Food Packaging Market Size, Share, Trends and Forecast by Packaging Type, Application, and Region, 2025-2033

Food Packaging Market Size and Share:

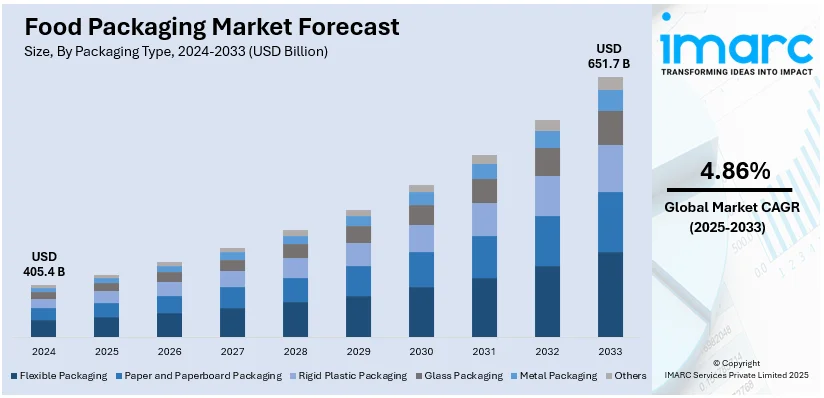

The global food packaging market size was valued at USD 405.44 Billion in 2024. The market is projected to reach USD 651.66 Billion by 2033, growing at a CAGR of 4.86% from 2025-2033. North America currently dominates the market, holding a market share of over 31.0% in 2024. The food packaging market share is increasing due to the growing concern over environmental issues and the bad impacts of plastic waste, along with the enhancement in packaging technology for increased shelf life and improved food safety.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 405.44 Billion |

| Market Forecast in 2033 | USD 651.66 Billion |

| Market Growth Rate (2025-2033) | 4.86% |

The global food packaging market growth is increasing, as it plays a crucial role in preserving food quality, extending shelf life, and ensuring safe distribution. The sector is diverse with several packaging materials like plastics, paper, glass, and metal, all offering unique strengths, including durability, cost-effectiveness, and recyclability. There is variability in packaging, including flexible pouches and cartons to rigid containers and vacuum-sealed options, with diversity by different product needs and consumer choices. Other market-shaping regulations include those dealing with food safety and environmental concerns, thereby compelling innovations in material design and waste management solutions. Food packaging demand has largely been pushed up by increasing demands for convenience foods, ready-to-eat meals, and snack products. Increasing consciousness regarding sustainability has pushed the demand for biodegradable, recyclable, and reusable packaging. Technologies such as active and intelligent packaging have transformed the industry by creating enhanced consumer experiences, including freshness indicators, tamper-proof seals, and better traceability. Emerging economies of Asia-Pacific and Latin America, in particular, drive growth, especially as they are rapidly urbanizing with higher disposable incomes and changing consumption patterns.

The United States has emerged as a key regional market for food packaging due to the rising demand from consumers to maintain the convenience, quality, and sustainability of their products. The United States employs a wide range of materials for its diverse food items, including plastic, paper, glass, and metal, demonstrating the remarkable innovation in this field. Packaged snacks, frozen foods, and ready-to-eat meals are all experiencing steady growth. Over the last few years, sustainability has gained significant attention, and consumers and businesses are looking for green packaging. There is growth in the recyclable, biodegradable, and compostable materials market as a result of strict regulations and consumer preference for environmentally responsible packaging. Technological advancements in smart packaging and advanced barrier coatings are revolutionizing the industry by improving shelf life, food safety, and the overall consumer experience. Trends in health-conscious eating, e-commerce, and innovations in packaging technologies continue to drive the U.S. market.

