthful alternatives to meat products. Many companies are jumping on the plant-based bandwagon, creating high convincing plant-based versions of traditional foods made from animals. Concerns about the environment are also making it important as these plant-based foods are less likely to contribute to environmental degradation in terms of carbon footprint than animal-derived products. Interest in sustainable packaging and other more eco-conscious ways of producing food is also high. Demand for plant-based foods remains continually bolstered. Food tech companies are intensely engaged with new, diverse offerings to help the world dine on more sustainable and health-conscious foods across other food categories. The future of food innovation is clearly being shaped by this very trend, favoring the market expansion.

Food Tech Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global food tech market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, application, and industry.

Analysis by Component:

- Hardware

- Software

- Services

In the global food tech market, the component segment plays a significant role, with hardware leading the way, accounting for 44.2% of the market share in 2024. Hardware components include smart kitchen appliances, automation systems, sensors, and food production machinery. These technologies enhance efficiency, improve food quality, and reduce human error. As consumers intensely embrace smart kitchens and automation in food production, hardware adoption is expected to continue rising.

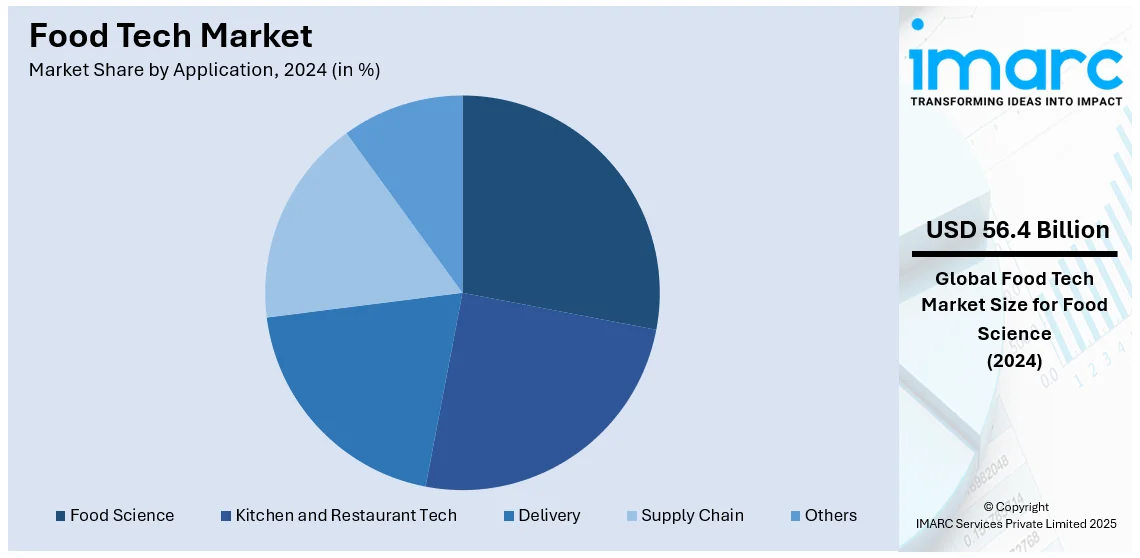

Analysis by Application:

- Food Science

- Kitchen and Restaurant Tech

- Delivery

- Supply Chain

- Others

Food Science dominates the global food tech market with a substantial share of 27.5% in 2024. Food science innovations focus on improving food safety, quality, and nutritional content using advanced technologies like biotechnology, genetic engineering, and artificial intelligence (AI). Research in food science aims to address challenges in food sustainability, shelf life, and processing techniques. This segment is crucial as it enables the development of healthier, more sustainable food products that cater to growing consumer health awareness. Other significant applications include kitchen tech, which enhances culinary efficiency, and food delivery tech, which focuses on streamlining food logistics. These applications support the larger goal of creating a more efficient, environmentally friendly food system, driving the future of the food tech industry.

Analysis by Industry:

- Fish, Meat, and Seafood

- Fruits and Vegetables

- Grain and Oil

- Dairy Products

- Beverages

- Bakery and Confectionery

- Others

The fish, meat, and seafood industry hold a significant market share of 24.6% in 2024 within the global food tech market. The industry is adopting technology to improve production processes, ensure sustainability, and reduce waste. Innovations such as lab-grown meats, sustainable aquaculture practices, and AI-driven monitoring systems have led to more efficient and environmentally friendly production. The growing consumer demand for healthier, more sustainable protein sources is driving advancements in this segment, making it a crucial part of the food tech ecosystem. Other industries, such as fruits, vegetables, dairy products, and beverages are also experiencing similar technological disruptions, each benefiting from innovations that enhance product quality, optimize supply chains, and address sustainability concerns.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