Global Food Packaging Market Trends:

Packaging innovation in design and aesthetics

Packaging design and aesthetics are critical attraction factors for buying and brand image enhancement. For example, International food and beverage company planned over 2 Billion USD in investment in sourcing food-grade recycled plastics for use in packaging while seeking to create a marketplace for recycled materials and launch a venture fund to fund packaging innovation. Creative and catchy packaging designs make the product look more appealing than the numerous other products available in the retail store, and thus purchasing decisions are significantly affected. The business will spend money on artistic and beautiful packaging that protects the product and projects the brand image and its values. Ergonomic design, labeling, and interactive features enhance the experience of the people. As packaging becomes even more critical for marketing, manufacturers are constantly coming up with new ideas and embracing the latest design fashions. Emphasis on design and aesthetics makes products unique and creates a sense of allegiance from the buyers. A recent increase in investments to come up with innovative packaging designs is among the factors that contribute to the growth of the food packaging market. During 2023, Tetra Pak worked with Flow Beverage and Live Nation Canada to launch the first-ever use of Tetra Pak's flexible packaging printing technology, enhancing Flow's carton graphics and opening new avenues of marketing possibilities. The collaboration aimed at delivering a remarkable experience to customers and expanding marketing opportunities through innovative beverage packaging.

Technological innovation in packaging end

Advanced packaging technologies, including quick response (QR) codes, radio-frequency identification (RFID) tags, and freshness indicators, provide updated information on the quality, source, and expiration dates of products, enhancing visibility and tracking. These packaging solutions, including antimicrobial agents and oxygen scavengers, help to preserve food freshness and extend shelf life. The advancements in the field of materials science are leading to the development of flexible, light, and long-lasting packaging that provides excellent barrier capabilities, thereby shaping the food packaging market trends. These developments enable producers to address changing consumer needs and adhere to industry regulations. Businesses can ensure improved product quality, minimize waste, and provide enhanced user experiences by using these cutting-edge technologies, which will eventually lead to higher consumer trust. This technological advancement is key to meeting present-day needs and raising the bar for food packaging companies. In 2023, Checkpoint Systems deployed RFID technology in the reusable containers of McDonald's outlets in over 1,200 French stores in response to new legislation that banned single-use tableware. The objective of this collaboration was to assist McDonald's in meeting its sustainability goals and enhance recycling activities in line with the regulations of regulatory bodies.

Sustainability and environmental issues

The increasing awareness about environmental issues and the negative impacts of plastic waste are fueling the sustainable food packaging demand. Individuals and regulatory bodies are pushing for the use of environmentally friendly materials and practices, thus compelling companies to switch to biodegradable, recyclable, and compostable packaging options. This shift toward sustainability will reduce the carbon footprint and mitigate the environmental impact of packaging waste. Global emissions, including plastics, account for 3.3% of total emissions, amounting to approximately 54.6 Billion Tons of CO2eq. Manufacturers are responding by creating new materials and packaging designs that reduce resource usage and improve recyclability. This focus on sustainability addresses pressing environmental concerns and aligns with consumer values, fostering brand loyalty. In 2023, Ball Corporation partnered with CavinKare to launch retort aluminum cans for CavinKare's milkshake varieties in India due to the increasing popularity of convenient drinks. This collaboration aimed to change the fate of the milk industry by making Ball aware of his expertise related to green packing.

Food Packaging Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global food packaging market, along with forecasts at the global and regional level from 2025-2033. The market has been categorized based on packaging type and application.

Analysis by Packaging Type:

- Flexible Packaging

- Paper and Paperboard Packaging

- Rigid Plastic Packaging

- Glass Packaging

- Metal Packaging

- Others

Flexible holds the biggest market with a share of 49.5% as per the food packaging market outlook due to its versatility, affordability, and excellent performance. Flexible packaging consists of bags, pouches, wraps, and films, which can easily assume multiple shapes and sizes. This results in excellent protection against contamination and also increases the shelf life of the food product. The lightweight nature of flexible packaging reduces transport costs and the green footprint, so this is something appealing to manufacturers and consumers alike. In addition, the ready-to-eat meals and the growing popularity of one-time portions increase market growth. Inventions in the field of material and printing also make flexible packaging better, allowing it to provide a more eye-catching and more informative design and match individual expectations about sustainability and convenience. In 2024, Domino Printing Sciences introduced a new TIJ solution for food packaging applications to give more effectiveness to the overprinting technique of TTO. It highly reduced the consumption of consumables and lessened the time brought up waste minimization of as high as 95% with 70% in cost-cutting from traditional TTO solutions.

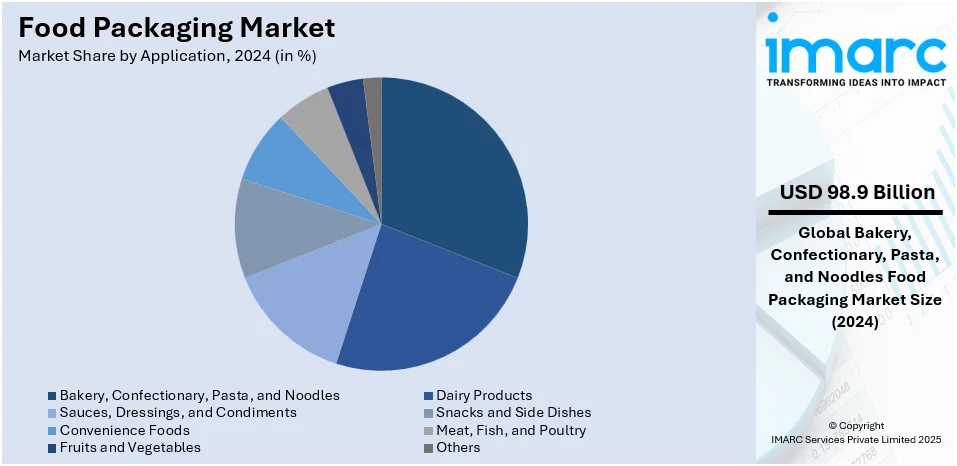

Analysis by Application:

- Bakery, Confectionary, Pasta, and Noodles

- Dairy Products

- Sauces, Dressings, and Condiments

- Snacks and Side Dishes

- Convenience Foods

- Meat, Fish, and Poultry

- Fruits and Vegetables

- Others

Bakery, confectionery, pasta, and noodles represent the largest market with a share of 24.4%, as consumers are presently widely consuming these items and the increasing requirement for practical and appealing packaging options. Consumer preferences for ready-to-eat and easy-to-preparation food items have increased demand for packaging that ensures fresh, safe, and shelf-stable food products. Packaging for this group is typically in the form of flexible pouches, wrappers, and cartons that are much more protective of moisture, light, and air and can ensure better food quality and taste. The increased demand for premium and handcrafted bakery and confectionery products also demands creative and aesthetically appealing packaging designs to increase consumer satisfaction. In December 2023, Mars China launched SNICKERS® low-GI dark chocolate cereal bars in recyclable, mono-material, flexible packaging. This initiative ensured Mars achieved some sustainability goals by offering low sugar content in packaging designed for simple recycling through specific channels. Asia-Pacific accounted for more than 40% of the market share in 2024.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

North America leads the market with a share of 31.0% due to the increased customer demand for processed foods and various advancements in the packaging technology sector. The F&B industry in this region is very developed and, therefore, necessitates effective as well as technologically advanced packaging to cater to the various demands of consumers. The increasing popularity of convenience foods, pre-packaged meals, and individual servings is catalyzing the demand for different kinds of packaging, including flexible, rigid plastic, and eco-friendly materials. Furthermore, the implementation of eco-friendly packaging options is driven by strict food safety regulations and the growing consumer focus on environmental sustainability. In 2023, Amcor launched curbside-recyclable AmFiber Performance Paper packaging in North America to be used in packaging food. Such packaging can deliver high-barrier protection, being compatible with all existing flexible packaging equipment in a sustainable solution.