The Asia-Pacific region holds a dominant position in the global food tech market with 32.3% market share in 2024. This growth is driven by the rapid technological advancements in food production, delivery, and consumption across countries like China, Japan, and India. The region's large population, growing middle class, and increased internet penetration contribute to the rising demand for food tech services such as food delivery platforms and meal kits. Additionally, Asia-Pacific is a key player in food manufacturing and innovation, with advancements in plant-based proteins, food processing technologies, and sustainable agricultural practices. As the region continues to modernize its food systems, the adoption of AI, automation, and smart kitchen technologies is expected to further accelerate the growth of food tech in this region. Other regions, including North America and Europe, also contribute to market growth, though Asia-Pacific leads the way.

Key Regional Takeaways:

North America Food Tech Market Analysis

The North American food tech market showcases rapid innovation along with rising demand from the consumers for convenient, sustainable, and healthy offerings. With enhanced infrastructures and significant technological adaptation levels, North America has evolved to be one of the prime places to witness innovation for food technologies with the range including online food ordering, smart kitchen gadgets, among many others. In recent years, meal kit services and food delivery apps have drastically increased in number, meeting consumer demands who are highly busy. Moreover, North America leads the marketplace in plant-based food innovation, with more companies which focuses on sustainable, alternative proteins. Another trend that emerged in this region is adoption of AI and IoT kitchen appliances as it is more efficient and personalized at home cooking. These provide food safety and traceability combined with transparency into the food chain which are also integral areas of progress, where technological advancements are important to improving quality to meet requirements from consumers with higher-quality standards.

United States Food Tech Market Analysis

The U.S. food tech market is one of the largest worldwide which is influenced highly by food innovation and technological input. Its driving factors are identified with accelerating development within its delivery systems, food science, kitchen technologies, and services for the market. Consumers within their convenience needs towards food businesses in terms of productivity and effectiveness. The sector has witnessed tremendous growth over the last few years in the areas of meal kit delivery services, smart kitchen appliances, and food safety technologies. In terms of adopting plant-based and lab-grown food technologies, the United States is also leading the way. The key players are established in the region, along with emerging startups in AI-driven food solutions and automation. The market is going to grow due to innovation and consumer interest in sustainable and healthier food options. The central investment coming from automation and delivery solutions will remain a part of the U.S. food tech ecosystem which will boost the market expansion.

Europe Food Tech Market Analysis

Europe's food tech market is growing rapidly as demand increases for more sustainable food production, intelligent kitchen technology, and innovative food delivery services. These are combined with heightening concern over food waste, sustainability, and what is happening to the planet. The market is focusing on plant-based alternatives with the minimization of food waste, and improvements in precision agriculture. Germany, the United Kingdom, and France are the main countries for innovation in food tech. These nations are characterized by a robust framework of regulations as well as highly informed consumers. The growth is fueled by the amplifying trend of meal kits, food delivery services, and AI adoption in food manufacturing. In line with this, there are a plethora of startup ecosystems that center on disruptive food production and supply chain technologies within this region. An increased investment in research and development, along with startups partnering with traditional food companies, are likely to speed up the market.

Asia Pacific Food Tech Market Analysis

The Asia Pacific is among the world's fastest growing markets in the food tech area. It's fast-moving, owing to rapid urbanization, an ever-changing taste, and rising middle-class income levels. Change in the food market is rapidly underway in such countries as China, India, Japan, and South Korea which are using new food technologies in the interest of growing concern regarding food security, nutrition, and sustainability. The region observes innovation in delivery services, smart kitchens, and food processing technology. Plant-based food options and lab-grown meat are popular in China. Affordable, tech-driven food solutions are very much in demand in India. Japan and South Korea are ahead in the game of adopting robotics and automation in food production. With investments pouring into the food tech ecosystem, from AI-driven technologies for production efficiency to Asia Pacific, it will be a big global hub in terms of innovation in food tech that offers solutions tailored to the diverse and large population.

Latin America Food Tech Market Analysis

A changing landscape is facing Latin America food tech, from an increasing need for efficient food production to more sustainable practices, and new innovative ways to deliver food. Brazil and Mexico are also on the key lists of nations, with the rising investment into food innovation. Food security is to bring high sustainability into the agriculture. Demand for plant-based and organic food products has been growing steadily in the market which is being pioneered by local start-ups and some international companies engaged in product innovation. Technology plays a vital role in streamlining the food supply chain, increasing food safety, and improving on distribution systems. The food delivery market is also going to be expanding rapidly, mostly in urban locations. Consumer preferences are evolving, and digital technologies continue to penetrate the region and drive the growth of Latin American food tech market, which attract investments in agricultural technology, automation, and health-conscious food alternatives.