Stringent regulatory policies related to sustainability and reduction of waste within the food packaging market drive its growth in Europe. With regards to this factor, there is growing demands on eco-friendly packages and environmental impact. Therefore, most companies opt for biodegradable and recyclable materials. Furthermore, organic and health-conscious trends in food attract demand for creative, protective packages that keep fresh and nutritional benefits. The ever-changing lifestyle pattern and urbanization also support growth in the food packaging market. Consumers prefer quick, easy meals that can be prepared on short notice.

The Asia Pacific food packaging market is accelerated by rapid urbanization, as well as an upsurge of disposable incomes with changing consumer lifestyles. With further growth in these middle-class customers in China and India, much more demand shall be observed, especially in the conveniences and ready-to-eat food categories; however, such demand shall again be attributed more to the requirements of consumers when it comes to awareness about safe food and keeping abreast about the shelf life. Sustainability issues are also on the rise, where governments and consumers are demanding the use of environmentally friendly materials and recycling programs, contributing to the increase in market growth.

The Latin America food packaging market is mainly boosted by population increase, urbanization, and high demand for processed and packaged food. Due to a lifestyle change, customers are consuming more convenience food, ready-to-eat foods, and snack foods, and this is increasing packaging requirements. On account of the demand for eco-friendly packaging solutions, sustainability is arising as an essential issue. According to the food packaging analysis, market growth in countries such as Brazil and Mexico are driven by expanding economies, a rapidly growing middle-class population, and increasing demand for product freshness and safety, supported by advancements in packaging technologies.

Rapid urbanization, economic growth, and altered consumer behavior with respect to convenience are the driving factors for food packaging in the Middle East and Africa. Enhanced disposable income in the GCC and African regions indicates that there is a higher demand for more packaged, ready-to-eat, and processed food. Online and modern retail channels further enlarge the market. Gains from sustainability are seen with governments and businesses focusing on reduction and eco-friendly packaging solutions for plastic waste that meet top-line and bottom-line compliance with regulatory and consumer expectations.

Key Regional Takeaways:

United States Food Packaging Market Analysis

In 2024, the United States held a market share of 78.80% due to the growing focus on eco-friendly and sustainable packaging. It has provided a massive thrust in the adoption of advanced food packaging methods. Reports indicate that across different areas, about 50% of consumers are willing to pay 1 to 3 percent more. The current preference of consumers has been shifting toward biodegradable and compostable materials, which meet environmental sustainability goals. Packaging solutions incorporate renewable resources such as plant-based polymers, reducing reliance on traditional plastics. Innovative designs that optimize material usage without sacrificing functionality are in vogue. This trend is also driven by government initiatives in waste reduction and encouraging businesses to adopt green packaging practices. As per the food packaging market reports, ready-to-eat meals, beverages, and frozen foods are widely accepted in recyclable and reusable containers. Strict regulations to reduce environmental impact have made packaging technologies evolve rapidly. Such innovations meet consumer demands while ensuring durability, safety, and extended product shelf life. The integration of such eco-conscious practices supports a circular economy, fostering widespread adoption across various industries.

Europe Food Packaging Market Analysis

Growth in the food and beverage industry has built an impressive demand for specialty packaging solutions for diversified product requirements. About 445k businesses operate in the food & drink wholesaling industry in Europe. Rigid and flexible packaging formats are increasingly used to support evolving consumer preferences for convenience and portability. Vacuum-sealed and modified atmosphere packaging extends the freshness of perishable items while retaining their flavor and nutritional value. Sophisticated designs with resealable features ensure practicality for on-the-go consumption. High-barrier materials that protect against moisture and oxygen are widely utilized to preserve sensitive products. According to food packaging market research, innovations such as portion-control packaging meet the increasing demand for healthier eating habits and individual servings. Premium designs for luxury food items have also emerged, focusing on aesthetic appeal and brand differentiation. As businesses strive to meet stringent safety and labeling requirements, advancements in food-safe inks and packaging traceability continue to enhance their offerings, reflecting evolving industry dynamics.

Asia Pacific Food Packaging Market Analysis

The rise in online food ordering and delivery has changed the face of food packaging, encouraging demand for flexible, safe, and aesthetically pleasing options. According to the India Brand Equity Foundation, the online food ordering and delivery market in India was valued at USD 28.3 Billion in 2022 and is expected to grow at a CAGR of 27% to around USD 117 Billion by 2028. The packaging, designed to be convenient and heat-retaining, makes sure the meal stays fresh even during transport. Single-use containers, tamper-evident seals, and spill-proof lids have become standard, answering the concerns of the customer on hygiene and security. Optimize storage and transport efficiency for firms that serve wide consumer preferences in lightweight, stackable designs. Demand for pre-packaged meal kits also spawned functional packaging that generates as little waste as possible. Innovations in print enable customized branding in packages as a form of marketing tool. Temperature resistance innovation ensures the delivery of both hot and cold meals at ideal temperatures. These advancements in packaging help in keeping the quality and presentation up, directly influencing the customer satisfaction rate in this very competitive food delivery landscape.

Latin America Food Packaging Market Analysis

Urban population increase and a growing workforce have led to the demand for food packaging tailored to fast-paced lifestyles. For example, 50.8% of Latin America's population is in the labor force, and this is expected to rise to 54.6% by 2050. Ready-to-eat meals, snack packs, and pre-cut fresh produce are examples of packaged products designed to cater to busy consumers. Compact, microwavable containers with easy-opening mechanisms ensure convenience for on-the-go consumption. Innovative packaging solutions emphasize durability and extended shelf life, reducing food waste while addressing storage challenges in smaller living spaces. The trend toward serving single portions supports the need for quick and portion-controlled meals. Functional designs featuring clear labeling and transparent materials cater to health-conscious consumers who seek detailed product information. Packaging that combines portability with aesthetic design improves the customer experience while fitting into contemporary, dynamic lifestyles, making it popular in urban areas.

Middle East and Africa Food Packaging Market Analysis

Growth in the tourism industry has raised the demand for food packaging solutions that are easy to consume and transport meals for tourists. According to the Dubai Department of Economy and Tourism, Dubai welcomed 16.79 Million international tourists during the first 11 months of 2024, between January and November, an increase of 9 percent compared to the same period last year. Portable and lightweight designs are prioritized to accommodate varying travel scenarios, including long journeys and outdoor excursions. Leak-proof, heat-sealed packaging ensures freshness of the meal and prevents spillage during transit. Compact storage is achieved with innovations like foldable containers and collapsible cups. Multi-compartment packaging promotes variety within a food group and maintains food separation. Moreover, the integration of sustainable materials reflects the growing environmental awareness among tourists. Packaging that promotes reusability and branding best aligns with the priorities of modern travelers. The improved protective materials ensure product integrity, which appeals to the increasing number of on-the-go consumers, including those exploring culinary experiences during their travels.

Leading Food Packaging Market Companies:

Market players have shifted toward more innovations, sustainability, and technological capabilities of the industry as a significant component of competitiveness in food packaging markets. Companies that responded to pressure from consumers and government agencies seeking higher sustainability placed substantial investments in research and development on eco-friendly solutions for packing, which include biodegradable, recyclable, and compostable materials and even smart packs with enhanced convenience using freshness indicator labels and sealed caps to further provide consumer convenience on matters of health, safety, and tampering protection. The packaging manufacturing sector is entering a partnership with food producers, allowing them to offer customized packaging that is of premium quality while offering environmental sensitivity. Further, there is also an innovation of using plant-based plastics and edible packaging that further advances the market evolution.

The report provides a comprehensive analysis of the competitive landscape in the food packaging market with detailed profiles of all major companies, including:

- Amcor PLC

- Crown Holdings Incorporated

- Owens-Illinois Inc.

- Tetra Pak Ltd.