Middle East and Africa Food Tech Market Analysis

Increasing need due to food security, climate change, and population growth in the region, the Middle East and Africa (MEA) is experiencing growth in the food tech market. Most areas of the region are now leading in adopting food tech with its high-tech infrastructure and investment in innovation especially through food delivery, cloud kitchens, and automation in food production. In Africa, efforts are made toward advancing agricultural productivity and reducing food scarcity through technological innovation, mainly in sustainable agricultural practices and food preservation. The demand for convenience and technology is on the rise in the region where there has been a significant interest in the application of robotics, AI, and digital platforms to make food distribution and traceability better and more accessible. Alternative proteins and plant-based foods are also on the rise significantly in the market, especially in countries like the UAE and South Africa. Further investments and collaboration between tech startups and traditional players in the food industry in the MEA region becomes intensely important in terms of global food tech innovation.

Competitive Landscape:

Food tech is highly competitive because of demand in convenience, sustainability, and technology. There are new companies that want to change various dimensions of the food industry in delivery, meal kits, kitchen automation, etc. Meal kit services have given a new direction to competition in that many companies have developed customized meal plans with fresh ingredients and convenient delivery to satisfy consumer demands. Further, food delivery has significantly evolved in the use of technology, allowing fast and efficient service through apps, real-time tracking, and customized recommendations. For restaurants, automation technologies are integrated to streamline the preparation of foods, reducing labor and increasing efficiency. Additionally, consumer interest in sustainability and plant-based food alternatives increases the demand for companies to adopt more environmentally friendly solutions, including sustainable packaging and offering plant-based product lines. This fast-changing competitive landscape calls on companies to advance from focus on innovation, customer experience, and operational efficiency to seek market leadership positions.

The report provides a comprehensive analysis of the competitive landscape in the food tech market with detailed profiles of all major companies, including:

- Delivery Hero SE

- HelloFresh SE

- Flytrex Inc

- Trax Technology Solutions PTE Ltd

- Cubiq Foods

- Lunchbox Technologies

- Miso Robotics

- Carlisle Technology

Latest News and Developments:

- In June 2024, Lunchbox Technologies, introduced a simplicity-focused approach to restaurant technology, resolving complex challenges through methods like the "5 Whys." This included automating payment authorization refreshes and alert systems for catering orders, ensuring operational efficiency and reducing manual interventions.

- In April 2024, HelloFresh SE expanded its Ready-to-Eat (RTE) service, Factor, to Sweden and Denmark, offering chef-prepared meals catering to diverse dietary preferences. This strategic move leverages HelloFresh’s direct-to-consumer (D2C) expertise, targeting convenience-focused Nordic consumers and reinforcing its global food solutions leadership.

Food Tech Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Billion |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Applications Covered | Food Science, Kitchen and Restaurant Tech, Delivery, Supply Chain, Others |

| Industries Covered | Fish, Meat, and Seafood, Fruits and Vegetables, Grain and Oil, Dairy Products, Beverages, Bakery and Confectionery, Others |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East, Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Brazil, Mexico |

| Companies Covered | Delivery Hero SE, HelloFresh SE, Flytrex Inc, Trax Technology Solutions PTE Ltd, Cubiq Foods, Lunchbox Technologies, Miso Robotics, Carlisle Technology. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the food tech market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global food tech market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the food tech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global food tech market was valued at USD 205.07 Billion in 2024.

The global food tech market is estimated to reach USD 601.46 Billion by 2033, exhibiting a CAGR of 11.60% from 2025-2033.

The key drivers in the global food tech market include growing consumer demand for convenience, online food delivery and meal kits, automation, and AI advancements in food preparation, interest in plant-based and sustainable food, and the necessity of more efficient and transparent food supply chains. These factors are transforming the food industry toward innovation and sustainability.

Asia Pacific currently dominates the market, holding a market share of over 32.3% in 2024. The market is driven by the rapid adoption of food delivery services, increasing demand for plant-based alternatives, and the growing trend of digitalization in food production and distribution across major economies in the region.

Some of the major players in the global food tech market include Delivery Hero SE, HelloFresh SE, Flytrex Inc, Trax Technology Solutions PTE Ltd, Cubiq Foods, Lunchbox Technologies, Miso Robotics, Carlisle Technology, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)