- American Packaging Corporation

- Ball Corporation

Latest News and Developments:

- May 2025: Diamond Edge Ventures (the corporate venture wing of Mitsubishi Chemical Group) participated in an oversubscribed seed funding round for Canadian startup Fresher Sustainable Technologies, aiming to accelerate the scale-up of their active food packaging that extends shelf life and reduces waste. Freshr’s proprietary FreshrPack™ technology integrates natural antimicrobial agents onto packaging films—offering compostable, recyclable, moisture-resistant solutions tailored for fresh proteins like fish. The investment aligns with Mitsubishi Chemical’s KAITEKI Vision 35 strategy and will support Freshr’s global expansion and manufacturing enhancement initiatives.

- April 2025: India’s Ministry of Health and Family Welfare, in coordination with FSSAI, launched a national initiative to promote sustainable food packaging, unveiling new guidelines and a labeling system to identify eco-friendly materials. The initiative includes the finalized use of recycled PET (rPET) in food packaging and was announced during a stakeholder consultation in Mumbai attended by over 1,500 participants. The drive emphasizes industry collaboration, regulatory alignment, and innovation to transition away from conventional plastics in favor of recyclable and biodegradable alternatives.

- January 2025: Kraft Heinz, in collaboration with the Rethinking Materials summit, inaugurated its Global Packaging Innovation Challenge to solicit sustainable, flexible packaging solutions—recyclable, compostable, durable, and user‑friendly—for food products. The competition is open to startups, universities, and businesses worldwide.

- January 2025: INEOS Styrolution has succeeded in a demonstration project using mechanically recycled polystyrene for yogurt cups. Using advanced sorting techniques, hot washing, and pelletizing, such a project required collaboration across the value chain to be achieved, marking a successful step in sustainability in food packaging.

- December 2024: Start-ups in Chennai are transforming food packaging through eco-friendly alternatives such as bagasse, cornstarch, and areca leaf products. Evaluation and Plastic Free Madras connect businesses with sustainable solutions, catering to the growing demand for biodegradable cutlery and containers. Entrepreneurs emphasize the growing market for sustainable packaging as brands prioritize eco-conscious practices. This shift underlines the confluence of environmental responsibility and business image in Chennai's dynamic market.

- May 2024: Tetra Pak Ltd. and the University of Georgia opened North America's first Tetra Recart® trial facility at the UGA Food Product Innovation and Commercialization Center, where food companies can test and develop environmentally friendly packaging solutions. The collaboration was meant to revolutionize food packaging by making more affordable and environmentally friendly alternatives to conventional canning processes.

- April 2024: American Packaging Corporation (APC) launches a new design using recyclable technology for pet food packaging. APC plans to replace non-recyclable laminates with PE-based materials. It uses modern materials and processes with varying package sizes following the guidelines of recyclability.

- February 2024: Amcor partnered with Stonyfield Organic and Cheer Pack North America to launch the first all-polyethylene (PE) spouted pouch for YoBaby yogurt, using AmPrima Plus film and Vizi caps to increase sustainability and recyclability. The new design modernized the traditional layered pack while maintaining high performance and reducing plastic usage.

Food Packaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Packaging Types Covered | Flexible, Paper and Paperboard, Rigid Plastic, Glass, Metal, Others |

| Applications Covered | Bakery, Confectionary, Pasta, and Noodles, Dairy Products, Sauces, Dressings, and Condiments, Snacks and Side Dishes, Convenience Foods, Meat, Fish, and Poultry, Fruits and Vegetables, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Amcor PLC, Crown Holdings Incorporated, Owens-Illinois Inc., Tetra Pak Ltd., American Packaging Corporation, Ball Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the food packaging market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global food packaging market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the food packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The food packaging market was valued at USD 405.44 Billion in 2024.

IMARC estimates the food packaging market to exhibit a CAGR of 4.86% during 2025-2033.

The food packaging market share is increasing due to the growing concern over environmental issues and the bad impacts of plastic waste, along with the enhancement in packaging technology for increased shelf life and improved food safety.

North America currently dominates the market with a share of 31.0% due to the increased customer demand for processed foods and various advancements in the packaging technology sector.

Some of the major players in the food packaging market include Amcor PLC, Crown Holdings Incorporated, Owens-Illinois Inc., Tetra Pak Ltd., American Packaging Corporation, Ball Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)